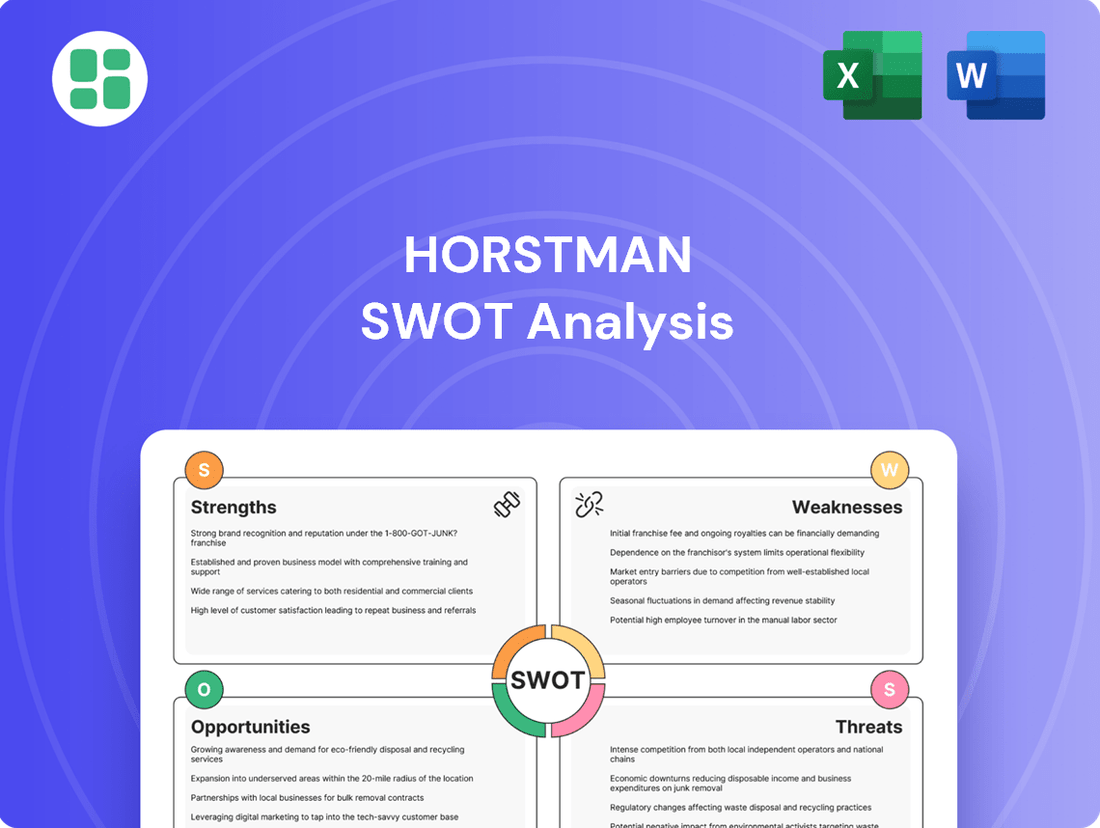

Horstman SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horstman Bundle

Horstman's market position is defined by unique strengths in specialized engineering, but also faces significant competitive pressures and evolving technological landscapes. Understanding these dynamics is crucial for any strategic decision-maker.

Want the full story behind Horstman's competitive advantages, potential threats, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning and research.

Strengths

Horstman stands as a global frontrunner in advanced suspension systems, specifically for armored vehicles. Their expertise in hydro-pneumatic and rotary damper technologies positions them uniquely in a crucial defense market. This specialization translates into significant competitive advantage and market authority.

This leadership is not just a title; it translates into tangible market preference. In 2024, Horstman secured key contracts with major defense manufacturers, underscoring their established reputation. For instance, their systems are integral to several next-generation armored personnel carriers currently in production, reflecting a sustained demand for their specialized solutions.

Horstman's proprietary advanced technology, exemplified by its InArm external suspension system, is a significant strength. This hydro-pneumatic and rotary damper innovation provides military vehicles with superior mobility and ride quality, while also enhancing survivability by creating more internal space. This technological edge is a crucial differentiator in the defense sector.

Horstman's advanced suspension systems are crucial for the performance and survivability of military vehicles. These systems significantly boost mobility and reduce the strain on internal components, directly impacting the operational effectiveness and crew safety of main battle tanks and armored personnel carriers.

Strong Partnerships and Global Reach

Horstman's strength in partnerships is evident through its collaborations with over 18 blue-chip prime contractors and government research centers worldwide. This robust network underscores the company's trusted position within the defense sector.

The company's global reach is further highlighted by its export sales extending to 28 countries. This broad international presence signifies the widespread acceptance and integration of Horstman's specialized solutions across diverse defense initiatives.

- Extensive Prime Contractor Network: Engagements with 18+ leading prime contractors.

- Global Market Penetration: Sales across 28 international markets.

