Humana Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humana Bundle

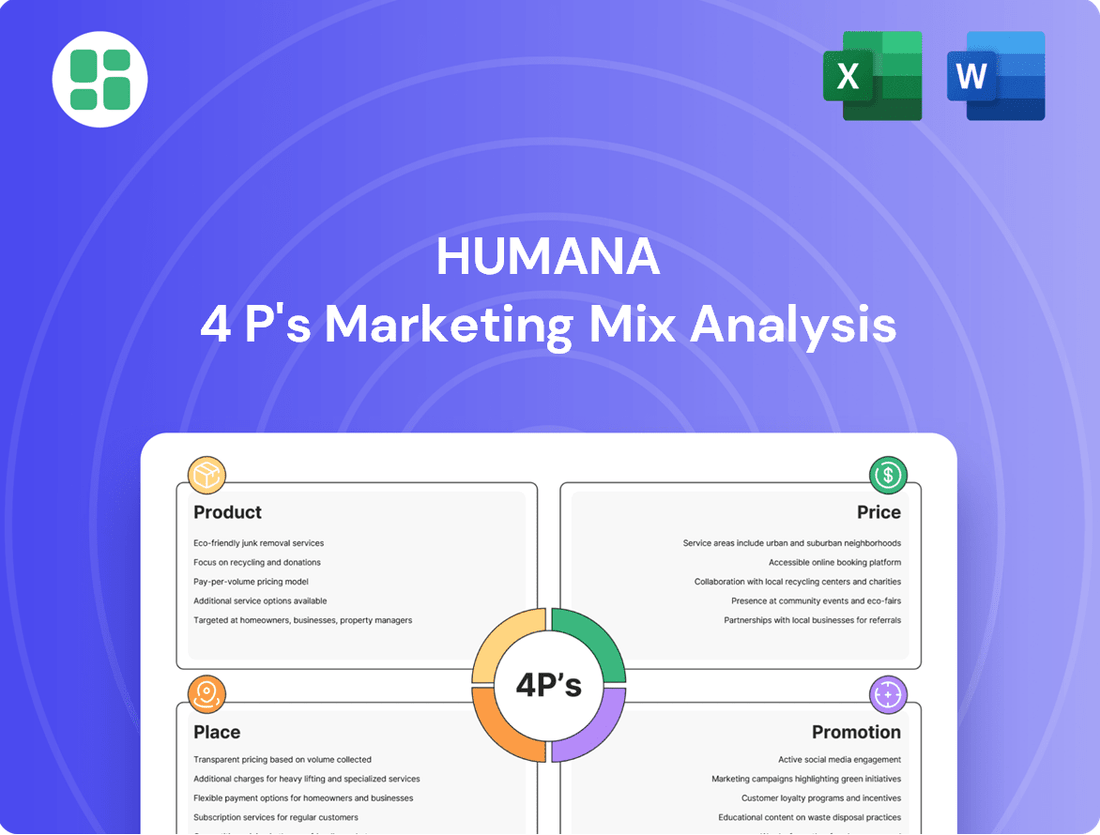

Dive into the strategic brilliance behind Humana's marketing efforts with our comprehensive 4Ps analysis. We dissect their product offerings, pricing structures, distribution channels, and promotional activities to reveal the core of their market success.

Discover how Humana masterfully blends its product portfolio, competitive pricing, accessible distribution, and impactful promotions to connect with its target audience. This detailed breakdown offers invaluable insights for anyone looking to understand or replicate effective marketing strategies.

Unlock the full potential of your own marketing plans by learning from Humana's proven approach. Get instant access to our expertly crafted, editable 4Ps Marketing Mix Analysis and elevate your strategic thinking.

Product

Humana's product strategy centers on a broad spectrum of health insurance, encompassing medical, dental, and vision coverage to meet varied consumer demands. This comprehensive approach ensures members can access necessary medical care.

Humana's product strategy heavily emphasizes government-sponsored programs, notably Medicare and Medicaid. This focus is a cornerstone of their market approach, aiming to serve a significant demographic. Their commitment to these programs is evident in their continuous expansion and product development.

