Humana Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humana Bundle

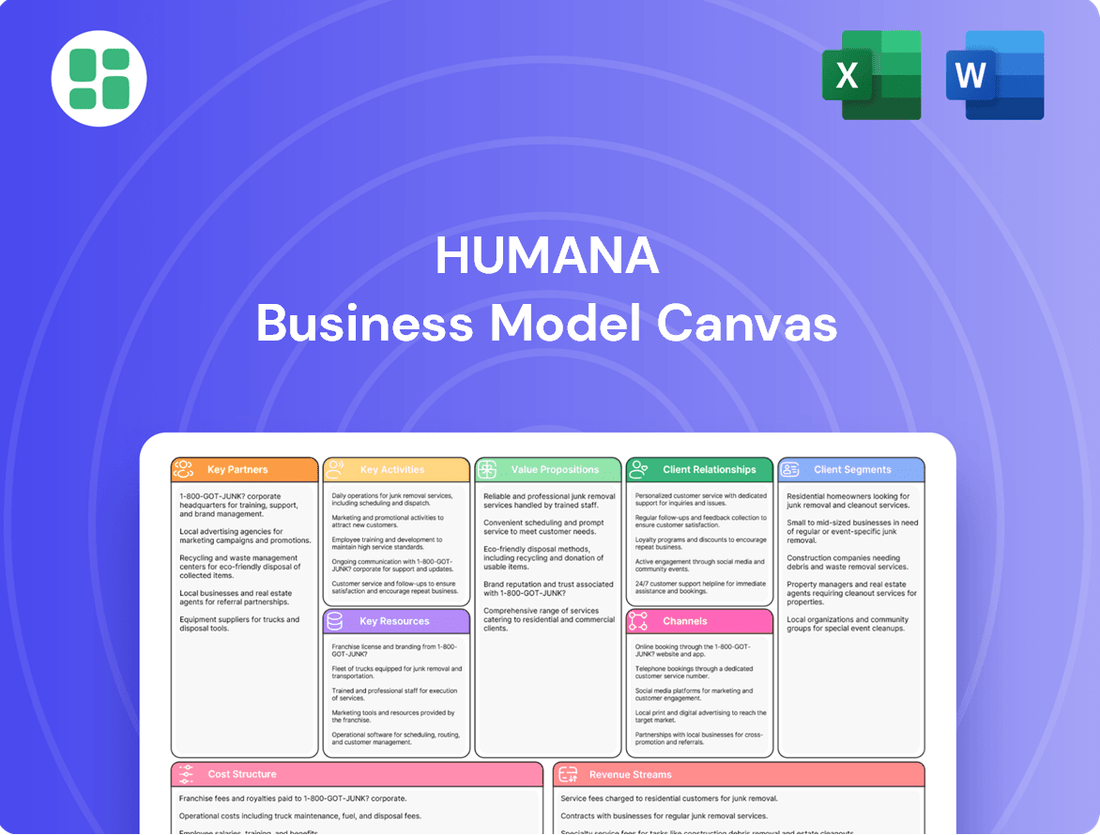

Unlock the strategic blueprint behind Humana's success with our comprehensive Business Model Canvas. Discover how they connect with diverse customer segments, forge key partnerships, and deliver unique value propositions in the healthcare industry. This detailed analysis is your key to understanding their revenue streams and cost structure.

Ready to gain a competitive edge? Our full Business Model Canvas for Humana provides an in-depth look at their core activities, resources, and channels, offering actionable insights for your own strategic planning. Download it now to see the complete picture and accelerate your business thinking.

Partnerships

Humana's operational success hinges on its vast network of healthcare providers, encompassing roughly 76,000 primary care physicians in 2024. These collaborations are vital for offering complete care and ensuring efficient service to its members.

The company actively cultivates robust relationships with hospitals, physician groups, and various other healthcare facilities. This ensures a comprehensive and accessible care ecosystem for Humana's beneficiaries.

Humana's strategic alliances with pharmaceutical companies are foundational to its pharmacy benefit management (PBM) operations. These partnerships are key to negotiating competitive drug pricing, which directly impacts the affordability and accessibility of medications for Humana's member base. For instance, in 2023, Humana's PBM segment, CenterWell Pharmacy, continued to leverage these relationships to manage drug costs effectively.

These collaborations are not just about price negotiation; they are vital for ensuring that members have access to the medications they need. By working closely with drug manufacturers, Humana can streamline the supply chain and improve medication adherence programs. In 2024, Humana's focus on integrated care models further solidifies the importance of these pharmaceutical partnerships.

CenterWell, Humana's healthcare services arm, has specifically prioritized investments in forging partnerships with pharmaceutical companies. This strategic approach aims to bolster direct-to-consumer sales channels for medications, creating a more integrated and convenient experience for patients. These efforts are part of a broader strategy to enhance patient outcomes and manage healthcare costs more efficiently.

Humana actively partners with technology firms to enhance its service offerings, particularly in data analytics and digital health solutions. These collaborations are designed to streamline operations and elevate the member experience. For example, Humana's partnership with Veda aims to significantly improve the precision of its provider directories, a critical component for member access to care.

Government Agencies

Humana's business model heavily relies on partnerships with government agencies, especially for its Medicare and Medicaid programs. These collaborations are fundamental to its operations, allowing the company to extend its reach and serve a wider array of individuals. In fact, a significant portion of Humana's revenue is tied to these government contracts.

