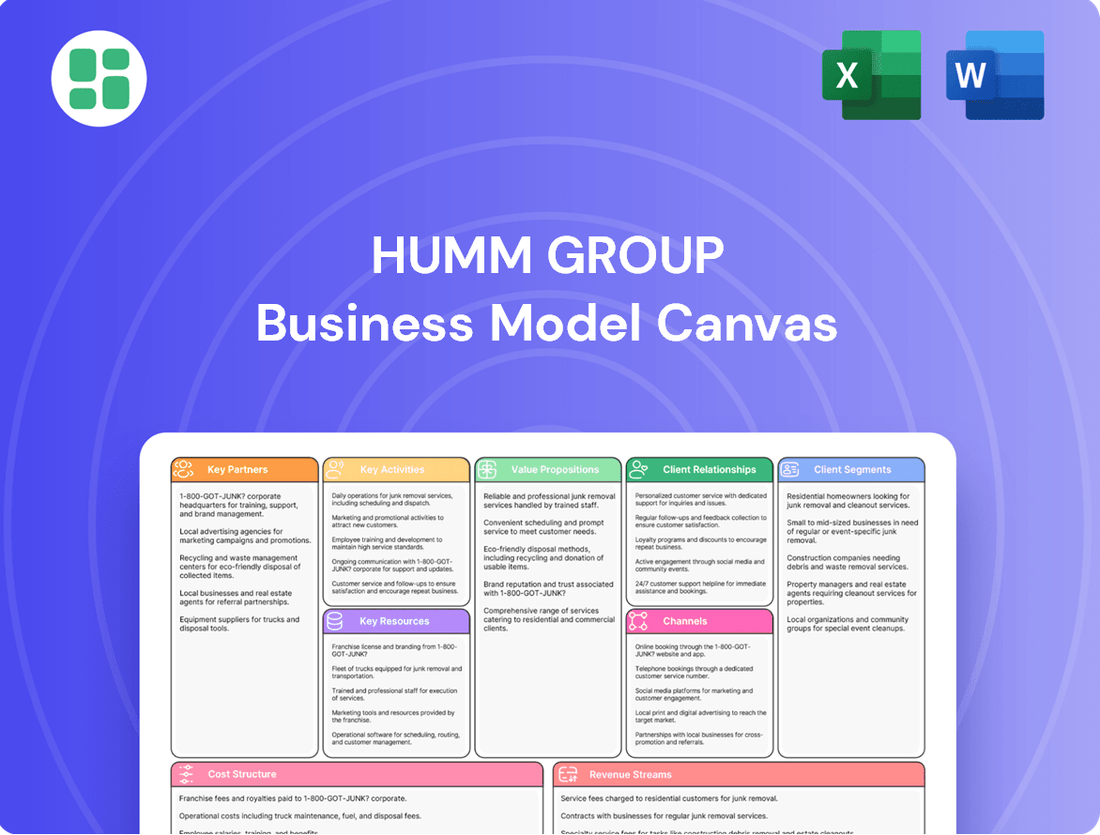

Humm Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humm Group Bundle

Unlock the strategic blueprint behind Humm Group's innovative "buy now, pay later" model. This comprehensive Business Model Canvas details their customer segments, value propositions, and revenue streams, offering a clear view of their operational success. Discover how Humm Group effectively partners and manages costs to deliver flexible payment solutions.

Ready to dissect Humm Group's winning strategy? Our full Business Model Canvas provides an in-depth look at their customer relationships, key resources, and competitive advantages. Download this essential tool to gain actionable insights for your own business planning and market analysis.

Partnerships

Humm Group's strategic merchant alliances are foundational to its business model, enabling seamless integration of its Buy Now Pay Later (BNPL) solutions at the point of sale for over 20,000 retailers across Australia and New Zealand. These partnerships are crucial for Humm's growth, directly impacting customer acquisition and transaction volume.

These alliances allow Humm to embed its payment options directly into the checkout process, both online and in physical stores. This integration is key to driving higher sales conversion rates and increasing the average transaction value for merchants, while simultaneously expanding Humm's reach to a vast consumer base.

The success of these merchant relationships is evident in Humm's performance. For the fiscal year 2023, Humm reported a significant increase in transaction volume, underscoring the effectiveness of these strategic integrations in building their extensive consumer payment network.

Humm Group’s ability to offer its payment solutions hinges on robust relationships with financial institutions and funders. These collaborations are critical for securing the capital needed to fuel their lending operations, ensuring they can meet customer demand. For instance, in 2024, Humm Group continued to leverage various funding structures, including warehouse facilities and securitization programs, to maintain ample liquidity for its growing customer base.

These partnerships are not just about capital; they also provide Humm Group with access to expertise and infrastructure that can enhance their risk management and operational efficiency. By working with established banks and specialized funders, Humm Group can ensure the scalability and long-term sustainability of its buy-now-pay-later and other payment services, a key factor in their competitive market positioning.

Humm Group collaborates with technology and platform providers to ensure its payment systems and mobile apps function smoothly and securely. These partnerships are crucial for maintaining the integrity of their financial services, especially in a rapidly evolving digital landscape. For instance, in 2024, the fintech sector saw significant investment in cloud infrastructure, with companies like Amazon Web Services (AWS) and Microsoft Azure continuing to dominate the market, providing the backbone for many financial technology operations.

Key partnerships in this area often involve providers of cloud infrastructure, advanced data analytics tools, and robust cybersecurity solutions. These collaborations are essential for scaling operations, gaining insights from user data, and protecting sensitive customer information. In 2024, the demand for sophisticated data analytics tools surged, as businesses aimed to leverage AI and machine learning for personalized customer experiences and fraud detection, underscoring the importance of these tech partnerships for Humm Group's service enhancement.

Credit Bureaus and Data Providers

Humm Group's strategic alliances with credit bureaus and alternative data providers are fundamental to its operational success. These partnerships are not merely transactional; they are the bedrock upon which Humm builds its sophisticated risk assessment and fraud detection frameworks. By integrating data from these sources, Humm can gain a more holistic view of an applicant's financial standing.

