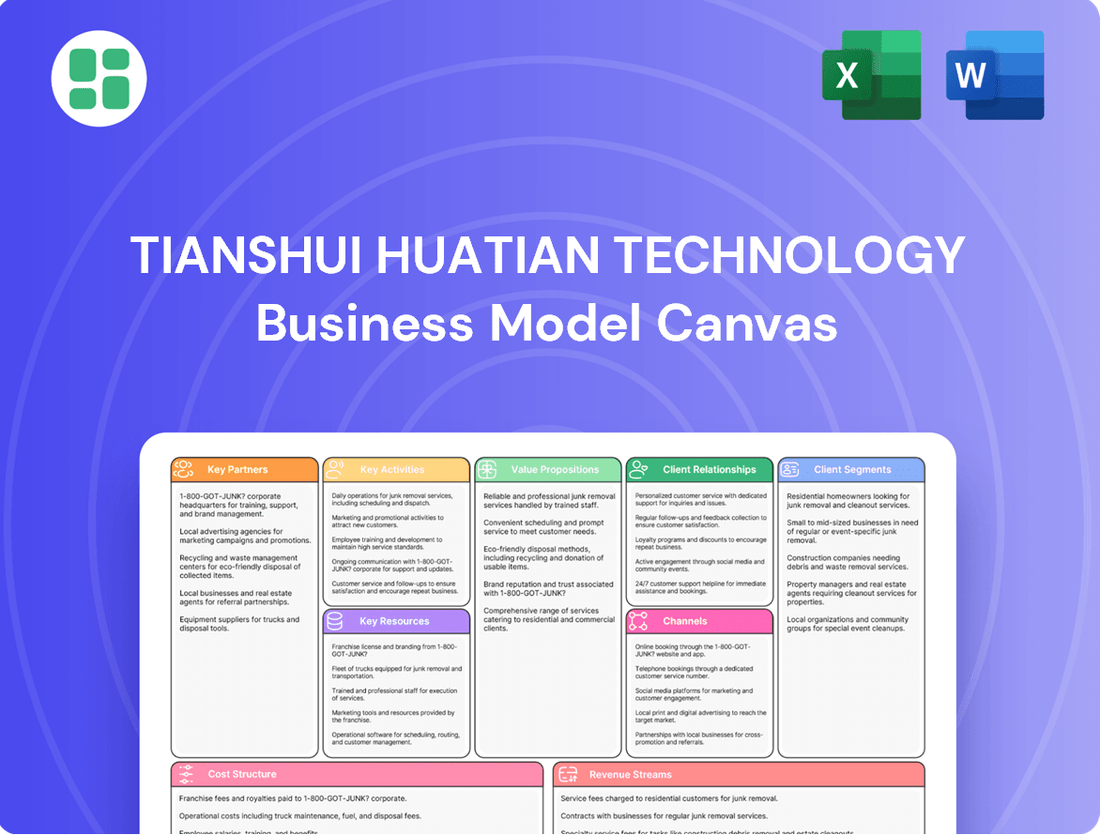

Tianshui Huatian Technology Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tianshui Huatian Technology Bundle

Unlock the strategic core of Tianshui Huatian Technology's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Gain actionable insights to fuel your own business growth.

Partnerships

Tianshui Huatian Technology's success in advanced semiconductor packaging and testing hinges on its relationships with key equipment suppliers. These partnerships are vital for securing access to the latest manufacturing technologies, ensuring high production quality and operational efficiency. For instance, in 2024, the company continued to invest in state-of-the-art equipment to meet the growing demand for sophisticated chip packaging solutions.

Collaborations with global leaders in semiconductor equipment manufacturing provide Tianshui Huatian Technology with essential maintenance and technical support. This ensures minimal downtime and optimal performance of their complex machinery. Such alliances can also foster joint development projects, allowing for the creation of specialized equipment precisely suited to Huatian's unique packaging requirements, thereby enhancing its competitive edge in the market.

Tianshui Huatian Technology relies heavily on a steady influx of critical raw materials like silicon wafers, bonding wires, molding compounds, and lead frames to maintain its production output. Securing these high-quality inputs is paramount for consistent manufacturing, controlling expenses, and guaranteeing the superior performance of their semiconductor offerings.

The company actively cultivates robust relationships with dependable material suppliers, often solidifying these connections through extended supply agreements and stringent quality assurance protocols. For instance, in 2023, the global semiconductor materials market saw significant growth, with demand for silicon wafers alone reaching an estimated 15.5 billion dollars, highlighting the strategic importance of these supplier partnerships.

Tianshui Huatian Technology, as a leading Outsourced Semiconductor Assembly and Test (OSAT) provider, forms crucial partnerships with both fabless semiconductor companies and Integrated Device Manufacturers (IDMs). These collaborations are the bedrock of their operational model, ensuring a consistent flow of assembly and testing orders by leveraging Huatian Technology's specialized capabilities.

By engaging with fabless firms, who focus on chip design without manufacturing, and IDMs that outsource specific production stages, Huatian Technology effectively integrates into the global semiconductor ecosystem. This symbiotic relationship allows them to benefit from the innovation of chip designers and the established manufacturing needs of IDMs, solidifying their position in the supply chain.

These key partnerships are often cemented through long-term contractual agreements and joint development initiatives. For instance, in 2023, the global OSAT market was valued at approximately $30 billion, with companies like Huatian Technology playing a significant role in supporting the production pipelines of major chip manufacturers worldwide.

Research and Development Institutions

Tianshui Huatian Technology actively collaborates with universities and research institutions to drive semiconductor packaging innovation. These partnerships provide access to cutting-edge research and specialized talent, crucial for developing advanced technologies like System-in-Package (SiP) and Through-Silicon Via (TSV). For instance, in 2024, the company continued its engagement with leading Chinese universities to explore novel materials and process improvements for high-density interconnects.

These collaborations are instrumental in Huatian Technology’s strategy to maintain a competitive edge. By tapping into the intellectual property and research capabilities of these external bodies, the company can accelerate the development and implementation of next-generation packaging solutions, including Fan-Out and Wafer-Level Packaging (WLP). This focus on R&D ensures they remain at the forefront of an evolving industry.

Huatian Technology also engages with technology consortia, fostering a collaborative ecosystem for semiconductor advancement. Such partnerships allow for shared investment in research and development, mitigating risks and pooling expertise. This approach is vital for tackling complex challenges in advanced packaging, ensuring the company’s technological leadership.

