Humana PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humana Bundle

Navigate the complex external landscape impacting Humana with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping the healthcare industry and Humana's strategic direction. Gain a crucial competitive advantage by leveraging these expert-driven insights. Download the full PESTLE analysis now to unlock actionable intelligence and refine your market strategy.

Political factors

Humana's significant involvement in government-sponsored healthcare programs like Medicare and Medicaid makes it acutely sensitive to shifts in healthcare legislation. The final Medicare Advantage rate notice for 2025, for instance, prompted Humana to revise its growth forecasts downward, signaling potential adjustments to plan benefits and market presence.

Furthermore, the Inflation Reduction Act's provisions, including the capping of out-of-pocket prescription drug costs and the elimination of the Medicare Part D 'donut hole' effective in 2025, directly affect Humana's financial liabilities and the cost burden for its beneficiaries.

Government funding for Medicare Advantage plans is a critical political factor for Humana. The Centers for Medicare & Medicaid Services (CMS) announced a 0.16% decrease in the benchmark rate for Medicare Advantage in 2025, a move that fell below industry expectations and prompted Humana to review its pricing strategies.

Humana's Medicare Advantage Star Ratings experienced a significant drop for the 2025 measurement year. This decline could adversely affect the company's 2026 quality bonus payments from CMS, impacting future financial results, even as Humana contests these rating outcomes in legal proceedings.

Humana, like other major health insurers, operates under intense regulatory oversight, especially concerning market concentration and potential antitrust violations. For instance, the Biden administration's focus on increasing antitrust enforcement in various sectors, including healthcare, signals a heightened risk of investigations and potential challenges to mergers or acquisitions. This environment necessitates careful navigation of compliance and competition laws.

Shifts in healthcare policy, such as those potentially arising from legislative debates in 2024 and 2025 regarding Medicare Advantage or prescription drug pricing, could significantly alter Humana's operating landscape. For example, proposed changes to payment models for Medicare Advantage plans, which represent a substantial portion of Humana's revenue, could directly impact profitability and require strategic adaptation of its offerings.

Humana's substantial reliance on government-sponsored programs, particularly Medicare and Medicaid, exposes it to rigorous governmental audits and investigations. In 2023, the Centers for Medicare & Medicaid Services (CMS) continued its audits of Medicare Advantage plans, and any findings of non-compliance could lead to financial penalties or restrictions on future contract awards, impacting revenue streams.

State-Level Healthcare Initiatives

Beyond federal regulations, state-level healthcare initiatives and specific contracts for programs like Medicaid play a crucial role in shaping Humana's business landscape. These state-specific policies can significantly impact Humana's operational strategies and financial performance.

Humana is actively pursuing growth in the Medicaid sector, evidenced by its new Virginia Medicaid contract commencing in July 2025. This expansion is expected to unlock substantial new revenue streams and market penetration opportunities for the company.

However, Humana must also contend with the complexities of state-specific rate adjustments and potential financial discrepancies within its Medicaid operations. Successfully managing these state-level financial dynamics is key to sustained profitability in this segment.

- State Medicaid Contracts: Humana's strategic expansion into state Medicaid programs, such as the new Virginia contract in July 2025, represents a significant growth avenue.

- Rate Adjustments: Navigating varying state-level reimbursement rate adjustments presents a key challenge, potentially impacting revenue predictability.

- Operational Alignment: Ensuring operational alignment with diverse state healthcare mandates is critical for efficient service delivery and compliance.

Political Stability and Election Cycles

The broader political landscape and upcoming election cycles in the United States, particularly the 2024 presidential election and subsequent congressional races, introduce significant uncertainty for healthcare policy. Discussions around expanding government-sponsored healthcare, such as 'Medicare for All' or other universal coverage models, could fundamentally alter the operating environment for private health insurers like Humana.

While a full transition to 'Medicare for All' is not anticipated in the immediate term, potential policy shifts remain a key consideration. For instance, proposals to lower the Medicare eligibility age or expand Medicare Advantage plans could directly influence Humana's market share and profitability.

Humana’s significant presence in Medicare Advantage, which served approximately 5.7 million Medicare Advantage members as of the end of the first quarter of 2024, makes it particularly sensitive to regulatory changes affecting this program.

- 2024 US Presidential Election: Heightened political debate around healthcare reform creates policy uncertainty.

- Medicare Advantage Sensitivity: Humana's large member base in Medicare Advantage makes it vulnerable to changes in program regulations and funding.