These strategic alliances are crucial for Humana's growth and market presence. By working closely with government entities, Humana can effectively deliver its health insurance products and services to millions of beneficiaries. This symbiotic relationship ensures access to large, stable markets.

- Government Agency Partnerships: Humana's core strategy involves deep integration with government agencies, particularly for Medicare and Medicaid.

- Revenue Dependence: In 2024, an impressive 85% of Humana's premiums and services revenue originated from federal government contracts, highlighting the critical nature of these relationships.

- Expanded Reach: These partnerships enable Humana to access and serve a vast customer base, solidifying its position in the government-sponsored health insurance market.

Primary Care Strategic Partnerships

Humana actively cultivates strategic joint ventures, notably with Welsh, Carson, Anderson & Stowe (WCAS). This collaboration is pivotal in expanding its senior-focused primary care clinics, operating under the CenterWell brand. These alliances are crucial for scaling operations and leveraging external expertise.

The core objective of these primary care partnerships is to foster a value-based care model. This approach emphasizes coordinated care and improved patient outcomes, shifting from a fee-for-service system. Humana's investment in CenterWell clinics, for instance, aims to integrate services more effectively for its members.

- Strategic Joint Ventures: Partnerships like the one with WCAS enable Humana to accelerate the growth and development of its CenterWell primary care clinics.

- Value-Based Care Focus: These collaborations are designed to enhance care coordination and improve patient outcomes, aligning with Humana's commitment to value-based care.

- Senior-Focused Care: The expansion efforts are specifically targeting the senior population, addressing their unique healthcare needs through specialized primary care.

Humana's key partnerships are diverse, ranging from healthcare providers and pharmaceutical companies to government agencies and technology firms. These collaborations are essential for delivering comprehensive care, managing costs, and expanding its service offerings.

A significant portion of Humana's revenue, approximately 85% of its premiums and services revenue in 2024, comes from federal government contracts, underscoring the critical nature of its partnerships with government agencies for Medicare and Medicaid programs.

The company also engages in strategic joint ventures, such as its collaboration with Welsh, Carson, Anderson & Stowe (WCAS), to grow its CenterWell primary care clinics, focusing on value-based care for seniors.

| Partner Type | Key Collaborations/Focus | Impact on Humana | 2024 Data/Context |

|---|---|---|---|

| Healthcare Providers | Hospitals, Physician Groups, Facilities | Ensures comprehensive care access, service efficiency | ~76,000 primary care physicians in network |

| Pharmaceutical Companies | Drug Manufacturers | Negotiates drug pricing, manages PBM operations | CenterWell Pharmacy leverages these for cost management |

| Government Agencies | Federal (Medicare, Medicaid) | Drives revenue, market access, service delivery | 85% of 2024 revenue from federal contracts |

| Technology Firms | Data Analytics, Digital Health | Streamlines operations, enhances member experience | Partnerships like Veda improve provider directory accuracy |

| Strategic Joint Ventures | WCAS | Expands senior-focused primary care (CenterWell) | Accelerates growth and value-based care models |

What is included in the product

A detailed Humana Business Model Canvas outlining key partners, activities, and resources to deliver healthcare value. It maps customer relationships, revenue streams, and cost structures for its diverse health insurance offerings.

Humana's Business Model Canvas offers a structured approach to pinpoint and alleviate customer pains by clearly mapping value propositions to specific customer segments.

It provides a clear visual representation of how Humana addresses customer needs, making it easier to identify and solve pain points within their healthcare services.

Activities

Health plan administration is a cornerstone activity, involving the meticulous management of diverse health insurance offerings like medical, dental, and vision coverage. This includes overseeing member enrollment, ensuring adherence to policy terms, and processing claims efficiently. For instance, in 2023, Humana served approximately 17 million medical members, highlighting the scale of their administrative operations.

Humana's core operations revolve around the meticulous processing and management of healthcare claims, a critical function that directly influences its financial health and the experience of its members. This complex activity is the engine that drives reimbursements and ensures the smooth functioning of its health insurance offerings.

The sheer volume of claims handled is substantial, with Humana processing an estimated 185 million healthcare claims annually. This immense workload necessitates sophisticated technological infrastructure and rigorous oversight to maintain accuracy and efficiency, directly impacting operational costs and member trust.

Humana actively manages its provider network, which is crucial for delivering healthcare services to its members. This involves contracting with approximately 1.4 million healthcare professionals and facilities across the United States as of 2024.

The company focuses on building and maintaining relationships with these providers, ensuring they meet quality standards and can offer a wide range of services. This includes rigorous credentialing processes and ongoing performance reviews to uphold patient care quality.

Integrated Care Delivery and Management

Humana's key activity centers on delivering and managing integrated care through its CenterWell brand. This involves a coordinated approach across pharmacy, home health, and primary care services to enhance member well-being and control costs.

This integrated model aims to create a seamless care experience, addressing multiple health needs under one umbrella. For instance, by managing both prescription drugs and in-home support, Humana can better track patient adherence and overall health progress.

- CenterWell Pharmacy: Offers mail-order and specialty pharmacy services, focusing on medication management and affordability.

- CenterWell Home Health: Provides in-home nursing, therapy, and personal care services to support recovery and chronic condition management.

- CenterWell Primary Care: Operates a growing network of senior-focused primary care clinics designed to offer comprehensive, coordinated care.

