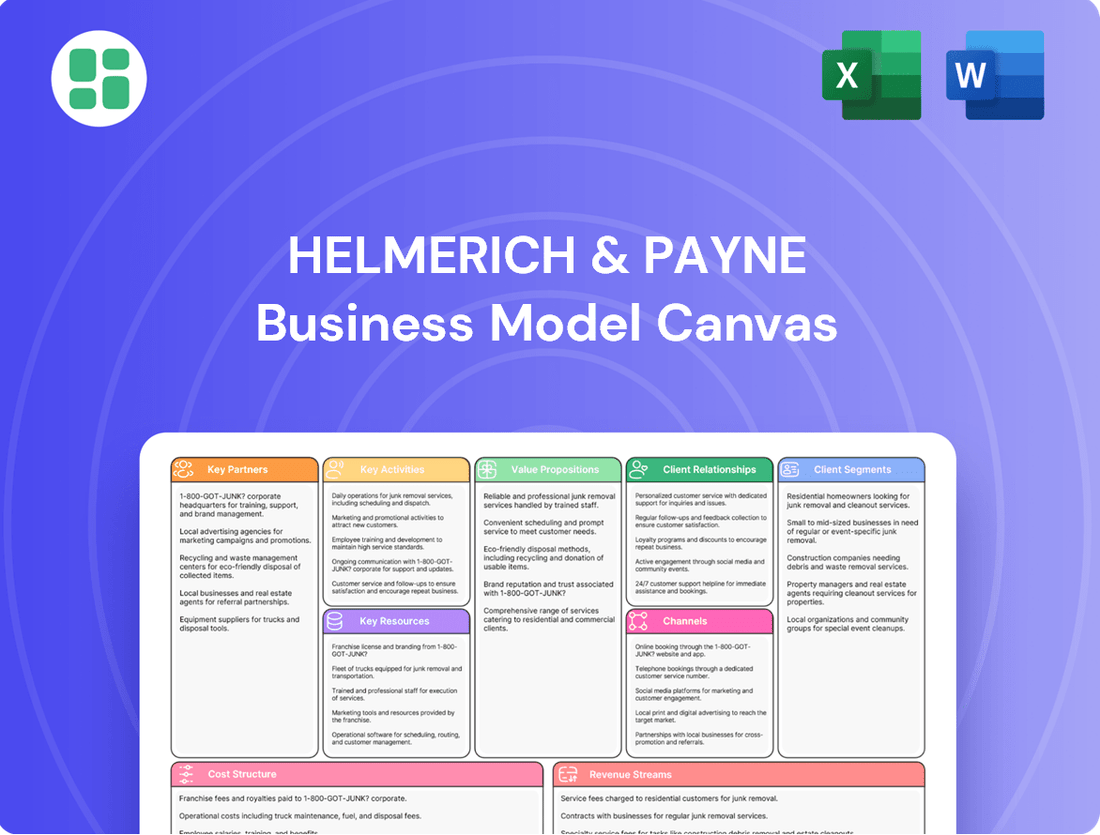

Helmerich & Payne Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helmerich & Payne Bundle

Unlock the strategic blueprint behind Helmerich & Payne's success with our comprehensive Business Model Canvas. This detailed analysis reveals their customer segments, value propositions, and key revenue streams, offering invaluable insights into their operational efficiency and market positioning. Ready to elevate your strategic thinking?

Partnerships

Helmerich & Payne (H&P) actively collaborates with specialized technology and software providers. These partnerships are essential for integrating cutting-edge automation, advanced directional drilling, and sophisticated survey management systems directly into their rig fleet.

These collaborations are vital for improving drilling accuracy and minimizing unproductive rig time, ultimately boosting operational efficiency for H&P's clients. For instance, H&P's investment in digital solutions, a key area for these partnerships, contributed to a significant improvement in rig performance metrics in recent years.

By teaming up with these tech innovators, H&P ensures it remains at the forefront of drilling technology advancements. This strategic approach allows them to offer superior performance and value, a critical factor in the competitive oil and gas services sector.

Helmerich & Payne (H&P) relies heavily on its equipment and component suppliers to maintain its extensive fleet of advanced drilling rigs. These partnerships are crucial for securing essential parts and consumables needed for new rig construction, ongoing upgrades, and routine maintenance, directly influencing operational uptime and efficiency. For instance, in 2023, H&P's capital expenditures for rig enhancements and new builds underscored the ongoing need for a robust supply of specialized components.

Helmerich & Payne (H&P) relies heavily on logistics and transportation partners to manage its vast fleet of drilling rigs and associated equipment. These partnerships are crucial for the efficient movement of rigs, components, and personnel across diverse operational regions, including extensive domestic operations within the United States and international ventures. For instance, in 2024, H&P's ability to redeploy rigs swiftly between North American basins directly impacts its revenue generation by reducing idle time.

The effectiveness of these logistics collaborations directly influences H&P's operational efficiency and cost management. By securing reliable transportation services, H&P minimizes costly downtime that occurs when rigs are waiting for relocation or setup, ensuring they are ready for deployment to meet client schedules. This is particularly important as H&P continues to invest in its advanced FlexRig technology, which requires specialized transport solutions.

Oilfield Service Companies

Helmerich & Payne (H&P) frequently partners with other oilfield service providers to offer comprehensive solutions. These collaborations often involve companies specializing in well completion, cementing, and wireline services, allowing H&P to present a more complete package to exploration and production (E&P) clients.

These strategic alliances enable H&P to streamline project execution and pursue more substantial and intricate drilling projects. For example, in 2024, the demand for integrated service offerings continued to grow, pushing companies like H&P to strengthen their partner networks to meet client needs for end-to-end solutions.

- Integrated Offerings: Partnerships allow H&P to bundle its advanced drilling capabilities with specialized services, creating a one-stop shop for E&P companies.

- Operational Efficiency: Collaborations reduce the need for E&P companies to manage multiple vendors, leading to smoother operations and potentially lower overall project costs.

- Market Access: By working with complementary service providers, H&P can access larger, more complex projects that might require a broader range of expertise than H&P offers alone.

Strategic Acquisition Targets (e.g., KCA Deutag)

Helmerich & Payne (H&P) strategically targets acquisitions to broaden its global reach and service capabilities. A prime example is the acquisition of KCA Deutag, a move designed to significantly expand H&P's presence in key international markets, particularly the Middle East.

