Tianshui Huatian Technology PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tianshui Huatian Technology Bundle

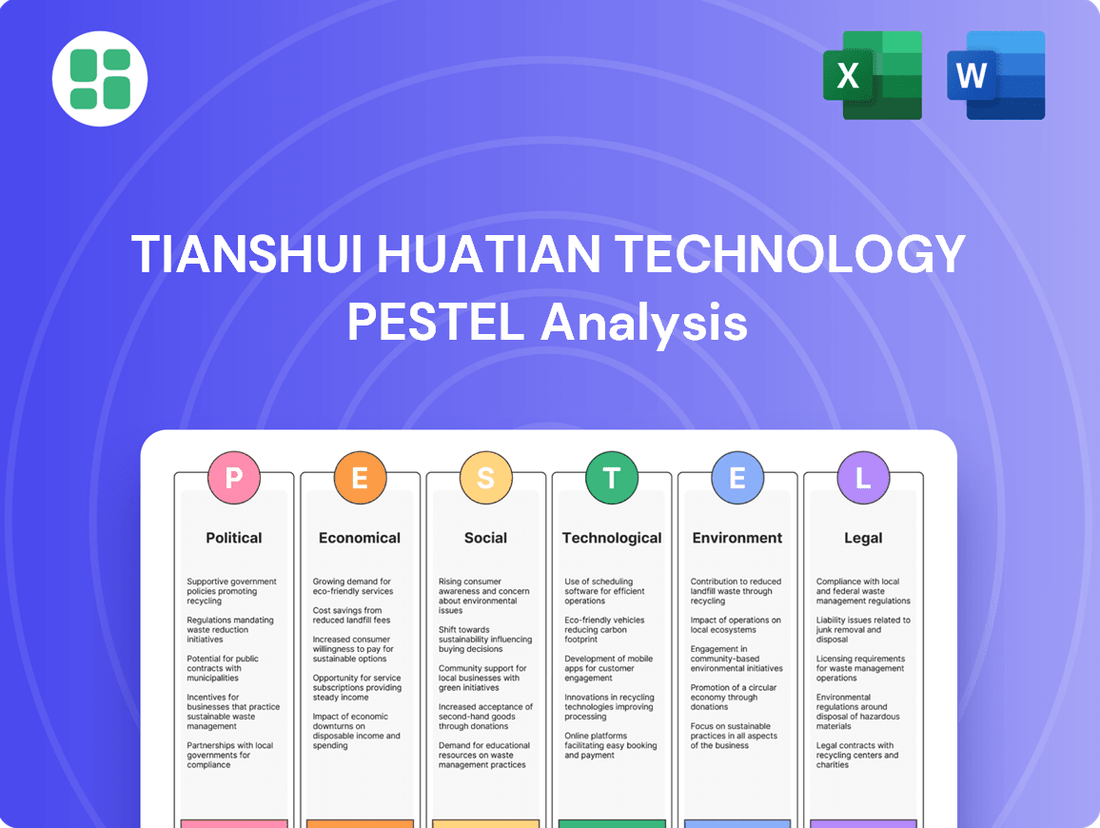

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Tianshui Huatian Technology's trajectory. Our PESTLE analysis provides a comprehensive overview of these external forces, empowering you to anticipate challenges and capitalize on emerging opportunities. Gain a competitive advantage by understanding the full market landscape. Download the complete PESTLE analysis now for actionable intelligence.

Political factors

The ongoing US-China trade and technology disputes are a major political factor affecting Tianshui Huatian Technology. These tensions, particularly concerning semiconductors, can lead to export controls that hinder access to advanced manufacturing equipment and designs. For instance, US restrictions on certain advanced semiconductor technologies, which have been evolving throughout 2024, directly challenge Chinese firms aiming for self-sufficiency.

These geopolitical realities compel companies like Tianshui Huatian to prioritize indigenous innovation and bolster their domestic supply chains. Building resilience against potential external disruptions is paramount, especially as the global semiconductor landscape remains influenced by these political dynamics. This strategic shift is crucial for long-term growth and stability.

The Chinese government's commitment to semiconductor self-sufficiency is a significant political factor. Initiatives like the 'Made in China 2025' strategy and the substantial capital injections into the National Integrated Circuit Industry Investment Fund (Big Fund 3.0) are driving this agenda.

These policies translate into tangible benefits for domestic companies like Tianshui Huatian, including generous state funding, tax incentives, and preferential loan terms. For instance, the Big Fund 3.0, launched in 2024, reportedly aims to raise over $20 billion, signaling continued robust government backing for the sector.

