Tianshui Huatian Technology SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tianshui Huatian Technology Bundle

Tianshui Huatian Technology's SWOT analysis reveals a company with significant technological strengths and a strong market presence, but also highlights potential challenges in global competition and evolving industry standards. Understanding these dynamics is crucial for anyone looking to invest or strategize within the semiconductor sector.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Tianshui Huatian Technology Co., Ltd. stands as a dominant force in the semiconductor packaging and testing sector. This leading market position, evidenced by its significant market share in China, provides substantial advantages in brand recognition and customer loyalty. The company's established scale allows for efficient operations, contributing to its competitive pricing and service capabilities within the global semiconductor supply chain.

Tianshui Huatian Technology's strength lies in its extensive service portfolio, encompassing integrated circuit packaging, testing, and assembly. This end-to-end capability provides clients with a holistic solution, simplifying their supply chains by minimizing the need for multiple service providers.

This broad spectrum of services not only diversifies Huatian Technology's revenue streams but also positions it as a highly desirable partner for semiconductor manufacturers seeking integrated solutions. For instance, in 2023, the company reported significant growth in its packaging and testing segment, contributing to its overall revenue of approximately $1.2 billion.

Tianshui Huatian Technology's strength lies in its deep specialization in advanced packaging solutions. This focus places them at the cutting edge of semiconductor innovation, meeting the growing need for integrated circuits that are more powerful, smaller, and energy-efficient. Their mastery of these sophisticated techniques is crucial for staying competitive and achieving sustained growth in a rapidly changing technological landscape.

Diverse Application Sectors

Tianshui Huatian Technology's strength lies in its broad reach across diverse application sectors. The company's products are integral to consumer electronics, automotive systems, industrial machinery, and communication networks. This wide-ranging market presence, as evidenced by its 2024 revenue streams across these segments, significantly lowers its dependence on any single industry.

This diversification is a key risk mitigator, shielding the company from the volatility inherent in any one market. For instance, while the consumer electronics sector might experience seasonal fluctuations, demand from the automotive or industrial sectors can provide a stabilizing influence. This broad customer base also opens avenues for synergistic growth, allowing Huatian Technology to capitalize on evolving technological demands across different industries.

Key sectors served by Tianshui Huatian Technology include:

- Consumer Electronics: Supplying components for smartphones, tablets, and other personal devices.

- Automotive: Providing solutions for in-car entertainment, advanced driver-assistance systems (ADAS), and electric vehicle components.

- Industrial: Offering specialized components for automation, control systems, and manufacturing equipment.

- Communication: Delivering essential parts for telecommunications infrastructure and networking equipment.

Commitment to Innovation and Quality

Tianshui Huatian Technology's unwavering commitment to innovation and quality is a significant strength. The company actively invests in research and development to pioneer new packaging technologies, ensuring its semiconductor products remain at the forefront of the industry. This focus on continuous improvement and stringent quality control not only enhances their technological capabilities but also solidifies their reputation for reliability among clients.

Their dedication translates into tangible benefits:

- Enhanced Technological Edge: By prioritizing R&D, Huatian Technology stays ahead of market trends and develops cutting-edge solutions.

- Reputation for Reliability: Consistent high-quality output builds trust and strengthens customer loyalty in a competitive landscape.

- Client Attraction and Retention: Innovative products and dependable quality are key differentiators that attract new business and retain existing clients, crucial for growth in the demanding semiconductor sector.

Tianshui Huatian Technology's market leadership in China's semiconductor packaging and testing sector is a core strength, bolstered by significant brand recognition and customer loyalty. Its operational scale enables cost efficiencies, allowing for competitive pricing and robust service delivery within the global supply chain. The company's comprehensive service offering, from integrated circuit packaging to testing and assembly, provides clients with a streamlined, end-to-end solution.

