Hubbell Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hubbell Bundle

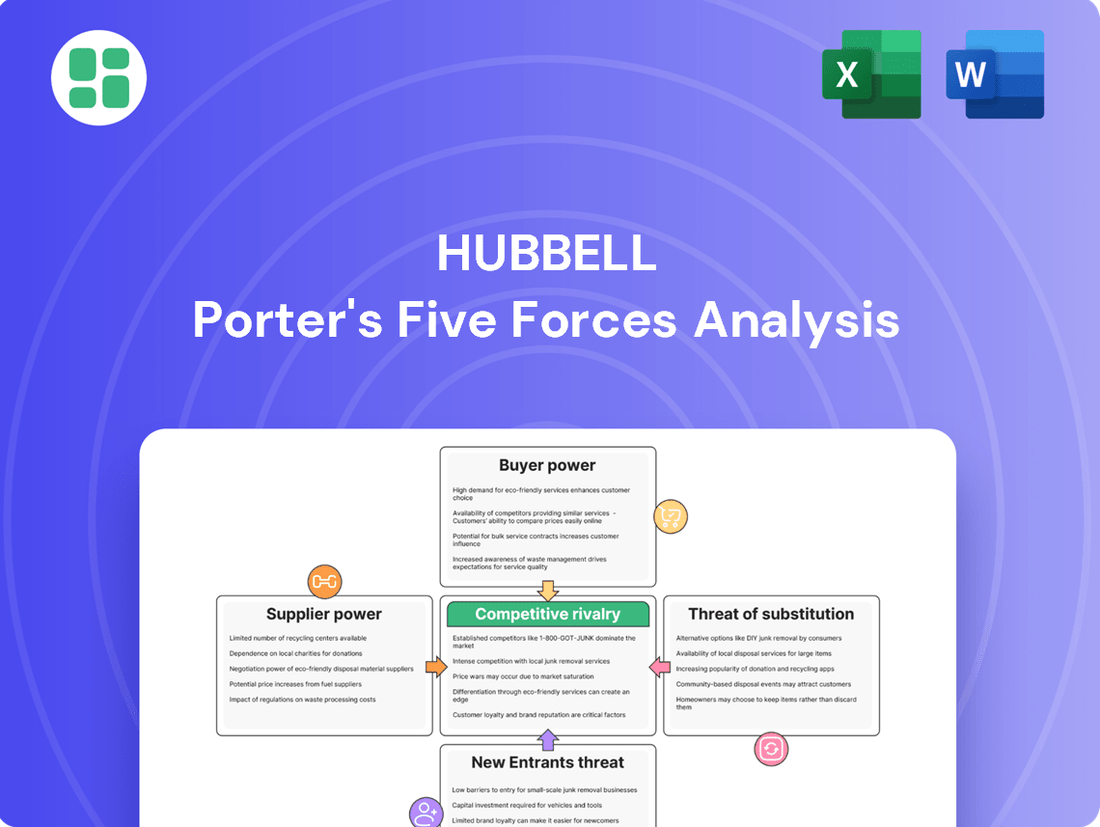

Hubbell's Five Forces Analysis provides a crucial lens to understand the competitive landscape of the electrical equipment industry. It dissects the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, all of which shape Hubbell's strategic positioning.

This preview only scratches the surface of the intricate dynamics at play. Unlock the full Porter's Five Forces Analysis to explore Hubbell’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hubbell's reliance on specialized electronic components, often with limited alternative suppliers, grants these providers significant bargaining power. This is particularly true for patented or highly technical parts crucial to their product lines.

Recent supply chain challenges, including those seen in 2023 and continuing into 2024, have amplified supplier influence. Material inflation, for instance, saw the Producer Price Index for manufactured goods rise by 0.8% in January 2024, directly impacting Hubbell's input costs and demonstrating supplier leverage.

The bargaining power of suppliers is a critical factor, heavily shaped by raw material costs and trade policies like tariffs. Hubbell's experience in Q1 2025 clearly illustrates this, reporting a net price/cost/productivity headwind directly linked to raw material inflation and the imposition of tariffs. This situation allows suppliers to pass on increased input costs, impacting the company's profitability.

