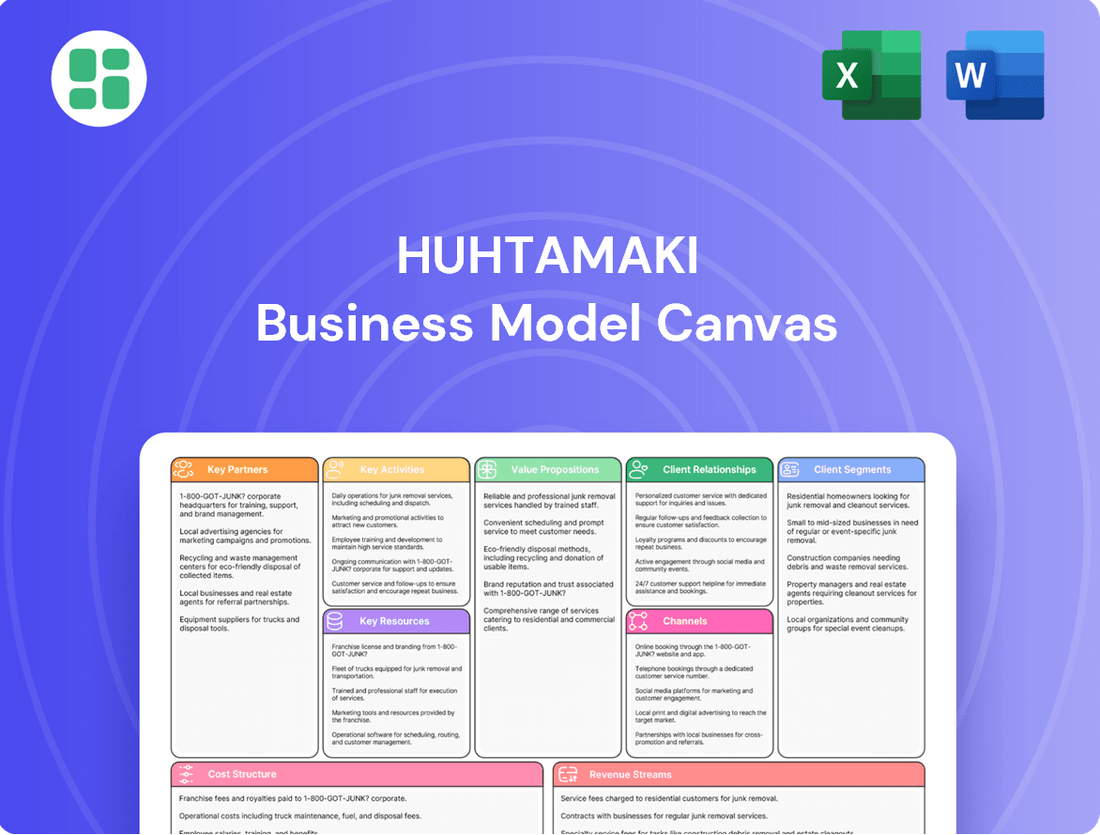

Huhtamaki Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huhtamaki Bundle

Discover the strategic framework that propels Huhtamaki forward. This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational excellence. Ready to dissect a successful global packaging leader's strategy? Download the full canvas now for actionable insights.

Partnerships

Huhtamaki’s commitment to sustainable packaging hinges on robust partnerships with raw material suppliers. These collaborations are essential for sourcing materials like recycled content, bio-based polymers, and fiber-based inputs, which are fundamental to Huhtamaki's environmentally conscious product lines.

These supplier relationships ensure a steady flow of high-quality, eco-friendly materials, directly supporting Huhtamaki's circular economy objectives. For instance, in 2024, Huhtamaki continued to expand its use of post-consumer recycled (PCR) plastics, with specific targets for increasing PCR content across its product portfolio, underscoring the critical role of its suppliers in achieving these ambitious goals.

Furthermore, working closely with suppliers fosters innovation in material science. This collaborative approach allows for the development of new, more sustainable materials and processing techniques, ultimately reducing the environmental footprint of Huhtamaki's packaging solutions.

Huhtamaki actively collaborates with technology firms and research bodies to pioneer advanced packaging. This includes joint efforts to enhance recyclability and develop high-barrier capabilities, evident in their new paperboard and flexible packaging innovations.

These partnerships are crucial for accelerating the creation and widespread adoption of sustainable packaging, directly addressing growing consumer and regulatory demands for environmentally friendly options.

Huhtamaki actively partners with waste management and recycling organizations to bolster the collection and processing of its recyclable and compostable packaging. These collaborations are crucial for developing and enhancing the infrastructure needed to support a circular economy.

By working with these entities, Huhtamaki ensures its packaging materials can be effectively channeled back into the production cycle, a key step in achieving its ambitious sustainability goals. For instance, in 2023, Huhtamaki reported a 5% increase in the use of recycled content across its product portfolio, underscoring the impact of such partnerships.

Key Customers for Co-development

Huhtamaki's strategic partnerships with leading food and beverage giants, quick-service restaurant chains, and prominent Fast-Moving Consumer Goods (FMCG) brands are foundational for co-developing tailored packaging. These collaborations are vital for ensuring Huhtamaki’s solutions precisely match client requirements, bolster product integrity, and support their sustainability goals. For instance, in 2024, Huhtamaki announced a significant partnership with a major global coffee chain to develop fully recyclable hot beverage cups, a move expected to divert thousands of tons of plastic from landfills annually.

These joint innovation initiatives foster the creation of market-leading packaging. By working closely with customers, Huhtamaki gains direct insights into evolving consumer preferences and regulatory landscapes, enabling them to proactively design innovative and compliant products. A prime example from 2023 involved a collaboration with a European snack manufacturer that resulted in a new compostable film packaging, which saw a 15% increase in shelf appeal according to initial consumer testing.

- Strategic Alliances: Collaborations with global food and beverage leaders.

- Customer-Centric Innovation: Developing packaging that meets specific client needs and sustainability targets.

- Market Leadership: Joint efforts driving the creation of cutting-edge packaging solutions.

- Sustainability Focus: Partnerships aimed at enhancing product protection and environmental responsibility.