- Potential Policy Shifts: Discussions around lowering Medicare eligibility age or expanding benefits could impact Humana's competitive landscape.

Political factors significantly shape Humana's operations, particularly its deep ties to government healthcare programs. The company's substantial Medicare Advantage membership, around 5.7 million as of Q1 2024, makes it highly susceptible to legislative changes impacting Medicare. For example, the 2025 Medicare Advantage benchmark rate decrease of 0.16% announced by CMS directly influences Humana's revenue projections and strategic planning.

The Inflation Reduction Act's 2025 provisions, such as the cap on out-of-pocket prescription drug costs, directly affect Humana's financial obligations and member costs. Humana's recent decline in Medicare Advantage Star Ratings for the 2025 measurement year poses a risk to its 2026 quality bonus payments from CMS, underscoring the impact of regulatory performance metrics.

| Political Factor | Impact on Humana | Data/Example |

|---|---|---|

| Medicare Advantage Regulations | Revenue and Profitability | 0.16% benchmark rate decrease for 2025 |

| Inflation Reduction Act | Cost Burden and Financial Liability | 2025 cap on out-of-pocket drug costs |

| Star Ratings | Quality Bonus Payments | Decline in ratings for 2025 measurement year affecting 2026 payments |

| State Medicaid Contracts | Revenue Growth | New Virginia Medicaid contract starting July 2025 |

What is included in the product

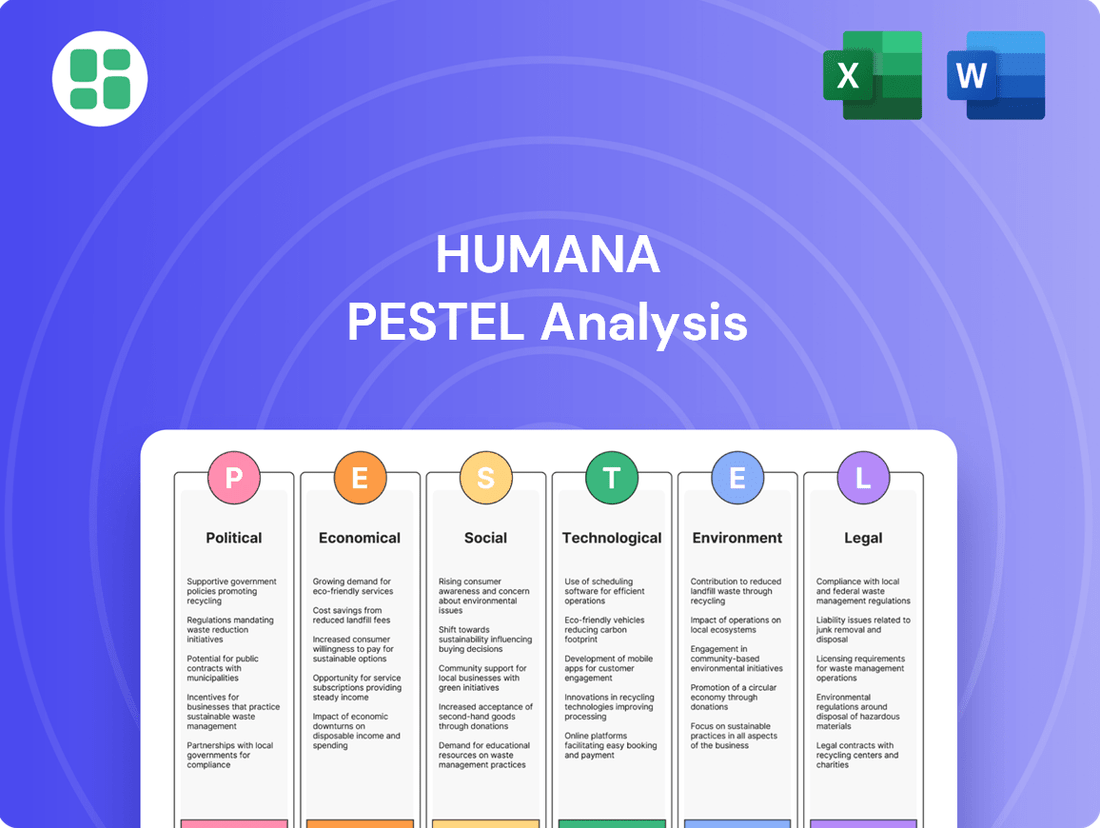

This Humana PESTLE analysis examines how external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions present both opportunities and threats.

