Humana Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humana Bundle

Humana's competitive landscape is shaped by powerful forces, from the intense rivalry among existing health insurers to the significant bargaining power of its customers. Understanding these dynamics is crucial for any stakeholder in the healthcare industry.

The complete report reveals the real forces shaping Humana’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The healthcare provider market is increasingly concentrated. Large hospital systems and specialized physician groups are consolidating, giving them substantial power when negotiating with insurers like Humana. This trend means providers can often demand higher payment rates, directly affecting Humana's expenses and overall profitability.

In 2024, the bargaining power of these consolidated provider groups remains a significant factor. While large insurers like Humana still represent substantial payors, providers who offer unique or essential services can effectively dictate their terms. This 'must-have' status allows them to command premium pricing, even when facing larger insurance entities.

Pharmaceutical companies, often working with Pharmacy Benefit Managers (PBMs), wield significant bargaining power. This stems from the essential nature of prescription drugs and the introduction of innovative, high-demand medications. For instance, in 2023, the US pharmaceutical market was valued at approximately $1.5 trillion, highlighting the immense scale and influence of these companies.

While Humana has its own pharmacy operations, the cost of pharmaceuticals remains a major factor. The ability of pharmaceutical firms to set high prices for patented drugs, coupled with potential regulatory changes impacting PBMs, directly affects Humana's expenses and its capacity to control drug expenditure. In 2023, Humana reported total pharmacy claims of over 200 million, underscoring the volume of its drug-related transactions and its vulnerability to supplier pricing.

Suppliers of advanced healthcare technology and data analytics are becoming increasingly crucial for health insurers like Humana. These vendors offer unique solutions that improve efficiency and customer interactions, such as AI-powered contact centers. For instance, in 2024, the healthcare AI market was projected to reach over $30 billion, indicating significant investment and reliance on these specialized providers.

Home Health and Clinical Service Providers

Humana's increasing emphasis on integrated care, particularly through its CenterWell segment which encompasses home-based care and clinical services, means it relies on a network of specialized providers. The availability and quality of these niche service providers can significantly impact Humana's capacity to execute its integrated care strategy, potentially granting these specialized suppliers a degree of bargaining power.

For instance, the demand for home health services is projected to grow substantially. In 2024, the US home healthcare market was valued at approximately $140 billion and is expected to expand at a compound annual growth rate (CAGR) of around 7.5% through 2030, driven by an aging population and a preference for in-home care. This growth signifies a robust market for home health and clinical service providers, potentially strengthening their position when negotiating with large payers like Humana.

- Provider Specialization: The highly specialized nature of certain clinical services, such as complex wound care or advanced physical therapy, can limit the pool of qualified providers, thereby increasing their bargaining power.

- Geographic Concentration: In certain regions, a limited number of high-quality home health agencies or specialized clinics might be the primary options for Humana, giving these suppliers more leverage.

- Quality and Reputation: Providers with strong reputations for excellent patient outcomes and high-quality care may command better terms due to their ability to attract and retain patients, which is crucial for Humana's network.

Limited Switching Costs for Certain Inputs

While Humana faces significant supplier power from essential partners like major hospital systems where switching costs are inherently high due to established relationships and integrated care pathways, there's a degree of flexibility with other operational inputs. For example, procuring standard office supplies or less specialized medical equipment often presents lower switching barriers. This allows Humana to leverage competitive pricing and service agreements, somewhat mitigating the overall supplier influence in these less critical areas.

In 2024, the healthcare industry continued to see consolidation among providers, which inherently strengthens the bargaining power of those larger, more dominant hospital networks. However, for ancillary services and non-clinical supplies, Humana's procurement strategies can still exert influence. For instance, a 2023 analysis by a leading healthcare consulting firm indicated that for non-specialized medical devices, average switching costs for payers were estimated to be around 5-10% of the annual procurement value, offering a tangible area for negotiation.

- Supplier Interdependence: Core healthcare delivery remains highly interdependent, meaning Humana cannot easily substitute critical medical providers.

