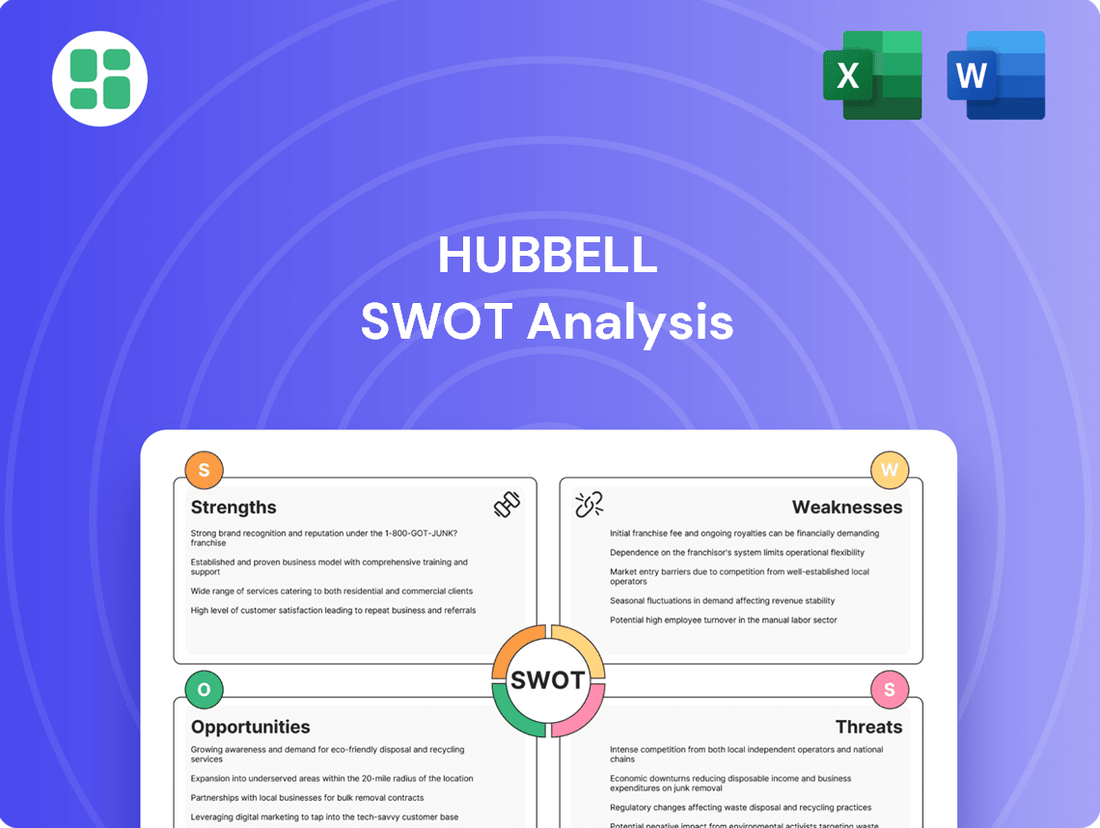

Hubbell SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hubbell Bundle

Hubbell’s established brand and diverse product portfolio present significant strengths in a competitive market. However, understanding the nuances of its operational efficiencies and potential market threats is crucial for strategic advantage.

Want the full story behind Hubbell's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hubbell's diverse product portfolio, spanning both Electrical Solutions and Utility Solutions, is a significant strength. This breadth ensures the company serves a wide range of critical sectors, including industrial, commercial, residential construction, and utility infrastructure.

The essential nature of these products for applications in telecommunications and broadband further solidifies Hubbell's market position. For instance, in 2023, Hubbell reported total net sales of $4.7 billion, with a substantial portion driven by these diverse offerings, highlighting their widespread demand.

This comprehensive product suite allows Hubbell to generate a diversified revenue base, reducing reliance on any single market segment. The company's solutions are fundamental to the safe, reliable, and efficient operation of essential services, a testament to their critical importance.

