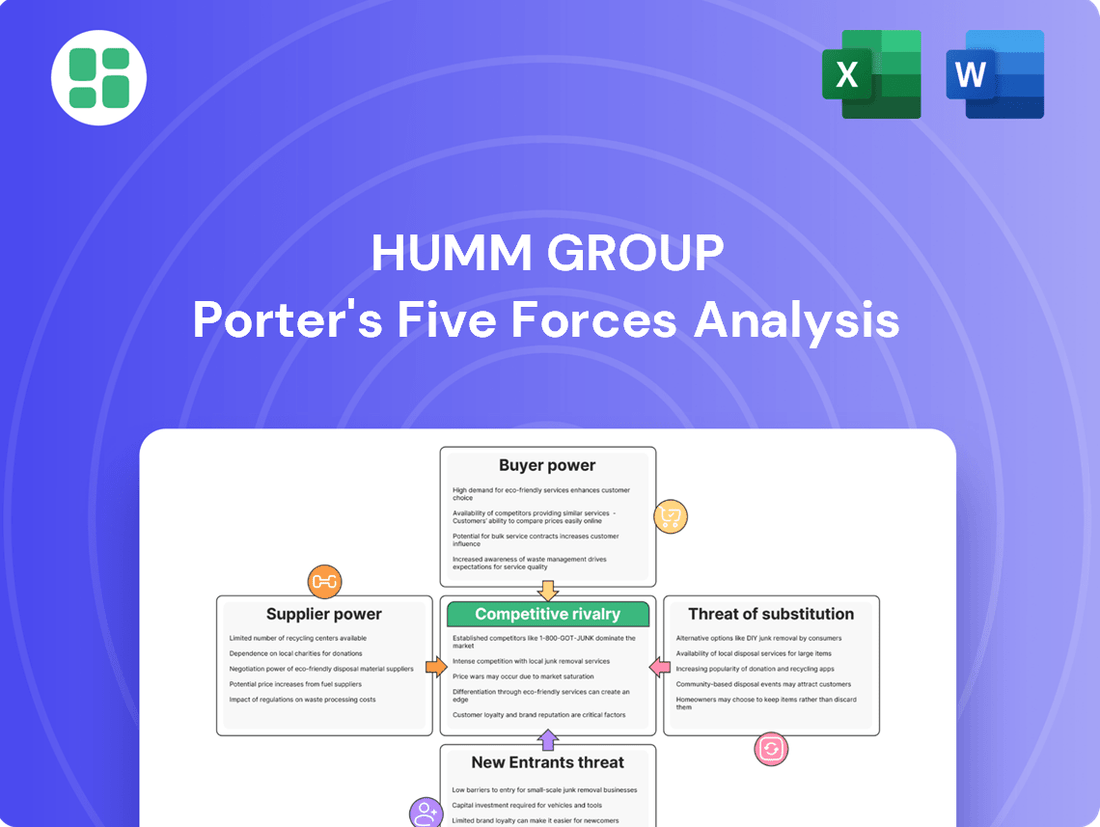

Humm Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humm Group Bundle

Humm Group operates in a dynamic financial services landscape, where understanding the competitive forces at play is crucial for success. Our Porter's Five Forces analysis delves into the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats posed by new entrants and substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Humm Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Humm Group's funding providers, including wholesale debt facilities and warehouse capacity, generally have moderate bargaining power due to the company's diversified funding strategy. This diversification means Humm isn't beholden to any single provider, lessening individual leverage.

In 2024, the cost of funding for companies like Humm remains sensitive to macroeconomic factors. For instance, increases in benchmark interest rates, such as the RBA cash rate, directly influence the cost of borrowing, potentially increasing Humm's expenses even with diverse funding sources.

Humm Group, like many financial services firms, relies heavily on technology and software providers for critical functions such as payment processing, data analytics, and overall operational infrastructure. The company's strategic move towards modernizing its IT platforms, including adopting cloud-hosted services, highlights this dependence. In 2024, the fintech landscape continues to evolve rapidly, with specialized software and data solutions becoming increasingly sophisticated.