- Operational Flexibility: For general administrative services and less specialized medical equipment, Humana can switch vendors more readily.

- Cost Mitigation: This ability to switch in certain areas allows Humana to negotiate better terms and limit the overall bargaining power of its suppliers.

The bargaining power of suppliers to Humana is significant, particularly from consolidated healthcare providers and pharmaceutical companies. In 2024, the trend of provider consolidation continued, allowing larger hospital systems to negotiate higher reimbursement rates, directly impacting Humana's costs. For instance, the pharmaceutical market's immense value, estimated at $1.5 trillion in 2023, underscores the leverage held by drug manufacturers, especially for patented and innovative medications.

Humana's reliance on specialized technology and niche service providers, such as those in the growing home healthcare market (valued at $140 billion in 2024), also grants these suppliers considerable influence. While Humana can achieve cost efficiencies in procuring less specialized items, the interdependence in core healthcare delivery and the specialized nature of certain clinical services limit its ability to easily substitute key suppliers, thereby strengthening supplier bargaining power.

| Supplier Category | Influence Factor | Humana's Position |

|---|---|---|

| Consolidated Hospital Systems | High negotiation power due to market concentration | Limited ability to substitute, high switching costs |

| Pharmaceutical Companies | Essential nature of drugs, patent protection, high R&D costs | Significant impact on costs, high volume of claims (over 200 million in 2023) |

| Specialized Technology Providers (e.g., AI) | Unique solutions, high market growth ($30 billion projected for healthcare AI in 2024) | Increasing reliance for efficiency and integrated care |

| Home Health & Clinical Services | Growing demand (7.5% CAGR projected), aging population | Crucial for integrated care strategy, niche providers gain leverage |

| Ancillary/Non-Specialized Supplies | Lower switching costs (estimated 5-10% of procurement value) | Ability to negotiate pricing, mitigate overall supplier power |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Humana's position in the healthcare industry.

Instantly identify and mitigate competitive threats with a comprehensive, visual breakdown of industry pressures.

Customers Bargaining Power

The significant role of government programs like Medicare and Medicaid grants substantial bargaining power to customers in the health insurance sector. Humana, as the second-largest Medicare Advantage provider, is heavily influenced by the Centers for Medicare & Medicaid Services (CMS) which sets reimbursement rates and regulatory frameworks. In 2024, Medicare Advantage enrollment continued to grow, with millions of beneficiaries choosing these plans, underscoring CMS's leverage.

Large employer groups wield significant influence over Humana due to their demand for comprehensive and cost-effective health benefits. These groups, often representing thousands of employees, can negotiate aggressively for better pricing, enhanced plan features, and improved service levels. For instance, in 2024, major corporations continue to scrutinize healthcare spending, pushing insurers like Humana to demonstrate clear value.

The ability of these large employers to switch providers or explore self-insurance options further amplifies their bargaining power. This competitive pressure compels Humana to maintain competitive pricing and develop flexible, customized benefit plans that meet the specific needs of diverse workforces. Failure to do so could result in the loss of substantial group contracts, impacting Humana's market share and revenue.

Individual consumers, especially those buying health insurance through marketplaces, are very focused on the cost of premiums and what they have to pay out-of-pocket. Factors like Affordable Care Act (ACA) subsidies significantly influence this price sensitivity. For instance, in 2024, a substantial portion of marketplace enrollees rely on these subsidies to make coverage affordable, highlighting the direct impact of government support on consumer purchasing decisions and their willingness to pay.

The growing availability of numerous insurance providers in many regions, coupled with a wider array of plan choices, gives individuals more power to compare and select the most cost-effective options. This increased consumer choice directly challenges Humana's pricing power, as individuals can readily switch to competitors offering better value or lower costs, forcing Humana to remain competitive in its pricing strategies to retain market share.

Information Availability and Digital Tools

The increasing availability of information and digital tools significantly empowers Humana's customers. These resources enable individuals to readily compare health insurance plans, scrutinize benefits, and evaluate costs across different providers. This enhanced transparency directly translates to a stronger bargaining position for consumers.

