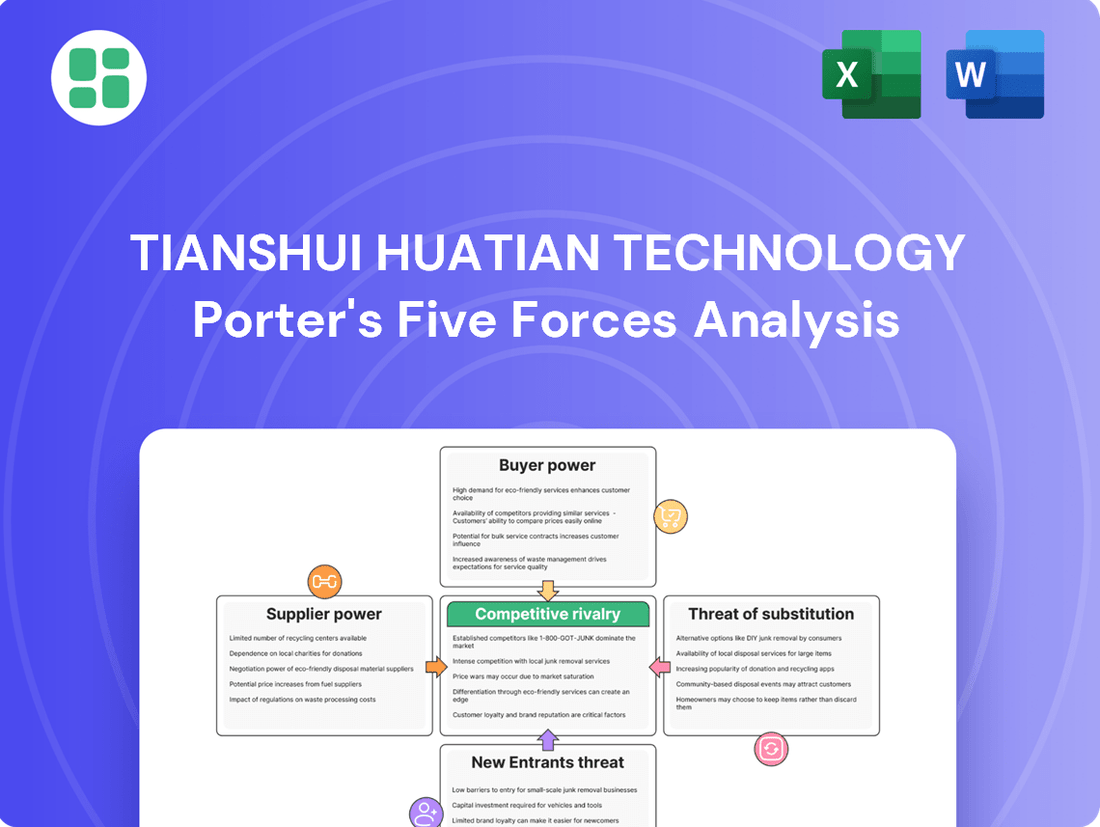

Tianshui Huatian Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tianshui Huatian Technology Bundle

Tianshui Huatian Technology navigates a complex landscape shaped by intense rivalry and the looming threat of substitutes. Understanding the delicate balance of buyer power and supplier leverage is crucial for any stakeholder in this sector.

The complete report reveals the real forces shaping Tianshui Huatian Technology’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of highly specialized semiconductor manufacturing and testing equipment, like advanced lithography machines, wield considerable influence. The scarcity of vendors for these crucial tools, such as ASML for EUV lithography, leaves Tianshui Huatian Technology with limited alternatives, thereby strengthening supplier bargaining power. For instance, ASML's dominance in EUV lithography, a critical technology for advanced chip production, means its pricing and delivery terms are often non-negotiable.

For Tianshui Huatian Technology, switching suppliers for critical semiconductor packaging and testing inputs presents significant hurdles. These include the costs associated with re-qualifying new materials or equipment, re-tooling production lines, and the potential for disruptive production delays. These substantial switching costs significantly limit the company's ability to easily change vendors, thereby strengthening the bargaining power of its current suppliers who offer integrated solutions vital to its operations.

Geopolitical tensions, especially between the U.S. and China, are reshaping the semiconductor landscape, impacting Tianshui Huatian Technology's access to advanced technologies and materials. These tensions can restrict the flow of critical components, thereby increasing the bargaining power of suppliers in unaffected regions.