This reliance can grant these suppliers a degree of bargaining power, especially when their solutions are highly specialized or present significant switching costs for Humm Group. For instance, a provider of unique fraud detection software or a proprietary data analytics platform could command stronger terms if Humm Group finds it challenging or expensive to migrate to an alternative. The increasing demand for robust cybersecurity and advanced AI-driven analytics in financial services further amplifies the leverage of suppliers offering these niche capabilities.

Data and credit bureau providers hold a moderate level of bargaining power over Humm Group. This is because access to comprehensive and accurate credit data is absolutely vital for Humm's ability to assess creditworthiness and manage risk effectively, particularly as new regulations mandate suitability assessments.

The essential nature of this information for responsible lending and minimizing credit losses means these providers are in a position to influence terms. For instance, in 2023, the global credit reporting market was valued at approximately $25.5 billion, highlighting the significant economic importance of these data sources.

Merchant Acquisition and Integration Partners

Humm Group's reliance on merchant acquisition and integration partners for its point-of-sale payment plans means these partners can wield some bargaining power. The complexity and cost of integrating Humm's services into different retail and e-commerce systems can influence the terms Humm negotiates. Larger merchants, in particular, may leverage their volume and technical capabilities to demand more favorable arrangements, potentially impacting Humm's profitability.

Humm Group actively works to manage this supplier power by cultivating a diverse network of channel partners and focusing on strong B2B relationships. This diversification reduces dependence on any single partner, thereby diluting individual bargaining leverage. For instance, in 2024, Humm Group reported a significant expansion of its merchant network, aiming to onboard thousands of new businesses across various sectors. This growth strategy is designed to provide Humm with a broader base of integration options, making it less susceptible to demands from any one large partner.

- Merchant Integration Effort: The technical demands of integrating Humm's payment solutions into diverse retail and e-commerce platforms can vary, influencing partner leverage.

- Partner Scale and Volume: Larger merchants with substantial transaction volumes often have greater capacity to negotiate better terms with Humm.

- Humm's Diversification Strategy: By onboarding a wide array of channel partners, Humm mitigates the risk of over-reliance on a few key integration providers.

- B2B Relationship Focus: Humm's commitment to strong business-to-business relationships aims to foster collaborative partnerships rather than purely transactional ones, potentially softening bargaining dynamics.

Marketing and Customer Acquisition Service Providers

While not traditional suppliers of raw materials, marketing and customer acquisition service providers are crucial for Humm Group’s ability to connect with its target consumer and business audiences. The efficiency and expense associated with these services, especially in a crowded marketplace, directly impact Humm's capacity for customer expansion and overall profitability. For instance, in 2023, the digital advertising market saw significant shifts, with cost-per-acquisition (CPA) metrics fluctuating based on platform and campaign type, directly affecting companies like Humm that rely on these channels.

Humm Group’s strategic focus on enhancing its customer-facing capabilities underscores the importance of these partnerships. The company's investments in technology and data analytics aim to optimize marketing spend and improve customer engagement, thereby mitigating the bargaining power of service providers by demonstrating value and seeking performance-based agreements.

- Marketing Service Costs: Fluctuations in digital ad spend and agency fees can impact Humm's customer acquisition costs.

- Effectiveness of Channels: The ability of marketing partners to deliver qualified leads and conversions is paramount.

- Strategic Partnerships: Humm's investments in customer acquisition technology aim to reduce reliance on costly external services.

- Market Competition: A competitive landscape for marketing services can potentially moderate their pricing power.

Humm Group's bargaining power with its suppliers is influenced by several factors, including the essential nature of their services, the cost of switching, and the overall market concentration of these providers.

For technology and software providers, Humm's dependence on specialized solutions like fraud detection or data analytics can grant these suppliers leverage, especially given the high switching costs. Similarly, data and credit bureau providers hold moderate power due to the critical need for accurate credit information in Humm's lending operations; the global credit reporting market's substantial valuation in 2023 underscores this importance.

Merchant integration partners also possess some bargaining power, particularly larger merchants with significant transaction volumes, who can negotiate more favorable terms. Humm mitigates this by diversifying its merchant network, aiming to onboard thousands of new businesses in 2024 to reduce reliance on any single partner.