While the health insurance sector is still navigating the complexities of digital customer experience, the trend towards greater accessibility of data is undeniable. This growing transparency fuels informed decision-making, making it easier for customers to switch providers if they find better value elsewhere, thus increasing potential churn and customer power.

- Digital comparison tools: Websites and apps allow for side-by-side analysis of health insurance offerings.

- Information accessibility: Government and private entities are making more plan details publicly available.

- Customer reviews: Online platforms provide insights into customer satisfaction and service quality.

Threat of Customer Self-Insurance or Alternative Models

Large employers are increasingly investigating self-insurance and Accredited Health Plans (AHPs) as ways to manage healthcare expenses, especially for specific services or employee groups. This trend allows them to take more direct control over their healthcare spending.

This shift signifies a growing latent bargaining power for customers, as it diminishes their dependence on fully insured products offered by companies like Humana. For instance, in 2024, a significant portion of the employer-sponsored health insurance market in the U.S. operates on a self-funded basis, giving these employers considerable leverage.

- Self-Insured Plans Dominance: By early 2024, over 60% of American workers were covered by self-insured health plans, demonstrating a substantial existing customer base with direct cost management capabilities.

- Growth of AHPs: The formation of Association Health Plans (AHPs) offers another avenue for employers to seek alternative coverage, potentially fragmenting the market and increasing customer choice.

- Cost Control Incentive: Employers are motivated by the potential for significant cost savings, which can be achieved by directly negotiating provider rates and managing claims, thereby reducing the need for traditional insurer markups.

- Impact on Insurers: This growing customer power can pressure insurers like Humana to offer more competitive pricing and flexible plan designs to retain large employer clients.

The bargaining power of customers in the health insurance market significantly impacts Humana. Government programs like Medicare and Medicaid, along with large employer groups, exert considerable influence through their ability to negotiate rates and switch providers. For instance, in 2024, millions of beneficiaries enrolled in Medicare Advantage plans, giving the Centers for Medicare & Medicaid Services substantial leverage over providers like Humana.

Individual consumers are increasingly empowered by accessible information and digital comparison tools, driving price sensitivity and demanding greater value. This trend forces Humana to maintain competitive pricing and offer flexible plan designs to retain its customer base.

| Customer Segment | Bargaining Power Drivers | Impact on Humana |

|---|---|---|

| Government Programs (Medicare/Medicaid) | Rate setting, regulatory frameworks, large enrollment numbers | Significant influence on revenue and operational strategies |

| Large Employers | Negotiation leverage for pricing and benefits, potential for self-insurance | Pressure for competitive pricing and customized plan offerings |

| Individual Consumers | Information accessibility, digital comparison tools, price sensitivity | Need for transparent pricing and value-driven product development |