Key aspects of these partnerships include:

- Access to cutting-edge research: Universities and institutes provide foundational and applied research in areas like advanced materials and miniaturization.

- Talent pipeline development: Collaborations help identify and recruit skilled engineers and researchers, addressing the industry's talent needs.

- Intellectual property sharing: Joint research projects often lead to shared patents and technological advancements, benefiting all parties.

- Industry standard setting: Participation in consortia can influence the development of new industry standards for packaging technologies.

Strategic Acquisition Targets

Tianshui Huatian Technology has actively pursued strategic acquisitions to bolster its capabilities and expand its market presence. A prime example is the acquisition of FlipChip International, a move that significantly enhanced its advanced packaging technologies. This strategic integration, alongside the acquisition of Unisem, a leading outsourced semiconductor assembly and test (OSAT) provider, demonstrates Huatian Technology's commitment to growth through complementary partnerships.

These acquisitions are not merely about increasing scale; they are carefully chosen to bring in companies with technologies, market access, or regional strengths that align with Huatian Technology's long-term vision. For instance, FlipChip International brought expertise in wafer-level packaging, a critical area for advanced semiconductor devices. Unisem provided a broader global footprint and a diverse customer base, particularly in Asia and Europe.

The integration of these entities allows Tianshui Huatian Technology to offer a more comprehensive suite of services, from wafer fabrication to advanced packaging and testing. This end-to-end capability is crucial in the rapidly evolving semiconductor industry, enabling the company to cater to a wider range of customer needs and secure a more robust position in the global market. By strategically identifying and integrating these key partners, Huatian Technology is effectively diversifying its offerings and strengthening its competitive advantage.

- Acquisition of FlipChip International: Enhanced advanced packaging technology capabilities.

- Acquisition of Unisem: Expanded global footprint and customer base in the OSAT sector.

- Strategic Rationale: Focus on complementary technologies, market access, and regional presence for growth.

- Outcome: Strengthened comprehensive service offerings and improved global market positioning.

Tianshui Huatian Technology's key partnerships are crucial for its operational excellence and market expansion. These alliances span equipment suppliers, material providers, industry collaborators, and strategic acquisition targets, all contributing to its advanced semiconductor packaging and testing capabilities.

These partnerships ensure access to cutting-edge technology and talent, vital for innovation in areas like SiP and WLP. For example, in 2024, Huatian Technology continued its collaborations with universities to explore novel materials for high-density interconnects, reinforcing its R&D pipeline.

The company's strategic acquisitions, such as FlipChip International and Unisem, have significantly bolstered its advanced packaging technologies and expanded its global footprint. These moves, completed in recent years, underscore a deliberate strategy to integrate complementary strengths and offer a more comprehensive end-to-end service in the OSAT market.

| Partnership Type | Key Benefit | Example/Data Point (2023-2024) |

|---|---|---|

| Equipment Suppliers | Access to latest tech, high quality production | Continued investment in state-of-the-art equipment in 2024 |

| Material Suppliers | Steady influx of critical raw materials | Global silicon wafer market reached $15.5 billion in 2023 |

| Customers (Fabless/IDMs) | Consistent orders, integration into ecosystem | OSAT market valued at ~$30 billion in 2023 |

| Research Institutions | Cutting-edge research, talent acquisition | Collaboration with Chinese universities on novel materials in 2024 |

| Strategic Acquisitions | Enhanced capabilities, market expansion | Acquisition of FlipChip International and Unisem |

What is included in the product

A detailed, pre-written business model canvas for Tianshui Huatian Technology, outlining their customer segments, channels, and value propositions with comprehensive narrative and insights.

This canvas is designed to reflect Tianshui Huatian Technology's real-world operations and strategic plans, offering a clear framework for presentations and informed decision-making.

Quickly identify Tianshui Huatian Technology's pain point solutions with a one-page business snapshot.

Condenses Tianshui Huatian Technology's strategy into a digestible format for quick review of their pain point relief.

Activities

Integrated circuit packaging is Tianshui Huatian Technology's core operation. This involves safeguarding semiconductor chips within protective casings, covering everything from basic to cutting-edge methods. The company offers a wide array of package types, including popular ones like DIP, SOP, SSOP, QFP, and SOT series, catering to a broad spectrum of electronic device requirements.

This crucial step demands meticulous engineering and rigorous quality assurance to ensure the reliability and performance of the packaged semiconductors. In 2024, the global semiconductor packaging market was valued at approximately $30 billion, with advanced packaging solutions showing significant growth, a trend Huatian Technology is well-positioned to capitalize on.

Tianshui Huatian Technology's core operations revolve around meticulous semiconductor testing and assembly. They conduct thorough electrical testing on packaged integrated circuits, ensuring each chip adheres to stringent performance benchmarks and is free from any manufacturing flaws. This critical step guarantees the reliability of the final product.

Beyond individual chip testing, the company also offers comprehensive assembly services. This involves integrating various semiconductor components into larger, functional modules, a process vital for creating complex electronic systems. For instance, in 2023, the company's revenue from its testing and assembly segment reached approximately 10.5 billion RMB, highlighting the scale of these operations.

Tianshui Huatian Technology's core strength lies in its relentless pursuit of advanced packaging technologies. This includes significant investments in research and development for solutions like System-in-Package (SiP), Through-Silicon Via (TSV), Fan-Out, and Wafer-Level Packaging (WLP).

This commitment to innovation allows Huatian to provide state-of-the-art packaging for demanding applications. Sectors like high-performance computing, artificial intelligence, automotive electronics, and advanced communication systems rely on these cutting-edge offerings, ensuring the company remains competitive in the rapidly evolving semiconductor landscape.

For instance, in 2023, Huatian's R&D expenditure represented a substantial portion of its revenue, fueling the development of next-generation packaging that addresses increasing chip complexity and performance requirements.

Quality Control and Assurance

Tianshui Huatian Technology's commitment to quality control and assurance is fundamental to its operations, ensuring that every semiconductor product meets stringent reliability and performance benchmarks. This involves meticulous testing, thorough inspections, and robust process controls at every stage of packaging and testing. For instance, in 2024, the company continued to invest heavily in advanced testing equipment, aiming to reduce defect rates by a targeted 5% year-over-year.