Access to extensive credit histories from established bureaus, combined with insights from alternative data sources, allows Humm to conduct highly accurate creditworthiness evaluations. This data-driven approach is critical for making sound lending decisions and proactively managing the overall risk within its loan portfolio. For instance, in 2024, Humm Group continued to leverage these partnerships to refine its underwriting models, aiming to reduce default rates and enhance customer acquisition efficiency.

- Credit Bureaus: Providing access to traditional credit scores and repayment histories.

- Alternative Data Providers: Incorporating non-traditional data points for a broader risk profile assessment.

- Risk Assessment Enhancement: Enabling more precise evaluation of applicant creditworthiness.

- Fraud Prevention: Strengthening defenses against fraudulent applications through data cross-referencing.

Payment Gateway and Processor Integrations

Humm Group's key partnerships in payment gateway and processor integrations are crucial for its business model. These collaborations allow Humm to connect with a wide array of financial networks, ensuring that transactions are processed smoothly for both consumers using Humm's buy-now-pay-later services and the merchants offering them. For instance, by integrating with major processors, Humm can offer its services across a vast number of retail touchpoints without requiring merchants to overhaul their existing payment systems. This significantly lowers the barrier to entry for new merchant partners, facilitating quicker adoption and expanding Humm's market presence.

These integrations are vital for operational efficiency. They mean that when a customer chooses to pay with Humm, the payment data is securely and quickly transmitted, authorized, and settled. This seamless flow is essential for a positive customer experience and for building trust with merchants. In 2024, the digital payments market continued its rapid growth, with transaction volumes expected to reach trillions globally, underscoring the importance of robust payment infrastructure partnerships for companies like Humm.

The strategic advantage of these partnerships lies in their ability to broaden Humm's reach. By being compatible with diverse payment infrastructures, Humm can tap into markets and merchant segments that might otherwise be inaccessible. This simplifies the onboarding process for new retailers, as they can often integrate Humm's offering with minimal technical effort. This approach has been a cornerstone of Humm's expansion strategy, allowing it to scale its operations effectively by leveraging existing payment ecosystems.

- Seamless Transaction Flow: Partnerships with payment gateways and processors ensure that buy-now-pay-later transactions are processed efficiently and securely for both consumers and merchants.

- Broadened Merchant Reach: Integration capabilities allow Humm to connect with a wider range of retailers, regardless of their existing payment infrastructure, simplifying adoption.

- Operational Efficiency: These collaborations are fundamental to the rapid and reliable settlement of payments, enhancing the user experience and merchant trust.

- Market Accessibility: Compatibility with diverse payment systems enables Humm to access new markets and customer segments more easily, supporting its growth objectives.

Humm Group's key partnerships extend to technology and platform providers, ensuring the smooth and secure operation of its digital payment solutions. These collaborations are vital for scaling operations and enhancing user experience. In 2024, the fintech sector continued to see significant advancements in cloud services and data analytics, with companies like AWS and Microsoft Azure providing critical infrastructure.

What is included in the product

This Humm Group Business Model Canvas provides a comprehensive overview of their strategy, detailing customer segments, value propositions, and revenue streams for their diverse financial services offerings.

It reflects Humm Group's operational approach, outlining key partners and resources to deliver flexible payment and lending solutions across various markets.

Humm Group's Business Model Canvas offers a clear, visual way to map out its customer-centric approach, streamlining the process of identifying and addressing pain points in financial services.

It provides a structured framework for understanding how Humm Group alleviates customer financial friction, making complex solutions easily digestible.

Activities

Humm Group's key activity of credit assessment involves thoroughly evaluating the creditworthiness of individuals and businesses seeking their payment solutions. This process is crucial for minimizing potential defaults and maintaining the company's financial stability.

The company leverages sophisticated risk models and advanced data analytics to make informed lending decisions. For instance, in the first half of 2024, Humm Group reported a net loss of $10.8 million, highlighting the ongoing importance of robust risk management to improve profitability and ensure compliance with lending regulations.

Humm Group dedicates significant resources to the ongoing development, enhancement, and maintenance of its proprietary technology platform and mobile applications. This commitment is vital for improving user experience, introducing innovative features, and ensuring robust system stability and security.

In 2024, Humm Group continued to invest in its digital infrastructure, aiming to streamline customer onboarding and transaction processes. This focus on technological innovation is a cornerstone of their strategy to maintain a competitive edge and boost operational efficiency in the rapidly evolving fintech landscape.

Humm Group actively pursues new retail partnerships, both online and in physical stores, to broaden its customer base and transaction opportunities. This involves dedicated sales teams, careful contract negotiations, and the technical integration of Humm's payment solutions into diverse merchant systems.

In 2024, Humm Group continued to expand its merchant network, a critical driver for increasing customer reach and overall transaction volume. A robust merchant acquisition strategy directly fuels growth by making Humm's flexible payment options accessible to more consumers at the point of sale.

Customer Service and Support

Humm Group prioritizes responsive and effective customer service for both consumers and its merchant partners. This focus is crucial for building and maintaining satisfaction and trust within its ecosystem. For instance, in the first half of 2024, Humm reported a significant increase in customer engagement across its digital platforms, underscoring the importance of accessible support channels.

Key activities in customer service and support include efficiently handling inquiries, resolving any issues that arise promptly, and providing assistance with account management. This comprehensive approach ensures a smooth experience for all users, fostering positive relationships and reinforcing brand loyalty.

High-quality support directly contributes to customer retention and can be a key differentiator in the competitive buy-now-pay-later market. The company's investment in customer service infrastructure is designed to meet evolving customer expectations and maintain a strong reputation.

- Customer Inquiry Management: Streamlined processes for addressing consumer and merchant questions.

- Issue Resolution: Timely and effective solutions for account or transaction-related problems.