What You See Is What You Get

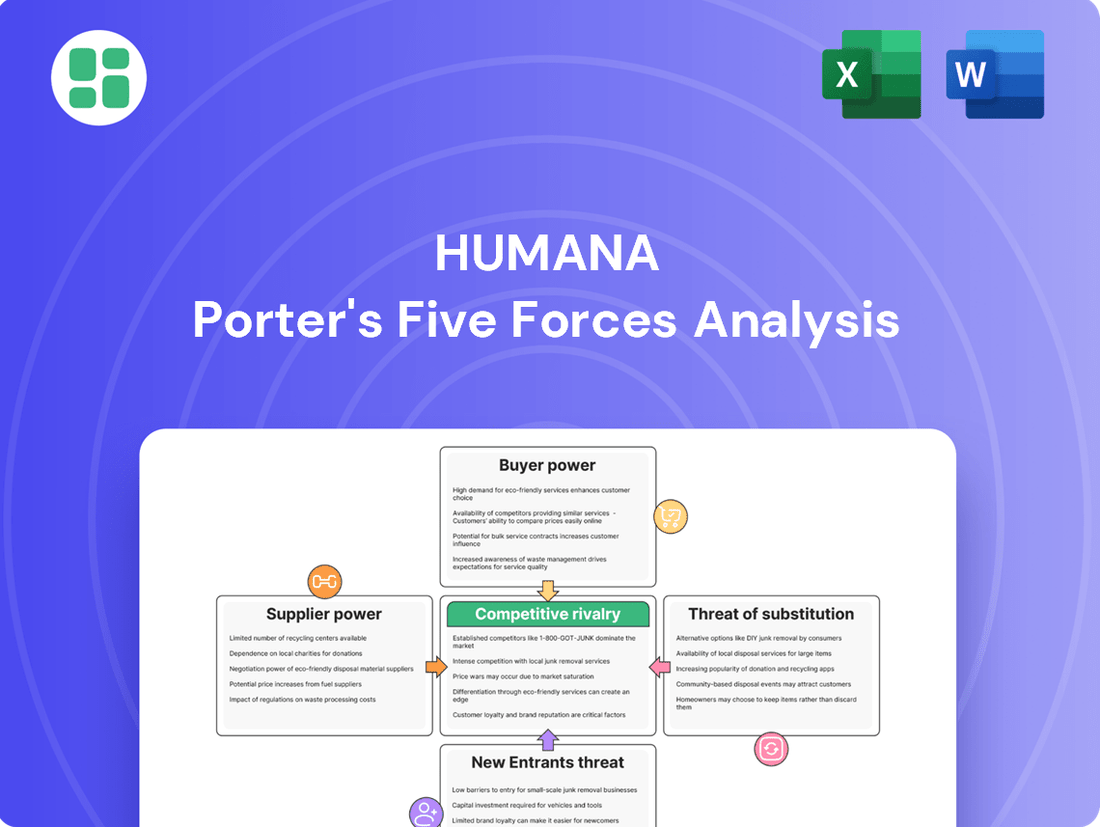

Humana Porter's Five Forces Analysis

This preview showcases the complete Humana Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the healthcare industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The U.S. health insurance sector is notably concentrated, with a handful of major companies like UnitedHealth Group, Elevance Health, CVS Health (Aetna), Cigna, and Humana wielding substantial market influence. This oligopolistic structure is particularly evident in lucrative segments like Medicare Advantage, where these giants often dominate.

This intense rivalry among a few powerful players fuels aggressive competition, as each seeks to capture greater market share and enhance profitability. For instance, in 2024, the combined market share of the top five health insurers in the U.S. remained exceptionally high, reflecting the mature and consolidated nature of the industry.

Humana, like its competitors, navigates significant pressure from escalating healthcare expenses, notably in prescription drug costs. For instance, the Centers for Medicare & Medicaid Services (CMS) projected that national health expenditures would reach $4.7 trillion in 2024, a substantial increase reflecting these rising costs.

Simultaneously, evolving regulatory landscapes, especially concerning Medicare Advantage and Medicaid programs, create a challenging operational environment. These changes necessitate insurers to diligently manage their medical loss ratios, pushing for greater efficiency and innovative cost-containment strategies across the board.

Competitive rivalry in the health insurance sector, including for Humana, is intensely fueled by product differentiation. Companies are actively developing integrated care models, embracing value-based care arrangements, and creating specialized plans, such as those for individuals with unique health needs. This focus on tailored solutions aims to capture specific market segments and build member loyalty.

Significant investments are being channeled into digital health services, artificial intelligence, and clinical excellence. These advancements are designed to elevate the customer experience and demonstrably improve health outcomes. For instance, Humana’s Center for Health Equity is a key initiative, reflecting a commitment to addressing disparities and innovating care delivery. By enhancing member engagement and health results, these efforts are crucial for attracting and retaining a customer base in a highly competitive environment.

Strategic M&A and Consolidation

Mergers and acquisitions remain a powerful driver of competitive rivalry in the healthcare sector, with companies like Humana actively pursuing consolidation to enhance their market position. These strategic moves aim to achieve greater economies of scale, broaden geographic reach, and integrate services, such as expanding into care delivery or pharmacy operations. For instance, in 2023, the healthcare industry saw significant M&A activity, reflecting this trend of consolidation.

