Hubbell Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hubbell Bundle

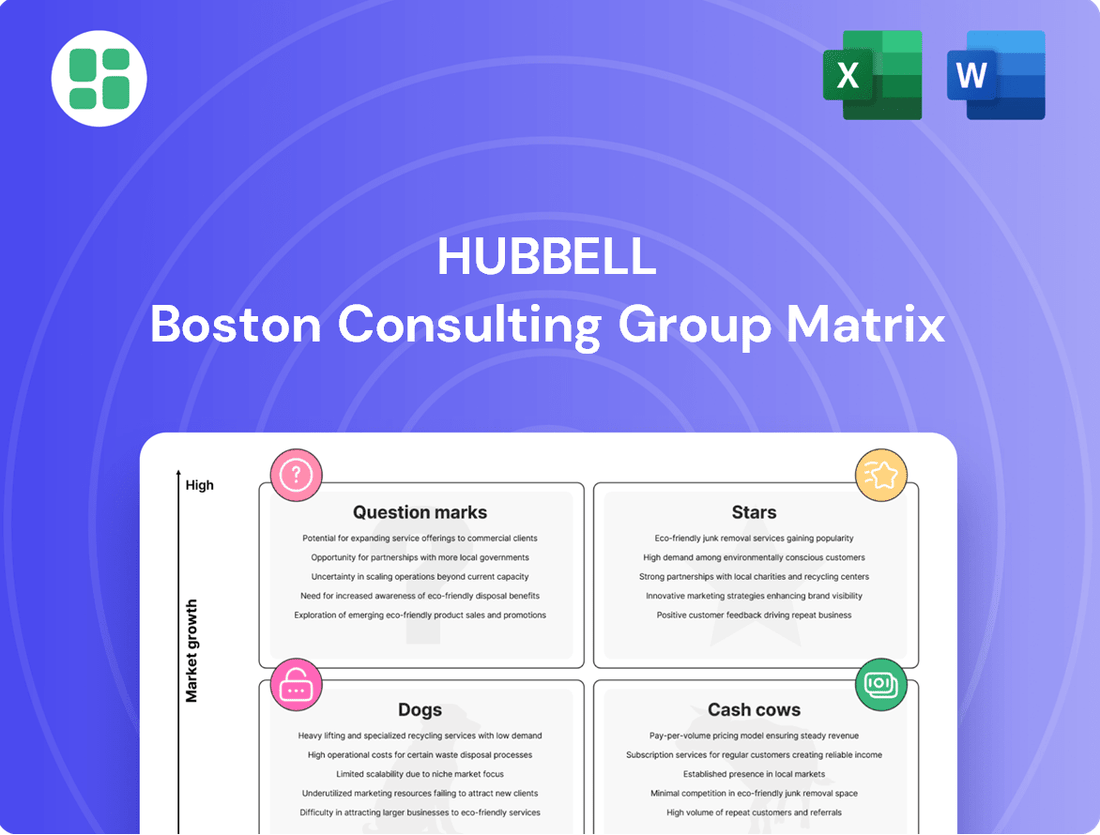

Unlock the strategic potential of Hubbell's product portfolio with a clear understanding of its position within the BCG Matrix. This analysis reveals which products are market leaders (Stars), reliable income generators (Cash Cows), underperformers (Dogs), or promising but unproven ventures (Question Marks).

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Hubbell's data center power solutions, encompassing connectors and grounding products, are seeing impressive double-digit growth. This surge is directly fueled by the escalating demand for infrastructure supporting AI and cloud computing. For instance, the global data center market was valued at approximately $240 billion in 2023 and is projected to exceed $360 billion by 2028, highlighting the immense scale of investment.

The dynamic nature of the data center market, particularly the significant investments in hyperscale facilities, presents a prime opportunity for Hubbell. Their robust connectivity and reliability solutions are essential components for these critical, high-growth environments. As of early 2024, hyperscale data center construction spending is projected to reach record levels, underscoring the demand for specialized power and connectivity infrastructure.

Grid modernization components for transmission and substations are experiencing robust, double-digit growth, driven by significant federal infrastructure investments. This surge is directly linked to the urgent requirement for a more resilient and efficient U.S. energy system. Hubbell has established strong market leadership in these critical areas.