This robust industrial policy directly supports Tianshui Huatian's growth by reducing operational costs and fostering innovation. The ultimate goal is to lessen China's dependence on foreign semiconductor technology, positioning domestic firms to lead in this critical industry.

China's semiconductor policy is increasingly favoring consolidation through mergers and acquisitions (M&A) rather than initial public offerings (IPOs). This strategic pivot aims to build stronger domestic champions by pooling resources and expertise. For instance, the National Integrated Circuit Industry Investment Fund, a key driver of the sector, has been observed to be more selective with its investments, potentially favoring M&A opportunities that promise greater synergy and technological advancement.

This industry-wide consolidation trend presents Tianshui Huatian Technology with a landscape ripe for strategic partnerships or even acquisitions. By integrating with or acquiring other entities, Tianshui Huatian could accelerate its technological development and market reach, aligning with the national objective of creating a more competitive and self-sufficient domestic semiconductor ecosystem.

National Security and Strategic Importance

Semiconductors are undeniably critical for national security, prompting heightened government oversight and intervention within the industry. This strategic importance directly impacts companies like Tianshui Huatian. The Chinese government's commitment to advancing its technological capabilities, with semiconductors at the forefront, signals a clear national priority. This focus can translate into advantages such as preferential treatment, but it also means increased scrutiny and potential pressure to align operations with national strategic objectives.

The drive for technological self-sufficiency in China, particularly in chip manufacturing, is a significant political factor. For instance, China's "Made in China 2025" initiative, though facing international pressure, highlights the long-term vision to dominate key high-tech sectors, including semiconductors. This national ambition directly benefits domestic players like Tianshui Huatian, potentially through subsidies and favorable policies. In 2023, China's investment in its domestic semiconductor industry reached significant levels, aiming to reduce reliance on foreign suppliers amidst geopolitical tensions.

- National Security Imperative: Semiconductors are classified as dual-use technologies, essential for advanced defense systems, cyber security, and critical infrastructure, making their domestic production a strategic imperative for nations like China.

- Government Support and Scrutiny: The Chinese government's substantial financial backing for its semiconductor sector, evidenced by billions invested annually, provides a strong tailwind for companies like Tianshui Huatian, but also subjects them to rigorous performance and strategic alignment reviews.

- Geopolitical Influence: International trade restrictions and export controls on advanced semiconductor technology, particularly from the United States and its allies, underscore the political landscape that Tianshui Huatian must navigate, influencing its access to global markets and advanced manufacturing equipment.

Trade Relations with Other Regions

While US restrictions on certain technology exports are a notable concern, Tianshui Huatian Technology's direct export revenue to regions like the European Union was relatively modest in recent reporting periods, indicating a lower immediate exposure to potential tariff hikes in those specific markets. For instance, in 2023, the EU accounted for a small single-digit percentage of their total international sales. This suggests that while global trade dynamics are crucial, the immediate impact of trade policies in non-US markets might be less pronounced.

Nonetheless, maintaining strong and stable trade relations across various global regions remains a key factor for Tianshui Huatian's long-term international business strategy. The company's ability to secure favorable trade agreements and ensure market access in diverse economic blocs directly influences its overall global competitiveness and growth potential.

Navigating the complexities of international trade landscapes, including varying regulatory environments and geopolitical shifts, is paramount. For example, in 2024, the company actively sought to diversify its supply chain and customer base, aiming to mitigate risks associated with concentrated trade dependencies.

The company's global competitiveness is therefore intrinsically linked to its adaptive capacity in managing these intricate international trade relationships. This includes monitoring trade policies and actively engaging in dialogues to foster a more predictable and supportive global trading environment.

The Chinese government's strategic push for semiconductor self-sufficiency, backed by significant state funding, directly benefits Tianshui Huatian. Initiatives like the National Integrated Circuit Industry Investment Fund, with its 2024 capital injections, provide substantial financial and policy support, fostering domestic innovation and reducing reliance on foreign technology. This national agenda aims to create robust domestic champions, positioning companies like Tianshui Huatian for accelerated growth and technological advancement within a protected ecosystem.

Geopolitical tensions, particularly US-China trade disputes impacting advanced semiconductor technology, necessitate a focus on indigenous innovation and resilient domestic supply chains for Tianshui Huatian. While export revenue to regions like the EU was modest in 2023, the company's global strategy hinges on adapting to evolving international trade policies and diversifying its market access.

The critical role of semiconductors in national security drives increased government oversight and intervention, aligning company operations with national strategic objectives. This heightened focus, while offering potential advantages like preferential treatment, also means greater scrutiny for firms like Tianshui Huatian.