This ongoing consolidation reshapes the competitive landscape by creating larger, more resource-rich entities that can exert greater influence. Such moves can lead to intensified competition as these consolidated players leverage their expanded capabilities to gain market share and drive innovation. The drive for vertical integration, in particular, allows companies to control more of the value chain, potentially leading to cost efficiencies and improved service offerings.

- Humana's strategic acquisitions aim to build scale and expand its care delivery capabilities.

- The healthcare M&A market in 2023 demonstrated a continued trend of consolidation.

- Consolidation creates larger rivals, intensifying competitive pressures across the industry.

- Vertical integration into services like pharmacy and care delivery is a key M&A strategy.

Medicare Advantage and Medicaid Market Dynamics

The competition within Medicare Advantage and Medicaid is incredibly intense. Even minor shifts in star ratings, government payment rates, or state contract awards can dramatically alter a company's standing. Humana, being a significant participant in these government-funded health insurance plans, directly contends with other large insurers who are also aggressively pursuing member enrollment and financial gains.

For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) announced a weighted average benchmark payment rate increase of 3.70% for Medicare Advantage plans. This figure, while seemingly small, has a substantial ripple effect on profitability and the ability to offer competitive benefits, directly influencing the competitive landscape.

- Intense Competition: Medicare Advantage and Medicaid markets are characterized by fierce rivalry among health insurers.

- Key Differentiators: Star ratings, reimbursement rates, and state contract wins are critical factors determining success.

- Humana's Position: As a major player, Humana faces direct competition from peers seeking to capture market share and enhance profitability.

- Impact of Reimbursement: A 3.70% weighted average benchmark payment rate increase in Medicare Advantage for 2024 highlights the sensitivity of the market to regulatory changes.

Competitive rivalry for Humana is fierce, particularly within the concentrated U.S. health insurance market. The presence of a few dominant players, including UnitedHealth Group, Elevance Health, CVS Health (Aetna), and Cigna, creates an oligopolistic environment where aggressive competition for market share is the norm. This intensity is further amplified by the pursuit of differentiation through integrated care models and specialized plans, alongside significant investments in digital health and AI to enhance member experience and outcomes.

Mergers and acquisitions are a significant factor, with companies like Humana strategically acquiring others to build scale and expand capabilities, as evidenced by the notable M&A activity in the healthcare sector throughout 2023. This consolidation leads to larger, more formidable competitors, intensifying overall market pressures. The critical Medicare Advantage and Medicaid segments are especially competitive, where success hinges on factors like star ratings, government payment rates, and contract awards, with a 3.70% weighted average benchmark payment rate increase for Medicare Advantage in 2024 underscoring the market's sensitivity to regulatory shifts.

| Competitor | 2023 Revenue (Approx. Billions USD) | Key Market Focus | 2024 Medicare Advantage Benchmark Rate Change |

|---|---|---|---|

| UnitedHealth Group | $371.6 | Diversified Health Services, Insurance | 3.70% |

| Elevance Health | $284.9 | Health Benefits, Pharmacy, Care Services | 3.70% |

| CVS Health (Aetna) | $238.0 | Pharmacy, Retail Health, Insurance | 3.70% |

| Cigna | $186.0 | Health Services, Insurance | 3.70% |

| Humana | $106.3 | Government-Sponsored Health Plans, Pharmacy | 3.70% |

SSubstitutes Threaten

Medical cost-sharing programs are emerging as a significant substitute for traditional health insurance, particularly for individuals seeking lower monthly outlays. These programs, often structured as non-profits and rooted in faith-based communities, pool member contributions to cover medical costs. While not legally defined as insurance, their appeal lies in offering a more affordable alternative, especially for catastrophic medical events.

For Humana, the growth of these programs presents a threat as they siphon off a segment of the market that might otherwise purchase conventional insurance plans. For instance, while specific market share data for cost-sharing programs is still developing, reports from industry observers in late 2023 and early 2024 indicated a notable uptick in inquiries and enrollments, suggesting a growing awareness and adoption rate among consumers disillusioned with rising premiums and deductibles of traditional insurance.