The demand for advanced grid components is amplified by the need to replace aging infrastructure, with the U.S. grid facing an estimated $1.5 trillion investment gap over the next decade. Hubbell's solutions, such as advanced circuit breakers and intelligent substation automation systems, directly address these modernization needs.

Hubbell's renewable energy interconnection products are crucial for smoothly integrating solar and wind power into the existing electrical grid. These components ensure reliable power flow, a vital aspect as the nation embraces cleaner energy sources.

The market for these products is experiencing significant growth, directly supporting the clean energy transition. In 2024, the U.S. saw renewable energy sources account for approximately 23% of utility-scale net generation, a figure projected to climb further.

Advanced Metering Infrastructure (AMI) & Smart Grid Solutions

Following its 2025 acquisition of Aclara Technologies, Hubbell significantly bolstered its Advanced Metering Infrastructure (AMI) and smart grid solutions. This expansion includes IoT-enabled meters and sophisticated analytics platforms, enhancing grid efficiency and data management for utilities.

The North American smart grid market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of 10%. This dynamic market environment positions Hubbell's advanced AMI and smart grid offerings as critical growth drivers for the company's future revenue streams.

- Market Growth: The North American smart grid market is expected to grow at a 10% CAGR, reaching an estimated $30 billion by 2027.

- Acquisition Impact: The Aclara acquisition in 2025 expanded Hubbell's smart grid portfolio, integrating advanced metering and data analytics capabilities.

- Solution Focus: Hubbell's AMI and smart grid solutions offer utilities enhanced grid visibility, operational efficiency, and data-driven decision-making.

- Competitive Positioning: These integrated solutions strengthen Hubbell's competitive stance in a rapidly evolving utility technology landscape.

Electrification Infrastructure Products

Hubbell's Electrification Infrastructure Products are central to the growing demand for electricity across various sectors, including electric vehicles, smart buildings, and industrial automation.

This trend fuels a significant and ongoing growth opportunity for Hubbell's extensive range of electrical solutions.

For instance, the global electric vehicle charging infrastructure market was valued at approximately $15.7 billion in 2023 and is projected to reach $104.8 billion by 2030, demonstrating the scale of this electrification megatrend.

- EV Charging Solutions: Hubbell provides critical components for EV charging stations, supporting the rapid expansion of charging networks.

- Smart Grid Technologies: Their products enable grid modernization, enhancing reliability and efficiency as electricity demand rises.

- Industrial Electrification: Hubbell's offerings support the electrification of industrial processes, driving efficiency and sustainability.

Hubbell's data center and grid modernization segments are clear Stars in the BCG matrix, exhibiting high growth and strong market positions. The surge in AI and cloud computing is a primary driver for data center solutions, while federal investments are propelling grid modernization. These areas represent significant opportunities for continued expansion and market leadership.

Hubbell's position in data center power solutions is bolstered by the booming demand for AI and cloud infrastructure, with the global data center market projected to grow significantly. Similarly, their grid modernization components are benefiting from substantial federal investments aimed at upgrading the U.S. energy system, addressing a critical infrastructure investment gap. These factors firmly place these segments as Stars.

Hubbell's renewable energy interconnection products and electrification infrastructure are also performing strongly, aligning with the global shift towards cleaner energy and increased electricity demand. The rapid growth in EV charging infrastructure and the broader trend of industrial electrification further solidify these segments' Star status.

The company's strategic acquisition of Aclara Technologies in 2025 has significantly enhanced its Advanced Metering Infrastructure (AMI) and smart grid capabilities, positioning these as key growth drivers within a market experiencing a healthy CAGR. This expansion into smart grid solutions, coupled with their electrification offerings, underscores Hubbell's commitment to capitalizing on major market trends.

| Segment | Market Growth Driver | Hubbell's Position | 2024 Outlook |

|---|---|---|---|

| Data Center Power Solutions | AI, Cloud Computing Demand | Strong, Double-Digit Growth | Continued High Demand |

| Grid Modernization | Federal Infrastructure Investment | Market Leadership | Robust, Double-Digit Growth |

| Renewable Energy Interconnection | Clean Energy Transition | Crucial for Integration | Significant Growth |

| Electrification Infrastructure | EVs, Smart Buildings, Industrial Automation | Central to Growing Demand | Significant Ongoing Opportunity |

| Advanced Metering Infrastructure (AMI) / Smart Grid | Utility Efficiency, IoT Integration | Bolstered by Aclara Acquisition | Robust Growth (10% CAGR projected) |

What is included in the product

The Hubbell BCG Matrix analyzes the company's business units based on market share and growth, guiding investment decisions.