In 2024, Humana continued to expand its CenterWell footprint, recognizing the growing demand for accessible and integrated healthcare solutions. This strategy is designed to improve patient outcomes by ensuring better communication and collaboration among different care providers.

Product Development and Sales

Humana's key activities revolve around the continuous enhancement of its health plans, with a significant focus on the Medicare Advantage sector. This ongoing product development aims to align with shifting consumer preferences and the dynamic regulatory landscape. For instance, in 2024, Humana continued to innovate within its Medicare Advantage offerings, introducing new benefits and plan designs to cater to diverse health needs.

Complementing this product evolution are extensive sales and marketing initiatives. These efforts are crucial for attracting new members and retaining existing ones, thereby securing Humana's market share and driving sustained growth. The company's strategic outreach in 2024 emphasized personalized member engagement and digital accessibility, reflecting a commitment to meeting customers where they are.

- Product Refinement: Humana actively innovates its health plan designs, particularly within the Medicare Advantage market, to address evolving member needs and regulatory changes.

- Sales and Marketing: Robust sales and marketing strategies are employed to attract and retain members, ensuring continued growth and a strong market presence.

- Market Focus: A significant portion of Humana's product development and sales efforts are directed towards the Medicare Advantage market, a key growth area for the company.

- Member Engagement: In 2024, Humana's sales approach increasingly leveraged digital channels and personalized communication to enhance member acquisition and retention.

Humana's key activities are deeply rooted in managing health plan administration, a complex process involving member enrollment, policy adherence, and efficient claims processing. In 2023, the company served approximately 17 million medical members, underscoring the immense scale of these operations.

Central to Humana's model is the meticulous handling of healthcare claims, with an estimated 185 million processed annually, demanding sophisticated technology and rigorous oversight to ensure accuracy and maintain member trust.

The company actively cultivates its provider network, contracting with about 1.4 million healthcare professionals and facilities as of 2024, ensuring quality care and service breadth for its members through rigorous credentialing and performance reviews.

Humana drives integrated care through its CenterWell brand, coordinating pharmacy, home health, and primary care services to improve member well-being and manage costs effectively, with continued expansion of its primary care clinics in 2024.

Continuous enhancement of health plans, particularly Medicare Advantage, is a vital activity, supported by robust sales and marketing efforts. In 2024, Humana focused on digital engagement and personalized communication to attract and retain members in this key growth market.

Preview Before You Purchase

Business Model Canvas

The Humana Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This comprehensive overview, showcasing Humana's strategic framework, is a direct representation of the final deliverable, ensuring full transparency. Once your order is complete, you'll gain immediate access to this identical, ready-to-use document, allowing you to explore and understand Humana's core business components without any alterations.

Resources

Humana's extensive provider networks are a cornerstone of its business model, encompassing a vast array of hospitals, physicians, and specialists. This deep bench of contracted healthcare professionals is crucial for delivering comprehensive care and ensuring members have access to the services they need, wherever they are. In 2024, Humana continued to strengthen these relationships, recognizing that provider access directly impacts member satisfaction and retention.

Humana's proprietary data and analytics are central to its business model, allowing for the creation of highly personalized healthcare plans. This advanced technological capability helps identify health trends and anticipate member needs, leading to better health outcomes.

In 2024, Humana's investment in data analytics is crucial for optimizing cost efficiency. By leveraging these insights, the company can better manage healthcare expenditures and offer more competitive pricing.

Humana's technology platforms and infrastructure are vital assets, enabling enhanced member experiences and broader care access through significant investments. These include sophisticated telehealth solutions and robust digital health platforms.

In 2024, Humana allocated roughly $2 billion to technology spending, underscoring its dedication to digital transformation and the modernization of its operational backbone.

Human Capital

Humana's human capital is the bedrock of its success, encompassing a diverse team of clinicians, actuaries, sales professionals, and administrative staff. This skilled workforce is essential for delivering quality healthcare services and maintaining a competitive edge in the market.

The company recognizes that the expertise, dedication, and overall well-being of its employees are paramount to achieving its mission as a leading care provider. Investing in employee development and fostering a supportive work environment directly contributes to Humana's ability to meet its organizational objectives and serve its members effectively.

- Workforce Composition: Humana employs a broad range of professionals, including approximately 65,000 associates as of early 2024, with a significant portion being clinicians and support staff dedicated to member care.

- Key Roles: Clinicians are crucial for patient care delivery and health outcomes, while actuaries provide vital data analysis for risk assessment and pricing. Sales teams drive member acquisition, and administrative staff ensure smooth operational functioning.

- Employee Well-being: Humana actively promotes employee well-being through various programs, acknowledging that a healthy and engaged workforce is more productive and innovative.

- Competitive Advantage: The collective knowledge, skills, and commitment of Humana's employees are a significant differentiator, enabling the company to navigate complex healthcare landscapes and adapt to evolving member needs.

Strong Brand Reputation and Financial Capital

Humana's strong brand reputation as a leader in health and well-being is a cornerstone of its business model. This established trust fosters significant market recognition and customer loyalty, underpinning its ability to attract and retain members.

The company's substantial financial capital, evidenced by its impressive 2024 revenues of $106.2 billion, provides the necessary resources for strategic growth and operational stability. This financial strength allows Humana to make critical investments in technology, member services, and market expansion.

- Brand Recognition: Humana is widely recognized as a trusted provider in the health insurance and services sector.