- Geographic Expansion: The KCA Deutag acquisition, finalized in early 2024, immediately provided H&P with a substantial footprint in regions like the Middle East and Europe, diversifying its operational base beyond its traditional North American strength.

- Service Offering Enhancement: This partnership, evolving into full integration, allows H&P to offer a more comprehensive suite of drilling services, including advanced solutions for complex international projects.

- Revenue Diversification and Customer Access: By integrating KCA Deutag's operations, H&P gains access to a new base of blue-chip international customers and diversifies its revenue streams, reducing reliance on any single market.

- Strengthening Global Leadership: The combined entity solidifies H&P's position as a global leader in onshore drilling, leveraging KCA Deutag's established international reputation and operational expertise.

Helmerich & Payne's key partnerships extend to technology and software providers, crucial for integrating advanced automation and drilling systems into their fleet. These collaborations enhance drilling accuracy and reduce rig downtime, as evidenced by H&P's focus on digital solutions improving rig performance.

Equipment suppliers are vital for maintaining H&P's rig fleet, ensuring a steady supply of parts for construction, upgrades, and maintenance, directly impacting operational uptime. Their capital expenditures in 2023 for rig enhancements highlight this dependency.

Logistics and transportation partners are essential for efficiently moving rigs and equipment across operational regions, including domestic and international sites. In 2024, H&P's swift rig redeployment capabilities in North America directly affect revenue by minimizing idle time.

H&P also partners with other oilfield service providers for integrated offerings, such as well completion and cementing, allowing them to present comprehensive solutions to E&P clients and pursue larger projects, a trend growing in 2024.

The acquisition of KCA Deutag in early 2024 significantly expanded H&P's international presence, particularly in the Middle East, enhancing their service offerings and diversifying revenue streams to solidify their global leadership in onshore drilling.

What is included in the product

A comprehensive overview of Helmerich & Payne's business model, organized into 9 classic BMC blocks, detailing their customer segments, value propositions, and revenue streams within the oil and gas drilling services industry.

The Helmerich & Payne Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, simplifying complex strategies for easier understanding and adaptation.

Activities

Helmerich & Payne's core activity revolves around the efficient operation and management of its extensive fleet of advanced drilling rigs. This encompasses deploying these rigs to oil and gas well sites, both within the United States and globally, and meticulously managing the skilled drilling crews responsible for the entire operation. H&P is dedicated to ensuring every drilling project is executed safely and with maximum efficiency, a testament to their commitment to customer success.

The company prioritizes maximizing rig utilization rates and overall performance, a crucial element in delivering value to their clients in the upstream oil and gas sector. This focus on operational excellence directly translates into cost-effectiveness and productivity for the companies that contract H&P's services. For instance, in the first quarter of 2024, Helmerich & Payne reported an average rig fleet operating days of 3,468, showcasing a strong utilization of their assets.

Helmerich & Payne (H&P) is deeply involved in the design and fabrication of its advanced FlexRigs, specifically engineered to tackle the complexities of both unconventional and conventional oil and gas plays. This hands-on approach ensures their fleet remains at the forefront of technological capability.

Maintaining and upgrading the existing rig fleet is a crucial activity for H&P. This focus on ongoing maintenance guarantees operational reliability, upholds stringent safety standards, and preserves the technological edge of their assets, which is vital for securing and executing contracts.

A significant part of rig fabrication and maintenance includes the conversion of existing rigs to meet the specific requirements of new contracts or for deployment in international markets. For instance, in 2023, H&P reported capital expenditures of approximately $661 million, a portion of which was dedicated to fleet upgrades and new builds, demonstrating their commitment to this key activity.

Helmerich & Payne's core activities heavily involve developing, integrating, and implementing cutting-edge drilling technologies. This includes advancements in automation, precise directional drilling, and sophisticated wellbore placement solutions.

The company's strategic focus on these technological innovations is designed to boost drilling efficiency and minimize human error. For instance, H&P's proprietary automation systems are geared towards achieving more consistent and predictable drilling outcomes.

By enhancing drilling productivity and reducing variability, H&P directly contributes to improving the overall economic performance of its clients' projects. This commitment to technological advancement underpins their value proposition in the competitive oil and gas services sector.

Contract Negotiation and Client Management

Helmerich & Payne's key activities center on securing lucrative drilling contracts through skillful negotiation with exploration and production companies. In 2024, the company continued to leverage its advanced rig technology to win bids, often focusing on performance-based incentives that align with client operational goals.

Effective client management is paramount, ensuring Helmerich & Payne consistently meets and exceeds the operational expectations of its diverse customer base. This focus on superior execution and relationship building is designed to foster loyalty and drive repeat business, a strategy that has historically proven successful for the company.

- Contract Negotiation: Securing long-term drilling contracts and performance-based agreements with major and independent oil and gas companies.

- Client Relationship Management: Understanding customer needs, delivering superior operational execution, and fostering strong, lasting relationships.

- Operational Excellence: Maintaining and deploying advanced drilling rig technology to meet client performance requirements.

Safety, Health, and Environmental (HSE) Compliance

Maintaining rigorous Safety, Health, and Environmental (HSE) standards is a core activity for Helmerich & Payne (H&P). This involves ensuring the safety of all personnel involved in drilling operations and actively minimizing any negative impact on the environment. H&P's proactive approach to HSE compliance is critical for operational integrity and stakeholder trust.

H&P's commitment extends to sustainability initiatives, with a strong focus on reducing greenhouse gas (GHG) emissions and continuously improving environmental management systems. This dedication is not just about regulatory adherence but also about responsible stewardship of resources.

- HSE Compliance: H&P prioritizes adherence to all relevant HSE regulations and industry best practices across its global operations.

- Personnel Safety: Implementing comprehensive safety protocols and training programs to protect employees and contractors from workplace hazards.

- Environmental Stewardship: Actively managing and reducing the environmental footprint of drilling activities, including waste management and emissions control.

- Sustainability Focus: Investing in technologies and processes aimed at lowering GHG emissions, with a target of reducing Scope 1 and Scope 2 emissions intensity by 20% by 2025 compared to a 2019 baseline.