Industry Associations and Advocacy Groups

Huhtamaki actively engages with industry associations and advocacy groups to influence packaging regulations and champion sustainable practices. This collaboration is crucial for advancing circular economy initiatives within the sector. For instance, their participation in the UN Global Compact underscores a commitment to global sustainability goals.

By adhering to standards such as the European Sustainability Reporting Standards (ESRS), Huhtamaki demonstrates its dedication to responsible business conduct and transparency. This engagement allows them to contribute to broader industry transformation, ensuring that their operations align with evolving environmental and social expectations.

- Shaping Regulations: Influence policy development to support sustainable packaging solutions.

- Promoting Sustainability: Drive adoption of eco-friendly materials and processes across the industry.

- Advancing Circularity: Collaborate on initiatives to improve recycling and reuse systems.

- Demonstrating Commitment: Adherence to global standards like ESRS and participation in UN Global Compact showcase responsible corporate citizenship.

Huhtamaki's key partnerships extend to technology providers and research institutions, crucial for developing advanced packaging solutions. These collaborations focus on enhancing recyclability and barrier properties, as seen in their innovative paperboard and flexible packaging advancements.

In 2024, Huhtamaki continued its focus on securing sustainable raw materials through strong supplier relationships, aiming to increase the use of recycled content. For example, they expanded their use of post-consumer recycled (PCR) plastics, with specific targets for increasing PCR content across their product portfolio.

Collaborations with waste management and recycling organizations are vital for Huhtamaki's circular economy goals, ensuring effective collection and processing of packaging materials. In 2023, Huhtamaki reported a 5% increase in the use of recycled content, demonstrating the impact of these partnerships.

Strategic alliances with major food, beverage, and QSR companies are central to co-developing tailored packaging solutions that meet client needs and sustainability targets. A notable 2024 partnership with a global coffee chain aims to introduce fully recyclable hot beverage cups.

| Partner Type | Focus Area | Example/2024 Data |

| Raw Material Suppliers | Sustainable Inputs, Recycled Content | Increased use of PCR plastics; targets for higher PCR content in 2024. |

| Technology & Research | Advanced Packaging, Recyclability | Developing new paperboard and flexible packaging innovations. |

| Waste Management & Recycling | Circular Economy Infrastructure | Ensuring effective collection and processing of packaging materials. |

| Food & Beverage Clients | Co-development, Customization | Partnership with major coffee chain for recyclable hot beverage cups in 2024. |

What is included in the product

This Huhtamaki Business Model Canvas provides a structured overview of their operations, detailing key customer segments, value propositions, and channels to market.

It outlines their approach to revenue streams, cost structure, key resources, and activities, offering a holistic view of their global packaging business.

Huhtamaki's Business Model Canvas acts as a pain point reliever by offering a clear, structured overview that simplifies complex strategic thinking.

It streamlines the process of understanding and communicating Huhtamaki's value proposition and operational framework, reducing confusion and accelerating strategic alignment.

Activities

Huhtamaki's commitment to Research and Development for Sustainable Packaging is a cornerstone of its business. This involves ongoing investment in creating innovative packaging that is both environmentally friendly and highly functional. The company actively explores new materials and refines existing designs to boost recyclability, ensuring products meet stringent food safety standards and extend shelf life.

Recent advancements highlight this focus, with Huhtamaki introducing paperboard solutions that significantly reduce plastic coating. Furthermore, their development of recyclable single-coated paper cups demonstrates a tangible step towards a circular economy. These efforts are crucial in a market increasingly demanding eco-conscious alternatives, with global sustainable packaging market projected to reach over $400 billion by 2027.

Huhtamaki's manufacturing and production operations are the backbone of its business, encompassing a global network of facilities dedicated to creating flexible, fiber, and foodservice packaging. These operations are meticulously managed to ensure efficient production processes, rigorous quality control, and strategic optimization of their manufacturing footprint. The company actively pursues efficiency improvements and cost savings across its production lines to enhance profitability.

In 2024, Huhtamaki continued to emphasize operational excellence. The company reported that its investments in automation and process improvements contributed to a more streamlined production flow. For instance, specific initiatives in their fiber packaging division aimed to reduce waste by an estimated 5% through optimized material usage and recycling protocols. This focus on lean manufacturing principles is crucial for maintaining a competitive edge in the packaging industry.

Huhtamaki's key activity involves meticulously managing its intricate global supply chain. This encompasses everything from securing raw materials like paper, pulp, and plastics to ensuring finished goods reach customers in 36 countries efficiently.

This complex operation is vital for maintaining product availability and ensuring timely, cost-effective distribution across its diverse markets. For instance, in 2023, Huhtamaki reported significant investments in optimizing its supply chain networks to enhance resilience and responsiveness.

Sales, Marketing, and Customer Relationship Management

Huhtamaki actively promotes and sells its extensive range of packaging solutions to a broad customer base. This includes major consumer packaged goods (CPG) companies, prominent foodservice operators, and leading retailers, showcasing their commitment to diverse market penetration.

Building and nurturing robust customer relationships is paramount. This is achieved through dedicated account management and comprehensive technical support, ensuring client needs are met effectively and fostering long-term partnerships.

Strategic pricing and initiatives focused on volume growth are central to their sales and marketing efforts. For instance, in 2024, Huhtamaki continued to leverage its global scale and innovation to secure key contracts and expand market share in high-demand sectors.

- Promoting diverse packaging solutions to CPGs, foodservice, and retailers.

- Maintaining strong customer ties via account management and technical support.

- Implementing strategic pricing and volume expansion strategies.

- Focusing on innovation to meet evolving customer demands in 2024.

Sustainability Program Execution and Reporting

Huhtamaki actively implements and meticulously monitors its ambitious sustainability goals, a core part of its business model. This involves a continuous effort to achieve targets like carbon-neutral production and ensuring all products are designed for circularity by 2030. Progress is diligently tracked and reported across key environmental metrics.

The company's commitment extends to transparently reporting on its environmental performance. This includes detailed data on greenhouse gas emissions, water usage, and waste reduction efforts. These crucial updates are regularly incorporated into their comprehensive annual reports, providing stakeholders with a clear view of their sustainability journey.

