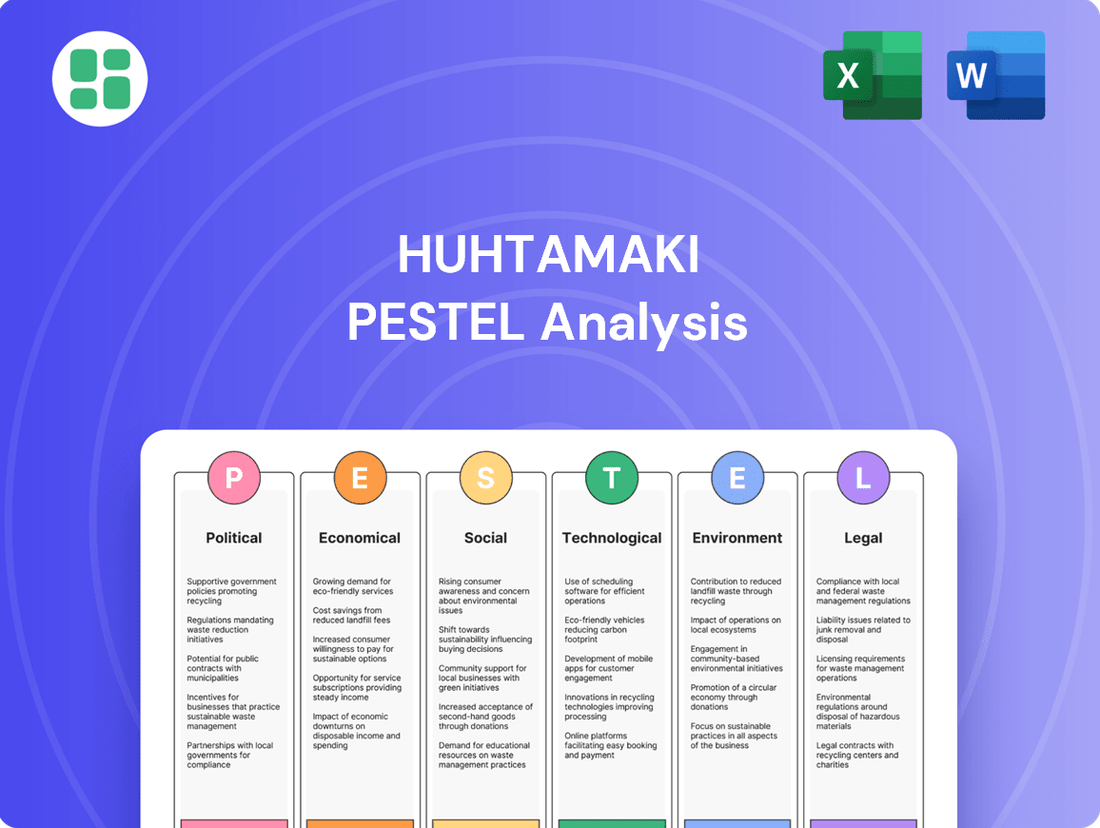

Huhtamaki PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huhtamaki Bundle

Navigate the complex global landscape impacting Huhtamaki with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping their operations and future growth. This expertly crafted report provides actionable intelligence to inform your strategic decisions and competitive positioning. Download the full version now and gain a critical market advantage.

Political factors

The European Union's Packaging and Packaging Waste Regulation (PPWR) is a major political driver, pushing for greater circularity and higher recycled content in packaging across member states. This legislation sets ambitious, legally binding targets for recyclability and recycling rates, directly impacting companies like Huhtamaki.

Huhtamaki has publicly supported the PPWR, acknowledging its role in driving sustainable packaging innovation. The company's commitment to developing fully recyclable solutions aligns with the EU's environmental policy objectives.

In 2024, the EU continued to finalize the PPWR, with discussions focusing on specific implementation details and targets. For instance, the regulation aims for all packaging to be reusable or recyclable in an economically viable way by 2030.

The U.S. is seeing a surge in Extended Producer Responsibility (EPR) laws for packaging, with states like California, Maine, and Colorado leading the charge. These regulations place the onus on manufacturers, including companies like Huhtamaki, to manage the end-of-life of their products. This shift is projected to significantly impact compliance costs, potentially adding millions annually for large packaging producers, and will require strategic adjustments in material sourcing and consumer engagement around recyclability.