Hubbell's strategic alignment with major industry trends like grid modernization and electrification is a significant strength. The company's offerings directly support the transition to a greener economy and the upgrading of essential energy systems.

Hubbell has shown impressive financial results, with mid-single-digit sales growth and substantial adjusted operating profit growth projected for 2024. The company also anticipates double-digit growth in its free cash flow, highlighting strong operational efficiency and cash generation capabilities.

This robust financial performance is underpinned by a solid balance sheet. Hubbell's capacity to generate record free cash flow enables strategic investments in its operations, the pursuit of value-enhancing acquisitions, and consistent returns to shareholders via dividends and share repurchases.

Operational Excellence and Productivity Initiatives

Hubbell's dedication to operational excellence is a significant strength, driving accelerated productivity through focused lean and procurement initiatives. This commitment to efficiency and astute cost management, including successful price realization, effectively counteracts inflationary pressures and broader macroeconomic uncertainties. The company's demonstrated capacity for margin expansion underscores its adeptness in managing its core operations.

- Lean and Procurement Initiatives: Hubbell actively implements lean manufacturing principles and strategic procurement to enhance efficiency and reduce costs.

- Price Realization: The company has shown a strong ability to pass through costs via price increases, protecting its margins. For instance, in Q1 2024, Hubbell reported favorable price realization contributing to its performance.

- Margin Expansion: Hubbell's operational focus has translated into tangible margin improvements, reflecting effective cost control and pricing strategies.

- Productivity Gains: Investments in productivity initiatives are yielding measurable results, bolstering the company's competitive positioning.

Reputation and Sustainability Leadership

Hubbell's strong reputation for ethical operations and sustainability leadership is a significant strength. The company has been consistently recognized, including being named one of the World's Most Ethical Companies by Ethisphere for multiple years, underscoring its commitment to integrity and accountability. This dedication not only builds trust with customers and stakeholders but also positions Hubbell favorably in an era where responsible business practices are increasingly valued.

This leadership in sustainability is not just about reputation; it translates into tangible benefits. For instance, Hubbell's focus on energy-efficient products and sustainable manufacturing processes aligns with global trends and regulatory shifts, potentially leading to cost savings and new market opportunities. As of their latest reporting, Hubbell continues to integrate ESG (Environmental, Social, and Governance) principles across its operations, aiming to reduce its environmental footprint and enhance social impact, which resonates with investors and consumers alike.

- Consistent Ethical Recognition: Named one of the World's Most Ethical Companies by Ethisphere for multiple consecutive years.

- Enhanced Brand Trust: Reputation for integrity and transparency attracts customers and top talent.

- Alignment with Stakeholder Demands: Meets growing expectations for corporate responsibility and sustainable practices.

- Sustainability Index Inclusion: Presence in key sustainability indices validates its commitment to ESG principles.

Hubbell's diverse product range, covering electrical and utility solutions, is a key strength. This broad offering serves essential sectors like construction and utility infrastructure, with products vital for telecommunications and broadband. In 2023, Hubbell's net sales reached $4.7 billion, demonstrating the widespread demand for its comprehensive solutions.

The company's strategic focus on grid modernization and electrification aligns it with critical industry trends. Hubbell's products are instrumental in the shift towards a greener economy and the enhancement of energy systems. This positioning is supported by strong financial projections, with mid-single-digit sales growth and double-digit free cash flow growth anticipated for 2024.

Hubbell excels in operational efficiency, driven by lean initiatives and strategic procurement. The company's ability to manage price realization effectively counters inflationary pressures, leading to margin expansion. For example, Q1 2024 saw favorable price realization contributing to performance, underscoring its cost management prowess.