- Carbon-Neutral Production Target: Huhtamaki aims for carbon-neutral production by 2030.

- Circularity by Design: All products are to be designed for circularity by 2030.

- Key Reporting Metrics: Progress is reported on greenhouse gas emissions, water management, and waste reduction.

- Annual Reporting Integration: Sustainability statements are a standard part of their annual reports, offering factual data on performance. For instance, in their 2023 reporting, Huhtamaki highlighted a 3% reduction in Scope 1 and 2 GHG emissions compared to 2022, reaching 26% reduction from the 2019 baseline.

Huhtamaki's key activities revolve around driving innovation in sustainable packaging, optimizing global manufacturing and supply chains, and actively engaging in sales and marketing to build strong customer relationships. The company also places a significant emphasis on achieving ambitious sustainability goals, which are meticulously monitored and reported.

In 2024, Huhtamaki continued its focus on developing eco-friendly solutions, such as paperboard alternatives to plastic coatings, and enhancing production efficiency through automation. Their supply chain management saw investments aimed at improving resilience, while strategic pricing and volume growth initiatives supported market expansion. The company also reported progress towards its 2030 circularity and carbon neutrality targets, with a 3% reduction in Scope 1 and 2 GHG emissions in 2023 compared to 2022.

| Key Activity Area | 2024 Focus/Developments | Supporting Data/Goals |

|---|---|---|

| Research & Development | Sustainable packaging innovation (e.g., reduced plastic coating) | Aiming for circularity by design for all products by 2030. |

| Manufacturing & Production | Operational excellence, automation, waste reduction | Targeting 5% waste reduction in fiber packaging through optimized material usage. |

| Supply Chain Management | Optimizing networks for resilience and responsiveness | Investments in supply chain optimization were highlighted in 2023 reporting. |

| Sales & Marketing | Strategic pricing, volume growth, customer relationship management | Securing key contracts and expanding market share in high-demand sectors. |

| Sustainability Goals | Achieving carbon-neutral production, transparent reporting | Aiming for carbon-neutral production by 2030; 3% GHG emission reduction in 2023. |

What You See Is What You Get

Business Model Canvas

The Huhtamaki Business Model Canvas preview you're viewing is the exact document you'll receive upon purchase. This isn't a generic template or a simplified sample; it's a direct representation of the comprehensive analysis that will be yours. You can be confident that the detailed breakdown of Huhtamaki's strategic elements, as presented here, will be fully accessible and ready for your use immediately after completing your transaction.

Resources

Huhtamaki holds significant intellectual property, notably patents covering innovative packaging designs and manufacturing processes. These include unique rim structures for paper cups, enhancing user experience, and advanced sealing varnishes that ensure product integrity. For instance, their development in paper cup technology aims to improve recyclability and performance.

The company also leverages proprietary technologies in flexible packaging, focusing on mono-material solutions that are easier to recycle. This commitment to sustainable materials, such as advanced polyolefins, provides a distinct edge in a market increasingly demanding environmentally friendly options. Huhtamaki's investment in R&D for these materials is a key differentiator.

Huhtamaki's global manufacturing footprint, comprising 101 operating locations spread across 36 countries, is a cornerstone of its business model. This extensive network is outfitted with advanced machinery, allowing for the efficient production of a wide array of packaging solutions.

These strategically located facilities are crucial for achieving both global scale and the agility to cater to specific local market demands. The company consistently invests in enhancing its production capacity and optimizing operational efficiency to maintain its competitive edge.

Huhtamaki's approximately 18,000 employees are a cornerstone of its business model, encompassing R&D specialists, engineers, sales, and operational staff. This diverse talent pool fuels the company's innovation and operational efficiency.

The expertise of these professionals in areas like packaging design, material science, and customer service is crucial for delivering high-quality solutions. Huhtamaki emphasizes continuous employee development and prioritizes workplace safety to maintain its competitive edge.

Strong Brand Reputation and Customer Relationships

Huhtamaki's strong brand reputation as a global leader in sustainable and innovative food packaging is a core intangible asset. This recognition fosters trust and attracts environmentally conscious consumers and businesses alike.

The company cultivates deep, long-standing relationships with major customers, often built through collaborative product development and reliable service. These partnerships are crucial for maintaining market share and driving future growth.

- Global recognition as a specialist in food packaging solutions.

- Customer loyalty driven by trust and consistent quality.

- Collaborative development with key clients strengthens partnerships.

- Brand equity supports premium pricing and new business acquisition.

Sustainable Raw Material Sourcing Network

Huhtamaki's sustainable raw material sourcing network is a cornerstone of its business model, enabling access to diverse materials like recycled fibers and bio-based plastics. This network directly supports their ambitious circular economy goals, significantly decreasing dependence on virgin, fossil-fuel derived resources. For instance, by 2023, Huhtamaki reported that 83% of their packaging materials were either recyclable, compostable, or made from renewable or recycled sources, highlighting the network's effectiveness.

Strategic procurement within this network is vital for ensuring consistent material availability and maintaining cost-effectiveness. This proactive approach allows Huhtamaki to navigate market volatility and secure the necessary inputs for their innovative packaging solutions. Their commitment is further underscored by targets such as achieving 100% of their products being recyclable, compostable, or reusable by 2030.

- Diversified Sourcing: Access to a broad range of sustainable materials, including recycled content and bio-polymers.

- Circularity Focus: Directly supports the company's transition to a circular economy, reducing virgin material consumption.

- Strategic Procurement: Ensures material availability and competitive pricing through careful supplier relationships and forward planning.

- Environmental Impact: Contributes to reduced carbon footprint and waste generation across their product lifecycle.

Huhtamaki's key resources include a robust portfolio of intellectual property, such as patents for innovative packaging designs and advanced manufacturing processes. Their investment in proprietary technologies for sustainable flexible packaging, like mono-material solutions, provides a significant competitive advantage. The company's extensive global manufacturing presence, with 101 sites across 36 countries, equipped with advanced machinery, ensures efficient and scalable production.

Huhtamaki's approximately 18,000 employees, comprising R&D specialists, engineers, and operational staff, are critical for driving innovation and operational excellence. The company's strong brand reputation as a leader in sustainable food packaging fosters customer trust and attracts new business. Furthermore, their deep relationships with major clients, cultivated through collaborative product development, are vital for market stability and growth.