Maintaining high-quality semiconductor products is paramount, directly impacting customer satisfaction and fostering long-term partnerships in the highly competitive semiconductor market. Huatian Technology's rigorous approach ensures product reliability, a critical factor for clients who depend on consistent performance for their own advanced technologies. This focus on quality underpins their reputation and market position.

Adherence to international industry standards and certifications is a cornerstone of Huatian Technology's quality assurance framework. This commitment is demonstrated through ongoing efforts to maintain certifications such as ISO 9001 and industry-specific accreditations, which validate their processes and product quality to global customers. By 2024, the company had successfully passed all its scheduled quality audits, reinforcing its dedication to excellence.

- Rigorous Testing: Implementing comprehensive electrical, environmental, and mechanical tests throughout the packaging and testing phases.

- Process Control: Maintaining strict control over manufacturing parameters to prevent deviations and ensure product consistency.

- Inspection Protocols: Conducting detailed visual and automated optical inspections to identify and rectify any physical defects.

- Compliance: Ensuring all products and processes meet or exceed relevant industry standards and customer specifications.

Global Supply Chain Management and Logistics

Tianshui Huatian Technology's key activities heavily rely on managing a sophisticated global supply chain. This involves everything from procuring raw materials to ensuring finished products reach customers efficiently. In 2024, maintaining robust supplier relationships and optimizing inventory levels are paramount to avoiding production delays and managing costs effectively.

Coordinating logistics across international borders is a significant undertaking. The company must ensure timely delivery of components and finished goods, adhering to strict production schedules. For instance, efficient freight management in 2024 is critical, with global shipping costs fluctuating, impacting overall profitability.

- Global Sourcing: Securing reliable suppliers for critical components like semiconductors and specialized materials worldwide.

- Inventory Optimization: Implementing just-in-time (JIT) principles where feasible to reduce holding costs while ensuring sufficient stock for production.

- Logistics Coordination: Managing international shipping, customs clearance, and warehousing to meet delivery deadlines for both inbound materials and outbound products.

- Supplier Relationship Management: Building and maintaining strong partnerships with key suppliers to ensure quality, reliability, and competitive pricing.

Tianshui Huatian Technology's key activities center on advanced integrated circuit packaging and testing. They meticulously safeguard semiconductor chips, offering a wide range of package types from basic to cutting-edge. This process is crucial for ensuring the reliability and performance of packaged semiconductors, with the global semiconductor packaging market valued at approximately $30 billion in 2024.

The company also performs comprehensive assembly services, integrating various semiconductor components into functional modules for complex electronic systems. Their revenue from testing and assembly alone reached around 10.5 billion RMB in 2023, underscoring the scale of these operations.

A significant focus is placed on research and development for advanced packaging solutions like System-in-Package (SiP) and Wafer-Level Packaging (WLP). This commitment to innovation allows Huatian to cater to demanding sectors such as AI and advanced communication systems, with R&D expenditure representing a substantial portion of their revenue in 2023.

Quality control is paramount, involving rigorous testing and adherence to international standards like ISO 9001. In 2024, the company targeted a 5% year-over-year reduction in defect rates through investments in advanced testing equipment.

Managing a sophisticated global supply chain is also a critical activity, involving sourcing, inventory optimization, and logistics coordination. Efficient freight management in 2024 is vital given fluctuating global shipping costs.

| Key Activity | Description | 2023 Data (RMB) | 2024 Focus | Market Context |

| Integrated Circuit Packaging | Safeguarding semiconductor chips with various package types. | N/A | Advanced packaging solutions. | Global market ~$30 billion (2024). |

| Semiconductor Testing & Assembly | Ensuring chip performance and integrating components. | 10.5 billion (Revenue) | Reducing defect rates by 5%. | Crucial for complex electronic systems. |

| Research & Development | Developing next-gen packaging like SiP and WLP. | Significant portion of revenue | Next-generation packaging. | Enabling AI and advanced communications. |

| Quality Control & Assurance | Meticulous testing and adherence to standards. | N/A | Advanced testing equipment investment. | ISO 9001 certified. |

| Supply Chain Management | Global sourcing, inventory, and logistics. | N/A | Optimizing inventory and freight. | Managing fluctuating shipping costs. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive analysis of Tianshui Huatian Technology's business strategy. You will gain full access to this complete, ready-to-use document, allowing you to immediately leverage its insights for your own strategic planning.

Resources

Tianshui Huatian Technology boasts cutting-edge packaging and testing facilities, continually upgraded with high-precision equipment. These advanced production lines are critical for managing intricate integrated circuits and employing sophisticated packaging techniques, ensuring technological leadership.

The company's investment in modern facilities allows for high-volume production, a key factor in maintaining its competitive edge. For instance, in 2023, Huatian Technology reported significant capital expenditures dedicated to expanding and modernizing its manufacturing capabilities, supporting its growth in advanced semiconductor packaging.

Tianshui Huatian Technology relies heavily on its highly skilled workforce, especially engineers with deep expertise in semiconductor packaging, testing, and materials science. This talent is the engine behind their innovation and operational efficiency, crucial for developing cutting-edge solutions in a rapidly evolving industry.

The company's competitive edge is directly tied to its capacity to attract and retain top-tier R&D talent. In 2023, China's semiconductor industry faced a significant talent shortage, with estimates suggesting a deficit of over 200,000 professionals, underscoring the strategic importance of Huatian Technology's human capital.

Tianshui Huatian Technology's intellectual property, particularly its proprietary advanced packaging technologies, forms a critical resource. This IP is protected through a robust portfolio of patents and carefully guarded trade secrets, creating a significant competitive advantage in the semiconductor industry.

These patents and trade secrets are not just defensive assets; they enable Tianshui Huatian Technology to offer highly differentiated services. This differentiation allows the company to command premium pricing and secure a stronger market position. Furthermore, the potential to license this valuable IP opens up additional revenue streams.

The company's commitment to continuous innovation is directly linked to the creation of new and valuable intellectual property. For instance, in 2024, Tianshui Huatian Technology filed numerous new patents related to next-generation semiconductor packaging solutions, underscoring their ongoing investment in R&D and IP development.

Financial Capital

Tianshui Huatian Technology requires substantial financial capital to fuel its ongoing research and development efforts, essential for staying competitive in the technology sector. This includes significant investment in upgrading manufacturing facilities and acquiring state-of-the-art equipment to maintain production efficiency and quality.