Export controls and the drive for regional supply chain diversification mean Huatian Technology may face fewer supplier options, potentially leading to higher costs and reduced availability of essential components. This situation naturally bolsters the influence of suppliers located in jurisdictions with more stable trade relations.

Concentration of Raw Material Suppliers

The bargaining power of suppliers for Tianshui Huatian Technology is significantly influenced by the concentration within specific raw material markets. While many materials may have numerous sources, the specialized high-purity chemicals and rare earth elements essential for advanced semiconductor packaging often come from a very limited number of global providers. This scarcity can give these niche suppliers considerable leverage over Tianshui Huatian Technology.

This concentration can translate into increased input costs and potential supply chain disruptions for Tianshui Huatian Technology. For instance, in 2024, the global supply of certain critical rare earth elements, vital for advanced electronics, faced increased scrutiny and price volatility due to geopolitical factors affecting a few key producing nations.

- Limited Suppliers for Critical Materials: Specific high-purity chemicals and rare earth elements, crucial for semiconductor packaging, are often sourced from a small pool of specialized global suppliers.

- Price and Supply Control: Consolidation or disruptions among these niche raw material providers can grant them substantial power to dictate pricing and control supply to Tianshui Huatian Technology.

- Impact on Input Costs: This concentrated supplier power can lead to higher raw material expenses for Tianshui Huatian Technology, directly affecting profitability.

- Supply Chain Vulnerabilities: Reliance on a few suppliers for essential components creates inherent vulnerabilities in Tianshui Huatian Technology's supply chain.

Supplier's Ability to Forward Integrate

The bargaining power of suppliers for Tianshui Huatian Technology is influenced by their potential to integrate forward into packaging services. While this is uncommon due to the specialized skills and investment needed, the mere possibility grants suppliers leverage, especially if they hold proprietary technology or control essential production stages. This threat of vertical integration by suppliers, even if not frequently realized, is a key factor in their overall power.

In the semiconductor packaging sector, where Tianshui Huatian Technology operates, suppliers of highly specialized materials or advanced manufacturing equipment could theoretically move into offering their own packaging solutions. For instance, a leading provider of a unique substrate material might consider developing in-house packaging capabilities to capture more value. This strategic option, though capital-intensive, serves as a constant reminder of the supplier's underlying influence.

- Supplier Specialization: Suppliers of critical, hard-to-replicate components or technologies possess greater leverage.

- Intellectual Property: Suppliers holding unique patents or proprietary processes can command better terms.

- Production Bottlenecks: Control over a vital stage in the manufacturing process enhances a supplier's power.

- Forward Integration Threat: The potential for suppliers to enter the customer's business space increases their bargaining strength.

Suppliers of critical, specialized materials and advanced manufacturing equipment hold significant bargaining power over Tianshui Huatian Technology. This power stems from the limited availability of these inputs and the high costs associated with switching suppliers, forcing Huatian Technology to accept supplier-dictated terms. For example, ASML's near-monopoly on EUV lithography machines means its pricing and delivery schedules are largely non-negotiable, impacting Huatian Technology's production planning and costs.

| Supplier Characteristic | Impact on Huatian Technology | Example (Illustrative) |

|---|---|---|

| Limited Supplier Base for Critical Inputs | Increased reliance and reduced negotiation leverage | ASML for EUV lithography equipment |

| High Switching Costs | Entrenchment of existing suppliers, limiting flexibility | Re-qualification of specialized chemicals or testing equipment |

| Concentration in Niche Raw Materials | Vulnerability to price volatility and supply disruptions | Rare earth elements essential for advanced packaging |

| Proprietary Technology/IP | Supplier control over essential production stages | Unique substrate materials with patented manufacturing processes |

What is included in the product

This analysis of Tianshui Huatian Technology's Porter's Five Forces reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its market position.

Instantly identify and strategize against competitive threats with a clear, actionable breakdown of Tianshui Huatian Technology's Porter's Five Forces.

Customers Bargaining Power

Tianshui Huatian Technology's diverse customer base across consumer electronics, automotive, industrial, and communication sectors significantly moderates customer bargaining power. This broad reach means no single customer segment can exert overwhelming influence, as demand is spread across various end-user markets. For instance, in 2023, the company reported that its top five customers accounted for a manageable portion of its revenue, demonstrating a healthy distribution of business.