Helmerich & Payne's key activities are centered on operating and maintaining its advanced drilling rig fleet, ensuring high utilization and performance for clients. This includes the design, fabrication, and ongoing upgrades of specialized rigs like FlexRigs, crucial for adapting to diverse oil and gas plays. The company also focuses on developing and integrating cutting-edge drilling technologies, such as automation and precise directional drilling, to enhance efficiency and reduce operational risks.

Securing drilling contracts through expert negotiation and maintaining strong client relationships are vital. Furthermore, H&P places paramount importance on rigorous Safety, Health, and Environmental (HSE) standards, alongside sustainability initiatives like reducing greenhouse gas emissions. For instance, in Q1 2024, H&P reported an average rig fleet operating days of 3,468, highlighting strong asset utilization.

| Key Activity | Description | 2024 Data/Context |

|---|---|---|

| Rig Operations & Maintenance | Efficient deployment and upkeep of advanced drilling rigs. | Q1 2024: 3,468 average rig fleet operating days. |

| Rig Design & Fabrication | Engineering and building specialized rigs like FlexRigs. | Ongoing investment in fleet modernization and new builds. |

| Technology Development | Implementing automation and advanced drilling solutions. | Focus on proprietary automation systems for consistent outcomes. |

| Contract Negotiation & Client Management | Securing contracts and ensuring client satisfaction. | Emphasis on performance-based incentives and superior execution. |

| HSE & Sustainability | Adhering to safety standards and reducing environmental impact. | Targeting a 20% reduction in Scope 1 & 2 GHG emissions intensity by 2025 (vs. 2019). |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a mockup or a sample; it represents the comprehensive and fully detailed analysis of Helmerich & Payne's business operations. Once your order is complete, you will gain full access to this identical, professionally structured document, ready for immediate use and customization.

Resources

Helmerich & Payne's (H&P) advanced FlexRigs, especially their super-spec models, are a cornerstone of their key physical resources. These rigs are engineered for enhanced efficiency and flexibility, allowing for superior drilling performance across diverse geological landscapes.

The strategic acquisition of KCA Deutag in 2024 significantly bolstered H&P's rig count, adding approximately 114 land rigs and 10 offshore rigs. This expansion directly amplifies their capacity and global reach in the drilling services sector.

Helmerich & Payne's (H&P) proprietary technology and intellectual property are core to its competitive advantage. They possess advanced drilling automation technologies, software, and innovative rig designs that set their services apart in the industry.

Key intellectual property includes systems like Autodriller Pro and AutoSlide. These technologies enable H&P to deliver superior solutions that enhance drilling efficiency, safety, and accuracy for their clients.

H&P consistently invests in research and development, ensuring they maintain a leading technological edge. For instance, in fiscal year 2023, H&P's capital expenditures included significant investments in technology and innovation, supporting their ongoing development of advanced drilling solutions.

Helmerich & Payne's (HP) business model hinges on its highly trained and experienced workforce. This includes skilled rig crews, engineers, and maintenance technicians who are adept at operating complex drilling equipment.

Their expertise is crucial for superior operational execution and upholding stringent safety standards, a key differentiator in the industry.

In 2024, HP continued to invest in training, ensuring its personnel are proficient with the latest drilling technologies, which directly impacts efficiency and client satisfaction.

Global Operational Infrastructure

Helmerich & Payne's global operational infrastructure is the backbone of its drilling services, encompassing a vast network of maintenance facilities, logistical hubs, and essential support services. This robust infrastructure is strategically positioned across its U.S. and international operating regions, ensuring the efficient deployment and upkeep of its sophisticated drilling fleet. For instance, as of the first quarter of 2024, H&P operated approximately 300 land rigs, each requiring significant logistical and maintenance support to maintain peak operational readiness.

This extensive network is critical for the timely servicing and repair of rigs, minimizing downtime and maximizing utilization rates. The company's logistical hubs are designed to manage the complex movement of equipment and personnel, facilitating rapid response to customer needs in diverse geographic locations. This operational efficiency directly translates into cost savings and enhanced service delivery for H&P's clients.

- Maintenance Facilities: Strategically located across operating regions to ensure rapid and efficient rig servicing and repairs.

- Logistical Hubs: Facilitate the movement of equipment, parts, and personnel, optimizing supply chain management.

- Support Services: Includes specialized teams for technical assistance, safety, and environmental compliance, ensuring smooth operations.

- Global Reach: Infrastructure supports operations in key oil and gas producing basins worldwide, enabling H&P to serve a diverse customer base.

Financial Capital and Liquidity

Helmerich & Payne's access to substantial financial capital is a cornerstone of its business model, allowing for significant investments in its extensive rig fleet. This financial strength is essential for undertaking large-scale projects like constructing new, advanced drilling rigs and upgrading existing ones to meet evolving industry demands. For instance, in fiscal year 2023, H&P reported capital expenditures of $764 million, underscoring their commitment to fleet modernization and technological advancement.

A robust balance sheet and ample liquidity are critical for H&P to navigate the cyclical nature of the oil and gas industry. This financial stability empowers the company to seize strategic growth opportunities, such as potential acquisitions, and to effectively manage periods of market volatility. As of the first quarter of fiscal year 2024, H&P maintained a strong liquidity position, with approximately $1.3 billion in cash and cash equivalents, providing a solid foundation for operational continuity and strategic initiatives.

- Financial Capital Access: Enables funding for rig construction, fleet upgrades, and strategic acquisitions.

- Liquidity Management: Supports investment in growth and resilience against market fluctuations.

- Fiscal Year 2023 Capital Expenditures: H&P invested $764 million in capital projects.

- Q1 FY2024 Liquidity: Approximately $1.3 billion in cash and cash equivalents.

Helmerich & Payne's (H&P) advanced FlexRigs, particularly their super-spec models, are a critical physical resource. These rigs are designed for superior drilling efficiency and adaptability across various geological conditions.

The company's proprietary technology and intellectual property, including systems like Autodriller Pro and AutoSlide, provide a significant competitive edge. These innovations enhance drilling precision, safety, and overall efficiency for clients.

A highly skilled and experienced workforce, comprising rig crews, engineers, and technicians, is fundamental to H&P's operations. In 2024, continued investment in personnel training ensures proficiency with the latest drilling technologies.

H&P's extensive global operational infrastructure, featuring maintenance facilities and logistical hubs, ensures efficient fleet deployment and upkeep. As of Q1 2024, H&P operated approximately 300 land rigs, each demanding robust support.