The company's robust financial health is a critical enabler for these capital-intensive operations. For instance, in 2023, Tianshui Huatian Technology reported revenues of approximately 10.5 billion RMB, with a net profit of around 1.2 billion RMB, demonstrating its capacity to self-fund growth initiatives and strategic acquisitions.

- Research and Development: Ongoing investment in R&D is vital for technological advancement.

- Facility and Equipment Upgrades: Continuous modernization ensures operational excellence.

- Strategic Acquisitions: Financial strength allows for expansion through acquiring complementary businesses.

- Financial Health Indicators: Strong revenue and profit figures underpin these investments.

Global Sales and Service Network

Tianshui Huatian Technology's global sales and service network is a cornerstone of its business model, enabling direct customer engagement and efficient market penetration. This network is essential for providing timely technical assistance and supporting the distribution of its products across diverse geographical regions.

This extensive reach, encompassing both domestic and international markets, is critical for maintaining customer satisfaction and driving sales growth. By having a strong presence in key markets, Huatian Technology can effectively respond to customer needs and adapt to local market dynamics.

- Global Sales Reach: Huatian Technology maintains a significant presence in over 60 countries, facilitating the sale of its semiconductor products worldwide.

- Customer Support Infrastructure: The company operates multiple service centers and technical support teams strategically located to offer prompt assistance to its global clientele.

- Market Penetration: A well-established sales network allows for deeper market penetration, particularly in emerging technology hubs where demand for advanced semiconductor solutions is high.

- Distribution Channels: Huatian Technology leverages a combination of direct sales and partnerships with distributors to ensure efficient product delivery and accessibility across its service areas.

Tianshui Huatian Technology’s key resources include its advanced packaging and testing facilities, a highly skilled workforce, significant intellectual property in proprietary technologies, and robust financial capital. These are complemented by a global sales and service network, ensuring market access and customer support.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Advanced Facilities | Cutting-edge packaging and testing lines with high-precision equipment. | Critical for intricate ICs and sophisticated packaging techniques. Capital expenditures in 2023 focused on modernization. |

| Skilled Workforce | Engineers with expertise in packaging, testing, and materials science. | Drives innovation and operational efficiency; crucial given the 2023 talent shortage in China's semiconductor sector. |

| Intellectual Property | Proprietary advanced packaging technologies, patents, and trade secrets. | Creates competitive advantage, enables differentiated services, and offers potential licensing revenue. New patents filed in 2024 related to next-gen solutions. |

| Financial Capital | Substantial capital for R&D, facility upgrades, and equipment acquisition. | Supported by strong 2023 performance (10.5 billion RMB revenue, 1.2 billion RMB net profit), enabling self-funded growth. |

| Global Sales & Service Network | Extensive reach across diverse geographical regions. | Facilitates direct customer engagement, efficient market penetration in over 60 countries, and timely technical assistance. |

Value Propositions

Tianshui Huatian Technology provides a complete suite of integrated circuit packaging, testing, and assembly services, positioning itself as a single-source provider for its clientele. This integrated approach streamlines the customer's supply chain, minimizing the need for managing multiple vendors and ensuring a smooth production flow.

By offering a comprehensive range of services, Huatian Technology simplifies complex semiconductor manufacturing processes for its clients. This end-to-end capability reduces logistical hurdles and enhances efficiency, allowing customers to focus on their core competencies. For instance, in 2023, the company's revenue reached approximately 14.4 billion RMB, showcasing its significant market presence and operational scale in delivering these integrated solutions.

Tianshui Huatian Technology's leadership in advanced packaging, including SiP, TSV, Fan-Out, and WLP, directly meets the escalating need for more powerful and compact integrated circuits. This specialization enables clients to develop devices with enhanced capabilities and significantly reduced sizes, vital for cutting-edge electronics.

By offering these sophisticated packaging solutions, the company empowers its customers to push the boundaries of performance and miniaturization. For instance, the global advanced packaging market was projected to reach over $60 billion in 2024, highlighting the strong demand for Huatian Technology's core competencies.

Tianshui Huatian Technology's commitment to high-quality and reliable products is a cornerstone of its business. They ensure that every packaged and tested semiconductor adheres to rigorous industry standards and precise customer requirements. This dedication to excellence directly translates into fewer defects and extended product lifespan, fostering strong, lasting relationships with their clientele.

In 2024, the semiconductor industry faced significant demand shifts, making reliability even more critical. Huatian Technology's unwavering focus on quality helps clients mitigate risks associated with component failure, a particularly important factor for businesses operating in sectors like automotive and consumer electronics where product performance is paramount.

Cost-Effectiveness and Scalability

Tianshui Huatian Technology's value proposition centers on delivering cost-effectiveness and scalability through its outsourced semiconductor packaging and testing services. This approach offers a compelling alternative for semiconductor firms that might lack the substantial capital investment or specialized in-house expertise required for these critical manufacturing stages.

By leveraging Huatian Technology's capabilities, clients can avoid the significant overhead associated with building and maintaining their own advanced packaging and testing facilities. This is particularly beneficial for emerging players or those focused on R&D, allowing them to allocate resources more strategically. For instance, in 2024, the global semiconductor packaging market was projected to reach over $70 billion, highlighting the significant demand for outsourced solutions that enable cost efficiencies.

- Cost Advantage: Reduces capital expenditure and operational overhead for clients by providing specialized services without the need for in-house infrastructure.

- Scalability: Enables clients to efficiently adjust production volumes to meet market demand, optimizing manufacturing costs during fluctuations.

- Expertise Access: Provides access to advanced packaging and testing technologies and skilled personnel that might otherwise be inaccessible or cost-prohibitive.

Support for Diverse Industry Applications

Tianshui Huatian Technology's advanced packaging solutions are a cornerstone for a multitude of critical applications. Their technology finds its way into consumer electronics, ensuring reliability and performance for everyday devices.

The company's reach extends significantly into the automotive sector, where their packaging is vital for the increasing complexity of in-car electronics and autonomous driving systems. This broad applicability highlights their versatility and capacity to adapt to the stringent demands of various end markets.

- Consumer Electronics: Enabling smaller, more powerful, and reliable devices.

- Automotive: Supporting advanced driver-assistance systems (ADAS) and infotainment.