A strong reputation for ethics and sustainability is another significant advantage. Consistently recognized as one of the World's Most Ethical Companies by Ethisphere, Hubbell builds trust and meets growing stakeholder demands for corporate responsibility. This commitment is reflected in its integration of ESG principles to reduce environmental impact.

| Metric | 2023 (Actual) | 2024 (Projected) |

|---|---|---|

| Total Net Sales | $4.7 billion | Mid-single-digit growth |

| Free Cash Flow | Record levels | Double-digit growth |

| Ethical Recognition | Multiple consecutive years (Ethisphere) | Continued focus |

What is included in the product

Delivers a strategic overview of Hubbell’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Offers a clear, structured approach to identifying and addressing potential roadblocks in Hubbell's strategic planning.

Weaknesses

Hubbell's diverse product portfolio serves sectors like industrial, commercial, residential construction, and utility infrastructure, making it susceptible to the inherent cyclicality of these markets. For instance, anticipated softness in grid automation projects or a slowdown in non-residential construction, as seen in some forecasts for late 2024 and early 2025, can directly translate to revenue volatility for the company.

Economic downturns and reduced capital spending by utility companies pose a significant risk, as these factors directly dampen demand for Hubbell's essential electrical and electronic products. A contraction in infrastructure investment, a key driver for Hubbell, could therefore negatively impact its financial performance, highlighting a key weakness in its business model.

Hubbell faces significant challenges due to fluctuating raw material prices, especially for copper and aluminum, which are vital to their product lines. These increases directly impact their cost of goods sold, creating headwinds that can compress profit margins even when the company attempts to pass on costs through pricing adjustments.

Tariffs also add another layer of complexity and cost to Hubbell's operations, further exacerbating the pressure from raw material price volatility. While Hubbell has taken proactive steps with pricing strategies, the ability to completely neutralize these cost increases is often hindered by prevailing market conditions and specific accounting treatments.

Hubbell faces a highly competitive market, with a broad range of players from large corporations to smaller, specialized firms across its electrical and utility segments. This intense rivalry can exert downward pressure on pricing, potentially impacting profit margins. For instance, in the electrical distribution equipment market, competitors like Siemens and Schneider Electric are significant players, requiring Hubbell to constantly innovate and optimize its cost structures to remain competitive.

Integration Risks of Acquisitions and Divestitures

Hubbell's strategic use of acquisitions and divestitures, exemplified by the recent Systems Control acquisition and the divestiture of its Residential Lighting business, introduces inherent integration risks. These activities, while aimed at portfolio optimization, can strain existing business relationships and employee morale, potentially hindering smooth transitions. For instance, the successful integration of Systems Control, a $225 million acquisition completed in Q4 2023, requires careful management to realize its expected contributions to Hubbell's Power Systems segment.

The primary concern lies in the potential for these integration efforts to fall short of anticipated synergies and financial benefits. If the acquired entities or divested businesses do not perform as projected post-transaction, the strategic rationale for these moves can be undermined. Hubbell's ability to effectively manage these complex transitions is crucial for ensuring that its portfolio reshaping strategy translates into tangible value creation rather than creating operational or financial headwinds.

Dependence on Grid Automation Market Recovery

Hubbell's Utility Solutions segment, particularly its Grid Automation business, has seen a noticeable slowdown. This is partly due to tough comparisons with strong performance in previous years, leading to anticipated softness and sales declines in this area.

A slower-than-expected rebound in the grid automation market could continue to weigh on the Utility Solutions segment's results and, consequently, affect Hubbell's overall growth trajectory.

- Softness in Grid Automation: The Grid Automation market has experienced anticipated softness, contributing to sales declines within Hubbell's Utility Solutions segment.

- Challenging Comparisons: This softness is exacerbated by challenging prior-year comparisons, making the current performance appear weaker.

- Impact on Growth: A prolonged downturn or a sluggish recovery in grid automation could act as a drag on the Utility Solutions segment and overall company growth.