Marketing and customer acquisition service providers' power is tied to the efficiency and cost of their services in a competitive market. Humm aims to manage this by optimizing its marketing spend and seeking performance-based agreements.

| Supplier Category | Bargaining Power Level | Key Influencing Factors | 2024/Recent Data Insight |

|---|---|---|---|

| Funding Providers | Moderate | Diversified funding strategy, macroeconomic sensitivity | Interest rate hikes in 2024 impact borrowing costs. |

| Technology & Software Providers | Moderate to High | Specialized solutions, high switching costs, demand for advanced capabilities | Increasing demand for AI-driven analytics in fintech. |

| Data & Credit Bureaus | Moderate | Essentiality of data for risk assessment, regulatory mandates | Global credit reporting market valued at ~$25.5 billion in 2023. |

| Merchant Integration Partners | Moderate | Technical integration effort, partner scale and transaction volume | Humm's 2024 strategy to onboard thousands of new merchants. |

| Marketing & Acquisition Services | Moderate | Cost of services, effectiveness of channels, market competition | Digital ad CPA metrics fluctuated in 2023. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Humm Group's position in the buy now, pay later and consumer finance sectors.

Humm Group's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive forces, perfect for quick, informed decision-making and pain point relief.

Customers Bargaining Power

Individual Buy Now, Pay Later (BNPL) consumers, especially younger ones, are drawn to the flexibility and interest-free nature of these payment plans, alongside intuitive digital interfaces. Their influence is significant, given the crowded BNPL market and the existence of other credit avenues. For instance, in 2024, BNPL usage continued its upward trend, with a substantial portion of Gen Z and Millennials utilizing these services for everyday purchases, indicating a strong demand for such payment flexibility.

Small to Medium Enterprises (SMEs) represent a significant customer base for Humm Group's business financing and point-of-sale finance solutions. Their bargaining power is shaped by the availability of alternative lending options, including traditional banks which are increasingly offering more flexible and accessible financing. For instance, in 2024, the SME lending market saw continued growth, with fintech lenders capturing a notable share, intensifying competition.

Humm Group aims to mitigate this customer bargaining power by emphasizing its differentiated service proposition. Factors like speed to decision in commercial asset finance and tailored solutions are crucial for customer retention. The ability to offer quicker approvals compared to traditional institutions can significantly reduce the incentive for SMEs to seek out competitors, thereby strengthening Humm's position.

Merchants act as customers for Humm Group by integrating their Buy Now Pay Later (BNPL) services to boost sales and customer acquisition. Their bargaining power is considered moderate. While they can switch between various BNPL providers, the significant revenue uplift and improved conversion rates offered by BNPL solutions can foster a degree of reliance on these platforms. Humm actively works to cultivate strong partnerships with these crucial channel partners.

Increased Regulatory Protections for Consumers

New Australian regulations, set to take effect in June 2025, mandate that Buy Now Pay Later (BNPL) providers like Humm Group must obtain credit licenses. This means they will be subject to responsible lending obligations, including conducting thorough suitability assessments for consumers and adhering to fee caps. These changes are designed to offer consumers greater protection.

These enhanced consumer protections directly bolster the bargaining power of customers. With stronger safeguards against unsuitable credit products and the potential for excessive charges, consumers are in a more empowered position when engaging with BNPL services.

- Increased Consumer Choice: Greater regulatory oversight can lead to more transparent and fair product offerings, allowing consumers to more easily compare and select services that best meet their needs.

- Reduced Information Asymmetry: Mandatory disclosures and suitability assessments ensure consumers are better informed about the terms and risks associated with BNPL products, leveling the playing field.

- Potential for Lower Costs: Fee caps and responsible lending obligations can limit the overall cost of credit for consumers, making BNPL services more attractive and affordable.

- Enhanced Recourse: Stronger regulatory frameworks often provide consumers with clearer avenues for dispute resolution and recourse if they encounter issues with a BNPL provider.

Access to Consumer Data Right (CDR)

The expansion of Australia's Consumer Data Right (CDR) to non-bank lending and Buy Now Pay Later (BNPL) products, slated for mid-2026, is set to significantly bolster consumer bargaining power. This initiative grants individuals greater control and transparency over their financial data, allowing for easier comparison and switching between providers.

This increased data portability directly enhances the bargaining power of customers. For instance, as of early 2024, the Australian Competition and Consumer Commission (ACCC) reported that over 120 accredited data recipients were active under the CDR, indicating a growing ecosystem where data-driven comparisons become more prevalent.