As semiconductor designs grow more intricate and smaller, clients increasingly depend on specialized advanced packaging solutions from OSAT firms like Tianshui Huatian Technology. This reliance is amplified by the growing demand for high-performance, energy-efficient, and compact components crucial for emerging technologies such as AI, 5G, and the automotive sector.

Customers face substantial switching costs when changing OSAT providers. These costs arise from the lengthy qualification processes, the integration of proprietary intellectual property, and the extended design cycles inherent in semiconductor development. For instance, a chip manufacturer might invest millions and many months in qualifying a specific packaging solution from Tianshui Huatian Technology, making a change to another vendor a costly and time-consuming endeavor.

Outsourcing Trend for Cost Efficiency and Scalability

The outsourcing trend in the semiconductor industry significantly impacts customer bargaining power. Fabless companies and even some Integrated Device Manufacturers (IDMs) increasingly opt to outsource packaging and testing services. This is primarily driven by the substantial capital expenditure and specialized knowledge needed for these processes.

This strategic shift towards outsourcing for cost efficiency and scalability directly diminishes the bargaining power of customers. By relying on external providers, customers reduce their ability to credibly threaten backward integration, a key lever in negotiating favorable terms. For example, in 2024, the global semiconductor outsourcing market, particularly for assembly, testing, and packaging (ATP), continued its robust growth, with many fabless firms prioritizing capital preservation and operational flexibility over in-house capabilities.

- Reduced Threat of Backward Integration: Customers outsourcing these functions are less likely to invest in their own packaging and testing facilities, weakening their leverage in negotiations.

- Focus on Core Competencies: Outsourcing allows customers to concentrate on chip design and innovation, areas where they possess a competitive advantage.

- Scalability Benefits: The ability to scale packaging and testing services up or down with demand, without significant fixed asset investment, further reduces customer reliance on in-house options.

- Cost Efficiency Gains: Specialized third-party providers often achieve economies of scale, offering more competitive pricing than individual companies could manage internally.

Price Sensitivity in Competitive End Markets

Customers, particularly those in fast-paced sectors like consumer electronics, often face intense competition, making them highly sensitive to price. This pressure forces Tianshui Huatian Technology to be cost-competitive while still offering advanced packaging solutions. For instance, in 2024, the global consumer electronics market experienced significant price competition, with average selling prices for smartphones seeing a slight decline year-over-year.

The drive for smaller, more powerful devices is a constant, but customers must ensure these advancements are economically feasible. This means Tianshui Huatian Technology needs to deliver innovation without making its packaging and testing services prohibitively expensive. The demand for miniaturization in 2024 continued, but affordability remained a key purchasing factor for end-consumers, impacting device manufacturers' cost structures.

- Price Sensitivity: High competition in end-markets like consumer electronics directly translates to customer pressure on pricing for packaging and testing services.

- Cost-Competitiveness: Tianshui Huatian Technology must balance technological advancements with the need to offer cost-effective solutions to remain attractive to price-sensitive customers.

- Economic Viability: Customer demand for miniaturization and high performance is tempered by the requirement for these features to be economically viable within their own product pricing strategies.

While Tianshui Huatian Technology benefits from high switching costs and the outsourcing trend, customer bargaining power is still a factor, particularly concerning price sensitivity in competitive markets like consumer electronics. The demand for advanced packaging in 2024 continues, but affordability remains a critical consideration for chip manufacturers.

Customers' need for cost-effective solutions means Tianshui Huatian Technology must balance innovation with competitive pricing. This pressure is evident as the global semiconductor market navigates evolving technological demands while managing overall production costs.

The bargaining power of customers is also influenced by the availability of alternative suppliers, although the specialized nature of advanced packaging can limit direct substitutes. However, customers can still exert pressure by consolidating orders or seeking longer-term contracts that offer volume discounts.

| Factor | Impact on Bargaining Power | Example/Data (2024 Context) |

|---|---|---|

| Switching Costs | Lowers customer bargaining power | Significant investment in qualification and design integration |

| Outsourcing Trend | Lowers customer bargaining power | Fabless firms prioritize capital preservation and flexibility |

| Price Sensitivity | Increases customer bargaining power | Intense competition in consumer electronics drives demand for cost-effective solutions |

| Availability of Alternatives | Moderate impact | Specialized nature limits direct substitutes, but volume consolidation is possible |

Same Document Delivered

Tianshui Huatian Technology Porter's Five Forces Analysis

This preview showcases the comprehensive Tianshui Huatian Technology Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the industry. You're looking at the actual document, meaning the exact, professionally formatted analysis you'll receive instantly upon purchase. This ensures transparency and immediate access to valuable strategic insights for your business needs.

