Huhtamaki Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huhtamaki Bundle

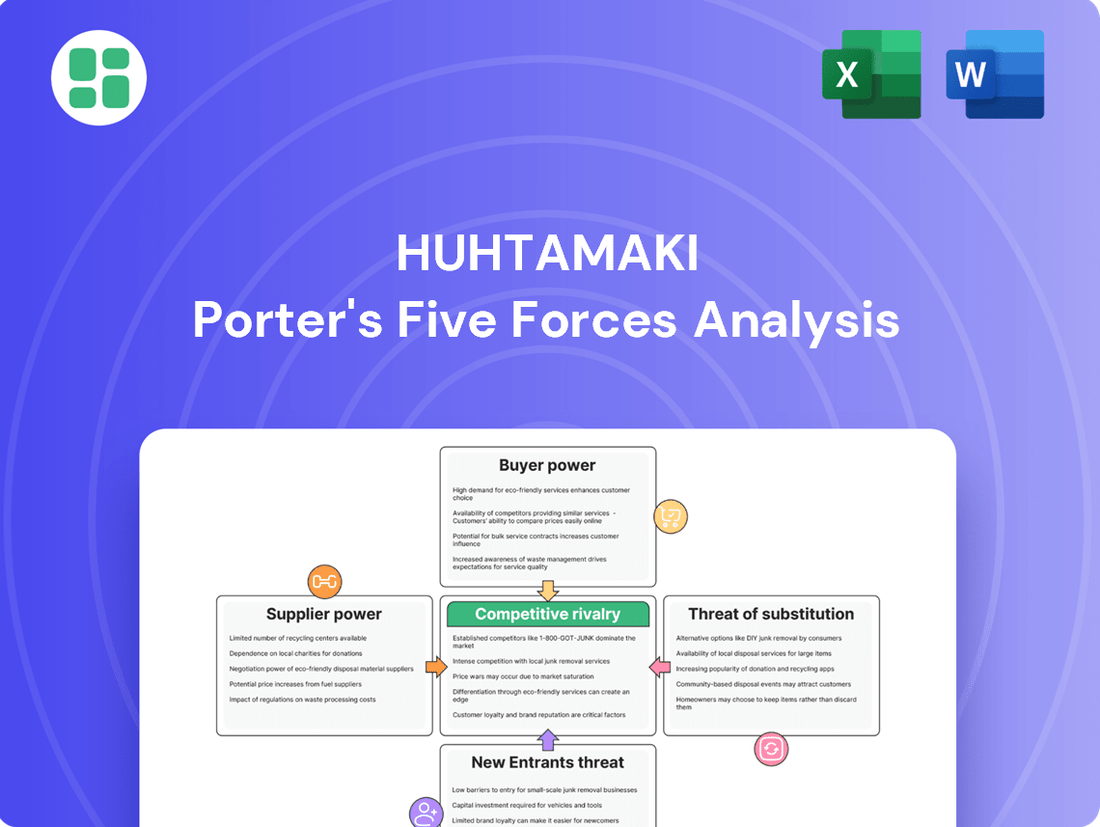

Huhtamaki's position in the packaging industry is shaped by intense competition, the bargaining power of its customers, and the constant threat of substitute products. Understanding these forces is crucial for navigating the market effectively.

The complete report reveals the real forces shaping Huhtamaki’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Raw material price volatility significantly shapes the bargaining power of suppliers for packaging companies like Huhtamaki. Fluctuations in the cost of essential inputs such as plastic resins (HDPE, LDPE, Polycarbonate), paperboard, and aluminum directly impact Huhtamaki's production costs and, consequently, its pricing power.

Global demand shifts, the price of crude oil and natural gas (key feedstocks for plastics), and the imposition of trade tariffs all contribute to this price instability. For instance, a surge in oil prices in late 2023 and early 2024 led to increased costs for plastic resins, strengthening the position of resin suppliers. Similarly, disruptions in the paper supply chain, perhaps due to increased demand for sustainable packaging or geopolitical events affecting timber, can empower paperboard manufacturers.

Market reports from early 2024 indicated that virgin plastic resin prices saw moderate increases, with some specialty grades experiencing sharper rises due to supply chain constraints. Aluminum prices also remained a key consideration, influenced by energy costs and global production levels. This dynamic pricing environment means suppliers who can offer more stable or predictable pricing, even at a premium, can wield considerable influence.

