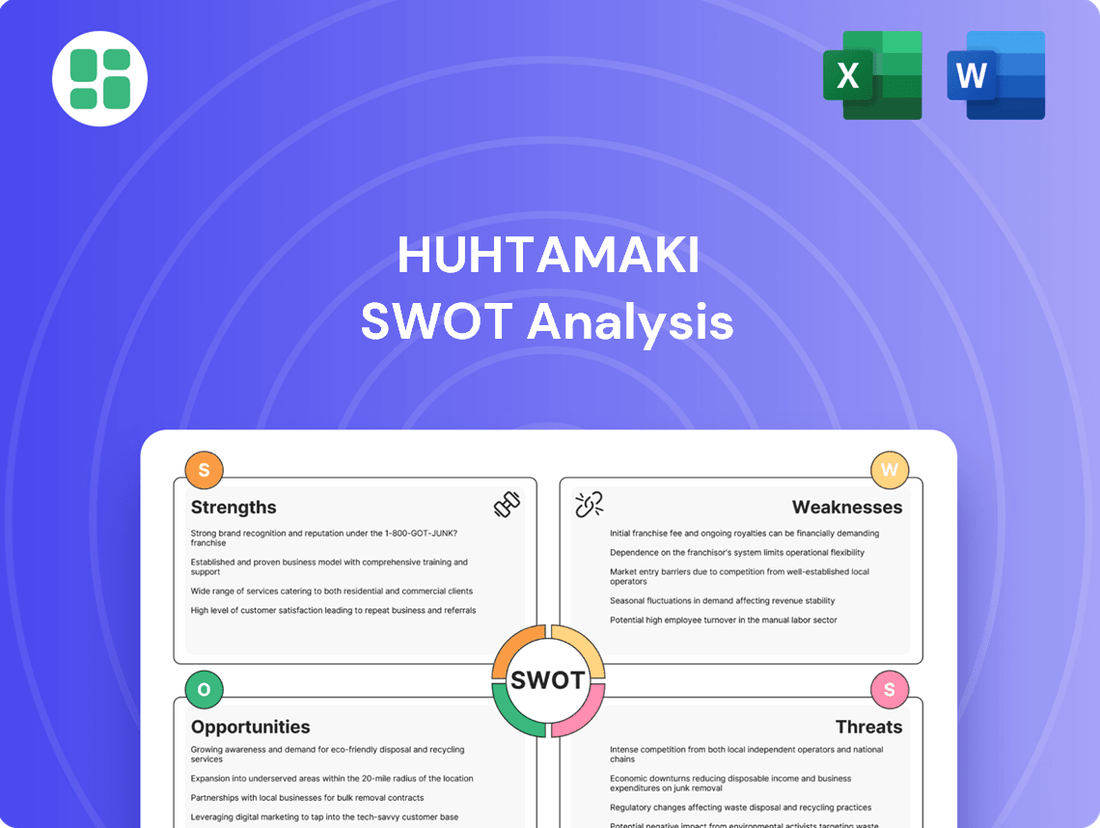

Huhtamaki SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huhtamaki Bundle

Huhtamaki's strengths lie in its global reach and diverse product portfolio, but its reliance on raw material prices presents a significant threat. Understanding these internal capabilities and external market forces is crucial for strategic planning.

Want the full story behind Huhtamaki's competitive advantages, potential weaknesses, and market opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Huhtamaki's substantial global footprint, spanning 36 countries and 101 locations with approximately 18,000 employees, is a key strength. This extensive international presence allows the company to cater to a wide array of industries and customer needs across the globe, diversifying its revenue streams and reducing dependence on any single market.

The company boasts a diverse product portfolio encompassing flexible packaging, fiber packaging, and foodservice packaging solutions. This variety not only broadens its market appeal but also acts as a buffer against downturns in specific sectors, contributing to overall business resilience and stability.

Huhtamaki demonstrates a robust dedication to sustainability, with a clear strategic objective to achieve carbon-neutral production and ensure all products are recyclable, compostable, or reusable by 2030. This forward-thinking approach is not just aspirational; it's backed by tangible action.

The company is actively investing in and developing innovative packaging solutions. For instance, Huhtamaki has successfully launched new paperboard options that significantly reduce plastic coating, and they've also ramped up production of flexible packaging designed for recyclability. These advancements directly address the increasing global demand for environmentally responsible packaging.

This strong commitment to eco-friendly practices positions Huhtamaki favorably in the market. It aligns perfectly with evolving consumer preferences and stricter regulatory landscapes that favor sustainable materials. As a result, Huhtamaki is solidifying its reputation as a frontrunner in the sustainable packaging industry, a sector experiencing significant growth driven by environmental consciousness.