A crucial resource is Huhtamaki's sustainable raw material sourcing network, which provides access to recycled fibers and bio-based plastics, supporting their circular economy objectives. By 2023, 83% of their packaging materials were recyclable, compostable, or made from renewable or recycled sources. This network ensures material availability and cost-effectiveness, aligning with their target of having 100% of their products be recyclable, compostable, or reusable by 2030.

| Key Resource | Description | Impact |

| Intellectual Property | Patents on packaging designs and manufacturing processes. | Enhances product performance and recyclability. |

| Proprietary Technologies | Mono-material solutions for flexible packaging. | Drives sustainability and market differentiation. |

| Global Manufacturing Footprint | 101 operating locations in 36 countries. | Enables scale, efficiency, and local market responsiveness. |

| Skilled Workforce | Approx. 18,000 employees with diverse expertise. | Fuels innovation, R&D, and operational efficiency. |

| Brand Reputation | Leader in sustainable and innovative food packaging. | Builds customer trust and supports premium positioning. |

| Customer Relationships | Long-standing partnerships with major clients. | Ensures market share and drives collaborative growth. |

| Sustainable Sourcing Network | Access to recycled and bio-based materials. | Supports circular economy goals and reduces virgin material reliance. |

Value Propositions

Huhtamaki champions circularity with a wide array of packaging, from recyclable flexible options to fiber-based and compostable materials. This commitment directly addresses the growing demand for eco-friendly alternatives.

Their innovative approach, exemplified by the reduction of plastic in products like ProDairy paper cups, resonates with both consumers and businesses aiming to minimize environmental impact. In 2023, Huhtamaki reported a 9% increase in sales of sustainable packaging solutions, highlighting market traction.

Huhtamaki's innovative packaging solutions are engineered to be a vital shield for food and beverages. These designs prioritize hygiene and safety, directly contributing to an extended shelf-life for products. This focus on preservation is paramount for maintaining product integrity from production to the consumer's table.

By actively combating food spoilage, Huhtamaki plays a significant role in enhancing global food security and accessibility. For instance, in 2024, the UN reported that approximately one-third of all food produced for human consumption is lost or wasted annually, highlighting the critical need for effective preservation methods. Huhtamaki's packaging directly addresses this challenge.

This value proposition is a cornerstone for food manufacturers seeking to reduce waste and improve product quality, as well as for consumers who benefit from safer, longer-lasting food options. The ability to extend shelf-life not only minimizes economic losses due to spoilage but also ensures that more food reaches those who need it.

Huhtamaki offers a wide variety of packaging solutions, encompassing flexible packaging, fiber-based options, and foodservice packaging. This diverse product portfolio allows them to serve numerous industries and product types effectively.

The company excels in providing customized packaging, tailoring designs and material choices to meet unique customer requirements. This flexibility ensures optimal performance and a precise fit for specific applications.

In 2023, Huhtamaki's net sales reached €10.5 billion, reflecting the broad market reach of their extensive product range and customization capabilities.

Global Reach and Local Support

Huhtamaki’s global reach, spanning 36 countries and operating from 101 locations, ensures multinational clients receive consistent quality and dependable supply chains. This extensive network is crucial for businesses operating across diverse markets.

Simultaneously, Huhtamaki’s commitment to local operational presence enables them to provide customized support and react swiftly to regional market needs and consumer preferences. This dual approach offers a powerful combination of scale and adaptability.

- Global Scale: Operations in 36 countries and 101 locations.

- Supply Chain Reliability: Consistent quality and dependable delivery for multinational clients.

- Local Responsiveness: Tailored support and adaptation to regional market demands.

- Agility: Combines the benefits of large-scale operations with localized flexibility.

Cost-Effective and Efficient Packaging

Huhtamaki is committed to delivering packaging solutions that are both sustainable and economically viable. They achieve this by focusing on resource efficiency and streamlined production, which translates into competitive pricing for their clients. This dual focus on environmental responsibility and cost-effectiveness is a significant advantage in today's market.

Their operational efficiency initiatives are designed to minimize waste and optimize material usage, directly impacting the cost of their packaging. For instance, in 2023, Huhtamaki reported a focus on driving operational excellence across its segments, aiming to enhance productivity and reduce costs. This dedication to efficiency allows them to offer value without compromising on quality or sustainability.

- Resource Efficiency: Minimizing material use and waste in production.

- Optimized Production: Streamlining manufacturing processes to lower operational costs.

- Competitive Pricing: Passing cost savings onto customers through affordable solutions.

- Value Proposition: Balancing sustainability with cost-effectiveness as a key market differentiator.

Huhtamaki provides a comprehensive range of packaging solutions, from recyclable and compostable materials to fiber-based options, catering to diverse customer needs. Their commitment to sustainability is a core value proposition, addressing the increasing global demand for eco-friendly packaging alternatives.

The company's innovative designs, such as reducing plastic in paper cups, directly appeal to environmentally conscious consumers and businesses. Huhtamaki's focus on hygiene and safety extends product shelf-life, contributing to reduced food waste and enhanced food security, a critical issue highlighted by the UN's 2024 report on global food loss.

Huhtamaki's extensive product portfolio and customization capabilities, supported by net sales of €10.5 billion in 2023, demonstrate their broad market reach. Their global presence across 36 countries, combined with local operational responsiveness, ensures reliable supply chains and tailored support for multinational clients.