Global trade conditions and geopolitical tensions, like the ongoing conflict in the Middle East, directly affect Huhtamaki. These situations can disrupt supply chains, alter consumer spending, and restrict market access, creating significant uncertainties for the company. For instance, the company's 2024 annual report specifically mentioned how these conflicts impact global brands in various regions, highlighting the tangible financial risks involved.

Food Safety and Hygiene Regulations

Huhtamaki, as a global leader in sustainable food packaging solutions, navigates a complex web of food safety and hygiene regulations that differ significantly across jurisdictions. These regulations are paramount, setting rigorous standards for the materials used, manufacturing processes, and the overall integrity of packaging to safeguard consumer health. For instance, the European Union's Regulation (EC) No 1935/2004 on materials and articles intended to come into contact with food sets broad safety principles, while specific national laws like the U.S. Food, Drug, and Cosmetic Act (FD&C Act) provide detailed requirements. Huhtamaki's commitment to innovation is deeply intertwined with meeting these critical safety mandates, ensuring their packaging solutions maintain the highest levels of hygiene for food and beverages. In 2024, the global food packaging market, valued at approximately $290 billion, continues to see regulatory compliance as a key driver, with ongoing updates to chemical migration limits and sustainability reporting requirements impacting material choices and production oversight.

Key aspects of these regulations impacting Huhtamaki include:

- Material Safety: Ensuring all packaging components are free from harmful substances and do not leach chemicals into food, adhering to standards like those set by the FDA for food contact substances.

- Production Hygiene: Implementing strict Good Manufacturing Practices (GMPs) throughout the production chain to prevent contamination, a focus reinforced by increasing audits and certifications in 2024.

- Traceability: Maintaining robust systems for tracking raw materials and finished products, crucial for rapid response to any safety concerns, a capability becoming more critical with evolving supply chain transparency demands.

- Allergen Management: Providing clear and accurate labeling regarding potential allergens, a requirement that has seen increased scrutiny and stricter enforcement globally in recent years.

Government Incentives for Sustainable Practices

Government policies offering incentives, subsidies, or tax breaks for companies adopting sustainable manufacturing processes, renewable energy, or developing eco-friendly materials can significantly influence Huhtamaki's investment strategies. For instance, the EU's Green Deal, aiming for climate neutrality by 2050, includes substantial funding for circular economy initiatives and sustainable packaging research, directly benefiting companies like Huhtamaki investing in these areas. These policies encourage further research and development into recyclable, compostable, and reusable packaging solutions, aligning with market demands and regulatory pressures.

These incentives support Huhtamaki's ambition to be a leader in sustainable packaging by reducing the financial burden of adopting greener technologies. For example, many countries are offering tax credits for investments in renewable energy sources for manufacturing operations, which can lower Huhtamaki's operational costs and improve its environmental footprint. The company's commitment to increasing its use of recycled and renewable materials, as highlighted in its 2023 sustainability report, is directly supported by such governmental financial backing.

- EU Green Deal funding: The European Union's commitment to climate neutrality by 2050 provides significant financial support for sustainable innovation, including packaging.

- Tax credits for renewables: Many nations offer tax credits for adopting renewable energy in manufacturing, directly impacting operational costs for companies like Huhtamaki.

- R&D support: Government grants and subsidies are available for research into biodegradable, compostable, and recyclable packaging materials.

- Circular economy initiatives: Policies promoting the circular economy encourage investment in technologies that facilitate packaging reuse and recycling.

Government policies, particularly in the EU with the Packaging and Packaging Waste Regulation (PPWR), are mandating higher recycled content and recyclability by 2030, directly influencing Huhtamaki's product development. The U.S. is also adopting Extended Producer Responsibility (EPR) laws, shifting end-of-life management costs to manufacturers, which is projected to add millions annually for large packaging firms. Geopolitical tensions, such as conflicts in the Middle East, create supply chain disruptions and market access issues, impacting global brands and their financial performance, as noted in Huhtamaki's 2024 annual report.

Government incentives, like the EU's Green Deal funding for circular economy initiatives, directly support Huhtamaki's investments in sustainable packaging research and development. Tax credits for renewable energy adoption in manufacturing further lower operational costs and improve environmental footprints. These financial supports are crucial for companies like Huhtamaki to meet increasing regulatory demands and market expectations for eco-friendly solutions.

| Policy Area | Impact on Huhtamaki | 2024/2025 Relevance |

| EU PPWR | Mandates recyclability & recycled content targets | Finalizing implementation details, driving innovation in materials |

| US EPR Laws | Increases manufacturer responsibility for end-of-life | Potential for significant annual compliance cost increases for producers |

| Geopolitical Tensions | Supply chain disruption, market access issues | Tangible financial risks impacting global brands and operations |

| Green Deal Funding | Supports R&D in circular economy and sustainable packaging | Reduces financial burden for adopting greener technologies |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Huhtamaki, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors present both challenges and strategic advantages.