Access to substantial financial capital is key, enabling investments in fleet modernization and technological advancements. H&P's fiscal year 2023 capital expenditures reached $764 million, reflecting this commitment.

A strong liquidity position, with approximately $1.3 billion in cash and cash equivalents as of Q1 FY2024, allows H&P to manage industry cycles and pursue strategic growth.

| Key Resource | Description | 2024 Data/Relevance |

| Advanced Rig Fleet | Super-spec FlexRigs designed for efficiency and adaptability. | Core physical asset, enabling superior drilling performance. |

| Proprietary Technology | Drilling automation software and innovative rig designs (e.g., Autodriller Pro). | Differentiator enhancing drilling efficiency, safety, and accuracy. |

| Skilled Workforce | Experienced rig crews, engineers, and technicians. | Crucial for operational execution and safety standards; ongoing training in 2024. |

| Global Infrastructure | Network of maintenance facilities, logistical hubs, and support services. | Supports ~300 land rigs (as of Q1 2024) for efficient deployment and maintenance. |

| Financial Capital | Access to funding for investments and operations. | FY2023 CapEx of $764 million; Q1 FY2024 liquidity of ~$1.3 billion. |

Value Propositions

Helmerich & Payne (H&P) delivers exceptional drilling productivity and reliability, a core value proposition for its customers. This is achieved through their advanced FlexRig technology and deep operational know-how.

Customers benefit from quicker drilling cycles and significantly less downtime, meaning their projects move forward more smoothly. In 2024, H&P's FlexRigs continued to set industry benchmarks for performance, contributing to an average rig operating day rate that reflects this superior efficiency.

Helmerich & Payne (H&P) offers cutting-edge technology and automation that significantly boost drilling accuracy and wellbore placement. This focus on innovation directly translates to better economic outcomes for their clients.

H&P's advanced digital solutions and automation capabilities are designed to deliver consistent and reliable results. This is particularly valuable given the evolving labor landscape in the industry, where a reduced skillset can be a challenge.

In 2024, H&P continued to emphasize its technological advancements, with a significant portion of its rig fleet equipped with advanced automation and directional drilling technologies. This commitment to innovation underpins their value proposition to customers seeking efficiency and predictability in their operations.

Helmerich & Payne (H&P) prioritizes top-tier safety and operational integrity, a core value proposition for clients. This commitment translates into minimizing risks for everyone involved in their operations and actively reducing environmental footprints.

Customers increasingly seek partners with strong Environmental, Social, and Governance (ESG) credentials. H&P's dedication to this, including ambitious greenhouse gas emissions reduction targets and comprehensive environmental management systems, directly addresses this demand, offering significant value.

In 2023, H&P reported a Total Recordable Incident Rate (TRIR) of 0.46, significantly below the industry average, underscoring their safety focus. This performance directly contributes to customer confidence and operational continuity.

Customized and Performance-Based Solutions

Helmerich & Payne (H&P) excels by offering customized drilling solutions, moving beyond one-size-fits-all approaches. They achieve this through flexible contracting models, notably performance-based contracts, which directly link H&P's compensation to achieving specific customer goals and superior operational outcomes.

This strategy is designed to generate additional value for both H&P and its clients by ensuring that success is shared. For instance, in 2024, H&P's focus on advanced rig technologies and data analytics enabled them to offer performance enhancements that could reduce drilling times by up to 10% for certain projects, directly impacting client profitability.

The core of this value proposition lies in tailoring solutions to unique project needs. This adaptability ensures that H&P's services are not just delivered, but are optimized for maximum efficiency and economic benefit in diverse operational environments.

- Flexible Contracting: H&P provides a range of contract structures, including performance-based agreements that reward successful outcomes.

- Tailored Drilling Solutions: Contracts are customized to meet the specific technical and economic objectives of each client's project.

- Value Creation: This approach aims to generate additional economic benefits for both H&P and its customers through shared success.

- Performance Incentives: Performance-based contracts directly incentivize H&P to achieve superior drilling results, aligning operational execution with client goals.

Global Reach and Diversified Operations

Helmerich & Payne's global reach, significantly amplified by the 2024 KCA Deutag acquisition, now extends to crucial oil and gas regions across the globe. This expanded footprint means H&P offers drilling services in North America, the Middle East, South America, Europe, and Africa, providing customers with a truly international operational capability.

This diversified geographic presence allows clients to leverage H&P's cutting-edge fleet and deep operational expertise in various international markets. For instance, as of the first quarter of 2024, H&P reported operating rigs in multiple international regions, underscoring their commitment to global service delivery.

- Global Footprint: Operations span North America, the Middle East, South America, Europe, and Africa.

- Acquisition Impact: The 2024 KCA Deutag acquisition significantly enhanced H&P's international presence.

- Customer Access: Clients benefit from H&P's advanced drilling technology and expertise across diverse geographies.

- Diversified Revenue Streams: Operating in multiple basins mitigates risks associated with reliance on any single market.

Helmerich & Payne (H&P) provides unparalleled drilling productivity and reliability, a key value proposition driven by their advanced FlexRig technology and extensive operational expertise. Customers experience faster drilling times and reduced downtime, ensuring project continuity.

H&P offers sophisticated technology and automation, enhancing drilling precision and wellbore placement for improved client economic results. Their digital solutions ensure consistent performance, addressing industry labor challenges.

Safety and operational integrity are paramount for H&P, minimizing risks and environmental impact. Their strong ESG focus, including emissions reduction targets, meets growing client demand for responsible partners.

H&P delivers customized drilling solutions through flexible contracting, including performance-based agreements that align compensation with client success. This approach, exemplified by up to a 10% potential reduction in drilling times in 2024 through technology and data analytics, creates shared value.