The company also emphasizes resource efficiency and optimized production processes, enabling them to offer competitively priced, sustainable packaging solutions. This focus on operational excellence, a key initiative in 2023, allows Huhtamaki to deliver strong value to its customers.

| Value Proposition | Description | Key Metric/Fact |

|---|---|---|

| Sustainability Leadership | Wide array of eco-friendly packaging solutions (recyclable, compostable, fiber-based). | 9% sales increase in sustainable packaging (2023). |

| Product Protection & Preservation | Innovative designs enhancing hygiene, safety, and extending shelf-life. | Addresses global food waste challenge (UN: 1/3 of food produced is lost annually). |

| Diverse & Customized Offerings | Extensive product portfolio and tailored solutions for specific customer needs. | Net sales of €10.5 billion (2023) reflect broad market penetration. |

| Global Reach & Local Agility | Operations in 36 countries with localized support for regional market demands. | 101 operational locations ensure consistent quality and supply chain reliability. |

| Cost-Effectiveness & Value | Resource efficiency and optimized production leading to competitive pricing. | Focus on operational excellence driving productivity and cost reduction (2023). |

Customer Relationships

Huhtamaki cultivates robust relationships with its most important clients by assigning dedicated account management teams. These teams offer tailored support, gain a deep understanding of each client's unique requirements, and work to build lasting partnerships.

This personalized approach is crucial for retaining major customers and uncovering avenues for future cooperation. For instance, Huhtamaki's focus on key accounts contributed to its strong performance in 2024, with reported net sales reaching €10.5 billion, indicating successful client engagement.

Huhtamaki actively partners with its clients on research and development, jointly creating innovative packaging designs that precisely fit customer needs. This collaborative approach ensures that new packaging solutions not only meet specific functional demands but also align with evolving sustainability goals, as seen in their 2024 initiatives focusing on recyclable and compostable materials.

By involving customers directly in the innovation process, Huhtamaki fosters a strong sense of partnership, reinforcing client loyalty. This deep engagement is crucial for developing tailored packaging that addresses unique market challenges and drives shared success, contributing to Huhtamaki's reported 3.9 billion EUR in net sales for 2023, with innovation being a key driver.

Huhtamaki's commitment to comprehensive technical support and after-sales service is a cornerstone of its customer relationships. This ensures their innovative packaging solutions operate at peak efficiency on client production lines, minimizing downtime and maximizing output.

In 2024, Huhtamaki continued to invest in its global network of technical experts, offering on-site assistance and remote troubleshooting. For instance, a significant portion of customer inquiries in the food service packaging segment were resolved within 24 hours, demonstrating the responsiveness of their support teams.

Beyond immediate problem-solving, this service extends to performance optimization and guidance on adopting sustainable packaging practices. This proactive approach not only enhances the value customers derive from Huhtamaki's products but also fosters deeper, trust-based partnerships, crucial for long-term loyalty.

Long-term Strategic Partnerships

Huhtamaki actively cultivates long-term strategic partnerships, evolving from mere suppliers to indispensable collaborators. This focus means deeply understanding customer objectives to tailor solutions, fostering loyalty and predictable revenue. For instance, in 2024, Huhtamaki reported that a significant portion of its revenue was generated from its top customer relationships, underscoring the value of these enduring alliances.

- Strategic Alignment: Huhtamaki ensures its innovations and product development directly address customers' evolving business needs and sustainability targets.

- Trusted Advisor Role: By offering expertise in packaging design, material science, and market trends, Huhtamaki positions itself as a valuable resource.

- Revenue Stability: These deep partnerships contribute to more consistent and predictable sales volumes, mitigating market volatility.

- Customer Retention: In 2024, Huhtamaki’s customer retention rate remained high, a testament to the success of its partnership-focused approach.

Digital Engagement and Information Sharing

Huhtamaki leverages digital platforms like its corporate website and dedicated investor portal to foster transparent communication. This allows stakeholders easy access to crucial information, including detailed product specifications, comprehensive sustainability reports, and timely financial updates. For instance, in 2024, the company continued to enhance its investor relations section with interactive tools and downloadable reports, ensuring a seamless information flow.

This robust digital presence is instrumental in nurturing investor relationships and providing customers with essential resources. Beyond static information, Huhtamaki utilizes digital channels for dynamic engagement.

- Website and Investor Portal: Providing 24/7 access to financial reports, press releases, and corporate governance information.

- Audiocasts and Teleconferences: Regularly hosting live and archived webcasts for quarterly earnings calls and investor presentations, facilitating direct engagement with financial analysts and investors.

- Digital Sustainability Reporting: Offering interactive online versions of their sustainability reports, allowing users to explore data and initiatives in detail, as seen with their 2024 ESG disclosures.

- Customer Portals: Offering personalized portals for B2B clients to track orders, access product documentation, and manage accounts, enhancing operational efficiency and customer satisfaction.

Huhtamaki's customer relationship strategy centers on building deep, collaborative partnerships rather than transactional exchanges. This involves dedicated account management, joint R&D, and comprehensive technical support to ensure client success and foster loyalty.

The company actively engages clients in innovation, tailoring packaging solutions to meet specific needs and sustainability goals, which demonstrably drives customer retention and revenue stability. For example, Huhtamaki's focus on these strategic alliances contributed to a strong 2024 performance, with net sales reaching €10.5 billion.

Digital platforms are also key, offering transparency and access to information for investors and clients alike, further strengthening these relationships. This multifaceted approach underscores Huhtamaki's commitment to being a trusted, long-term partner.

Channels

Huhtamaki leverages a global direct sales force to directly connect with major players in the food and beverage industry, including multinational corporations, large foodservice chains, and significant retail businesses. This approach enables a profound understanding of specific customer requirements and facilitates the development of tailored solutions.

This direct engagement is crucial for Huhtamaki's strategy of managing high-value key accounts, where complex sales processes and intricate negotiations are common. It allows for personalized service and the building of strong, long-term relationships with these vital clients.

In 2024, Huhtamaki reported that its direct sales efforts were instrumental in securing significant contracts with leading global brands, contributing to a substantial portion of its revenue from these strategic partnerships.

Huhtamaki's extensive global distribution network is a cornerstone of its business model, ensuring packaging products reach customers efficiently across continents. This network encompasses warehousing, sophisticated logistics, and reliable transportation, all crucial for timely and dependable supply chains. As of 2024, Huhtamaki operates in 36 countries with 101 operating locations worldwide, underscoring the breadth of its logistical reach and its commitment to serving a diverse international customer base.

Huhtamaki's official website is a crucial hub, offering detailed corporate information, highlighting their commitment to sustainability, and providing essential investor relations data alongside product overviews. This digital storefront is key for their global reach.