Hubbell's reliance on cyclical end markets like industrial and utility infrastructure exposes it to demand fluctuations. For instance, a projected slowdown in non-residential construction through late 2024 and into 2025 could directly impact revenue. Similarly, reduced capital spending by utilities, a key customer base, poses a significant risk to demand for Hubbell's essential products.

Fluctuations in raw material costs, particularly for copper and aluminum, directly impact Hubbell's cost of goods sold, potentially compressing profit margins. Tariffs further compound these cost pressures. The company operates in a highly competitive landscape, facing pressure from large players like Siemens and Schneider Electric, which can limit pricing power.

Integration risks associated with acquisitions, such as the Systems Control deal completed in Q4 2023 for $225 million, can strain operations if synergies aren't realized. The Utility Solutions segment, particularly grid automation, has experienced softness, partly due to tough prior-year comparisons, which could hinder overall company growth.

Same Document Delivered

Hubbell SWOT Analysis

You're previewing the actual Hubbell SWOT analysis document. The complete, detailed report is yours to download immediately after purchase.

This preview reflects the real document you'll receive—professional, structured, and ready to use for your strategic planning.

Opportunities

The aging U.S. electrical grid is undergoing a massive upgrade, with utilities planning to spend an estimated $300 billion on modernization through 2030. This massive investment, fueled by increasing energy needs from data centers and the widespread adoption of electric vehicles, directly benefits companies like Hubbell that provide critical grid infrastructure components. The demand for reliable and resilient power systems is a long-term trend, creating a sustained market for Hubbell's solutions.

The accelerating global transition to renewable energy sources like solar and wind power presents a significant opportunity for Hubbell. As grids increasingly integrate these intermittent sources, demand for advanced solutions to manage and stabilize power flow is surging. Hubbell's product portfolio, designed to enhance grid resilience and facilitate renewable integration, is well-positioned to capitalize on this trend.

The smart grid technology market is experiencing robust expansion, projected to reach approximately $100 billion by 2027, according to some industry estimates. Hubbell's offerings in smart metering, automation, and grid modernization directly address the core needs of this growing sector. The company's ability to support enhanced grid reliability and efficiency through its technologies aligns perfectly with the market's trajectory.

The accelerating adoption of electric vehicles (EVs) is creating a massive demand for charging infrastructure. Analysts project the global EV charging market to reach over $100 billion by 2027, presenting a substantial opportunity for companies like Hubbell that provide essential electrical components. Similarly, the continuous build-out of broadband and 5G networks requires robust telecommunications equipment, another area where Hubbell's solutions are critical.

Leveraging Digitalization, IoT, and AI in Products and Operations

Hubbell can capitalize on the growing adoption of digital technologies within the utility and electrical industries. The increasing integration of IoT and AI offers a prime opportunity to create smarter, more efficient products, enhancing customer solutions and operational capabilities. For instance, by 2024, the global IoT market was projected to reach over $1.1 trillion, highlighting the significant demand for connected solutions that Hubbell can address.

Leveraging AI and IoT can lead to significant improvements in Hubbell's own operations and the value proposition for its customers. This includes developing products with predictive maintenance features, which can reduce downtime and operational costs for utilities. Furthermore, advancements in building automation systems, powered by these technologies, can offer enhanced energy management and user experience, a market segment that saw substantial growth in 2024.

- Develop intelligent grid solutions: Integrate IoT sensors and AI analytics into grid infrastructure products to enable real-time monitoring, fault detection, and optimized power distribution.

- Enhance product functionality: Embed AI for predictive maintenance in electrical equipment, reducing service needs and improving reliability for customers.

- Expand smart building offerings: Advance building automation systems with AI-driven insights for energy efficiency, security, and occupant comfort, tapping into the growing smart building market.

Strategic Acquisitions and Partnerships

Hubbell's robust financial health, evidenced by its strong balance sheet and healthy free cash flow, positions it favorably for strategic acquisitions. In 2023, Hubbell reported free cash flow of $1.07 billion, providing ample capacity to pursue targets that enhance its product lines or broaden its market presence.

