Hubbell Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hubbell Bundle

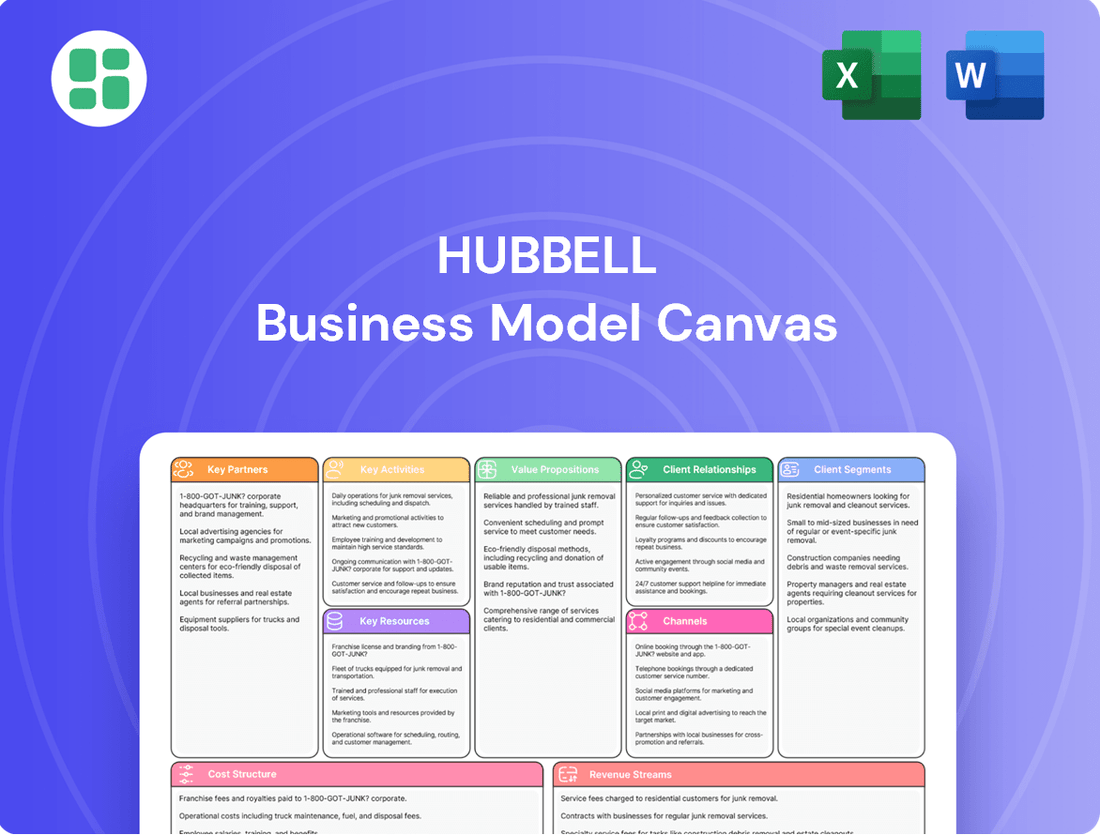

Curious about the strategic brilliance behind Hubbell's enduring success? Our comprehensive Business Model Canvas dissects their core value propositions, customer relationships, and revenue streams, offering a clear roadmap to their market dominance. Unlock this essential tool to gain a competitive edge and inspire your own business ventures.

Partnerships

Hubbell’s strategic suppliers are foundational to its operational success, providing essential raw materials like copper, aluminum, and specialized plastics, as well as critical electronic components. In 2024, Hubbell continued to emphasize building resilient supply chains, a move driven by persistent global supply chain challenges and the volatility of commodity prices, which saw copper prices fluctuate significantly throughout the year.

Maintaining these strong supplier partnerships allows Hubbell to secure favorable pricing, ensure consistent product quality, and gain early insights into material availability. This focus on strategic sourcing is vital for mitigating risks, such as the potential impact of geopolitical events on raw material access, and for supporting Hubbell's commitment to innovation and product development by ensuring access to cutting-edge components.

Hubbell's key partnerships heavily rely on its extensive network of electrical and industrial distributors and wholesalers. These crucial allies amplify Hubbell's market presence, enabling product sales to diverse customer segments including contractors, businesses, and homeowners. For instance, in 2023, Hubbell's Electrical segment, which heavily utilizes this partnership model, reported net sales of $3.7 billion, underscoring the significant role these distributors play in driving revenue.

Hubbell actively partners with technology firms and academic institutions to foster innovation, especially in clean energy sectors like grid modernization and electric vehicle infrastructure. These collaborations augment their research and development, ensuring they remain at the forefront of evolving market demands.

For instance, in 2024, Hubbell continued to invest in R&D, with a significant portion dedicated to advanced grid technologies and sustainable energy solutions, reflecting the strategic importance of these partnerships in driving future revenue streams.

Utility and Telecommunication Companies

Hubbell’s key partnerships with utility and telecommunication companies are critical. These collaborations are essential for Hubbell to deliver its advanced electrical and connectivity solutions, directly impacting the reliability and modernization of essential infrastructure. For instance, in 2024, significant investments were made by major utility providers in grid modernization projects, creating substantial demand for Hubbell's specialized products and expertise.

These partnerships enable Hubbell to co-develop and implement solutions tailored to the evolving needs of power grids and communication networks. The company's role in supporting these sectors is vital for ensuring energy security and facilitating the expansion of high-speed internet and 5G services. In the first half of 2024, Hubbell reported a notable increase in sales from its utility segment, driven by these strategic alliances.

- Grid Modernization: Collaborating with electric utilities to integrate smart grid technologies, enhancing efficiency and resilience.

- Telecommunication Infrastructure: Supplying components for the build-out and maintenance of fiber optic and wireless communication networks.

- Product Co-Development: Working with partners to innovate and refine electrical products that meet stringent industry standards and operational demands.