Huhtamaki's commitment to sustainable packaging, featuring recyclable, compostable, and bio-based materials, naturally intensifies its dependence on suppliers who can provide these specialized inputs. This focus means that companies offering these innovative, eco-friendly materials are in a stronger position to negotiate terms, as demand for such solutions continues to rise across the industry.

Suppliers possessing unique capabilities in producing advanced, sustainable materials gain significant bargaining power. This leverage is amplified by the growing market preference for environmentally conscious packaging, making it challenging for Huhtamaki to source these critical components at scale and on favorable terms.

The supply market for Huhtamaki's critical components, like specialized polymers and advanced fiber pulps, shows a degree of concentration. A few dominant global suppliers control a significant portion of these essential raw materials, giving them considerable leverage.

This concentration means these major suppliers can dictate pricing and supply terms more effectively. If Huhtamaki faces high switching costs to alternative suppliers, perhaps due to specialized equipment or long-term contracts, these dominant players can exert even greater bargaining power, potentially impacting Huhtamaki's profitability and operational stability.

Impact of Petrochemical Industry Dynamics

The bargaining power of suppliers for Huhtamaki is significantly influenced by the petrochemical industry. A large portion of packaging materials, especially plastics, originate from petrochemicals. This means supplier power is directly tied to the global oil market and the overall health of the petrochemical sector.

Geopolitical events and economic fluctuations that impact oil prices have a direct effect on the cost of these crucial plastic raw materials. Consequently, these shifts can directly influence Huhtamaki's input expenses, potentially squeezing profit margins.

- Petrochemical Dependence: Plastics, a core material for many packaging solutions, are derived from petrochemical feedstocks.

- Oil Price Volatility: Fluctuations in crude oil prices, driven by global supply and demand, directly impact the cost of these feedstocks. For example, Brent crude oil prices averaged around $82 per barrel in early 2024, a significant factor for raw material costs.

- Supplier Concentration: The petrochemical industry can be concentrated, giving major producers substantial leverage in pricing and supply agreements.

- Limited Substitutes: While alternatives exist, plastics often remain the most cost-effective and versatile option for many packaging applications, reducing Huhtamaki's ability to switch suppliers easily.

Supplier's Forward Integration Potential

Huhtamaki's suppliers, particularly those providing raw materials like paper pulp or specialized resins, might possess the capability to integrate forward into packaging production. For instance, a large pulp producer could potentially establish its own converting facilities to manufacture molded fiber packaging, directly competing with Huhtamaki. This threat means suppliers could leverage their manufacturing capacity to capture more of the value chain, thereby increasing their leverage over Huhtamaki.

If key suppliers were to integrate forward, Huhtamaki's choices for sourcing critical components would diminish. This reduction in alternatives would empower those suppliers to dictate more stringent terms, such as higher prices or less favorable payment schedules, knowing that Huhtamaki would have fewer options to turn to. For example, if a primary supplier of barrier coatings for food packaging were to start producing finished packaging themselves, Huhtamaki would face increased costs and potentially supply disruptions if they couldn't secure comparable alternatives quickly.

- Supplier Forward Integration Threat: Key suppliers of raw materials like paper pulp or specialized plastics could establish their own packaging manufacturing operations.

- Impact on Bargaining Power: This reduces Huhtamaki's sourcing options, giving integrated suppliers more leverage to demand better terms.

- Example Scenario: A major resin supplier entering the finished flexible packaging market could force Huhtamaki to accept higher material costs or less favorable contracts.

Suppliers of essential raw materials for Huhtamaki, such as specialized resins and paper pulp, hold considerable bargaining power. This is amplified by market concentration, where a few key players dominate the supply of critical components, allowing them to dictate terms. For instance, in early 2024, prices for certain virgin plastic resins saw moderate increases due to supply chain constraints, impacting Huhtamaki’s input costs.

Huhtamaki's increasing focus on sustainable packaging materials further strengthens the position of suppliers who can provide these niche, eco-friendly inputs. These specialized suppliers are in a better position to negotiate favorable terms due to the growing market demand for sustainable solutions. The petrochemical industry's influence is also significant; fluctuations in oil prices, like the average of around $82 per barrel for Brent crude in early 2024, directly translate to raw material costs for plastics, a core component for Huhtamaki.