It provides actionable insights for strategic decision-making by highlighting current trends and future implications specific to Humana's healthcare market.

The Humana PESTLE Analysis offers a streamlined, summarized version of complex external factors, serving as a crucial pain point reliever for busy executives needing quick insights for strategic decision-making.

Economic factors

Humana faces significant headwinds from rising medical costs and general inflation, directly impacting its profitability. For instance, the company cited unexpectedly high medical costs as a key factor affecting its 2024 financial results.

The outlook for 2025 is also challenged, with Humana stating that the announced Medicare Advantage rates were insufficient to counter the prevailing medical cost trends. This highlights the critical need for robust cost containment strategies.

To navigate this environment, Humana must focus on effective cost management and pursue strategic growth opportunities to ensure sustained profitability in the face of these economic pressures.

Consumer spending power, directly tied to economic conditions and employment rates, significantly impacts the demand for health insurance. While government programs offer a safety net, the market for supplemental and commercial plans remains sensitive to economic slowdowns, affecting affordability.

In the US, personal consumption expenditures saw a notable increase in early 2024, indicating underlying consumer confidence, though inflation rates continue to be a key consideration for household budgets. Humana's strategy to simplify healthcare navigation and reduce costs directly addresses these consumer sensitivities.

Fluctuations in interest rates directly influence Humana's investment income. For instance, a rising rate environment in 2024 could boost returns on Humana's fixed-income portfolio, positively impacting its overall financial performance. Conversely, a downturn in market conditions can lead to a decrease in the fair market value of its equity holdings.

Changes in the fair market value of publicly traded equity securities, a common occurrence in dynamic markets, can significantly affect Humana's reported earnings. For example, if market volatility in 2024 causes a substantial decline in the value of Humana's equity investments, this would negatively impact its consolidated pretax results and earnings per share, even if the underlying business operations remain strong.

Medicare Advantage Market Dynamics

The Medicare Advantage market is intensely competitive, forcing providers like Humana to constantly evaluate their pricing and benefit structures. Economic pressures, including evolving government reimbursement rates, directly impact profitability and strategic decisions. Humana's adjustments to its 2025 Medicare Advantage plans, such as potential benefit reductions or premium increases in certain regions, highlight these market dynamics.

These strategic shifts are driven by the need to ensure sustainable value creation amidst changing economic conditions. Humana's decision to exit specific unprofitable plans and counties in 2025 reflects a calculated response to rate adjustments and a portfolio rebalancing effort. This demonstrates how economic factors necessitate adaptive business strategies within the healthcare sector.

- Competitive Landscape: The Medicare Advantage market is characterized by numerous national and regional insurers vying for market share.

- Pricing Strategies: Insurers must balance competitive premiums with the cost of benefits and regulatory requirements.

- Rate Changes Impact: Government rate announcements, such as those affecting 2025 plans, directly influence insurer profitability and plan offerings.

- Portfolio Rebalancing: Companies like Humana are actively adjusting their geographic presence and product offerings to optimize financial performance.

Financial Performance and Guidance

Humana's financial performance is a key economic factor, with its revenue growth, earnings per share (EPS), and benefit ratio serving as vital indicators. The company demonstrated robust financial health in its Q1 2025 performance, surpassing analyst expectations for EPS.

Humana raised its full-year 2025 guidance for both adjusted EPS and revenue, signaling confidence in its operational strategies and market positioning. This upward revision reflects successful cost management and a strategic shift in its business focus, even as it navigated certain revenue challenges and a dip in GAAP EPS attributed to non-core financial items.

- Q1 2025 EPS Beat: Humana exceeded earnings per share forecasts for the first quarter of 2025.

- Raised Full-Year 2025 Guidance: The company increased its outlook for both adjusted EPS and revenue for the entirety of 2025.

- Strategic Rebalancing: Performance indicates effective cost control and strategic adjustments to improve financial outcomes.

- GAAP EPS Decline: A reduction in GAAP EPS was noted, primarily due to the impact of non-core financial items.

Economic headwinds, including persistent inflation and rising medical costs, continue to pressure Humana's profitability. For instance, the company cited higher-than-expected medical costs as a significant factor impacting its 2024 financial performance, and the 2025 Medicare Advantage rates were deemed insufficient to offset these trends.