The company's specialization in advanced packaging technologies positions it at the forefront of semiconductor innovation, catering to the demand for more powerful, compact, and energy-efficient integrated circuits. This expertise is vital for maintaining competitiveness and driving growth in a dynamic technological environment. Huatian Technology's broad market reach across consumer electronics, automotive, industrial, and communication sectors diversifies its revenue streams, mitigating risks associated with reliance on any single industry.

| Metric | 2023 Value (Approx.) | Significance |

|---|---|---|

| Total Revenue | $1.2 billion | Demonstrates strong market presence and sales capabilities. |

| Market Share (China Packaging & Testing) | Leading | Indicates significant competitive advantage and brand strength. |

| R&D Investment | Significant | Underpins technological leadership and product innovation. |

What is included in the product

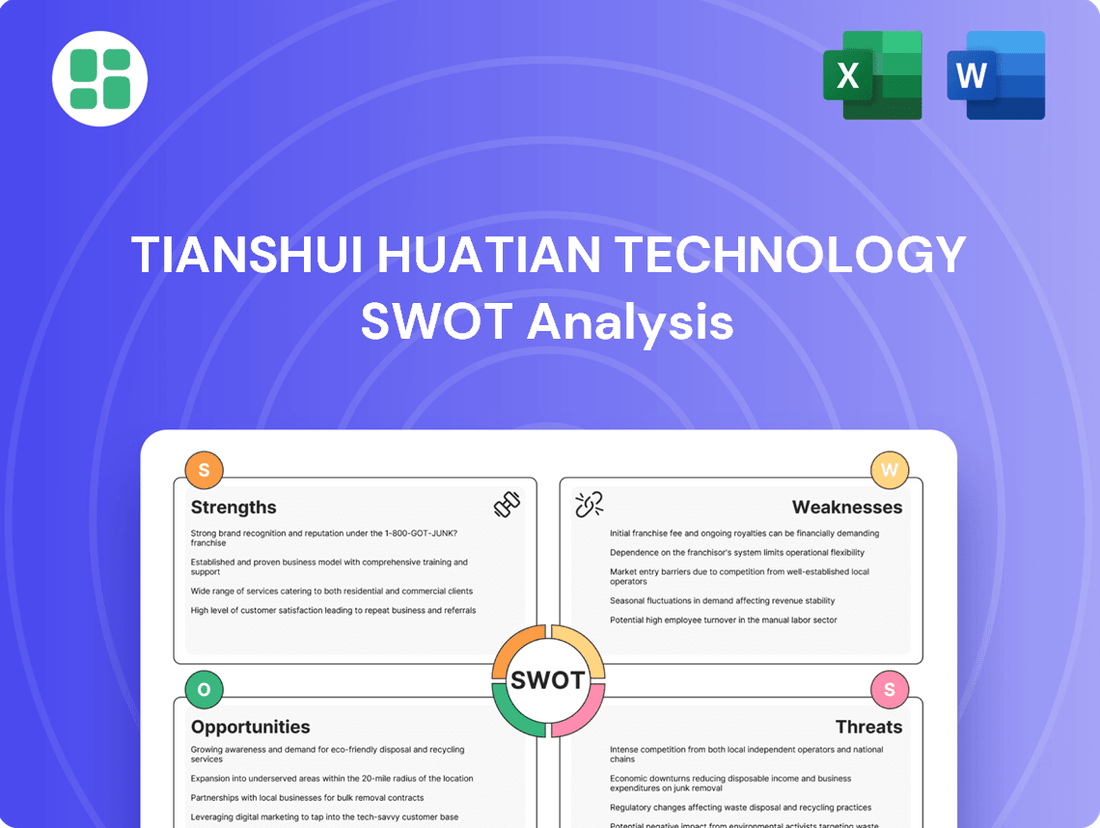

Delivers a strategic overview of Tianshui Huatian Technology’s internal and external business factors, mapping its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Tianshui Huatian Technology's strategic challenges, turning potential weaknesses into opportunities.

Weaknesses

The semiconductor packaging and testing sector, where Tianshui Huatian Technology operates, is inherently capital-intensive. This means substantial upfront investment is needed for cutting-edge manufacturing equipment, ongoing research and development, and continuous facility modernization. For instance, advanced packaging technologies often require specialized machinery that can cost millions of dollars per unit.

These high capital expenditure requirements can place a significant strain on a company's financial resources. It often necessitates consistent access to external financing, which can limit the company's agility in pursuing other strategic opportunities or weathering economic downturns. In 2023, Tianshui Huatian Technology reported capital expenditures of approximately 2.2 billion RMB, highlighting the scale of investment required.

Maintaining a competitive position in this dynamic industry demands perpetual reinvestment in technology and capacity. This constant need to upgrade and expand can directly impact short-term profitability as resources are channeled into future growth rather than immediate returns. The pressure to stay ahead technologically means that a substantial portion of earnings must be plowed back into the business.

