Helmerich & Payne Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helmerich & Payne Bundle

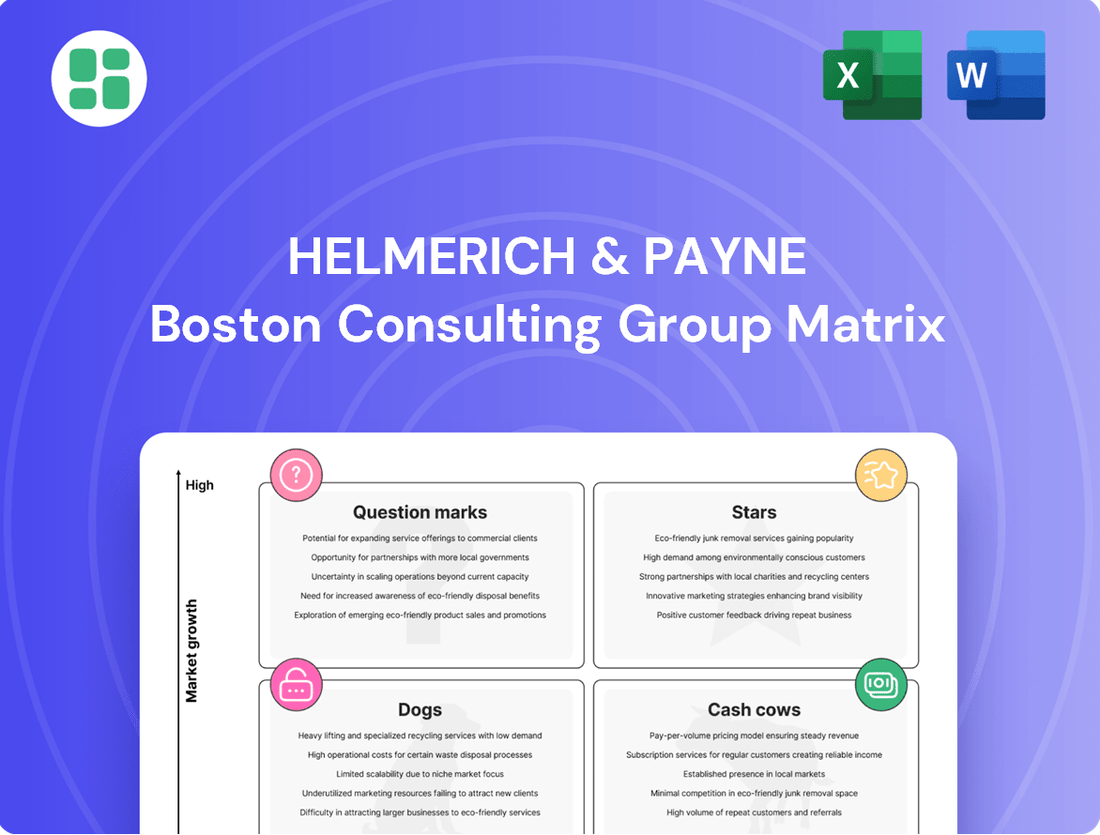

Unlock the strategic potential of Helmerich & Payne's product portfolio with our comprehensive BCG Matrix analysis. See at a glance which segments are driving growth, which are generating steady income, and which might require a strategic rethink.

Don't settle for a partial view. Purchase the full BCG Matrix report to gain detailed quadrant placements, understand the underlying market dynamics, and receive actionable insights to optimize your investment and resource allocation for Helmerich & Payne.

Stars

Helmerich & Payne's High-Performance FlexRigs, often referred to as super-spec rigs, are the company's stars in the BCG matrix. These advanced drilling units hold a commanding position, accounting for roughly one-third of all super-spec rigs operating in the U.S. land market.

These rigs are engineered with sophisticated features such as AC drive systems and high hookload capacities, making them indispensable for the efficient drilling of challenging unconventional wells. This technological edge translates directly into superior productivity and operational efficiency for H&P in the competitive U.S. land drilling sector.