Consumer spending power, influenced by employment and inflation, directly affects demand for health insurance. While government programs provide a baseline, commercial and supplemental plans are sensitive to economic slowdowns, impacting affordability and Humana's strategic focus on cost reduction and simplified navigation.

Humana's financial results demonstrate resilience and strategic adaptation. The company surpassed Q1 2025 EPS expectations and raised its full-year 2025 guidance for both adjusted EPS and revenue, reflecting effective cost management and a strategic shift, despite a noted dip in GAAP EPS due to non-core financial items.

| Metric | 2024 Impact | 2025 Outlook |

|---|---|---|

| Medical Costs | Higher than expected, impacting profitability. | Continued trend, challenging Medicare Advantage rates. |

| Consumer Spending | Personal consumption expenditures increased early 2024. | Sensitivity to inflation and affordability of supplemental plans. |

| Investment Income | Rising interest rates in 2024 could boost fixed-income returns. | Market volatility can impact equity holdings' fair market value. |

| Medicare Advantage Rates | Inadequate to counter medical cost trends for 2025. | Forcing adjustments to pricing, benefits, and geographic presence. |

| Financial Performance | Q1 2025 EPS beat expectations; Full-year 2025 guidance raised. | Strategic rebalancing and cost control driving improved outlook. |

Preview Before You Purchase

Humana PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Humana PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed understanding of the external forces shaping Humana's strategic landscape.

Sociological factors

The aging U.S. population is a significant driver for Humana, particularly with its emphasis on Medicare Advantage. This demographic trend means more seniors require specialized healthcare services, creating a natural demand for primary care tailored to older adults, home health solutions, and robust insurance plans designed for their needs.

Humana is actively responding to this by expanding its CenterWell Senior Primary Care centers. As of early 2024, the company operates over 250 such locations, aiming to provide integrated care and better health outcomes for the growing senior demographic, which is projected to see continued growth in the coming years.

Societal focus is increasingly shifting towards proactive health management and holistic well-being, a trend that perfectly complements Humana's integrated care approach. This growing emphasis on preventive health and personalized care is a significant driver for the company's strategic direction.

Humana's commitment to this shift is evident in its 2024 Impact Report, which details investments in preventive initiatives and efforts to enhance health outcomes through customized care plans. For example, the report notes a 15% increase in member participation in wellness programs year-over-year.

Looking ahead to 2025, Humana is doubling down on mental health support and expanding fitness benefits, recognizing these as crucial components of overall wellness. This forward-looking strategy aims to meet evolving consumer demands for comprehensive health solutions.

Humana recognizes that social determinants of health profoundly impact well-being, driving a strategic focus on community-level interventions. In 2024, Humana Healthy Horizons actively fostered partnerships and invested in healthcare infrastructure, aiming to improve access and address state-specific needs. A key initiative involved conducting over 423,000 SDOH screenings for its Medicaid members, gathering crucial data to inform targeted support.

Consumer Preferences for Digital Health

Consumers, especially older adults, are increasingly favoring digital health options like virtual doctor visits and online health management tools. This societal trend is reshaping how healthcare is accessed and delivered.

Humana is capitalizing on this by enhancing its digital offerings for Medicare beneficiaries. For instance, their user-friendly apps facilitate appointment scheduling, virtual consultations, and health tracking, streamlining care management and improving operational efficiency. In 2024, Humana reported a significant increase in digital engagement, with over 70% of its Medicare Advantage members utilizing at least one digital tool.

- Digital Health Adoption: A growing preference for virtual care and online health management among all age groups, notably seniors.

- Humana's Strategy: Leveraging technology to provide accessible and efficient care management through apps for scheduling, virtual visits, and health monitoring.

- Impact on Operations: Digital tools improve efficiency and member engagement, supporting Humana's mission to improve health outcomes.

- Market Trend: By 2025, it's projected that over 80% of healthcare interactions for Medicare recipients will involve digital touchpoints, underscoring the importance of Humana's digital investments.

Workforce Well-being and Talent Management

Attracting and retaining a skilled healthcare workforce is a significant societal challenge, particularly with projections indicating potential labor shortages in the coming years. Humana recognizes this and actively invests in its employees, aiming to cultivate a culture that prioritizes belonging and overall well-being. This focus extends to creating a supportive work environment that includes opportunities for professional development, which is essential for delivering high-quality patient care and ensuring operational efficiency.