Furthermore, the threat of supplier forward integration, where raw material producers might enter the packaging manufacturing space themselves, could reduce Huhtamaki's sourcing options and increase supplier leverage. This scenario could lead to stricter contract terms and potentially higher material costs for Huhtamaki.

| Raw Material | Key Influencing Factors (Early 2024) | Impact on Supplier Bargaining Power |

|---|---|---|

| Plastic Resins (e.g., HDPE, LDPE) | Oil price volatility (Brent crude ~ $82/barrel), petrochemical industry health, supply chain disruptions | High; concentrated supply, direct link to volatile energy markets |

| Paperboard/Pulp | Demand for sustainable packaging, timber supply, energy costs | Moderate to High; increasing demand for eco-friendly options, potential supply chain sensitivities |

| Aluminum | Energy costs, global production levels, trade policies | Moderate; influenced by energy prices and broader industrial output |

| Specialty Sustainable Materials | Innovation in eco-friendly solutions, market preference for sustainability | High; limited number of specialized suppliers, strong demand growth |

What is included in the product

This analysis unpacks the competitive forces shaping Huhtamaki's industry, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position and profitability.

Easily identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Huhtamaki.

Customers Bargaining Power

Huhtamaki's customer base is dominated by large, global food and drink corporations. These major players, including multinational food brands and extensive quick-service restaurant chains, possess substantial purchasing power. Their sheer scale allows them to negotiate highly competitive pricing and favorable contract terms, significantly influencing Huhtamaki's margins.

Customer demand for sustainable packaging is a significant force influencing Huhtamaki. Growing consumer awareness and stricter environmental regulations are pushing brands to seek packaging that is recyclable, compostable, or made from renewable materials. For instance, by 2024, many regions are expected to have enhanced Extended Producer Responsibility (EPR) schemes, directly impacting packaging choices and costs for brands.

Huhtamaki's capacity to innovate in sustainable packaging directly counters this customer power. By developing proprietary technologies for biodegradable or easily recyclable materials, Huhtamaki can create unique value propositions. If these sustainable innovations are difficult for competitors to replicate, it strengthens Huhtamaki's position, making customers less likely to switch based solely on price or standard offerings.

Customers in the food and beverage sector remain highly sensitive to price, even as demand for sustainable packaging grows. This means Huhtamaki must balance eco-friendly solutions with cost-effectiveness. For instance, in 2024, many major food retailers continued to push for lower packaging costs, with some indicating a willingness to absorb only a small premium for recycled content, often less than 5%.

The constant pressure for cost-effective packaging that also enhances product shelf life and provides convenience forces Huhtamaki to prioritize operational efficiencies. This dual demand means that any increase in sustainable material costs must be offset by internal savings to remain competitive. Reports from industry analysts in early 2024 highlighted that packaging innovation focused on reducing material usage and improving logistics were key strategies to manage these customer-driven cost pressures.

Low Switching Costs for Standard Products

Customers can easily switch packaging suppliers, especially for standard items like basic cardboard boxes or generic plastic films. This ease of transition means that if Huhtamaki’s pricing isn't competitive, or if a competitor offers slightly better terms, a customer can move their business without significant hassle or expense.

This low switching cost directly amplifies customer bargaining power. For instance, in 2024, the global packaging market saw continued price sensitivity, with many buyers actively seeking cost reductions. A company that produces a high volume of standardized packaging might find that its clients can obtain comparable products from multiple suppliers, forcing Huhtamaki to be more competitive on price to retain business.

- Low Switching Costs: Customers can easily change packaging providers for standardized products.

- Increased Bargaining Power: This flexibility allows customers to demand better pricing and terms.

- Market Dynamics: In 2024, price competition in the packaging sector remained a key factor for many buyers.

- Competitive Pressure: Huhtamaki must remain cost-competitive to retain clients who can readily switch.

Backward Integration Threat from Large Customers

Large food and drink manufacturers possess the potential to backward integrate into packaging production, particularly for their high-volume, standardized packaging requirements. This capability, even if not frequently exercised, grants them considerable leverage in price negotiations with packaging suppliers like Huhtamaki.

For instance, a major beverage company could explore setting up its own bottling line or even a basic form-fill-seal operation for common bottle types, thereby internalizing a portion of the packaging value chain. Such a move would directly impact Huhtamaki's sales volumes for those specific product categories.

- Potential for Backward Integration: Large customers can consider in-house packaging manufacturing for standardized, high-volume needs, directly impacting Huhtamaki's market share in those segments.