Hubbell is actively addressing these supplier-driven cost pressures. The company is implementing strategic pricing actions to offset the impact of rising raw material expenses and tariffs. For instance, in Q1 2025, the company noted that while raw material inflation and tariffs presented a headwind, their pricing initiatives were helping to mitigate these effects.

The ease with which Hubbell can switch between its suppliers significantly influences the bargaining power of those suppliers. For standard, commodity-like components, Hubbell likely faces low switching costs, enabling it to source from various vendors and thus diminish individual supplier leverage.

However, if Hubbell relies on highly specialized or proprietary components, the cost of switching suppliers could be substantial. This would involve not only the expense of finding a new supplier but also the considerable investment in redesigning products, rigorous testing, and the lengthy process of qualifying new parts, thereby increasing the bargaining power of existing suppliers.

Supplier's Product Differentiation

Suppliers offering highly differentiated or unique products in the advanced electrical and utility solutions space wield significant bargaining power. If a supplier's component offers a distinct performance advantage or is integral to Hubbell's product innovation, they can negotiate higher prices and more favorable terms. For instance, in 2024, specialized semiconductor manufacturers supplying critical components for smart grid technology saw increased pricing power due to the limited number of qualified suppliers and the high R&D investment required for such advanced materials.

- Supplier Differentiation: Companies providing unique, high-performance components for smart grid or advanced power distribution systems can command premium pricing.

- Criticality to Innovation: Components essential for Hubbell's next-generation product development, such as specialized insulation materials or advanced sensor technology, increase supplier leverage.

- Limited Alternatives: A lack of readily available substitutes for a supplier's specialized product strengthens their negotiating position.

- Impact on Hubbell's Margins: The cost of these differentiated components directly influences Hubbell's product profitability and competitive pricing.

Threat of Forward Integration by Suppliers

Suppliers might threaten Hubbell by integrating forward, essentially entering Hubbell's market themselves. This is typically a minor concern for Hubbell due to the intricate manufacturing and distribution systems involved. However, for suppliers with highly specialized technologies, this remains a potential, albeit infrequent, risk.

For instance, a supplier of a unique, patented electrical component could potentially leverage its intellectual property to manufacture and sell finished products directly to end-users, bypassing Hubbell. While Hubbell's 2024 revenue of $4.5 billion and its extensive global operations present significant barriers to entry, a focused supplier could still target specific product segments.

- Forward integration by suppliers is a potential, though generally low, threat to Hubbell.

- This threat is more pronounced for niche suppliers possessing unique or proprietary technologies.

- Hubbell's established manufacturing scale and distribution network act as significant deterrents to most suppliers.

Suppliers of specialized components crucial for Hubbell's advanced product lines, such as those used in smart grid technology, possess considerable bargaining power. This is exacerbated by limited alternative suppliers and the high cost of switching, which can involve significant redesign and qualification efforts.

In 2024, Hubbell faced direct impacts from supplier pricing power, as noted in their Q1 2025 reporting of net price/cost/productivity headwinds linked to raw material inflation and tariffs. This demonstrates suppliers' ability to pass on increased input costs, affecting Hubbell's profitability.

Hubbell's strategy to counter this involves pricing actions to offset rising raw material expenses. For example, in Q1 2025, pricing initiatives were instrumental in mitigating the negative effects of inflation and tariffs, highlighting the ongoing negotiation dynamics.

| Factor | Impact on Hubbell | Example Data (2024/2025) |

| Supplier Differentiation | Premium pricing for unique components | Specialized semiconductor manufacturers for smart grid tech |

| Switching Costs | High for proprietary parts | Product redesign, testing, qualification |

| Input Cost Inflation | Increased raw material expenses | PPI for manufactured goods up 0.8% Jan 2024 |

| Tariffs | Additional cost burden | Q1 2025 net price/cost/productivity headwind |

What is included in the product

Uncovers the five key competitive forces shaping Hubbell's industry, providing strategic insights into rivalry, buyer and supplier power, new entrants, and substitutes.

Quickly identify and address competitive threats with a visual representation of all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Hubbell's diverse customer base, spanning industrial, commercial, residential construction, utility, telecommunications, and broadband infrastructure, significantly dilutes the bargaining power of any single customer segment. This broad reach means that no one sector holds a disproportionate sway over Hubbell's overall revenue. For instance, in 2023, Hubbell's Electrical Segment, which serves many of these end markets, reported net sales of $3.9 billion, showcasing the wide distribution of its revenue streams.