- Increased Data Transparency: Consumers will have a clearer view of their financial obligations and available options.

- Easier Provider Switching: Simplified data sharing facilitates switching to more competitive BNPL or lending services.

- Enhanced Comparison Capabilities: Customers can leverage their data to find better rates and terms.

The bargaining power of customers for Humm Group is influenced by both individual consumers and merchants. Individual BNPL users, particularly younger demographics, value flexibility and interest-free options, a demand evident in 2024's continued BNPL usage growth among Gen Z and Millennials. Merchants, as Humm's clients, possess moderate power due to the availability of alternative BNPL providers, though the revenue benefits of these services can create some reliance.

Upcoming Australian regulations, effective June 2025, will mandate credit licenses for BNPL providers, imposing responsible lending obligations and fee caps. This directly strengthens customer bargaining power by increasing consumer protection and reducing information asymmetry. Furthermore, the planned expansion of Australia's Consumer Data Right (CDR) to BNPL products by mid-2026 will grant consumers greater data control, facilitating easier comparison and switching between providers, thereby enhancing their leverage.

| Customer Segment | Bargaining Power Factor | Impact on Humm Group |

|---|---|---|

| Individual BNPL Users | Demand for flexibility, interest-free options; availability of alternatives | Moderate to High; increased choice and regulatory protection empower users. |

| Merchants (BNPL Clients) | Availability of competing BNPL providers; revenue uplift from BNPL integration | Moderate; reliance on BNPL benefits can temper switching incentives. |

| SMEs (Business Finance Clients) | Access to alternative lending options (banks, fintechs) | Moderate to High; intensified competition in SME lending impacts Humm's pricing and terms. |

Preview Before You Purchase

Humm Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Humm Group, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering actionable insights into the industry's dynamics.

Rivalry Among Competitors

The Australian Buy Now, Pay Later (BNPL) landscape is fiercely contested. Humm Group faces significant pressure from dominant players such as Afterpay and Zip Co, who collectively command a substantial portion of the market. This intense competition necessitates constant adaptation and strategic maneuvering to maintain relevance and market share.

This rivalry is fueled by aggressive marketing campaigns, a relentless pursuit of product innovation, and a strong emphasis on crafting personalized customer journeys. For instance, Afterpay's continued expansion into new markets and Zip Co's strategic partnerships demonstrate the ongoing efforts by these established players to capture and retain customers, directly impacting Humm Group's growth potential.

Traditional financial institutions are stepping up their game against Buy Now, Pay Later (BNPL) providers. Many banks are either launching their own BNPL services or bolstering existing credit card and personal loan options to directly challenge fintech newcomers. This move intensifies competition by leveraging established customer relationships and robust regulatory frameworks.

Humm Group's strategic diversification across consumer and commercial finance, including credit cards, significantly dilutes the impact of intense rivalry. By operating in multiple geographies such as Australia, New Zealand, Ireland, Canada, and the UK, the company spreads its risk and avoids over-reliance on any single market segment. This broad operational footprint allows Humm Group to leverage its strengths in different regions and product categories, thereby softening the blow of competition.

Focus on Profitability and Cost Management

Humm Group is keenly focused on profitability and rigorous cost management to navigate intense competitive rivalry. This strategy involves driving operational efficiencies and implementing tighter credit settings to bolster financial health.

By prioritizing these areas, Humm Group aims to maintain a robust financial standing even when facing significant market pressures and competition.

- Profitability Focus: Humm Group's strategy centers on enhancing profitability through improved operational efficiency and cost control.

- Cost Management: The company actively pursues prudent cost management initiatives to strengthen its financial position.

- Credit Settings: Humm Group has tightened its credit settings as part of its approach to managing risk and improving financial performance.

- Market Resilience: This strategic focus is designed to ensure Humm Group remains financially sound amidst a highly competitive landscape.

Regulatory Changes Leveling the Playing Field

New regulations in Australia are significantly impacting the Buy Now, Pay Later (BNPL) sector, aiming to create a more equitable competitive landscape. As of late 2024, the requirement for BNPL providers to obtain credit licenses and adhere to responsible lending obligations, similar to traditional lenders, is a major shift. This move is designed to impose comparable compliance burdens across all market participants.