Rivalry Among Competitors

Tianshui Huatian Technology operates in a fiercely competitive global Outsourced Semiconductor Assembly and Test (OSAT) market. Major players like ASE Technology Holding Co., Ltd., Amkor Technology, JCET Group, and Tongfu Microelectronics vie for market dominance, pushing for constant innovation and cost efficiencies. This intense rivalry means companies must continually invest in advanced technologies and streamline operations to stay ahead.

Competitive rivalry in the semiconductor packaging sector, including for firms like Tianshui Huatian Technology, is intensifying around advanced packaging capabilities. This includes sophisticated techniques such as 2.5D/3D integration, fan-out wafer-level packaging (FOWLP), and system-in-package (SiP) solutions, which are becoming key differentiators.

Companies are channeling significant R&D investments into these areas to deliver superior performance, miniaturization, and enhanced thermal management. For instance, the global advanced packaging market was valued at approximately $40 billion in 2023 and is projected to grow substantially, underscoring the importance of technological leadership as a battleground.

The Outsourced Semiconductor Assembly and Test (OSAT) market is experiencing robust expansion, with projections showing a compound annual growth rate (CAGR) between 7.8% and 11.5% from 2025 through 2034. This significant growth is fueled by escalating demand from key sectors like artificial intelligence (AI), 5G telecommunications, and the automotive industry.

This impressive market growth acts as a powerful magnet for investment, encouraging established OSAT providers to scale up their manufacturing capabilities and pour resources into cutting-edge technologies. Consequently, the competition among existing players to capture a larger share of this expanding market becomes considerably more intense.

Price Pressure and Economies of Scale

The packaging industry, particularly for traditional components, often experiences intense price pressure. This is driven by the commodity nature of many products and the substantial capital investment required to operate efficiently. Companies like Tianshui Huatian Technology must achieve high production volumes to spread these costs, making operational efficiency and high utilization rates critical for profitability.

The pursuit of economies of scale incentivizes larger players to engage in aggressive pricing to capture market share. For instance, in 2023, the global packaging market was valued at approximately $1.1 trillion, with significant competition across various segments. Companies that can optimize their supply chains and manufacturing processes gain a distinct advantage, often leading to price wars that squeeze margins for less efficient competitors.

- High Capital Expenditures: Setting up advanced manufacturing facilities for packaging requires significant upfront investment, creating barriers to entry but also necessitating high operational throughput to justify the costs.

- Economies of Scale: Larger production volumes lead to lower per-unit costs, giving bigger companies a pricing advantage and driving consolidation.

- Price Sensitivity: In segments where packaging is largely commoditized, buyers are highly sensitive to price, forcing suppliers to compete on cost.

- Operational Efficiency: Companies must maintain high utilization rates of their machinery and optimize logistics to keep costs down and remain competitive on price.

Geographic Concentration and Strategic Expansion

The OSAT market's heavy concentration in the Asia-Pacific region, a hub for key players and manufacturing, intensifies competition among established firms. This intense regional rivalry is a significant driver for companies like Tianshui Huatian Technology to pursue strategic expansion. For instance, in 2024, the Asia-Pacific region continued to hold a dominant share, estimated at over 70% of the global OSAT market, underscoring the concentrated nature of the industry.

This geographic concentration fuels a dynamic environment where companies actively seek to diversify their operations and customer bases. Strategic expansion might involve venturing into underserved geographic markets or developing specialized OSAT services to differentiate themselves. This push for diversification is crucial for mitigating risks associated with over-reliance on a single region and for capturing emerging growth opportunities in new markets.

- Asia-Pacific Dominance: The Asia-Pacific region accounts for a substantial majority of global OSAT manufacturing and demand.

- Intensified Rivalry: Geographic concentration leads to heightened competition among OSAT providers within this key region.

- Strategic Expansion Drivers: Companies are motivated to expand geographically or into niche services to reduce risk and find new growth avenues.