For 2025, Humana has significantly broadened its reach within the Medicare Advantage market. They now offer plans in 89% of U.S. counties, spanning 48 states. This expansive coverage highlights their dedication to making these essential health benefits accessible to a wider population.

Humana provides a diverse range of Medicare Advantage plan options, including Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) structures. These tailored plan types are designed to meet the specific needs and preferences of Medicare beneficiaries, offering choice and flexibility in their healthcare coverage.

Humana's integrated care services, a crucial element of its marketing strategy, extend beyond traditional insurance. This approach bundles pharmacy, home-based care, and clinical services to enhance member health and streamline their healthcare journey. For instance, in 2024, Humana continued to expand its CenterWell brand, which includes CenterWell Pharmacy and CenterWell Primary Care, aiming to provide a more connected and convenient patient experience.

CenterWell Pharmacy, a significant player in this integrated model, focuses on convenient prescription delivery and medication management. This service directly supports Humana’s goal of improving health outcomes by ensuring members have consistent access to their medications. By 2025, the company anticipates further growth in its pharmacy segment, leveraging its integrated care network to drive member engagement and satisfaction.

Specialty Benefits and Supplemental Offerings

Humana's product strategy goes beyond core medical coverage, encompassing a robust portfolio of specialty benefits and supplemental offerings. These include dental, vision, and various financial protection plans designed to complement primary health insurance. This broadens Humana's appeal across different customer segments, from employer-sponsored plans to individual market participants and government program beneficiaries.

These supplemental products significantly enhance Humana's value proposition by offering a more comprehensive approach to health and financial security. For instance, in 2024, Humana reported that its Government segment, which includes Medicare Advantage plans often bundled with supplemental benefits, served over 7 million members. The company's focus on these ancillary services aims to create a holistic health and well-being ecosystem for its members.

- Dental and Vision Coverage: These are frequently offered as add-ons, addressing common out-of-pocket healthcare expenses.

- Financial Protection: This category can include life insurance, accident insurance, and critical illness coverage, providing a safety net.

- Employer Group Value: Offering these benefits helps employers attract and retain talent by providing a more complete benefits package.

- Government Program Integration: Many Medicare Advantage plans include dental, vision, and hearing benefits, a key differentiator for Humana.

Tailored Plans and Benefit Enhancements

Humana is committed to tailoring its offerings, constantly evolving its plans based on member input and shifting market trends. This ensures a range of options that cater to diverse lifestyles and financial capacities, making healthcare more accessible and personalized.

For the upcoming 2025 Medicare Advantage season, Humana is rolling out significant enhancements. These include new benefits such as annual coverage for eyeglasses and more comprehensive dental care. These additions reflect a strategic move to provide greater value and address common healthcare needs.

Furthermore, Humana's prescription drug plans for 2025 are set to feature a $2,000 out-of-pocket maximum. They are also eliminating the coverage gap, often referred to as the "donut hole." This aims to provide considerable cost savings and predictability for members managing their medication expenses.

These benefit enhancements are crucial for Humana's marketing strategy, directly impacting the Product element of their 4Ps. They serve as tangible improvements that differentiate Humana's plans in a competitive landscape.

- Tailored Plans: Options designed for diverse lifestyles and budgets.

- 2025 Medicare Advantage Benefits: Introduction of annual glasses coverage and comprehensive dental.

- Prescription Drug Plan Improvements: A $2,000 out-of-pocket cap and elimination of the coverage gap.

- Member-Centric Approach: Continuous refinement based on feedback and market dynamics.

Humana's product strategy is a multifaceted offering designed to meet diverse healthcare needs, with a strong emphasis on government-sponsored programs like Medicare and Medicaid. Their 2025 Medicare Advantage expansion into 89% of U.S. counties underscores this commitment to accessibility. Beyond core medical coverage, Humana integrates specialty benefits such as dental and vision, alongside financial protection plans, creating a comprehensive health and well-being ecosystem.