H&P's global reach, significantly expanded by the 2024 KCA Deutag acquisition, now covers North America, the Middle East, South America, Europe, and Africa, offering clients international operational capabilities. This diversified presence allows clients to access H&P's advanced fleet and expertise across various markets.

| Value Proposition | Key Enablers | Customer Benefit | 2024 Data/Context |

|---|---|---|---|

| Drilling Productivity & Reliability | FlexRig Technology, Operational Know-How | Faster drilling, less downtime | FlexRigs set industry performance benchmarks. |

| Technology & Automation | Digital Solutions, Advanced Automation | Improved accuracy, better economic outcomes | Significant rig fleet equipped with advanced automation. |

| Safety & ESG Focus | Strong Safety Culture, ESG Initiatives | Minimized risks, reduced environmental footprint | TRIR of 0.46 in 2023, below industry average. |

| Customized Solutions & Flexible Contracting | Performance-Based Contracts, Tailored Services | Shared success, optimized efficiency | Performance enhancements potentially reducing drilling times by up to 10%. |

| Global Reach | KCA Deutag Acquisition, International Operations | Access to advanced technology worldwide | Operations in North America, Middle East, South America, Europe, Africa. |

Customer Relationships

Helmerich & Payne (H&P) cultivates robust customer connections via dedicated account managers and specialized technical support. These teams collaborate intimately with clients, delving into their unique drilling requirements to craft personalized solutions. This hands-on approach, evident in their client retention rates, ensures a high degree of satisfaction and operational synergy.

Helmerich & Payne (H&P) prioritizes securing long-term contracts with major and independent oil and gas producers, fostering stability and predictable revenue streams. These agreements, often spanning multiple years, allow for robust financial planning and resource allocation.

These enduring relationships frequently deepen into strategic partnerships, where H&P's advanced drilling technologies and operational expertise are integral to complex, multi-year projects. For instance, in 2024, H&P's focus on technology integration and customer collaboration continued to drive demand for its premium offerings in key basins.

Helmerich & Payne (H&P) actively partners with its clients on innovative solutions, tackling specific drilling hurdles with tailored technology. This collaborative spirit transforms H&P from a mere service provider into a true problem-solver.

In 2024, this customer-centric innovation directly contributed to H&P’s ability to secure long-term contracts by demonstrating tangible value and a deep understanding of client needs. This focus on co-creation fosters strong customer loyalty and drives shared success.

Performance-Based Contracting Model

Helmerich & Payne (H&P) is enhancing customer relationships through a strategic shift to performance-based contracting. This model directly links H&P's compensation to achieving specific operational milestones and successful well outcomes for their clients.

This approach fosters stronger partnerships by aligning H&P's incentives with customer success. It clearly demonstrates a commitment to delivering tangible, measurable value, building trust and reinforcing long-term collaboration.

- Performance Metrics: Contracts often include targets for drilling speed, footage per day, and wellbore quality.

- Incentive Alignment: Bonuses are paid for exceeding performance benchmarks, while penalties may apply for failing to meet them.

- Value Demonstration: This model showcases H&P's confidence in its technology and operational expertise.

- Customer Focus: It prioritizes the client's ultimate goal of efficient and cost-effective resource extraction.

Transparent Communication and Reporting

Helmerich & Payne (H&P) prioritizes clear and open communication with its clients. This involves sharing details about how operations are going, safety statistics, and the company's environmental initiatives. By keeping customers informed, H&P builds a strong foundation of trust.

H&P's commitment to accountability is evident in its regular reporting. This includes updates through investor relations channels and comprehensive sustainability reports. For instance, in their 2023 annual report, H&P highlighted a commitment to reducing Scope 1 and Scope 2 greenhouse gas emissions by 20% by 2030 compared to a 2019 baseline.

- Operational Transparency: Sharing performance data ensures clients are aware of service delivery and efficiency.

- Safety Metrics: Openly reporting safety performance reinforces H&P's dedication to a secure working environment.

- Sustainability Efforts: Communicating progress on environmental goals demonstrates corporate responsibility.

- Investor Relations: Regular engagement through investor relations and sustainability reports builds confidence and trust.

Helmerich & Payne (H&P) fosters deep customer relationships through dedicated account management and proactive technical support, tailoring solutions to specific drilling needs. This client-centric approach, reinforced by long-term contracts and performance-based agreements, ensures alignment and mutual success, a strategy that continued to drive demand for their advanced offerings throughout 2024.

H&P's commitment extends to collaborative innovation, positioning them as strategic partners who solve complex drilling challenges alongside their clients. This focus on co-creation and transparent communication, including detailed operational and safety reporting, builds significant trust and loyalty, as evidenced by their consistent client retention.

The company's emphasis on performance-based contracts, where compensation is tied to achieving client-specific operational milestones, directly aligns H&P's incentives with customer success. This model, which saw continued emphasis in 2024, clearly demonstrates H&P's confidence in its technology and operational expertise, prioritizing efficient resource extraction for their clients.

H&P's dedication to transparency is further highlighted through regular reporting on operational performance, safety metrics, and sustainability initiatives, such as their commitment to reducing greenhouse gas emissions. This open communication builds a robust foundation of trust and accountability.

| Customer Relationship Aspect | Description | 2024 Focus/Impact |

|---|---|---|

| Dedicated Support | Account managers and technical teams provide personalized solutions. | Continued focus on client-specific needs, driving demand for premium services. |

| Long-Term Contracts | Securing multi-year agreements with major producers for revenue stability. | Provided a foundation for robust financial planning and resource allocation. |

| Performance-Based Contracts | Incentives tied to achieving client operational milestones and well outcomes. | Strengthened partnerships by aligning H&P's success with customer success. |

| Collaborative Innovation | Partnering with clients to develop tailored technological solutions. | Transformed H&P into a problem-solver, fostering loyalty and shared success. |

| Transparency & Communication | Sharing operational, safety, and sustainability data openly. | Built trust and accountability through regular reporting and investor relations. |

Channels

Helmerich & Payne leverages its dedicated direct sales force and business development teams to cultivate relationships with oil and gas exploration and production (E&P) companies. These professionals are the frontline for identifying emerging drilling needs and showcasing H&P's advanced rig technologies and operational expertise. Their efforts are crucial in securing new contracts and expanding H&P's market share.

In 2024, H&P's sales and business development functions were instrumental in navigating a dynamic energy market. The company reported a significant portion of its revenue derived from long-term drilling contracts, a testament to the effectiveness of these teams in building and maintaining strong client partnerships. For instance, their focus on technological solutions helped secure agreements for advanced rigs in key shale plays, contributing to H&P's robust backlog.

Industry conferences and trade shows are vital for Helmerich & Payne. For instance, H&P actively participates in events like the International Petroleum Technology Conference (IPTC) and the Offshore Technology Conference (OTC). These gatherings allow H&P to demonstrate its advanced drilling technologies and solutions to a global audience of industry professionals and potential clients.