- Market Diversification: Expansion efforts aim to broaden operational footprints and customer portfolios beyond existing strongholds.

Competitive rivalry in the OSAT sector is fierce, with major players like ASE Technology, Amkor, and JCET Group constantly innovating and focusing on cost efficiencies. This intense competition is particularly evident in advanced packaging technologies like 2.5D/3D integration and fan-out wafer-level packaging, where R&D investments are crucial for differentiation.

The global OSAT market's projected growth, with a CAGR between 7.8% and 11.5% from 2025-2034, fuels this rivalry as companies aim to capture a larger share. This expansion is driven by demand from AI, 5G, and automotive sectors, making technological leadership a key battleground.

Price pressure is significant, especially for commoditized packaging. High capital expenditures necessitate economies of scale and operational efficiency, leading larger firms to compete aggressively on price. In 2023, the global packaging market was valued at approximately $1.1 trillion, highlighting the scale of competition.

The concentration of OSAT manufacturing and demand in the Asia-Pacific region, which held over 70% of the global market in 2024, intensifies regional competition. This drives companies like Tianshui Huatian Technology to pursue strategic expansion and market diversification to mitigate risks and capitalize on new opportunities.

| Key OSAT Competitors | Advanced Packaging Focus | 2023 Market Share Estimate (Global OSAT) |

| ASE Technology Holding Co., Ltd. | 2.5D/3D, SiP | ~15-20% |

| Amkor Technology | Fan-out WLP, SiP | ~10-15% |

| JCET Group | 2.5D/3D, SiP | ~10-15% |

| Tongfu Microelectronics | Advanced SiP, 2.5D | ~5-10% |

SSubstitutes Threaten

For fabless semiconductor companies and many Integrated Device Manufacturers (IDMs), there are virtually no direct substitutes for outsourced semiconductor assembly and test (OSAT) services. The sheer scale of investment needed for advanced packaging and testing equipment, coupled with the specialized expertise required, makes in-house operations prohibitively expensive and complex for most chip designers.

This lack of viable alternatives strengthens the bargaining power of OSAT providers like Tianshui Huatian Technology. For instance, the global OSAT market was valued at approximately $35 billion in 2023, with significant growth projected, underscoring the essential nature of these services and the limited options for companies to bypass them.

Large Integrated Device Manufacturers (IDMs) like Intel and Samsung maintain substantial in-house packaging and testing operations, especially for their cutting-edge or proprietary chip designs. This internal capacity acts as an indirect threat to OSAT (Outsourced Semiconductor Assembly and Test) providers by reducing the overall market demand for external services.

While the industry generally favors outsourcing, these IDMs’ retained capabilities represent a strategic alternative, potentially limiting the total addressable market for OSAT companies. For instance, Intel's continued investment in advanced packaging technologies like Foveros demonstrates their commitment to internal development, impacting the growth potential for external partners.

While advancements like monolithic integration could theoretically reduce reliance on external packaging, the reality is that the slowing of Moore's Law has made advanced packaging techniques, such as chiplets and 3D stacking, more critical than ever for achieving performance improvements. This trend actually strengthens the position of specialized packaging providers.

For instance, the increasing complexity of high-performance computing and AI processors necessitates sophisticated packaging solutions that integrate multiple dies, a core competency for companies like Tianshui Huatian Technology. The global advanced packaging market was valued at approximately $45 billion in 2023 and is projected to grow significantly, underscoring the sustained demand for these services.

Software-Based Solutions and System-Level Optimization

While software-based solutions and system-level optimization aren't direct replacements for the physical packaging and assembly services offered by OSATs like Tianshui Huatian Technology, they represent a potential long-term, indirect threat. Advancements in areas like cloud computing and system-level integration could theoretically reduce the reliance on certain specialized hardware components, thereby impacting the demand for their manufacturing. For instance, the increasing sophistication of software-defined networking might lessen the need for dedicated hardware network interface cards in some applications.

These shifts are more about changing the nature of demand rather than eliminating it entirely. The value proposition might move from purely physical chip characteristics to the overall system efficiency and integration capabilities. For example, in 2024, the global cloud computing market was valued at over $600 billion, indicating a significant shift towards software-centric solutions across various industries. This trend, while not an immediate danger, suggests a need for OSATs to stay attuned to how technological evolution might alter the hardware landscape they serve.