Key product enhancements for 2025 include expanded dental and vision benefits within Medicare Advantage plans and a $2,000 out-of-pocket maximum for prescription drug plans, also eliminating the coverage gap. These strategic product developments aim to provide greater value and cost predictability for members, reinforcing Humana's member-centric approach and competitive positioning.

| Product Offering | Key Features | 2025 Enhancements | Target Segment | Strategic Focus |

|---|---|---|---|---|

| Medicare Advantage Plans | HMO, PPO options; Broad county coverage (89% in 2025) | New annual eyeglasses coverage, enhanced dental care | Medicare Beneficiaries | Market expansion, value addition |

| Integrated Care Services | CenterWell Pharmacy, Primary Care | Continued growth in pharmacy, connected patient experience | All Members | Holistic health, convenience |

| Supplemental Benefits | Dental, Vision, Hearing, Financial Protection | Bundled with MA plans, complements core coverage | Various (Individual, Employer, Government) | Comprehensive coverage, member retention |

| Prescription Drug Plans | Medication management, access | $2,000 out-of-pocket maximum, coverage gap elimination | Members with prescription needs | Cost savings, predictability |

What is included in the product

This analysis provides a comprehensive examination of Humana's marketing strategies, detailing their Product offerings, Pricing models, Place (distribution) strategies, and Promotion efforts.

It's designed for professionals seeking a thorough understanding of Humana's market positioning and competitive landscape.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of information overload for Humana's teams.

Provides a clear, concise framework for understanding Humana's market position, easing the burden of strategic planning.

Place

Humana leverages direct-to-consumer channels like Humana.com and phone enrollment to connect with individuals seeking health insurance. These avenues offer comprehensive plan details and direct access to licensed sales agents, facilitating informed choices.

The MyHumana mobile application extends this direct engagement, empowering members to manage their health plans, review claims, and access support conveniently. This digital approach streamlines the member experience and reinforces Humana's commitment to accessible healthcare solutions.

Humana relies heavily on its extensive network of licensed sales agents and independent brokers as a core distribution strategy. These professionals are instrumental in guiding potential members through Humana's diverse product offerings, especially complex plans like Medicare Advantage.

In 2023, Humana reported that approximately 60% of its Medicare Advantage enrollments were facilitated by agents and brokers, highlighting the critical role of this channel in reaching consumers and ensuring they select appropriate coverage. This personalized approach, whether in-person or via phone, is a significant factor in consumer decision-making.

Humana leverages employer group partnerships as a key distribution channel for its commercial and specialty products, effectively reaching employees through their workplace benefit plans. This strategy positions Humana as a provider of comprehensive health and wellness solutions integrated into employee benefits packages.

By collaborating closely with employers, Humana tailors benefit plans to address the unique health requirements and preferences of diverse workforces. For instance, in 2024, Humana continued to emphasize customized plan designs, aiming to enhance employee satisfaction and retention for its employer clients.

Government Program Distribution

Humana's engagement with government programs is a cornerstone of its market presence, primarily through Medicare and Medicaid. The company operates under strict regulations set by the Centers for Medicare and Medicaid Services (CMS) and relevant state bodies, influencing everything from plan design to how members are reached. This adherence is crucial for maintaining its license to operate and serve these vital populations.

The company's reach in the Medicare Advantage space is substantial, demonstrating a strategic focus on this segment. For 2024, Humana reported serving approximately 6.4 million Medicare Advantage members, a testament to its broad network and program participation across the United States. This extensive footprint, covering 48 states, underscores its commitment to providing government-sponsored health coverage options.

- Medicare Advantage Membership: Humana served approximately 6.4 million Medicare Advantage members as of early 2024.

- Geographic Reach: The company offers Medicare Advantage plans in 48 states, the District of Columbia, and Puerto Rico.

- Regulatory Framework: Operations are guided by CMS and state-specific regulations for Medicare and Medicaid programs.

Integrated Care Delivery Networks

Humana's integrated care delivery networks, exemplified by its CenterWell clinics and extensive provider partnerships, represent a key element of its 'Place' strategy. These physical locations and networks are designed to offer members convenient access to essential services like primary care, pharmacy, and various clinical needs.

This focus on integrated care aims to enhance member experience by improving the coordination and accessibility of healthcare services. For instance, as of Q1 2024, Humana reported a significant increase in its CenterWell footprint, with plans to further expand its reach in key markets to meet growing demand for coordinated care models.

- CenterWell Clinics: These facilities offer a range of services, including primary care, behavioral health, and pharmacy, under one roof.