Quickly identify underperforming units, relieving the pain of resource misallocation.

Cash Cows

Hubbell's Core Electrical Construction Products, encompassing wiring devices, rough-in electricals, and traditional lighting, represent a significant Cash Cow in their BCG Matrix. These items cater to established construction markets, generating steady revenue and healthy profit margins.

The strength of these products lies in Hubbell's substantial market share and the enduring trust associated with its brand name. For instance, in 2023, Hubbell reported strong performance in its Electrical segment, which heavily features these mature product lines, contributing significantly to overall profitability and cash flow generation.

Conventional utility distribution components, like insulators, arresters, and connectors, form the bedrock of existing electrical grid infrastructure. This segment operates within a stable, mature market, crucial for the ongoing maintenance and gradual modernization of our extensive power networks.

These essential parts generate dependable cash flow, requiring relatively low investment for marketing and promotion. For instance, Hubbell's Electrical segment, which encompasses many of these components, saw robust performance, with revenues consistently contributing to the company's overall stability in the years leading up to and including 2024.

Hubbell's Industrial Control & Connectivity Solutions are its cash cows. These products, essential for various industrial operations, demonstrate consistent demand and profitability. For instance, in 2023, Hubbell reported that its Industrial segment, which includes these solutions, saw a net sales increase of 10.4% to $1.3 billion. This segment benefits from Hubbell's established market presence and the critical nature of its offerings, ensuring steady revenue streams and a commanding market share despite not being in a high-growth phase.

Long-standing Safety & Security Communication Systems

Hubbell's GAI-Tronics brand, a cornerstone in safety and security communication systems for over 70 years, exemplifies a classic Cash Cow within the BCG Matrix. This segment, focused on emergency phones and related equipment, operates in a mature but fundamentally critical market.

The enduring need for reliable emergency communication ensures a stable and predictable revenue stream for GAI-Tronics. Its long-established reputation for dependability and deep market penetration means demand remains consistent, requiring little incremental investment to maintain its position.

- Brand Strength: GAI-Tronics boasts over 70 years of experience in emergency communications.

- Market Position: Operates in a mature but essential market for safety and security.

- Cash Flow Generation: Provides consistent, reliable cash flow with minimal reinvestment needs.

- Low Growth, High Share: Characterized by low market growth but a dominant market share, typical of a Cash Cow.

Specialty Infrastructure Products for Stable Markets

Hubbell's Specialty Infrastructure Products, nestled within its Utility Solutions segment, represent classic cash cows. These are not the flashy, high-growth grid modernization components, but rather the reliable, established products that keep essential infrastructure running smoothly. Think of specialized connectors, protective enclosures, or durable underground systems. These items cater to mature markets where demand is steady, not explosive.

These products typically command a strong, often leading, market share in their specific niches. This dominance allows Hubbell to generate consistent and predictable cash flow. For example, in 2024, Hubbell reported that its Utility Solutions segment continued to be a significant contributor to overall revenue, with a substantial portion of this stemming from its established product lines. While specific figures for individual product categories aren't always broken out, the segment's overall stability underscores the cash-generating power of these mature offerings.

The beauty of these cash cows lies in their low need for reinvestment. Unlike growth-oriented products that require significant R&D and marketing to capture new market share, these specialty items are largely self-sustaining. Hubbell can therefore extract substantial cash from these businesses to fund other, more growth-oriented initiatives within the company or to return capital to shareholders. In 2024, the company's capital allocation strategy continued to emphasize balanced returns, partly enabled by the strong cash generation from its mature product portfolios.

- Dominant Niche Market Share: These products hold leading positions in their specific, well-defined infrastructure segments.