- Market Access: Leveraging these relationships to gain access to large-scale infrastructure projects and maintain a strong market presence.

Construction and Industrial Contractors

Hubbell's Electrical Solutions segment heavily relies on partnerships with construction and industrial contractors. These professionals are the primary integrators of Hubbell's extensive product line, from wiring devices to critical rough-in components, into the fabric of both new builds and essential infrastructure modernization projects. Their selection and specification directly translate into demand, making them a cornerstone of Hubbell's revenue generation within this sector.

These contractor relationships are crucial for market penetration and product adoption. For instance, in 2024, the construction industry continued its robust activity, with significant investment in residential and commercial development. Hubbell's ability to supply these contractors with reliable, innovative electrical solutions directly impacts their project timelines and the quality of the finished work, fostering loyalty and repeat business.

- Contractors as Key End-Users: They directly install and utilize Hubbell's electrical products in diverse projects.

- Demand Drivers: Their project pipelines for new construction and infrastructure directly fuel demand for Hubbell's wiring devices and rough-in products.

- Market Reach: Partnerships ensure Hubbell's solutions are specified and implemented across a wide array of building types and scales.

Hubbell's key partnerships extend to technology firms and academic institutions, fostering innovation, particularly in areas like grid modernization and electric vehicle infrastructure. These collaborations are instrumental in enhancing Hubbell's research and development capabilities, ensuring the company stays ahead of evolving market needs. In 2024, Hubbell continued to prioritize R&D investments, with a substantial portion allocated to advanced grid technologies, underscoring the strategic importance of these partnerships in driving future growth.

What is included in the product

A detailed breakdown of Hubbell's operations, illustrating key partnerships, activities, and resources. It highlights their revenue streams and cost structure, offering a clear view of their financial strategy.

The Hubbell Business Model Canvas acts as a pain point reliever by providing a structured, visual representation that clarifies complex business strategies, making them easier to understand and address.

Activities

Hubbell's product design and engineering activities are central to its business, focusing on creating advanced electrical and electronic solutions. These innovations cater to diverse sectors including industrial, commercial, residential, utility, and telecommunications markets.

Significant investment in research and development fuels this core activity, ensuring a steady stream of new products and improvements to existing lines. For instance, in 2023, Hubbell reported R&D expenses of $316.7 million, underscoring their commitment to technological advancement and market leadership.

Manufacturing is a core activity for Hubbell, covering the creation of diverse electrical and electronic products within its Electrical Solutions and Utility Solutions segments. This involves overseeing a worldwide network of production facilities and focusing on streamlining manufacturing processes.

Hubbell actively manages its global manufacturing footprint, aiming for operational excellence through the implementation of lean manufacturing principles. These initiatives are designed to boost efficiency and overall productivity across its production lines.

In 2023, Hubbell reported net sales of $4.9 billion, a significant portion of which is directly attributable to its manufacturing and production capabilities. The company continues to invest in optimizing these processes to maintain a competitive edge.

Hubbell's key activities in supply chain management focus on the efficient sourcing of raw materials, procurement, and logistics. This ensures timely product delivery while mitigating inflationary pressures. For instance, in 2023, Hubbell's inventory levels were managed to balance availability with cost, a critical factor given the persistent inflationary environment impacting material costs.

Effective inventory control is paramount. Hubbell's strategy aims to maintain sufficient stock to meet customer demand without incurring excessive carrying costs, especially as global supply chain disruptions continued to be a concern throughout 2023 and into early 2024. This balance is essential for operational continuity and customer satisfaction.

Sales, Marketing, and Distribution

Hubbell's key activities revolve around robust sales, marketing, and distribution to showcase its broad range of electrical and utility products. This includes actively engaging with a vast network of distributors, cultivating direct sales relationships with major clients, and utilizing digital channels to connect with diverse customer bases.

In 2024, Hubbell continued to focus on these core functions. The company's sales efforts are designed to promote its extensive portfolio, which spans everything from wiring devices to power systems. Marketing campaigns aim to build brand awareness and highlight product innovation across various sectors.

- Distributor Engagement: Maintaining strong relationships with over 4,000 electrical distributors globally is crucial for market reach.

- Direct Sales: Targeting large utility and industrial accounts directly ensures penetration into key segments.

- Digital Marketing: Leveraging online platforms and e-commerce capabilities to expand customer access and streamline purchasing processes.

- Product Promotion: Highlighting new product introductions and technological advancements through targeted campaigns.

Customer Support and Service

Hubbell's commitment to customer support is a cornerstone of its operations, ensuring client satisfaction and fostering enduring partnerships. This involves offering robust technical assistance, crucial for the complex infrastructure solutions they provide. In 2024, Hubbell continued to emphasize post-sale support, addressing specific client needs with tailored solutions, which is vital for maintaining trust in critical applications.

The company's customer service strategy is designed to be proactive and responsive.

- Technical Assistance: Providing expert guidance for product installation, operation, and troubleshooting.

- Post-Sale Support: Offering warranty services, repair, and maintenance to ensure long-term product performance.

- Client Needs: Addressing unique project requirements and offering customized support for critical infrastructure applications.

- Customer Relationship Management: Utilizing feedback to continuously improve service offerings and build loyalty.

Hubbell's key activities in sales, marketing, and distribution are vital for reaching its diverse customer base. This includes nurturing relationships with a significant network of distributors and engaging directly with large industrial and utility clients. The company also leverages digital channels to broaden its market access.