A clear, actionable overview of Huhtamaki's PESTLE factors, enabling swift identification of potential challenges and opportunities to inform strategic decisions and alleviate planning anxieties.

Economic factors

Inflationary pressures on key cost components like fiber, plastic resins, labor, and energy pose a notable short-term risk for Huhtamaki. These rising input costs directly impact operational expenses.

Despite a decrease in sales prices in 2024, driven by the pass-through of lower raw material costs, Huhtamaki experienced a negative impact on its adjusted EBIT. This was primarily due to concurrent increases in labor, transportation, and energy expenses, highlighting the challenge of cost management.

Effective management of these fluctuating input costs is paramount for Huhtamaki to sustain and improve its profitability margins in the current economic climate.

Huhtamaki experienced a challenging first half of 2024, with muted consumer demand and persistent inflation eroding purchasing power in many of its key markets. This combination directly impacted the company's sales volumes.

While the latter half of 2024 indicated a slow but steady recovery, regional and product-specific disparities remained. For instance, the demand for pre-packed food solutions, particularly egg packaging, saw a notable uptick, contrasting with a continued subdued performance in on-the-go packaging segments.

Huhtamaki's financial health is intrinsically tied to the ebb and flow of the global economy. When the world economy is robust, demand for Huhtamaki's packaging solutions tends to rise, supporting its revenue and profitability. Conversely, economic downturns or financial market instability can introduce significant headwinds, impacting consumer spending and, consequently, the demand for packaged goods.

Despite a generally positive trajectory, with Huhtamaki reporting improved profitability through 2024, the outlook for 2025 suggests a more measured pace. The company anticipates trading conditions to remain relatively stable, indicating a cautious environment rather than a period of rapid expansion. This stability, however, is a positive backdrop for a company focused on strategic growth.

Huhtamaki's commitment to maintaining a strong financial position is a key strategic element. This robust financial footing is not merely about weathering economic storms; it's designed to actively fuel the company's pursuit of profitable growth opportunities. By having ample resources, Huhtamaki is better positioned to invest in new markets, innovative products, and operational enhancements that can drive long-term value creation.

Currency Rate Fluctuations

Currency rate fluctuations present a significant short-term business risk for Huhtamaki due to its widespread operations in 36 countries. These movements can directly impact the company's reported net sales and overall financial performance.

For instance, foreign currency translation adjustments can create headwinds. In the second quarter of 2025, Huhtamaki experienced a negative impact of EUR -34 million on its net sales when compared to the exchange rates from 2024, highlighting the tangible effect of these currency shifts.

- Global Exposure: Huhtamaki's presence in 36 countries exposes it to a variety of currency exchange rate risks.

- Financial Impact: Fluctuations can negatively affect reported net sales and profitability.

- Q2 2025 Data: A EUR -34 million reduction in net sales was observed in Q2 2025 due to currency rate movements compared to 2024 rates.

Investment in Efficiency and Cost Savings

Huhtamaki has been actively pursuing an efficiency program designed to generate substantial cost savings. The company's objective is to achieve EUR 100 million in savings by the year 2025.

By the close of 2024, Huhtamaki had already realized approximately EUR 76 million of these targeted savings, demonstrating a strong commitment to operational improvement and financial discipline. This strategic emphasis on enhancing performance and reducing expenditures is crucial for maintaining and boosting competitiveness, especially when navigating challenging market conditions.

- Targeted Savings: EUR 100 million by 2025.

- Achieved Savings (2024): Approximately EUR 76 million.

- Strategic Importance: Enhances competitiveness and profitability.

