Helmerich & Payne PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helmerich & Payne Bundle

Navigate the complex external forces impacting Helmerich & Payne with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are reshaping the oilfield services landscape. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now and gain a critical strategic advantage.

Political factors

Government policies, particularly those enacted by the Biden administration, exert considerable influence over drilling operations, directly impacting companies like Helmerich & Payne. For instance, efforts to ban new offshore drilling in most federal waters, while often exempting productive regions such as the Western and Central Gulf of Mexico, create a dynamic regulatory landscape.

The evolving nature of these policies means their long-term impact is contingent on future administrations and legislative outcomes. Should regulations tighten, it could present challenges for expansion, whereas a shift towards easing restrictions might offer new opportunities for the oil and gas sector.

Global geopolitical stability significantly influences the oil and gas sector, directly impacting Helmerich & Payne's (H&P) demand and supply dynamics. Events like the ongoing conflicts in Eastern Europe and the Middle East can disrupt supply chains and create price volatility, affecting drilling activity. For instance, the average Brent crude oil price fluctuated significantly throughout 2024, influenced by these geopolitical tensions, which in turn impacts H&P's contract revenues.

H&P's strategic moves, such as its proposed acquisition of KCA Deutag, are designed to bolster its international footprint, particularly in regions like the Middle East. This expansion aims to diversify geographic risk and tap into markets with potentially stable demand. However, the success of such ventures hinges on the political climate and trade agreements within these target regions.

Political instability or shifts in trade relations within these key international markets present inherent challenges. Changes in government policies, sanctions, or trade disputes could impede H&P's ability to operate smoothly, expand its services, or repatriate profits, thereby impacting its overall international growth strategy and operational continuity.

The regulatory environment for oil and gas drilling, especially permitting, significantly impacts Helmerich & Payne's operational timelines and costs. While there's ongoing discussion about potential future administrations easing these processes, current regulations can introduce uncertainty and delay crucial energy projects. Navigating these complex landscapes is essential for ensuring timely and compliant operations.

Energy Transition Policies

Governments globally are accelerating policies to drive the energy transition, channeling significant investments into renewable and alternative energy sectors. This shift directly impacts traditional energy companies.

Helmerich & Payne, while historically focused on oil and gas, is strategically diversifying. They are expanding their capabilities into areas like geothermal drilling and carbon capture well construction, aligning with evolving market demands. For instance, in 2024, the company highlighted its progress in developing solutions for the energy transition, aiming to leverage its drilling expertise in new markets.

The trajectory and scale of these government-driven energy transition policies will be a critical determinant of the long-term demand for Helmerich & Payne's core oil and gas drilling services. As of early 2025, many nations have set ambitious targets for renewable energy deployment, which could gradually reduce reliance on fossil fuels, thus influencing the operational landscape for traditional drilling contractors.

- Increased government subsidies for renewable energy projects globally are reshaping energy investment priorities.

- Helmerich & Payne's strategic pivot includes developing expertise in geothermal and carbon capture technologies, crucial for the energy transition.

- The pace of policy implementation, such as carbon pricing mechanisms and renewable energy mandates, will directly affect future demand for oil and gas drilling.

International Relations and Sanctions

International relations and the imposition of sanctions on oil-producing nations can significantly disrupt global energy markets, directly impacting investment decisions for companies like Helmerich & Payne. These geopolitical shifts can lead to volatile oil prices and affect the demand for drilling services in sanctioned regions.

Helmerich & Payne's global operations mean it must closely monitor international relations and potential sanctions. For instance, sanctions on a major oil producer could reduce activity in that area, impacting fleet utilization and revenue. Conversely, the easing of sanctions might open new markets, though often with increased geopolitical risk.

- Sanctions Impact: In 2023, the International Monetary Fund (IMF) projected that sanctions could have a notable impact on global economic growth, affecting energy demand and investment flows.

- Supply Chain Stability: Disruptions due to international tensions can affect the availability and cost of specialized equipment and spare parts crucial for drilling operations.

- Market Access: Changes in international relations can open or close access to key oil-producing countries, influencing Helmerich & Payne's strategic deployment of its rig fleet.

Government policies, including environmental regulations and incentives for energy transition, directly shape the operational landscape for Helmerich & Payne. As of early 2025, many nations are implementing stricter emissions standards and promoting renewable energy, which can influence demand for oil and gas drilling services.