While the overall diversity limits individual customer leverage, certain large utility clients or major distribution partners might still possess considerable influence due to their volume of purchases. These entities can negotiate for better terms or pricing, especially given the essential nature of Hubbell's products in infrastructure projects. For example, large utility contracts often involve substantial order volumes that can shift negotiation dynamics.

Hubbell's customer bargaining power is significantly shaped by how sensitive buyers are to price and how unique they perceive Hubbell's products to be. For standard electrical components, which often resemble commodities, customers can easily switch suppliers if prices rise, giving them considerable leverage. This price sensitivity is a key factor in their bargaining power.

Conversely, when Hubbell offers specialized utility solutions or products under its well-regarded premium brands, the situation changes. These differentiated offerings mean customers are less likely to find direct substitutes, reducing their price sensitivity and thus their bargaining power. This allows Hubbell to maintain better pricing and margins on these specific product lines.

Customers wield significant bargaining power when they have numerous readily available alternatives to Hubbell's products. This ease of switching to a competitor, or finding substitute goods, directly amplifies their leverage.

Hubbell operates in a competitive landscape where customers can often find similar quality products from other manufacturers. If these alternatives are priced more attractively, customers' inclination to switch increases, thereby strengthening their bargaining position against Hubbell.

For instance, in the electrical equipment sector, while Hubbell is a major player, the market includes numerous competitors offering comparable products. A 2024 market analysis indicated that over 30% of surveyed industrial buyers reported easily finding alternative suppliers for essential electrical components, a factor that directly impacts pricing negotiations.

Customer's Cost of Switching Suppliers

The cost for customers to switch from Hubbell's electrical and utility products to a competitor's offerings directly influences their bargaining power. When these switching costs are substantial, it limits the customer's ability to pressure Hubbell on pricing or terms.

For critical infrastructure components, such as those used in power grids or industrial facilities, the expenses associated with switching can be significant. This includes the cost of new equipment, installation labor, potential system integration challenges, and the time and resources needed for regulatory re-approvals. These high switching costs effectively reduce the bargaining power of these customers.

- High Switching Costs: For specialized components like advanced switchgear or integrated control systems, the cost to replace and re-certify can run into tens or hundreds of thousands of dollars per installation.

- Integration Complexity: Many of Hubbell's products are designed to work within existing, complex electrical systems. Replacing these requires not just the new product but also potential modifications to the surrounding infrastructure.

- Regulatory Hurdles: In sectors like utilities and heavy industry, components often require specific certifications and compliance with stringent safety standards. Switching suppliers necessitates a new approval process, adding time and expense.

Information Availability and Purchasing Volume

The bargaining power of customers is significantly amplified by information availability and purchasing volume. Large clients, such as major utilities and prominent contractors, often possess sophisticated procurement systems and a wealth of market data. This allows them to negotiate terms more effectively, leveraging their knowledge of pricing and alternatives.

Their substantial purchasing volumes are a critical factor, granting them leverage to demand preferential pricing, discounts, or tailored product specifications. For instance, in the electrical equipment sector, a utility company placing an order for thousands of transformers can command better terms than a small distributor buying a few units.

- Information Access: Customers with access to market intelligence and competitor pricing can identify opportunities for better deals.

- Volume Discounts: Bulk purchases by large customers frequently result in lower per-unit costs.

- Customization Demands: Significant order sizes can empower customers to request specific product modifications or service levels.

- Negotiation Leverage: The ability to switch suppliers or delay purchases, backed by comprehensive information and volume, strengthens customer negotiation power.

Hubbell's broad customer base across various sectors like utilities, telecommunications, and construction inherently limits the bargaining power of any single customer. This diversification, evident in its 2023 Electrical Segment net sales of $3.9 billion, means no one customer group can dictate terms. However, large utility clients or major distributors, due to their significant purchase volumes, can still exert considerable influence on pricing and terms, especially for essential infrastructure products.