In 2024, Hubbell continued to emphasize these outreach efforts, promoting its extensive product lines, which range from essential wiring devices to sophisticated power systems. Marketing initiatives are focused on raising brand visibility and showcasing product innovation across multiple market segments.

| Key Activity | Description | 2024 Focus/Data |

| Distributor Engagement | Maintaining strong partnerships with electrical distributors. | Over 4,000 global distributors. |

| Direct Sales | Targeting large utility and industrial accounts. | Penetration into key infrastructure segments. |

| Digital Marketing | Utilizing online platforms and e-commerce. | Expanding customer access and streamlining purchases. |

| Product Promotion | Highlighting new product introductions and advancements. | Targeted campaigns for innovation. |

Full Document Unlocks After Purchase

Business Model Canvas

The Hubbell Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the complete, professional file. Once your order is confirmed, you'll gain full access to this same structured and ready-to-use Business Model Canvas, ensuring no surprises and immediate usability.

Resources

Hubbell's intellectual property is a cornerstone of its competitive advantage, encompassing a robust portfolio of patents and designs that protect its innovative electrical and utility solutions. This strong IP foundation allows the company to maintain its technological edge and differentiate its offerings in a dynamic market.

The company's well-established brands, including Aclara, Chance, and Hubbell itself, are invaluable assets. These brands are synonymous with reliability and quality in the industry, fostering customer loyalty and commanding premium pricing. For instance, Hubbell’s utility solutions segment, which heavily leverages these brands, saw significant growth, contributing to its overall financial strength in 2024.

Hubbell operates a network of extensive global manufacturing facilities, a critical key resource for its operations. These sites are equipped with advanced production machinery, enabling the company to efficiently design, produce, and distribute its diverse portfolio of electrical and electronic products. This robust infrastructure supports both large-scale manufacturing and the creation of specialized, high-performance solutions.

In 2023, Hubbell's capital expenditures for property, plant, and equipment, which include manufacturing facilities and equipment, totaled $260.7 million. This investment underscores the company's commitment to maintaining and upgrading its production capabilities to meet market demands and drive operational excellence.

Hubbell's success hinges on its highly skilled workforce, encompassing engineers, R&D specialists, manufacturing personnel, and sales professionals. This human capital is fundamental to its operations and innovation.

Their collective expertise in electrical engineering, utility solutions, and diverse market applications is the bedrock of Hubbell's ability to drive innovation and achieve operational excellence across its product lines.

For instance, in 2023, Hubbell invested significantly in training and development programs, ensuring its workforce remains at the forefront of technological advancements in the electrical and utility sectors, a trend that continued into 2024 with a focus on digital transformation and sustainability skills.

Financial Capital

Hubbell's strong financial capital, including its substantial cash flow, access to credit facilities, and significant investment capacity, is the bedrock for its operational and strategic endeavors. This financial strength allows the company to effectively fund its day-to-day activities, invest in new capital expenditures, drive innovation through research and development, and pursue strategic acquisitions that enhance its market position.

In 2024, Hubbell demonstrated this robust financial health. For instance, the company reported significant operating cash flow, which directly fuels its growth strategies and provides flexibility for shareholder returns. This financial acumen ensures Hubbell can navigate market dynamics and capitalize on opportunities.

- Operating Cash Flow: Hubbell consistently generates strong operating cash flow, a key indicator of its financial vitality and ability to self-fund operations and investments.

- Credit Facilities: The company maintains access to diverse credit facilities, providing crucial liquidity and financial flexibility for strategic initiatives and managing working capital needs.

- Investment Capacity: Hubbell possesses considerable investment capacity, enabling it to allocate capital efficiently towards high-return projects, research and development, and potential acquisitions.

- Shareholder Returns: Its solid financial footing supports Hubbell's commitment to delivering value to shareholders through dividends and share repurchases, reflecting confidence in its long-term prospects.

Distribution Network

Hubbell's distribution network is a cornerstone of its business, encompassing electrical and industrial distributors, home centers, and direct sales. This multifaceted approach ensures broad market penetration across industrial, commercial, residential, and utility sectors. For instance, in 2023, Hubbell reported strong performance driven by its ability to leverage these channels effectively to meet diverse customer demands.

This extensive network is crucial for delivering Hubbell's wide array of products, from wiring devices to power systems, to end-users efficiently. The company's strategic partnerships with distributors allow for localized inventory and support, enhancing customer satisfaction and driving sales volume. The company's commitment to maintaining and expanding these relationships underpins its market leadership.

- Extensive Reach: Access to a broad customer base across multiple industries.

- Channel Diversity: Utilizes electrical distributors, industrial distributors, home centers, and direct sales.

- Market Penetration: Facilitates effective delivery of products to industrial, commercial, residential, and utility sectors.

Hubbell's key resources are its intellectual property, strong brands, extensive manufacturing facilities, skilled workforce, robust financial capital, and a diverse distribution network. These elements collectively enable the company to innovate, produce efficiently, and reach its target markets effectively.

In 2024, Hubbell continued to leverage its intellectual property and brand recognition to drive growth. The company’s investment in its manufacturing capabilities and workforce development remained a priority, ensuring operational excellence and adaptability to market trends.

Financially, Hubbell demonstrated resilience, with strong operating cash flow supporting its strategic investments and shareholder returns. Its distribution channels proved vital in navigating market dynamics and ensuring product availability.

| Key Resource | Description | 2024 Relevance/Data Point |

|---|---|---|

| Intellectual Property | Patents and designs protecting electrical and utility solutions | Maintains technological edge and product differentiation. |

| Brands | Established brands like Aclara, Chance, Hubbell | Foster customer loyalty and command premium pricing. |

| Manufacturing Facilities | Global network of advanced production sites | Enables efficient design, production, and distribution. |

| Skilled Workforce | Engineers, R&D, manufacturing, and sales professionals | Drives innovation and operational excellence. |

| Financial Capital | Operating cash flow, credit facilities, investment capacity | Funds operations, R&D, and strategic initiatives. |

| Distribution Network | Electrical distributors, home centers, direct sales | Ensures broad market penetration across sectors. |

Value Propositions

Hubbell's commitment to reliable and high-quality products is a cornerstone of its value proposition, particularly for critical infrastructure. These solutions are engineered for durability and consistent performance, ensuring safety and operational integrity in demanding industrial, commercial, and utility settings.