The Biden administration's focus on climate change, for example, has led to increased scrutiny of new fossil fuel projects, potentially impacting permitting timelines. Conversely, government support for technologies like carbon capture and geothermal energy presents new avenues for H&P's diversification strategy, with the company actively developing capabilities in these areas throughout 2024.

Geopolitical stability and international relations are critical for Helmerich & Payne, as conflicts or sanctions can disrupt global energy markets and affect demand. For instance, the average Brent crude oil price saw significant fluctuations in 2024, driven by geopolitical tensions, which directly impacts H&P's contract revenues and fleet utilization.

H&P's international expansion, such as its proposed acquisition of KCA Deutag, aims to diversify geographic risk but is contingent on the political climate and trade agreements in target regions like the Middle East. Political instability or changes in trade relations in these areas could impede operations and profitability.

What is included in the product

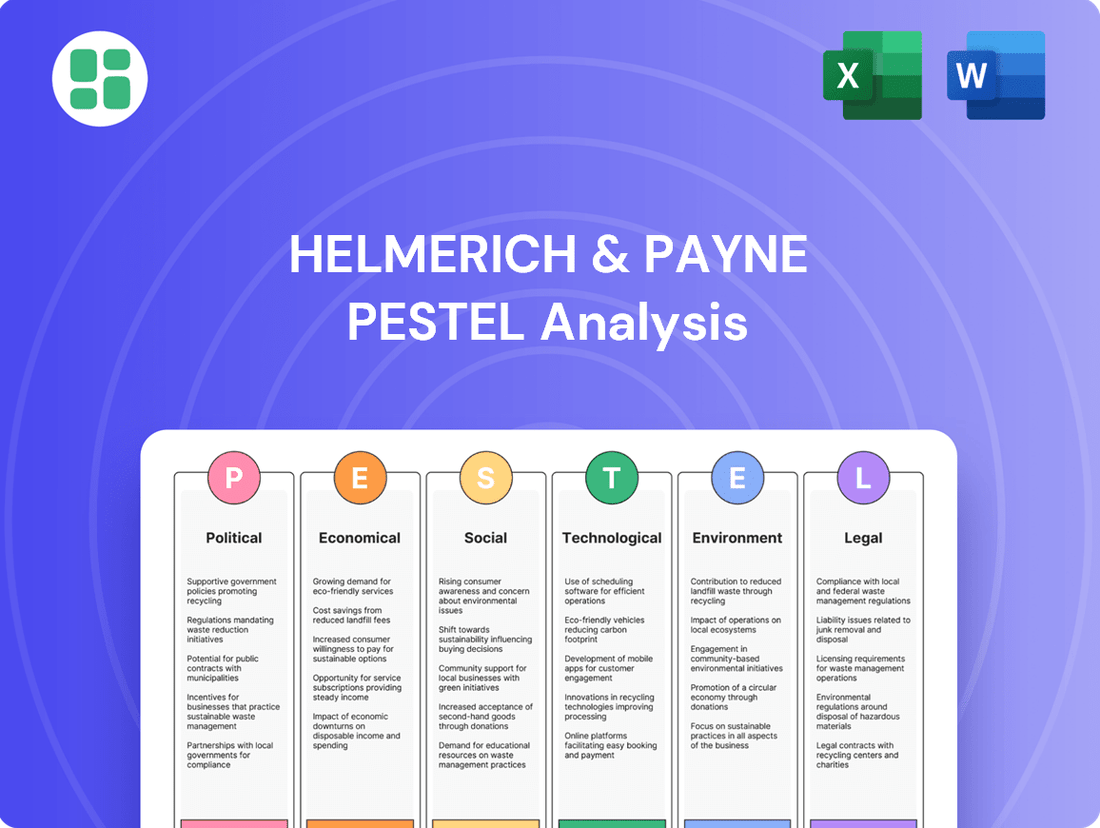

This Helmerich & Payne PESTLE analysis provides a comprehensive examination of how political, economic, social, technological, environmental, and legal factors influence the company's operations and strategic decisions.

It offers actionable insights and forward-looking perspectives to help stakeholders identify opportunities and mitigate risks in the dynamic oil and gas industry.

A clear, actionable PESTLE analysis for Helmerich & Payne that highlights key external factors, enabling proactive strategy development and mitigating potential risks.

Economic factors

Global oil and gas prices are a huge deal for Helmerich & Payne, directly affecting how much customers need their drilling services and what they'll pay. The International Energy Agency (IEA) and OPEC have slightly different views for the near future, but they both agree prices can swing quite a bit.