Humana's commitment to its workforce is reflected in its talent management strategies. For instance, in 2023, the company reported a voluntary turnover rate of 18.5%, a figure they aim to reduce through enhanced employee engagement initiatives. They offer various programs designed to support employee health and career growth, including extensive training modules and tuition reimbursement, underscoring the importance of a healthy and motivated workforce for sustained success in the healthcare sector.

- Workforce Stability: Addressing potential healthcare worker shortages is a key societal concern impacting service delivery.

- Employee Investment: Humana prioritizes employee well-being and development to attract and retain talent.

- Positive Work Environment: Fostering a sense of belonging and offering growth opportunities are central to Humana's talent strategy.

- Operational Impact: A committed and skilled workforce is crucial for maintaining high-quality care and business performance.

Societal shifts towards preventative health and holistic well-being align perfectly with Humana's integrated care model, driving demand for its services. The company's 2024 Impact Report highlights a 15% year-over-year increase in member participation in wellness programs, underscoring this trend. By 2025, Humana is expanding mental health support and fitness benefits to meet evolving consumer expectations for comprehensive wellness solutions.

Technological factors

Humana is significantly boosting its investment in digital health and telemedicine, aiming to enhance patient access, care quality, and operational streamlining. For instance, the company's 2025 Medicare Advantage offerings are set to feature intuitive apps and online platforms, enabling seniors to better manage their health, book appointments, and engage in remote consultations with healthcare professionals.

Telemedicine and remote monitoring are recognized as vital components for supporting independent living among the elderly and ensuring uninterrupted healthcare delivery. Humana's commitment is underscored by its strategic focus on these technologies to bridge geographical gaps and provide more convenient, patient-centric care solutions.

Artificial Intelligence (AI) is a transformative technological force for Humana, poised to elevate customer service, deepen clinical understanding, and streamline operations. Humana's CenterWell initiative is actively investigating roughly 20 distinct AI applications. These include ambient AI designed to alleviate clinician burnout and AI-powered tools for improving patient engagement concerning prescription adherence. Furthermore, pilots are underway in home health and call centers to leverage AI for guiding agents towards more effective patient interactions.

Humana is also strategically employing AI to optimize its prior authorization procedures. This integration has demonstrably led to substantial reductions in administrative expenses and a notable decrease in denial rates, showcasing AI's tangible impact on efficiency and cost management.

Humana is heavily investing in data analytics to unlock deeper clinical insights and enhance its population health management strategies. This focus allows for more personalized patient care, a critical differentiator in today's healthcare landscape.

The company recognizes the immense potential of interoperability, aiming to streamline information exchange across the healthcare ecosystem. By simplifying and automating data sharing, Humana anticipates significant value creation for physicians, facilitating faster access to patient records and reducing the need for redundant procedures.

Interoperability solutions are projected to save physicians valuable time and reduce healthcare costs by minimizing errors and improving diagnostic accuracy. For instance, estimates suggest that improved data sharing could reduce administrative burdens by up to 20% for healthcare providers.

Cybersecurity and Data Privacy

As Humana increasingly relies on digital platforms and patient data, cybersecurity and data privacy are critical technological factors. The company actively manages these risks, recognizing that safeguarding sensitive health information is paramount to maintaining trust and compliance. Humana's commitment is reflected in its ESG reporting, where data privacy and protection are key performance indicators. This focus ensures secure data storage and the maintenance of reliable IT infrastructure, essential for its operations.

Humana's approach to cybersecurity and data privacy is directly influenced by evolving technological threats and stringent regulatory landscapes. The company's investment in advanced security measures aims to protect against breaches and ensure compliance with regulations like the Health Insurance Portability and Accountability Act (HIPAA). In 2023, the healthcare industry saw a significant rise in cyberattacks, underscoring the importance of Humana's proactive stance. For instance, reports indicate a substantial increase in ransomware attacks targeting healthcare providers, making robust defenses a non-negotiable aspect of Humana's technological strategy.

Humana's dedication to data privacy is not just a matter of compliance but a strategic imperative. The company's ESG disclosures highlight its efforts in securing patient data and maintaining the integrity of its digital systems. This includes:

- Implementing advanced encryption protocols for data at rest and in transit.

- Conducting regular vulnerability assessments and penetration testing.

- Providing ongoing cybersecurity awareness training for all employees.

- Developing and testing comprehensive incident response plans.