Helmerich & Payne (H&P) distinguishes itself in the oil and gas industry through its commitment to technological innovation, particularly in rig automation and digital solutions. This focus on advanced automation systems is a key differentiator, as operators increasingly seek rigs that offer enhanced productivity and safety.

In 2024, H&P continued to see strong customer demand for its technologically advanced rigs. For instance, the company reported that a significant portion of its operating fleet in the U.S. land market featured its advanced automation capabilities, contributing to improved drilling efficiencies and reduced non-productive time for clients.

H&P's digital technology platform plays a crucial role in delivering greater value to customers by optimizing operational performance. This includes providing real-time data analytics and predictive maintenance, which help customers achieve greater uptime and cost savings. The company’s investment in these areas positions its rig automation and digital solutions as a strong performer within its portfolio.

Helmerich & Payne (H&P) is strategically shifting towards performance-based contracting, moving beyond traditional day-rate structures. This model allows for a base rate with added incentives tied to operational efficiency and project success, directly aligning with customer demands for optimized drilling outcomes.

As of early 2024, approximately 50% of H&P's active U.S. land rig fleet is operating under these performance-based contracts. This significant adoption highlights H&P's strong market position within a rapidly evolving segment of the drilling industry, reflecting a clear move towards value-driven service delivery.

Leading Position in Complex Unconventional Drilling

Helmerich & Payne's leading position in complex unconventional drilling, particularly in the Permian Basin, firmly places it in the Star category of the BCG Matrix. Their market share in this crucial region has grown to an impressive 37%, highlighting their dominance in an area characterized by demanding drilling operations.

The increasing complexity of horizontal shale wells necessitates advanced technology solutions, a niche where H&P's FlexRigs excel. This technological advantage is a key driver of their success and market leadership in a technically challenging segment.

- Market Share Growth: H&P's market share in the Permian Basin reached 37% by early 2024.

- Technological Edge: FlexRigs are specifically designed to handle the complexities of modern horizontal shale wells.

- Industry Demand: The demand for sophisticated drilling technology is high due to the increasing technical requirements of unconventional plays.

- Strategic Positioning: This leadership in a high-growth, technically demanding segment solidifies H&P's Star status.

Optimized Drilling for Extended Laterals

The industry's push for longer horizontal wells, known as extended laterals, requires specialized drilling equipment and sophisticated methods. Helmerich & Payne (H&P) is well-positioned to meet this demand with its advanced rig fleet and integrated drilling solutions.

H&P's FlexRig technology, designed for efficiency and precision, is particularly suited for the complexities of drilling extended laterals. This focus allows them to secure a significant portion of this lucrative and expanding market segment.

- Extended Laterals Demand: The trend for longer horizontal sections in unconventional wells is a key industry driver, increasing the need for advanced drilling capabilities.

- H&P's Advantage: H&P's FlexRigs and integrated solutions are engineered to efficiently handle the demands of these extended lateral wells.

- Market Position: This specialization enables H&P to maintain a leading position in a high-value and growing segment of the drilling market.

- 2024 Data Context: In 2024, the average lateral length for new unconventional wells continued to increase, with many operators targeting lengths exceeding 10,000 feet, a segment where H&P's optimized rigs excel.

Helmerich & Payne's advanced FlexRigs are its stars, dominating the super-spec rig market in the U.S. land sector. These rigs, accounting for about a third of all super-spec units, are crucial for drilling complex unconventional wells efficiently. This technological superiority translates into enhanced productivity for H&P.