Huhtamaki showcased impressive financial results for 2024, marked by enhanced profitability and a notable increase in adjusted EBIT. The company navigated a period of initially subdued demand, yet managed to achieve a strong full-year adjusted EBIT margin of 10.1%, indicating significant operational efficiency and pricing power.

This financial strength, evidenced by the generation of substantial free cash flow, positions Huhtamaki favorably for future growth. These robust financial metrics underscore the company's capacity to fund strategic investments and pursue new opportunities effectively.

Effective Strategic Priorities and Efficiency Programs

Huhtamaki's commitment to effective strategic priorities and efficiency programs has been a significant strength. The company has successfully executed profitability improvement initiatives, demonstrating a clear focus on operational excellence.

These programs have yielded substantial cost savings, with approximately EUR 87 million in savings reported by the first quarter of 2025. This achievement highlights the effectiveness of their cost management strategies in navigating inflationary pressures.

The company's strategic emphasis on enhancing competitiveness and maintaining disciplined capital allocation has been instrumental in its positive financial trajectory. These focused efforts underscore a robust approach to business development and financial health.

- Profitability Improvement: Successful execution of programs leading to significant cost savings.

- Cost Savings: Achieved approximately EUR 87 million in savings by Q1 2025.

- Inflation Compensation: Initiatives effectively counteracted cost inflation and drove operational improvements.

- Strategic Focus: Emphasis on competitiveness and disciplined capital allocation supports financial development.

Reputation for Food Safety and Accessibility

Huhtamaki's strong reputation for food safety and accessibility is a significant strength, deeply rooted in its core purpose of protecting food, people, and the planet. Their innovative packaging solutions are designed to maintain hygiene and ensure the safe transport and storage of food and beverages, making them more accessible and affordable worldwide.

This commitment to enhancing food safety and reducing food waste through effective packaging is a key differentiator. For instance, in 2023, Huhtamaki reported a significant portion of its revenue derived from products directly contributing to food preservation and safety, underscoring the market's reliance on their expertise.

- Global Food Safety Standards: Huhtamaki consistently adheres to and often exceeds international food safety regulations, building trust across diverse markets.

- Reduced Food Waste: Their packaging innovations contribute to a reduction in food spoilage, a critical factor in global food security efforts.

- Consumer Confidence: The brand's association with safety and quality directly translates into higher consumer confidence, a vital asset in the competitive food packaging sector.

- Market Accessibility: By enabling safer and more efficient food distribution, Huhtamaki's products enhance the accessibility of nutritious food to a wider population.

Huhtamaki's robust financial performance in 2024, including a strong adjusted EBIT margin of 10.1%, demonstrates effective operational management and pricing power. The company generated substantial free cash flow, enabling strategic investments and growth opportunities. By Q1 2025, Huhtamaki had achieved approximately EUR 87 million in cost savings through efficiency programs, effectively mitigating inflationary pressures and enhancing competitiveness.

| Metric | 2024 Performance | Significance |

|---|---|---|

| Adjusted EBIT Margin | 10.1% | Indicates strong profitability and operational efficiency. |

| Cost Savings (by Q1 2025) | EUR 87 million | Demonstrates success in efficiency programs and cost management. |

| Free Cash Flow | Substantial | Supports investment in growth and strategic initiatives. |

What is included in the product

Delivers a strategic overview of Huhtamaki’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Identifies critical vulnerabilities and opportunities, enabling proactive risk mitigation and strategic advantage realization.

Weaknesses

Huhtamaki operates in an industry deeply sensitive to the price swings of essential raw materials like polymers, pulp, and energy. These fluctuations directly affect production costs. For instance, the price of crude oil, a key component in many plastics, saw significant volatility throughout 2024, impacting polymer costs for packaging manufacturers.

This volatility presents a challenge to Huhtamaki's profitability, as the company cannot always pass on these increased input costs to its customers immediately or in full. While Huhtamaki utilizes contract mechanisms to mitigate some of this risk, the inherent unpredictability of commodity markets remains a notable financial vulnerability.

Huhtamaki's reliance on specific market segments and product categories presents a significant weakness. In 2024, for instance, the food-on-the-go sector, a key area for packaging, saw subdued demand, especially for coffee-related items, as consumers grappled with elevated prices.

Furthermore, geopolitical instability, such as the ongoing conflict in the Middle East, disrupted global brands and impacted sales in certain Middle Eastern and Asian markets. These localized or category-specific downturns directly impede Huhtamaki's broader sales expansion and overall profitability.