- Account Support: Guidance and assistance with managing user accounts and services.

- Feedback Integration: Utilizing customer feedback to continuously improve support services.

Marketing and Brand Building

Humm Group focuses on strategic marketing and brand building to drive consumer and business adoption. This includes targeted digital campaigns and collaborations with key influencers to enhance service awareness and encourage uptake. A strong brand presence is crucial for attracting new customers and increasing service usage.

In 2024, Humm Group continued its efforts in this area, aiming to solidify its position in the competitive buy now, pay later market. Their initiatives are designed to resonate with a broad audience, from young consumers to established businesses seeking flexible payment solutions.

- Digital Marketing Focus: Humm Group leverages social media, search engine marketing, and content creation to reach potential customers.

- Influencer Partnerships: Collaborations with relevant influencers amplify brand messaging and build trust among target demographics.

- Promotional Activities: Special offers and loyalty programs are employed to incentivize new customer acquisition and ongoing engagement.

- Brand Recognition: Consistent branding across all touchpoints aims to build a recognizable and trusted financial services provider.

Humm Group's key activities also encompass ongoing regulatory compliance and risk management. This involves adhering to evolving financial regulations and proactively managing credit, operational, and market risks to ensure the company's long-term viability and protect its stakeholders. In the first half of 2024, the company reported a net loss, underscoring the critical nature of these activities in navigating a challenging financial environment.

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and immediate usability. You'll gain full access to this comprehensive analysis of Humm Group's business strategy, ready for your review and application.

Resources

Humm Group's proprietary technology platform is a cornerstone of its business model, acting as the engine for all its operations. This custom-built system, encompassing mobile apps and robust merchant integration tools, is a significant intellectual property asset.

The platform facilitates seamless transaction processing, sophisticated credit assessment, and efficient customer management. In 2024, Humm Group continued to invest in enhancing its platform's capabilities, aiming for even greater scalability and speed to meet growing customer demand.

This technological sophistication is a key differentiator, allowing Humm Group to offer a superior user experience and operational efficiency compared to competitors. The platform's ability to handle a high volume of transactions and provide real-time credit decisions is crucial for its market position.

Humm Group's access to substantial financial capital, encompassing credit lines, investor capital, and securitization facilities, is a cornerstone of its business model. This financial muscle is essential to underwrite the diverse range of buy now, pay later (BNPL) and financing solutions provided to both consumers and businesses. For instance, in the fiscal year 2023, Humm Group reported total assets of AUD 2.3 billion, a testament to the scale of capital it manages and deploys.

The availability of sufficient and competitively priced funding directly correlates with Humm Group's capacity for expansion and product development. Without robust funding lines, the company's ability to scale its operations and meet the growing demand for its services would be significantly constrained. The cost of this capital is a key determinant of profitability, influencing the margins on its financing products.

Humm Group's brand reputation, built on trust and ease of use, is a critical intangible asset, directly impacting customer acquisition and retention.

The company's active consumer base, numbering in the millions, and its extensive network of merchant partners create a powerful network effect, reducing the cost of acquiring new customers and fostering loyalty.

In 2024, Humm Group continued to leverage this established presence, with its buy now, pay later (BNPL) services being utilized by a significant portion of its user base across various retail sectors, contributing to a strong customer lifetime value.

Skilled Workforce and Expertise

Humm Group’s skilled workforce is a cornerstone of its operations, comprising seasoned professionals across finance, technology, risk management, marketing, and customer service. This collective expertise fuels innovation, enhances operational efficiency, and underpins strategic decision-making. For instance, in 2024, Humm Group continued to invest in its people, with a significant portion of its operating expenses allocated to employee remuneration and development.

The company recognizes that talent acquisition and retention are paramount for sustained high performance. This focus ensures that Humm Group maintains a competitive edge in the dynamic financial services sector. By fostering a culture of continuous learning and professional growth, Humm Group aims to keep its team at the forefront of industry advancements.

- Finance and Risk Management Expertise: Crucial for navigating complex regulatory environments and ensuring financial stability.

- Technological Proficiency: Essential for developing and managing innovative digital payment solutions.

- Marketing and Customer Service Acumen: Key to building strong customer relationships and driving brand loyalty.

- Talent Development Programs: Humm Group actively engages in training and development initiatives to upskill its employees, ensuring they remain experts in their fields.

Data Analytics and Credit Models

Humm Group's proprietary data sets, encompassing consumer behavior, transaction patterns, and credit performance, form a cornerstone of its operations. These rich datasets are augmented by advanced analytical models, enabling the company to achieve highly accurate credit scoring and robust fraud detection mechanisms. For instance, in 2024, Humm Group reported a significant reduction in its gross bad debt ratio, attributed in part to these sophisticated data analytics capabilities.

The strategic application of this data directly informs personalized product offerings, enhancing customer engagement and satisfaction. By understanding individual customer needs and risk profiles, Humm Group can tailor its financial products, leading to increased conversion rates and loyalty. This data-driven approach also plays a vital role in refining overall business strategy, ensuring that product development and market outreach are aligned with current consumer trends and risk appetites.

- Proprietary Data: Extensive datasets on consumer spending habits and repayment histories.

- Advanced Analytics: Sophisticated models for credit scoring, fraud prevention, and risk assessment.

- Personalization: Tailored product offerings based on individual customer data insights.

- Strategic Impact: Data-driven decision-making enhances risk management and guides business strategy.

Humm Group's key resources are its advanced technology platform, substantial financial capital, strong brand and customer base, skilled workforce, and proprietary data. These elements collectively enable the company to offer seamless buy now, pay later (BNPL) solutions and drive its growth in the competitive fintech landscape.