China's semiconductor policy increasingly favors consolidation, potentially through M&A, to build stronger domestic players. This trend presents Tianshui Huatian with opportunities for strategic partnerships or acquisitions to enhance technological capabilities and market reach, aligning with national goals for a self-sufficient semiconductor industry.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Tianshui Huatian Technology, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid in strategic decision-making and identifying market opportunities.

This PESTLE analysis for Tianshui Huatian Technology offers a clear, summarized version of complex external factors, acting as a pain point reliever by simplifying market understanding for strategic decision-making.

Economic factors

The global semiconductor packaging and testing market is booming, fueled by the insatiable demand for sophisticated technologies such as 5G, artificial intelligence, and the Internet of Things. This expansion is a significant tailwind for Tianshui Huatian Technology, as it directly correlates with the need for their core services.

Projections indicate the market will reach substantial figures, with some analyses suggesting it could approach $100 billion by 2027, highlighting a strong and sustained demand for semiconductor manufacturing support. This robust market environment offers Tianshui Huatian a fertile ground for continued growth and strategic development.

China's economic growth, projected to be around 5% in 2024 and potentially similar in 2025, fuels a robust demand for skilled tech talent and the adoption of advanced technologies, especially in sectors like artificial intelligence and sophisticated manufacturing. This expansion directly translates into increased opportunities for companies like Tianshui Huatian.

The domestic Chinese market is a critical engine for the semiconductor industry, bolstered by significant government backing that is accelerating the expansion of IT services. In 2023, China's IT services market reached an estimated $240 billion, a figure expected to grow, providing a substantial customer base for Tianshui Huatian's offerings.

Tianshui Huatian is well-positioned to capitalize on this strong internal market demand, as the government's focus on technological self-sufficiency and the burgeoning domestic consumption of advanced electronics create a favorable environment for its growth and market penetration.

China's semiconductor industry is navigating a complex landscape. Despite anticipated market growth, the sector faces a potential slowdown in 2025, largely due to existing wafer fab overcapacity. This situation is exacerbated by ongoing US export controls, which are projected to curb semiconductor equipment spending. For instance, industry analysts forecast a significant drop in capital expenditures by Chinese chipmakers in 2025 compared to previous years.

This overcapacity creates a challenging environment for companies involved in semiconductor packaging and testing, such as Tianshui Huatian Technology. The increased supply of chips could lead to downward pressure on prices and thinner profit margins. To counter this, Tianshui Huatian will likely need to focus on operational efficiencies and explore avenues for cost optimization to maintain its competitive edge in the market.

Investment and Funding Landscape

The Chinese government's commitment to its semiconductor sector is evident through initiatives like the National Integrated Circuit Industry Investment Fund, Phase III (Big Fund 3.0), launched in 2024 with a reported capital of 344 billion yuan. This significant investment underscores a strategic push for domestic technological advancement and supply chain security. Tianshui Huatian Technology has directly benefited from such policies, receiving substantial government subsidies that have historically supported its capital expenditures and research and development activities, crucial for staying competitive in the rapidly evolving semiconductor market.

While government backing remains a cornerstone, the evolving investment landscape presents new dynamics. A notable trend observed in 2024 and projected into 2025 is the increasing preference for mergers and acquisitions (M&A) as a primary route for company growth and consolidation, potentially overshadowing traditional initial public offerings (IPOs) for some firms. This strategic shift could influence how companies like Tianshui Huatian access capital for expansion and technological upgrades.

- Government Support: China's Big Fund 3.0, launched in 2024 with 344 billion yuan, highlights continued state investment in semiconductors.

- Subsidies for Huatian: Tianshui Huatian Technology has historically received significant government subsidies, bolstering its R&D and capital expenditure.

- M&A Trend: The increasing emphasis on mergers and acquisitions over IPOs in 2024-2025 may reshape fundraising and expansion strategies for tech firms.

Consumer Electronics Demand

Consumer electronics, encompassing everything from the latest smartphones and tablets to smartwatches and other wearables, are a major force behind the need for semiconductor packaging and testing equipment. Tianshui Huatian's business is directly linked to the ups and downs of demand and the pace of new product introductions in this dynamic consumer space.

The industry saw significant growth, with global consumer electronics sales projected to reach approximately $1.1 trillion in 2024, according to Statista. This robust market directly fuels demand for the advanced packaging solutions Tianshui Huatian provides.

Furthermore, the relentless drive for smaller, more powerful devices in consumer electronics necessitates sophisticated packaging techniques. This trend is a key factor supporting Tianshui Huatian's focus on advanced packaging technologies.

- Smartphones: Global smartphone shipments are expected to reach around 1.17 billion units in 2024, driving demand for advanced mobile chip packaging.

- Wearables: The wearable device market is projected to grow, with shipments expected to exceed 100 million units in 2024, requiring specialized packaging for miniaturized components.