- Government Research Center Collaborations: Partnerships with key research institutions.

- Diversified Defense Program Integration: Solutions adopted in multiple global defense programs.

Commitment to Innovation and Modernization

Horstman demonstrates a strong commitment to innovation, consistently investing in research and development to stay ahead in the defense sector. Their development of solutions like HydroCore showcases a forward-thinking approach to scalable mobility architecture and future upgrade capabilities.

This dedication ensures Horstman's products remain cutting-edge and adaptable to evolving military requirements.

- HydroCore: A prime example of their innovative drive, offering scalable mobility architecture.

- Future Upgrade Requirements: Designed to accommodate future enhancements and evolving military needs.

- Next-Generation Integration: Facilitates integration into future armored vehicle platforms.

- Addressing Future Threats: Proactively developing solutions to counter emerging military challenges.

Horstman's core strength lies in its highly specialized and advanced hydro-pneumatic and rotary damper suspension technologies, particularly for armored vehicles. This technological leadership, exemplified by systems like InArm, provides a significant competitive edge in the defense market. Their established reputation is validated by key contracts secured in 2024 for next-generation armored personnel carriers, demonstrating ongoing demand and market preference for their innovative solutions.

The company's robust global presence is a significant asset, with sales extending to 28 countries and partnerships with over 18 prime contractors and research centers. This wide integration into diverse defense programs, including those for main battle tanks and armored personnel carriers, highlights the widespread trust and acceptance of Horstman's systems. Their commitment to R&D, as seen with HydroCore, ensures their technology remains at the forefront, adaptable to future military requirements and emerging threats.

| Metric | Value (2024/2025 Data) | Significance |

|---|---|---|

| Prime Contractor Network | 18+ | Indicates strong industry relationships and trust. |

| Global Market Reach | 28 Countries | Demonstrates broad international acceptance and integration. |

| Key Contracts Secured | Multiple (2024) | Validates technological leadership and market demand. |

| R&D Investment Focus | HydroCore Development | Highlights commitment to future-proofing technology. |

What is included in the product

Delivers a strategic overview of Horstman’s internal capabilities and external market dynamics.

Offers a clear, actionable framework to identify and address strategic challenges, reducing uncertainty.

Weaknesses

Horstman's specialized focus on the defense sector creates a significant vulnerability. Its revenue streams are intrinsically tied to the cyclical nature of global defense spending and government procurement timelines. For instance, a slowdown in defense budgets, as seen in some European nations during periods of fiscal consolidation, directly translates to reduced demand for Horstman's offerings.

Policy shifts within major defense-spending countries can also abruptly alter market dynamics. A change in government or a strategic pivot away from certain military technologies could severely impact Horstman's order books. This dependency means that economic downturns or geopolitical realignments affecting key client nations pose a direct threat to the company's financial stability and growth prospects.

Horstman's deep specialization in advanced suspension systems for armored vehicles, while a clear strength, inherently creates a concentration risk. This intense focus on a single defense sector means the company has limited product diversification, potentially capping its growth avenues in broader commercial or industrial markets.

Horstman, like many defense contractors, faces extended sales cycles in the defense industry. These cycles can stretch for years, from initial contract bids and development to final product delivery. For instance, major defense procurement programs often have planning and testing phases that can take 5-10 years or more before significant revenue is realized.

Intense Competition in a Specialized Field

The armored vehicle suspension system market, while specialized, is far from a monopoly. Horstman faces robust competition from global players like RENK, its parent company, as well as Cemar International and other manufacturers vying for significant defense contracts. This intense rivalry necessitates ongoing investment in research and development to stay ahead technologically and maintain competitive pricing strategies to secure and retain market share.

The pressure to innovate is constant, as defense ministries worldwide seek the most advanced and reliable suspension solutions for their armored fleets. For instance, in 2024, major defense procurement cycles are underway in several key markets, presenting opportunities but also heightening the competitive landscape. Horstman's ability to consistently deliver cutting-edge technology at a compelling price point will be crucial for its sustained leadership.

- Global Competitors: RENK (parent company), Cemar International, and other specialized manufacturers.

- Market Dynamics: Intense competition for major defense contracts requires continuous innovation.

- Strategic Imperative: Maintaining market share depends on competitive pricing and technological advancement.

- 2024 Focus: Defense procurement cycles in key markets intensify the competitive environment.

Potential for Supply Chain Vulnerabilities

Horstman's reliance on specialized components for its advanced hydro-pneumatic and rotary damper technologies presents a significant weakness. This dependence on a niche supply chain, potentially involving unique materials or manufacturing processes, could lead to disruptions. For instance, a shortage of a critical semiconductor component, which impacted global automotive production by an estimated 10-20% in early 2024, could similarly affect Horstman's production schedules.

Furthermore, global geopolitical instabilities, such as trade disputes or regional conflicts, can exacerbate these supply chain vulnerabilities. These factors can lead to increased material costs or outright shortages, directly impacting Horstman's operational efficiency and profitability. The company's ability to secure consistent and cost-effective access to these specialized inputs is therefore a key concern.