- Software Optimization: Cloud computing and edge computing advancements can consolidate processing power, potentially reducing the need for certain specialized hardware components that OSATs manufacture.

- System-Level Integration: As systems become more integrated, the demand for individual, highly specialized packaged components might decrease in favor of more consolidated solutions.

- Emerging Paradigms: While still nascent, quantum computing and neuromorphic computing could, in the long term, redefine hardware requirements, impacting the types of packaging and assembly services needed.

- Indirect Impact: These threats are indirect, affecting the overall demand for specific hardware types rather than directly substituting the core OSAT service of packaging and testing.

Alternative Materials or Manufacturing Processes

The emergence of entirely new materials or manufacturing processes, such as fully integrated photonics or bio-computing, could bypass traditional semiconductor fabrication and packaging. This represents a potential long-term substitution threat for companies like Tianshui Huatian Technology. For instance, advancements in quantum computing, while still nascent, could eventually offer alternative processing capabilities that diminish reliance on current silicon-based architectures.

However, the semiconductor industry benefits from extremely high barriers to entry, including massive capital investment for fabrication plants (fabs) and a deeply entrenched ecosystem of suppliers and expertise. Tianshui Huatian Technology, as a significant player in this space, benefits from this established infrastructure. The sheer scale of investment required for new semiconductor technologies, often in the tens of billions of dollars, makes rapid shifts to entirely new paradigms unlikely in the short to medium term.

Furthermore, continuous innovation within existing semiconductor technologies, such as the ongoing development of advanced packaging techniques and novel materials like gallium nitride (GaN) for specific applications, actively mitigates the threat of substitution. These incremental improvements often meet emerging market needs more readily than disruptive, unproven technologies. For example, the demand for higher power efficiency in electric vehicles and 5G infrastructure is being met by GaN, a material that complements rather than replaces traditional silicon in many areas.

- High Capital Investment: Establishing a leading-edge semiconductor fabrication facility can cost upwards of $20 billion, creating a significant barrier to entry for potential disruptors.

- Established Ecosystem: The semiconductor industry relies on a complex global supply chain and specialized talent pool, which are difficult and time-consuming to replicate.

- Continuous Innovation: Ongoing advancements in materials science and manufacturing processes within the current semiconductor paradigm tend to address new market demands, thereby reducing the immediate threat from radical substitutions.

For Tianshui Huatian Technology and other OSAT providers, direct substitutes for their core assembly and testing services are virtually nonexistent due to the immense capital and expertise required for advanced packaging. While large IDMs like Intel and Samsung possess in-house capabilities, this primarily reduces overall market demand rather than substituting the specialized services OSATs offer. The ongoing trend towards chiplets and 3D stacking, driven by the slowing of Moore's Law, actually reinforces the need for expert OSAT providers.

Emerging technologies like quantum computing and novel materials present long-term substitution threats, but the semiconductor industry's high barriers to entry, including massive investment and a complex ecosystem, make rapid shifts unlikely. Continuous innovation within existing semiconductor technologies, such as advanced packaging and materials like gallium nitride (GaN), actively addresses new market needs, thereby mitigating immediate substitution risks. For instance, the global advanced packaging market was valued at approximately $45 billion in 2023, highlighting its critical and ongoing role.

| Potential Substitute | Nature of Threat | Impact on OSATs | Example/Data Point |

|---|---|---|---|

| In-house IDM Capabilities | Reduced market demand | Limits total addressable market | Intel's Foveros investment |

| Software Optimization (Cloud/Edge) | Indirect, shifts hardware needs | May reduce demand for certain components | Global cloud computing market > $600 billion (2024) |

| Radical New Technologies (Quantum, Bio-computing) | Long-term, disruptive | Could bypass traditional processes | Nascent quantum computing advancements |

Entrants Threaten

Entering the advanced semiconductor packaging and testing sector, where Tianshui Huatian Technology operates, requires immense upfront capital. Companies need to invest billions in state-of-the-art machinery, sterile cleanroom environments, and cutting-edge research and development to even begin competing.

This significant financial hurdle acts as a powerful deterrent for potential new players. For instance, establishing a new semiconductor fabrication plant, which often includes advanced packaging capabilities, can easily cost upwards of $10 billion, making it exceptionally difficult for newcomers to match the scale and technological prowess of established firms like Tianshui Huatian Technology.