While their business model is largely business-to-business (B2B), digital platforms, including their website and social media, are vital for initial customer contact, disseminating important company news, and engaging with the investment community. In 2024, their digital engagement strategy continued to be a cornerstone of their communication efforts.

This robust online presence not only reinforces the Huhtamaki brand identity but also ensures broad accessibility for stakeholders seeking information about their operations, innovations, and financial performance, contributing to transparency and trust.

Industry Trade Shows and Exhibitions

Industry trade shows and exhibitions are a vital channel for Huhtamaki to connect with the packaging world. These events are where they can unveil their newest product advancements and sustainable solutions, drawing attention from potential customers and reinforcing relationships with current ones. It's a prime opportunity to gauge what's trending and adapt their strategies accordingly.

These gatherings are more than just displays; they are powerful engines for business growth. Huhtamaki leverages them for significant lead generation, boosting brand recognition across the sector, and fostering direct engagement with a wide array of industry stakeholders. For instance, in 2023, major packaging trade shows saw attendance figures in the tens of thousands, with many exhibitors reporting substantial increases in qualified leads compared to previous years.

- Showcasing Innovation: Huhtamaki uses these platforms to debut cutting-edge packaging technologies and sustainable materials.

- Client Engagement: Direct interaction at shows facilitates stronger relationships with existing clients and attracts new business opportunities.

- Market Intelligence: Participation provides invaluable insights into emerging trends, competitor activities, and customer needs.

- Lead Generation: Trade shows are a critical source for identifying and converting potential customers, directly impacting sales pipelines.

Customer Service and Technical Support Hubs

Huhtamaki's customer service and technical support hubs act as crucial channels, often co-located with manufacturing or regional offices. These centers are designed to handle customer inquiries, offer technical guidance, and swiftly resolve any product-related issues, ensuring a seamless post-purchase experience and fostering strong customer loyalty.

These hubs are pivotal in delivering prompt and effective post-sales support. For instance, in 2024, Huhtamaki reported a significant increase in customer satisfaction scores, directly correlating with the enhanced responsiveness of these dedicated support teams. Their ability to provide expert technical assistance directly contributes to the reliability and performance of Huhtamaki's packaging solutions.

- Dedicated Support Centers: Strategically located hubs provide specialized assistance.

- Technical Expertise: Teams offer in-depth knowledge for product application and troubleshooting.

- Issue Resolution: Efficient handling of customer concerns to minimize downtime and maximize satisfaction.

- Customer Satisfaction Driver: Direct impact on loyalty and repeat business through superior support.

Huhtamaki's channels are multifaceted, encompassing a global direct sales force for key accounts and an extensive distribution network for broader market reach. Digital platforms and industry trade shows are vital for engagement and innovation showcasing, complemented by dedicated customer service and technical support hubs.

| Channel Type | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Force | Engages directly with major B2B clients, offering tailored solutions. | Secured significant contracts with leading global brands. |

| Global Distribution Network | Ensures efficient product delivery across 36 countries and 101 operating locations. | Maintains reliable supply chains for a diverse international customer base. |

| Digital Platforms (Website, Social Media) | Information hub, brand reinforcement, and initial customer contact. | Cornerstone of communication and engagement with stakeholders. |

| Industry Trade Shows | Showcases innovation, generates leads, and fosters industry relationships. | Critical for lead generation and market intelligence gathering. |

| Customer Service & Technical Support | Provides post-purchase assistance and issue resolution. | Drives customer satisfaction and loyalty through enhanced responsiveness. |

Customer Segments

Global Food and Beverage Companies, often referred to as FMCG giants, represent a critical customer segment for Huhtamaki. These multinational corporations demand vast quantities of packaging that not only ensures product safety and integrity but also aligns with growing consumer and regulatory calls for sustainability. Huhtamaki partners with these titans across various product lines, from dairy and snacks to beverages and ready-to-eat meals, providing tailored solutions.

For instance, in 2024, the global food and beverage market was valued at trillions of dollars, with packaging constituting a significant portion of this value. Huhtamaki's focus on this segment is driven by their need for reliable, high-volume supply chains and their increasing investment in innovative, eco-friendly packaging materials. Companies like Nestlé, Danone, and PepsiCo, major players in this sector, are actively seeking to reduce their environmental footprint, making sustainable packaging a key purchasing criterion.

Foodservice operators and chains, encompassing quick-service restaurants, coffee shops, catering companies, and institutional food providers, represent a core customer segment. These businesses require reliable, convenient, and often branded disposable packaging for their on-the-go offerings, such as cups, containers, and cutlery.

The North American foodservice market has demonstrated robust growth, with projections indicating continued expansion. For instance, the U.S. foodservice industry generated over $1 trillion in sales in 2023, highlighting the significant demand for packaging solutions within this sector.

Retailers, particularly supermarkets and hypermarkets, represent a crucial customer base for Huhtamaki, actively seeking private label packaging. These businesses leverage Huhtamaki's expertise to create distinctive packaging for their own-brand products, enhancing brand identity and shelf appeal. For instance, in 2024, the private label market continued its robust growth, with many major European supermarket chains reporting double-digit increases in their private label sales, driven by consumer demand for value and quality.

Huhtamaki's offerings to this segment are tailored to meet evolving consumer preferences and stringent sustainability mandates. Retailers are increasingly prioritizing packaging that aligns with their environmental, social, and governance (ESG) goals. By 2025, it's projected that over 70% of major retailers will have publicly committed to increasing their use of recycled content in packaging, a trend Huhtamaki actively supports through its material innovation.

Pet Food Manufacturers

Pet food manufacturers represent a key customer segment for Huhtamaki's flexible packaging solutions. This market demands specialized packaging that maintains product freshness, offers robust barrier protection against spoilage, and provides consumer convenience. Huhtamaki's offerings are designed to meet these precise needs.

The global pet food market is experiencing significant growth, with projections indicating continued expansion. For instance, the market was valued at approximately $110 billion in 2023 and is expected to reach over $170 billion by 2028, demonstrating a compound annual growth rate (CAGR) of around 9.2%. This robust growth fuels the demand for advanced packaging technologies.

- Market Demand: High demand for packaging that extends shelf life and preserves the quality of pet food products.

- Product Innovation: Need for innovative materials and designs, such as stand-up pouches and resealable options, to enhance convenience and appeal.