Innovation in Integrated Care Technology

Humana's commitment to integrated care, spanning pharmacy, home-based, and clinical services, is significantly amplified by technological advancements. For instance, in 2024, the company continued to refine its logistics for home prescription delivery, aiming for greater efficiency and member convenience. This focus on optimizing delivery routes and inventory management is crucial for a seamless member experience.

Technological innovation also plays a vital role in streamlining home health operations. By enhancing referral and intake processes through digital platforms, Humana can expedite patient access to care. This digital transformation not only improves operational efficiency but also ensures that members receive timely and appropriate support in their homes.

Furthermore, Humana leverages technology to personalize primary care. In 2025, expect continued investment in data analytics and AI to better understand individual member needs, leading to more tailored care plans. This data-driven approach aims to proactively manage health conditions and improve overall health outcomes for its members.

- Optimized Home Delivery: Continued focus on efficient logistics for prescription delivery in 2024.

- Digital Intake for Home Health: Technology enhancing referral and intake processes for home-based services.

- Personalized Primary Care: Utilizing data and AI in 2025 to tailor primary care to individual member needs.

- Improved Health Outcomes: Technological integration across services to enhance member health and experience.

Humana's technological investments are driving significant advancements in patient care and operational efficiency. The company's 2025 Medicare Advantage plans highlight user-friendly digital tools for seniors to manage health and access telemedicine, demonstrating a commitment to accessible healthcare.

Artificial intelligence is being strategically deployed across Humana's operations, with the CenterWell initiative exploring approximately 20 AI applications. These range from ambient AI to reduce clinician burnout to AI-powered tools for improving patient medication adherence, with pilots underway in home health and customer service centers.

Data analytics is crucial for Humana to gain deeper clinical insights and enhance population health management, enabling more personalized patient care. Interoperability solutions are also a focus, aiming to streamline data exchange and reduce administrative burdens for physicians, potentially cutting costs by up to 20%.

Cybersecurity and data privacy are paramount due to the sensitive nature of health information. Humana invests in advanced security measures, including encryption and regular vulnerability assessments, to protect against breaches and ensure HIPAA compliance, a critical factor given the rise in healthcare cyberattacks.

Legal factors

Humana navigates a dense regulatory landscape, shaped by federal and state laws like the Affordable Care Act (ACA) and specific Medicare and Medicaid rules. Staying compliant with these ever-changing legal structures is paramount, as modifications can significantly affect profitability and operational strategies.

The company's significant dependence on government contracts, particularly for Medicare Advantage plans, exposes it to substantial legal risks. For instance, in 2023, Humana's Medicare Advantage membership reached approximately 5.7 million, highlighting the scale of its government program participation and the associated compliance burden.

Medicare Advantage program regulations, including rate adjustments, risk adjustment models, and Star Ratings methodologies, create a complex legal landscape directly impacting Humana's operations and financial performance. These rules dictate how the company is reimbursed and how its quality is assessed.

Humana is currently involved in litigation concerning the 2025 Star Ratings. A negative ruling could substantially reduce its 2026 quality bonus payments, which are a critical revenue stream. For instance, in 2023, quality bonuses represented a significant portion of Medicare Advantage plans' revenue, and changes to these ratings can have millions in financial consequences.

Humana, as a healthcare provider, must rigorously adhere to privacy laws such as HIPAA, which govern the handling of sensitive patient data. Failure to comply can result in significant legal penalties and damage to its reputation. In 2024, the healthcare industry continues to see increased scrutiny on data breaches, with fines for HIPAA violations potentially reaching millions of dollars.

Antitrust and Market Competition Laws

Antitrust and market competition laws are a significant consideration for Humana. The healthcare sector, particularly health insurance, has faced heightened scrutiny regarding consolidation and how companies operate to ensure fair competition. Humana, as a major player, must diligently adhere to these regulations to prevent its business strategies from hindering market competition.

Navigating these legal frameworks is crucial for Humana's strategic growth. Any potential mergers, acquisitions, or initiatives aimed at expanding its market presence could face legal challenges if they are perceived to violate antitrust provisions. For instance, in 2024, the Federal Trade Commission (FTC) continued its aggressive stance against healthcare mergers, with numerous deals facing intense review or outright challenges, underscoring the critical nature of compliance for companies like Humana.

- Regulatory Scrutiny: Increased focus on healthcare industry consolidation by agencies like the FTC and Department of Justice (DOJ).