By early 2024, H&P's market share in the Permian Basin reached 37%, underscoring its leadership in demanding drilling environments. The increasing trend towards extended laterals, with wells often exceeding 10,000 feet in 2024, further solidifies the demand for H&P's specialized FlexRig technology, positioning them strongly in this high-value market segment.

| Rig Type | Market Position | Key Features | 2024 Relevance |

|---|---|---|---|

| FlexRigs (Super-Spec) | Star | AC Drive, High Hookload, Advanced Automation | Dominant in U.S. Land, Essential for Extended Laterals |

| U.S. Land Market Share | N/A | ~33% of Super-Spec Rigs | Indicates strong industry presence |

| Permian Basin Share | N/A | 37% (early 2024) | Highlights leadership in demanding regions |

What is included in the product

This BCG Matrix overview analyzes Helmerich & Payne's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic recommendations on investment, holding, or divesting each segment based on market share and growth.

A clear, one-page overview of Helmerich & Payne's business units within the BCG Matrix, instantly clarifying strategic priorities.

Cash Cows

Helmerich & Payne's (H&P) Established U.S. Land Drilling Fleet, primarily within its North America Solutions (NAS) segment, functions as a classic Cash Cow. As of March 31, 2025, this segment boasted 224 land rigs in the United States, a testament to its significant market presence.

Despite a challenging market where the overall U.S. rig count saw a decline of approximately 5% in fiscal 2024, H&P's NAS segment not only maintained its operational rig count but also expanded its market share. This resilience highlights the segment's robust competitive advantages and operational excellence.

The mature nature of the U.S. land drilling market, coupled with H&P's strong competitive positioning and high operational efficiency, ensures that this fleet consistently generates stable and predictable cash flows, making it a vital Cash Cow for the company.

Helmerich & Payne's mature U.S. operations are clearly its cash cows, consistently generating substantial profits. In the third fiscal quarter of 2025, the North America Solutions segment alone posted a direct margin of $266 million, a testament to its robust performance. This segment is the backbone of H&P's financial strength, accounting for a significant 88% of the company's revenue in fiscal 2023.

These established U.S. activities are remarkably efficient, producing more cash than is needed for their own upkeep and expansion. This surplus cash flow is crucial, as it provides the financial fuel for H&P to invest in other business areas and reward its shareholders through dividends and buybacks. The company's commitment to maintaining a 50% gross margin within this segment further underscores its status as a reliable source of capital.

Helmerich & Payne's Offshore Solutions segment, bolstered by the acquisition of KCA Deutag's offshore management contract operations, acts as a reliable Cash Cow. This segment consistently generates steady cash flows, primarily from its established presence in the U.S. Gulf of Mexico.

As a prominent global provider of offshore operations and platform maintenance, the Offshore Solutions segment thrives in a mature, low-growth market. Its predictable performance is a significant contributor to the company's overall financial stability.

Legacy Conventional Drilling Services

Helmerich & Payne's legacy conventional drilling services function as a Cash Cow within the BCG Matrix. While the company's strategic focus is on the higher-growth unconventional market, its substantial fleet still caters to conventional drilling needs. This segment generates a consistent and stable revenue stream from mature, albeit slower-growing, oil and gas fields.

These conventional services leverage H&P's decades of operational experience and existing infrastructure, requiring relatively low capital expenditure for maintenance and market share preservation. For instance, in fiscal year 2023, H&P reported approximately 3,600 active rigs, a significant portion of which are capable of serving conventional plays, contributing to their steady performance.

- Stable Revenue Generation: Conventional drilling services provide a predictable income source, underpinning overall financial stability.

- Low Investment Requirement: Minimal new capital is needed to maintain market position in these established segments.

- Operational Expertise Leverage: H&P's long history in the industry translates to efficient and reliable service delivery in conventional markets.

- Fleet Utilization: The robust fleet, even when not deployed in unconventional plays, ensures consistent utilization and revenue from conventional contracts.

Strong Balance Sheet and Dividend Payouts

Helmerich & Payne's robust financial health, evidenced by its investment-grade credit rating, positions its mature operations as strong cash cows. As of June 30, 2025, the company held $187 million in cash and short-term investments, complemented by an undrawn $950 million credit facility, underscoring its financial stability and capacity for shareholder returns.