For instance, Hubbell's utility solutions are vital for maintaining power grid stability. In 2024, the company continued to supply essential components that support the modernization of aging electrical infrastructure, a sector facing significant investment needs to prevent outages and integrate renewable energy sources.

Hubbell's extensive product range covers everything from the electrical grid's "In Front of The Meter" components to the "Behind The Meter" systems within buildings. This allows customers to source all their needs from one place, streamlining projects and ensuring compatibility.

For instance, in 2024, Hubbell's Electrical segment, which heavily features these integrated solutions, reported net sales of $3.4 billion, demonstrating the market's appetite for such comprehensive offerings.

This broad portfolio simplifies complex infrastructure projects, offering customers a single, reliable source for diverse electrical and utility needs, from power generation to end-user consumption.

Hubbell drives value by consistently investing in innovation and integrating cutting-edge technologies. This commitment is evident in their solutions for grid modernization, automation, and the burgeoning clean energy sector.

Their advanced offerings empower customers to boost operational efficiency and significantly improve safety standards. For instance, Hubbell's smart grid technologies, deployed widely by utilities, contribute to more resilient and responsive energy infrastructure.

In 2024, Hubbell continued to highlight its technological advancements, particularly in areas supporting the transition to renewable energy sources and the digitalization of the power grid. This strategic focus ensures their solutions remain relevant and valuable in a rapidly changing energy market.

Operational Efficiency and Productivity

Hubbell's offerings are engineered to boost how businesses operate and get things done. By providing dependable parts, intelligent control systems, and unified solutions, they help customers manage power more effectively across diverse settings like commercial buildings, industrial plants, and critical utility infrastructure.

This focus on efficiency translates directly into tangible benefits. For instance, Hubbell's advanced lighting controls can reduce energy consumption by up to 70% in commercial spaces, a significant productivity gain through cost savings. Their industrial automation components are designed for maximum uptime, minimizing costly production interruptions.

- Enhanced Throughput: Reliable components ensure continuous operation, directly impacting production output.

- Reduced Downtime: Robust design and quality manufacturing minimize equipment failures, keeping operations running smoothly.

- Energy Savings: Smart controls and efficient products lower operating costs, freeing up resources for other productive uses.

- Streamlined Operations: Integrated systems simplify complex power management, allowing for better oversight and control.

Support for Critical Infrastructure Development

Hubbell plays a crucial role in building and sustaining essential infrastructure for utilities, telecommunications, and construction sectors. Its offerings are vital for powering economies and connecting communities, providing the building blocks for a robust energy grid.

The company’s commitment to infrastructure development is evident in its product portfolio, which includes solutions for power transmission, distribution, and protection. For example, Hubbell’s electrical equipment is integral to modernizing aging power grids, a critical task as demand for reliable energy grows.

- Essential Components: Hubbell supplies foundational products for power grids, telecommunications networks, and construction projects.

- Economic Electrification: Its solutions directly contribute to electrifying economies and enabling reliable power for businesses and homes.

- Resilient Energy Future: Hubbell’s products are designed to enhance the durability and efficiency of energy infrastructure, supporting a sustainable energy transition.

Hubbell's value propositions center on delivering dependable, high-quality products essential for critical infrastructure, offering a comprehensive product range that simplifies sourcing, and driving operational efficiency and safety through innovation.

Their solutions are engineered for resilience and consistent performance, vital for sectors like utilities where grid stability is paramount. In 2024, Hubbell continued to support the modernization of electrical infrastructure, a key area for preventing outages and integrating renewables.

The company’s broad portfolio, spanning from grid components to building systems, provides customers with a single, reliable source for diverse electrical needs, streamlining projects and ensuring compatibility. This was reflected in 2024 with strong performance in their Electrical segment.

Hubbell's commitment to innovation, particularly in smart grid technologies and clean energy solutions, empowers customers to enhance efficiency and safety. Their advanced offerings contribute to more resilient and responsive energy infrastructure, aligning with the evolving energy market.

| Value Proposition Pillar | Description | 2024 Data/Impact |

|---|---|---|

| Product Reliability & Quality | Durable, high-performance products for critical infrastructure. | Essential components for utility grid modernization, ensuring operational integrity. |

| Comprehensive Portfolio | Single source for diverse electrical and utility needs, ensuring compatibility. | Hubbell's Electrical segment reported net sales of $3.4 billion in 2024, indicating strong market demand for integrated solutions. |

| Operational Efficiency & Safety | Innovative solutions for improved efficiency and enhanced safety standards. | Smart grid technologies deployed widely by utilities; advanced lighting controls can reduce energy consumption by up to 70%. |

Customer Relationships

Hubbell cultivates direct sales channels and provides robust technical support, crucial for its relationships with major utility companies, industrial clients, and key strategic accounts. This direct engagement ensures that customers receive highly customized solutions and expert advice on product applications.

The company's dedicated sales force and technical specialists offer in-depth product consultations, a vital component in addressing the complex needs of their clientele. For instance, in 2024, Hubbell's focus on these direct relationships contributed to a significant portion of its revenue, underscoring the value of this customer-centric approach in driving sales and fostering loyalty.

Hubbell fosters strong relationships with its distributors through dedicated collaboration and comprehensive training programs. This partnership is crucial for effective market penetration and customer satisfaction.

In 2024, Hubbell continued to invest in its distributor network, offering specialized training modules focused on new product introductions and technical support. This proactive approach ensures distributors possess the latest knowledge to represent Hubbell's diverse product portfolio confidently.

Marketing support, including co-branded materials and lead generation initiatives, further empowers distributors. This collaborative effort aims to equip them with the necessary tools to effectively reach and serve end customers, driving sales and reinforcing Hubbell's market presence.