- Tablets: While mature, the tablet market continues to represent a steady demand for semiconductor packaging, with shipments anticipated to remain stable.

China's economic trajectory, with growth anticipated around 5% for 2024 and potentially continuing into 2025, directly stimulates demand for advanced technologies and skilled labor within the semiconductor sector. This robust domestic economic activity creates a favorable environment for companies like Tianshui Huatian, aligning with national goals for technological self-sufficiency.

The semiconductor industry in China, while experiencing growth, faces headwinds from wafer fab overcapacity and US export controls impacting equipment spending, potentially leading to price pressures. Tianshui Huatian must therefore prioritize operational efficiency and cost management to maintain its competitive edge amidst these macroeconomic shifts.

Government initiatives, such as the 2024 launch of China's Big Fund 3.0 with 344 billion yuan, underscore a sustained commitment to domestic semiconductor advancement. Tianshui Huatian has historically benefited from such state support, receiving subsidies that are vital for its research and development and capital expenditure, crucial for staying ahead in this dynamic market.

Preview Before You Purchase

Tianshui Huatian Technology PESTLE Analysis

The preview you see here is the exact Tianshui Huatian Technology PESTLE Analysis document you’ll receive after purchase. It's fully formatted and ready to use, providing a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company.

Sociological factors

China's booming tech industries, particularly in areas like artificial intelligence and advanced manufacturing, are experiencing a critical shortage of skilled workers. Projections indicate a deficit of millions of qualified professionals by 2025, creating a significant hurdle for companies like Tianshui Huatian in securing the specialized engineers and technicians needed for their high-tech packaging and testing services.

To navigate this talent crunch, Tianshui Huatian must prioritize offering attractive compensation packages and robust continuous learning programs. These initiatives are crucial for not only attracting top-tier talent but also for ensuring their retention within the competitive landscape.

Consumers increasingly desire smaller, more powerful, and energy-saving electronic gadgets. This trend directly fuels the demand for sophisticated semiconductor packaging that enables these advancements. For Tianshui Huatian, this means their expertise in advanced packaging is crucial, necessitating ongoing innovation to keep pace with shrinking device sizes and added features.

The market's expectation for portability and rapid performance significantly influences how semiconductor packaging is designed. For example, the global smartphone market, a key consumer of these technologies, saw shipments reach approximately 1.17 billion units in 2023, with a continued focus on sleeker designs and faster processors, directly impacting packaging requirements.

Government initiatives are actively pushing IT infrastructure and investment into secondary cities, not just major hubs. This strategic shift, evident in China's 14th Five-Year Plan (2021-2025) which emphasizes balanced regional development, could reshape labor migration patterns. For Tianshui Huatian, this means a potential decentralization of talent, impacting where they might locate future facilities and how they recruit skilled workers.

This focus on regional development is creating new talent pools outside of traditional tech centers. For instance, by 2024, China aims to have over 80% of its population living in urban areas, a trend that will naturally spread skilled labor across more regions. This presents Tianshui Huatian with opportunities to tap into emerging tech hubs and diversify its workforce sourcing strategies.

Workforce Adaptation to Automation and AI

Chinese workers are showing a growing belief that uniquely human skills, such as strategic thinking and interpersonal relationship building, will become even more valuable as automation and AI become more prevalent. This sentiment points to a societal readiness to embrace technological advancements in the workplace, suggesting a positive outlook on the integration of AI and robotics within industries like semiconductor manufacturing.

This societal shift underscores a critical need for robust reskilling and upskilling initiatives. Tianshui Huatian Technology, to effectively harness the benefits of automation, must proactively invest in comprehensive workforce training programs. Such programs will equip employees with the necessary competencies to thrive in roles that are augmented by AI and robotics, ensuring the company remains competitive.

- Workforce Confidence: A significant portion of the Chinese workforce anticipates an increased demand for human-centric skills in an automated future.

- Upskilling Imperative: The semiconductor sector, including companies like Tianshui Huatian, faces a clear mandate to invest in training to adapt to AI and robotics integration.

- Strategic Investment: Tianshui Huatian's success hinges on its commitment to developing its workforce's capabilities to leverage new technologies effectively.

Education and Skill Development Initiatives

China's commitment to boosting its technological workforce is evident in its national strategies. The latest Five-Year Plan, for instance, emphasizes significant government funding for reskilling and upskilling initiatives, particularly targeting the technology sector. This focus is designed to bridge existing skills gaps and cultivate a robust talent pool for industries like semiconductors.

These educational and vocational training programs are vital for providing a consistent supply of qualified professionals needed by companies such as Tianshui Huatian Technology. By aligning with these national objectives, Tianshui Huatian can proactively build its future workforce.