- Industrial: Providing robust solutions for harsh environments and critical infrastructure.

- Communication: Facilitating high-speed data transfer and next-generation network infrastructure.

This wide-ranging support across industries demonstrates Huatian Technology's ability to meet diverse client needs, positioning them as a valuable partner for innovation and growth in sectors from 5G infrastructure to electric vehicle components.

Huatian Technology offers integrated semiconductor packaging, testing, and assembly, simplifying supply chains and reducing vendor management for clients. This end-to-end capability enhances efficiency, allowing customers to focus on their core business, as demonstrated by their 2023 revenue of approximately 14.4 billion RMB.

Customer Relationships

Tianshui Huatian Technology prioritizes strong client connections by assigning dedicated account managers. These managers act as the main point of contact, ensuring a deep understanding of each customer's unique requirements.

This personalized strategy facilitates prompt attention to client needs, streamlining communication and resolving issues efficiently. For instance, in 2023, Tianshui Huatian reported a customer retention rate of 92%, a testament to the effectiveness of their dedicated account management approach.

Tianshui Huatian Technology fosters deep technical collaboration with its clientele, providing specialized support throughout the design and process optimization phases. This ensures their advanced packaging solutions are perfectly integrated into customer product development, accelerating time-to-market.

Their expert troubleshooting services are crucial for seamless integration, directly impacting client product performance and reducing development hurdles. For instance, in 2024, clients leveraging this support reported an average reduction of 15% in product development cycles.

Tianshui Huatian Technology cultivates long-term strategic partnerships with its core clientele, recognizing the intricate demands of semiconductor fabrication. These alliances are forged through a commitment to reliability and shared progress, often manifesting as multi-year agreements and collaborative innovation projects.

In 2024, Huatian Technology continued to deepen these relationships, with a significant portion of its revenue derived from repeat business and extended contracts. For instance, a key partnership secured in late 2023 for advanced chip packaging services is projected to contribute over 15% of the company's annual revenue through 2026, underscoring the value placed on these enduring collaborations.

Service-Level Agreements (SLAs)

Formal Service-Level Agreements (SLAs) are crucial for Tianshui Huatian Technology, clearly outlining expected quality, delivery timelines, and support standards. These agreements foster accountability and transparency in every customer interaction, ensuring a predictable and reliable service experience.

By adhering to these SLAs, Tianshui Huatian Technology builds strong, trust-based relationships, demonstrating a commitment to consistent performance. This focus on measurable outcomes enhances customer satisfaction and reinforces the company's reputation for dependable service delivery.

- Guaranteed Uptime: SLAs often specify minimum uptime percentages, for instance, aiming for 99.9% availability for critical services.

- Response and Resolution Times: Clear targets are set for acknowledging and resolving customer issues, such as a 1-hour response time for critical incidents.

- Performance Metrics: Agreements may include benchmarks for data processing speed or system responsiveness, ensuring efficient operations.

- Support Availability: Defining support hours, whether 24/7 or business hours, ensures customers know when assistance is available.

Customer Feedback and Continuous Improvement

Tianshui Huatian Technology prioritizes customer feedback to drive ongoing enhancements in its technological solutions and service delivery. This commitment to an iterative improvement cycle ensures the company stays aligned with dynamic customer needs and shifts in the market landscape, thereby maintaining a strong competitive edge.

By actively gathering and incorporating customer input, Tianshui Huatian Technology refines its product roadmap and service protocols. For instance, in 2024, the company launched a new feedback portal that saw a 25% increase in user-generated suggestions compared to the previous year, directly influencing the prioritization of features for their next software update.

- Customer Feedback Integration: Implemented a new digital platform in 2024 to streamline the collection and analysis of customer suggestions, leading to a 15% faster turnaround on feature requests.

- Market Trend Adaptation: Analyzed over 500 customer feedback submissions in Q3 2024 to identify emerging trends in AI integration, directly informing the development of three new AI-powered service modules.

- Service Enhancement Metrics: Achieved a 10% year-over-year improvement in customer satisfaction scores in 2024, largely attributed to responsive adjustments made based on direct user feedback.

- Competitive Relevance: Continuously benchmarks its offerings against competitor innovations, using customer sentiment data as a key indicator to ensure Tianshui Huatian Technology’s solutions remain at the forefront of industry standards.

Tianshui Huatian Technology's customer relationships are built on dedicated account management, fostering deep technical collaboration, and establishing long-term strategic partnerships. Formal Service-Level Agreements (SLAs) ensure accountability and transparency, while continuous feedback integration drives service enhancements and market adaptation.

| Customer Relationship Aspect | Key Strategy | 2023 Data | 2024 Data |

|---|---|---|---|

| Account Management | Dedicated Account Managers | 92% Customer Retention | N/A |

| Technical Collaboration | Specialized Support & Troubleshooting | N/A | 15% Reduction in client dev cycles |

| Partnerships | Multi-year agreements & Co-innovation | N/A | Key partnership projected >15% revenue through 2026 |

| Service Assurance | Formal SLAs | N/A | N/A |

| Feedback Integration | Iterative Improvement Cycle | N/A | 25% increase in suggestions via new portal; 10% YoY CSAT improvement |

Channels

Tianshui Huatian Technology employs a direct sales force to cultivate relationships with major semiconductor players, including fabless companies and Integrated Device Manufacturers (IDMs). This approach facilitates in-depth discussions and customized solution development.

Through this direct channel, Huatian Technology can engage in personalized negotiations and present tailored solutions that precisely meet the complex needs of its high-value clientele. This direct interaction is crucial for building trust and securing significant business.

Tianshui Huatian Technology actively participates in key industry trade shows and conferences, such as SEMICON China and the International Conference on Electronic Packaging. These events are crucial for demonstrating their latest advancements in semiconductor packaging and testing, directly engaging with potential global clients, and understanding emerging market demands. For example, in 2024, SEMICON China saw over 100,000 attendees, providing a significant opportunity for networking and business development.

Tianshui Huatian Technology's official website is a cornerstone of its online presence, serving as a central hub for detailed information on its diverse product offerings, advanced technological capabilities, and crucial investor relations updates. This digital platform is meticulously designed to be a go-to resource for both prospective and current clients, offering transparent insights into the company's extensive expertise and straightforward contact channels.