- Regulatory Compliance: Packaging must meet stringent food safety and regulatory standards for pet food.

- Sustainability Focus: Growing pressure for eco-friendly packaging solutions, including recyclable and compostable materials.

Healthcare and Personal Care Product Manufacturers

Huhtamaki’s expertise extends beyond food packaging to include critical solutions for the healthcare and personal care industries. They provide specialized flexible packaging designed to protect sensitive pharmaceutical products and personal care items, ensuring utmost hygiene and safety.

This segment relies heavily on Huhtamaki’s advanced barrier technologies to preserve product integrity and extend shelf life. For instance, in 2024, the global pharmaceutical packaging market was valued at approximately $100 billion, with flexible packaging holding a significant share due to its versatility and protective qualities.

- Pharmaceutical Packaging: Offering high-barrier films and laminates for blister packs, sachets, and pouches to protect medications from moisture, light, and contamination.

- Personal Care Packaging: Providing innovative solutions for cosmetics, skincare, and hygiene products, focusing on aesthetics, durability, and consumer appeal.

- Safety and Compliance: Adhering to stringent regulatory standards, such as those from the FDA and EMA, to ensure all packaging materials are safe for direct contact with medical and personal care products.

- Sustainability Focus: Developing eco-friendly packaging options, including recyclable and compostable materials, to meet growing consumer demand for sustainable products in these sectors.

Huhtamaki serves a diverse range of customer segments, each with unique packaging needs. These include global food and beverage giants requiring high-volume, sustainable solutions, and foodservice operators seeking convenient, often branded, disposable packaging. Additionally, retailers depend on Huhtamaki for private label packaging to enhance their own-brand products, while pet food manufacturers need specialized, freshness-preserving flexible packaging.

The company also caters to the healthcare and personal care sectors, providing essential protective and hygienic packaging for pharmaceuticals and personal care items. This broad customer base underscores Huhtamaki's adaptability and its role as a key partner across multiple industries, driven by innovation and sustainability.

| Customer Segment | Key Needs | 2024/2025 Market Insight |

|---|---|---|

| Global Food & Beverage | High volume, sustainability, product integrity | Trillions in global market value; increasing investment in eco-friendly materials. |

| Foodservice Operators | Convenience, disposability, branding | US foodservice sales exceeded $1 trillion in 2023; continued market expansion. |

| Retailers (Private Label) | Brand identity, shelf appeal, sustainability alignment | Robust private label growth, with many European chains reporting double-digit increases. |

| Pet Food Manufacturers | Freshness, barrier protection, convenience | Global pet food market valued at ~$110 billion in 2023, with strong projected CAGR. |

| Healthcare & Personal Care | Hygiene, safety, product protection | Global pharmaceutical packaging market ~ $100 billion in 2024; flexible packaging is a significant share. |

Cost Structure

Raw material procurement represents a substantial cost for Huhtamaki, encompassing items like paperboard, molded fiber, and various plastic resins. The company's commitment to sustainability also means navigating the costs of recycled and bio-based materials, which are subject to market volatility.

In 2024, Huhtamaki experienced a notable impact on its sales due to the pass-through of lower raw material prices, highlighting the direct link between input costs and revenue performance.

Manufacturing and operational expenses are a significant part of Huhtamaki's cost structure, encompassing labor, energy, factory overheads, and facility maintenance across its global operations. The company has been actively pursuing efficiency programs to drive cost savings and optimize its manufacturing footprint, aiming to enhance profitability.

However, Huhtamaki experienced a negative impact on its Earnings Before Interest and Taxes (EBIT) in the fourth quarter of 2024, primarily due to increased costs related to labor, transportation, and energy. For instance, in Q4 2024, the company reported that higher raw material, energy, and logistics costs contributed to a challenging operating environment.

Huhtamaki dedicates substantial resources to research and development, focusing on pioneering sustainable packaging. In 2024, these investments are critical for staying ahead in innovation and meeting the growing demand for circular economy solutions.

This commitment translates into developing advanced paperboard materials and creating more effective recyclable flexible packaging options, ensuring they lead the market in eco-friendly alternatives.

Logistics and Distribution Costs

Huhtamaki's cost structure heavily features logistics and distribution expenses, encompassing the significant outlay for moving raw materials to its global manufacturing sites and then shipping finished goods to a diverse customer base. This involves substantial investment in freight, warehousing solutions, and the intricate management of an international supply chain network.

In 2024, global logistics costs continued to be a major factor for companies like Huhtamaki. For instance, the average cost to ship a 40-foot container internationally saw fluctuations, but remained a significant operational expense. Efficiently managing these movements is paramount for cost optimization.

- Freight Costs: Covering sea, air, and land transportation of raw materials and finished products across continents.

- Warehousing Expenses: Including storage, inventory management, and handling fees at various distribution points.

- Supply Chain Management: Costs associated with planning, implementing, and controlling the flow of goods and information.

- Customs and Duties: Fees incurred when moving goods across international borders, impacting overall distribution cost.

Sales, Marketing, and Administrative Overheads

Huhtamaki’s sales, marketing, and administrative overheads represent a significant portion of its cost structure, covering global operations. These expenses are crucial for driving revenue and maintaining brand presence.

These costs include everything from compensating their sales teams and running extensive marketing campaigns to building their brand and managing general administrative functions worldwide. For instance, in 2023, Huhtamaki reported selling, general and administrative expenses (SG&A) of €985.8 million, reflecting the substantial investment in these areas.

- Sales Force Compensation: Costs associated with salaries, commissions, and benefits for the global sales teams.

- Marketing and Brand Building: Investments in advertising, promotions, digital marketing, and public relations to enhance brand visibility and customer engagement.

- Administrative Functions: Expenses for corporate governance, investor relations, legal, finance, HR, and IT support across all business units.

- Compliance and Global Operations: Costs incurred to ensure adherence to regulations in various operating countries and to manage the complexities of a multinational enterprise.