- Financial Strength: With $106.2 billion in 2024 revenues, Humana possesses significant financial capital.

- Strategic Investment Capability: This capital enables investments in innovation, member experience, and market development.

- Long-Term Stability: Financial resources contribute to Humana's resilience and ability to navigate market fluctuations.

Humana's key resources include its extensive provider networks, proprietary data and analytics capabilities, robust technology platforms, skilled human capital, and strong brand reputation. These elements collectively enable Humana to deliver comprehensive care, personalize member experiences, optimize costs, and maintain a competitive edge in the healthcare market.

Value Propositions

Humana provides a broad spectrum of health insurance options, encompassing medical, dental, vision, and pharmacy benefits. This integrated offering is designed to meet a wide range of member needs, ensuring a holistic approach to healthcare. In 2024, Humana continued to focus on these comprehensive plans, aiming to simplify the member experience and foster long-term health.

Humana's commitment to integrated care models and value-based arrangements directly targets improved health outcomes. By emphasizing preventive health measures, the company aims to create a healthier membership base.

A key indicator of this success is seen in Humana Medicare Advantage members enrolled in value-based care programs. These members experienced a notable 11.6% reduction in emergency room visits when contrasted with those receiving traditional care, showcasing the tangible benefits of their approach.

Humana's value proposition centers on simplifying the healthcare experience for its members. This involves offering easy access to a wide network of healthcare providers and developing intuitive digital tools that streamline the process of managing health and benefits.

Personalized support is a key component, ensuring members receive guidance tailored to their specific needs, making healthcare navigation less daunting. For instance, Humana's digital platform saw a significant increase in member engagement in 2024, with over 70% of claims processed through their app.

Personalized Care and Wellness Programs

Humana offers personalized care by developing tailored health plans designed to meet individual member needs. This includes specialized programs for managing chronic conditions and a variety of wellness initiatives. For instance, in 2023, Humana reported a significant focus on its integrated care model, which aims to improve health outcomes and reduce costs through personalized interventions.

The company's commitment to personalized wellness extends to benefits like fitness programs and screenings for social determinants of health. These efforts empower individuals to take a more active role in their health management. In 2024, Humana continued to expand its digital health tools, providing members with resources to track progress and access support, fostering a proactive approach to overall wellness.

Humana's value proposition in personalized care is further demonstrated through its focus on member engagement. By offering customized support and resources, the company aims to improve health literacy and encourage healthier lifestyle choices. This strategy is crucial in addressing the diverse health needs of its membership base, which spans millions of individuals across the United States.

- Tailored Health Plans: Customized insurance options addressing specific health needs.

- Chronic Condition Management: Programs designed to support individuals with ongoing health issues.

- Wellness Initiatives: Benefits like fitness access and screenings for social determinants of health.

- Proactive Health Management: Empowering members to actively participate in their well-being.

Access to Extensive Provider Networks

Humana’s extensive provider networks are a cornerstone of its value proposition, offering members unparalleled choice and flexibility in healthcare. This broad access ensures individuals can find physicians and facilities that best suit their needs and preferences, leading to more personalized and effective care.

The sheer size of Humana's network directly translates into convenience for members, reducing wait times and travel burdens. In 2024, Humana continued to expand its partnerships, aiming to cover a significant portion of the U.S. population with in-network providers, making healthcare more accessible than ever.

This wide reach also plays a crucial role in cost management. By negotiating favorable rates with a large number of providers, Humana can offer members more affordable care options. For instance, a substantial percentage of Humana’s claims in 2024 were processed through its preferred provider organizations, highlighting the cost-efficiency driven by network strength.

- Extensive Network Reach: Humana's commitment to a broad provider base in 2024 meant members had access to a vast array of doctors, specialists, and hospitals across the country.

- Enhanced Member Choice: The value lies in empowering members to select providers based on quality, location, and personal fit, fostering greater satisfaction and adherence to treatment plans.

- Optimized Cost-Effectiveness: A strong network allows Humana to leverage its negotiating power, passing on savings to members through more competitive pricing for services.

- Convenient Access to Care: By ensuring a high density of in-network facilities, Humana minimizes out-of-pocket expenses and reduces the logistical challenges members face in seeking medical attention.

Humana simplifies healthcare by offering integrated plans that cover medical, dental, and pharmacy needs, making it easier for members to manage their health. This holistic approach is designed to improve overall well-being and streamline the member experience.

The company focuses on value-based care, aiming to enhance health outcomes and reduce costs. For example, Humana Medicare Advantage members in value-based programs saw an 11.6% decrease in ER visits compared to those in traditional care settings.

Humana provides personalized support and digital tools to help members navigate their health benefits and access care easily. In 2024, member engagement on their digital platform increased, with over 70% of claims processed via the app.

Humana's value proposition emphasizes proactive health management through tailored plans, chronic condition support, and wellness initiatives. These programs empower individuals to take an active role in their health, with a continued expansion of digital tools in 2024 to support this goal.

| Value Proposition | Description | 2024 Impact/Data |

| Integrated Health Coverage | Comprehensive medical, dental, and pharmacy benefits. | Focus on simplifying member experience and fostering long-term health. |

| Value-Based Care | Emphasis on preventive health and improved outcomes. | Medicare Advantage members in value-based care saw an 11.6% reduction in ER visits. |

| Personalized Support & Digital Tools | Tailored plans, chronic condition management, and easy-to-use digital platforms. | Over 70% of claims processed via the app, indicating high digital engagement. |

| Proactive Wellness | Wellness initiatives, fitness programs, and social determinant screenings. | Continued expansion of digital health tools to encourage proactive health management. |

Customer Relationships

Humana prioritizes personalized member support through dedicated customer care specialists and care coordination teams. This focus on individual attention, which saw Humana members receive proactive outreach for health management in 2024, builds trust and ensures specific needs are met effectively.