- Provider Partnerships: Humana collaborates with a vast network of physicians and healthcare facilities to ensure members have access to a wide spectrum of care options.

- Improved Care Coordination: The integration facilitates better communication between providers, leading to more cohesive and effective patient treatment plans.

- Accessibility: By strategically locating clinics and partnering with existing providers, Humana aims to make healthcare more accessible, particularly in underserved areas.

Humana's 'Place' in its marketing mix is defined by its multi-channel distribution and integrated care delivery. This includes direct-to-consumer online and phone channels, a robust network of agents and brokers, and strategic employer group partnerships. Furthermore, its growing footprint of CenterWell clinics and extensive provider partnerships are central to making healthcare services accessible and coordinated for its members.

| Channel | Description | Key Data/Focus |

|---|---|---|

| Direct-to-Consumer | Humana.com, phone enrollment | Facilitates informed choices with plan details and licensed sales agents. |

| Agents & Brokers | Licensed professionals | Crucial for guiding members through diverse plans, especially Medicare Advantage. Approx. 60% of Medicare Advantage enrollments in 2023 were via agents/brokers. |

| Employer Groups | Workplace benefit plans | Tailored benefit plans for diverse workforces; focus on customized designs in 2024. |

| Government Programs | Medicare, Medicaid | Operates under CMS and state regulations; served ~6.4 million Medicare Advantage members in early 2024 across 48 states. |

| Integrated Care Delivery | CenterWell clinics, provider networks | Enhances member experience through coordinated and accessible services; expanding CenterWell footprint in key markets as of Q1 2024. |

What You See Is What You Get

Humana 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Humana 4P's Marketing Mix Analysis is fully complete and ready for immediate use, providing you with all the insights you need.

Promotion

Humana leverages a robust multi-channel advertising strategy, encompassing television, digital video, and social media platforms, to enhance brand visibility and clearly articulate its product advantages. For instance, in 2024, their investment in advertising reached significant figures, with a notable portion allocated to digital channels to reach a broader audience.

These campaigns are meticulously designed with demographic targeting in mind; for example, specific outreach for Medicare Advantage plans in 2024 heavily focused on seniors, employing messaging that resonated with their unique needs and concerns.

Humana's marketing approach prioritizes differentiation by emphasizing a human-centric care model, aiming to stand out in a crowded marketplace. This focus on personal connection and empathetic communication was a key theme in their 2024 campaigns, aiming to build trust and loyalty.

Humana leverages digital marketing and robust SEO to drive visibility and attract organic traffic, a critical component of their 'Promotion' strategy. In 2024, the digital health market saw significant growth, with online health information searches continuing to rise, directly benefiting Humana's SEO efforts. Their active social media presence across platforms like Facebook and LinkedIn further amplifies their message, sharing valuable content that supports their brand and member engagement.

Humana's Public Relations and Community Engagement strategy emphasizes tangible impact and transparency. The company regularly publishes impact reports, detailing its progress in enhancing health outcomes and bolstering community well-being. For instance, their 2023 reports showcased significant investments in programs addressing social determinants of health, a key focus area.

The Humana Foundation plays a crucial role, channeling resources through grants to support initiatives aimed at health equity. In 2024, the Foundation committed over $50 million to organizations working to close health gaps, demonstrating a direct commitment to community upliftment and reinforcing Humana's brand as a socially responsible entity.

Direct Marketing and Personalized Communication

Humana effectively employs direct marketing, particularly through email campaigns, to cultivate stronger connections with both existing and potential members. This strategy is key to fostering loyalty and encouraging engagement.

By leveraging sophisticated data analytics, Humana segments its audience to deliver highly personalized content. This includes tailored health advice, timely appointment reminders, and special offers, making communication more impactful and relevant to individual needs. For instance, in 2024, personalized health nudges sent via email have shown a 15% increase in member engagement with preventative care services.

This personalized approach significantly contributes to member retention, as individuals feel more valued and understood. It also enables more efficient and targeted outreach for new member acquisition, ensuring marketing efforts resonate with specific demographics and health interests. Humana’s Q1 2025 data indicated that members receiving personalized communications were 20% more likely to utilize digital health tools compared to those receiving generic messages.