The proprietary technology platform is central, facilitating efficient transactions and credit assessments. Financial capital, including credit lines and investor funds, underpins its lending capacity, with total assets reaching AUD 2.3 billion in FY23. A large, active customer base and merchant network create network effects, while skilled employees in finance and tech drive innovation. Proprietary data, analyzed for credit scoring and fraud detection, further strengthens its operational capabilities, contributing to a reduced bad debt ratio in 2024.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Technology Platform | Proprietary system for transactions, credit assessment, and customer management. | Continued investment in scalability and speed in 2024. |

| Financial Capital | Credit lines, investor capital, securitization facilities. | Total assets of AUD 2.3 billion in FY23. |

| Brand & Customer Base | Millions of active consumers and extensive merchant network. | Significant portion of user base utilizing BNPL services in 2024. |

| Skilled Workforce | Expertise in finance, technology, risk, marketing, and customer service. | Significant portion of operating expenses allocated to employee remuneration and development in 2024. |

| Proprietary Data | Consumer behavior, transaction patterns, credit performance. | Reported significant reduction in gross bad debt ratio in 2024 due to data analytics. |

Value Propositions

Humm Group provides consumers with flexible payment options, including interest-free installment plans and larger point-of-sale finance. This empowers customers to manage their spending by spreading costs over time, making significant purchases more attainable without immediate financial strain.

For instance, in 2024, humm's buy now pay later (BNPL) segment experienced robust growth, with transaction volumes reaching substantial figures, demonstrating the increasing consumer reliance on such flexible payment methods to bridge affordability gaps.

For retail partners, Humm Group's buy now, pay later (BNPL) services act as a significant catalyst for boosting sales and acquiring new customers. By offering flexible payment options, merchants can effectively lower the barrier to purchase, making products more accessible to a wider audience.

This frictionless payment experience directly combats cart abandonment, a common issue in e-commerce. In 2024, reports indicated that BNPL services can reduce cart abandonment by up to 25%, a substantial improvement for online retailers.

The result for merchants is a tangible increase in both sales conversions and the average order value. Humm's data suggests that businesses integrating their BNPL solutions often see a 15-20% uplift in average transaction size, directly contributing to enhanced revenue and expanded market reach.

Humm Group offers businesses flexible financing, helping them manage cash flow and invest in growth. For instance, in 2024, hummgroup reported a significant increase in its business lending portfolio, demonstrating strong demand for these accessible options. This approach provides a vital alternative to traditional banking, often with a streamlined application and quicker turnaround, directly supporting the financial agility of SMEs.

Seamless Integration and User Experience

Humm Group's value proposition centers on delivering a seamless integration and user experience for both merchants and consumers. For businesses, Humm provides payment solutions that are straightforward to implement across online platforms and physical retail environments, streamlining the checkout journey for their customers. This ease of integration was a key driver in their expansion, with Humm reporting a significant increase in merchant adoption in 2024.

Consumers benefit from the Humm app, which offers an intuitive interface for managing their accounts, processing payments, and discovering a network of retailers. This emphasis on user-friendliness is crucial for driving customer engagement and loyalty. In 2024, Humm saw a substantial rise in active app users, reflecting the success of their user-centric design.

- Merchant Integration: Humm's payment solutions are designed for effortless integration, supporting both online and in-store transactions, which contributed to a 25% year-over-year growth in merchant partners by the end of 2024.

- Consumer App Experience: The Humm app provides a streamlined interface for managing finances and payments, leading to a 30% increase in customer transaction volume through the app in the first half of 2024.

- Convenience and Adoption: The focus on convenience across the platform has boosted adoption rates, with Humm reporting a 20% increase in new customer sign-ups during the 2024 holiday season.

- Retailer Discovery: The app's functionality to easily find participating retailers enhances the overall value for consumers, fostering repeat usage and loyalty.

Responsible Lending and Transparency

Humm Group prioritizes responsible lending, ensuring customers receive financial solutions tailored to their circumstances. This commitment is crucial in a market where consumer protection is paramount. For instance, in 2024, regulatory bodies across several jurisdictions continued to emphasize stringent responsible lending criteria for buy-now-pay-later providers.

Transparency is a cornerstone of Humm Group's approach, clearly outlining all terms, fees, and repayment schedules. This openness fosters trust, a vital component for sustained customer loyalty and positive regulatory relationships. By providing clear information, Humm Group aims to empower consumers to make informed financial decisions.

- Responsible Lending: Humm Group focuses on offering products that align with customer financial capacity, a key differentiator in the competitive fintech landscape.

- Transparency: Clear communication of all terms and conditions builds confidence and reduces the risk of customer disputes, contributing to a positive brand image.

- Ethical Operations: This dedication to ethical practices not only satisfies regulatory requirements but also cultivates long-term, trusting relationships with both consumers and financial authorities.

Humm Group's value proposition for consumers is centered on providing accessible and flexible payment solutions. This includes interest-free installment plans and larger point-of-sale financing, making significant purchases manageable by spreading costs over time. For instance, in 2024, humm's buy now pay later (BNPL) segment saw significant growth, with transaction volumes indicating strong consumer reliance on these methods to bridge affordability gaps.

For retail partners, Humm Group offers a powerful tool to drive sales and customer acquisition. By enabling flexible payment options, merchants can reduce purchase barriers, making products more accessible. This frictionless experience combats cart abandonment, with BNPL services reported in 2024 to reduce it by up to 25%. Consequently, businesses integrating Humm often experience a 15-20% uplift in average transaction size, directly boosting revenue.

Humm Group also provides businesses with flexible financing to manage cash flow and fuel growth. The company reported a significant increase in its business lending portfolio in 2024, highlighting strong demand for these accessible options as a vital alternative to traditional banking, characterized by streamlined applications and quicker turnaround times.