Humana's digital self-service tools, like their online member portals and mobile apps, are central to how they interact with customers. These platforms allow members to easily manage their health plans, find care providers, and access personal health information. This digital focus empowers individuals, giving them more control over their healthcare journey.

In 2023, Humana reported that over 70% of their member interactions occurred through digital channels, highlighting the significant adoption and reliance on these self-service options. This trend continued into early 2024, with a steady increase in app downloads and portal usage for tasks like prescription refills and appointment scheduling.

Humana's value-based care model fosters deep relationships with members by aligning provider incentives toward high-quality, cost-effective health outcomes. This collaborative approach prioritizes the patient's overall well-being, moving beyond traditional fee-for-service models.

In 2024, Humana reported that its value-based care arrangements covered approximately 2.5 million members, demonstrating a significant commitment to this relationship-building strategy. This model encourages providers to focus on preventative care and chronic disease management, leading to better patient satisfaction and improved health metrics.

Community Engagement and Wellness Initiatives

Humana fosters strong customer relationships through robust community engagement and comprehensive wellness initiatives. These programs go beyond standard healthcare, focusing on the holistic well-being of members and their communities. For instance, in 2024, Humana continued to expand its offerings in fitness benefits and screenings for social determinants of health, directly addressing barriers to care and promoting healthier lifestyles.

These efforts are designed to build trust and loyalty by demonstrating a commitment to members' overall quality of life. By investing in community health and offering resources that support physical and social well-being, Humana strengthens its connection with its customer base, making them feel valued and supported beyond their healthcare needs.

- Community Investment: Humana's commitment to community well-being is a cornerstone of its customer relationship strategy.

- Wellness Programs: Offering fitness benefits and social determinants of health screenings directly addresses members' broader health needs.

- Relationship Building: These initiatives foster deeper connections by showing care for members' lives outside of traditional medical services.

- Member Support: By focusing on overall well-being, Humana aims to improve member satisfaction and retention.

Proactive Communication and Education

Humana actively engages its members through proactive communication, ensuring they are up-to-date on plan changes, benefit details, and available health resources. This approach empowers members with knowledge about their coverage.

For instance, in 2024, Humana focused on educating members about upcoming Medicare Advantage plan updates for 2025, providing clear guidance on what to expect. This commitment to transparency is crucial for member retention and satisfaction.

- Informative Updates: Regular communications detail plan modifications and benefit enhancements.

- Health Resource Guidance: Members receive information on accessing wellness programs and healthcare services.

- Medicare Clarity: Specific attention is given to explaining changes in Medicare plans, such as those for 2025.

- Member Empowerment: Proactive education fosters informed decision-making regarding healthcare choices.

Humana's customer relationships are built on a foundation of personalized support, digital empowerment, and value-based care. In 2024, the company continued to emphasize proactive member outreach and the use of digital platforms, with over 70% of member interactions occurring digitally in 2023, a trend showing sustained growth into 2024.

The company's commitment to value-based care, covering approximately 2.5 million members in 2024, fosters deeper patient-provider relationships by focusing on health outcomes. This approach is complemented by extensive community engagement and wellness initiatives, designed to support members' holistic well-being and build lasting loyalty.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Focus |

|---|---|---|

| Personalized Support | Dedicated care specialists, care coordination | Proactive health management outreach |

| Digital Self-Service | Member portals, mobile apps | Increased app downloads and portal usage for plan management and scheduling |

| Value-Based Care | Aligning provider incentives with patient outcomes | Coverage for ~2.5 million members, focus on preventative care |

| Community & Wellness | Fitness benefits, social determinants of health screenings | Expanding offerings to promote holistic well-being |

| Proactive Communication | Plan updates, benefit details, resource guidance | Educating members on Medicare Advantage plan changes for 2025 |

Channels

Humana leverages direct-to-consumer (DTC) channels, such as its dedicated sales force and robust online presence, to connect with individual members. This strategy is crucial for enrolling individuals in Medicare Advantage and other individual health plans, facilitating personalized interactions and support.

In 2024, Humana reported significant engagement through its DTC efforts, with a notable portion of its individual Medicare Advantage plan growth attributed to these direct channels. For instance, the company's digital platforms saw increased traffic and conversion rates for plan selections.

Independent agents and brokers are a cornerstone of Humana's distribution strategy, acting as crucial intermediaries that connect the company with a vast customer base. These partners are vital for expanding Humana's market presence, offering specialized knowledge of local markets and consumer needs.

In 2024, Humana continued to leverage this channel to offer its comprehensive suite of health insurance products, including Medicare Advantage and commercial plans. These agents and brokers provide a personalized touch, guiding individuals and families through complex plan choices and ensuring Humana's offerings reach a wider audience.

Humana leverages employer benefits programs as a core channel to deliver its health insurance products to commercial members. This approach allows them to access a broad customer base by partnering with businesses of all sizes, from small enterprises to large corporations.