These regulatory changes are anticipated to foster consolidation within the industry. Smaller BNPL operators, potentially lacking the resources to meet the increased compliance demands, may find it challenging to continue independently. This could lead to mergers or acquisitions, thereby reducing the number of players and potentially curbing some of the more aggressive, high-risk competitive strategies previously observed in the market.

- Credit Licensing: BNPL providers now need Australian Credit Licence (ACL) to operate.

- Responsible Lending: Obligations include assessing borrower's financial situation and suitability of the credit.

- Market Impact: Expect increased compliance costs for all BNPL firms.

- Industry Consolidation: Smaller players may struggle with new regulatory requirements, potentially leading to market consolidation.

Humm Group faces intense rivalry from established BNPL players like Afterpay and Zip Co, alongside traditional banks entering the space. This competition drives innovation and customer acquisition efforts, forcing Humm to focus on profitability and cost management. New Australian regulations requiring credit licenses and responsible lending obligations for BNPL providers, effective late 2024, are expected to increase compliance costs and potentially lead to industry consolidation, thereby altering the competitive landscape.

| Competitor | Market Share (Estimated 2024) | Key Strategies |

|---|---|---|

| Afterpay | ~40-50% (Australia) | Global expansion, merchant partnerships, loyalty programs |

| Zip Co | ~20-30% (Australia) | Acquisitions (e.g., Sezzle), diverse product offerings, international growth |

| Traditional Banks (e.g., CommBank, Westpac) | Increasing presence | Launching own BNPL solutions, enhancing credit card features |

SSubstitutes Threaten

Traditional credit cards and personal loans represent a substantial threat of substitution for Humm Group's buy now, pay later (BNPL) and installment payment services. These established financial products offer alternative ways for consumers to manage purchases and access credit, potentially diverting customers away from Humm's offerings.

While BNPL solutions like Humm's often emphasize interest-free installment payments, credit cards provide a revolving credit facility and can include attractive loyalty programs and rewards. This differentiation means that consumers seeking different benefits, such as ongoing credit access or travel points, might opt for credit cards instead of BNPL for their purchases.

Personal loans also serve as a substitute, particularly for larger purchases where consumers might prefer a fixed repayment schedule over a longer term than typically offered by BNPL. For instance, in 2024, the average personal loan interest rate hovered around 10-12%, a figure that, while carrying interest, might be perceived as more manageable for certain debt amounts compared to the shorter repayment cycles of some BNPL products.

For consumers, the most basic substitute for any form of credit, including Buy Now Pay Later (BNPL) services offered by companies like Humm Group, is simply saving up to make a purchase outright. This approach bypasses debt and interest entirely, making it an attractive option for individuals who prioritize financial discipline and avoiding borrowing costs. In 2024, with ongoing economic uncertainties, a significant portion of consumers are expected to lean more heavily on savings.

Traditional lay-by systems, where customers pay in installments and receive goods only after the final payment, represent a direct substitute for Buy Now, Pay Later (BNPL) services like those offered by Humm Group. These methods, often managed in-house by retailers, bypass the need for third-party financing, potentially reducing customer acquisition costs for the retailer and offering a simpler payment structure for consumers. For example, many smaller independent retailers continue to offer lay-by as a core payment option, particularly for higher-value items, catering to a segment of the market that may be wary of credit or prefer a more controlled payment process.

Direct Debit and Account-to-Account Payments

The increasing prevalence of real-time payments and direct account-to-account (A2A) transactions presents a significant threat of substitutes for humm group's buy now, pay later (BNPL) services. These methods allow consumers and businesses to settle payments instantly and efficiently, often bypassing the need for credit facilities and associated fees.

While A2A payments aren't a direct replacement for longer-term installment plans, they can diminish the demand for short-term financing for immediate purchases. For instance, a consumer looking to buy a product might opt for an instant A2A payment if the funds are available, rather than spreading the cost over several months via BNPL.

The growth in this area is substantial. By the end of 2023, A2A payment volumes globally were projected to reach trillions of dollars, with continued strong growth expected through 2024 and beyond. This shift signifies a fundamental change in payment behavior, favoring speed and direct fund transfer over credit-based solutions.

- Direct Debit and Account-to-Account (A2A) Payments: Growing rapidly as alternatives to traditional credit and installment payment methods.