The company's commitment to consistent dividend payouts further solidifies its cash cow status. This practice highlights the reliable generation of excess cash from its established business segments, allowing for direct shareholder value enhancement.

- Financial Strength: Investment-grade credit rating and substantial liquidity.

- Shareholder Returns: Consistent dividend payouts signal strong cash flow generation.

- Operational Maturity: Established segments reliably produce excess cash.

Helmerich & Payne's (H&P) North America Solutions (NAS) segment, representing its U.S. land drilling fleet, is a prime example of a Cash Cow. This segment, with 224 land rigs in the U.S. as of March 31, 2025, consistently generates stable cash flows due to its mature market position and operational efficiency. Despite a 5% decline in the overall U.S. rig count in fiscal 2024, H&P's NAS segment expanded its market share, demonstrating its competitive strength and ability to produce more cash than required for its own maintenance and growth.

The company's legacy conventional drilling services also function as a Cash Cow. These operations, while in a slower-growing market, leverage H&P's extensive experience and infrastructure. With a significant portion of its approximately 3,600 active rigs in fiscal year 2023 capable of conventional plays, these services provide a predictable revenue stream with minimal new capital investment needed for market share preservation.

H&P's Offshore Solutions segment, particularly its U.S. Gulf of Mexico operations, acts as a reliable Cash Cow. As a global provider of offshore operations and platform maintenance, this segment thrives in a mature, low-growth market, contributing significantly to the company's financial stability with its predictable performance.

The company's overall financial health, including an investment-grade credit rating and substantial liquidity as of June 30, 2025 ($187 million in cash and short-term investments), underscores the Cash Cow status of its mature operations. Consistent dividend payouts further validate this, signaling the reliable generation of excess cash from these established business segments.

| Segment | BCG Category | Key Characteristics | Financial Contribution (Illustrative) |

| North America Solutions (U.S. Land Drilling) | Cash Cow | Mature market, high operational efficiency, market share growth, stable cash flow generation. | Direct margin of $266 million (Q3 FY25), 88% of FY23 revenue. |

| Legacy Conventional Drilling Services | Cash Cow | Established infrastructure, low capital expenditure, consistent revenue from mature fields. | Steady revenue stream from a significant portion of 3,600 active rigs (FY23). |

| Offshore Solutions | Cash Cow | Mature, low-growth market, predictable performance, stable cash flows from U.S. Gulf of Mexico. | Consistent contributor to overall financial stability. |

What You See Is What You Get

Helmerich & Payne BCG Matrix

The Helmerich & Payne BCG Matrix you are previewing is the identical, fully formatted report you will receive upon purchase. This means no watermarks or demo content will be present in the final version, ensuring you get a professional, ready-to-use strategic analysis. The insights and structure you see here are precisely what will be delivered, allowing for immediate application in your business planning. You can confidently expect this document to be the complete, unedited strategic tool you need.

Dogs

Helmerich & Payne's older, conventional rigs, those not benefiting from ongoing technological upgrades, are increasingly becoming a concern. In 2024, the market's preference has shifted decisively towards highly efficient, technologically advanced drilling equipment, leaving these legacy rigs vulnerable.

These outdated assets are likely experiencing significant pressure due to oversupply in the market and downward trends in day rates. Their utilization rates are expected to be low, and their contribution to overall profitability is minimal as the industry demands superior performance from its drilling fleet.

Marginal International Drilling Ventures, prior to the KCA Deutag acquisition, represented Helmerich & Payne's (H&P) question mark in the BCG Matrix. This segment consistently struggled with the weakest operating margins, frequently dipping into negative territory. H&P’s international solutions had failed to capture substantial market share across most global markets.

Continued investment in these ventures, particularly in areas marked by significant geopolitical instability or fierce competition, without a defined strategy for market dominance, would be ill-advised. For instance, in 2023, H&P's international rig count remained a small fraction of its North American operations, highlighting the segment's limited impact and the need for strategic re-evaluation.