- Leverage in Negotiations: The mere threat of backward integration provides customers with significant bargaining power, enabling them to demand more favorable pricing and terms from Huhtamaki.

- Impact on Huhtamaki: Huhtamaki must remain competitive in pricing and innovation to deter major clients from pursuing in-house packaging solutions.

Huhtamaki faces significant customer bargaining power due to the concentrated nature of its client base, primarily consisting of large global food and beverage corporations. These major buyers, such as multinational food brands and extensive quick-service restaurant chains, wield substantial purchasing influence, allowing them to negotiate highly competitive pricing and favorable contract terms, which directly impacts Huhtamaki's profit margins.

Customers' sensitivity to price remains a critical factor, even as demand for sustainable packaging rises. For instance, in 2024, many large food retailers continued to exert pressure for lower packaging costs, with some indicating a limited willingness to absorb premiums for recycled content, often less than 5%. This necessitates Huhtamaki balancing eco-friendly solutions with cost-effectiveness.

| Customer Characteristic | Impact on Huhtamaki | 2024 Market Insight |

|---|---|---|

| Concentrated Buyer Base | High purchasing power, leading to price pressure | Dominance of large global food & beverage corporations |

| Price Sensitivity | Need for cost-competitive solutions | Limited willingness to pay premiums for sustainable materials |

| Low Switching Costs (for standard items) | Risk of customer attrition if not competitive | Continued price competition in the packaging sector |

| Potential for Backward Integration | Leverage in negotiations, threat of lost sales | Exploration of in-house production by large clients |

Preview the Actual Deliverable

Huhtamaki Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, comprehensive Huhtamaki Porter's Five Forces Analysis, detailing the competitive landscape, buyer and supplier power, threat of new entrants and substitutes, and the intensity of rivalry within the packaging industry. This professionally written analysis is ready for your immediate use.

Rivalry Among Competitors

The global food packaging market is a massive and expanding arena, characterized by fierce competition. Numerous companies, from large multinational corporations to smaller, niche providers, are constantly battling for a larger piece of this lucrative market.

This intense rivalry is fueled by the market's significant growth potential. For instance, the global food packaging market was valued at approximately $294.6 billion in 2023 and is projected to reach $402.5 billion by 2030, growing at a compound annual growth rate of 4.5%. This expansion attracts new entrants and intensifies efforts from existing players.

The competitive landscape includes both established giants with extensive resources and agile, specialized companies focusing on specific packaging solutions. This dynamic creates a challenging environment where innovation, cost-efficiency, and product differentiation are paramount for success.

Huhtamaki faces intense competition from global giants like Amcor, Sonoco, Berry Global, and Mondi, who offer a broad range of packaging solutions. These major players, along with a multitude of regional and niche competitors, vie for market share across flexible, fiber, and foodservice packaging, often mirroring Huhtamaki's product offerings and sustainability commitments.

In 2023, Amcor reported net sales of approximately $15.1 billion, highlighting its significant scale and reach. Similarly, Sonoco’s 2023 revenues were around $7.3 billion, demonstrating its substantial presence in the packaging industry. This competitive landscape means Huhtamaki must constantly innovate and differentiate to maintain its position.

Innovation, especially in sustainable packaging, is a major battleground for companies like Huhtamaki. They are pouring money into research and development to create packaging that's recyclable, compostable, or reusable. For instance, in 2024, the global sustainable packaging market was projected to reach over $400 billion, highlighting the intense focus on these advancements.

Continuous innovation is no longer optional; it's crucial for staying competitive. Companies that can offer cutting-edge, eco-friendly packaging solutions gain a significant edge. Huhtamaki's investment in new materials and designs directly impacts its ability to attract environmentally conscious customers and maintain market share against rivals pushing similar advancements.

Price Competition and Operational Efficiency

Price is a major battleground in the packaging sector, fueling aggressive competition. Huhtamaki, like its peers, faces constant pressure to offer competitive pricing, which directly impacts market share and profitability.

To navigate this, companies must skillfully blend sustainable advancements with affordability. This necessitates a relentless pursuit of operational efficiencies and cost reduction initiatives to maintain a competitive edge.

- Price Sensitivity: The packaging market is highly price-sensitive, especially for commodity products, forcing companies to compete aggressively on cost.

- Innovation vs. Cost: Balancing the investment in new, sustainable materials and designs with the need for cost-effective production is a constant challenge.