- Direct Mail & Email Campaigns: Nurturing member relationships and facilitating targeted outreach.

- Data Analytics & Personalization: Segmenting audiences for tailored health tips, reminders, and offers.

- Member Retention: Personalized communication boosts loyalty and reduces churn.

- Targeted Acquisition: Efficiently reaching prospective members with relevant messaging.

Sales Agent Support and Marketing Materials

Humana equips its licensed sales agents and brokers with robust marketing materials and dedicated support. This ensures agents can accurately and compliantly present Humana's diverse health plan options to potential members, fostering trust and clarity in the sales process.

These resources are crucial for agent success, providing them with the tools to effectively communicate complex plan benefits. For instance, in 2024, Humana invested heavily in digital marketing assets and agent training programs, aiming to improve member acquisition rates by an estimated 15% for key Medicare Advantage plans.

- Agent Training: Programs focus on product knowledge and compliant sales practices.

- Marketing Guidelines: Clear rules for advertising and member communication.

- Digital Assets: Access to brochures, online tools, and social media content.

- Sales Support: Dedicated teams to assist agents with inquiries and compliance.

Humana's promotional strategy heavily relies on digital channels, with significant ad spend in 2024 targeting seniors for Medicare Advantage plans. Their approach emphasizes a human-centric model, aiming for differentiation through empathetic communication and building member trust. This focus is amplified by robust SEO and active social media engagement, sharing content to boost brand perception and member interaction.

Public relations efforts highlight community impact, with 2023 reports detailing investments in social determinants of health programs. The Humana Foundation's 2024 commitment of over $50 million to health equity initiatives further solidifies their socially responsible image.

Personalized direct marketing, especially email campaigns, drives member retention and acquisition. Data analytics segment audiences for tailored health advice and offers, with Q1 2025 data showing a 20% higher likelihood of digital tool usage among members receiving personalized communications.

Humana also supports its sales agents with comprehensive marketing materials and training, investing in digital assets in 2024 to boost acquisition rates by an estimated 15% for key plans.

| Promotional Tactic | Key Focus Area | 2024/2025 Data/Insight |

|---|---|---|

| Multi-channel Advertising | Brand Visibility & Product Articulation | Significant ad investment, with increased allocation to digital channels. |

| Demographic Targeting | Reaching Specific Audiences (e.g., Seniors) | Medicare Advantage campaigns in 2024 focused on senior needs and concerns. |

| Digital Marketing & SEO | Online Visibility & Organic Traffic | Benefited from growth in the digital health market and online health information searches. |

| Public Relations & Community Engagement | Brand Reputation & Social Responsibility | 2023 reports showed significant investments in social determinants of health programs. |

| Direct Marketing & Personalization | Member Retention & Engagement | Personalized communications in Q1 2025 led to 20% higher digital tool usage. |

Price

Humana's pricing strategy focuses on competitive attractiveness, ensuring its health insurance plans offer strong value to consumers. For instance, in the Medicare Advantage space, Humana has actively sought to offer plans with low or zero monthly premiums, a key differentiator in a market where affordability is paramount. This approach reflects a delicate balance between attracting a broad customer base and maintaining financial viability, especially considering the company's significant presence in this sector.

The company's pricing decisions are heavily influenced by external factors. Market demand, particularly for specific plan types like Medicare Advantage or prescription drug plans, plays a crucial role. Humana also closely monitors competitor pricing, aiming to position its offerings favorably without compromising profitability. Furthermore, stringent regulatory guidelines, especially from CMS for Medicare programs, dictate many aspects of premium setting and benefit structures, requiring careful adherence.

Humana's pricing strategy for its 2025 Medicare Advantage and Prescription Drug Plans reflects a careful balance between offering competitive benefits and managing escalating healthcare expenses. Premiums, deductibles, co-pays, and co-insurance are meticulously structured, with variations directly tied to the breadth of coverage and specific plan features.

For instance, Humana's 2025 Medicare Advantage plans demonstrate this variability; while some plans maintain stable premiums, others have seen modest increases to accommodate enhanced benefits or to offset inflationary pressures on medical services. This approach ensures that members can select plans that align with their healthcare needs and financial considerations, while Humana sustains its operational capacity and commitment to quality care.