- Merger & Acquisition Impact: Antitrust reviews can significantly delay or block Humana's strategic growth through M&A activities.

- Market Expansion Challenges: Expansion into new markets or service areas may be subject to competition law assessments.

- Compliance Costs: Ensuring compliance requires ongoing legal counsel and potentially restructuring business practices, adding to operational expenses.

Fraud, Waste, and Abuse Regulations

Government programs such as Medicare and Medicaid operate under strict rules designed to combat fraud, waste, and abuse. Humana, as a major participant in these programs, must implement and maintain strong compliance initiatives to identify and prevent these illicit activities. Failure to do so can result in severe legal consequences, including substantial fines and damage to the company's reputation.

Humana's commitment to addressing fraud, waste, and abuse is clearly outlined within its legal and privacy practices. For instance, in 2023, the Centers for Medicare & Medicaid Services (CMS) reported recovering over $3.2 billion through various anti-fraud efforts, highlighting the significant financial stakes involved. Humana's proactive approach, therefore, is not just a regulatory necessity but a critical business imperative.

- Robust Compliance Programs: Humana invests in sophisticated systems and trained personnel to detect and prevent fraudulent claims and practices.

- Legal Penalties: Violations can lead to substantial fines, exclusion from government programs, and civil or criminal prosecution.

- Reputational Risk: Incidents of fraud, waste, or abuse can severely damage public trust and Humana's brand image.

- Industry Trends: With CMS actively pursuing fraud, the healthcare industry saw a 15% increase in reported healthcare fraud cases between 2022 and 2023, underscoring the need for vigilance.

Humana operates under a complex web of federal and state regulations, including the Affordable Care Act and specific rules for Medicare and Medicaid programs. These laws directly influence Humana's business model, reimbursement rates, and operational strategies, making compliance a critical factor in its financial performance.

The company's substantial reliance on government contracts, particularly its 5.7 million Medicare Advantage members as of 2023, subjects it to rigorous oversight. Changes in program regulations, such as risk adjustment methodologies or Star Ratings, can have significant financial implications, impacting revenue streams and quality bonus payments.

Humana faces legal challenges, including ongoing litigation regarding the 2025 Star Ratings, which could affect its 2026 quality bonus payments. The healthcare industry also sees increased scrutiny on data privacy, with HIPAA violations in 2024 potentially leading to multi-million dollar fines, underscoring the need for robust data protection measures.

Antitrust laws are also a key legal consideration, especially as the FTC and DOJ maintain an aggressive stance on healthcare consolidation. Any M&A activity by Humana in 2024 faced intense review, highlighting the importance of adhering to competition laws to avoid delays or outright blocking of strategic growth initiatives.

| Legal Factor | Impact on Humana | Data/Example |

| Regulatory Compliance | Affects operational strategies and profitability. | Humana's Medicare Advantage membership was ~5.7 million in 2023. |

| Government Program Rules | Impacts reimbursement and financial performance. | Litigation over 2025 Star Ratings could reduce 2026 quality bonus payments. |

| Data Privacy (HIPAA) | Risk of significant fines and reputational damage. | HIPAA violations in 2024 can incur multi-million dollar fines. |

| Antitrust Laws | Can delay or block M&A and market expansion. | FTC scrutiny on healthcare mergers in 2024. |

Environmental factors

Humana acknowledges the direct link between environmental health and human well-being, recognizing that climate change and other environmental hazards can significantly impact health outcomes. This understanding is a cornerstone of their sustainability strategies, aiming to mitigate these risks.

The healthcare sector, including Humana, increasingly views climate change as a substantial public health concern. For instance, extreme weather events, exacerbated by climate change, can lead to increased respiratory illnesses and heat-related conditions, directly affecting Humana's member population and healthcare costs.

In 2024, the World Health Organization projected that climate change could cause an additional 250,000 deaths per year between 2030 and 2050 due to malnutrition, malaria, diarrhea, and heat stress. Humana's environmental efforts are thus intrinsically tied to its mission of improving health.

Humana is actively pursuing sustainability, demonstrating a commitment to reducing its environmental impact. In 2024, these initiatives resulted in a significant 14.5% decrease in Scope 1 and 2 emissions. Furthermore, the company successfully reduced air emissions by 242,315 metric tons through its electronic recycling programs.

Looking ahead, Humana has established ambitious, science-based targets for further emission reductions. The company aims to achieve a substantial 54.6% reduction in its Scope 1 and 2 greenhouse gas emissions by the year 2032, underscoring a long-term dedication to environmental stewardship.