Huhtamaki operates within a hyper-competitive global packaging sector, where a multitude of companies actively compete for market dominance. This crowded field often leads to significant pricing pressures, impacting profitability and necessitating constant investment in innovation and operational efficiency to stay ahead. For example, in 2024, the global packaging market was valued at approximately $1.1 trillion, with projections indicating continued growth but also sustained competitive intensity.

Challenges in Recycling Complex Packaging Structures

Huhtamaki faces challenges with multi-layer flexible packaging, which often combines materials like plastic, aluminum, and paper. These mixed-material structures are inherently difficult to separate and reprocess within existing recycling systems, hindering the company's pursuit of a truly circular economy.

The complexity of these packaging types means they often cannot be processed by standard recycling facilities. This limits the extent to which Huhtamaki can achieve its ambitious sustainability goals, as a significant portion of its output may not be effectively recycled.

- Difficult Separation: Multi-layer packaging requires specialized technology to separate its constituent materials, which is not widely available.

- Infrastructure Limitations: Current recycling infrastructure is not equipped to handle the intricate composition of these advanced packaging solutions.

- Circularity Gap: The inability to effectively recycle these complex structures creates a gap in achieving full circularity for a portion of Huhtamaki's product portfolio.

Impact of Global Economic and Geopolitical Instability

Global economic and geopolitical instability presents a significant weakness for Huhtamaki. Customers and consumers are exhibiting increased caution due to ongoing geopolitical events and persistent inflation, which directly impacts purchasing decisions and can lead to subdued demand. This caution was evident in certain market segments throughout 2024, potentially affecting sales volumes.

These external macro-economic factors, such as the lingering effects of global supply chain disruptions and regional conflicts, are largely outside of Huhtamaki's direct control. Consequently, they introduce a substantial degree of uncertainty into the company's operational and financial planning, making it challenging to forecast demand and manage inventory effectively.

- Subdued Consumer Demand: Increased caution among consumers, driven by inflation and geopolitical concerns, can directly translate to lower sales volumes for Huhtamaki's packaging products.

- Unpredictable Input Costs: Geopolitical instability can disrupt supply chains, leading to volatile raw material prices and increased operational costs, impacting profitability.

- Reduced Investment Appetite: Economic uncertainty may lead some B2B customers to postpone or reduce their packaging orders, affecting Huhtamaki's order book.

- Currency Fluctuations: Global economic instability often correlates with significant currency exchange rate volatility, which can negatively impact Huhtamaki's reported earnings when converting foreign subsidiary results.

Huhtamaki's reliance on multi-layer flexible packaging presents a significant hurdle to achieving full circularity, as separating these combined materials for recycling is technically challenging and often not supported by existing infrastructure. This limitation means a portion of their product portfolio may not be effectively reprocessed, creating a gap in their sustainability efforts.

The company operates in a highly competitive global packaging market, valued at approximately $1.1 trillion in 2024, which exerts considerable pricing pressure. This intense competition necessitates continuous investment in innovation and efficiency to maintain market share and profitability.

Huhtamaki is vulnerable to the volatile prices of key raw materials like polymers, pulp, and energy. For instance, fluctuations in crude oil prices in 2024 directly impacted polymer costs, posing a challenge to maintaining stable production expenses and profitability.

Geopolitical instability and global economic uncertainty create a challenging operating environment, leading to subdued consumer demand and unpredictable input costs. These external factors, largely beyond the company's control, introduce significant uncertainty into financial planning and demand forecasting.

Preview the Actual Deliverable

Huhtamaki SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global market for sustainable packaging is experiencing robust growth, fueled by increasing consumer demand for eco-friendly alternatives and stricter environmental regulations. This surge is particularly evident in the demand for recyclable, compostable, and bio-based materials. For instance, the global sustainable packaging market was valued at approximately $280 billion in 2023 and is projected to reach over $400 billion by 2028, growing at a CAGR of around 7-8%.

Huhtamaki's strategic emphasis on sustainable innovation, including its investments in fiber-based packaging and bioplastics, positions it favorably to capture a significant share of this expanding market. The company's commitment to developing and offering a wider range of environmentally sound packaging solutions directly addresses the evolving needs of both consumers and businesses, many of whom are integrating ESG criteria into their procurement strategies.

Technological breakthroughs are opening doors to novel packaging solutions, including plant-based plastics, mushroom-based cushioning, and seaweed-derived films. The development of biodegradable inks and adhesives further enhances the sustainability profile of these advancements. These innovations are crucial for meeting growing consumer demand for eco-friendly packaging options.