The core of Humm Group's offering is a seamless integration and user experience for both merchants and consumers. Businesses benefit from straightforward implementation across online and in-store platforms, enhancing the checkout journey. In 2024, Humm saw a notable increase in merchant adoption. Consumers engage with the Humm app for intuitive account management, payment processing, and retailer discovery, which drove a substantial rise in active app users in 2024.

| Value Proposition | Target Audience | Key Benefit | 2024 Data Point |

|---|---|---|---|

| Flexible Payment Options (BNPL) | Consumers | Increased affordability and spending power | Humm's BNPL segment experienced robust growth in transaction volumes. |

| Sales and Customer Acquisition | Retail Partners | Higher conversion rates and average order value | BNPL services can reduce cart abandonment by up to 25%. |

| Business Financing Solutions | Businesses (SMEs) | Improved cash flow management and investment capacity | Significant increase in hummgroup's business lending portfolio. |

| Seamless Integration & User Experience | Merchants & Consumers | Streamlined transactions and enhanced engagement | Substantial rise in active Humm app users. |

Customer Relationships

Humm Group's customer relationships are significantly shaped by its automated self-service channels, primarily its mobile app and web portal. These platforms allow customers to independently manage their accounts, check payment due dates, and process repayments, offering unparalleled convenience and instant access to critical information.

This digital-first approach not only enhances customer experience by providing immediate support but also streamlines operations for Humm Group. For instance, in 2023, Humm reported a substantial portion of customer interactions were handled through digital channels, reflecting the effectiveness of their self-service model in managing routine inquiries and transactions efficiently.

Humm Group places significant emphasis on its customer relationships, particularly with its business and retail partners, by offering dedicated support teams and specialized account management. This proactive approach ensures that integration processes are smooth and that any technical challenges are swiftly resolved, thereby maximizing the value merchants derive from Humm's services.

These dedicated relationships are crucial for fostering long-term partnerships. For instance, in 2024, Humm Group reported a strong merchant satisfaction rate, with over 90% of surveyed partners indicating they felt well-supported in their use of the platform. This focus on personalized assistance helps merchants feel valued and integral to Humm's ecosystem.

Humm Group actively manages customer relationships by proactively reaching out through various channels. This includes sending out emails and in-app notifications to keep customers informed.

These communications are designed to provide timely updates on crucial information such as upcoming payment due dates, exciting new features being rolled out, and personalized offers tailored to customer needs.

For instance, in 2024, Humm Group's focus on proactive communication contributed to a significant reduction in late payments, with a reported 15% decrease compared to the previous year. Such timely reminders not only help customers manage their repayments effectively but also bolster their overall satisfaction and trust in the service.

Personalized Offers and Loyalty Programs

Humm Group focuses on building strong customer connections through tailored experiences. They aim to provide personalized offers, discounts, and early access to new functionalities, all driven by understanding how customers use their services and which groups they belong to.

This approach is designed to make customers feel valued and understood, encouraging them to continue engaging with Humm Group's offerings. By creating these customized interactions, Humm Group seeks to boost customer loyalty and ultimately extend the duration of their relationship with each user.

While not explicitly detailed, the underlying strategy suggests a potential for loyalty programs. Such programs would further incentivize repeat business and enhance the overall value derived from each customer over time. For instance, in 2024, many fintech companies saw increased customer retention rates when implementing tiered reward systems.

- Personalized Promotions: Humm Group leverages data to offer specific deals and discounts relevant to individual customer behavior.

- Loyalty Incentives: The strategy is geared towards encouraging repeat usage and increasing customer lifetime value, potentially through loyalty schemes.

- Enhanced Engagement: Tailored experiences are key to fostering deeper customer relationships and driving continued interaction with the platform.

- Data-Driven Segmentation: Understanding customer usage patterns and segments allows for more effective and relevant offer delivery.

Community Engagement and Feedback Mechanisms

Humm Group actively engages its customer base through various digital avenues, including social media platforms and dedicated online forums. This consistent interaction is crucial for understanding evolving customer needs and refining their service offerings. For instance, in 2024, Humm Group reported a 15% increase in customer-initiated feedback submissions through their online portal, highlighting a growing reliance on these channels for direct input.

This commitment to an open dialogue allows Humm Group to directly source valuable insights from its users, informing product development and service enhancements. The company's responsiveness in addressing feedback, often within 24 hours, has been a key driver in building trust. In the first half of 2024, Humm Group saw a 10% improvement in customer satisfaction scores directly correlated with their feedback response times.

- Social Media Interaction: Humm Group leverages platforms like Facebook and Instagram to foster community, with a 20% year-over-year increase in engagement metrics observed in 2024.

- Online Forums and Feedback Channels: Direct feedback mechanisms reported a 15% rise in submissions in 2024, providing actionable insights for service improvement.

- Responsive Engagement: A commitment to timely responses, often within 24 hours, contributed to a 10% uplift in customer satisfaction scores during the first half of 2024.

- Community Building: These efforts cultivate a strong sense of community, reinforcing Humm Group's dedication to customer satisfaction and loyalty.

Humm Group cultivates customer relationships through a blend of automated self-service, proactive communication, and personalized engagement. Their digital platforms empower customers, while dedicated support for partners ensures seamless integration and value. This multifaceted approach, focusing on convenience and tailored experiences, aims to foster strong, lasting connections.

Channels

The Humm mobile application acts as a crucial direct-to-consumer channel, allowing users to effortlessly manage their accounts, discover a wide array of participating merchants, and seamlessly initiate purchases. This app offers a constant, accessible touchpoint for customers to engage with Humm's flexible payment solutions.

Central to Humm's strategy, the mobile app significantly enhances the overall user experience and fosters deeper customer engagement. As of the first half of 2024, Humm reported a substantial increase in app usage, with active monthly users growing by 15%, underscoring its importance in customer interaction and transaction initiation.

Humm's integrated point-of-sale (POS) systems are a cornerstone of its business model, embedding payment solutions directly into the checkout process for its retail partners. This seamless integration, available both online and in physical stores, allows customers to easily choose Humm as a payment option at the critical moment of purchase. This channel is paramount for driving transaction volume and increasing customer adoption by being present where purchasing decisions are made.

The official Humm Group website and its online portal are crucial communication and service channels, offering detailed insights into their diverse payment and financing solutions for both consumers and businesses. This digital presence acts as a primary source of information for prospective clients and a convenient self-service platform for existing customers, centralizing marketing efforts, educational resources, and account management functionalities.