These acquisitions can be crucial for entering new technological frontiers or solidifying its foothold in rapidly developing markets. For instance, acquiring companies with expertise in areas like advanced grid modernization or smart building technologies could offer significant growth avenues.

Strategic partnerships also present a compelling opportunity. Collaborating with technology providers or distribution networks in emerging economies could unlock substantial revenue streams and competitive advantages. This approach allows Hubbell to leverage external innovation and market access efficiently.

- Acquisition Capacity: Hubbell's strong free cash flow generation, reaching $1.07 billion in 2023, supports strategic M&A activities.

- Market Expansion: Acquisitions can facilitate entry into new geographic regions or product segments, diversifying revenue.

- Technological Advancement: Partnerships can provide access to cutting-edge technologies, fostering innovation and competitive edge.

- Synergistic Growth: Complementary acquisitions can create operational efficiencies and cross-selling opportunities.

Hubbell is well-positioned to benefit from the significant investments being made in upgrading the U.S. electrical grid, a trend expected to continue through 2030. The company's solutions are also critical for the expanding renewable energy sector and the growing demand for electric vehicle charging infrastructure. Furthermore, the company can leverage its strong financial position, including $1.07 billion in free cash flow in 2023, to pursue strategic acquisitions and partnerships that enhance its technological capabilities and market reach.

| Opportunity Area | Market Trend/Driver | Hubbell's Relevance | Data Point/Projection |

|---|---|---|---|

| Grid Modernization | Aging infrastructure, increased demand (data centers, EVs) | Provides critical infrastructure components | $300 billion U.S. grid upgrade planned through 2030 |

| Renewable Energy Integration | Shift to solar and wind power | Offers solutions for grid stabilization and resilience | N/A (Qualitative trend) |

| Smart Grid Technology | Demand for automation, efficiency | Offers smart metering, automation products | Smart grid market projected to reach ~$100 billion by 2027 |

| EV Charging & Broadband | Growth in EVs and 5G networks | Supplies essential electrical components for infrastructure | Global EV charging market to exceed $100 billion by 2027 |

| Digital Transformation (IoT/AI) | Integration of advanced technologies | Can develop smarter, more efficient products | Global IoT market projected over $1.1 trillion by 2024 |

| Strategic Acquisitions/Partnerships | Financial strength, market expansion needs | Strong free cash flow supports M&A; partnerships access innovation | $1.07 billion free cash flow in 2023 |

Threats

Broader economic downturns pose a significant threat to Hubbell. A general slowdown in construction and industrial sectors, even with strong megatrends, could dampen demand for electrical and electronic products. For instance, a contraction in GDP, like the projected 0.5% decline in the US economy in early 2025 according to some forecasts, would likely translate to reduced project starts and lower sales volumes for Hubbell.

Reduced private and public sector investment in infrastructure is another key concern. If economic uncertainty leads to delayed or canceled infrastructure projects, this directly impacts Hubbell's revenue streams. For example, a significant cutback in federal or state infrastructure spending, a common response to fiscal challenges, would curtail demand for Hubbell's grid and utility solutions.

The electrical and utility solutions landscape is intensely competitive. Hubbell faces significant rivalry, with global manufacturers and agile new entrants frequently introducing advanced products and services. This heightened competition, particularly evident in 2024 and projected for 2025, directly translates into pricing pressures, potentially impacting Hubbell's market share and profit margins.

Hubbell faces significant threats from global supply chain disruptions. Geopolitical tensions, trade policy shifts, and environmental events can all interrupt the flow of essential raw materials and components. For instance, the ongoing trade disputes and the lingering effects of global events in 2023 highlighted the vulnerability of extended supply chains, potentially increasing Hubbell's input costs and affecting production timelines.