- Operational Excellence: Huhtamaki's focus on streamlining manufacturing processes, optimizing supply chains, and implementing lean principles is crucial for cost management.

- Market Dynamics: In 2024, fluctuating raw material costs and energy prices further intensify the need for operational efficiency to absorb these impacts and maintain price competitiveness.

Consolidation and Strategic Partnerships

The packaging industry is actively experiencing consolidation and the formation of strategic partnerships, significantly altering the competitive landscape. Major players are merging or acquiring smaller entities to gain market share, enhance operational efficiencies, and broaden their product portfolios.

These alliances often focus on critical areas like research and development for sustainable packaging solutions, securing access to recycling infrastructure, or expanding global distribution networks. For instance, in 2024, several significant mergers and acquisitions were announced within the flexible packaging segment, aimed at creating more integrated supply chains and increasing R&D capabilities in bioplastics and advanced recycling technologies.

- Increased Scale and Market Power: Consolidations create larger, more powerful entities capable of negotiating better terms with suppliers and customers, thereby intensifying competition for smaller, independent firms.

- R&D Synergies: Partnerships pooling R&D resources can accelerate innovation in areas like sustainable materials and smart packaging, forcing rivals to invest more heavily to keep pace.

- Supply Chain Integration: Alliances focused on vertical integration, from raw material sourcing to end-of-life solutions, build more resilient and cost-effective operations, posing a challenge to less integrated competitors.

- Global Reach Expansion: Mergers that extend geographical presence allow companies to serve multinational clients more effectively, raising the bar for market access and service delivery.

Huhtamaki operates in a highly competitive environment where rivalry among existing players is intense. This is driven by a large number of global and regional competitors offering similar packaging solutions, particularly in the growing sustainable packaging segment. Companies like Amcor, with 2023 net sales of approximately $15.1 billion, and Sonoco, reporting around $7.3 billion in 2023 revenues, represent significant competitive forces due to their scale and broad product portfolios. The pressure to innovate, especially in eco-friendly materials, and maintain cost-competitiveness is constant, as evidenced by the projected over $400 billion valuation of the global sustainable packaging market in 2024.

| Competitor | Approx. 2023 Revenue (USD Billions) | Key Product Areas | Competitive Focus |

| Amcor | 15.1 | Flexible packaging, Rigid packaging | Innovation, Sustainability, Global Reach |

| Sonoco | 7.3 | Paper and industrial converted products, Protective packaging | Cost Efficiency, Diversified Solutions |

| Berry Global | 9.0 (approx. FY23) | Consumer packaging, Industrial packaging | Scale, Product Breadth, Sustainability Initiatives |

| Mondi | 8.5 (approx. FY23) | Paper and packaging, Flexible packaging | Sustainable Solutions, Integrated Value Chain |

SSubstitutes Threaten

The growing momentum behind reusable and refillable packaging systems presents a substantial long-term substitute threat to Huhtamaki's predominantly single-use product portfolio. This trend is fueled by both increasing consumer demand for sustainable options and a significant legislative push across various regions, aiming to curb waste from disposable packaging.

While challenges like consumer convenience and the initial cost of implementing reusable infrastructure persist, this sector is witnessing considerable investment and innovation. For instance, by 2024, pilot programs for refillable containers are expanding, with some major food and beverage companies actively exploring these models to meet evolving market expectations and regulatory pressures.

The growing consumer preference for unpackaged or minimalist goods presents a significant threat of substitutes for Huhtamaki. This trend, fueled by environmental concerns and a desire for cost savings, sees consumers opting for bulk buying and loose produce, directly bypassing the need for individually packaged food items. For instance, the global bulk food market was valued at approximately $50 billion in 2023 and is projected to grow steadily, indicating a tangible shift away from pre-packaged convenience.

The continuous development of novel packaging materials presents a significant threat of substitution. Innovations like edible films or advanced bioplastics, which are not currently central to Huhtamaki's product portfolio, could emerge as viable alternatives to traditional packaging. For instance, the global bioplastics market, valued at approximately USD 50 billion in 2023, is projected to grow substantially, indicating a strong trend towards sustainable and potentially disruptive materials.

If these emerging alternatives become scalable and cost-effective, they possess the potential to displace Huhtamaki's existing packaging solutions, particularly in sectors prioritizing sustainability and novel consumer experiences. The increasing consumer demand for eco-friendly options, coupled with regulatory pressures, further amplifies this threat, pushing manufacturers to explore and adopt these new material technologies.