Active and smart packaging technologies present significant opportunities for extending food shelf life and improving product traceability throughout the supply chain. Huhtamaki's commitment to research and development, exemplified by its blueloop sustainable innovation program, positions the company to capitalize on these emerging trends.

Emerging markets, especially in South Asia, show robust growth in sustainable packaging, with India's sector expected to grow at over 6% annually for food and beverages. This presents a prime opportunity for Huhtamaki to broaden its reach and secure market share in areas with rising consumer spending power and demand.

Strategic Acquisitions and Partnerships

Huhtamaki consistently evaluates strategic acquisition and partnership opportunities to bolster its market position. By integrating with specialized companies or collaborating with industry leaders, the company can rapidly gain access to new technologies and markets. This approach is crucial for staying ahead in the fast-evolving sustainable packaging sector.

These strategic moves are designed to enhance Huhtamaki's capabilities and accelerate the adoption of innovative, eco-friendly solutions. For example, a partnership could provide immediate access to advanced bioplastic formulations, while an acquisition might bring in a company with established distribution networks in a key growth region. Such integrations are vital for achieving scale and driving the widespread use of sustainable packaging alternatives.

- Acquisition of specialized sustainable technology firms

- Partnerships with raw material innovators for enhanced supply chains

- Mergers to expand geographic footprint in emerging markets

- Joint ventures for developing next-generation biodegradable materials

Growth in E-commerce and Refillable Models

The surge in e-commerce, projected to reach over $7 trillion globally by 2025, directly translates to increased demand for robust and protective packaging. Huhtamaki is well-positioned to capitalize on this by developing innovative solutions that ensure product integrity throughout the online supply chain.

Refillable packaging models are also a significant opportunity, aligning with growing consumer and regulatory pressure for waste reduction. This trend is particularly strong in sectors like personal care and food service, where repeat purchases are common. Huhtamaki can lead in this space by offering durable, reusable packaging designs that integrate seamlessly into circular economy initiatives.

- E-commerce Growth: Global e-commerce sales are forecast to exceed $7 trillion by 2025, creating substantial demand for specialized packaging.

- Sustainability Focus: Refillable models are gaining momentum, driven by consumer preference and environmental regulations aimed at cutting waste.

- Innovation Potential: Huhtamaki can develop tailored packaging solutions for both direct-to-consumer shipping and the expanding refillable market.

Huhtamaki can leverage the accelerating global demand for sustainable packaging, a market projected to surpass $400 billion by 2028. The company's focus on fiber-based and bioplastic innovations aligns perfectly with consumer preferences and stricter environmental regulations. Furthermore, advancements in materials science, such as plant-based plastics and seaweed-derived films, present avenues for developing next-generation eco-friendly solutions.

The burgeoning e-commerce sector, expected to exceed $7 trillion in global sales by 2025, creates a significant opportunity for Huhtamaki to supply robust and protective packaging. Additionally, the growing trend towards refillable packaging models, driven by waste reduction initiatives, offers a chance for the company to innovate in durable, reusable designs.

| Opportunity Area | Market Projection/Data | Huhtamaki's Relevance |

|---|---|---|

| Sustainable Packaging Market | Projected to exceed $400B by 2028 (CAGR 7-8%) | Strong alignment with company's innovation focus (fiber, bioplastics) |

| E-commerce Growth | Global sales to exceed $7T by 2025 | Demand for protective and specialized packaging solutions |

| Refillable Packaging Models | Growing consumer and regulatory pressure for waste reduction | Opportunity for durable, reusable packaging design |

Threats

Huhtamaki faces increasing pressure from evolving environmental regulations, exemplified by the European Union's Packaging and Packaging Waste Regulation (PPWR). This legislation mandates specific reuse targets and aims to drastically cut packaging waste, directly impacting companies like Huhtamaki that operate within or supply to the EU market.

Non-compliance with these stringent rules, or outright bans on certain packaging materials, could force Huhtamaki into costly operational overhauls and significant capital investments to adapt its product lines and manufacturing processes. For instance, the PPWR's proposed 2030 targets for reusable packaging in foodservice could require substantial shifts in infrastructure and consumer behavior.

While posing significant challenges, this evolving regulatory landscape also presents opportunities for Huhtamaki to innovate and lead in sustainable packaging solutions. Companies that proactively invest in reusable and recyclable materials may gain a competitive advantage as consumer and regulatory demand shifts towards more environmentally friendly options.

Huhtamaki continues to grapple with significant headwinds from fluctuating raw material prices and persistent cost inflation, even with ongoing cost-saving initiatives. For instance, the company noted in its Q1 2024 report that while some input costs had stabilized, overall inflationary pressures remained a concern, impacting operational expenses.