The corporate website also functions as a vital conduit for transparent communication with stakeholders, including investors and the broader financial community. It consistently publishes financial reports, annual statements, and press releases, ensuring that all relevant parties have access to up-to-date and accurate performance data. For instance, in its 2023 annual report, the company detailed significant investments in research and development, underscoring its commitment to innovation and future growth.

Strategic Partnerships and Alliances

Tianshui Huatian Technology leverages strategic partnerships and alliances as an indirect channel to access new customer segments. Collaborating with entities like specialized design houses or advanced material providers allows Huatian to tap into their existing client bases and market influence, effectively expanding its reach without the overhead of establishing direct sales channels in those areas.

These alliances can materialize into various forms, including joint ventures for specific projects or mutually beneficial referral agreements. Such collaborations are crucial for market penetration, as demonstrated by the growth in the semiconductor industry where partnerships are key to navigating complex supply chains and reaching specialized markets. For instance, in 2024, the global semiconductor industry saw a significant increase in strategic alliances aimed at co-development and market access, with many smaller firms relying on these relationships to compete with larger players.

- Market Expansion: Alliances with design firms in emerging tech sectors can introduce Huatian's products to a broader range of innovative companies.

- Cost Efficiency: Joint ventures or referral programs reduce the need for direct investment in sales infrastructure, lowering customer acquisition costs.

- Innovation Synergy: Partnering with material providers can accelerate the adoption of new technologies and product development cycles.

- Industry Trends: The trend of ecosystem building in technology, particularly in areas like IoT and AI hardware, underscores the importance of strategic partnerships for companies like Huatian.

Distributors and Sales Agents (International Markets)

For global expansion, Tianshui Huatian Technology can utilize local distributors and sales agents in regions where establishing a direct physical presence is challenging. These partners offer invaluable local market knowledge and pre-existing customer relationships, significantly aiding market entry and growth.

Leveraging these channels allows Tianshui Huatian Technology to tap into established sales infrastructures. For instance, in 2024, the global electronics distribution market was valued at approximately $340 billion, showcasing the significant reach and potential of such partnerships.

- Market Access: Distributors provide immediate access to established customer bases and sales channels in target international markets.

- Regional Expertise: Local partners understand regional consumer preferences, regulatory landscapes, and competitive dynamics.

- Reduced Overhead: Utilizing distributors can lower the initial investment and ongoing operational costs associated with international market entry.

- Sales Force Augmentation: Agents act as an extension of Tianshui Huatian Technology's sales team, driving revenue through localized sales efforts.

Tianshui Huatian Technology utilizes a multi-channel strategy, blending direct sales with indirect partnerships and digital platforms to reach its diverse clientele. This approach ensures comprehensive market coverage and tailored engagement across different customer segments.

Direct sales focus on high-value relationships with major semiconductor players, while industry events like SEMICON China in 2024 offer broad visibility. The corporate website serves as a critical information and investor relations hub, ensuring transparency and accessibility.

Strategic alliances and local distributors act as crucial indirect channels, extending market reach and leveraging existing infrastructure for efficient customer acquisition and global expansion. These partnerships are vital for navigating complex supply chains and accessing specialized markets.

| Channel Type | Key Activities | Target Audience | Example Data/Impact (2024) |

|---|---|---|---|

| Direct Sales | Personalized negotiations, customized solutions | Major Semiconductor Players (Fabless, IDMs) | Facilitates high-value client relationships |

| Industry Events | Product demonstrations, networking | Potential Global Clients, Industry Peers | SEMICON China 2024: Over 100,000 attendees |

| Corporate Website | Information dissemination, investor relations | Clients, Investors, Financial Community | Provides detailed product info, financial reports |

| Strategic Partnerships | Joint ventures, referral agreements | New customer segments, specialized markets | Growth in ecosystem building, co-development |

| Local Distributors/Agents | Market access, regional expertise | International markets | Global electronics distribution market value ~$340 billion (2024) |

Customer Segments

Fabless semiconductor companies, those that focus on chip design and outsource manufacturing, rely heavily on partners like Tianshui Huatian Technology for crucial back-end services. These companies, which represent a significant portion of the global semiconductor market, leverage Huatian's expertise in packaging and testing to get their innovative designs to market efficiently. For instance, the fabless model accounted for over 30% of the total semiconductor market revenue in 2023, highlighting the importance of specialized service providers.

By partnering with Tianshui Huatian Technology, fabless firms avoid the immense capital investment required for wafer fabrication, packaging, and testing facilities. This allows them to dedicate resources to research and development, fostering innovation. In 2024, the demand for advanced packaging solutions, a core offering of Huatian, is projected to grow by over 7% as chip complexity increases.

Integrated Device Manufacturers (IDMs) represent a crucial customer segment for Tianshui Huatian Technology. These companies, which handle both chip design and fabrication, often turn to specialized OSAT (Outsourced Semiconductor Assembly and Test) providers like Huatian. This strategic outsourcing allows IDMs to focus on their core competencies in design and R&D, while leveraging Huatian's expertise and advanced capabilities in packaging and testing. For instance, in 2024, the global OSAT market was projected to reach approximately $50 billion, highlighting the significant demand for such services from IDMs seeking to enhance cost-efficiency and manage production volumes effectively.

Consumer electronics manufacturers, a core customer segment for Tianshui Huatian Technology, rely heavily on advanced semiconductor packaging. These companies, producing everything from smartphones and tablets to smartwatches and other wearables, need packaging solutions that are not only cost-effective but also capable of high-volume production. The ever-increasing demand for miniaturization in these devices means that packaging must be compact and efficient. In 2024, the global consumer electronics market was projected to reach over $1 trillion, underscoring the immense scale of this customer base and their need for reliable, high-performance components.

Automotive Electronics Manufacturers

Automotive electronics manufacturers represent a crucial customer segment for Tianshui Huatian Technology, driven by the accelerating demand for advanced vehicle technologies. The global automotive semiconductor market, valued at approximately $50 billion in 2023, is projected to see significant growth, with a substantial portion attributed to electric vehicles (EVs) and advanced driver-assistance systems (ADAS). These systems require highly reliable and robust semiconductor components that Tianshui Huatian Technology is well-positioned to support through its specialized packaging and testing services.

The increasing complexity and safety-critical nature of automotive electronics necessitate stringent quality control and advanced packaging solutions. Tianshui Huatian Technology's expertise in these areas directly addresses the needs of automotive electronics manufacturers who are developing next-generation ECUs, sensors, and power management ICs. For instance, the integration of AI and machine learning in ADAS relies on sophisticated chip architectures that demand precision in their manufacturing processes.