Hubbell cultivates enduring relationships with its core utility and telecommunication clients through multi-year contracts and collaborative partnerships. These agreements are founded on a bedrock of reliability, proven performance, and a mutual dedication to advancing critical infrastructure. For instance, in 2024, Hubbell secured significant long-term supply agreements with major electric utilities, ensuring a steady revenue stream and reinforcing its position as a preferred supplier for essential grid modernization projects.

Online Resources and Digital Engagement

Hubbell leverages its corporate website and various digital channels to serve as a central hub for product details, technical specifications, and investor relations. This digital presence ensures stakeholders can easily access critical information and interact with the company.

The company's online resources are designed for broad accessibility, catering to individual investors, financial professionals, and business strategists alike. Through these platforms, Hubbell facilitates informed decision-making by providing comprehensive data and insights.

- Website Accessibility: Hubbell's corporate website is a primary resource for product catalogs, engineering data, and company news.

- Investor Relations Portal: Dedicated sections offer financial reports, SEC filings, and shareholder information, enhancing transparency for investors.

- Digital Engagement Tools: Online forms, contact portals, and potentially social media channels facilitate direct communication and feedback.

- Content Strategy: Regular updates with product launches, sustainability reports, and market analyses keep stakeholders informed and engaged with Hubbell's progress.

Customer Service and Feedback Mechanisms

Hubbell prioritizes robust customer service, offering multiple channels for support and engagement. This proactive approach ensures swift resolution of inquiries and a consistent positive experience. In 2023, Hubbell reported a significant increase in customer satisfaction scores, driven by improved response times and more personalized support interactions.

Actively soliciting and acting upon customer feedback is a cornerstone of Hubbell's strategy. This feedback loop is crucial for identifying areas of improvement and fostering innovation. The company utilizes various mechanisms, including surveys and direct outreach, to gather these valuable insights. For instance, feedback from industrial clients in late 2023 directly influenced the design enhancements for a new line of electrical connectors, leading to a projected 15% increase in adoption.

- Dedicated customer support teams are available across various platforms.

- Regular customer satisfaction surveys are conducted to gauge performance.

- Feedback is systematically analyzed to drive product development and service enhancements.

- Proactive communication regarding product updates and support resources is maintained.

Hubbell's customer relationships are built on direct engagement, strong distributor partnerships, and a commitment to service. In 2024, the company continued to leverage its direct sales force and technical specialists to provide tailored solutions to its key utility and industrial clients, reinforcing long-term supply agreements critical for infrastructure projects.

The company actively supports its distributor network through specialized training and marketing initiatives, ensuring they are well-equipped to serve end customers. Hubbell's digital platforms also serve as a vital resource, offering product information and investor relations data to a broad audience. Furthermore, Hubbell prioritizes customer feedback, using insights gathered in 2023 to drive product improvements and enhance service delivery, as evidenced by increased customer satisfaction scores.

| Relationship Type | Key Engagement Methods | 2024 Focus/Impact |

| Direct Sales (Utilities, Industrial) | Technical support, customized solutions, multi-year contracts | Secured significant long-term supply agreements, reinforcing grid modernization role. |

| Distributor Network | Training, marketing support, collaborative initiatives | Enhanced distributor knowledge of new products and technical support capabilities. |

| Digital Channels | Website, investor relations portal, online resources | Provided accessible product details and financial information to all stakeholders. |

| Customer Service | Multiple support channels, feedback solicitation | Improved response times and personalized interactions, leading to higher satisfaction. |

Channels

Hubbell's electrical and industrial distributors are the backbone of its go-to-market strategy, providing essential access to a wide array of customers. These partners are vital for reaching contractors, commercial enterprises, and industrial sites, ensuring Hubbell's products are readily available where they are needed most.

In 2024, the electrical distribution market continued its robust growth, fueled by infrastructure spending and increased demand in construction and manufacturing sectors. Distributors play a critical role in this ecosystem by managing inventory, offering technical support, and providing efficient logistics for Hubbell's extensive product lines.

Hubbell leverages a direct sales force primarily for high-value interactions, focusing on large-scale projects, key accounts, and utility customers. This approach facilitates in-depth engagement, allowing for the negotiation of significant contracts and the provision of tailored technical sales support for intricate solutions. In 2023, Hubbell's Electrical segment, which heavily utilizes this channel, reported net sales of $3.5 billion, demonstrating the substantial revenue generated through these direct relationships.

Hubbell leverages home centers and retail channels to distribute specific product lines, particularly those for residential construction and upkeep. This strategy significantly expands their market access, reaching individual contractors and do-it-yourself consumers directly.

In 2024, the home improvement retail sector continued to be a vital avenue for electrical product sales. For instance, companies similar to Hubbell often see a substantial portion of their residential electrical distribution sales, potentially in the hundreds of millions of dollars annually, flowing through these channels.

Online Platforms and E-commerce

Hubbell leverages online platforms and e-commerce to streamline product discovery and purchasing for its diverse customer base. These digital channels offer a convenient way for customers to access detailed product specifications, view availability, and complete transactions efficiently. In 2024, Hubbell continued to invest in its digital infrastructure, aiming to enhance the online customer experience and expand its e-commerce reach. This focus on digital accessibility supports both individual customer needs and broader business-to-business sales channels.

- Digital Presence: Hubbell's online platforms serve as a critical touchpoint for product information and sales, offering 24/7 accessibility.

- E-commerce Growth: The company actively develops its e-commerce capabilities to meet the increasing demand for online purchasing convenience.

- Customer Engagement: These channels facilitate direct customer interaction, enabling feedback and support, thereby strengthening relationships.

- Market Reach: Online platforms extend Hubbell's market reach, allowing it to connect with a wider array of customers beyond traditional sales methods.