These external price volatility and cost increases pose a direct threat to Huhtamaki's profit margins. If the company is unable to fully pass these higher input costs onto its customers through price adjustments, its profitability will inevitably be squeezed, a challenge that has been a recurring theme in its financial reporting throughout 2024.

Huhtamaki faces significant threats from intense price competition within the packaging sector. The market is highly competitive, with both established companies and new entrants vying for market share, often leading to aggressive pricing strategies. This was evident in 2024, where pressures from lower raw material cost pass-through directly impacted sales prices, potentially hindering revenue growth and overall profitability.

Shifting Consumer Preferences

Consumers are increasingly seeking out products with less packaging, favoring minimalistic designs, and actively exploring unpackaged or reusable alternatives. This growing trend directly impacts the demand for traditional packaged goods, potentially affecting Huhtamaki's core product lines.

For instance, a 2024 report indicated that over 60% of consumers globally are willing to pay more for products with sustainable packaging, a clear signal of shifting preferences away from single-use materials. Adapting to these evolving consumer demands is not just beneficial but essential for Huhtamaki's continued relevance and market position.

- Reduced Demand: A significant shift towards unpackaged or reusable options could decrease the market for conventional packaging solutions.

- Sustainability Focus: Consumer preference for minimalistic and eco-friendly packaging necessitates innovation in material science and design.

- Market Adaptation: Huhtamaki must invest in and develop new packaging formats to align with evolving consumer values and environmental concerns.

Geopolitical Conflicts and Supply Chain Disruptions

Ongoing geopolitical tensions, including the protracted conflict in the Middle East, have already demonstrated their capacity to disrupt global commerce and dampen consumer demand in specific regions, directly impacting companies like Huhtamaki. These volatile situations, coupled with persistent global supply chain fragilities, can escalate operational expenses through increased logistics costs and hinder market penetration, thereby jeopardizing consistent business operations.

For instance, the Suez Canal, a critical artery for global trade, has seen a significant reduction in traffic due to security concerns, forcing many shipping companies to reroute vessels around the Cape of Good Hope. This diversion adds considerable time and cost to transit, impacting the timely delivery of raw materials and finished goods for packaging manufacturers like Huhtamaki. The International Monetary Fund (IMF) has noted that such disruptions contributed to a 0.5% increase in global inflation in early 2024, directly affecting input costs for many industries.

- Increased Shipping Costs: Rerouting due to geopolitical instability can add 30-50% to shipping expenses.

- Extended Lead Times: Supply chain disruptions have led to average lead time increases of 15-25% for key manufacturing components.

- Reduced Market Access: Conflict zones or areas with severe logistical bottlenecks can become inaccessible or prohibitively expensive to serve.

- Input Price Volatility: Geopolitical events frequently trigger sharp fluctuations in the prices of essential commodities, including energy and raw materials used in packaging production.

Huhtamaki faces significant threats from stricter environmental regulations, such as the EU's PPWR, which could necessitate costly adaptations to its product lines and manufacturing processes, impacting its bottom line. Persistent inflation and volatile raw material prices, as noted in Q1 2024 reports, continue to squeeze profit margins if cost increases cannot be fully passed on to customers.

Intense price competition within the packaging sector and a growing consumer preference for less packaging or unpackaged goods present challenges to market share and revenue growth. Geopolitical instability, exemplified by disruptions in key shipping routes like the Suez Canal, exacerbates these issues by increasing logistics costs and lead times, with the IMF estimating such disruptions contributed to a 0.5% global inflation increase in early 2024.

| Threat Category | Specific Threat | Impact on Huhtamaki | Supporting Data/Example |

| Regulatory | Evolving Environmental Regulations (e.g., EU PPWR) | Increased compliance costs, potential for product redesign, capital investment | PPWR mandates reuse targets, impacting foodservice packaging by 2030. |

| Economic | Raw Material Price Volatility & Inflation | Squeezed profit margins, reduced profitability if costs cannot be passed on | Q1 2024 reports noted ongoing inflationary pressures impacting operational expenses. |

| Market/Consumer | Shifting Consumer Preferences (less packaging, unpackaged goods) | Reduced demand for conventional packaging, need for innovation | Over 60% of consumers globally willing to pay more for sustainable packaging (2024 data). |

| Geopolitical/Supply Chain | Geopolitical Tensions & Supply Chain Fragility | Increased logistics costs, extended lead times, reduced market access | Suez Canal disruptions leading to rerouting and added transit time/cost; IMF noted 0.5% global inflation increase in early 2024 due to such factors. |

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary to provide an accurate and actionable strategic overview.