Tianshui Huatian Technology faces fierce global competition, a significant weakness. The semiconductor packaging and testing industry is crowded with both established giants and agile newcomers, creating constant pressure. For instance, in 2023, the global semiconductor market saw intense price competition, impacting profitability across the sector, with companies like ASE Technology Holding and Amkor Technology being major rivals.

Tianshui Huatian Technology's reliance on global supply chains presents a significant weakness. The company sources critical raw materials and specialized components from international suppliers, making it susceptible to disruptions. For instance, in 2023, global semiconductor shortages, partly driven by geopolitical factors, impacted production schedules across various electronics manufacturers, a scenario Huatian Technology could face.

Technological Obsolescence Risk

The semiconductor sector is characterized by breakneck technological evolution, creating a significant risk of obsolescence for Tianshui Huatian Technology's current packaging and testing methodologies. Companies that don't rapidly embrace new advancements risk falling behind. For instance, the transition to advanced packaging techniques like 2.5D and 3D integration, driven by demands for higher performance and miniaturization, requires constant adaptation.

Failure to invest consistently in research and development to keep pace with these shifts could make existing solutions uncompetitive. The industry saw significant R&D spending from major players in 2024, with TSMC investing an estimated $30 billion and Intel around $25 billion, highlighting the scale of investment needed to stay relevant.

This necessitates substantial and continuous capital allocation towards R&D to maintain a competitive edge. Without this, Tianshui Huatian Technology's offerings could quickly become outdated, impacting its market position.

Key considerations include:

- Rapid technological advancements: The semiconductor industry's pace of innovation poses a constant threat of obsolescence.

- Need for continuous innovation: Stagnation in adopting new packaging and testing technologies can quickly render current solutions irrelevant.

- Significant R&D investment: Maintaining competitiveness requires substantial and ongoing financial commitment to research and development.

- Impact of advanced packaging: The industry's move towards 2.5D and 3D packaging demands proactive adoption of these new techniques.

Potential for Profit Margin Pressure

Tianshui Huatian Technology, operating in a highly competitive landscape, may experience pressure to reduce its service fees from major integrated device manufacturers (IDMs) and fabless companies. This dynamic can squeeze profit margins, even with the substantial investments required for cutting-edge technology and stringent quality control.

For instance, in the semiconductor packaging and testing sector, where Tianshui Huatian Technology is active, pricing power is often influenced by the volume commitments and negotiation leverage of larger clients. This can create a challenging environment for maintaining healthy profitability.

- Price Competition: Intense competition from both domestic and international players in the outsourced semiconductor assembly and test (OSAT) market can force price reductions.

- Customer Concentration: Reliance on a few large customers could give them significant bargaining power, leading to downward pressure on service fees.

- Rising Operational Costs: Increasing costs for advanced materials, skilled labor, and sophisticated equipment, coupled with the need for continuous R&D, can further strain profit margins.

The capital-intensive nature of semiconductor packaging and testing necessitates significant and ongoing investment in advanced equipment and R&D, potentially straining financial resources and limiting agility. For example, Tianshui Huatian Technology's capital expenditures were approximately 2.2 billion RMB in 2023, illustrating the scale of these demands.

Intense global competition and the rapid pace of technological evolution pose a threat of obsolescence. Companies like ASE Technology Holding and Amkor Technology are major rivals, and failing to invest in R&D, which saw major players like TSMC and Intel spending billions in 2024, can lead to uncompetitive offerings.

Reliance on global supply chains exposes the company to disruptions, as seen with the semiconductor shortages in 2023 that impacted production schedules across the industry. Furthermore, pressure from large clients can lead to reduced service fees, squeezing profit margins amidst rising operational costs for materials, labor, and equipment.

Full Version Awaits

Tianshui Huatian Technology SWOT Analysis

This is the actual Tianshui Huatian Technology SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt of the comprehensive report, offering a clear view of the insights contained within.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete strategic understanding of Tianshui Huatian Technology's market position.

Opportunities

The relentless advancement of technologies like AI, IoT, 5G, and electric vehicles is dramatically escalating the global need for semiconductors. This trend presents a prime opportunity for Tianshui Huatian Technology to boost its output and reach a wider array of rapidly expanding industries.

The semiconductor market is projected for robust growth, with global revenues expected to reach $700 billion by 2025, up from approximately $600 billion in 2024, according to industry forecasts. This expanding market size directly translates into increased potential for Tianshui Huatian Technology to capture greater market share.