Customers have more power when Hubbell's products are seen as commodities with many alternatives. In 2024, over 30% of industrial buyers reported easily finding substitute electrical components, increasing their leverage. Conversely, Hubbell's specialized, premium-branded products reduce customer price sensitivity and bargaining power due to fewer readily available substitutes.

High switching costs protect Hubbell from customer pressure. For critical infrastructure components, replacing Hubbell products involves substantial expenses for new equipment, installation, integration, and regulatory re-approvals, significantly reducing customer leverage. For example, switching advanced switchgear can cost hundreds of thousands of dollars per installation.

Information availability and purchase volume are key customer bargaining tools. Large clients leverage market data and substantial order sizes to negotiate favorable pricing and customized specifications, as seen when utility companies order thousands of transformers, commanding better terms than smaller buyers.

| Factor | Impact on Customer Bargaining Power | Hubbell's Position | Example/Data Point |

|---|---|---|---|

| Customer Diversification | Lowers overall power | Broad market reach | 2023 Electrical Segment Sales: $3.9 billion |

| Large Customer Volume | Increases power | Negotiation leverage for key accounts | Utility transformer orders |

| Product Differentiation | Lowers power | Premium brands, specialized solutions | Reduced price sensitivity for niche products |

| Availability of Substitutes | Increases power | Commoditized components | 30%+ industrial buyers find alternatives (2024) |

| Switching Costs | Lowers power | High for integrated infrastructure | $100k+ for advanced switchgear replacement |

| Information & Volume | Increases power | Sophisticated procurement | Bulk discounts, customization demands |

What You See Is What You Get

Hubbell Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual Hubbell Porter's Five Forces Analysis, detailing the competitive landscape of the industry. Once you complete your purchase, you’ll get instant access to this exact, comprehensive file, ready for your strategic planning needs.

Rivalry Among Competitors

Hubbell faces a fragmented and diverse competitive landscape, with numerous players across its Electrical Solutions and Utility Solutions segments. This includes large, diversified industrial conglomerates as well as smaller, highly specialized manufacturers. The intensity of this rivalry isn't uniform; Hubbell often competes with different sets of companies depending on the specific product or market it's targeting, meaning its competitive set is not static.

Competitive rivalry within the electrical equipment industry is significantly shaped by product differentiation. Hubbell, for instance, actively pursues innovation, consistently introducing new products, especially in high-growth sectors like grid modernization, electrification, and smart technologies. This focus on technological advancement allows them to stand out from competitors.

Companies that successfully differentiate their offerings through superior technology, unwavering quality, or exceptional customer service can effectively reduce the intensity of direct price-based competition. For example, Hubbell's investment in R&D, which has historically been a substantial portion of their operating expenses, fuels this differentiation. In 2023, Hubbell reported significant investments in product development, contributing to their ability to command premium pricing and maintain market share even amidst intense rivalry.

The electrical and utility solutions markets, while largely mature, are seeing renewed growth. This expansion is fueled by crucial trends like the modernization of electrical grids, the increasing integration of renewable energy sources, and the booming demand from data center construction. For instance, the global smart grid market was valued at approximately $30 billion in 2023 and is projected to grow significantly in the coming years.

While this overall market growth can temper direct rivalry by creating more opportunities for everyone, competition remains fierce for market share, particularly within these high-growth segments. Companies are vying for dominance in areas like advanced grid management software and specialized components for renewable energy infrastructure.

High Fixed Costs and Capacity Utilization

The electrical and utility product manufacturing sector is characterized by substantial fixed costs. These include investments in advanced manufacturing plants, ongoing research and development for new technologies, and extensive distribution infrastructure. For instance, establishing a new, state-of-the-art production facility can easily run into hundreds of millions of dollars.

These high fixed costs create a strong incentive for companies to operate at high capacity utilization. When demand falters, manufacturers may aggressively cut prices to keep production lines running and cover their overhead. This dynamic intensifies competitive rivalry, as firms prioritize volume to amortize their fixed investments over more units.

- Significant Capital Outlay: Industries like electrical equipment manufacturing often require substantial upfront investment in plant, property, and equipment.

- Capacity Utilization Pressure: High fixed costs mean that the cost per unit decreases significantly as production volume increases, driving a need for high capacity utilization.