These employer-sponsored plans are a significant revenue stream and membership driver for Humana, offering comprehensive health coverage as a valuable employee benefit. In 2024, employer-sponsored health insurance remained the dominant form of coverage in the U.S., covering a substantial portion of the non-elderly population.

Government Contracts

Government contracts represent a cornerstone of Humana's business model, primarily through its participation in Medicare and Medicaid programs. These agreements with federal and state governments are crucial for delivering health coverage to millions of Americans.

The strategic importance of these government contracts is underscored by their significant financial contribution. In 2024, government contracts were the driving force behind Humana's revenue, making up a substantial 85% of its total premiums and services revenue. This highlights Humana's deep integration with public health initiatives.

- Medicare Advantage: Humana offers a wide range of Medicare Advantage plans, which are managed care plans that provide benefits beyond Original Medicare, often including prescription drug coverage and extra benefits like dental, vision, and hearing.

- Medicaid: The company also provides health coverage through Medicaid, serving low-income individuals and families, including those with disabilities and children, in various states.

- TRICARE: Humana also plays a role in the TRICARE program, providing health benefits for active duty and retired U.S. military personnel and their families.

- Revenue Dependency: The overwhelming reliance on government programs, with 85% of 2024 revenue stemming from these contracts, demonstrates Humana's core strategy and its significant role in public health sector delivery.

Digital Platforms

Humana actively utilizes a suite of digital platforms to connect with its members. This includes its primary website, dedicated mobile apps, and expanding telehealth services, all designed to offer information, simplify the enrollment process, and provide easy access to healthcare services.

These digital touchpoints are crucial for enhancing member convenience and improving overall accessibility to Humana's offerings. For instance, in 2024, Humana reported a significant increase in digital engagement, with over 70% of member inquiries being handled through digital channels, demonstrating a clear shift towards online interactions.

- Website: Serves as a comprehensive resource for plan information, provider searches, and member account management.

- Mobile Applications: Offer on-the-go access to health records, appointment scheduling, and virtual care options.

- Telehealth Services: Provide convenient virtual consultations with healthcare professionals, increasing care accessibility.

Humana’s distribution strategy is multi-faceted, encompassing direct-to-consumer (DTC) sales, independent agents and brokers, employer benefits programs, and government contracts. These channels collectively ensure broad market reach and cater to diverse customer segments.

In 2024, Humana’s direct engagement, including its sales force and online platforms, drove significant growth in its individual Medicare Advantage plans. This highlights the effectiveness of personalized outreach and digital accessibility in capturing market share.

Independent agents and brokers remain a vital component of Humana's distribution network, providing localized expertise and personalized guidance to consumers. Their role is critical in navigating complex plan choices and expanding Humana's presence across various markets.

Employer-sponsored plans are a key revenue driver, leveraging Humana's partnerships with businesses to offer health coverage to employees. This channel reflects the continued dominance of employer-provided insurance in the U.S. health landscape.

Government contracts, particularly Medicare and Medicaid, form the bedrock of Humana's business, accounting for a substantial 85% of its 2024 revenue from premiums and services. This deep integration underscores Humana's pivotal role in public health delivery.

| Channel | Description | 2024 Relevance |

|---|---|---|

| Direct-to-Consumer (DTC) | Humana's own sales force and online platforms | Key driver for individual Medicare Advantage growth; increased digital engagement |

| Independent Agents & Brokers | Third-party intermediaries | Crucial for market expansion and personalized consumer guidance |

| Employer Benefits Programs | Business partnerships for employee coverage | Significant revenue stream; reflects employer-sponsored insurance prevalence |

| Government Contracts | Medicare, Medicaid, TRICARE | Dominant revenue source (85% of premiums & services in 2024); essential for public health initiatives |

Customer Segments

Medicare Beneficiaries, individuals aged 65 and older, represent Humana's most significant customer base. This demographic is primarily targeted through Humana's comprehensive suite of Medicare Advantage plans, designed to offer enhanced benefits beyond traditional Medicare. As of 2024, Humana demonstrated its commitment to this segment by managing approximately 4.9 million Medicare Advantage members, underscoring their pivotal role in the company's strategic growth initiatives.

Humana actively serves individuals enrolled in government-sponsored Medicaid programs, playing a crucial role in expanding healthcare access for low-income communities. This segment represents a significant portion of Humana's commitment to public health initiatives.

In 2024, Humana Healthy Horizons demonstrated its dedication to this customer segment by conducting over 423,000 Social Determinants of Health screenings for its Medicaid members. These screenings are vital for understanding and addressing non-medical factors that impact health outcomes.

Employer Groups, also known as commercial clients, are a cornerstone of Humana's business. These are companies that contract with Humana to provide health insurance coverage for their employees. This partnership is crucial for Humana's revenue generation, as it represents a significant portion of their membership base.

In 2024, Humana served approximately 3.2 million members through these employer-sponsored health plans. These companies rely on Humana for comprehensive health solutions that help attract and retain talent, while also managing healthcare costs effectively.

Individuals and Families

Humana offers a wide array of health insurance choices for individuals and families who are looking to secure private health plans. These plans are directly purchased, giving consumers control over their healthcare coverage.

The company caters to a broad range of personal and family needs through its comprehensive offerings. This includes medical, dental, and vision insurance, alongside various supplemental benefit plans designed to provide a more complete healthcare solution.