Huhtamaki's financial performance in 2024 and the outlook for 2025 are shaped by a complex interplay of economic factors. While the company saw some recovery in the latter half of 2024, persistent inflation and muted consumer demand in certain segments continued to present challenges. The company anticipates trading conditions to remain relatively stable in 2025, suggesting a cautious economic environment. Currency fluctuations also remain a significant risk, as evidenced by a EUR -34 million impact on net sales in Q2 2025 due to unfavorable currency movements compared to 2024 rates.

| Economic Factor | Impact on Huhtamaki | Data/Observation |

|---|---|---|

| Inflation | Increased operational costs (labor, energy, materials) | Negative impact on adjusted EBIT in 2024 despite lower raw material costs. |

| Consumer Demand | Varied by segment; overall muted in early 2024 | Sales volumes impacted; recovery in pre-packed food, subdued on-the-go packaging. |

| Economic Outlook | Stable but cautious trading conditions expected for 2025 | Company anticipates measured pace rather than rapid expansion. |

| Currency Fluctuations | Risk to reported net sales and financial performance | EUR -34 million negative impact on net sales in Q2 2025 vs. 2024 rates. |

Preview the Actual Deliverable

Huhtamaki PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive Huhtamaki PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Consumers are increasingly prioritizing environmental impact, leading to a significant surge in demand for packaging that is sustainable, recyclable, or compostable. This societal evolution is a powerful driver for companies like Huhtamaki, influencing their product development and material sourcing strategies throughout 2024 and into 2025.

This growing consumer awareness is translating into market pressure, with reports indicating that over 70% of consumers in major markets are willing to pay more for products with sustainable packaging. For instance, a 2024 survey found that 65% of global consumers actively seek out brands that use eco-friendly packaging, directly impacting purchasing decisions and pushing the industry towards greener alternatives.

Consumer lifestyles are increasingly shaping food packaging demand. The trend leans towards convenience for on-the-go consumption, though this can be impacted by economic factors. For instance, while pre-packed items like egg cartons saw increased demand in 2024, sales for single-serve coffee cups in some chains experienced a dip due to persistent inflation affecting discretionary spending.

Huhtamaki actively monitors these shifts, adjusting its offerings to align with evolving consumer preferences. This includes developing packaging solutions that support both ready-to-eat meals and those designed for home preparation, ensuring they meet the needs of a dynamic market.

Societal awareness around food loss and waste is increasing, with a parallel focus on food safety and hygiene. This heightened consciousness directly influences consumer preferences, driving demand for packaging that effectively preserves food quality and extends its shelf life. For instance, a 2024 report indicated that 70% of consumers are more likely to purchase products with packaging that clearly communicates its role in reducing food waste.

Huhtamaki's business model is well-positioned to capitalize on these evolving consumer concerns. By offering innovative packaging solutions designed to minimize spoilage and maintain product integrity throughout the supply chain, the company directly addresses the desire for both waste reduction and enhanced food safety. This strategic alignment is crucial for maintaining market relevance and meeting the expectations of an increasingly informed consumer base.

Preference for Convenience and Functional Design

Modern consumers increasingly value convenience, demanding packaging that simplifies their routines. This includes ease of opening, resealability, and portability, often favoring single-serve options. Huhtamaki's focus on user-centric design directly addresses this trend, creating packaging that is both functional and intuitive.

Huhtamaki's commitment to functional design is evident in its product development, aiming to enhance the consumer experience. For example, in 2024, the company continued to innovate with packaging that offers improved barrier properties and easier handling, aligning with the desire for less fuss in everyday consumption.

The demand for convenience translates into specific packaging features that influence purchasing decisions. Consider these key consumer preferences:

- Ease of opening: Consumers expect packaging that can be opened without tools or excessive effort.

- Resealability: For multi-serving products, the ability to reseal packaging to maintain freshness is highly desirable.

- Portability: Packaging designed for on-the-go consumption needs to be leak-proof and easy to carry.

- Single-serve formats: These cater to individual consumption needs and reduce food waste.

Health and Wellness Trends

The increasing focus on health and wellness is significantly shaping consumer preferences in food and beverage packaging. This translates into a higher demand for materials perceived as healthier, safer, and more environmentally friendly. For instance, a 2024 survey indicated that 65% of consumers are more likely to purchase products with sustainable packaging, directly influencing choices in dairy and fresh food sectors.

Huhtamaki is responding to this by innovating packaging solutions that cater to health-conscious consumers. This includes reducing the amount of plastic used in packaging for products like milk and yogurt, and exploring alternative, biodegradable materials. These shifts are crucial as consumers increasingly associate packaging with the overall healthiness of the product itself.

Key impacts on Huhtamaki include:

- Increased demand for sustainable and recyclable materials: Consumers are actively seeking out packaging that aligns with their wellness goals, pushing for less plastic and more paper or compostable options.

- Innovation in barrier technologies: Developing packaging that maintains product freshness and safety without relying heavily on traditional plastics is a growing priority.

- Consumer perception linkage: Packaging is increasingly viewed as an extension of the product's health attributes, making material choice a critical factor in purchasing decisions.