Impact of Digitalization on Food Delivery Models

The rise of digital platforms and evolving food delivery models presents a significant threat of substitutes for traditional food packaging. As e-commerce in the food sector expands, there's a growing demand for packaging solutions that are lighter, more robust for transit, and potentially more sustainable, directly challenging existing packaging norms. For instance, the global online food delivery market was valued at approximately $150 billion in 2023 and is projected to continue its strong growth trajectory, indicating a shift in consumer purchasing habits that impacts packaging demand.

New delivery paradigms, such as ghost kitchens and direct-to-consumer meal kits, are altering traditional packaging requirements. These models may favor specialized, often more compact, and sometimes reusable packaging designs over the bulkier, standardized options previously used. This innovation in delivery can lead to a reduction in overall packaging volume per meal, or a shift towards materials that better preserve food quality during extended transit times, thereby substituting conventional packaging approaches.

- Evolving Delivery Models: Ghost kitchens and direct-to-consumer meal kits are reshaping packaging needs, often favoring specialized, lighter, and more protective solutions.

- E-commerce Growth: The expanding online food delivery market, valued at around $150 billion in 2023, drives demand for transit-ready and potentially reduced packaging.

- Material Innovation: Substitutes may emerge in the form of biodegradable or reusable packaging materials, directly competing with traditional plastic and paperboard options.

- Consumer Preferences: Increasing consumer awareness regarding sustainability is pushing for packaging alternatives that minimize waste and environmental impact.

Consumer Anti-Packaging Sentiment

Consumers are increasingly aware of packaging's environmental footprint, particularly plastic waste. This growing sentiment fuels a demand for products with reduced or no packaging. For instance, a 2024 survey indicated that 65% of consumers are more likely to purchase from brands that use sustainable packaging solutions.

This anti-packaging movement directly impacts companies like Huhtamaki by encouraging consumers to seek alternatives. They may opt for bulk buying, reusable containers, or products that inherently require less packaging, effectively substituting traditionally packaged goods.

- Growing Environmental Awareness: Consumers are more informed about the negative impacts of excessive packaging, especially plastics.

- Demand for Minimalist Packaging: This awareness drives preference for products with less or no packaging.

- Brand Choice Influence: Consumers actively choose brands demonstrating strong commitments to packaging waste reduction.

- Substitution Effect: The trend encourages consumers to find alternatives to conventionally packaged items.

The threat of substitutes for Huhtamaki is significant, driven by evolving consumer preferences and technological advancements. Reusable and refillable packaging systems are gaining traction, supported by legislative action and consumer demand for sustainability. For instance, by 2024, many companies are actively exploring refillable container models. Additionally, the growing preference for unpackaged goods, with the global bulk food market valued at approximately $50 billion in 2023, directly bypasses the need for traditional packaging.

| Substitute Category | Description | Market Data/Trend Example |

|---|---|---|

| Reusable/Refillable Packaging | Consumer-driven shift towards systems that minimize single-use packaging. | Pilot programs expanding in 2024; increasing investment in infrastructure. |

| Unpackaged/Minimalist Goods | Consumer choice for bulk buying and loose products, reducing packaging demand. | Global bulk food market ~ $50 billion (2023), showing steady growth. |

| Novel Packaging Materials | Emergence of advanced bioplastics, edible films, or other innovative materials. | Global bioplastics market ~ USD 50 billion (2023), with strong projected growth. |

| Evolving Delivery Models | Changes in food delivery (ghost kitchens, meal kits) requiring specialized packaging. | Online food delivery market ~ $150 billion (2023), indicating shifts in consumer habits. |

Entrants Threaten

Establishing a significant foothold in the packaging sector, particularly for a global player like Huhtamaki operating across flexible, fiber, and foodservice segments, necessitates immense capital outlay. This includes building state-of-the-art manufacturing plants, acquiring sophisticated machinery, and investing heavily in research and development to stay competitive.

The sheer scale of these initial investments creates a formidable barrier to entry. For instance, setting up a new flexible packaging plant can easily cost tens of millions of dollars, and this doesn't even account for the ongoing R&D and market development needed to compete with established giants. This high capital intensity effectively deters many potential new competitors from entering the market.

The food packaging industry faces a complex web of regulations, from rigorous food safety standards to evolving recyclability mandates and environmental directives like the EU Taxonomy and European Sustainability Reporting Standards (ESRS). Navigating this intricate landscape demands substantial expertise and continuous investment in compliance, creating a significant barrier for potential new entrants aiming to enter markets like the one Huhtamaki operates in.