To capitalize on this, Tianshui Huatian can forge strategic partnerships with universities and vocational training centers. Such collaborations can help tailor educational curricula to industry needs, creating direct talent pipelines.

- Government investment in reskilling and upskilling programs is a key component of China's national development strategy, aiming to enhance the technological capabilities of its workforce.

- The semiconductor industry, a critical area of focus, relies heavily on a skilled labor force, making educational initiatives paramount.

- Tianshui Huatian Technology can leverage these government-backed programs by collaborating with educational institutions to develop specialized training and apprenticeship opportunities, ensuring a steady flow of qualified talent.

Chinese workers increasingly value human-centric skills like strategic thinking and interpersonal abilities as automation grows. This societal trend indicates a positive reception to integrating AI and robotics in manufacturing, suggesting Tianshui Huatian can benefit from this mindset.

To leverage this, Tianshui Huatian must invest in comprehensive training programs to equip employees for AI-augmented roles. This proactive approach ensures the company remains competitive by fostering a workforce adept at collaborating with new technologies.

Technological factors

The semiconductor packaging sector is experiencing a surge of innovation, with technologies like chiplet partitioning, 2.5D/3D packaging, and hybrid bonding becoming increasingly important. These advancements are key to boosting performance and reducing the physical size of electronic components.

Tianshui Huatian Technology's focus on developing cutting-edge packaging solutions, including the wider adoption of flip-chip and fan-out wafer-level packaging (FO-WLP), strategically positions the company to benefit from the growing demand for high-performance applications. The global advanced packaging market was valued at approximately $45 billion in 2023 and is projected to reach over $70 billion by 2028, demonstrating significant growth potential.

China's semiconductor industry saw a surge in patent applications, with over 50,000 filed in 2023, a 15% increase from the previous year, reflecting a strategic push for technological self-sufficiency. This intensified R&D investment is a direct response to ongoing US export controls, aiming to bolster domestic capabilities.

Tianshui Huatian Technology's commitment to developing high-quality semiconductor products and advanced solutions directly supports this national objective of technological independence. The company's R&D expenditure grew by 20% in 2024, reaching ¥1.5 billion, underscoring its dedication to innovation in a competitive landscape.

The manufacturing sector, including packaging, is seeing a significant uptick in automation and AI. Robotic arms are becoming standard for tasks like assembly and material handling, while AI-powered vision systems are revolutionizing quality control by detecting even minor defects with remarkable accuracy. These advancements are directly translating to smoother operations and a higher caliber of finished products.

Tianshui Huatian Technology can capitalize on these technological shifts to refine its own manufacturing. By adopting more automation, the company can expect to not only speed up production but also minimize costly human errors. This strategic integration is key to optimizing production costs and staying competitive in a market that increasingly values efficiency and precision.

The global market for packaging automation is on a strong growth trajectory. Projections indicate a compound annual growth rate (CAGR) of around 7.5% from 2023 to 2030, with the market expected to reach approximately $65 billion by 2030. This robust expansion underscores the increasing adoption of these technologies across the industry.

Emergence of New Applications (AI, 5G, IoT, Automotive)

The rapid expansion of technologies like artificial intelligence (AI), 5G networks, the Internet of Things (IoT), and advanced automotive systems is creating a significant surge in demand for sophisticated semiconductor components. Tianshui Huatian's expertise in advanced packaging and testing is crucial for enabling these high-growth sectors. For instance, the global AI chip market was projected to reach over $100 billion by 2024, underscoring the need for specialized semiconductor solutions.

Meeting the evolving requirements of these dynamic fields necessitates continuous innovation in Tianshui Huatian's packaging technologies. This includes developing solutions that can handle increased processing power, higher data transfer rates, and enhanced reliability for applications ranging from autonomous driving systems to complex AI algorithms. The automotive sector alone is expected to see semiconductor content per vehicle rise significantly, with some estimates suggesting it could exceed $2,000 by 2030.

To capitalize on these trends, Tianshui Huatian must adapt its offerings to support:

- AI Acceleration: Packaging solutions that facilitate the high-bandwidth memory and advanced interconnects required for AI processors.

- 5G Infrastructure: Components for base stations and user equipment that demand low latency and high throughput.

- IoT Devices: Miniaturized and power-efficient packaging for a vast array of connected devices.

- Automotive Electronics: Robust and reliable packaging solutions for in-vehicle systems, including advanced driver-assistance systems (ADAS) and infotainment.