The semiconductor industry's shift towards sophisticated packaging like heterogeneous integration and chiplets presents a significant opportunity for Tianshui Huatian Technology. These advanced methods allow for the integration of multiple smaller chips, boosting performance and functionality. This trend is accelerating, with the advanced packaging market projected to reach $100 billion by 2025, a substantial increase from previous years.

Tianshui Huatian Technology's existing expertise in advanced packaging directly aligns with these industry demands. By continuing to invest in and refine these cutting-edge solutions, the company can solidify its competitive edge. This strategic focus is crucial for capturing a larger share of this expanding market and driving future revenue growth.

Tianshui Huatian Technology, a significant player in China's semiconductor industry, has a clear opportunity to broaden its reach by entering new geographic markets. This could involve targeting regions with burgeoning electronics manufacturing sectors or those actively developing their own semiconductor supply chains, potentially in Southeast Asia or other developing economies.

Strategic international expansion offers a dual benefit of diversifying Tianshui Huatian's revenue streams and mitigating risks associated with over-reliance on any single domestic market. For instance, by establishing a presence in markets like India, which aims to boost its domestic electronics production, the company could tap into a substantial new customer base and secure future growth.

Strategic Partnerships and Acquisitions

Tianshui Huatian Technology can explore strategic partnerships and acquisitions to bolster its market position. For instance, acquiring a company with advanced semiconductor manufacturing techniques could significantly upgrade its production capabilities.

Such moves can accelerate the integration of cutting-edge technologies, potentially leading to a more diversified product line and increased competitiveness. In 2024, the global semiconductor M&A market saw significant activity, with deal values reaching billions, indicating a strong appetite for consolidation and technological advancement within the industry.

Opportunities include:

- Acquiring startups with novel materials science expertise.

- Forming alliances with AI chip design firms to integrate advanced processing capabilities.

- Purchasing smaller competitors to gain market share in specific geographic regions or product categories.

Government Support for Domestic Semiconductor Industry

Governments worldwide, with a strong emphasis on China, are channeling significant resources into bolstering domestic semiconductor manufacturing to ensure technological sovereignty. This presents a substantial opportunity for Tianshui Huatian Technology, as a prominent player within China's semiconductor ecosystem.

These initiatives often translate into tangible benefits for companies like Huatian Technology, including direct subsidies, preferential tax treatments, and access to government-backed research and development funding. For instance, China's national integrated circuit industry investment fund, often referred to as the "Big Fund," has been a major driver of growth, with its Phase II fund alone reportedly reaching over $20 billion, aiming to boost advanced manufacturing capabilities. Such support can significantly lower operational and R&D expenditures, paving the way for accelerated growth and innovation.

- Favorable Policy Environment: Expect continued government backing through policies aimed at increasing domestic chip production and reducing reliance on foreign suppliers.

- Increased R&D Investment: Access to government grants and subsidies can fuel innovation and the development of next-generation semiconductor technologies.

- Market Access and Expansion: Government support can also facilitate market penetration and expansion within China and potentially in allied regions.

The increasing demand for semiconductors driven by AI, IoT, 5G, and EVs offers Tianshui Huatian Technology a significant growth avenue. The global semiconductor market is projected to reach $700 billion by 2025, presenting a substantial opportunity for market share expansion.

Advancements in semiconductor packaging, such as heterogeneous integration, are creating new opportunities, with this market expected to hit $100 billion by 2025. Huatian Technology's expertise in this area positions it well to capitalize on this trend.

Geographic expansion into emerging markets like Southeast Asia could diversify revenue streams and mitigate domestic market risks. Strategic partnerships and acquisitions in 2024, which saw billions invested in semiconductor M&A, could also enhance capabilities and market reach.