These platforms are essential for networking and forging new business relationships. In 2023, H&P showcased its latest innovations, including advancements in automation and digital drilling, at various key industry exhibitions, reinforcing its position as a technology leader.

Participation in these events also directly supports customer acquisition and retention efforts. By engaging with operators and service companies at these shows, H&P gains valuable market insights and opportunities to secure new contracts, contributing to its revenue streams.

Helmerich & Payne's corporate website and dedicated investor relations portal are central to their digital communication strategy. These platforms act as primary hubs for sharing crucial company data, including detailed financial reports, sustainability initiatives, and updates on their technological advancements. In 2023, H&P reported a revenue of $3.4 billion, with a significant portion of their investor communications accessible through these online channels.

Existing Client Relationships and Referrals

Helmerich & Payne (H&P) capitalizes on its established client base, where a strong history of operational success fosters trust and encourages repeat business. These enduring partnerships are a primary conduit for growth, as satisfied customers frequently recommend H&P to their industry peers.

The company's reputation, built on delivering reliable and efficient drilling services, directly translates into a powerful referral engine. This organic business development significantly reduces customer acquisition costs and reinforces H&P's market position.

- Repeat Business: H&P's customer retention is a key performance indicator, reflecting the value delivered to long-term partners.

- Referral Network: Positive client experiences fuel a robust referral network, opening doors to new contracts with Exploration and Production (E&P) companies.

- Market Reputation: A track record of excellence in the demanding oil and gas sector enhances H&P's brand, making it a preferred choice for drilling solutions.

Acquired Business Networks (e.g., KCA Deutag)

Helmerich & Payne's strategic acquisitions, like the significant deal involving KCA Deutag, are pivotal for expanding its global footprint. This move grants H&P immediate access to KCA Deutag's existing customer relationships and operational infrastructure in key international regions. For instance, KCA Deutag brought a strong presence in markets such as the Middle East and Europe, areas where H&P sought to bolster its operations. This allows for accelerated market penetration, bypassing the time and resources typically required to build new customer channels and operational networks from the ground up.

The integration of acquired entities directly enhances H&P's customer relationships and market reach. By absorbing established businesses, H&P inherits a ready-made client base and a deeper understanding of local market dynamics. This is crucial for navigating diverse regulatory environments and customer expectations across different geographies. The 2024 outlook for such strategic integrations points towards continued emphasis on expanding international service capabilities, leveraging acquired networks to drive revenue growth and operational efficiencies.

Key benefits of these acquired business networks include:

- Expanded Geographic Reach: Immediate access to new international markets and customer bases.

- Accelerated Market Penetration: Faster entry into new regions by leveraging existing infrastructure and relationships.

- Enhanced Service Offering: Integration of complementary services and technologies from acquired entities.

- Synergistic Growth Opportunities: Realization of cost savings and revenue enhancements through combined operations.

Helmerich & Payne's direct sales force and business development teams are crucial for building relationships with E&P companies, showcasing H&P's technology, and securing new contracts. In 2024, these teams were instrumental in securing long-term drilling contracts, contributing to a robust backlog by highlighting advanced rig capabilities in key shale plays.

Industry events and trade shows, such as the International Petroleum Technology Conference and the Offshore Technology Conference, are vital for H&P to demonstrate its advanced drilling technologies and solutions to a global audience. These platforms facilitate networking, foster new business relationships, and provide valuable market insights, directly supporting customer acquisition and retention efforts.

H&P's established client base and strong reputation for reliable and efficient drilling services create a powerful referral engine, significantly reducing customer acquisition costs and reinforcing its market position. Repeat business and positive client experiences fuel a robust referral network, making H&P a preferred choice for drilling solutions.

Strategic acquisitions, like the KCA Deutag deal, have been pivotal for expanding H&P's global footprint, granting access to new customer relationships and operational infrastructure in key international regions. This accelerates market penetration by leveraging acquired networks, enhancing service offerings, and creating synergistic growth opportunities.

Customer Segments

Major integrated oil and gas companies are a cornerstone customer segment for drilling service providers like Helmerich & Payne. These giants, operating on a global scale, require sophisticated drilling solutions for both established conventional fields and challenging unconventional resource plays. In 2024, these companies continued to drive demand for advanced drilling technologies and reliable operational support, often engaging in multi-year projects that necessitate consistent performance and efficiency.

These customers, such as ExxonMobil, Chevron, and Shell, typically seek out drilling partners capable of delivering high-performance rigs and integrated services. They value a proven track record of safety and operational excellence, especially when tackling complex geological formations or operating in remote or harsh environments. For instance, the ongoing development of deepwater reserves or the extraction of tight oil and gas resources necessitates specialized equipment and expertise that only a few select service companies can reliably provide.

Independent Exploration and Production (E&P) companies represent a crucial customer segment for Helmerich & Payne, particularly those operating in the U.S. onshore market. These entities, ranging from small to mid-sized operations, are keenly focused on maximizing efficiency and cost-effectiveness within specific geological basins.

Their primary driver is the ability to deploy drilling rigs swiftly and adapt to the dynamic needs of unconventional plays. The Permian Basin, for instance, remains a key area where these companies seek optimized drilling programs. In 2024, the U.S. rig count, a strong indicator of E&P activity, has shown resilience, with an average of around 620 rigs active for much of the year, reflecting ongoing demand from this segment.

International Oil and Gas Operators represent a crucial customer segment for Helmerich & Payne, comprising state-owned entities and major exploration and production (E&P) companies active beyond North America. These clients typically operate in diverse geographies such as the Middle East, South America, Europe, and Africa, each presenting distinct operational landscapes and regulatory frameworks.

These sophisticated operators often require specialized drilling solutions and possess unique logistical challenges. They actively seek experienced international drilling contractors, like Helmerich & Payne, to navigate complex environments and meet demanding project timelines. The global nature of their operations means they value partners with a proven track record in remote and challenging locations.

In 2024, the global upstream oil and gas market saw continued investment, with international operators playing a significant role. For instance, many national oil companies in the Middle East continued to invest heavily in maintaining and expanding production capacity. Helmerich & Payne's ability to deploy advanced rig technologies and provide comprehensive operational support is a key draw for these international players looking to optimize their drilling campaigns and secure long-term resource development.