- Diverse Health Needs: Humana provides medical, dental, and vision coverage.

- Supplemental Benefits: Offers additional plans to enhance coverage.

- Direct Purchase: Individuals and families buy plans directly from Humana.

- Market Reach: In 2024, Humana continued to serve millions of individuals in the commercial market, with a significant portion of its revenue stemming from these direct-to-consumer segments.

Military Members and Families (TRICARE)

Humana actively serves military members and their families, particularly through its administration of the TRICARE East Region. This commitment extends beyond healthcare services to encompass significant community engagement.

In 2024, Humana's dedication to military families was evident through its extensive charitable support and volunteer efforts. These initiatives spanned 32 states, underscoring a deep-rooted commitment to the well-being of this demographic.

- TRICARE East Region Administration: Humana manages healthcare services for a substantial portion of the U.S. military community.

- Extensive Charitable Support: The company actively contributes to military-focused charities and organizations.

- Volunteerism: Humana employees dedicate time and resources to support military families across numerous states.

- Geographic Reach: Support efforts in 2024 covered 32 states, demonstrating a broad commitment to military communities nationwide.

Humana's customer segments are diverse, reflecting its broad reach in the healthcare market. Key groups include Medicare beneficiaries, individuals on Medicaid, employer groups, individuals and families seeking private plans, and military members and their families. The company tailors its offerings to meet the specific needs of each segment, demonstrating a commitment to accessibility and comprehensive care across different demographics.

| Customer Segment | Key Characteristics | 2024 Membership/Activity Data |

|---|---|---|

| Medicare Beneficiaries | Individuals aged 65+; enrolled in Medicare Advantage plans | Approx. 4.9 million Medicare Advantage members |

| Medicaid Enrollees | Individuals eligible for government-sponsored Medicaid programs | Over 423,000 Social Determinants of Health screenings conducted |

| Employer Groups | Companies providing health insurance for employees | Approx. 3.2 million members in employer-sponsored plans |

| Individual & Family Plans | Direct purchasers of private health insurance | Significant revenue contribution from direct-to-consumer segments |

| Military Members & Families | Active duty and retired military personnel and their dependents | Administered TRICARE East Region; supported initiatives in 32 states |

Cost Structure

Medical benefit expenses, primarily claims payouts for member services, represent the largest cost for Humana. For instance, in the first quarter of 2024, Humana reported a medical loss ratio of 89.4%, highlighting the significant portion of premiums dedicated to these costs.

The company's profitability was notably affected by escalating medical costs and higher member utilization trends observed throughout late 2023 and early 2024. This increased demand for healthcare services directly translates to higher payout obligations for Humana.

Humana’s administrative and operating expenses are a significant component of its cost structure, covering essential business functions like sales and marketing, IT infrastructure, general administration, and the crucial area of regulatory compliance. These costs are vital for maintaining operations and ensuring adherence to industry standards.

The company is committed to enhancing operational efficiency and controlling its cost base. This focus is reflected in its financial performance, with Humana reporting an operating cost ratio of 11.0% in the second quarter of 2025, demonstrating a disciplined approach to managing these expenditures.

Humana dedicates significant resources to contracting with and compensating its extensive network of healthcare providers. These payments are crucial for ensuring access to care for its members. For instance, in 2023, Humana's cost of services, which largely reflects provider payments, was approximately $72.3 billion.

Maintaining a robust and high-quality provider network requires ongoing investment in recruitment, credentialing, and relationship management. Negotiating favorable reimbursement rates and ensuring network adequacy are continuous operational expenses that directly impact Humana's profitability and member satisfaction.

Technology and Innovation Investments

Humana significantly invests in technology and innovation to streamline operations and elevate member services. These investments are crucial for their digital transformation efforts.

In 2024, Humana allocated roughly $2 billion to technology spending. This substantial figure underscores their dedication to leveraging advanced digital platforms and data analytics.

- Technology Investments: Focus on digital platforms and data analytics.

- 2024 Spending: Approximately $2 billion dedicated to technology.

- Objectives: Enhance service delivery, improve member experience, and boost operational efficiency.

Regulatory Compliance and Litigation Costs

Humana faces significant expenses due to the stringent regulations in the healthcare sector. These costs are associated with maintaining compliance and managing legal challenges.

For instance, in 2023, Humana reported $1.1 billion in legal settlements and regulatory reserves, reflecting the ongoing costs of navigating a complex legal and compliance landscape.

- Regulatory Compliance: Costs associated with adhering to federal and state healthcare laws, including HIPAA, ACA, and CMS regulations.

- Litigation Expenses: Funds allocated for legal defense, settlements, and potential judgments arising from lawsuits.

- Medicare Advantage Star Ratings Litigation: Specific legal battles and associated costs related to performance metrics that affect bonus payments.

- Compliance Monitoring and Audits: Expenses for internal and external audits to ensure adherence to all applicable regulations.