- Stable, Predictable Cash Flow: They provide consistent revenue streams due to steady demand in established markets.

- Low Reinvestment Needs: Unlike growth products, they require minimal capital for R&D or aggressive market expansion.

- Funding for Growth Initiatives: The strong cash generated supports investment in other areas of Hubbell's business.

Hubbell's established electrical construction products, including wiring devices and traditional lighting, are prime examples of cash cows. These mature offerings benefit from a strong brand reputation and a significant market share in the steady construction sector.

These products generate consistent, reliable cash flow with minimal need for further investment. For instance, Hubbell's Electrical segment, which includes these mature product lines, demonstrated resilient performance throughout 2023 and into 2024, contributing substantially to the company's overall financial stability and profitability.

The company's Industrial Control & Connectivity Solutions also function as cash cows. These critical industrial components enjoy consistent demand and high market penetration, ensuring predictable revenue streams and robust profitability for Hubbell. In 2023, Hubbell's Industrial segment saw a notable net sales increase, underscoring the strength of these established offerings.

| Product Category | BCG Status | Key Characteristics | 2023/2024 Relevance |

|---|---|---|---|

| Core Electrical Construction Products | Cash Cow | High Market Share, Mature Market, Stable Cash Flow | Significant contributor to Electrical segment revenue and profitability. |

| Utility Distribution Components | Cash Cow | Essential Infrastructure, Low Reinvestment Needs, Steady Demand | Underpinning of grid stability, consistent revenue for Utility Solutions segment. |

| Industrial Control & Connectivity | Cash Cow | Critical Industrial Need, Established Brand, High Profitability | Drove strong performance in Industrial segment, with notable sales growth. |

| Specialty Infrastructure Products | Cash Cow | Dominant Niche Share, Predictable Revenue, Low Growth Investment | Supported overall Utility Solutions segment stability and provided capital for growth. |

Delivered as Shown

Hubbell BCG Matrix

The Hubbell BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after completing your purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete, analysis-ready strategic tool designed for immediate business application.

Dogs

Hubbell's divestiture of its residential lighting business in 2024 clearly placed it in the Dogs category of the BCG matrix. This move signals the company's assessment of this segment as having low growth prospects and likely a minor market share within the broader lighting industry.

The strategic rationale behind this divestment was to sharpen Hubbell's focus on areas offering greater potential for expansion and profitability. By shedding non-core assets, the company aims to allocate resources more effectively towards its Stars and Cash Cows.

Legacy telecommunications products, those not focused on broadband or 5G, are likely experiencing a downturn. These older product lines, such as traditional copper-based network infrastructure, are seeing reduced investment as the industry shifts towards faster, more advanced technologies. Hubbell's strategic reallocation of resources indicates a move away from these less competitive segments.

In 2024, the telecommunications equipment market continued its strong emphasis on 5G deployment and fiber optic expansion. While specific segment data for legacy products is not always granularly reported, the overall trend shows a decline in demand for older copper infrastructure. Hubbell's reported strategic shifts in its portfolio reflect this market reality, with a greater focus on components supporting next-generation networks.

Within Hubbell's Grid Automation segment, certain sub-segments are showing signs of weakness, contributing to an overall organic sales decline of 15% in Q1 2025. This downturn is partly attributed to tough comparisons with the previous year's performance.

Specifically, product lines within Grid Automation that are lagging in technological adoption or failing to meet evolving market needs are likely experiencing low market share and stagnant growth. These underperforming areas require careful evaluation for potential divestiture or strategic repositioning.

Non-strategic Water and Gas Distribution Products

Hubbell has identified its water and gas distribution products as a segment experiencing lower growth. This suggests these businesses are likely in mature markets where Hubbell's market position might be modest or where the company is strategically reducing its capital allocation. These factors position them as potential candidates for divestiture within the BCG matrix framework.

For instance, in 2024, Hubbell's Utility Solutions segment, which houses these products, may reflect slower revenue expansion compared to other, more dynamic areas of the business. Companies often re-evaluate portfolios to focus on high-growth, high-market-share stars, leading to the potential divestment of cash cows or even question marks if they drain resources without significant future potential.

- Low Growth Market: Water and gas distribution infrastructure often operates in established, slower-growing markets.