Societal trends highlight a growing demand for convenience, with consumers favoring packaging that simplifies their routines through features like easy opening and resealability. This preference is evident in the continued popularity of single-serve formats and portable packaging, directly influencing Huhtamaki's product development strategies for 2024 and beyond.

Health and wellness consciousness is a significant sociological factor, driving consumer preference for packaging perceived as healthier and more environmentally friendly. Reports from 2024 indicate that a substantial majority of consumers are more likely to choose products with sustainable packaging, impacting sectors like dairy and fresh foods.

The increasing awareness of food loss and waste, coupled with a focus on food safety, is boosting demand for packaging that effectively preserves quality and extends shelf life. Consumer surveys in 2024 revealed that a significant percentage of shoppers actively seek packaging that communicates its role in waste reduction.

Consumer demand for convenience, health, and sustainability is shaping the packaging market. For example, in 2024, the demand for pre-packed items like egg cartons increased, while sales of single-serve coffee cups saw a dip in some regions due to economic pressures affecting discretionary spending.

| Consumer Preference | Impact on Packaging Demand | Huhtamaki's Response (Examples) |

|---|---|---|

| Convenience (easy open, resealable) | Increased demand for user-friendly designs | Development of intuitive opening mechanisms and secure resealable closures. |

| Health & Wellness | Preference for sustainable, less plastic materials | Innovation in biodegradable materials and reduction of plastic in dairy packaging. |

| Food Waste Reduction | Demand for packaging that extends shelf life | Focus on advanced barrier technologies to maintain product freshness. |

Technological factors

Huhtamaki's commitment to sustainable material science is evident in its development of advanced solutions designed to replace conventional plastics. The company is a frontrunner in areas like mono-material technologies and smooth molded fiber (SMF), offering more environmentally friendly alternatives.

The company's investment in commercializing recyclable and compostable packaging is a key technological factor. For instance, Huhtamaki has recently launched new fiber lid production lines, showcasing its dedication to utilizing renewable resources and advancing the circular economy in packaging.

Huhtamaki's technological drive centers on achieving 100% recyclability, compostability, or reusability for all its products by 2030, a bold move towards a circular economy. This commitment is already yielding tangible results, with innovations like single-coated paper cups for dairy products significantly cutting down on plastic usage while preserving product integrity.

The packaging industry, including companies like Huhtamaki, is increasingly adopting smart packaging. This involves integrating technologies for better product tracking, preventing counterfeits, and even allowing consumers to interact with packaging. For instance, a 2024 report indicated that the global smart packaging market was projected to reach over $40 billion, highlighting significant growth potential.

Automation and Production Efficiency

Huhtamaki is significantly investing in automation to boost production efficiency and reduce costs. This strategic focus on optimizing its manufacturing processes is key to maintaining a competitive edge in the packaging industry. For instance, the company's successful deployment of Epicor Kinetic for financial and capacity planning demonstrates its commitment to streamlining operations.

These in-house capabilities are crucial for enhancing overall operational performance and improving customer service by ensuring better planning and resource allocation. The company’s ongoing efforts in automation are expected to yield tangible benefits in terms of throughput and waste reduction.

- Increased Throughput: Automation directly contributes to higher output volumes by enabling faster production cycles.

- Cost Reduction: Optimized processes and reduced manual intervention lead to lower operational expenses.

- Enhanced Quality Control: Automated systems often incorporate advanced quality checks, minimizing defects.

- Improved Planning: Systems like Epicor Kinetic provide better visibility for capacity and financial planning, supporting strategic decision-making.

Barrier Technologies

Technological advancements in barrier properties are revolutionizing packaging, directly impacting product shelf life and quality preservation, particularly within the food sector. Huhtamaki is actively investing in these innovations, exemplified by its Omnilock™ Ultra Paper and metalized flexible packaging solutions. These materials are engineered to provide robust protection against moisture, oxygen, and light, essential for maintaining freshness across a wide array of consumer goods.

The drive for enhanced barrier performance is a key technological factor for packaging companies like Huhtamaki. In 2024, the global flexible packaging market, a significant segment for Huhtamaki, was projected to reach over $130 billion, with a substantial portion driven by the demand for advanced barrier functionalities. Huhtamaki's commitment to developing these high-performance materials positions it to capitalize on this growing market need.

- Enhanced Shelf Life: Barrier technologies significantly extend the usability of perishable goods, reducing waste.

- Product Integrity: Protection against external elements ensures product quality and consumer safety.