The rise of direct primary care (DPC) and membership-based healthcare models presents a significant threat of substitution for traditional health insurance providers like Humana. These models allow patients to pay a recurring fee directly to physicians for comprehensive primary care services, often including unlimited visits and basic lab work. This direct relationship bypasses the complexities and limitations of insurance, appealing to individuals prioritizing straightforward access to routine health management.

In 2024, the DPC market continued its expansion, with estimates suggesting that over 10,000 physicians are now practicing under DPC models in the United States. This growth signifies a tangible shift in how consumers are accessing primary care, directly impacting the need for traditional insurance plans for these specific services.

The increasing prevalence of self-insured employer plans poses a significant threat of substitution for traditional insurance providers like Humana. In 2024, a substantial portion of large employers, often those with over 200 employees, continue to embrace self-funding models. This allows them to directly manage healthcare expenditures and customize benefits, bypassing the need for fully-insured products.

Limited-Benefit and Short-Term Medical Plans

Short-term medical plans and fixed indemnity plans present a notable threat of substitutes for traditional health insurance, particularly for individuals prioritizing cost savings or temporary coverage. These plans offer a lower premium compared to ACA-compliant policies, providing benefits for unexpected medical events or fixed cash payouts for specific services. For instance, short-term plans, which typically last up to 12 months, can be renewed for a total of 36 months, offering a flexible alternative for those not needing continuous comprehensive coverage.

These substitute products appeal to a specific segment of the market, often healthier individuals who are less concerned about long-term chronic condition management or those seeking coverage during transitional periods, such as between jobs. While they don't cover pre-existing conditions or essential health benefits mandated by the Affordable Care Act, their lower cost makes them an attractive option for budget-conscious consumers. In 2024, the market for these types of plans continues to see interest, reflecting a persistent demand for more affordable, albeit less comprehensive, health coverage options.

The threat is amplified by the fact that these plans can siphon off a portion of the customer base that might otherwise opt for more robust, albeit pricier, insurance. This creates a competitive pressure on providers of comprehensive coverage to demonstrate their value proposition more effectively.

- Cost-Effectiveness: Short-term and fixed indemnity plans offer significantly lower premiums than ACA-compliant plans.

- Target Audience: Primarily attracts healthy individuals or those needing temporary coverage, not comprehensive long-term care.

- Limited Benefits: These plans do not cover pre-existing conditions or essential health benefits, posing a risk for those with ongoing medical needs.

- Market Impact: They serve as a partial substitute, potentially reducing the market share for insurers offering full-coverage plans.

Wellness Programs and Digital Health Solutions

Non-insurance wellness programs and standalone digital health solutions present a significant threat of substitutes for traditional health insurance. These offerings, which focus on prevention, chronic disease management, and virtual care, can bypass comprehensive insurance policies by directly addressing health needs and cost reduction. For instance, digital platforms offering personalized health coaching or remote patient monitoring can substitute for certain in-person doctor visits or disease management services typically covered by insurance.

The growing adoption of these solutions is driven by their convenience and often lower out-of-pocket costs for consumers. In 2024, the digital health market continued its robust expansion, with investments pouring into areas like telehealth and AI-powered health management tools. This trend means individuals might opt for these direct-to-consumer health services instead of relying solely on their insurance plans for wellness and preventative care.

The impact is particularly felt in areas where insurance coverage for preventative services might be limited or come with high deductibles. Consider these points:

- Direct Health Management: Consumers are increasingly using apps for fitness tracking, nutrition advice, and mental wellness, reducing reliance on insurance for basic health maintenance.

- Virtual Care Accessibility: Telehealth platforms provide convenient access to medical consultations, substituting for traditional in-office visits for non-emergency conditions.

- Chronic Disease Solutions: Digital tools for managing conditions like diabetes or hypertension offer personalized support and monitoring, potentially lowering the need for frequent insurance-covered specialist appointments.

- Cost-Effectiveness: For many individuals, the direct cost of these digital solutions can be more predictable and lower than insurance premiums and copays for similar services.