Unconventional Resource Developers

Helmerich & Payne's (H&P) customer base is significantly driven by companies focused on extracting unconventional resources, particularly shale oil and gas. These operators require specialized drilling equipment tailored for the unique challenges of horizontal drilling and hydraulic fracturing. In 2024, H&P continued to see robust demand from these segments, with their super-spec rigs playing a crucial role in maximizing efficiency and recovery rates.

These unconventional resource developers, often referred to as shale operators, are H&P's core clientele. They need highly mobile and pad-capable rigs that can efficiently move between well pads, a critical factor in optimizing drilling programs. H&P's investment in advanced drilling technologies directly addresses these operational demands, enabling faster drilling times and improved wellbore placement, which are paramount for profitability in these plays.

- Shale Operators: Companies primarily engaged in the exploration and production of shale oil and natural gas.

- Rig Requirements: Demand for super-spec, pad-capable rigs with advanced automation and directional drilling capabilities.

- Efficiency Focus: Customers prioritize technologies that enhance drilling speed, reduce non-productive time, and improve hydrocarbon recovery.

- Market Share: H&P's fleet is heavily utilized by these operators, reflecting their dominance in the unconventional resource development sector.

Geothermal and Carbon Capture Project Operators

Helmerich & Payne (H&P) is increasingly serving operators focused on geothermal energy and carbon capture projects. These clients need H&P's advanced drilling technologies and operational know-how to tap into these developing energy sectors. For instance, H&P's FlexRig technology is well-suited for the demanding conditions often encountered in geothermal drilling.

The market for geothermal and carbon capture is expanding, driven by global decarbonization efforts. In 2024, investments in clean energy technologies, including geothermal and carbon capture, are projected to see significant growth, creating a robust demand for specialized drilling services. H&P's ability to adapt its existing fleet and expertise to these new applications positions it to capture a share of this burgeoning market.

- Geothermal Operators: Require high-temperature, high-pressure drilling capabilities and specialized downhole tools.

- Carbon Capture Operators: Need precision drilling for injection wells and potentially enhanced oil recovery (EOR) applications to store captured CO2.

- H&P's Value Proposition: Offers advanced rig technology, experienced personnel, and a track record in complex drilling environments.

- Market Opportunity: Growing global focus on emissions reduction and sustainable energy sources fuels demand for these services.

Helmerich & Payne's customer base is diverse, primarily serving major integrated oil and gas companies and independent exploration and production (E&P) firms. These clients require advanced drilling solutions for both conventional and unconventional resource extraction. In 2024, demand from shale operators, particularly in the U.S. onshore market like the Permian Basin, remained a significant driver, with the U.S. rig count averaging around 620 active rigs for much of the year.

International oil and gas operators also represent a key segment, seeking H&P's expertise in diverse global geographies. Furthermore, H&P is expanding its reach into emerging sectors like geothermal energy and carbon capture projects, leveraging its advanced rig technology and operational experience to meet the demands of these growing clean energy markets.

Cost Structure

Helmerich & Payne's (H&P) cost structure heavily relies on the operational expenses of its extensive rig fleet. This includes significant outlays for fuel, lubricants, and routine maintenance, essential for keeping these complex machines running efficiently.

Beyond day-to-day consumables, H&P also dedicates substantial resources to the upkeep and repair of its rigs. This involves the cost of replacement parts, specialized labor for repairs, and the more significant expense of periodic overhauls to maintain optimal performance and safety standards.

For instance, in the first quarter of fiscal year 2024, H&P reported total operating expenses of $565.5 million, with rig operating and maintenance costs forming a substantial portion of this figure, reflecting the capital-intensive nature of their business.

Helmerich & Payne's cost structure is heavily influenced by its substantial personnel expenses. The company employs a large, skilled workforce, encompassing rig crews, field supervisors, engineers, and administrative personnel, all of whom contribute significantly to operational costs.

These personnel costs include not only salaries and wages but also comprehensive benefits packages, ongoing training, and recruitment efforts, especially for highly specialized roles crucial in advanced drilling operations. For instance, in 2023, Helmerich & Payne reported total employee compensation and benefits expenses of approximately $1.7 billion, reflecting the significant investment in its human capital.

Helmerich & Payne (H&P) faces substantial capital expenditures, primarily for building new drilling rigs and enhancing its existing FlexRig fleet. These investments are crucial for staying competitive and meeting evolving customer demands, particularly for international operations which require specialized outfitting.

The company's capital expenditure guidance for fiscal year 2025 anticipates a notable uplift in free cash flow generation. This suggests a strategic deployment of capital aimed at improving operational efficiency and profitability in the coming year.

Technology Development and Research & Development (R&D)

Helmerich & Payne (H&P) dedicates significant resources to technology development and R&D, a core component of its cost structure. These investments are vital for creating next-generation drilling technologies, advanced automation software, and cutting-edge digital solutions that enhance operational efficiency and safety.

For instance, H&P's focus on digitalization and automation, including its iSeries™ rigs, represents a substantial commitment to R&D. These technologies aim to provide customers with superior performance and cost-effectiveness. In 2024, the company continued to invest in these areas, recognizing their importance in a rapidly evolving energy landscape.

- Technology Development: H&P invests heavily in developing new drilling technologies, such as advanced directional drilling systems and improved rig automation.

- R&D Expenses: These costs are critical for maintaining H&P's competitive advantage and delivering innovative solutions to the oil and gas industry.

- Automation Software: Development of sophisticated software for rig control, data analytics, and remote operations forms a significant portion of R&D spending.

- Digital Solutions: H&P's commitment to digital transformation includes creating platforms for real-time performance monitoring and predictive maintenance, requiring ongoing R&D investment.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Helmerich & Payne encompass a range of essential overhead costs. These include corporate salaries for executive and support staff, operational costs for office spaces, expenditures on legal and accounting services, insurance premiums, and the expenses tied to regulatory compliance and maintaining investor relations. These functions are critical for the smooth operation and strategic direction of the company.

The recent acquisition of KCA Deutag is a significant factor influencing H&P's G&A structure. This integration is projected to unlock substantial expense synergies. Management anticipates these synergies will translate into overall reductions in the company's cost structure, enhancing efficiency and profitability as the two entities become more integrated.

- Corporate Overhead: Covers salaries for non-operational staff, executive compensation, and administrative support.

- Operational Support: Includes office rent, utilities, IT infrastructure, and general office supplies.