- Huhtamaki's Innovation: Solutions like Omnilock™ Ultra Paper demonstrate a focus on advanced barrier capabilities.

- Market Demand: The increasing consumer preference for longer-lasting and high-quality packaged products fuels the need for these technologies.

Huhtamaki's technological focus on sustainability is driving innovations in material science, such as mono-material and smooth molded fiber technologies, to replace traditional plastics. The company is also investing in advanced barrier properties for packaging, exemplified by its Omnilock™ Ultra Paper, to enhance product shelf life and integrity. By 2024, the global flexible packaging market, a key area for Huhtamaki, was projected to exceed $130 billion, underscoring the demand for such advanced solutions.

| Technology Area | Huhtamaki's Focus | Market Relevance (2024 Projections) |

|---|---|---|

| Sustainable Materials | Mono-material, Smooth Molded Fiber (SMF) | Growing demand for eco-friendly alternatives |

| Barrier Properties | Omnilock™ Ultra Paper, metalized flexible packaging | Flexible packaging market projected >$130 billion |

| Automation | Epicor Kinetic for planning, production optimization | Efficiency gains, cost reduction in manufacturing |

| Smart Packaging | Integration for tracking, consumer interaction | Global smart packaging market projected >$40 billion |

Legal factors

The European Parliament's approval of the Packaging and Packaging Waste Regulation (PPWR) in April 2024 presents a significant regulatory shift for companies like Huhtamaki. This legislation introduces stringent, legally binding targets for packaging recyclability and mandates increased use of recycled content across the EU.

This new regulatory landscape directly influences Huhtamaki's operational strategies, pushing for innovation in packaging materials and design to meet these evolving requirements. The PPWR aims to reduce packaging waste and promote a circular economy, impacting how Huhtamaki sources, manufactures, and distributes its products.

The regulation supports the use of renewable, paper-based single-use packaging where it is environmentally sound and appropriate, aligning with Huhtamaki's focus on sustainable fiber-based solutions. For instance, the PPWR sets a target for all packaging to be reusable or recyclable in an economically viable way by 2030, a key consideration for Huhtamaki's product development pipeline.

Global and regional directives, like the European Union's Single-Use Plastics Directive (SUPD), are a significant legal factor for Huhtamaki. This directive, which came into full effect in mid-2021, aims to reduce plastic pollution by banning certain single-use plastic items and setting targets for recycled content. For instance, the SUPD mandates that by 2025, beverage containers must contain at least 25% recycled plastic.

These regulations directly influence Huhtamaki's strategic direction, pushing the company to accelerate its transition from plastic-heavy products to more sustainable options, particularly fiber-based packaging. This regulatory pressure is a key driver for Huhtamaki's investments in research and development for alternative materials and the expansion of its fiber packaging solutions, aligning with market demand for eco-friendly alternatives.

New laws are emerging that limit harmful chemicals in packaging, like PFAS and bisphenols. These substances, often used for their grease and water resistance, are facing increasing scrutiny due to potential health and environmental concerns. For instance, the European Union continues to expand its restrictions on PFAS, with proposed comprehensive bans expected to impact various packaging applications by 2025.

Huhtamaki needs to stay ahead of these changes, investing in research and development to create packaging that meets these new standards. This involves finding alternative materials and formulations that are both safe and functional, ensuring their products remain compliant and competitive in markets with stricter chemical regulations.

Extended Producer Responsibility (EPR) Laws

The increasing number of Extended Producer Responsibility (EPR) laws, particularly in U.S. states, directly impacts packaging manufacturers like Huhtamaki by shifting the financial and operational burden for product end-of-life management. These regulations require producers to bear the costs associated with recycling and waste disposal, compelling adjustments to business strategies and material sourcing to ensure compliance.

Huhtamaki must navigate a complex and evolving legal landscape, as more jurisdictions implement EPR schemes. For instance, states like Maine, Oregon, and Colorado have enacted packaging EPR laws, with others actively considering similar legislation. This trend necessitates proactive adaptation, potentially involving investments in recycling infrastructure or the development of more easily recyclable packaging solutions to meet these new legal obligations.

- EPR laws are expanding globally and within the US, creating new compliance requirements for packaging producers.

- Huhtamaki faces increased financial responsibility for the collection, sorting, and recycling of its products.

- Compliance may necessitate changes in packaging materials and design to align with EPR mandates.

- The cost of EPR compliance could influence pricing and investment decisions for the company.