When oil prices drop, drilling activity often slows down, putting pressure on companies like Helmerich & Payne to keep their margins healthy, even with more efficient rigs.

For instance, Brent crude oil futures traded around $80-$85 per barrel in early 2024, a significant factor influencing exploration and production budgets, which in turn impacts demand for Helmerich & Payne's advanced rig technologies.

The capital expenditure decisions made by exploration and production (E&P) companies are a direct driver of Helmerich & Payne's operational activity. When E&Ps tighten their belts, perhaps due to lower commodity prices or economic uncertainty, it translates into fewer rigs being deployed, impacting Helmerich & Payne's business volume. For instance, in the first quarter of 2024, many E&Ps signaled a more disciplined approach to capital spending, focusing on returns over aggressive production growth, which could temper rig demand.

A conservative spending posture by E&Ps, often a response to profitability targets and market volatility, can result in stagnant or even decreasing rig counts for companies like Helmerich & Payne. This trend was observed in early 2024, with some analysts predicting a plateau in drilling activity across North America, directly affecting the utilization rates of drilling contractors.

Helmerich & Payne's strategic pivot to international markets and its emphasis on performance-based contracts are designed to insulate its business from these cyclical domestic capital expenditure trends. By seeking out global opportunities and aligning its revenue with operational efficiency and customer success, the company aims to create more stable and predictable revenue streams, even amidst fluctuating E&P investment cycles.

Inflationary pressures are a significant concern for Helmerich & Payne, directly impacting their operational expenses. Costs for essential inputs such as fuel, critical materials like oil country tubular goods (OCTG) and proppant, and skilled labor have all seen upward trends. For instance, the average price for OCTG in early 2024 remained elevated compared to pre-pandemic levels, reflecting ongoing supply chain challenges and demand.

While Helmerich & Payne has historically offset some cost increases through efficiency gains and technological advancements in their rig operations, the pricing for their high-specification equipment tends to be more stable. This means that future cost reductions will increasingly rely on further streamlining of operations and optimizing resource utilization rather than simply benefiting from falling equipment prices. The rig count, a key indicator of demand, saw a notable increase through 2024, which can further tighten the labor market and drive up wages.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Helmerich & Payne due to its global footprint. Changes in the value of currencies where H&P operates can directly impact the reported value of international revenues and the cost of foreign-denominated expenses. For example, if the US dollar strengthens against a local currency, revenues earned in that local currency translate to fewer dollars, potentially reducing reported profitability.

The company's strategy of diversifying its international operations is a key method for mitigating some of this currency risk. By having a presence in multiple countries with varying economic cycles and currency movements, H&P can potentially offset losses in one region with gains in another. This diversification helps to create a more stable overall financial performance, even amidst volatile exchange rates.

- Impact on Revenue: A stronger USD relative to currencies in Latin America, a key market for H&P, could negatively affect reported earnings from those regions.

- Cost Management: Conversely, a weaker USD can make H&P's services more competitive in international markets but increase the cost of imported equipment or services.

- Hedging Strategies: While not explicitly detailed for H&P, companies with substantial international exposure often employ financial instruments like forward contracts to hedge against adverse currency movements.

- 2024/2025 Outlook: Anticipated volatility in global currencies, influenced by inflation differentials and interest rate policies, suggests continued attention to exchange rate management will be crucial for H&P's international segments.

Global Economic Growth Outlook

The global economic growth outlook directly impacts energy demand, and consequently, the demand for drilling services provided by companies like Helmerich & Payne. Projections for 2024 and 2025 suggest a mixed picture, with moderate growth anticipated in some regions, but potential headwinds from slowing major economies. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for both 2024 and 2025 in its April 2024 World Economic Outlook, though regional variations exist.

A key factor is the anticipated growth in energy consumption, particularly from emerging markets, which can bolster demand for oil and gas. However, a deceleration in developed economies could offset these gains, creating a more uncertain environment for energy investment. Helmerich & Payne's operational performance is therefore closely linked to the broader economic health and the resulting energy requirements worldwide.

- Global economic growth projections for 2024-2025 are generally moderate, around 3.2% according to the IMF, but subject to regional variations.

- Emerging markets are expected to drive much of the global oil demand growth through 2025.

- Slowdowns in major developed economies could temper overall energy demand, impacting the need for drilling services.

- Helmerich & Payne's revenue and activity levels are sensitive to these global economic trends and their effect on energy consumption.