- Price Competition: To maintain high utilization, especially during economic downturns or periods of oversupply, companies may engage in price wars, impacting profitability across the industry.

- Barriers to Exit: The specialized nature of assets and high exit costs can also trap companies in competitive markets, further fueling rivalry.

Mergers, Acquisitions, and Strategic Alliances

Mergers, acquisitions, and strategic alliances are dynamic forces reshaping the competitive landscape. Companies actively pursue these strategies to bolster market share, acquire cutting-edge technologies, or streamline operations. Hubbell, for instance, demonstrated this by integrating Systems Control in 2023, a move that significantly altered its competitive positioning.

These consolidations can lead to fewer, larger competitors, intensifying rivalry. For example, the electrical equipment industry has seen notable M&A activity, with larger players acquiring smaller ones to expand their product portfolios and geographical reach. This trend can create significant barriers to entry for new businesses.

- Increased Market Concentration: M&A activity can lead to a more concentrated market, where a few dominant players control a larger share.

- Technological Advancement: Acquisitions often bring new technologies and intellectual property into larger companies, accelerating innovation.

- Synergies and Efficiencies: Companies aim for cost savings and operational efficiencies through mergers, which can impact pricing and profitability across the sector.

- Competitive Response: The actions of one company through M&A often trigger similar responses from rivals, creating a ripple effect in the industry.

Hubbell operates in a competitive environment with numerous players, ranging from large conglomerates to specialized manufacturers. Differentiation through innovation, quality, and customer service is key, as seen in Hubbell's significant R&D investments, contributing to their ability to maintain market share and premium pricing. The industry's high fixed costs incentivize aggressive pricing to ensure capacity utilization, especially during economic slowdowns, intensifying rivalry.

Mergers and acquisitions, like Hubbell's 2023 acquisition of Systems Control, are actively reshaping the competitive landscape, leading to increased market concentration and a drive for technological advancement and operational efficiencies among remaining players.

| Competitor Type | Key Characteristics | Impact on Rivalry |

|---|---|---|

| Diversified Conglomerates | Broad product portfolios, significant financial resources | Intense competition across multiple segments, potential for price wars |

| Specialized Manufacturers | Niche expertise, agile innovation | Targeted competition in specific product categories, focus on technological differentiation |

| New Entrants (Tech-focused) | Digital solutions, smart grid technologies | Disruptive innovation, pressure on incumbents to adopt new technologies |

SSubstitutes Threaten

The threat of substitutes is amplified by technological advancements that offer superior functionality or cost savings. For instance, the increasing efficiency and decreasing cost of renewable energy sources like solar and wind present a growing substitute for traditional grid-based power, impacting demand for related electrical infrastructure components. In 2024, global renewable energy capacity additions were projected to reach record levels, further solidifying this trend.

Emerging technologies such as advanced battery storage and smart grid solutions also act as substitutes by enabling more efficient energy management and potentially reducing reliance on certain conventional electrical components. The continuous innovation in areas like the Internet of Things (IoT) and artificial intelligence is also paving the way for new electronic systems that could replace older, less integrated solutions, offering enhanced performance and connectivity.

The threat of substitutes for traditional electrical equipment is increasing as demand for energy efficiency and smart technologies grows. Solutions offering advanced energy management or automation can replace older, less efficient systems. This trend is particularly evident in the utility and building management sectors.

For instance, the global smart grid market was valued at approximately $36.5 billion in 2023 and is projected to reach over $100 billion by 2030, indicating a significant shift towards smarter, more efficient infrastructure. Hubbell is actively participating in this evolving landscape by offering its own smart grid capabilities and IoT-enabled meters, directly addressing this substitute threat by providing competitive solutions within the emerging market.

Innovation in materials science and manufacturing constantly introduces potential substitutes. For example, advancements in halogen-free materials and other sustainable components are reshaping the electronics and industrial sectors, offering alternatives that might be more cost-effective or environmentally friendly.

Decentralized Energy Generation and Storage

The growing trend of decentralized energy generation, including rooftop solar panels and home battery storage, presents a potential substitute threat to traditional utility infrastructure. As more consumers adopt these distributed energy resources (DERs), their reliance on Hubbell's conventional grid components could diminish, impacting demand for certain product lines. For instance, the U.S. solar industry saw installations grow by approximately 40% year-over-year in 2023, reaching over 30 gigawatts, indicating a significant shift in energy consumption patterns.