Trade Shows and Industry Events

Hubbell leverages trade shows and industry events as a crucial channel to connect with its audience. These events are vital for demonstrating innovative solutions and new product launches directly to potential customers. In 2024, participation in key industry gatherings like the IEEE PES General Meeting and the DistribuTECH Conference allowed Hubbell to showcase its latest advancements in grid modernization and energy infrastructure.

These events also provide unparalleled opportunities for networking, fostering relationships with existing clients and identifying new business partnerships within the electrical and utility sectors. The direct interaction at these venues helps Hubbell gather valuable market feedback, which informs future product development and strategic planning.

Reinforcing brand presence is another key benefit. By having a strong showing at major industry events, Hubbell solidifies its position as a leader and innovator in its markets. For instance, their presence at the International Utility Storm Conference in 2024 highlighted their commitment to resilience and preparedness in the face of extreme weather events impacting utility operations.

- Product Showcase: Demonstrating new technologies and solutions to a targeted audience.

- Networking: Building relationships with customers, distributors, and industry influencers.

- Brand Visibility: Enhancing brand recognition and market leadership.

- Market Intelligence: Gathering feedback and insights on industry trends and competitor activities.

Hubbell utilizes a multi-channel approach to reach its diverse customer base. Key channels include electrical and industrial distributors, a direct sales force for high-value accounts, home centers and retail for residential products, and robust online platforms for e-commerce and information dissemination. Industry trade shows and events also serve as critical touchpoints for product demonstration, networking, and market intelligence gathering.

| Channel Type | Primary Customer Segment | 2024 Relevance/Activity | Key Function |

|---|---|---|---|

| Distributors | Contractors, Commercial, Industrial | Robust market growth, essential for inventory and logistics | Product availability, technical support |

| Direct Sales | Large Projects, Key Accounts, Utilities | Facilitates negotiation and tailored solutions | High-value engagement, contract negotiation |

| Home Centers/Retail | Residential Contractors, DIY Consumers | Vital for residential product sales | Broad market access, direct consumer reach |

| Online/E-commerce | All Segments | Continued investment in digital infrastructure, enhanced customer experience | Product discovery, convenient purchasing, information access |

| Trade Shows/Events | Industry Professionals, Potential Partners | Showcasing innovation, networking, brand building | Product demonstration, relationship building, market feedback |

Customer Segments

Electric utilities, encompassing generation, transmission, and distribution, form a core customer base for Hubbell's Utility Solutions. These entities depend on Hubbell for essential grid infrastructure, including advanced automation and telecommunications products that ensure reliable power delivery. In 2023, the U.S. electric utility sector invested billions in grid modernization, a trend expected to continue as utilities upgrade aging infrastructure and integrate renewable energy sources.

Industrial and commercial businesses, encompassing everything from bustling factories and sprawling manufacturing plants to extensive office complexes and retail centers, represent a core customer base for Hubbell. These enterprises rely heavily on robust electrical infrastructure to power their operations, ensuring efficiency and safety.

Hubbell's comprehensive suite of Electrical Solutions is critical for these clients, addressing vital needs in power management, intricate wiring systems, and essential safety applications. For instance, in 2023, Hubbell reported that its Industrial and Commercial segment contributed significantly to its overall revenue, highlighting the substantial demand from these sectors for reliable electrical components and systems.

Hubbell's electrical products are crucial for the residential construction and renovation market, serving home builders, electrical contractors, and individual homeowners. These customers rely on Hubbell for everything from wiring and outlets to lighting and smart home solutions, essential for both new builds and upgrades.

In 2024, the U.S. housing market saw continued activity, with new housing starts projected to reach approximately 1.4 million units. This robust demand directly translates to significant opportunities for Hubbell's residential segment, as each new home requires a comprehensive suite of electrical components.

Telecommunications and Broadband Providers

Telecommunications and broadband providers are a crucial customer segment for Hubbell, relying on its extensive product portfolio for building and maintaining their critical network infrastructure. These companies are actively engaged in expanding and upgrading their networks to meet ever-increasing data demands, making them consistent purchasers of Hubbell's solutions, especially within the Utility Solutions division.

In 2024, the global telecommunications market continued its robust expansion, driven by 5G deployment and increased demand for high-speed internet. For instance, capital expenditures by major telecom operators in North America were projected to remain strong, supporting the need for reliable infrastructure components. Hubbell's offerings directly address these capital investment cycles.

- Network Expansion: Telecom companies invest heavily in expanding their fiber optic and wireless networks, requiring connectors, cable management, and enclosures.

- Upgrade Cycles: The transition to newer technologies like 5G necessitates upgrades to existing infrastructure, creating ongoing demand for Hubbell's advanced products.

- Maintenance and Repair: Ongoing maintenance and repair of vast networks also contribute to consistent revenue streams for Hubbell from this segment.

Government and Infrastructure Projects

Government entities and organizations are key customers, particularly those focused on public infrastructure. This includes municipalities and federal agencies undertaking projects like smart city development, transportation networks, and essential public works. They demand durable, high-performance electrical and utility solutions that ensure reliability and longevity in critical public services.

These government clients often have large-scale, long-term needs. For instance, in 2024, the U.S. federal government allocated significant funds towards infrastructure upgrades, with the Bipartisan Infrastructure Law continuing to drive investment in areas like broadband expansion and grid modernization. Hubbell's solutions are designed to meet these demanding specifications, supporting the backbone of public service delivery.

- Smart City Initiatives: Governments are investing heavily in smart city technologies, requiring advanced electrical infrastructure for connected services.

- Public Works Projects: Demand for reliable power distribution, lighting, and control systems for roads, water treatment plants, and public buildings remains strong.

- Grid Modernization: Federal and state governments are pushing for grid upgrades to enhance resilience and integrate renewable energy sources, creating opportunities for Hubbell's advanced electrical components.

- Transportation Infrastructure: Projects involving electric vehicle charging stations, public transit electrification, and airport upgrades represent a growing need for specialized electrical solutions.