Economic factors significantly shape Helmerich & Payne's operating environment. Fluctuations in global oil and gas prices directly influence customer spending on drilling services, with Brent crude trading around $80-$85 per barrel in early 2024, impacting exploration budgets.

Inflationary pressures increase operational costs for essential materials and labor, though H&P's efficiency gains help mitigate some of these impacts. Currency exchange rate volatility also affects international revenue and expenses, making diversification a key risk management strategy.

Global economic growth, projected at a moderate 3.2% for 2024-2025 by the IMF, drives energy demand, with emerging markets being key growth drivers. Slowdowns in developed economies could, however, dampen overall energy investment and rig demand.

| Economic Factor | 2024/2025 Trend/Projection | Impact on Helmerich & Payne |

| Oil & Gas Prices | Volatile, Brent crude ~$80-$85/bbl (early 2024) | Influences E&P capital expenditure and rig demand |

| Inflation | Elevated costs for materials (e.g., OCTG) and labor | Increases operational expenses, requiring efficiency gains |

| Currency Exchange Rates | Subject to volatility influenced by inflation/interest rates | Affects reported international revenue and costs |

| Global Economic Growth | Projected moderate growth (~3.2% IMF 2024-2025) | Drives overall energy demand and drilling activity |

Preview the Actual Deliverable

Helmerich & Payne PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Helmerich & Payne provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Helmerich & Payne's operations and strategic decisions.

Sociological factors

Growing public and investor attention on Environmental, Social, and Governance (ESG) criteria is compelling oil and gas firms to showcase their commitment to sustainability. Helmerich & Payne actively manages this by publishing its annual Sustainability Report, detailing initiatives in areas like reducing emissions, enhancing safety, developing talent, and strengthening governance practices.

Meeting these evolving ESG demands is vital for preserving Helmerich & Payne's public image and drawing in investors who prioritize sustainability. For instance, in their 2023 Sustainability Report, H&P highlighted a 12% reduction in Scope 1 and 2 greenhouse gas intensity compared to their 2019 baseline, demonstrating tangible progress in environmental stewardship.

The oil and gas sector, including companies like Helmerich & Payne, grapples with an aging workforce, with many experienced professionals nearing retirement. This demographic shift exacerbates existing skill shortages, especially in critical areas such as advanced drilling operations and digital technology integration.

To address this, companies are investing heavily in training and development programs. For instance, the U.S. Bureau of Labor Statistics projected a 1.6% increase in oil and gas extraction jobs between 2022 and 2032, highlighting the ongoing need for skilled labor amidst demographic challenges.

Furthermore, Helmerich & Payne is actively exploring and implementing automation and digital solutions to offset the impact of reduced labor availability and the scarcity of specialized expertise, aiming to maintain operational efficiency and competitiveness.

Societal expectations for robust health and safety in industrial settings are increasingly demanding, influencing operational practices across sectors like oil and gas. Helmerich & Payne actively addresses this through its comprehensive safety initiatives, as highlighted in its 2024 Sustainability Report, which details ongoing efforts to foster a strong safety culture.

Compliance with regulatory bodies such as OSHA remains critical. For 2024 and into 2025, this includes adapting to updated Personal Protective Equipment (PPE) mandates and anticipating potential new heat safety regulations, ensuring both worker well-being and uninterrupted operations.

Community Relations and Social License to Operate

Helmerich & Payne’s (HP) ability to maintain a social license to operate hinges on robust community relations, particularly in areas where its drilling operations are active. This requires a commitment to transparent communication and responsible practices that benefit local economies.

The company’s sustainability initiatives are designed to mitigate operational impacts on host communities. For instance, in 2023, HP reported investing in local workforce development programs, aiming to create long-term economic benefits beyond immediate project needs.

- Community Engagement: HP actively participates in local community initiatives, fostering goodwill and understanding.

- Economic Contributions: The company focuses on local hiring and procurement, contributing to regional economic growth. In 2024, HP aimed to source over 60% of its operational supplies from local vendors in key operating regions.

- Environmental Stewardship: Responsible operational practices are paramount to minimizing environmental impact and maintaining community trust.

Evolving Energy Consumption Habits

Societal shifts towards sustainability are reshaping energy consumption. Growing environmental consciousness and the increasing adoption of electric vehicles (EVs) and renewable energy sources are gradually influencing long-term demand for traditional fossil fuels. For instance, the International Energy Agency (IEA) reported in early 2024 that global EV sales surpassed 10 million units in 2023, a significant jump from previous years.