Medical cost-sharing programs and direct primary care (DPC) models are emerging as significant substitutes for traditional health insurance, offering lower costs and more direct patient relationships. By 2024, DPC models were adopted by over 10,000 physicians in the US, indicating a growing preference for these alternatives over conventional insurance for primary care needs.

Short-term medical plans and fixed indemnity plans also present a threat, appealing to healthier individuals or those needing temporary, less comprehensive coverage due to their lower premiums. Furthermore, digital health solutions and wellness programs are increasingly used for preventative care and chronic disease management, bypassing traditional insurance for routine health needs.

| Substitute Type | Key Features | Market Trend (2024) | Impact on Humana |

|---|---|---|---|

| Medical Cost-Sharing Programs | Lower monthly outlays, pooled contributions, not legally insurance | Growing inquiries and enrollments | Siphons off potential traditional insurance customers |

| Direct Primary Care (DPC) | Recurring fee for comprehensive primary care, direct physician relationship | Over 10,000 physicians practicing DPC in the US | Reduces demand for insurance for routine primary care |

| Short-Term/Fixed Indemnity Plans | Lower premiums, temporary or fixed cash payouts, limited benefits | Persistent demand for affordable, less comprehensive coverage | Attracts healthier individuals, reducing market share for full-coverage plans |

| Digital Health/Wellness Programs | Telehealth, personalized health coaching, remote monitoring | Robust market expansion, increased investment in telehealth and AI tools | Substitutes for insurance in preventative care and chronic disease management |

Entrants Threaten

The health insurance sector is a capital-intensive business. For instance, in 2023, major health insurers reported billions in revenue, requiring significant upfront investment for operations, claims processing, and technology infrastructure. This financial muscle is essential to absorb initial losses and maintain solvency.

Beyond capital, the industry is heavily regulated. Companies must navigate a labyrinth of federal and state laws, including the Affordable Care Act (ACA) and specific state mandates for licensing and product offerings. In 2024, compliance costs for health insurers continue to rise, adding another layer of difficulty for potential new players.

Established brand loyalty and the intricate development of provider networks represent significant hurdles for new entrants aiming to compete with established players like Humana. Humana benefits from deep-rooted trust and recognition among its member base, cultivated over years of service. For instance, in 2023, Humana reported serving 17 million medical members, a testament to its established market presence and member loyalty.

Creating comparable provider networks, which are essential for offering comprehensive care and attracting members, is a substantial undertaking for any newcomer. These networks are not built overnight; they require extensive negotiation, relationship building, and a proven track record. The sheer scale and quality of Humana's existing provider relationships, spanning numerous states and specialties, are difficult and costly to replicate, acting as a powerful deterrent.

Large incumbent health insurers like Humana benefit from substantial economies of scale. This means they can spread their fixed costs, such as administrative overhead and technology investments, across a vast number of members. For example, in 2024, major insurers managed millions of policies, allowing them to achieve lower per-member costs for claims processing and provider negotiations compared to a new entrant.

These scale advantages translate into significant cost efficiencies. Humana, for instance, can negotiate better rates with hospitals and pharmaceutical companies due to its large membership base. A new entrant would find it incredibly challenging to replicate these negotiated rates, making it difficult to compete on price and offer a comparable range of benefits without facing considerable financial strain.

Complexity of Integrated Care Models

Humana's strategic pivot towards integrated care, exemplified by its CenterWell primary care centers and burgeoning home health services, establishes a formidable barrier for potential new entrants. This vertically integrated approach, encompassing patient care delivery and health insurance, is exceptionally challenging and capital-intensive to replicate. For instance, as of early 2024, Humana reported significant investments in its CenterWell segment, aiming to expand its footprint and capabilities, making it difficult for newcomers to achieve comparable scale and operational efficiency.

The sheer complexity and substantial upfront investment required to build a comparable integrated care ecosystem present a significant threat deterrent. New players would need to navigate not only the regulatory landscape of healthcare but also invest heavily in physical infrastructure, technology, and a skilled workforce across multiple service lines. This complexity means that replicating Humana's model would likely demand billions in capital and years of development, effectively limiting the pool of viable new entrants.