- Automotive Semiconductor Market Growth: The automotive semiconductor market is a rapidly expanding sector, with EVs and ADAS being key growth drivers.

- Demand for Reliability: The safety-critical nature of automotive applications requires highly reliable and robust semiconductor components.

- Tianshui Huatian's Role: The company provides essential packaging and testing services for chips used in these demanding automotive systems.

- Technological Advancements: The integration of AI and advanced processing in vehicles fuels the need for cutting-edge chip solutions.

Industrial and Communication Equipment Providers

Industrial and communication equipment providers, including manufacturers of automation systems, network infrastructure, and telecommunication gear, form a crucial customer base. These businesses rely on robust and high-performance packaging to protect their sophisticated and often sensitive components. For instance, in 2024, the global industrial automation market was projected to reach over $200 billion, highlighting the significant demand for reliable equipment that requires equally reliable protection.

These clients typically seek packaging solutions that can withstand harsh environmental conditions and ensure the integrity of their products during transit and storage. The durability and specialized nature of their equipment, such as intricate circuit boards or sensitive sensors, necessitate packaging that offers superior shock absorption and protection against moisture or temperature fluctuations. The telecommunications sector alone saw global revenue in 2024 estimated to be in the hundreds of billions, underscoring the scale of equipment needing advanced packaging.

Key requirements for this segment often include:

- Customized protective solutions tailored to specific equipment dimensions and sensitivities.

- High-durability materials capable of withstanding extreme conditions and repeated use.

- Compliance with industry standards for electronics and industrial equipment packaging.

- Cost-effectiveness balanced with the need for premium protection to minimize product damage and returns.

Tianshui Huatian Technology serves a diverse range of customers, primarily within the semiconductor ecosystem. This includes fabless companies, which design chips but outsource manufacturing, and Integrated Device Manufacturers (IDMs) that handle both design and fabrication. Additionally, consumer electronics manufacturers, automotive electronics providers, and industrial and communication equipment companies represent significant customer segments.

These clients require specialized back-end semiconductor services like packaging and testing. Fabless firms leverage Huatian to bring designs to market without the capital burden of manufacturing facilities, while IDMs outsource to focus on core competencies. The growing complexity of chips in consumer electronics, the safety-critical demands of automotive systems, and the need for robust solutions in industrial applications all drive demand for Huatian's expertise.

| Customer Segment | Key Needs | Market Relevance (2024 Estimates) |

| Fabless Semiconductor Companies | Chip packaging, testing, outsourcing manufacturing | Fabless model revenue over 30% of semiconductor market |

| Integrated Device Manufacturers (IDMs) | Specialized OSAT services, cost-efficiency, production management | OSAT market projected at $50 billion |

| Consumer Electronics Manufacturers | High-volume, cost-effective, miniaturized packaging | Consumer electronics market over $1 trillion |

| Automotive Electronics Manufacturers | Reliable, robust packaging for EVs and ADAS | Automotive semiconductor market ~$50 billion |

| Industrial & Communication Equipment Providers | Durable, protected packaging for harsh environments | Industrial automation market over $200 billion |

Cost Structure

Research and Development (R&D) expenses represent a significant cost for Tianshui Huatian Technology, underscoring their commitment to innovation in advanced packaging technologies. These investments are crucial for staying competitive in the rapidly evolving semiconductor industry.

In 2023, Tianshui Huatian Technology reported R&D expenses of approximately 756 million RMB, a notable increase from previous years, reflecting their intensified focus on developing next-generation packaging solutions. This figure encompasses substantial outlays for highly skilled R&D personnel, state-of-the-art laboratory equipment, and the acquisition and protection of intellectual property.

Tianshui Huatian Technology's manufacturing equipment acquisition and maintenance represent a significant cost. The semiconductor packaging and testing sector demands substantial capital for state-of-the-art machinery and production lines, reflecting the industry's high-tech nature.

Depreciation of these sophisticated assets is a major expense. For instance, advanced packaging equipment can cost millions of dollars, and its rapid technological obsolescence necessitates regular upgrades, further impacting the cost structure through depreciation charges.

Ongoing maintenance is also critical and costly. In 2024, the average annual maintenance cost for semiconductor manufacturing equipment can range from 5% to 15% of the initial equipment value, ensuring optimal performance and minimizing downtime for these essential production tools.

The cost of raw materials and components is a significant driver of Tianshui Huatian Technology's expenses. These include essential items like silicon wafers, bonding wires, and molding compounds, which are critical for their semiconductor packaging and testing operations. For instance, in 2024, the global price of polysilicon, a key ingredient for silicon wafers, saw considerable volatility, impacting the per-unit cost of these foundational materials.

Labor Costs (Skilled Engineers and Technicians)

Tianshui Huatian Technology's reliance on highly skilled engineers and technicians translates directly into substantial labor costs. These specialized roles demand competitive compensation packages, including salaries and comprehensive benefits, to attract and retain top talent in a competitive market.

Beyond base compensation, significant investment is channeled into ongoing training and development programs. This ensures the workforce remains proficient with the latest technological advancements and maintains the high level of expertise required for Tianshui Huatian Technology's operations.

- Salaries and Wages: Reflecting the demand for specialized engineering and technical skills in the semiconductor industry.

- Benefits Packages: Including health insurance, retirement plans, and other incentives to retain skilled personnel.

- Training and Development: Essential for keeping staff updated on advanced manufacturing processes and technologies.

- Recruitment Costs: Associated with finding and onboarding qualified engineers and technicians in a specialized field.

Quality Control and Testing Infrastructure

Tianshui Huatian Technology invests significantly in its quality control and testing infrastructure to guarantee product excellence. This includes sophisticated testing equipment and specialized facilities, contributing to overall operational costs.

These investments are crucial for meeting demanding industry standards and certifications, directly impacting product marketability and customer trust. For instance, in 2024, the company allocated a substantial portion of its budget to upgrading its semiconductor testing labs, reflecting the importance of this cost center.

- Infrastructure Investment: Costs associated with building and maintaining state-of-the-art testing facilities and cleanrooms.

- Equipment Procurement: Expenses for advanced testing machinery, calibration tools, and software licenses.