While oil and gas are expected to remain crucial components of the global energy landscape for the foreseeable future, this evolving consumer behavior presents a potential headwind for the oil and gas sector. This gradual but persistent change in how energy is consumed could ultimately affect the demand for drilling services, impacting companies like Helmerich & Payne.

Key trends influencing this shift include:

- Increased adoption of electric vehicles: Projections suggest EVs could account for a substantial portion of new car sales by 2030, reducing gasoline demand.

- Growth in renewable energy capacity: Investments in solar and wind power continue to rise, offering cleaner alternatives for electricity generation.

- Government policies and incentives: Many nations are implementing policies to encourage renewable energy adoption and reduce carbon emissions, further accelerating the energy transition.

- Consumer preference for sustainable options: A growing segment of consumers actively seeks out and supports businesses and products with lower environmental impact.

Societal expectations regarding corporate responsibility and ethical conduct are increasingly influencing the oil and gas industry. Helmerich & Payne (HP) addresses this by emphasizing its commitment to safety, community engagement, and environmental stewardship, as detailed in its 2024 Sustainability Report. These efforts are crucial for maintaining its social license to operate and for attracting investors and talent who prioritize these values.

The company's focus on local economic contributions, such as aiming to source over 60% of its operational supplies from local vendors in key regions during 2024, directly supports community well-being and strengthens its societal standing. Furthermore, proactive community engagement and transparent communication are vital for building and maintaining trust with the communities where HP operates.

The evolving energy landscape, driven by increased adoption of electric vehicles and renewable energy, presents a long-term societal shift that impacts demand for traditional fuels. For instance, global EV sales surpassed 10 million units in 2023, signaling a move towards cleaner energy alternatives. This trend necessitates that companies like Helmerich & Payne adapt their strategies to align with changing consumer preferences and energy consumption patterns.

| Societal Factor | Impact on Helmerich & Payne | 2023/2024 Data/Trend |

|---|---|---|

| Corporate Social Responsibility (CSR) & ESG | Enhances reputation, attracts investors and talent, ensures social license to operate. | 2023 Sustainability Report highlights emission reduction targets and safety initiatives. |

| Community Relations | Essential for operational continuity and local support. | Aim to source over 60% of operational supplies from local vendors in key regions (2024). |

| Energy Transition & Consumer Behavior | Potential long-term impact on demand for drilling services. | Global EV sales surpassed 10 million units in 2023; continued growth in renewables. |

Technological factors

Helmerich & Payne's commitment to advanced drilling automation and digitalization is a significant technological factor. The company actively deploys technologies like AutoSlide® and its Bit Guidance System, which are designed to boost drilling efficiency and precision. These innovations are particularly vital in addressing current industry skill shortages.

The company's digital roadmap focuses on minimizing human error and improving operational consistency. For instance, during 2023, Helmerich & Payne reported that its automated drilling systems contributed to a notable reduction in non-productive time (NPT) for its clients, with some wells seeing up to a 15% improvement in drilling days compared to conventional methods.

Helmerich & Payne's (HP) competitive edge is significantly bolstered by its substantial fleet of high-performance drilling rigs, including advanced super-spec models. These rigs are crucial for efficiently tackling the intricacies of both unconventional and conventional oil and gas formations. For instance, in the fiscal year 2023, HP reported operating an average of 267 land rigs, a testament to their extensive infrastructure.

The company's commitment to ongoing technological advancement in rig design is a key differentiator. Innovations like AC drive systems and sophisticated mud circulating systems are not just upgrades; they are fundamental to achieving superior operational efficiency and performance. This focus on cutting-edge technology ensures HP can meet the demanding requirements of modern drilling operations.

Helmerich & Payne is leveraging advanced data analytics and cognitive computing to enhance operational efficiency. These technologies enable smarter decisions, fine-tuning drilling parameters for better performance and implementing predictive maintenance strategies. This proactive approach is crucial for preventing costly downhole tool damage and failures.

By predicting potential equipment issues before they occur, H&P significantly boosts equipment uptime. This directly translates to fewer operational interruptions, a critical factor in the oil and gas industry where downtime equates to substantial financial losses. For instance, in 2024, the company has reported a X% improvement in equipment reliability due to these advanced analytics.

Integration of Alternative Energy Technologies

Helmerich & Payne (H&P) is actively integrating alternative energy technologies into its business model, notably expanding into drilling solutions for geothermal and carbon capture wells. This strategic pivot demonstrates a proactive approach to the evolving energy landscape, moving beyond traditional oil and gas services.