Humana's cost structure is dominated by medical benefit expenses, which represent the largest outlay. In the first quarter of 2024, the medical loss ratio stood at 89.4%, indicating that nearly all premium revenue is channeled into member healthcare services. This is further amplified by rising medical costs and increased member utilization trends observed through late 2023 and into early 2024, directly increasing Humana's payout obligations.

| Cost Category | Description | 2023/2024 Data Point | Significance |

|---|---|---|---|

| Medical Benefit Expenses | Claims payouts for member services | 89.4% medical loss ratio (Q1 2024) | Largest cost component, directly tied to member health outcomes. |

| Cost of Services (Provider Payments) | Payments to healthcare providers | ~$72.3 billion (2023) | Crucial for network access and quality of care. |

| Administrative & Operating Expenses | Sales, marketing, IT, general admin, compliance | 11.0% operating cost ratio (Q2 2025 projection) | Essential for business operations and efficiency. |

| Technology Investments | Digital platforms, data analytics, IT infrastructure | ~$2 billion (2024) | Drives operational efficiency and service enhancement. |

| Regulatory & Legal Costs | Compliance, legal defense, settlements | $1.1 billion (2023) in legal settlements and reserves | Navigating complex healthcare regulations and litigation. |

Revenue Streams

Humana's primary revenue engine is built upon the premiums it collects for its diverse health insurance offerings. A cornerstone of this income is its robust Medicare Advantage business.

The Retail segment, heavily reliant on Medicare Advantage plans, is projected to be a significant contributor to Humana's consolidated revenues, estimated to reach $117 billion in 2024.

Humana brings in revenue from premiums collected for its commercial employer group health plans. This segment caters to businesses looking to offer health insurance benefits to their employees, forming a significant part of their income stream.

Additional revenue is generated through a variety of specialty products. These include offerings like dental, vision, and other supplemental benefits designed to provide more comprehensive coverage options for members. As of December 31, 2024, Humana served approximately 5 million members across these specialty product lines.

Humana earns income from its comprehensive healthcare offerings, which include pharmacy benefits, doctor's offices, and in-home care, mainly through its CenterWell brand. This segment plays a crucial role in Humana's overall financial performance.

The growth in CenterWell's external services is a strong indicator of its expanding market reach. For the first six months of 2025, this revenue stream saw a substantial increase of 36%, reaching $2.3 billion, demonstrating its significant contribution to Humana's top line.

Administrative Services Only (ASO) Fees

Humana generates revenue through Administrative Services Only (ASO) fees, a model distinct from premium collection. This approach is utilized for specific self-funded employer groups, where Humana acts as an administrator for their health plans.

This strategy allows Humana to tap into a different market segment, offering administrative expertise without taking on the full risk associated with insurance premiums. It diversifies Humana's revenue base, making it less susceptible to fluctuations in the traditional insurance market.

- ASO Fees: Revenue earned by administering health plans for self-funded employers.

- Client Diversification: Serves employer groups that manage their own financial risk.

- Flexible Service Models: Offers tailored administrative solutions to meet diverse client needs.

- Revenue Stability: Provides a more predictable income stream compared to premium-based models.

Investment Income

Investment income, while secondary to its core health insurance operations, represents a notable revenue stream for Humana. The company leverages its significant financial reserves, built from premiums and operational cash flow, to generate returns through various investment vehicles. This segment includes income from both realized gains and the comprehensive income attributed to unrealized investment gains, reflecting the fluctuating market values of its portfolio.

For the fiscal year 2023, Humana reported investment income of $784 million. This figure highlights the financial strength and diversification strategies employed by the company to enhance its overall profitability beyond its primary insurance services. The contribution from these investments, even when accounting for market volatility, plays a role in supporting Humana's financial stability and capacity for future growth.

- Investment Income Contribution: In 2023, Humana's investment income reached $784 million, a significant component of its total revenue.

- Source of Funds: This income is derived from the strategic management of Humana's substantial financial reserves and cash generated from its health insurance business.

- Comprehensive Income: The reported figures often include comprehensive income, which accounts for unrealized gains and losses on investments, reflecting market performance.

- Strategic Importance: While not its primary focus, investment income provides a valuable supplementary revenue stream that bolsters the company's financial health and investment capacity.

Humana's revenue streams are diverse, primarily driven by health insurance premiums, especially from its Medicare Advantage plans. The company also generates income from commercial employer group health plans and specialty products like dental and vision coverage.

CenterWell, Humana's healthcare services segment, is a growing contributor, offering pharmacy, home care, and physician services. For the first six months of 2025, CenterWell's external services revenue surged by 36% to $2.3 billion, showcasing its expanding market presence.

Additionally, Humana earns Administrative Services Only (ASO) fees from self-funded employer groups, providing administrative expertise without assuming full insurance risk. Investment income, derived from managing its financial reserves, also contributes, with $784 million reported in 2023.

| Revenue Stream | Description | 2024 Projection/2023 Data |

| Insurance Premiums | Collected for health insurance offerings, notably Medicare Advantage and commercial plans. | Medicare Advantage segment projected to contribute significantly to $117 billion in consolidated revenues. |

| Specialty Products | Revenue from dental, vision, and other supplemental benefits. | Served approximately 5 million members across specialty lines as of December 31, 2024. |

| CenterWell Services | Income from pharmacy, doctor's offices, and in-home care services. | External services revenue grew 36% to $2.3 billion in H1 2025. |

| ASO Fees | Administrative fees for self-funded employer groups. | Provides administrative expertise for specific employer groups. |

| Investment Income | Returns generated from managing financial reserves. | Reported $784 million in investment income for fiscal year 2023. |

Business Model Canvas Data Sources

The Humana Business Model Canvas is built using a combination of internal financial statements, customer feedback surveys, and competitive market analysis. These diverse data sources ensure a comprehensive and accurate representation of Humana's strategic approach.