Supply Chain Resilience through Domestic Equipment Development

US export controls have significantly spurred China's drive towards self-sufficiency in semiconductor manufacturing equipment (SME). This strategic shift has seen Chinese suppliers capturing increased market share across various critical technologies, a trend expected to continue through 2024 and 2025.

This intensified focus on domestic equipment development is designed to lessen dependence on foreign suppliers and bolster the local supply chain. For Tianshui Huatian Technology, this translates into a potential for more reliable and consistent access to the essential machinery needed for its operations, mitigating risks associated with international trade restrictions.

Key areas of advancement in China's domestic SME sector include lithography, etching, and deposition tools. For instance, by the end of 2023, domestic players had reportedly achieved notable progress in certain etching equipment segments, with some suppliers seeing their market share grow by over 10% year-on-year.

- Domestic SME Market Share Growth: Chinese suppliers are increasingly gaining traction in critical semiconductor manufacturing equipment segments.

- Reduced Foreign Dependence: The push for indigenization aims to create a more robust and less vulnerable local supply chain.

- Strategic Advantage for Tianshui Huatian: Enhanced domestic SME availability offers Tianshui Huatian more stable access to vital manufacturing tools.

- Technological Advancements: Significant progress is being made in areas like etching and deposition equipment, with market share gains reported by domestic manufacturers.

Technological advancements in semiconductor packaging, such as chiplet partitioning and 2.5D/3D integration, are crucial for enhancing performance and miniaturization. Tianshui Huatian Technology's focus on these areas, including flip-chip and fan-out wafer-level packaging, positions it well in a global advanced packaging market projected to exceed $70 billion by 2028.

China's drive for technological self-sufficiency, evidenced by a 15% increase in semiconductor patent applications in 2023, directly benefits companies like Tianshui Huatian. The company's 20% R&D expenditure growth in 2024, reaching ¥1.5 billion, underscores its commitment to innovation amidst a landscape shaped by export controls.

The increasing adoption of automation and AI in manufacturing, with the packaging automation market expected to reach $65 billion by 2030, offers Tianshui Huatian opportunities to boost efficiency and product quality. This aligns with the growing demand from sectors like AI and 5G, where specialized semiconductor solutions are paramount.

The strategic development of domestic semiconductor manufacturing equipment (SME) in China, spurred by export controls, is enhancing supply chain stability for companies like Tianshui Huatian. Progress in areas like etching equipment, with domestic players gaining over 10% market share by end-2023, signifies a more resilient operational environment.

| Technology Area | Market Projection (2028) | Tianshui Huatian's Focus | Key Driver |

|---|---|---|---|

| Advanced Packaging | >$70 billion | Chiplet, 2.5D/3D, Flip-Chip, FO-WLP | Performance & Miniaturization |

| AI Chip Market | >$100 billion (2024 est.) | High-bandwidth memory packaging | AI Acceleration Demand |

| Packaging Automation | ~$65 billion (2030 est.) | Robotics, AI Vision Systems | Efficiency & Quality Control |

| Domestic SME Development | N/A | Utilizing improved local equipment | Technological Self-Sufficiency |

Legal factors

US export controls on advanced semiconductors and manufacturing equipment present a significant legal hurdle for Tianshui Huatian. These restrictions, aimed at limiting China's access to cutting-edge chips with potential military applications, could curtail Huatian's ability to acquire critical technologies, designs, and access to certain international markets. For instance, in October 2023, the US Department of Commerce expanded its export controls, impacting a broader range of advanced AI chips and semiconductor manufacturing equipment.

China's commitment to bolstering intellectual property (IP) protection, particularly within the vital semiconductor industry, directly impacts Tianshui Huatian Technology. The company must actively manage its innovative packaging technologies within this evolving legal framework, both at home and abroad, to safeguard its creations and prevent any potential IP infringements.

The surge in semiconductor patent applications filed in China, reaching over 69,000 in 2023 according to the China National Intellectual Property Administration (CNIPA), underscores the critical need for Tianshui Huatian to implement and enforce strong IP strategies. This increasing volume of filings signifies a heightened awareness and competitive drive within the sector, making robust IP management essential for sustained growth and market position.

New mandatory local standards for pollutant discharge in the semiconductor industry, like those revised in Shanghai in 2024, are tightening limits on water and air pollutants. Tianshui Huatian must ensure its facilities adhere to these evolving environmental regulations to prevent fines and operational interruptions, showcasing a dedication to sustainable manufacturing.

Labor Laws and Employment Regulations

Tianshui Huatian Technology, operating within China, navigates a landscape of dynamic labor laws and employment regulations. These rules govern crucial aspects like minimum wage standards, workplace safety protocols, and fair employment practices. For instance, China's minimum wage policies are subject to regular adjustments by provincial governments, directly impacting labor costs for companies like Huatian.