However, this shift also creates opportunities for Hubbell. The company is well-positioned to supply the necessary components for integrating these new energy sources into the existing grid. This includes advanced metering, grid automation equipment, and specialized connectors for solar and storage systems. In 2024, investments in grid modernization to accommodate DERs are projected to increase, with utilities allocating billions to upgrade their infrastructure to handle bidirectional power flow and manage distributed generation effectively.

- Decentralized Energy Resources (DERs): Rooftop solar and battery storage systems offer alternatives to centralized power.

- Reduced Reliance: Increased DER adoption could lessen demand for traditional utility grid components.

- Market Growth: U.S. solar installations grew by ~40% in 2023, highlighting the expanding DER market.

- Hubbell's Role: Hubbell can supply integration solutions for DERs, mitigating the substitution threat.

DIY and Open-Source Solutions in Niche Markets

In certain niche electrical components markets, the rise of DIY and open-source solutions presents a minor threat of substitution. For hobbyists and small-scale projects, these alternatives can reduce the demand for commercially manufactured parts.

For instance, the burgeoning maker movement and the accessibility of 3D printing technology in 2024 have enabled individuals to create custom components, potentially bypassing traditional suppliers for low-volume, specialized needs.

- DIY Component Creation: Reduced reliance on commercial suppliers for custom or obsolete parts.

- Open-Source Designs: Facilitates replication and modification of existing components.

- Niche Market Impact: Primarily affects smaller, specialized segments rather than broad-market electrical components.

The threat of substitutes is intensifying due to advancements in energy efficiency and smart technologies, which offer alternatives to traditional electrical components. For example, the increasing adoption of electric vehicles (EVs) is driving demand for charging infrastructure, which can be seen as a substitute for traditional gasoline-based fueling systems and the electrical components that support them. The global EV market continued its rapid expansion through 2024, with sales projections indicating sustained growth.

Furthermore, the development of advanced materials and modular designs can lead to components that are more durable, easier to install, or require less maintenance, thereby substituting for older, less sophisticated products. This innovation directly impacts the lifecycle and replacement demand for Hubbell's established product lines.

The convergence of digital and physical infrastructure also creates substitute opportunities. For instance, software-defined networking and advanced analytics can perform functions previously handled by specialized hardware, reducing the need for certain physical electrical components.

| Substitute Category | Example | Impact on Traditional Components | 2024 Market Trend/Data |

|---|---|---|---|

| Renewable Energy | Rooftop Solar & Battery Storage | Reduced reliance on grid infrastructure | Global renewable capacity additions projected to reach record levels. |

| Smart Technologies | IoT-enabled meters, Smart Grid Solutions | Increased efficiency, potential displacement of older systems | Global smart grid market valued at ~$36.5 billion in 2023, growing rapidly. |

| Decentralized Energy | Home energy management systems | Less demand for centralized utility components | U.S. solar installations grew ~40% in 2023. |

| Electric Vehicles | EV Charging Infrastructure | Shift in energy consumption patterns, demand for new electrical solutions | Continued rapid expansion of the global EV market. |

Entrants Threaten

The electrical and utility products industry, especially for companies like Hubbell that offer a wide range of manufactured goods and distribution, demands significant upfront capital. This includes building and maintaining advanced manufacturing plants, investing heavily in research and development to stay competitive, and establishing robust, widespread distribution channels.

These substantial capital requirements act as a formidable barrier, deterring potential new players from entering the market. For instance, the average capital expenditure for a new utility-scale solar farm in 2024 can range from $1 million to $2 million per megawatt, illustrating the scale of investment needed in related infrastructure sectors.

Hubbell benefits from a long-standing reputation for quality and reliability, especially in critical infrastructure sectors like utilities and industrial applications. This deep-seated trust, built over decades, makes it difficult for newcomers to gain immediate traction.

Building such brand trust and establishing deep customer relationships, particularly with large utilities, is a time-consuming and costly endeavor for new entrants. For instance, securing contracts with major utility providers often requires extensive vetting and proven performance history, which new players lack.