- Strategic Re-evaluation: Hubbell may be assessing these businesses for their long-term strategic fit and potential return on investment.

- Divestment Potential: Businesses with limited growth prospects and market share can become candidates for sale to optimize the overall portfolio.

- Resource Allocation: Focusing investment on higher-growth areas is a common strategy for companies like Hubbell.

Outdated Industrial Electrical Products

Outdated industrial electrical products, those not adapted for modern efficiency or digital integration, are likely to see their market share shrink. These items often demand significant upkeep while offering minimal financial returns, fitting the profile of Dogs in the BCG Matrix.

For instance, older circuit breakers or transformers that don't support smart grid technology or advanced diagnostics would fall into this category. In 2024, the demand for energy-efficient industrial equipment is paramount, with many legacy products failing to meet these evolving standards.

- Declining Market Relevance: Products lacking smart features or energy efficiency updates struggle to compete.

- High Maintenance Costs: Older equipment often requires more frequent and costly repairs.

- Low Return on Investment: Despite maintenance expenses, these products generate diminishing revenue.

Hubbell's divestiture of its residential lighting business in 2024, along with the strategic de-emphasis on legacy telecommunications products and certain underperforming segments within Grid Automation, clearly places these areas in the Dogs category of the BCG matrix. These segments are characterized by low growth prospects and often a minor or declining market share, prompting a strategic reallocation of resources towards more promising business units.

The company's focus on divesting or deprioritizing these underperforming assets, such as older industrial electrical products that lack modern integration, aims to streamline operations and improve overall profitability. By shedding these low-return businesses, Hubbell can better concentrate its capital and management attention on its Stars and Cash Cows, ensuring more efficient resource allocation for future growth and market leadership.

For example, the 2024 divestiture of the residential lighting business, coupled with the reported 15% organic sales decline in Q1 2025 for certain Grid Automation sub-segments, highlights Hubbell's proactive approach to portfolio management. These moves are consistent with identifying and addressing business units that are no longer competitive or aligned with the company's long-term strategic objectives.

The water and gas distribution products, identified as experiencing lower growth in 2024, also fit the Dogs profile. Mature markets and potentially modest market positions for these offerings suggest they may be candidates for divestiture to optimize the company's overall strategic direction and financial performance.

| Business Segment | BCG Category | Key Indicators | Strategic Rationale |

|---|---|---|---|

| Residential Lighting | Dogs | Divested in 2024; Low growth prospects | Focus on higher-potential segments |

| Legacy Telecommunications Products | Dogs | Declining demand for copper infrastructure; Shift to 5G/fiber | Resource reallocation to advanced technologies |

| Underperforming Grid Automation Sub-segments | Dogs | 15% organic sales decline (Q1 2025); Lagging tech adoption | Potential divestiture or repositioning |

| Water and Gas Distribution Products | Dogs | Lower growth identified (2024); Mature markets | Potential divestment for portfolio optimization |

| Outdated Industrial Electrical Products | Dogs | Lack of smart features/efficiency; High maintenance costs | Shrinking market share; Low ROI |

Question Marks

Hubbell is strategically focusing on AI-driven infrastructure, particularly for the booming data center sector. This aligns with the high-growth potential of emerging technologies. For instance, the global data center market was valued at approximately $200 billion in 2023 and is projected to grow significantly, driven by AI and cloud computing demands.

While these represent promising opportunities, Hubbell's current market share in these highly specialized, nascent AI infrastructure applications may be modest. The company is likely in the early stages of establishing its presence and capturing market share in these cutting-edge segments, which are characterized by rapid innovation and evolving standards.

New niche renewable energy technologies, like advanced battery storage or specialized geothermal components, could be considered question marks for Hubbell. These areas offer significant growth potential, but Hubbell's current market share is likely small, necessitating substantial investment to build scale and market presence.

For instance, the global advanced battery market was projected to reach over $100 billion by 2024, indicating a substantial opportunity. Hubbell's investment in these emerging sectors, while potentially costly upfront, could position them for future market leadership in these high-growth segments.