Attracting and retaining top talent in China's increasingly competitive job market necessitates strict adherence to these labor statutes. Offering competitive salary packages and ensuring compliant working conditions are paramount for success. By the end of 2024, many Chinese provinces saw wage increases, reflecting a national trend towards improved worker compensation.

Key legal considerations for Tianshui Huatian include:

- Compliance with the Labor Contract Law: Ensuring all employment contracts meet legal requirements regarding terms, conditions, and termination.

- Adherence to Social Insurance Contributions: Properly contributing to state-mandated pension, medical, unemployment, and work-related injury insurance schemes for all employees.

- Workplace Safety Regulations: Maintaining a safe working environment in line with national and industry-specific safety standards, crucial for manufacturing operations.

- Minimum Wage Adherence: Keeping abreast of and complying with the latest minimum wage rates set by local authorities, which saw an average increase of 4-6% across major cities in early 2025.

Anti-Monopoly and Fair Competition Laws

China's commitment to fostering a robust semiconductor industry, including encouraging consolidation through mergers and acquisitions, means anti-monopoly and fair competition laws are increasingly important. These regulations are designed to prevent market dominance and ensure a level playing field for all players. For Tianshui Huatian, adherence to these laws is crucial, especially if the company pursues significant expansion or already commands a substantial market share.

The State Administration for Market Regulation (SAMR) in China actively enforces these regulations. In 2023, SAMR continued its scrutiny of large tech deals, with a notable focus on sectors deemed critical for national development. While specific actions against Tianshui Huatian aren't publicly detailed, the general regulatory environment signals a need for proactive compliance. Companies operating in strategic sectors like semiconductors are under particular observation to ensure fair competition.

- Increased Regulatory Scrutiny: China's SAMR is actively reviewing mergers and acquisitions, particularly in technology and strategic industries.

- Fair Competition Emphasis: The government aims to prevent monopolistic practices and ensure a competitive market environment for semiconductor companies.

- Compliance for M&A: Tianshui Huatian must navigate anti-monopoly reviews if it engages in significant mergers or acquisitions to consolidate its position.

- Market Dominance Awareness: Companies with a dominant market position need to be particularly mindful of fair competition regulations to avoid penalties.

Tianshui Huatian Technology faces significant legal challenges due to US export controls on advanced semiconductors and manufacturing equipment. These regulations, implemented to curb China's access to critical technologies, could impede Huatian's ability to procure essential components and designs, impacting its global market reach. For example, expanded US controls in October 2023 specifically targeted advanced AI chips and related manufacturing tools, directly affecting companies in this sector.

China's evolving intellectual property (IP) laws are crucial for Huatian, especially concerning its innovative packaging technologies. The nation's increasing emphasis on IP protection within the semiconductor industry, evidenced by over 69,000 semiconductor patent applications filed in China in 2023, necessitates robust IP strategies for companies like Huatian to safeguard their innovations and maintain a competitive edge.

| Legal Factor | Impact on Tianshui Huatian | Relevant Data/Trend (2023-2025) |

|---|---|---|

| US Export Controls | Restricts access to advanced semiconductor technology and equipment. | US expanded controls in Oct 2023 on AI chips and manufacturing equipment. |

| Intellectual Property (IP) Laws | Requires strong IP protection strategies for innovative technologies. | Over 69,000 semiconductor patent applications filed in China in 2023. |

| Environmental Regulations | Mandates adherence to stricter pollutant discharge standards. | Revised local standards in Shanghai (2024) tightened water/air pollutant limits. |

| Labor Laws | Governs wages, safety, and employment practices. | Provincial minimum wage adjustments in China (e.g., 4-6% avg. increase in major cities by early 2025). |

| Anti-Monopoly Laws | Ensures fair competition, particularly relevant for M&A. | SAMR actively scrutinizes tech deals, with focus on strategic sectors (2023). |

Environmental factors

The semiconductor manufacturing sector, including companies like Tianshui Huatian Technology, is navigating a landscape of increasingly stringent environmental regulations. China, a key market for semiconductor production, introduced new mandatory local standards for pollutant discharge that became effective in 2024. These regulations specifically target reductions in water and air pollutants, directly impacting manufacturing processes.

To maintain operational compliance and mitigate environmental impact, Tianshui Huatian will need to allocate significant capital towards advanced pollution control technologies. This includes investments in wastewater treatment facilities and air purification systems to meet the new, stricter emission limits. Proactive adoption of sustainable manufacturing practices is no longer optional but a necessity for long-term viability and corporate responsibility.