The utility and electrical sectors are characterized by significant regulatory hurdles. New entrants must comply with rigorous safety, performance, and environmental standards, a process that often involves obtaining numerous certifications. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce strict emissions standards for power generation, adding substantial compliance costs for any new facility.

Economies of Scale and Experience Curve

Existing players, such as Hubbell, leverage significant economies of scale in their operations. This translates to lower per-unit costs in manufacturing, raw material procurement, and distribution networks. For instance, in 2023, Hubbell reported net sales of $4.9 billion, reflecting the substantial volume of their operations.

New entrants would find it challenging to match these cost efficiencies without substantial initial investment and achieving comparable sales volumes. This cost disadvantage makes it difficult for newcomers to compete effectively on price against established manufacturers.

Furthermore, the experience curve plays a crucial role. Companies like Hubbell have refined their processes over years, leading to greater efficiency and lower production costs as cumulative output increases. This accumulated knowledge and operational maturity create a high barrier to entry.

- Economies of Scale: Hubbell's 2023 net sales of $4.9 billion demonstrate their significant operational volume.

- Cost Disadvantage for New Entrants: Newcomers struggle to achieve similar per-unit cost efficiencies without matching Hubbell's scale.

- Experience Curve Benefits: Years of refined processes lead to greater efficiency and lower costs for established players.

- Barrier to Entry: The combination of scale and experience makes it difficult for new companies to compete on price.

Access to Distribution Channels and Supply Chains

New entrants often struggle to gain access to established distribution channels and supply chains, a critical hurdle in the electrical and utility products market. Hubbell, for instance, has cultivated deep-rooted relationships with a diverse network of distributors, contractors, and maintains direct sales channels to utility companies. This extensive network is not easily replicated.

Securing comparable access to these established channels presents a significant barrier for newcomers. Building the necessary infrastructure and trust to compete with Hubbell's existing supply chain and distribution footprint requires substantial investment and time. For example, in 2024, the average lead time for specialized electrical components could extend significantly for unproven suppliers, impacting their ability to meet customer demand reliably.

- Established Network: Hubbell's long-standing relationships with distributors and contractors provide a significant competitive advantage.

- Cost of Entry: New entrants face high costs in replicating Hubbell's distribution and supply chain infrastructure.

- Supply Chain Reliability: Building a reliable supply chain comparable to Hubbell's can take years and substantial capital.

- Market Access: Limited access to key customer segments, like major utility providers, hinders new entrants.

The threat of new entrants for Hubbell is generally low, primarily due to the substantial capital required to establish manufacturing facilities, R&D capabilities, and extensive distribution networks. For instance, building a modern electrical component manufacturing plant can easily cost tens of millions of dollars in 2024, a significant hurdle for startups.

Furthermore, established brand reputation and deep customer relationships, especially with utility companies, are difficult and time-consuming for newcomers to replicate. New entrants also face stringent regulatory compliance, which adds to the cost and complexity of entering the market. For example, obtaining UL certification for electrical products in 2024 involves rigorous testing and can take several months.

Economies of scale enjoyed by incumbents like Hubbell, evidenced by their 2023 net sales of $4.9 billion, create a significant cost disadvantage for potential new entrants. The experience curve, which leads to greater efficiency and lower costs with cumulative output, further solidifies this barrier.

Access to established distribution channels and supply chains is another major impediment. New companies often struggle to secure comparable access, as demonstrated by the extended lead times for specialized electrical components from unproven suppliers in 2024.

| Barrier | Description | Examples/Data Points (2023-2024) |

| Capital Requirements | High upfront investment for manufacturing, R&D, and distribution. | New manufacturing plant costs: tens of millions USD. |

| Brand Reputation & Relationships | Time-consuming to build trust and secure utility contracts. | UL certification lead times: several months. |

| Regulatory Hurdles | Compliance with safety, performance, and environmental standards. | EPA emissions standards for power generation. |

| Economies of Scale | Lower per-unit costs due to high production volume. | Hubbell's 2023 net sales: $4.9 billion. |

| Distribution & Supply Chain Access | Difficulty in replicating established networks. | Extended lead times for unproven suppliers of specialized components. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and government economic indicators to provide a comprehensive view of competitive pressures.