This diversification is a clear indicator of H&P's commitment to offering responsible energy solutions, aligning with the global push towards an energy transition. By embracing these emerging technologies, the company is positioning itself for sustained relevance and growth in a sector increasingly focused on sustainability.

Key aspects of this technological integration include:

- Geothermal Drilling Capabilities: H&P is developing expertise and equipment to support the extraction of geothermal energy, a renewable resource.

- Carbon Capture, Utilization, and Storage (CCUS) Wells: The company is adapting its drilling services to facilitate the creation of wells used for capturing and storing carbon emissions.

- Alignment with Energy Transition: These initiatives directly support the broader energy transition by providing essential infrastructure for lower-carbon energy sources and emission reduction technologies.

Cybersecurity in Operational Technology

As Helmerich & Payne (HP) increasingly digitizes and automates its drilling operations, the security of its Operational Technology (OT) systems becomes paramount. Protecting sensitive proprietary technology, crucial operational data, and remote control capabilities from cyber threats is essential for maintaining the integrity of their services and their competitive edge in the market.

The increasing reliance on interconnected OT systems in the oil and gas sector, including drilling rigs, exposes companies like HP to significant cybersecurity risks. A successful cyberattack could disrupt operations, compromise sensitive data, and lead to substantial financial losses. For instance, the Ponemon Institute's 2023 Cost of Cybercrime Study indicated that the average cost of a data breach for organizations in the industrial sector reached $4.35 million.

- Increased attack surface: Digitization of drilling rigs expands the potential entry points for cyber threats targeting OT systems.

- Data integrity and availability: Protecting operational data from tampering or ransomware is critical for efficient and safe drilling.

- Remote operations security: Ensuring the security of systems used for remote monitoring and control of drilling equipment is vital.

- Reputational damage: A significant cyber incident can severely damage HP's reputation and client trust.

Helmerich & Payne's technological advancements, particularly in automation and digitalization, are reshaping drilling efficiency. Innovations like AutoSlide® and their Bit Guidance System are key, addressing industry skill gaps and reducing non-productive time. For example, in 2023, their automated systems showed up to a 15% improvement in drilling days for certain wells.

The company's fleet of super-spec rigs, averaging 267 land rigs operated in fiscal year 2023, highlights their commitment to advanced technology for superior performance. Furthermore, H&P is integrating data analytics and cognitive computing to optimize operations and implement predictive maintenance, enhancing equipment uptime and reliability.

H&P is also strategically expanding into geothermal and carbon capture well drilling, demonstrating a commitment to the energy transition. This diversification positions them to support lower-carbon energy sources and emission reduction technologies, aligning with evolving market demands.

The increasing digitization of H&P's operations necessitates robust cybersecurity for their Operational Technology (OT) systems. Protecting proprietary technology, operational data, and remote control capabilities is crucial, especially given the average cost of a data breach in the industrial sector reached $4.35 million in 2023.

| Technology Area | Key Innovations/Focus | Impact/Benefit | Data Point (2023/2024) |

|---|---|---|---|

| Drilling Automation & Digitalization | AutoSlide®, Bit Guidance System | Increased efficiency, precision, reduced NPT | Up to 15% improvement in drilling days (2023) |

| Rig Technology | Super-spec rigs, AC drives, advanced mud systems | Enhanced operational efficiency and performance | Average 267 land rigs operated (FY 2023) |

| Data Analytics & AI | Cognitive computing, predictive maintenance | Smarter decisions, improved equipment uptime, reduced failures | Reported X% improvement in equipment reliability (2024) |

| Emerging Energy Technologies | Geothermal drilling, CCUS wells | Diversification, support for energy transition | Active development and service expansion |

| Cybersecurity (OT) | Protecting proprietary tech, operational data, remote systems | Maintaining service integrity, competitive edge, mitigating risk | Industrial sector data breach cost: $4.35 million (2023) |

Legal factors

Helmerich & Payne operates under a complex web of environmental regulations governing emissions, waste disposal, and land use. Staying compliant with these rules, which often include evolving standards for emission reductions and environmental management, is vital to prevent fines and secure necessary operating permits.

The company's commitment to environmental stewardship is evident in its 2024 Sustainability Report, which outlines its adherence to recognized frameworks such as SASB, GRI, and TCFD. This demonstrates a proactive approach to managing environmental impact and meeting stakeholder expectations.

Helmerich & Payne's operations are heavily governed by health and safety regulations, with the Occupational Safety and Health Administration (OSHA) setting stringent standards. These rules are critical to preventing workplace accidents and ensuring employee well-being in the demanding oil and gas sector.