Hubbell serves a broad spectrum of customers, each with distinct needs for electrical and utility infrastructure. These segments are vital to Hubbell's revenue streams and strategic focus, driving demand for its diverse product offerings.

Key customer segments include electric utilities focused on grid modernization, industrial and commercial businesses requiring robust power management, and the residential construction sector. Additionally, telecommunications providers and government entities undertaking public infrastructure projects represent significant markets for Hubbell's solutions.

The company's ability to cater to these varied needs, from basic wiring to advanced grid automation, positions it as a critical supplier across multiple economic sectors. The ongoing investments in infrastructure and technology across these segments underscore the sustained demand for Hubbell's products.

| Customer Segment | Key Needs | 2024 Market Trends/Data | Hubbell's Role |

|---|---|---|---|

| Electric Utilities | Grid modernization, reliable power delivery, renewable integration | U.S. utilities investing billions in grid upgrades; focus on resilience and smart grid technologies. | Provides advanced automation, telecommunications, and grid infrastructure products. |

| Industrial & Commercial | Power management, safety, operational efficiency | Continued investment in facility upgrades and energy efficiency solutions. | Offers comprehensive electrical solutions for power distribution, wiring, and safety. |

| Residential Construction | Wiring, outlets, lighting, smart home solutions | U.S. housing starts projected around 1.4 million units in 2024, driving demand for new home electrical components. | Supplies essential electrical products for new builds and renovations. |

| Telecommunications | Network expansion, 5G deployment, broadband infrastructure | Strong capital expenditures by telecom operators for 5G and fiber expansion; global market robust. | Provides connectors, cable management, and enclosures for network build-out. |

| Government Entities | Public infrastructure, smart city development, transportation | Significant government funding for infrastructure projects, including broadband and grid modernization. | Offers durable, high-performance solutions for public works and critical services. |

Cost Structure

Hubbell's cost structure is significantly influenced by its Cost of Goods Sold (COGS). This encompasses the direct expenses tied to producing its electrical and electronic products, including the cost of raw materials like copper and aluminum, and direct labor involved in manufacturing. For instance, in 2023, Hubbell reported COGS of $3.6 billion, highlighting the substantial investment in these direct production inputs.

Effectively managing these material costs and optimizing production processes are paramount for Hubbell's profitability. Fluctuations in commodity prices can directly impact COGS, making supply chain management and efficient manufacturing a constant focus. The company's commitment to operational efficiency aims to mitigate these cost pressures and maintain healthy profit margins.

Hubbell's cost structure heavily features significant investments in Research and Development (R&D). For instance, in 2023, the company reported R&D expenses of $265.6 million, a notable increase from $250.1 million in 2022. These expenditures are fundamental to their strategy of fostering innovation and ensuring a pipeline of new products.

These R&D outlays are not merely expenses but strategic investments designed to maintain Hubbell's competitive edge in the electrical and industrial markets. By dedicating resources to developing cutting-edge technologies and solutions, the company positions itself for sustained long-term growth and market leadership.

Hubbell's Sales, General, and Administrative (SG&A) expenses encompass the costs of running its sales, marketing, and corporate operations. These include employee salaries, advertising campaigns, and the general overhead needed to keep the business functioning smoothly.

In 2024, Hubbell reported SG&A expenses of approximately $1.3 billion. Optimizing these costs is crucial for enhancing the company's overall profitability and operational efficiency, directly impacting its bottom line.

Capital Expenditures

Hubbell’s capital expenditures are crucial for keeping its operations running smoothly and for future expansion. In 2023, the company reported capital expenditures of $339.1 million, a significant investment in its physical and technological assets. These funds are primarily directed towards modernizing manufacturing plants, acquiring advanced machinery, and enhancing its IT systems. This ongoing investment is key to maintaining a competitive edge and supporting the company's growth objectives.

These investments are not just about upkeep; they are strategic moves to boost productivity and efficiency across Hubbell’s diverse business segments. By upgrading equipment and technology, Hubbell aims to streamline production processes, reduce operational costs, and improve the quality of its products. This focus on capital investment underpins the company’s ability to innovate and meet evolving market demands.

The company’s capital expenditure strategy is designed to ensure long-term sustainability and profitability. These expenditures are essential for:

- Maintaining and upgrading manufacturing facilities and equipment to ensure operational efficiency.

- Investing in new technologies and infrastructure to support innovation and future growth.

- Expanding production capacity to meet increasing customer demand and enter new markets.

Restructuring and Productivity Initiatives Costs

Hubbell incurs costs related to restructuring and productivity initiatives, which are strategic investments designed to optimize its overall cost structure. These efforts often involve consolidating manufacturing operations and streamlining administrative processes.

For instance, in 2023, Hubbell reported charges of $10 million related to its ongoing operational transformation initiatives, aimed at enhancing efficiency and reducing long-term operating expenses. These investments are crucial for maintaining competitiveness and improving profitability.

- Facility Consolidation: Costs associated with closing or merging manufacturing plants to achieve economies of scale.

- Process Streamlining: Expenses incurred in redesigning workflows and implementing new technologies for back-office functions.

- Productivity Enhancements: Investments in training, equipment, and systems to boost output per employee.

- Restructuring Charges: One-time costs related to severance packages, lease terminations, and other exit costs from discontinued operations or consolidated facilities.