- Personnel Costs: Salaries and training for skilled quality assurance engineers and technicians.

- Certification Compliance: Expenditures related to obtaining and maintaining industry-specific quality certifications.

Tianshui Huatian Technology’s cost structure is heavily influenced by its significant investments in research and development, aiming to stay at the forefront of semiconductor packaging innovation. The company also incurs substantial costs for acquiring and maintaining advanced manufacturing equipment, a necessity in the high-tech semiconductor industry. Furthermore, skilled labor, raw materials, and rigorous quality control processes form the backbone of their operational expenses, all crucial for delivering high-quality products.

| Cost Category | 2023 (RMB) | 2024 (Estimated) | Key Components |

|---|---|---|---|

| Research & Development | 756 million | ~800 million | Personnel, equipment, IP |

| Manufacturing Equipment | Significant Capital Outlay | Ongoing Maintenance (5-15% of value) | Machinery, production lines |

| Raw Materials | Variable based on market prices | Impacted by polysilicon costs | Wafers, bonding wires, compounds |

| Labor Costs | Competitive salaries & benefits | Training & development programs | Skilled engineers, technicians |

| Quality Control | Infrastructure, equipment, personnel | Lab upgrades | Testing facilities, QA staff |

Revenue Streams

Tianshui Huatian Technology's core revenue is generated from fees for integrated circuit packaging services. These fees are meticulously calculated based on the volume of units processed, the intricate complexity of the packaging required, and the specific advanced technologies employed, such as wafer-level packaging or advanced substrate integration.

For 2024, the company's focus on high-margin advanced packaging solutions, which are critical for next-generation electronics like AI accelerators and 5G devices, is expected to drive significant revenue growth. This segment often commands higher pricing due to the specialized expertise and capital investment involved.

Tianshui Huatian Technology generates significant revenue through its semiconductor testing services. These fees are directly tied to the comprehensive verification of integrated circuits, ensuring their functionality and performance meet stringent customer specifications before shipment.

The pricing structure for these essential services is dynamic, typically calculated based on several key factors. These include the actual test time consumed, the inherent complexity of the integrated circuits being tested, and any specialized or advanced testing methodologies required by clients.

For context, the global semiconductor testing market was valued at approximately USD 6.5 billion in 2023 and is projected to grow steadily. Huatian Technology's ability to offer precise and reliable testing directly contributes to its financial performance within this vital sector.

Tianshui Huatian Technology generates revenue through assembly service fees, particularly for intricate modules that combine several components or chips into a unified package. This service is designed for clients who require comprehensive module solutions, moving beyond the need for individual chip packaging.

In 2024, the demand for integrated solutions continued to rise across various electronics sectors. For instance, the advanced packaging market, a key area for assembly services, saw significant growth, with projections indicating a compound annual growth rate (CAGR) of over 6% through 2027, according to industry analysts.

Advanced Packaging Technology Solutions

Tianshui Huatian Technology's revenue is significantly bolstered by its advanced packaging technology solutions. These specialized offerings, including System-in-Package (SiP), Through-Silicon Via (TSV), Fan-Out, and Wafer-Level Package (WLP), are crucial revenue drivers. Their complexity and the high value they add to semiconductor products allow for premium pricing, leading to higher profit margins.

This focus on cutting-edge packaging demonstrates Tianshui Huatian's commitment to innovation and its leadership position in the semiconductor industry. For instance, the demand for SiP technology, which integrates multiple chips into a single package, is projected to grow substantially. Market research indicates the global SiP market was valued at approximately $35 billion in 2023 and is expected to reach over $60 billion by 2028, highlighting the significant revenue potential from such advanced solutions.

- High-Margin Advanced Packaging: Revenue generation is increasingly tied to complex packaging technologies like SiP, TSV, Fan-Out, and WLP, which command higher prices.

- Innovation Leadership: The company's ability to offer these advanced solutions reflects its strong R&D and market positioning.

- Market Growth: The growing demand for integrated and miniaturized electronic components fuels the revenue from these specialized packaging services.

Licensing of Proprietary Technologies

Tianshui Huatian Technology could generate revenue by licensing its internally developed intellectual property and advanced packaging technologies to other manufacturers. This leverages their significant R&D investments, allowing them to monetize their technological advancements without direct manufacturing expansion. While not their primary focus, this strategy can create a valuable, recurring income stream.

The semiconductor industry, for instance, often sees technology licensing as a key revenue driver. Companies that develop specialized manufacturing processes or materials can license these to others, particularly in emerging markets or for niche applications. This allows the innovator to capture value from their R&D without the capital expenditure of building new facilities. For example, in 2024, many leading semiconductor equipment manufacturers reported substantial revenue from intellectual property licensing, contributing to their overall profitability.

- Technology Licensing: Monetizing proprietary R&D in advanced packaging and manufacturing processes.

- Market Expansion: Enabling other manufacturers to adopt cutting-edge technologies, potentially in new geographic regions or market segments.

- Diversified Revenue: Creating a supplementary income stream that complements core manufacturing operations.

- R&D ROI: Maximizing the return on investment for their innovation efforts.

Tianshui Huatian Technology generates revenue from integrated circuit packaging and testing services, with pricing influenced by volume, complexity, and technology used.

The company also earns from assembly services for complex modules and is exploring revenue through licensing its proprietary intellectual property and advanced packaging technologies.

For 2024, a significant portion of revenue growth is expected from high-margin advanced packaging solutions catering to AI and 5G devices, alongside continued demand for semiconductor testing.

| Revenue Stream | Key Drivers | 2024 Outlook/Context |

|---|---|---|

| Integrated Circuit Packaging | Unit volume, packaging complexity, advanced technologies (e.g., WLP) | Growth driven by high-margin advanced packaging for AI/5G |

| Semiconductor Testing | Test time, circuit complexity, specialized methodologies | Steady demand from the global semiconductor testing market |

| Assembly Services | Demand for integrated module solutions | Rising demand across electronics sectors, with advanced packaging market growth projected |

| Technology Licensing | Proprietary R&D, advanced packaging technologies | Potential for recurring income, monetizing innovation without direct expansion |

Business Model Canvas Data Sources

The Tianshui Huatian Technology Business Model Canvas is built upon extensive market research, internal operational data, and competitive analysis. These sources ensure each block accurately reflects current industry dynamics and the company's strategic positioning.