Segments of the U.S. oil and gas sector, particularly those in extremely low-activity, mature basins, can be considered Dogs for Helmerich & Payne. These areas are characterized by declining production and limited opportunities for new drilling, often due to persistently low commodity prices or the depletion of economically viable reserves. For instance, while the overall U.S. land rig count saw fluctuations, certain plays within mature basins might remain at minimal activity levels, reflecting the challenges of generating meaningful returns in such environments.

Highly Commoditized Drilling Services

In the highly commoditized drilling services segment, Helmerich & Payne (H&P) faces intense competition. When services offer little differentiation, H&P's offerings may find it challenging to secure premium pricing or consistently high utilization rates. This environment typically yields lower profit margins and limited strategic advantages.

- Low Margins: Highly commoditized services often operate on thin profit margins due to price-based competition.

- Utilization Challenges: With many providers, maintaining high rig utilization can be difficult, impacting revenue generation.

- Limited Differentiation: When services are largely interchangeable, H&P may struggle to stand out and command a premium.

Underperforming Acquired Assets

While the KCA Deutag acquisition by Helmerich & Payne (HP) is a strategic move, some of the newly integrated assets might not be performing as expected. If these acquired units struggle with integration or consistently miss profitability goals, they could turn into costly burdens, draining resources without generating sufficient returns.

The International Solutions segment, for instance, experienced a notable operating loss in the third quarter of 2025. This performance was influenced by the full integration costs of the acquisition and a goodwill impairment charge. Such figures highlight specific areas within the acquired portfolio that require substantial improvement or may need to be considered for divestiture.

- Underperforming Assets: Acquired KCA Deutag units that fail to integrate or meet profit targets can become cash traps.

- Q3 2025 Performance: The International Solutions segment reported a significant operating loss in Q3 2025.

- Contributing Factors: The loss was partly due to acquisition integration costs and a goodwill impairment charge.

- Strategic Review Needed: These underperforming areas necessitate a turnaround strategy or potential divestment.

Helmerich & Payne's older, conventional rigs, those not benefiting from ongoing technological upgrades, are increasingly becoming a concern. In 2024, the market's preference has shifted decisively towards highly efficient, technologically advanced drilling equipment, leaving these legacy rigs vulnerable.

These outdated assets are likely experiencing significant pressure due to oversupply in the market and downward trends in day rates. Their utilization rates are expected to be low, and their contribution to overall profitability is minimal as the industry demands superior performance from its drilling fleet.

Segments of the U.S. oil and gas sector, particularly those in extremely low-activity, mature basins, can be considered Dogs for Helmerich & Payne. These areas are characterized by declining production and limited opportunities for new drilling, often due to persistently low commodity prices or the depletion of economically viable reserves. For instance, while the overall U.S. land rig count saw fluctuations, certain plays within mature basins might remain at minimal activity levels, reflecting the challenges of generating meaningful returns in such environments.

In the highly commoditized drilling services segment, Helmerich & Payne (H&P) faces intense competition. When services offer little differentiation, H&P's offerings may find it challenging to secure premium pricing or consistently high utilization rates. This environment typically yields lower profit margins and limited strategic advantages.

| Category | Description | 2024 Outlook | Key Challenges | Example |

| Legacy Rigs | Older, conventional drilling units | Low utilization, declining day rates | Technological obsolescence, market preference shift | Unupgraded rigs in mature basins |

| Commoditized Services | Drilling services with little differentiation | Price-based competition, thin margins | Intense competition, difficulty commanding premium pricing | Standard drilling operations in highly competitive markets |

Question Marks

Helmerich & Payne's (H&P) expansion into Saudi Arabia with super-spec FlexRigs for unconventional natural gas projects positions them in a high-growth area. This strategic move, however, reflects an investment phase where market share is still being built, and initial operational costs are being absorbed.

The International Solutions segment's operating loss in Q3 2025, partly due to the KCA Deutag acquisition, underscores the significant upfront investment required for entering and scaling operations in new international unconventional drilling markets like Saudi Arabia.