Government support, particularly in China, through initiatives like the "Big Fund" (Phase II reportedly over $20 billion), provides financial backing and R&D opportunities, lowering costs and fostering innovation.

| Opportunity Area | Market Projection | Huatian Technology Alignment |

|---|---|---|

| Semiconductor Demand Growth | $700 billion by 2025 | Leverage existing production for AI, IoT, EV sectors |

| Advanced Packaging Market | $100 billion by 2025 | Utilize expertise in heterogeneous integration and chiplets |

| International Market Entry | Growing electronics manufacturing in SE Asia | Diversify revenue, reduce single-market reliance |

| Government Support & R&D | China's "Big Fund" Phase II >$20 billion | Access subsidies, preferential tax, R&D funding |

Threats

Ongoing geopolitical tensions, particularly between major global powers, can lead to trade restrictions, tariffs, and export controls on semiconductor technology and equipment. For instance, in 2023, the US implemented new restrictions on semiconductor exports to China, impacting companies reliant on that market. These measures could disrupt Tianshui Huatian Technology's access to critical components or limit its market reach, severely impacting its operations and profitability. Navigating these complexities is a significant challenge as supply chains become increasingly politicized.

Global economic downturns, such as the projected slowdown in major economies during 2024-2025, can severely dampen consumer and industrial spending on electronics. This directly translates to reduced demand for semiconductor packaging and testing services, a core business for Tianshui Huatian Technology.

Market volatility, characterized by unpredictable economic cycles, poses a significant threat by causing fluctuations in order volumes. For instance, a sharp economic contraction could lead to a substantial drop in orders, impacting revenue predictability and complicating strategic financial planning for Huatian Technology.

The semiconductor sector, including companies like Tianshui Huatian Technology, is experiencing heightened regulatory oversight. This scrutiny covers areas such as environmental impact, fair labor standards, and the safeguarding of sensitive data. For instance, in 2024, several regions intensified their focus on e-waste recycling within the electronics manufacturing supply chain, potentially impacting production costs.

New or more stringent regulations can translate into increased operational expenses. Companies may need to invest substantially in compliance systems and processes to meet these evolving standards. Failure to adapt could result in financial penalties or operational disruptions, underscoring the importance of proactive regulatory engagement.

Talent Shortages and Retention Challenges

The semiconductor industry, particularly in specialized areas like advanced packaging and testing, faces a significant threat from talent shortages. Tianshui Huatian Technology, like its peers, relies on a highly skilled workforce of engineers and technicians. A global scarcity of these specialized professionals can drive up labor costs and complicate recruitment efforts.

These talent deficits can directly impact operational efficiency and the pace of innovation. For instance, a report from the Semiconductor Industry Association (SIA) in late 2023 highlighted a projected need for tens of thousands of new semiconductor professionals in the coming years, underscoring the intensity of this challenge. This shortage makes it harder for companies like Huatian Technology to scale operations and maintain a competitive edge.

- Skilled Workforce Dependency: Semiconductor packaging and testing demand specialized engineering and technical expertise, making talent a critical resource.

- Global Talent Scarcity: A worldwide shortage of these skilled professionals increases competition for talent, potentially raising Huatian Technology's labor costs.

- Recruitment and Retention Hurdles: Attracting and keeping key personnel in a tight labor market presents ongoing challenges that can impact operational stability and innovation.

Intellectual Property Infringement Risks

Tianshui Huatian Technology operates in a highly competitive, technology-driven sector, making intellectual property (IP) infringement a significant threat. Competitors may attempt to copy or utilize their proprietary packaging technologies and unique designs without authorization.

Protecting its intellectual assets is paramount for Tianshui Huatian Technology. The company must remain vigilant against potential infringements that could undermine its competitive edge and market position.

Engaging in legal disputes over IP can be financially draining and divert essential resources away from core business activities like research and development. For instance, in 2023, the global semiconductor industry saw a notable increase in IP litigation, with average legal costs often running into millions of dollars, impacting profitability and strategic focus.

- Risk of Unauthorized Use: Competitors may seek to replicate Tianshui Huatian Technology's advanced packaging solutions.

- Costly Litigation: Legal battles over IP infringement can deplete financial reserves and management attention.

- Market Share Erosion: Unchecked infringement can lead to a loss of market share and diminished brand value.

Geopolitical tensions and trade restrictions, like those seen in 2023 impacting semiconductor exports, pose a direct threat to Tianshui Huatian Technology's supply chain and market access. Economic downturns projected for 2024-2025 could also significantly reduce demand for its services. Furthermore, the industry faces increasing regulatory scrutiny, with intensified focus on environmental compliance in 2024, potentially increasing operational costs.

SWOT Analysis Data Sources

This analysis draws upon a robust foundation of data, including Tianshui Huatian Technology's official financial reports, comprehensive market research, and insights from industry experts to provide a thorough strategic evaluation.