- Significant Capital Investment: Replicating Humana's integrated care model requires substantial financial resources, estimated in the billions, to establish primary care centers, home health operations, and supporting technology infrastructure.

- Operational Complexity: Managing a vertically integrated system involving diverse healthcare services, insurance, and patient data demands sophisticated operational expertise and robust management systems.

- Time to Market: Developing a comprehensive integrated care network comparable to Humana's existing infrastructure would take many years, allowing Humana to further solidify its market position and competitive advantages.

- Regulatory Hurdles: New entrants must contend with complex healthcare regulations and compliance requirements across various service lines, adding another layer of difficulty and cost to market entry.

Data and Technological Infrastructure Needs

The healthcare industry, including companies like Humana, is increasingly dependent on advanced data analytics, artificial intelligence, and robust IT infrastructure. These technologies are crucial for accurate risk assessment, delivering personalized patient care, and optimizing operational efficiency.

New entrants face a substantial barrier due to the immense investment and specialized expertise required to develop or acquire these sophisticated technological capabilities. For instance, in 2024, major health insurers are investing billions in AI and data platforms to enhance member engagement and predictive health analytics, a cost that can be prohibitive for startups.

- Significant IT Investment: New entrants need to invest heavily in cloud computing, data warehousing, and cybersecurity to handle vast amounts of sensitive patient data.

- AI and Machine Learning Expertise: Acquiring or developing talent in AI and machine learning is essential for advanced analytics, fraud detection, and personalized health recommendations.

- Regulatory Compliance: Meeting stringent data privacy regulations like HIPAA requires substantial resources and expertise, adding to the technological infrastructure burden.

- Scalability Challenges: Building infrastructure that can scale with growing membership and data volume is a complex and costly undertaking for new market participants.

The threat of new entrants into the health insurance market, particularly for a company like Humana, is significantly mitigated by several formidable barriers. These include the immense capital required, stringent regulatory compliance, established brand loyalty, and the complexity of building extensive provider networks.

New players must also contend with the substantial economies of scale enjoyed by incumbents, which translate into lower per-member costs and greater negotiating power. Furthermore, Humana's strategic investments in integrated care models, such as its CenterWell primary care centers, create a complex and capital-intensive ecosystem that is difficult for newcomers to replicate.

The reliance on advanced technology, including AI and data analytics, also poses a significant hurdle, demanding considerable investment and specialized expertise. These combined factors collectively limit the number of viable new entrants, thereby protecting Humana's market position.

| Barrier to Entry | Description | Impact on New Entrants | Humana's Advantage (2024 Data) |

|---|---|---|---|

| Capital Requirements | Significant upfront investment in operations, technology, and network development. | Prohibitive for many potential entrants. | Billions in revenue and assets, enabling sustained investment. |

| Regulatory Landscape | Navigating complex federal and state healthcare laws and compliance. | Increases costs and time to market. | Established compliance infrastructure and expertise. |

| Brand Loyalty & Networks | Building trust and comprehensive provider relationships takes time and effort. | Difficulty in attracting members and ensuring care access. | 17 million medical members (2023) and extensive provider contracts. |

| Economies of Scale | Lower per-member costs due to large membership base. | Inability to compete on price or offer comparable benefits. | Manages millions of policies, achieving cost efficiencies. |

| Integrated Care Models | Developing primary care, home health, and insurance capabilities. | High capital and operational complexity to replicate. | Significant investments in CenterWell expansion (early 2024). |

| Technology & Data Analytics | Investment in AI, data platforms, and IT infrastructure. | Requires specialized talent and substantial financial outlay. | Billions invested in AI and data platforms for enhanced analytics. |

Porter's Five Forces Analysis Data Sources

Our Humana Porter's Five Forces analysis is built upon a foundation of diverse data sources, including Humana's annual reports, industry-specific market research from firms like IBISWorld, and regulatory filings from government agencies. This multi-faceted approach ensures a comprehensive understanding of the competitive landscape.