Humana emphasizes efficient resource utilization, focusing on minimizing water and energy consumption and reducing reliance on single-use items. This commitment is evident in their 2024 efforts, where they diverted 141 tons of furniture and office supplies from landfills through donation for reuse, directly contributing to waste reduction goals.

Furthermore, Humana actively partners with property owners to enhance energy efficiency in both new construction projects and renovation initiatives. This strategic approach to resource management and waste reduction aligns with broader environmental sustainability objectives, demonstrating a tangible impact on minimizing their ecological footprint.

Corporate Social Responsibility and ESG Reporting

Humana embeds environmental stewardship within its comprehensive Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) strategy. This commitment is clearly articulated in its 2024 Impact Report and Annual and Sustainability Report, showcasing its dedication to environmental sustainability.

The company actively aligns its reporting with globally recognized frameworks, including SASB, TCFD, GRI, and the UN Sustainable Development Goals. This adherence ensures a high degree of transparency regarding Humana's environmental performance and progress.

- Environmental Performance Metrics: Humana's reporting provides specific data points on its environmental impact, such as greenhouse gas emissions reduction targets and progress. For instance, in its 2023 reporting (data available for 2024 planning), the company aimed for a 25% reduction in Scope 1 and 2 greenhouse gas emissions by 2030 against a 2019 baseline.

- Resource Management: The reports detail initiatives focused on water conservation and waste reduction across its operations.

- Supply Chain Sustainability: Humana also assesses and encourages environmental responsibility within its supply chain.

- Climate Risk Disclosure: Following TCFD recommendations, Humana discloses its approach to identifying, assessing, and managing climate-related risks and opportunities.

Environmental Health Concerns and Community Impact

Humana recognizes that community well-being is intrinsically linked to environmental health. The company actively promotes initiatives that foster healthier surroundings for its members, understanding that a cleaner environment contributes to better health outcomes. This focus extends beyond direct patient care to encompass broader community impact.

For instance, Humana's commitment to environmental stewardship is evident in its efforts to reduce its own operational footprint, which indirectly benefits the communities it serves. This holistic approach aims to create a positive feedback loop where improved environmental conditions lead to healthier populations, aligning with Humana's core mission.

- Community Health Investment: In 2023, Humana invested over $300 million in community health initiatives, many of which have environmental components like promoting access to healthy foods and safe outdoor spaces.

- Sustainability Goals: Humana has set targets to reduce its greenhouse gas emissions by 25% by 2030 compared to a 2019 baseline, contributing to cleaner air and water in the communities where its employees and members live.

- Partnerships for Impact: The company collaborates with local organizations to address environmental factors affecting health, such as improving air quality in urban areas or promoting green spaces in underserved neighborhoods.

Humana understands that environmental factors directly influence public health, a core concern for the company. Climate change, for example, contributes to health issues like respiratory problems and heat stress, impacting their member base and increasing healthcare costs.

The company is actively working to reduce its environmental footprint. In 2024, Humana achieved a 14.5% reduction in Scope 1 and 2 emissions and diverted 141 tons of furniture and office supplies from landfills through reuse programs.

Humana has set ambitious goals, aiming for a 54.6% reduction in Scope 1 and 2 greenhouse gas emissions by 2032. They also focus on efficient resource use, minimizing water and energy consumption and reducing single-use items.

Humana's commitment to environmental stewardship is integrated into its CSR and ESG strategies, with reporting aligned with frameworks like SASB and TCFD. In 2023, the company invested over $300 million in community health initiatives, many with environmental benefits.

| Environmental Initiative | 2024 Data/Progress | Target/Goal |

|---|---|---|

| Scope 1 & 2 Emissions Reduction | 14.5% decrease | 54.6% reduction by 2032 (vs. 2019 baseline) |

| Waste Diversion (Furniture/Supplies) | 141 tons diverted from landfills | Continued focus on reuse and recycling |

| Community Health Investment (with environmental components) | Over $300 million (2023) | Ongoing support for initiatives promoting healthy environments |

PESTLE Analysis Data Sources

Our Humana PESTLE analysis draws from a comprehensive blend of data, including government health policy reports, economic indicators from agencies like the Bureau of Labor Statistics, and industry-specific market research from reputable firms. We also incorporate social trend analyses and technological adoption forecasts to ensure a holistic view of the macro-environment.