- Reduced Need for Short-Term Financing: A2A payments can bypass the necessity for immediate credit, impacting BNPL demand for smaller, instant purchases.

- Efficiency and Cost Savings: These methods offer faster settlement and often lower transaction costs for both consumers and merchants.

- Market Penetration: A2A payment adoption is increasing across various sectors, indicating a broader consumer and business acceptance of these payment rails.

Emerging Fintech Lending Alternatives

The threat of substitutes for Humm Group is amplified by the burgeoning fintech lending sector in Australia. These emerging alternatives are rapidly gaining traction by offering streamlined digital experiences and competitive pricing, directly challenging traditional lending models.

Fintech lenders are particularly adept at catering to small and medium-sized enterprises (SMEs), a key demographic for Humm. For instance, in 2023, the Australian fintech sector saw significant growth, with alternative lending platforms processing billions in loans, often with approval times measured in hours rather than days.

- Faster Processing: Fintech solutions often leverage advanced algorithms for credit assessment, drastically reducing loan approval times compared to conventional banks.

- Simplified Applications: Online-first platforms offer user-friendly interfaces and minimal paperwork, making the borrowing process more accessible.

- Competitive Rates: Lower overheads and efficient operations allow many fintech lenders to offer attractive interest rates and flexible repayment terms.

This continuous innovation means new substitute products are constantly entering the market, forcing established players like Humm to adapt or risk losing market share to more agile competitors.

The threat of substitutes for Humm Group's BNPL services is significant, with traditional credit cards and personal loans offering established alternatives. While BNPL often touts interest-free periods, credit cards provide revolving credit and rewards, appealing to different consumer needs. Personal loans, especially for larger purchases, offer fixed, longer-term repayment structures, which might be preferred by some over BNPL's shorter cycles. For example, in 2024, personal loan rates averaged around 10-12%, presenting a different cost-benefit analysis for consumers.

Beyond traditional credit, consumers can opt to save for purchases, bypassing debt and interest entirely. This "pay now with savings" approach gained traction in 2024 amidst economic uncertainties. Furthermore, lay-by systems, often managed by retailers themselves, offer a debt-free installment option, appealing to those wary of credit or preferring a simpler, controlled payment process.

The rise of real-time payments and direct account-to-account (A2A) transactions also poses a threat, diminishing the need for short-term financing for immediate purchases. A2A payment volumes are projected to continue their strong growth through 2024, reflecting a shift towards faster, direct fund transfers over credit-based solutions. This evolving payment landscape, coupled with the rapid growth of agile fintech lenders in Australia, presents a dynamic competitive environment for Humm Group.

| Substitute Type | Key Features | Consumer Appeal | 2024 Market Context |

|---|---|---|---|

| Credit Cards | Revolving credit, rewards programs, loyalty points | Ongoing credit access, travel benefits | Widely adopted, competitive interest rates |

| Personal Loans | Fixed repayment schedules, longer terms | Predictable budgeting for larger purchases | Average interest rates ~10-12% |

| Savings | No debt, no interest | Financial discipline, avoidance of borrowing costs | Increasingly favored due to economic uncertainty |

| Lay-by Systems | Retailer-managed installments, goods after final payment | Debt-free, controlled payment process | Offered by independent retailers for higher-value items |

| A2A Payments | Instantaneous, direct fund transfer | Speed, efficiency, bypasses credit needs for immediate purchases | Trillions in global volume by end of 2023, strong ongoing growth |

| Fintech Lending | Streamlined digital experience, fast approvals | Accessibility, competitive pricing for SMEs | Billions processed in Australia in 2023, hours for approvals |

Entrants Threaten

The upcoming Australian Buy Now Pay Later (BNPL) legislation, set to take effect in June 2025, introduces a significant barrier for potential new entrants. All BNPL providers will be mandated to obtain an Australian credit licence and adhere to stringent responsible lending obligations.

This regulatory shift dramatically elevates the compliance costs and operational complexity for any new company looking to enter the Australian BNPL market. The need for licensing and robust responsible lending frameworks creates substantial hurdles, effectively deterring many new players.

Establishing a financial services company, especially one involved in lending like Humm Group, demands significant upfront capital. This capital is needed not only for building the initial lending portfolio but also for investing in robust technology infrastructure and covering ongoing operational expenses. For instance, many fintech startups in Australia struggle to secure the necessary seed funding, with venture capital investment in the Australian fintech sector seeing fluctuations, though it remained a key area of interest in 2024.