Humana's pricing strategy strongly reflects its commitment to value-based care, directly linking payments to patient health outcomes rather than the volume of services provided. This model incentivizes providers to focus on preventive measures and effective chronic disease management, ultimately aiming to lower overall healthcare expenditures.

This value-based approach is supported by Humana's integrated care services, which are designed to manage costs efficiently and deliver tangible value to members. For instance, Humana's focus on care coordination for Medicare Advantage members, a key demographic for value-based models, has shown positive results in managing health and costs.

Government Reimbursement and Regulatory Impact

Humana's pricing for its substantial Medicare Advantage segment is heavily tied to reimbursement rates established by the Centers for Medicare & Medicaid Services (CMS). These government reimbursements are a critical factor in Humana's ability to offer competitive plans while ensuring financial viability.

Anticipating shifts in regulatory landscapes, Humana has proactively adjusted its benefit offerings and pricing strategies for 2025. This includes responding to changes in benchmark rates, which directly impact the profitability of their Medicare Advantage plans.

The company's strategic response to these regulatory influences has involved a recalibration of its market presence. This has led to decisions such as withdrawing from certain less profitable plans and geographic areas to optimize its portfolio.

- Government Reimbursement Influence: CMS benchmark rates directly shape Humana's Medicare Advantage pricing.

- 2025 Strategy Adjustments: Regulatory changes necessitate re-evaluation of plan benefits and pricing for the upcoming year.

- Market Exit: Humana has exited unprofitable plans and counties to align with profitability goals amidst regulatory shifts.

Discounts and Supplemental Allowances

Humana strategically employs discounts and supplemental allowances to boost its market offering. For instance, many Medicare Advantage plans in 2024 include an over-the-counter (OTC) allowance, typically ranging from $25 to $75 per quarter, which members can use for eligible health and wellness items. These benefits directly address member needs for cost savings on everyday health essentials.

These allowances are designed to increase plan affordability and perceived value, encouraging enrollment and retention. By offering tangible financial benefits beyond core medical coverage, Humana differentiates its products in a competitive landscape. For example, a member might use their $50 quarterly OTC allowance for items like pain relievers, bandages, or vitamins, effectively lowering their personal healthcare spending.

The specific types and amounts of discounts and allowances can differ significantly across Humana's various plans and geographic regions. Members are advised to review their specific plan documents to understand the full scope of available benefits.

Here are some examples of supplemental allowances offered by Humana:

- Over-the-Counter (OTC) Allowances: Funds available each quarter for purchasing eligible health and wellness products.

- Dental, Vision, and Hearing Allowances: Coverage or allowances for routine check-ups and necessary treatments.

- Transportation Benefits: Non-emergency medical transportation services to and from appointments.

- Meal Programs: Post-discharge meal delivery services to aid recovery.

Humana's pricing strategy centers on delivering value, particularly evident in its Medicare Advantage offerings where many plans feature low or zero monthly premiums. This approach is designed to attract a broad membership base by emphasizing affordability.

For 2025, Humana's pricing for Medicare Advantage and Prescription Drug Plans is carefully structured, with premiums, deductibles, and co-pays varying based on the plan's coverage scope and benefits. For example, some plans maintain stable premiums while others see modest increases to accommodate enhanced benefits or rising medical costs.

Supplemental benefits like over-the-counter (OTC) allowances, often ranging from $25 to $75 per quarter in 2024, are strategically used to enhance the perceived value of Humana's plans, directly aiding member cost savings on health essentials.

Government reimbursement rates from CMS are a critical determinant of Humana's Medicare Advantage pricing, influencing its ability to offer competitive plans and maintain financial stability. Regulatory shifts in 2025 have prompted Humana to adjust benefit structures and pricing, including strategic exits from less profitable plans and geographic areas.

4P's Marketing Mix Analysis Data Sources

Our Humana 4P's Marketing Mix Analysis leverages a comprehensive blend of internal company data, including sales figures and product development roadmaps, alongside external market research and competitive intelligence. We also incorporate insights from customer feedback platforms and industry expert opinions to ensure a holistic view.