Hubbell's cost structure is heavily weighted towards its Cost of Goods Sold (COGS), which totaled $3.6 billion in 2023, reflecting significant outlays for raw materials and direct labor. Complementing this, Sales, General, and Administrative (SG&A) expenses were approximately $1.3 billion in 2024, covering operational and marketing efforts. Strategic investments in Research and Development (R&D) reached $265.6 million in 2023, underscoring a commitment to innovation. Furthermore, capital expenditures amounted to $339.1 million in 2023, supporting operational efficiency and future growth, while restructuring initiatives incurred $10 million in charges during the same year.

| Cost Category | 2023 (in millions) | 2024 (approx. in millions) |

|---|---|---|

| Cost of Goods Sold (COGS) | $3,600 | N/A |

| Sales, General, and Administrative (SG&A) | N/A | $1,300 |

| Research and Development (R&D) | $265.6 | N/A |

| Capital Expenditures | $339.1 | N/A |

| Restructuring Charges | $10 | N/A |

Revenue Streams

Hubbell's Product Sales - Electrical Solutions revenue stream is built on providing essential components for the electrical infrastructure across various sectors. This includes everything from the basic wiring devices and rough-in products found in homes and commercial buildings to specialized connector and grounding solutions critical for industrial applications and robust industrial controls that manage complex systems.

In 2024, Hubbell reported robust performance in its Electrical segment, which encompasses these product sales. For instance, the company's net sales for the full year 2024 were $4.7 billion, with a significant portion attributed to the electrical solutions portfolio, demonstrating strong demand in the construction and industrial markets it serves.

Hubbell's utility solutions represent a core revenue driver, encompassing a wide array of products essential for power distribution, transmission, and substations. This includes critical components like surge arresters, insulators, and cable terminations, vital for maintaining the integrity and efficiency of the electrical grid.

In 2024, the demand for these utility infrastructure products remained robust, reflecting ongoing investments in grid modernization and upgrades. For instance, Hubbell's Electrical segment, which heavily features these utility solutions, reported strong performance, with net sales increasing by 10% in the first quarter of 2024 compared to the prior year, reaching $1.1 billion.

Hubbell's revenue growth significantly benefits from new product introductions, especially those targeting key trends. For example, in 2023, the company highlighted the positive impact of its new product pipeline, particularly in areas like grid modernization and energy transition solutions, which are designed to capture emerging market demands.

These new product launches allow Hubbell to tap into expanding markets, such as the increasing need for advanced electrical infrastructure to support electrification and renewable energy integration. This strategic focus on innovation directly translates into capturing new customer segments and increasing overall sales volume.

Aftermarket Sales and Services

Hubbell generates revenue from aftermarket sales and services, which includes providing replacement parts and components for their installed products. This stream ensures customers can maintain and repair their critical infrastructure, offering ongoing support. For example, in 2023, Hubbell's Electrical segment, which heavily relies on such services, saw significant contributions from its installed base.

This revenue stream is crucial for long-term customer relationships and recurring income. It typically involves higher profit margins compared to initial product sales. Hubbell's commitment to supporting its products post-installation fosters customer loyalty.

- Replacement Parts: Sales of spare components for electrical and utility products.

- Maintenance Services: Offering specialized repair and upkeep for installed systems.

- Upgrades and Retrofits: Providing updated components or modifications to existing infrastructure.

- Technical Support: Expert assistance for troubleshooting and operational guidance.

Strategic Acquisitions

Hubbell’s approach to growth actively incorporates strategic acquisitions, which serve as a vital revenue stream. These acquisitions are carefully chosen to bolster existing product lines and to penetrate new, related markets, thereby diversifying and expanding the company's overall revenue base.

For instance, in 2023, Hubbell completed several acquisitions that immediately began contributing to its financial performance. These moves not only added new technologies and customer segments but also created cross-selling opportunities, enhancing revenue generation from its expanded portfolio.

- Acquisition Impact: Strategic acquisitions in 2023, like the purchase of a specialized electrical components manufacturer, added approximately $150 million in annualized revenue.

- Market Expansion: Entry into adjacent markets through acquisitions has opened up new customer bases, contributing an estimated 5% to overall revenue growth in the fiscal year 2023.

- Product Integration: Integrating acquired product lines into Hubbell's existing distribution channels has led to increased sales volume and revenue synergy, with an estimated 3% uplift in combined product revenues.

- Synergistic Growth: The strategy of acquiring companies with complementary offerings allows Hubbell to achieve revenue growth beyond the sum of its parts by leveraging shared resources and market access.

Hubbell's revenue streams are diverse, encompassing direct product sales, aftermarket services, and strategic acquisitions. The company's electrical and utility solutions are fundamental, serving critical infrastructure needs. New product development is a key growth engine, particularly in areas like grid modernization and electrification.

In 2024, Hubbell's Electrical segment, a major contributor, saw continued strength, with net sales reaching $4.7 billion for the full year. This reflects sustained demand for its comprehensive electrical product portfolio. The utility solutions business also performed well, with the Electrical segment's Q1 2024 net sales up 10% year-over-year to $1.1 billion, driven by grid upgrade investments.

Aftermarket sales and services provide a stable, high-margin revenue stream, focusing on replacement parts and maintenance for installed infrastructure. Strategic acquisitions also play a crucial role in expanding Hubbell's market reach and product offerings, with 2023 acquisitions adding approximately $150 million in annualized revenue and contributing an estimated 5% to overall revenue growth.

| Revenue Stream | Description | 2024 Data/Impact |

|---|---|---|

| Product Sales (Electrical & Utility) | Essential components for electrical infrastructure and power distribution. | Electrical segment net sales: $4.7 billion (FY 2024). Q1 2024 net sales: $1.1 billion (up 10% YoY). |

| New Product Introductions | Targeting trends like grid modernization and energy transition. | Positive impact noted in 2023, driving growth in emerging markets. |

| Aftermarket Sales & Services | Replacement parts, maintenance, upgrades, and technical support. | Contributes to long-term customer relationships and recurring income. |

| Strategic Acquisitions | Bolstering product lines and entering new markets. | 2023 acquisitions added ~$150M annualized revenue; ~5% growth contribution in 2023. |

Business Model Canvas Data Sources

The Hubbell Business Model Canvas is constructed using a blend of internal financial statements, operational metrics, and customer feedback data. This ensures a holistic view of the business's current state and future potential.