The advanced semiconductor packaging and testing industry, where Tianshui Huatian Technology operates, demands significant technological sophistication. Success hinges on deep expertise in materials science, mechanical and electrical engineering, and precise process control, creating a high barrier for newcomers.

Developing the proprietary intellectual property, cultivating a highly skilled workforce, and acquiring the intricate operational knowledge required are substantial hurdles. For instance, the capital expenditure for a state-of-the-art advanced packaging facility can easily reach hundreds of millions of dollars, a daunting figure for potential entrants in 2024.

Established OSAT companies, like Tianshui Huatian Technology, benefit from deep-rooted relationships with leading semiconductor firms. These existing partnerships are built on years of trust and proven performance, making it challenging for newcomers to break in.

New entrants must navigate lengthy and costly qualification processes. This can take several years and requires substantial investment to prove their capabilities and meet the stringent standards demanded by major players in the semiconductor industry, creating a significant barrier.

Economies of Scale and Cost Advantages

Tianshui Huatian Technology, a major player in the semiconductor packaging and testing industry, benefits from substantial economies of scale. This allows them to negotiate better prices for raw materials and spread significant research and development expenses over a vast production volume.

New companies entering the market would find it incredibly difficult to replicate these cost advantages. For instance, in 2023, the global semiconductor packaging market was valued at approximately $58.9 billion, with established firms like Huatian Technology already operating at peak efficiency. A new entrant would face immense pressure to compete on price, a critical factor in this sector.

- Economies of Scale: Huatian Technology leverages its large production capacity to reduce per-unit costs in material sourcing and manufacturing.

- R&D Cost Absorption: Significant investments in advanced packaging technologies are spread across a high output volume, lowering the R&D burden for each unit.

- Distribution Efficiencies: Established logistics networks further contribute to cost savings, making it challenging for newcomers to match pricing.

- Price Sensitivity: The semiconductor market often experiences price fluctuations, making cost competitiveness a primary barrier to entry for less established firms.

Intellectual Property and Patent Portfolios

The semiconductor packaging and testing industry is heavily reliant on intellectual property. Companies like Tianshui Huatian Technology possess substantial patent portfolios covering advanced packaging designs, manufacturing processes, and sophisticated testing techniques. For instance, as of early 2024, many established players hold thousands of patents, creating significant barriers to entry.

New companies entering this market would likely face considerable hurdles in developing their own proprietary technologies without infringing on existing patents. This necessitates either substantial investment in research and development to create truly novel solutions or the expenditure of significant capital on licensing agreements for established technologies.

- Intellectual Property Barrier: The semiconductor packaging sector is characterized by a high density of patents, making it difficult for new entrants to operate without licensing existing technology.

- R&D Investment: Developing unique, non-infringing technologies requires substantial upfront investment in research and development, a significant challenge for startups.

- Licensing Costs: Acquiring licenses for essential patented technologies can be prohibitively expensive, further increasing the cost of market entry.

- Competitive Landscape: Established firms with extensive patent portfolios enjoy a competitive advantage, as they can leverage their IP to protect their market share and deter new competition.

The threat of new entrants in the advanced semiconductor packaging and testing sector, where Tianshui Huatian Technology operates, is generally low due to substantial barriers. The industry demands massive capital investment, estimated in the billions for advanced facilities, and requires deep technological expertise in areas like materials science and process control. Furthermore, established players benefit from strong customer relationships and extensive patent portfolios, making it exceedingly difficult for newcomers to gain traction. For instance, the capital expenditure for a state-of-the-art advanced packaging facility can easily reach hundreds of millions of dollars, a daunting figure for potential entrants in 2024.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Billions required for advanced machinery and cleanrooms. | Extremely high; deters most potential competitors. |

| Technological Sophistication | Expertise in materials science, engineering, and process control. | Significant; requires deep R&D and skilled workforce. |

| Intellectual Property | Extensive patent portfolios protect existing technologies. | High; necessitates costly licensing or novel R&D. |

| Customer Relationships | Long-standing partnerships with leading semiconductor firms. | Difficult to replicate; lengthy qualification processes. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Tianshui Huatian Technology is built upon a foundation of comprehensive data, including the company's annual reports, industry-specific market research from firms like CINNO Research and QYResearch, and publicly available financial filings.