- Professional Services: Encompasses legal fees, accounting services, audit costs, and consulting expenses.

- Compliance & Investor Relations: Costs related to SEC filings, shareholder communications, and maintaining good corporate governance.

Helmerich & Payne's cost structure is dominated by operational expenses related to its rig fleet, including fuel, lubricants, and maintenance. Personnel costs, encompassing salaries, benefits, and training for a large skilled workforce, are also a major component. Capital expenditures for new rigs and technology development, alongside general and administrative overhead, further shape the company's financial outlays.

| Cost Category | Description | Significance |

|---|---|---|

| Operational Expenses | Fuel, lubricants, routine maintenance, parts, specialized labor for repairs. | Essential for keeping the extensive rig fleet running and maintained. |

| Personnel Costs | Salaries, wages, benefits, training for rig crews, engineers, and administrative staff. | Represents a significant investment in human capital, crucial for skilled operations. |

| Capital Expenditures | Building new rigs, enhancing existing fleet, technology development. | Investments to maintain competitiveness and meet evolving industry demands. |

| General & Administrative (G&A) | Corporate salaries, office costs, legal, accounting, insurance, compliance. | Overhead costs supporting overall company operations and strategic direction. |

Revenue Streams

Helmerich & Payne's core revenue comes from charging clients a daily rate for utilizing its advanced drilling rigs and comprehensive services. These day rates are not static; they fluctuate significantly based on factors like the rig's technological sophistication, the geographical area of operation, and the specialized requirements of the client's drilling project.

For instance, in the first quarter of fiscal year 2024, H&P reported an average daily rig revenue of $25,000, showcasing the substantial income generated from these operational contracts. This figure underscores the direct correlation between rig utilization and the company's top-line performance.

Helmerich & Payne is increasingly structuring its contracts to include performance-based incentives. This means a part of their earnings is directly linked to how well their drilling operations perform, specifically focusing on operational efficiency and successful well completions.

This shift allows H&P to earn performance bonuses, which can significantly boost revenue per rig day when they exceed targets. For instance, in the first quarter of fiscal year 2024, H&P reported that approximately 20% of their revenue was tied to performance-based incentives, demonstrating a tangible impact on their financial results.

Helmerich & Payne (HP) generates revenue through ancillary services and equipment rental, supplementing its core drilling services. This includes offering specialized drilling tools and other support functions that enhance customer drilling programs.

International Contract Revenue

Helmerich & Payne (H&P) generates substantial revenue from international drilling contracts, with long-term agreements in regions such as the Middle East playing a key role in diversifying its income. This global presence helps mitigate risks associated with regional downturns in the oil and gas industry.

The strategic acquisition of KCA Deutag in 2024 significantly expanded H&P's international footprint and bolstered its international contract revenue. This move broadened the company's geographic reach and enhanced its service offerings in key global markets, contributing to a more robust and diversified revenue base.

- International Contract Revenue: Revenue derived from drilling services provided outside the United States.

- Geographic Diversification: Long-term contracts in regions like the Middle East reduce reliance on any single market.

- Impact of KCA Deutag Acquisition: The 2024 acquisition significantly enhanced and diversified H&P's international revenue streams by adding new markets and capabilities.

- Revenue Contribution: International operations are a crucial component of H&P's overall revenue, contributing to financial stability and growth.

Technology Licensing and Digital Solutions

While Helmerich & Payne (H&P) primarily generates revenue from its contract drilling services, its significant investment in proprietary technology and digital solutions, such as its RigAI platform, presents a compelling opportunity for technology licensing. This could evolve into a distinct revenue stream, capitalizing on the company's expertise in advanced drilling automation and optimization. For example, in fiscal year 2023, H&P reported substantial investments in technology development, hinting at the potential for these innovations to be monetized beyond internal use.

The company's commitment to digital transformation, including its focus on data analytics and remote operational capabilities, positions it to offer these solutions to other industry players. This would likely be a higher-margin business compared to traditional rig operations, leveraging existing intellectual property and software development. H&P's ongoing efforts to enhance operational efficiency through technology are a clear indicator of the value embedded in their digital offerings.

- Technology Licensing: Potential to license H&P's proprietary drilling automation and optimization software.

- Digital Solutions: Offering data analytics and remote operational capabilities to third parties.

- Higher Margin Potential: This stream could offer improved profitability due to leveraging existing IP.

- Strategic Focus: Aligns with H&P's ongoing investment in digital transformation and innovation.

Helmerich & Payne's revenue streams are primarily driven by contract drilling services, where clients pay a daily rate for rig usage and associated services. These rates are dynamic, influenced by rig technology, location, and project specifics. For fiscal year 2024's first quarter, H&P reported an average daily rig revenue of $25,000.

Performance-based incentives are also a growing component, linking earnings to operational efficiency and successful well completions. In Q1 FY2024, approximately 20% of H&P's revenue was tied to these performance metrics, demonstrating a clear financial incentive for superior operational outcomes.

Beyond core drilling, H&P generates revenue from ancillary services, equipment rentals, and international contracts, notably in the Middle East. The 2024 acquisition of KCA Deutag significantly expanded this international revenue base, broadening geographic reach and service capabilities.

The company is also exploring technology licensing and digital solution offerings, such as its RigAI platform, which could create higher-margin revenue streams by leveraging its proprietary advancements in drilling automation and data analytics.

| Revenue Stream | Description | Key Drivers | FY2024 Q1 Data Point |

|---|---|---|---|

| Contract Drilling Services | Daily rates for rig usage and services | Rig tech, location, project needs | Average daily rig revenue: $25,000 |

| Performance-Based Incentives | Bonuses tied to operational efficiency and well completions | Exceeding performance targets | ~20% of revenue tied to incentives |

| Ancillary Services & Rentals | Specialized tools and support functions | Customer program enhancement | N/A |

| International Contracts | Drilling services outside the US | Long-term agreements, geographic diversification | Significant contribution post-KCA Deutag acquisition |

| Technology Licensing/Digital Solutions | Licensing proprietary software and offering digital services | Proprietary tech, data analytics, automation | Investment in RigAI and digital transformation |

Business Model Canvas Data Sources

The Helmerich & Payne Business Model Canvas is informed by a robust blend of financial disclosures, industry analysis, and operational data. These sources ensure a comprehensive understanding of our market position and strategic direction.