Tianshui Huatian's semiconductor manufacturing relies heavily on resources like water, energy, and specialized raw materials. The company must navigate the availability and sustainable sourcing of these inputs, while also addressing the environmental footprint of its entire supply chain. For instance, the global semiconductor industry's water consumption is substantial, with some estimates suggesting that producing a single chip can require thousands of liters of water.

Geopolitical factors significantly influence the supply of critical minerals essential for semiconductor production, such as rare earth elements. Disruptions in these supply lines, potentially exacerbated by international tensions, could directly impact Huatian's production capacity and costs. In 2024, the concentration of rare earth mining in a few countries highlights this vulnerability.

The electronics industry, including semiconductor manufacturing, faces mounting pressure concerning waste generation, especially electronic waste (e-waste). Tianshui Huatian Technology must proactively adopt robust waste management strategies, focusing on recycling and integrating circular economy principles into its packaging and testing operations.

There's a clear market push for sustainable materials and packaging that can be recycled. For instance, by 2025, the global e-waste is projected to reach 74 million metric tons, a significant increase from previous years, highlighting the urgency for companies like Tianshui Huatian to address these environmental concerns through innovative solutions.

Energy Consumption and Carbon Footprint

Semiconductor manufacturing is notoriously energy-hungry, directly impacting a company's carbon footprint. For Tianshui Huatian, this means a significant focus on enhancing operational energy efficiency is crucial. This includes exploring investments in renewable energy sources to mitigate environmental impact and meet escalating global sustainability targets.

China is actively prioritizing climate technology, recognizing it as a significant driver for job creation and economic development. This trend presents both challenges and opportunities for Tianshui Huatian, as it navigates evolving environmental regulations and the growing demand for sustainable practices within the tech sector.

- Energy Intensity: Semiconductor fabrication plants can consume vast amounts of electricity, often exceeding that of large industrial complexes.

- Carbon Footprint: The reliance on electricity, frequently sourced from fossil fuels, contributes substantially to greenhouse gas emissions.

- Renewable Energy Adoption: Companies like Tianshui Huatian are increasingly pressured to invest in solar, wind, or other clean energy solutions to decarbonize their operations.

- China's Climate Tech Focus: The Chinese government's emphasis on green technologies aims to foster innovation and create new employment opportunities in sustainable industries.

Corporate Social Responsibility (CSR) and Green Initiatives

There's a significant global push for companies to show they care about social responsibility, especially when it comes to the environment. This means Tianshui Huatian can really boost its image by focusing on eco-friendly practices.

By developing innovative packaging, Tianshui Huatian can also lead the way in using greener manufacturing methods and materials. This not only helps the planet but also makes the company more attractive to customers and investors who prioritize sustainability. For instance, in 2024, the global sustainable packaging market was valued at approximately $285 billion and is projected to grow significantly, indicating a strong demand for environmentally sound solutions.

- Growing Market Demand: The global market for sustainable packaging is expanding rapidly, presenting opportunities for companies like Tianshui Huatian.

- Brand Enhancement: Adopting green initiatives can significantly improve brand perception and attract environmentally conscious consumers.

- Investor Appeal: Environmental, Social, and Governance (ESG) factors are increasingly important for investors, with sustainable companies often seeing better access to capital.

- Regulatory Compliance: Proactive environmental measures can help Tianshui Huatian stay ahead of evolving environmental regulations.

Tianshui Huatian Technology faces increasing environmental scrutiny, particularly regarding its energy consumption and carbon footprint. The semiconductor industry's high energy demands, often met by fossil fuels, necessitate a shift towards renewable energy sources to align with global sustainability goals and China's focus on climate technology. By 2025, the global e-waste is projected to reach 74 million metric tons, underscoring the need for Tianshui Huatian to implement robust waste management and circular economy principles.

| Environmental Factor | Description | Impact on Tianshui Huatian | Data Point (2024/2025) |

| Pollution Control | Stricter discharge standards for water and air pollutants. | Requires investment in advanced pollution control technologies. | New mandatory local standards effective 2024 in China. |

| Resource Management | High water and energy usage in manufacturing. | Need for sustainable sourcing and efficient resource utilization. | A single chip can require thousands of liters of water. |

| Waste Management | Increasing generation of electronic waste (e-waste). | Mandates adoption of recycling and circular economy principles. | Global e-waste projected to reach 74 million metric tons by 2025. |

| Energy Consumption | High electricity demand contributes to carbon footprint. | Pressure to invest in renewable energy and improve efficiency. | Semiconductor fabrication plants can consume electricity exceeding large industrial complexes. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Tianshui Huatian Technology draws from a comprehensive blend of official government reports, reputable financial news outlets, and leading market research firms. This ensures a robust understanding of political, economic, social, and technological factors impacting the company.