The acquisition of KCA Deutag in January 2025 propelled Helmerich & Payne (H&P) into a global onshore drilling powerhouse. This strategic move, however, places the integrated entity's International Solutions segment squarely in the question mark category of the BCG matrix. With an operating loss reported for this segment post-acquisition, it's a cash consumer, demanding significant investment for integration and operational optimization to unlock its high growth potential.

Helmerich & Payne (H&P) is strategically expanding into geothermal drilling, a move that positions them to capitalize on the growing demand for renewable energy solutions. This diversification into an emerging market, while requiring substantial investment, offers significant long-term growth potential as the world prioritizes sustainability and energy transition. H&P's existing expertise in drilling technology provides a strong foundation for this new venture, though their current market share in geothermal is likely minimal.

New Market Entries in Emerging International Regions

Helmerich & Payne's strategic push into new emerging international markets, aiming for regions with high growth potential but limited current presence, aligns with the characteristics of a Question Mark in the BCG Matrix. These ventures require significant capital outlay for equipment, skilled labor, and market cultivation, often before generating substantial revenue. For instance, in 2024, H&P has been actively exploring opportunities in regions like Southeast Asia and parts of Africa, where the demand for advanced drilling services is projected to rise, but their footprint is minimal.

- New Market Entry Costs: Significant upfront investment in specialized rigs, technology, and local workforce training is a hallmark of these Question Mark entries.

- Growth Potential vs. Current Share: H&P targets regions with high projected demand for oil and gas extraction services, even if their current market share is negligible.

- Cash Consumption: These operations are cash-intensive in their initial phases, focusing on establishing operations and securing contracts rather than immediate profitability.

- Future Growth Drivers: Success in these nascent markets is crucial for H&P's long-term diversification and expansion strategy, potentially transforming them into future Stars.

Early-Stage Advanced Drilling Technologies

Helmerich & Payne (H&P) is actively exploring next-generation drilling technologies that go beyond their current automated and digital offerings. These early-stage innovations, such as advanced rig designs and novel drilling processes, hold significant promise for transforming operational efficiency and enhancing safety. However, their path to widespread market adoption and profitability is still being defined, necessitating substantial research and development investment and rigorous market validation to elevate them to Star status within the BCG matrix.

H&P's commitment to R&D in this area is crucial for future growth. For instance, the company has historically invested heavily in technology, with capital expenditures on technology and innovation often representing a significant portion of their overall spending. While specific figures for these early-stage projects are proprietary, the company's consistent focus on technological advancement underscores their strategic importance. This forward-looking approach aims to secure a competitive edge in an evolving industry.

- Future Rig Designs: Exploring modular or highly automated rig concepts for faster deployment and reduced footprint.

- Novel Drilling Processes: Investigating techniques like advanced directional drilling or new wellbore construction methods.

- High R&D Investment: Significant capital allocation is required to move these concepts from lab to field-ready solutions.

- Market Uncertainty: Adoption hinges on demonstrating clear economic benefits and safety improvements to customers.

Helmerich & Payne's (H&P) ventures into new international markets and emerging technologies like geothermal drilling represent significant investments with uncertain future returns, fitting the Question Mark quadrant. These initiatives demand substantial capital to build market share and prove viability, consuming cash in their early stages. Success here could transform them into future Stars, driving long-term growth for the company.

| Initiative | Market Potential | Current Share | Investment Needs | BCG Quadrant |

|---|---|---|---|---|

| International Expansion (e.g., Saudi Arabia) | High (Unconventional Gas) | Low to Moderate | High (Infrastructure, Operations) | Question Mark |

| Geothermal Drilling | Growing (Renewable Energy) | Minimal | High (Technology, Market Development) | Question Mark |

| Next-Gen Drilling Tech R&D | Transformative Potential | Nascent | High (Research, Validation) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data from Helmerich & Payne's official reports, industry research on the oil and gas sector, and competitive benchmarking.