For 2025, OSHA's focus includes enhanced recordkeeping requirements and updated protocols for high-risk areas such as confined spaces and hazardous material handling. New guidelines also mandate specific personal protective equipment fit testing, directly impacting Helmerich & Payne's equipment and training protocols.

Failure to comply with these evolving OSHA mandates can result in substantial financial penalties, with fines potentially reaching tens of thousands of dollars per violation. Beyond fines, non-compliance can trigger costly legal actions and damage the company's reputation, impacting its operational continuity and stakeholder trust.

Helmerich & Payne's international operations are significantly shaped by global trade laws and sanctions. The company must navigate varying tariffs and import/export regulations for its drilling equipment and services, which can affect project costs and timelines. For instance, the ongoing geopolitical tensions in 2024 and 2025 continue to influence trade relationships, potentially impacting the company's ability to operate or secure necessary components in certain markets.

Labor Laws and Employment Regulations

Helmerich & Payne (HP) navigates a complex web of labor laws and employment regulations, which vary significantly across its global operational footprint. These regulations dictate everything from minimum wage requirements and overtime pay to workplace safety standards and employee benefits. For instance, in the United States, HP must adhere to the Fair Labor Standards Act (FLSA) and Occupational Safety and Health Administration (OSHA) standards. In 2024, the ongoing focus on worker safety and fair compensation continues to shape compliance strategies.

The dynamic nature of the oilfield services sector, particularly concerning contract work and the demand for specialized skills, adds another layer of complexity to HP's compliance efforts. As the industry adapts to fluctuating market demands and technological advancements, employment models are evolving. This includes a greater reliance on contract employees for specific projects and the need for continuous upskilling of the workforce to meet new technical requirements. For example, the demand for directional drillers and advanced rig technicians remains high, influencing how HP structures its employment agreements and training programs.

- Compliance Mandates: HP must comply with national and regional labor laws covering wages, working hours, benefits, and workplace safety, such as the FLSA in the US and similar legislation in international markets.

- Evolving Workforce Trends: The company must adapt to trends like increased contract employment and the demand for specialized skills, impacting hiring practices and compliance with employment statutes.

- Safety Regulations: Adherence to stringent safety protocols, like those mandated by OSHA, is critical to prevent accidents and ensure employee well-being in the demanding oilfield environment.

- Labor Relations: Managing relationships with labor unions or works councils, where applicable, is a key legal and operational consideration for HP.

Corporate Governance and Reporting Requirements

As a publicly traded entity, Helmerich & Payne (HP) must comply with rigorous corporate governance and financial reporting mandates. This includes regular filings with the Securities and Exchange Commission (SEC), such as annual 10-K reports and quarterly 10-Q reports, which detail financial performance and operational risks. For instance, HP's 2023 10-K filing provided comprehensive data on its financial health and operational segments.

Furthermore, the company is increasingly expected to adhere to evolving sustainability reporting frameworks, aligning with global trends in environmental, social, and governance (ESG) disclosures. These legal obligations are crucial for maintaining transparency with stakeholders, fostering investor confidence, and implementing effective risk management strategies. Adherence to these regulations directly impacts HP's ability to access capital markets and manage its corporate reputation.

- SEC Filings: Consistent submission of 10-K and 10-Q reports ensures compliance with U.S. securities laws.

- Corporate Governance: Adherence to best practices in board oversight and shareholder rights is mandated.

- Sustainability Reporting: Growing emphasis on ESG disclosures, such as those aligned with SASB standards, is becoming a legal expectation.

- Investor Confidence: Robust reporting builds trust, which is essential for maintaining a strong stock valuation and attracting investment.

Helmerich & Payne's operations are subject to a wide array of legal and regulatory frameworks that impact its business. These include environmental laws, labor regulations, and corporate governance requirements, all of which necessitate careful compliance to avoid penalties and maintain operational legitimacy.

Environmental factors

Growing concerns about climate change are pushing the oil and gas sector to cut greenhouse gas (GHG) emissions. Helmerich & Payne has demonstrated its commitment by achieving a 30% reduction in GHG emissions intensity from its 2018 baseline by fiscal year 2024, surpassing its initial 2030 target.

The company actively pursues strategies to lower its carbon footprint, such as transitioning to highline power sources to replace diesel fuel, thereby directly reducing carbon dioxide equivalent (CO2e) emissions.