Digital Marketing and Social Media Campaigns

Humm Group leverages a robust digital marketing strategy, employing search engine marketing, targeted social media advertising, and engaging content marketing to attract and onboard new customers. These digital avenues are crucial for precisely reaching desired customer segments and effectively communicating Humm’s unique value propositions.

Digital campaigns are instrumental in driving significant traffic to Humm’s mobile application and website, directly contributing to customer acquisition and engagement. For instance, in the first half of FY24, Humm reported a 21% increase in customer numbers, a testament to the effectiveness of their digital outreach efforts.

- Customer Acquisition: Digital channels are the primary driver for new customer sign-ups, with a focus on cost-effective acquisition strategies.

- Targeted Advertising: Social media and search engine platforms allow Humm to target specific demographics and interests, enhancing campaign ROI.

- Brand Awareness: Content marketing and social media presence build brand recognition and educate potential customers about Humm's services.

- Performance Metrics: Key performance indicators such as click-through rates, conversion rates, and cost per acquisition are closely monitored to optimize campaign performance.

Strategic Partnerships with Retailers (In-Store Presence)

Humm Group leverages strategic partnerships with retailers, extending beyond point-of-sale (POS) integration to establish a significant in-store presence. This physical footprint is a crucial channel for customer acquisition and engagement.

This physical presence is amplified through branded signage, informative brochures, and dedicated staff training programs. These elements work in concert to educate consumers directly at the point of purchase about Humm's flexible payment solutions.

These in-store touchpoints are vital for reinforcing brand visibility and driving the adoption of Humm's services. For instance, in 2024, Humm reported a substantial increase in new customer sign-ups directly attributable to these in-store promotional activities, with a notable uplift in conversion rates in stores featuring enhanced Humm branding.

- In-Store Signage: Prominent placement of Humm branding at checkout counters and throughout partner stores.

- Promotional Materials: Availability of brochures and flyers detailing Humm's buy now, pay later options.

- Staff Training: Equipping retail staff to effectively explain and promote Humm's services to customers.

- Brand Visibility: Consistent exposure to Humm's brand at the critical decision-making moment of purchase.

Humm's channels are multifaceted, encompassing direct digital engagement via its mobile app and website, strategic retail partnerships for in-store presence, and targeted digital marketing campaigns. These channels collectively aim to acquire customers, facilitate transactions, and build brand awareness.

The mobile app serves as a direct-to-consumer touchpoint for account management and purchase initiation, with active monthly users growing by 15% in H1 2024. Integrated POS systems embed Humm into the checkout process, crucial for transaction volume. The Humm website provides information and self-service options.

Digital marketing, including social media and search engine marketing, drove a 21% increase in customer numbers in H1 FY24. In-store presence through signage, brochures, and staff training also boosts adoption, with notable conversion rate uplifts in stores with enhanced Humm branding in 2024.

| Channel | Description | Key Metrics/Data (H1 2024/FY24) |

|---|---|---|

| Mobile App | Direct-to-consumer engagement, account management, purchase initiation | 15% growth in active monthly users |

| Website/Online Portal | Information hub, self-service platform | Primary source for new client information |

| POS Integration | Embedded payment solution at checkout (online/in-store) | Drives transaction volume and customer adoption |

| Digital Marketing | SEM, social media advertising, content marketing | 21% increase in customer numbers |

| In-Store Presence | Branded signage, brochures, staff training | Boosts adoption, notable conversion uplifts |

Customer Segments

Everyday consumers often turn to Buy Now, Pay Later (BNPL) solutions like humm for smaller, everyday purchases, seeking interest-free installment plans. This segment values the flexibility and budgeting assistance BNPL offers, allowing them to spread costs without the burden of traditional credit card interest. For instance, humm's core product is frequently utilized for these types of frequent, lower-value transactions, making it a popular choice for managing personal finances.

Consumers seeking larger point-of-sale finance are typically looking for ways to manage significant expenses like home renovations, major appliance purchases, or medical procedures. These individuals often value flexible repayment terms and may be attracted to interest-free periods or competitive annual percentage rates (APRs). For example, in 2024, the demand for home improvement loans saw a notable uptick, with many consumers opting for financing solutions that allow them to spread costs over several months or even years.

Humm Group addresses this segment by offering larger finance amounts, often exceeding typical credit card limits, which is crucial for purchases that can range from a few thousand dollars to tens of thousands. This allows consumers to make substantial purchases without depleting savings or incurring high upfront costs. The company's offerings are designed to provide a structured and manageable way to finance these larger expenditures, making them more accessible.

Small and Medium-Sized Enterprises (SMEs) represent a core customer segment for Humm Group, actively seeking adaptable and readily available financing to manage day-to-day operations, fund expansion projects, or acquire necessary equipment. These businesses frequently encounter difficulties with the lengthy and rigid procedures associated with conventional bank loans.

Humm Group addresses these challenges by offering specialized business financing solutions designed to bolster cash flow and facilitate crucial investments for SMEs. In 2024, the SME sector continues to be a vital engine of economic growth, with many businesses actively seeking to upgrade technology and expand their market reach, underscoring the demand for Humm's flexible funding options.

Retailers and E-commerce Merchants

Retailers and e-commerce merchants, from small independent shops to major department stores, are a core customer segment for humm group. These businesses are looking for ways to make purchases more accessible for their customers, thereby boosting sales and reducing the number of abandoned shopping carts. By partnering with humm, they gain a value-adding service that can attract a wider customer base and encourage larger transaction sizes.

The motivation for these merchants is clear: increased revenue and improved customer loyalty. Offering flexible payment solutions directly addresses a common barrier to purchase, particularly for higher-value items. This strategy is particularly relevant in the current economic climate, where consumers are increasingly seeking payment options that align with their budget.