Product Safety and Hygiene Standards

Huhtamaki, a leading global food packaging company, operates under a complex web of legal requirements concerning product safety and hygiene. These regulations are critical for market access and consumer trust, ensuring that packaging materials do not contaminate or degrade the food and beverages they contain. For instance, the European Union's Regulation (EC) No 1935/2004 sets out general requirements for materials and articles intended to come into contact with food, a framework Huhtamaki must adhere to across its European operations.

Compliance necessitates stringent quality control measures throughout the supply chain, from raw material selection to the final manufacturing processes. This includes rigorous testing for chemical migration and ensuring that all components meet approved substance lists. Failure to comply can result in significant penalties, product recalls, and damage to brand reputation, impacting Huhtamaki's ability to serve major food and beverage clients who demand unwavering safety standards.

- Global Regulatory Landscape: Huhtamaki navigates diverse international regulations, including FDA standards in the United States and EFSA guidelines in Europe, for food contact materials.

- Material Safety Compliance: Adherence to regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) is vital for sourcing safe and compliant raw materials.

- Hygiene in Manufacturing: Facilities must meet strict hygiene standards, such as those outlined by HACCP (Hazard Analysis and Critical Control Points), to prevent contamination during production.

- Impact of Non-Compliance: In 2024, the global food packaging industry faced increased scrutiny, with fines for safety violations potentially reaching millions of dollars, underscoring the financial risk of non-compliance.

The evolving legal framework for packaging, particularly the EU's Packaging and Packaging Waste Regulation (PPWR), mandates increased recycled content and recyclability targets, directly impacting Huhtamaki's product development and material sourcing strategies. New restrictions on chemicals like PFAS, with comprehensive bans anticipated by 2025, necessitate investment in safer alternatives for grease and water resistance in packaging. Furthermore, the proliferation of Extended Producer Responsibility (EPR) laws in the US and globally shifts end-of-life management costs to producers, compelling companies like Huhtamaki to adapt their packaging designs and potentially invest in recycling infrastructure.

| Regulatory Area | Key Legislation/Directive | Impact on Huhtamaki | Compliance Deadline/Status | Example Data Point |

| Packaging Waste & Circularity | EU Packaging and Packaging Waste Regulation (PPWR) | Mandates higher recycled content, recyclability targets, and potential reuse requirements. | Approved April 2024, implementation ongoing. | Target: All packaging reusable or recyclable by 2030. |

| Chemical Restrictions | EU PFAS restrictions (proposed) | Limits use of PFAS in various packaging applications. | Proposed comprehensive bans expected by 2025. | PFAS are used for grease and water resistance. |

| Producer Responsibility | US State EPR Laws (e.g., Maine, Oregon) | Shifts financial and operational burden for end-of-life management to producers. | Enacted in several states, with more considering legislation. | EPR schemes cover collection, sorting, and recycling costs. |

| Food Contact Materials | EU Regulation (EC) No 1935/2004 | Sets general requirements for materials intended to come into contact with food. | Ongoing compliance requirement. | Ensures no contamination or degradation of food. |

Environmental factors

Huhtamaki is actively pursuing climate change mitigation, with validated science-based targets. They aim to cut absolute Scope 1 and 2 greenhouse gas emissions by 27.5% by 2030 and reduce Scope 3 emissions from end-of-life products by 13.5%.

The company's commitment extends to achieving 100% renewable electricity usage and carbon-neutral production by 2030. This proactive approach positions Huhtamaki to navigate evolving environmental regulations and consumer expectations regarding sustainability.

Huhtamaki's environmental strategy centers on becoming a leader in sustainable packaging, with a significant emphasis on the circular economy. This means their product development prioritizes recyclability, compostability, or reusability, aiming to minimize waste and maximize resource utilization.

The company actively engages in industry collaborations to drive circularity, recognizing that systemic change is crucial. For instance, by 2023, Huhtamaki reported that 93% of its packaging solutions were designed to be recyclable, compostable, or reusable, showcasing tangible progress towards its circularity goals.

Huhtamaki is actively managing environmental risks beyond just carbon, with a keen focus on water scarcity and biodiversity. They are conducting specific assessments for these issues, especially in areas like India. This proactive approach shows a commitment to understanding and mitigating their impact on natural resources.

By 2025, Huhtamaki plans to have detailed biodiversity and water scarcity mitigation plans in place and actively implemented. This timeline highlights their dedication to sustainable operations and protecting vital ecosystems, recognizing the interconnectedness of business and environmental health.