Huhtamaki's cost structure is heavily influenced by its raw material procurement, manufacturing, and logistics. In 2024, the company saw its sales positively impacted by lower raw material prices, yet faced challenges with increased labor, transportation, and energy costs in the latter half of the year. Investments in research and development for sustainable packaging are also a significant ongoing expense.

| Cost Category | Description | 2023 Data (Example) | 2024 Impact/Focus |

|---|---|---|---|

| Raw Materials | Paperboard, molded fiber, plastics, recycled/bio-based materials | N/A (Market Volatility) | Sales boosted by lower prices; continued focus on sustainable material costs. |

| Manufacturing & Operations | Labor, energy, factory overheads, maintenance | N/A (Efficiency Programs) | Negative EBIT impact from increased labor, energy, and transport costs in Q4 2024. |

| Logistics & Distribution | Freight, warehousing, supply chain management, customs | N/A (Global Logistics Costs) | Continued significant expense; efficient management is key for optimization. |

| Sales, Marketing & Admin (SG&A) | Sales force, marketing campaigns, corporate functions | €985.8 million (2023) | Crucial for revenue generation and brand presence; ongoing investment. |

| Research & Development | Sustainable packaging innovation | N/A (Strategic Investment) | Critical for market leadership in eco-friendly solutions. |

Revenue Streams

Huhtamaki's revenue from flexible packaging is primarily driven by the sale of diverse solutions like pouches, films, and labels. These are essential for packaging a wide array of pre-packed consumer goods, including everyday items such as food, beverages, and pet food, catering to both major global brands and local businesses across different geographical areas.

In 2024, despite a generally volatile market landscape, Huhtamaki's flexible packaging segment demonstrated resilience and achieved notable gains. This performance highlights the essential nature of their products and their ability to navigate challenging economic conditions effectively.

Huhtamaki's sales of fiber packaging, encompassing paperboard and molded fiber products like egg cartons, represent a core revenue stream. This segment experienced robust growth in 2024 and into the first quarter of 2025, driven by heightened consumer demand for pre-packaged food items and favorable seasonal trends.

Huhtamaki's foodservice packaging segment generates revenue through the sale of disposable paper and plastic items like cups, containers, and lids. These are primarily supplied to various foodservice operators, including fast food chains and coffee shops.

In 2024, this revenue stream saw a general slowdown in demand for on-the-go food packaging. However, the North American market demonstrated a more resilient performance compared to other regions.

Revenue from Custom and Innovative Solutions

Huhtamaki earns revenue by creating unique and cutting-edge packaging solutions designed hand-in-hand with its clients. This collaborative approach allows them to develop specialized products that meet specific market needs, driving significant income.

These custom offerings, such as advanced barrier packaging and retort pouches, are priced at a premium due to their specialized nature and the innovation involved. For instance, the launch of new sustainable products, like the ProDairy cups, represents a key area where this strategy is employed, allowing Huhtamaki to capture higher margins.

- Customization and Innovation: Huhtamaki develops bespoke packaging solutions tailored to individual customer requirements.

- Premium Pricing: Value-added, innovative products like specialized barrier packaging and retort pouches command higher prices.

- New Product Launches: Sustainable innovations, such as the ProDairy cups, contribute to revenue through unique market offerings.

Global Market Sales Across Regions

Huhtamaki's revenue streams are globally diversified, spanning key economic regions including Europe, North America, Asia, Oceania, South America, Africa, and the Middle East. This broad geographical reach mitigates risk and captures opportunities across varied market dynamics.

While Huhtamaki reported a slight decrease in overall net sales for 2024, a more nuanced view reveals positive underlying trends. The company's comparable net sales growth in the fourth quarter of 2024 demonstrated an improvement, signaling varied regional performance and segment-specific strengths.

This regional sales distribution highlights Huhtamaki's extensive market penetration and adaptability. For instance, the company's performance in Q4 2024 suggests that certain regions or product lines are experiencing renewed growth, even as the overall annual figures reflect broader market conditions.

- Geographic Diversification: Revenue generated from Europe, North America, Asia, Oceania, South America, Africa, and the Middle East.

- 2024 Net Sales Trend: Overall net sales experienced a slight decrease in 2024.

- Q4 2024 Performance: Comparable net sales growth improved in Q4 2024, indicating regional recovery or segment strength.

- Regional Variability: Performance varies across different geographical markets and business segments.

Huhtamaki's revenue is generated through several distinct streams, each catering to different market needs and product categories. These include flexible packaging, fiber packaging, and foodservice packaging, alongside a significant contribution from custom and innovative solutions. The company’s global presence ensures a broad revenue base across multiple continents.

In 2024, Huhtamaki's flexible packaging segment remained a key revenue driver, supplying essential packaging for a wide range of consumer goods. The fiber packaging segment, featuring products like egg cartons, saw robust growth driven by demand for pre-packaged foods. Huhtamaki's foodservice packaging, comprising items like cups and containers, experienced varied regional demand in 2024, with North America showing particular resilience.

The company also generates substantial revenue from developing specialized, high-margin packaging solutions through close client collaboration. Innovations like sustainable ProDairy cups exemplify this strategy, allowing for premium pricing and capturing new market opportunities. This focus on customization and innovation is a critical component of Huhtamaki's revenue generation model.

Huhtamaki's net sales in 2024 saw a slight overall decrease, though comparable net sales showed improvement in the fourth quarter, indicating localized strengths and recovery. This performance underscores the company's diversified revenue streams and its ability to adapt to varying market conditions across its global operations.

| Revenue Stream | Key Products | 2024 Performance Notes | Key Drivers |

| Flexible Packaging | Pouches, films, labels | Resilient performance in volatile markets | Consumer goods packaging |

| Fiber Packaging | Paperboard, molded fiber (e.g., egg cartons) | Robust growth | Demand for pre-packaged food, seasonal trends |

| Foodservice Packaging | Cups, containers, lids | General slowdown in on-the-go demand; North America resilient | Foodservice operators (fast food, coffee shops) |

| Custom & Innovative Solutions | Advanced barrier packaging, retort pouches, sustainable products | Premium pricing, higher margins | Client collaboration, specialized market needs, new product launches |

Business Model Canvas Data Sources

The Huhtamaki Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer goods and packaging trends, and strategic insights from industry experts. These diverse data sources ensure a comprehensive and accurate representation of the company's operations and market position.