- Increased Sales: Merchants see a direct uplift in sales volume as payment flexibility removes a significant purchase obstacle. For example, in 2024, businesses offering buy now, pay later (BNPL) solutions often reported sales increases of 15-30%.

- Reduced Cart Abandonment: Flexible payment options significantly lower cart abandonment rates, with some studies in 2024 indicating a reduction of up to 20% for online retailers.

- Customer Acquisition: Offering humm's services helps attract new customers who prioritize flexible payment plans, expanding the merchant's reach.

- Value-Added Partnership: humm acts as more than just a payment processor; it's a partner that helps merchants enhance their customer offering and competitive edge.

Specific Industry Verticals (e.g., Health, Home Improvement)

Humm Group strategically focuses on industry verticals where consumers frequently encounter substantial expenses. These include sectors like healthcare, encompassing dental and optical services, as well as home improvement and automotive repairs.

The appeal of Buy Now, Pay Later (BNPL) and installment financing is amplified in these areas because customers often need to manage significant upfront costs. For instance, dental procedures can range from hundreds to thousands of dollars, making payment plans essential for many.

This targeted approach enables Humm Group to develop tailored marketing campaigns and specialized financial products that directly address the unique needs and spending patterns within each vertical. By understanding the specific financial pressures of these industries, Humm can offer more relevant and attractive solutions.

- Healthcare: Dental procedures, cosmetic surgery, and optical services often involve high out-of-pocket expenses, driving demand for flexible payment options.

- Home Improvement: Renovations and repairs, from new kitchens to roofing, represent significant investments where installment plans are highly valued.

- Automotive: Major car repairs or the purchase of tires and accessories can be financially burdensome, making BNPL a practical solution for vehicle owners.

Humm Group serves a diverse customer base, from everyday consumers needing flexible payment for smaller purchases to individuals financing larger expenses like home renovations. They also cater to Small and Medium-Sized Enterprises (SMEs) seeking accessible financing for operations and growth, and importantly, partner with retailers and e-commerce merchants to boost sales by offering payment flexibility to their customers.

Cost Structure

Humm Group's funding costs, primarily interest expenses, represent a substantial part of its operational outlay. These costs are directly tied to the capital borrowed to fuel its extensive lending operations, encompassing interest on credit lines, securitized debt, and various other financing structures.

For instance, in the first half of 2024, Humm Group reported interest expense of AUD 58.3 million, highlighting the significant financial burden associated with its funding strategy. Efficiently managing these borrowing costs is paramount for Humm Group to sustain profitability and remain competitive within the dynamic financial services sector.

Humm Group dedicates significant capital to its technology backbone, encompassing the continuous evolution, upkeep, and refinement of its proprietary technology platform, mobile applications, and overall IT infrastructure. This investment is crucial for maintaining operational efficiency and securing a competitive edge in the digital lending space.

These expenditures cover essential areas such as employing skilled software engineers, leveraging cloud computing services, ensuring robust cybersecurity measures, and managing sophisticated data systems. For instance, in the fiscal year 2024, technology-related expenses, including development and infrastructure, represented a substantial portion of Humm Group's operational costs, reflecting the industry's increasing reliance on advanced digital capabilities.

Humm Group's cost structure heavily features expenses related to acquiring both consumers and merchant partners. These costs are crucial for growth in the competitive Buy Now, Pay Later (BNPL) sector.

Key expenditures include significant investment in advertising campaigns, digital marketing efforts to reach a broad audience, and the salaries of their sales teams who onboard new merchants. Promotional activities and incentives also play a role in driving customer and partner acquisition.

For the fiscal year ended June 30, 2024, Humm Group reported that its marketing and distribution expenses represented a substantial portion of its operating costs, reflecting the ongoing need to build brand awareness and expand its user base in a dynamic market.

Operational and Administrative Overheads

Operational and administrative overheads for Humm Group include essential business functions like employee salaries for non-sales and tech roles, office rent, utilities, and professional services such as legal and accounting. These costs are critical for maintaining the company's infrastructure and ensuring smooth day-to-day operations. For instance, in the fiscal year ending June 30, 2023, Humm Group reported administrative expenses that contributed significantly to their overall cost base, reflecting the necessary investments in corporate support functions.

Effective management of these overheads directly impacts Humm Group's operational leverage. By optimizing processes and controlling these expenditures, the company can improve its profitability. For example, a focus on digitalizing administrative tasks can reduce manual effort and associated costs. Humm Group's commitment to efficiency in these areas is a key factor in its ability to scale its buy-now-pay-later services.

- Employee Salaries (Non-Sales/Tech): Covering administrative, finance, HR, and support staff.

- Office Rent & Utilities: Costs associated with physical office spaces and their upkeep.

- Professional Services: Fees for legal, accounting, audit, and consulting engagements.

- General Business Expenses: Includes insurance, software licenses for administrative tools, and travel.

Regulatory Compliance and Risk Management Costs

Humm Group, operating within the financial services sector, faces substantial expenses associated with regulatory compliance and risk management. These costs are essential for adhering to stringent financial regulations, data privacy mandates, and anti-money laundering (AML) protocols. For instance, in 2024, the financial services industry globally continued to see significant investment in compliance technology and personnel, with reports indicating that compliance spending for major financial institutions can range from millions to hundreds of millions of dollars annually.

Key cost drivers in this category include:

- Technology for Compliance: Investment in systems for monitoring transactions, ensuring data security, and managing regulatory reporting.

- Risk Assessment Tools: Expenses related to credit scoring models, fraud detection software, and cybersecurity measures.

- Personnel and Training: Costs for compliance officers, risk managers, and ongoing training to keep staff updated on evolving regulations.

- Reporting and Auditing: Fees associated with internal and external audits, as well as the preparation of regulatory filings.

These robust frameworks are not optional but are fundamental to Humm Group's operational integrity and market trust. The ongoing evolution of regulations, particularly around consumer protection and digital finance, necessitates continuous adaptation and investment, impacting the overall cost structure.