Hubbell's advanced IoT-enabled devices for grid applications, potentially extending beyond Aclara's current portfolio, represent a strategic push into high-growth segments like smart metering and grid analytics. These next-generation solutions are designed for enhanced sensing, monitoring, and control, aiming to improve grid efficiency and reliability.

While these areas offer significant future potential, Hubbell's investment in these nascent technologies likely places them in the early adoption phase, demanding substantial capital expenditure to capture market share. For instance, the global smart grid market was valued at approximately $30 billion in 2023 and is projected to grow significantly, with IoT devices forming a critical component of this expansion.

Recently Launched Innovative Products in Electrical Solutions

Hubbell's Electrical Solutions segment is a dynamic area for innovation, with recent product launches focusing on smart grid technologies and advanced power distribution. For instance, the introduction of their new intelligent circuit breaker series in late 2023, designed for enhanced grid resilience and remote monitoring, represents a significant move into a high-growth market. While these products are engineered to meet future demands, their initial market penetration is naturally low, placing them in the Question Mark category of the BCG matrix.

These innovative solutions, such as the recently unveiled connected lighting controls offering advanced energy management capabilities, are positioned to capture emerging market opportunities. Despite their technological sophistication and potential for high future growth, their current market share is minimal. Hubbell is investing heavily in sales and marketing to drive adoption, a common strategy for Question Mark products aiming to transition into Stars.

- Smart Grid Technologies: New intelligent circuit breakers with remote monitoring capabilities.

- Energy Management: Connected lighting controls for advanced energy efficiency.

- Low Initial Market Share: Products are in early adoption phases, requiring significant market development.

- High Growth Potential: Targeting evolving market needs and technological advancements in electrical infrastructure.

Specialized Broadband/5G Infrastructure Components

Specialized Broadband/5G Infrastructure Components are likely positioned as question marks within Hubbell's BCG Matrix. The telecom sector's robust investment in 5G and fiber broadband, projected to see significant growth through 2024 and beyond, creates a high-potential market for these advanced network components.

These highly technical, new offerings cater to a rapidly expanding market, but as emerging products, they would initially possess a low market share. Hubbell's strategy here would involve significant investment to gain traction and establish a competitive foothold against established players in this evolving technological landscape.

- High Growth Market: The global 5G infrastructure market was valued at approximately $39.4 billion in 2023 and is expected to grow substantially, driven by increased demand for faster connectivity and new applications.

- Low Market Share: As a newer entrant with specialized components, Hubbell would be working to capture market share in a competitive environment, requiring focused sales and marketing efforts.

- Investment Required: Significant R&D and capital expenditure are necessary to develop and scale production of these advanced components, aligning with the characteristics of a question mark in the BCG framework.

Question Marks for Hubbell represent areas with high growth potential but currently low market share. These are often new product lines or emerging technologies where the company is investing to build future dominance. Success hinges on converting these into Stars through strategic investment and market penetration.

For example, Hubbell's focus on AI-driven infrastructure for data centers, while a high-growth area, likely places them in the early stages of market capture for these specialized components. Similarly, new niche renewable energy technologies and advanced IoT-enabled grid devices fall into this category.

These segments demand significant upfront investment in research, development, and market development. The goal is to capitalize on rapid market expansion and establish a strong competitive position before competitors solidify their hold.

Here's a look at some potential Question Mark areas for Hubbell:

| Category | Specific Product/Technology | Market Growth Potential | Hubbell's Current Market Share | Strategic Focus |

|---|---|---|---|---|

| Data Center Infrastructure | AI-specific cooling and power distribution components | Very High (driven by AI adoption) | Low to Moderate | Investment in R&D and targeted sales for high-density computing environments. |

| Renewable Energy | Advanced energy storage solutions for grid stabilization | High (driven by grid modernization and renewables integration) | Low | Partnerships and product development to address grid intermittency challenges. |

| Smart Grid & IoT | Next-generation grid analytics and predictive maintenance sensors | High (driven by grid efficiency and reliability demands) | Low | Integration with existing platforms and expansion of data services. |

| Broadband/5G Infrastructure | Specialized fiber optic components for 5G densification | High (driven by 5G rollout and increased data traffic) | Low to Moderate | Focus on high-performance, reliable components for demanding network conditions. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.