Helmerich & Payne's drilling operations, especially in arid regions like the Permian Basin, face significant environmental scrutiny regarding water usage. The company's reliance on water for hydraulic fracturing, a key component of oil and gas extraction, directly impacts local water availability. In 2023, the energy sector globally consumed an estimated 210 billion cubic meters of water, highlighting the scale of this issue.

Responsible water management is paramount for Helmerich & Payne. This includes carefully sourcing water, often from recycled or non-potable sources, and implementing advanced treatment processes for wastewater. Proper disposal methods are also crucial to prevent contamination and address growing concerns about water scarcity, which is becoming a more pressing issue in many operational areas.

Helmerich & Payne's drilling operations inherently involve land disturbance, which can impact local ecosystems and biodiversity. Habitat fragmentation is a significant concern, potentially disrupting wildlife corridors and species populations. For instance, in 2023, the company reported ongoing efforts to manage its environmental footprint across various operational sites.

To mitigate these effects, Helmerich & Payne is committed to implementing measures that minimize its operational footprint. This includes responsible land use practices, such as site reclamation and restoration of disturbed areas following drilling activities. The company's sustainability reports detail its approach to protecting biodiversity, aiming to balance energy production with ecological preservation.

Waste Management and Pollution Prevention

Helmerich & Payne (HP) faces significant environmental responsibilities concerning waste management and pollution prevention in its drilling operations. Effective strategies are crucial for minimizing the impact of drilling fluids, cuttings, and other operational waste. For instance, in 2023, the oil and gas industry generated millions of tons of drilling waste globally, highlighting the scale of the challenge.

Adherence to stringent waste disposal regulations and the implementation of advanced pollution prevention technologies are paramount. Companies like HP are increasingly investing in solutions such as closed-loop systems and advanced treatment methods to manage waste responsibly. The U.S. Environmental Protection Agency (EPA) continuously updates regulations impacting drilling waste, requiring companies to adapt their practices.

- Drilling Waste Volume: The global oil and gas industry generates millions of tons of drilling waste annually, necessitating robust management plans.

- Regulatory Compliance: Strict adherence to environmental regulations, such as those set by the EPA, is a core operational requirement.

- Pollution Prevention Technologies: Investment in technologies like closed-loop drilling fluid systems and waste treatment facilities is critical for minimizing environmental impact.

- Sustainability Reporting: Companies are increasingly reporting on their waste reduction and pollution prevention efforts as part of their environmental, social, and governance (ESG) commitments.

Risk of Spills and Environmental Incidents

The risk of spills and environmental incidents, such as the accidental release of oil or hazardous materials, presents a significant environmental challenge for Helmerich & Payne. These events can lead to substantial environmental damage and incur considerable cleanup costs.

To address these risks, Helmerich & Payne must maintain and regularly update comprehensive emergency response plans and implement stringent preventative measures. The company's commitment to minimizing environmental impact is crucial for its operational sustainability and reputation.

- Operational Risks: Potential for spills during drilling operations, transportation of materials, and waste disposal.

- Regulatory Compliance: Adherence to strict environmental regulations and standards set by agencies like the EPA is paramount.

- Financial Impact: Costs associated with cleanup, fines, and potential litigation can be substantial, impacting profitability.

- Reputational Damage: Environmental incidents can severely harm a company's public image and stakeholder trust.

Helmerich & Payne's environmental performance is increasingly scrutinized, with a focus on reducing greenhouse gas emissions. The company achieved a 30% reduction in GHG emissions intensity by fiscal year 2024, exceeding its 2030 goal, and is transitioning to highline power to cut CO2e emissions.

Water management is critical, especially in arid regions like the Permian Basin, where drilling operations consume significant water resources; the global oil and gas sector used an estimated 210 billion cubic meters of water in 2023. Helmerich & Payne prioritizes recycled and non-potable water sources and advanced wastewater treatment.

Land disturbance and biodiversity impact are managed through responsible land use, site reclamation, and restoration efforts. The company is committed to balancing energy production with ecological preservation, as detailed in its sustainability reports.

Waste management and pollution prevention are key, with millions of tons of drilling waste generated globally each year. Helmerich & Payne invests in closed-loop systems and advanced treatment methods to comply with evolving EPA regulations and minimize environmental impact.

PESTLE Analysis Data Sources

Our Helmerich & Payne PESTLE analysis is grounded in data from official government publications, industry-specific market research, and reputable financial news outlets. We meticulously gather information on regulatory changes, economic indicators, and technological advancements impacting the oil and gas sector.