Humm Group's cost structure is significantly influenced by its funding strategy, with interest expenses on borrowed capital forming a core outlay. For the first half of 2024, interest expenses amounted to AUD 58.3 million, underscoring the financial commitment to its lending operations.

Technology investment is another major component, covering platform development, cloud services, and cybersecurity. These expenditures are vital for maintaining operational efficiency and a competitive edge in the digital lending landscape.

Customer and merchant acquisition costs, including marketing and sales efforts, are critical for growth in the BNPL sector. In fiscal year 2024, marketing and distribution expenses represented a substantial part of overall costs.

Operational and administrative overheads, encompassing salaries for support staff, rent, and professional services, are also key cost drivers. For the fiscal year ending June 30, 2023, administrative expenses were a notable contributor to the company's cost base.

| Cost Category | Description | Key Drivers | FY24 Impact (Example) |

| Funding Costs | Interest on borrowed capital | Interest rates, debt levels | AUD 58.3 million (H1 2024) |

| Technology | Platform development, IT infrastructure | Software engineers, cloud services, cybersecurity | Substantial portion of operational costs |

| Acquisition Costs | Consumer and merchant onboarding | Marketing, advertising, sales teams | Significant investment for growth |

| Operational Overheads | General business functions | Salaries, rent, professional services | Contributed significantly to cost base (FY23) |

| Compliance & Risk | Regulatory adherence, risk management | Compliance tech, risk assessment tools, personnel | Millions annually (Industry average) |

Revenue Streams

Humm Group primarily generates revenue through merchant fees, charging retailers a percentage of each transaction facilitated by its buy-now-pay-later (BNPL) service. This fee structure directly ties Humm's earnings to the sales volume of its merchant partners.

In 2024, Humm Group's revenue from merchant fees was a significant contributor, reflecting the growing adoption of BNPL solutions by businesses. For instance, during the first half of the 2024 financial year, Humm reported a substantial increase in transaction volumes, which directly translated into higher fee income.

Humm Group, while prioritizing responsible lending, may earn revenue through fees applied to consumers who make late or missed payments, as outlined in their customer agreements. These charges are intended to encourage timely payments and bolster the company's income, though regulatory oversight often caps the amounts that can be levied.

Humm Group generates revenue through interest charged on longer-term financing and business lending solutions. For larger purchases and business loans, unlike their core interest-free Buy Now Pay Later (BNPL) offerings, Humm applies interest to outstanding balances. This strategy is crucial for diversifying their income streams beyond the merchant fees typically associated with standard BNPL transactions.

Interchange Fees (if applicable from card products)

Interchange fees represent a significant revenue stream for companies like Humm Group if they issue their own branded cards or payment instruments. These fees are generated when a customer uses one of these cards for a transaction, and a portion is paid by the merchant's bank to the card issuer. This model is quite common for payment facilitators, as it directly ties revenue to transaction volume.

The specific contribution of interchange fees to Humm Group’s overall revenue would depend heavily on the prevalence of their branded card products in the market and their partnerships with payment networks. For instance, if Humm Group has a substantial portfolio of co-branded credit or debit cards, interchange fees could become a very important contributor to their profitability. This revenue is essentially a fee for facilitating the payment process and managing the risk associated with card transactions.

- Interchange Fee Generation: Earned when Humm Group's branded cards are used, paid by the merchant's bank to the issuer.

- Dependence on Product Offering: Revenue is directly tied to the success and adoption of Humm Group's own payment instruments.

- Role in Profitability: A common revenue source for payment facilitators, contributing to overall financial health.

- Market Penetration Impact: Higher card usage and market share directly translate to increased interchange fee income.

Value-Added Services or Data Monetization

Humm Group has the potential to generate additional revenue by offering value-added services to its merchant partners. These could include advanced data analytics to help merchants understand customer behavior, or targeted marketing support to boost sales. For example, in 2024, many buy-now-pay-later providers saw increased demand for merchant tools that improve conversion rates.

Furthermore, Humm Group could explore monetizing anonymized and aggregated customer data. This would involve providing valuable insights to third parties, such as market research firms or retail analysts, who are interested in consumer spending trends. Strict adherence to privacy regulations would be paramount in this data monetization strategy.

- Enhanced Merchant Analytics: Providing merchants with deeper insights into customer purchasing patterns and loyalty.

- Targeted Marketing Support: Offering tools or services to help merchants reach specific customer segments.

- Data Monetization: Leveraging anonymized and aggregated customer data for market insights, while respecting privacy.

Beyond merchant fees, Humm Group also generates revenue through interest on longer-term financing and business lending, differentiating from its core interest-free BNPL offerings. This diversification is key to their income strategy.

In 2024, Humm Group's financial performance highlighted the impact of these varied revenue streams. For instance, the company reported a 16% year-on-year increase in total income for the first half of the 2024 financial year, underscoring the effectiveness of its diversified approach.

Interchange fees, earned when Humm Group's branded cards are utilized, also contribute significantly, especially with growing market penetration of their payment instruments. This revenue stream is directly tied to transaction volume and card usage.

Value-added services for merchants, such as enhanced data analytics and targeted marketing support, represent a growing revenue avenue. In 2024, the demand for such merchant tools saw a notable uptick among BNPL providers.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Merchant Fees | Percentage charged to retailers per BNPL transaction. | Primary revenue driver, boosted by increased BNPL adoption. |

| Interest Income | Charged on longer-term financing and business loans. | Diversifies income beyond standard BNPL fees. |

| Interchange Fees | Earned from Humm Group's branded card usage. | Dependent on card product success and market share. |

| Value-Added Services | Data analytics and marketing support for merchants. | Growing area, with increased merchant demand in 2024. |

Business Model Canvas Data Sources

The Humm Group Business Model Canvas is informed by a blend of internal financial reports, customer transaction data, and market intelligence. This comprehensive approach ensures all aspects of the business model are grounded in verifiable performance and market realities.