Established players like Humm Group leverage significant brand recognition and customer trust, making it difficult for newcomers to gain traction. In 2024, a significant portion of consumers still gravitate towards well-known financial services providers, viewing them as more secure and reliable.

New entrants must invest heavily in marketing and customer acquisition to build a comparable level of trust and awareness. This often translates to higher initial operating costs and a longer path to profitability compared to incumbents with established customer loyalty.

Technological Investment and Platform Modernization

Developing and maintaining cutting-edge technology platforms requires significant capital outlay, acting as a barrier for potential new entrants in the fintech space. Humm Group's commitment to IT modernization, evidenced by its continued investment in platform upgrades, raises the ante for newcomers who must establish comparable technological infrastructure. For instance, in the fiscal year 2024, Humm Group continued its strategic investments in technology to enhance customer experience and operational efficiency, aiming to solidify its competitive edge.

The substantial cost associated with building and maintaining secure, scalable, and user-friendly technology platforms presents a considerable hurdle for new companies entering the market. Humm Group's ongoing expenditure on platform modernization establishes a high benchmark that prospective entrants must meet or exceed.

- Significant Capital Investment: Fintechs need substantial funds for platform development, security, and ongoing maintenance.

- Technological Sophistication: Humm Group's advanced platforms require new entrants to replicate or surpass this complexity.

- Competitive Edge: Modernized platforms offer better user experience and operational efficiency, a difficult standard for startups to achieve quickly.

- Regulatory Compliance: Ensuring platforms meet stringent financial regulations adds another layer of cost and complexity for new players.

Merchant Network and Ecosystem Integration

Humm Group has cultivated an extensive network of merchant partners spanning retail, solar, health, and home improvement sectors. This broad reach presents a significant barrier for new entrants. For instance, as of early 2024, Humm reported a substantial number of active merchants, indicating a deeply embedded presence within various consumer spending ecosystems.

Establishing a comparable merchant network and achieving seamless integration into diverse retail and service ecosystems requires substantial capital investment and considerable time. New entrants would face the challenge of replicating Humm's established relationships and the trust built over years of operation. This integration effort is crucial for offering a competitive buy now, pay later (BNPL) solution that is readily accessible to consumers at the point of sale.

- Extensive Merchant Network: Humm Group's established presence across multiple industries creates a significant hurdle for new competitors.

- Ecosystem Integration Costs: New entrants must invest heavily to build similar merchant relationships and integrate their services into existing retail and service platforms.

- Competitive Landscape: The difficulty in replicating Humm's network means new players face fierce competition to gain market share.

- Consumer Trust and Accessibility: Overcoming Humm's established consumer trust and ensuring widespread accessibility at checkout points are critical challenges for newcomers.

The upcoming Australian BNPL legislation, effective June 2025, mandates licensing and responsible lending, significantly raising barriers for new entrants by increasing compliance costs and operational complexity.

High capital requirements for technology, operations, and customer acquisition, coupled with the need to build brand trust, pose substantial challenges for newcomers aiming to compete with established players like Humm Group.

Humm Group's extensive merchant network, built over years, is a formidable obstacle for new entrants, requiring significant investment and time to replicate the same level of ecosystem integration and consumer accessibility.

| Factor | Humm Group's Position | Impact on New Entrants |

|---|---|---|

| Regulatory Compliance (from June 2025) | Prepared for Australian credit licensing and responsible lending obligations. | Significant upfront investment and operational complexity required to meet new standards. |

| Capital Investment Needs | Established capital base for technology, operations, and brand building. | Requires substantial seed funding for platform development, security, and marketing to gain market share. |

| Merchant Network Strength | Broad network across retail, solar, health, and home improvement sectors. | Difficulty in replicating Humm's deep integration and trust, demanding considerable time and resources. |

| Customer Trust & Brand Recognition | High consumer trust and awareness in 2024. | New entrants must invest heavily in marketing to build comparable trust and attract customers. |

Porter's Five Forces Analysis Data Sources

Our Humm Group Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Humm Group's annual reports, investor presentations, and financial statements. We also integrate insights from industry-specific market research reports and reputable financial news outlets to capture the competitive landscape.