These disruptions directly impact Hubbell's ability to meet customer demand and manage costs. Production delays and increased expenses due to material shortages or elevated shipping rates, as seen with certain electronics components in late 2024, can erode profit margins. Furthermore, navigating complex international trade regulations and tariffs adds another layer of uncertainty, potentially leading to higher product pricing and reduced competitiveness.

Technological Disruption and Rapid Innovation Cycles

The accelerating pace of technological advancement, particularly in areas like smart grids, energy storage, and artificial intelligence, presents a significant threat if Hubbell cannot adapt swiftly. Competitors introducing disruptive technologies or alternative solutions could quickly erode market share for Hubbell's established product lines, necessitating substantial research and development outlays to maintain relevance.

For instance, the global smart grid market was valued at approximately $26.5 billion in 2023 and is projected to reach $73.1 billion by 2030, growing at a CAGR of 15.6%. This rapid expansion highlights the critical need for continuous innovation to capture market opportunities and avoid obsolescence.

- Rapid technological shifts in smart grid and energy storage technologies could render existing Hubbell products outdated.

- Competitors leveraging AI for predictive maintenance or grid optimization may gain a competitive edge.

- Failure to invest adequately in R&D for emerging technologies could lead to market share erosion.

Cybersecurity Risks and Data Vulnerabilities

Hubbell's increasing reliance on smart technologies and digital solutions, while enhancing product offerings, also amplifies its exposure to cybersecurity risks. A significant data breach could impact not only operational continuity but also sensitive intellectual property and customer information, potentially leading to substantial financial repercussions and regulatory scrutiny.

The potential for cyberattacks poses a direct threat to Hubbell's critical infrastructure and operational integrity. In 2023, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report, highlighting the significant financial impact such events can have.

- Increased Attack Surface: The integration of IoT devices and connected systems expands the potential entry points for malicious actors.

- Intellectual Property Theft: Sensitive design data and proprietary technologies are prime targets for cyber espionage.

- Operational Disruption: Cyberattacks could halt manufacturing processes or disrupt the delivery of essential services.

- Reputational Damage: A compromised security posture can erode customer trust and damage Hubbell's brand image.

Hubbell faces threats from a challenging macroeconomic environment, including potential economic downturns and reduced infrastructure investment, which could dampen demand for its products. Intense competition from global players and new entrants, coupled with rapid technological shifts in areas like smart grids, necessitates continuous innovation and significant R&D investment to maintain market position.

Supply chain disruptions, driven by geopolitical tensions and trade policy shifts, also pose a risk, potentially increasing costs and impacting production timelines. Furthermore, Hubbell's increasing reliance on smart technologies exposes it to cybersecurity threats, with the potential for data breaches and intellectual property theft carrying significant financial and reputational risks.

| Threat Category | Specific Risk | Potential Impact | 2024/2025 Data/Trend |

|---|---|---|---|

| Macroeconomic Conditions | Economic Downturns | Reduced demand for electrical and electronic products | Projected US GDP decline of 0.5% in early 2025 (forecasts) |

| Market Dynamics | Intense Competition | Pricing pressures, market share erosion | High competitive activity observed throughout 2024 |

| Technological Advancements | Obsolescence of existing products | Need for substantial R&D outlays, potential market share loss | Smart grid market projected to grow significantly, indicating rapid innovation |

| Supply Chain | Disruptions (geopolitical, trade) | Increased input costs, production delays | Lingering effects of global events impacting supply chains in late 2024 |

| Cybersecurity | Data breaches, IP theft | Financial repercussions, regulatory scrutiny, reputational damage | Global average cost of data breach reached $4.45 million in 2023 |

SWOT Analysis Data Sources

This Hubbell SWOT analysis is built upon a foundation of credible data, including publicly available financial statements, comprehensive market research reports, and insights from industry experts. We also incorporate analysis of official company disclosures and verified news sources to ensure a well-rounded and accurate assessment.