Established players like Huhtamaki possess deeply entrenched global supply chains for raw materials, a significant barrier to entry. For instance, in 2024, the packaging industry's reliance on specific polymers and paper pulp means new entrants must secure reliable and cost-effective sourcing, which is a substantial hurdle.

Furthermore, Huhtamaki benefits from extensive, well-established distribution networks that efficiently reach diverse customer bases across continents. Building comparable infrastructure to match this reach would require immense capital investment and time for any new competitor, making market access a formidable challenge.

Brand Loyalty and Existing Customer Relationships

Major food and drink companies often have deeply entrenched relationships with their current packaging suppliers, often built over many years. These partnerships are founded on trust, consistent quality, and tailored services that meet specific production needs. For instance, a major beverage producer might have a decade-long agreement with a specific flexible packaging provider, benefiting from customized material science and just-in-time delivery.

Newcomers face a significant hurdle in overcoming this established brand loyalty. To gain traction, a new entrant would need to present a remarkably attractive offer, perhaps through groundbreaking sustainable packaging solutions or a demonstrably lower cost structure without compromising quality. For example, a new entrant might need to achieve at least a 15-20% cost advantage to even begin to compete for large contracts where switching costs are substantial.

- Established Trust: Long-standing relationships foster confidence in reliability and product consistency.

- Customized Solutions: Existing suppliers often provide packaging tailored to specific product lines and manufacturing processes.

- Switching Costs: Changing suppliers can involve significant investment in new tooling, testing, and supply chain integration.

- Disruptive Innovation Required: New entrants must offer a compelling reason, such as superior sustainability or a substantial price reduction, to entice customers away from proven partners.

Proprietary Technology and Intellectual Property

The threat of new entrants in the packaging sector, particularly concerning proprietary technology and intellectual property, is significantly influenced by the substantial R&D investment required for innovation. Developing cutting-edge, sustainable packaging solutions, a key differentiator, necessitates deep technological expertise and often patented processes.

For instance, companies investing heavily in areas like advanced biodegradable materials or smart packaging technologies create a high hurdle for newcomers. A new entrant would need to either replicate this R&D expenditure or acquire existing intellectual property to compete effectively.

- R&D Investment: Companies like Amcor reported investing over $250 million in R&D in their 2023 fiscal year, focusing on sustainable packaging innovations.

- Patented Technologies: The packaging industry sees numerous patent filings annually, protecting novel material compositions and manufacturing techniques.

- Acquisition Costs: Acquiring a company with established proprietary technology can cost hundreds of millions, if not billions, of dollars, further deterring smaller entrants.

- Market Entry Barrier: The need to build or buy significant intellectual property makes it challenging for new players to gain immediate traction against established, technologically advanced competitors.

The threat of new entrants in the packaging industry is generally moderate due to significant barriers. High capital requirements for advanced manufacturing and R&D, coupled with stringent regulatory compliance, deter many potential new players. Established players like Huhtamaki benefit from strong brand loyalty and deep supply chain relationships, making it difficult for newcomers to gain market share without substantial disruptive innovation or investment.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Setting up a modern packaging plant requires tens of millions of dollars. | High deterrent, limits entry to well-funded entities. | Estimated $50M+ for a new flexible packaging facility. |

| Regulatory Compliance | Adherence to food safety, environmental, and recyclability standards is complex. | Increases operational costs and time-to-market. | ESRS reporting mandates significant upfront investment in data systems. |

| Supply Chain & Distribution | Securing raw materials and establishing efficient logistics networks is challenging. | New entrants struggle to match scale and cost-effectiveness. | Global packaging firms leverage long-term raw material contracts. |

| Customer Relationships & Switching Costs | Deeply entrenched supplier relationships and costs to switch are substantial. | Requires significant value proposition to overcome inertia. | Major CPG companies may have multi-year contracts with existing suppliers. |

| Technology & IP | Proprietary technologies and R&D investment create a competitive edge. | New entrants must invest heavily or acquire IP to compete. | Amcor's 2023 R&D spend exceeded $250M, focusing on sustainable innovations. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Huhtamaki leverages a robust combination of data sources, including annual reports, investor presentations, and industry-specific market research from firms like Euromonitor and Mintel. This ensures a comprehensive understanding of competitive dynamics.