Reduction of Virgin Plastic Content

Huhtamaki is actively addressing environmental concerns by decreasing its use of virgin plastic in packaging. This strategic shift is driven by growing global awareness and increasing regulatory mandates pushing for more sustainable materials.

A key initiative demonstrating this commitment is the creation of single-coated paper cups for dairy products. These innovative cups contain less than 10% plastic, directly responding to consumer preferences for packaging with a lower plastic footprint.

- Reduced Virgin Plastic: Huhtamaki aims to significantly lower virgin plastic content across its product lines.

- Innovative Materials: Development of recyclable paper cups with minimal plastic (under 10%) for dairy applications.

- Consumer Demand: Alignment with market trends favoring reduced plastic packaging.

- Regulatory Compliance: Proactive response to evolving environmental regulations.

Waste Management and Recycling Infrastructure

Huhtamaki's commitment to sustainable packaging, including recyclable and compostable options, is directly influenced by the state of global waste management. The effectiveness of these solutions hinges on the availability and efficiency of waste collection and recycling systems worldwide. For instance, while Huhtamaki develops innovative materials, their true environmental benefit is realized only when these materials are properly processed post-consumption.

The company's progress in material science is crucial, but the ultimate success of its sustainable packaging strategy depends on broader improvements in post-consumer waste management infrastructure. This includes investments in advanced sorting technologies and expanded collection networks. Without robust infrastructure, the potential of eco-friendly packaging to reduce landfill waste and promote a circular economy remains limited.

Consider these points regarding waste management and recycling infrastructure:

- Global Recycling Rates: Despite growing efforts, global recycling rates remain a challenge. In 2023, the Ellen MacArthur Foundation reported that only about 9% of all plastic ever produced has been recycled, highlighting the significant gap Huhtamaki's innovations aim to address.

- Infrastructure Investment: Significant investment is needed to upgrade and expand waste management facilities. For example, the European Union's Circular Economy Action Plan aims to increase the recycling of municipal waste to 65% by 2035, a target that requires substantial infrastructure development.

- Compostability Challenges: While compostable packaging offers an alternative, its effectiveness is tied to the availability of industrial composting facilities. Many regions lack widespread access to these facilities, meaning compostable items can end up in landfills or contaminate conventional recycling streams.

- Huhtamaki's Role: Huhtamaki actively participates in industry initiatives and partnerships aimed at improving collection and recycling systems. Their focus on designing for recyclability and compostability encourages the development of better waste management practices.

Huhtamaki's environmental strategy is deeply intertwined with global waste management infrastructure. While the company innovates with recyclable and compostable packaging, its ultimate success relies on effective collection and recycling systems. For example, the Ellen MacArthur Foundation reported in 2023 that only about 9% of all plastic ever produced has been recycled, underscoring the challenge.

The company's focus on reducing virgin plastic, exemplified by its single-coated paper cups with less than 10% plastic, directly addresses consumer demand and regulatory shifts. However, the effectiveness of compostable options is contingent on the availability of industrial composting facilities, which are not universally accessible.

Huhtamaki is actively involved in industry collaborations to improve waste management practices, recognizing that systemic improvements are crucial for its sustainable packaging solutions to achieve their full environmental potential.

| Environmental Factor | Huhtamaki's Action/Goal | Data/Context (as of latest available, likely 2023/2024) |

|---|---|---|

| Climate Change Mitigation | Science-based targets for GHG emission reduction (Scope 1, 2, 3) | Aim to cut Scope 1 & 2 by 27.5% by 2030. Reduce Scope 3 from end-of-life by 13.5%. |

| Renewable Energy & Carbon Neutrality | 100% renewable electricity and carbon-neutral production | Targeting 2030 for both goals. |

| Circular Economy & Material Design | Focus on recyclable, compostable, or reusable packaging | By 2023, 93% of packaging designed for recyclability, compostability, or reusability. |

| Virgin Plastic Reduction | Decreasing virgin plastic use, developing low-plastic alternatives | Single-coated paper cups with <10% plastic for dairy. |

| Water Scarcity & Biodiversity | Conducting assessments and developing mitigation plans | Plans to have detailed mitigation plans in place and implemented by 2025. |

| Waste Management Infrastructure Dependency | Designing for recyclability/compostability, participating in industry initiatives | Global plastic recycling rate ~9% (2023 data). EU aims for 65% municipal waste recycling by 2035. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Huhtamaki synthesizes data from reputable sources including the World Bank, OECD, and leading market research firms. We incorporate official government reports on environmental regulations, economic indicators, and technological advancements to ensure a comprehensive view.