- Specialized Component Dependence: Manufacturing advanced hydro-pneumatic and rotary dampers requires unique materials and parts, creating a concentrated supply chain.

- Disruption Risks: Global events, including trade tensions and regional conflicts, can interrupt the flow of these specialized components.

- Cost Volatility: Supply chain disruptions can lead to unpredictable increases in the cost of raw materials and components, impacting Horstman's margins.

- Material Shortages: A limited number of suppliers for critical components heightens the risk of shortages, potentially halting production.

Horstman's specialized focus on the defense sector creates a significant vulnerability, as its revenue streams are intrinsically tied to the cyclical nature of global defense spending and government procurement timelines. For instance, a slowdown in defense budgets, as seen in some European nations during periods of fiscal consolidation, directly translates to reduced demand for Horstman's offerings.

Policy shifts within major defense-spending countries can also abruptly alter market dynamics. A change in government or a strategic pivot away from certain military technologies could severely impact Horstman's order books. This dependency means that economic downturns or geopolitical realignments affecting key client nations pose a direct threat to the company's financial stability and growth prospects.

Horstman's deep specialization in advanced suspension systems for armored vehicles, while a clear strength, inherently creates a concentration risk. This intense focus on a single defense sector means the company has limited product diversification, potentially capping its growth avenues in broader commercial or industrial markets.

What You See Is What You Get

Horstman SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Horstman's strategic position.

This is a real excerpt from the complete document, showcasing the detailed breakdown of Horstman's Strengths, Weaknesses, Opportunities, and Threats. Once purchased, you’ll receive the full, editable version.

You’re viewing a live preview of the actual SWOT analysis file for Horstman. The complete version, offering actionable insights, becomes available after checkout.

Opportunities

Global defense spending is on an upward trajectory, with projections indicating continued growth through 2025 and beyond. For instance, the Stockholm International Peace Research Institute (SIPRI) reported a 6.8% increase in global military expenditure in 2023, reaching an estimated $2,443 billion. This robust spending environment fuels significant investments in modernizing existing military vehicle fleets and developing entirely new armored platforms.

This escalating demand for advanced military hardware directly translates into a substantial opportunity for Horstman. The company is well-positioned to capitalize on this trend by offering its cutting-edge suspension systems for both the modernization of current vehicle programs and the development of next-generation armored vehicles. Successfully securing new contracts in this expanding market could significantly boost Horstman's revenue streams and solidify its market presence within the defense sector.

The continuous advancement in armored vehicle technology, such as the integration of hybrid-electric propulsion and autonomous driving systems, directly fuels the demand for advanced suspension solutions. Horstman's expertise positions it to capitalize on this trend by developing sophisticated systems that enhance cross-country speed and stability for these evolving platforms.

Horstman can capitalize on its research and development strengths to pioneer next-generation suspension systems that seamlessly integrate with emerging mobility technologies. This proactive approach allows the company to stay ahead of the curve in a rapidly changing defense landscape, ensuring its offerings remain relevant and competitive.

Horstman can leverage its expertise in hydro-pneumatic and rotary damper technology to enter new defense sectors. For instance, adapting these systems for naval applications, such as stabilizing weapon systems or improving vehicle suspension on amphibious craft, presents a significant growth avenue.

This strategic pivot could tap into the growing global naval defense spending, which was projected to reach over $200 billion in 2024, offering Horstman a chance to diversify its customer base and revenue streams beyond its current ground vehicle focus.

Strategic Partnerships and Collaborations

Horstman can significantly expand its market reach and technological capabilities by forming strategic alliances with other defense technology firms and vehicle manufacturers. These collaborations enable the development of more comprehensive, integrated solutions, opening doors to new government and commercial programs. For instance, Horstman's collaboration with Textron on the HydroCore solution exemplifies how co-development can lead to shared research and development costs and faster market entry.

These partnerships are crucial for navigating the complex defense procurement landscape. By combining expertise, Horstman can offer more compelling bids for larger, more integrated defense contracts. The success of HydroCore, which integrates Horstman's advanced suspension technology with Textron's vehicle platforms, demonstrates the tangible benefits of such strategic alignments, leading to broader market penetration and increased sales opportunities.

Key benefits of these strategic partnerships include:

- Access to New Markets: Partnerships can provide entry into markets or programs that Horstman might not be able to access independently.

- Reduced R&D Costs: Sharing the burden of research and development with partners lowers the financial risk and accelerates innovation cycles.

- Enhanced Solution Offerings: Integrating Horstman's core technologies with complementary partner capabilities creates more robust and attractive product suites.

- Increased Program Wins: Collaborative bids are often more competitive, especially for complex, multi-system defense projects.

Demand for Enhanced Crew Protection and Survivability

The modern battlefield presents increasingly sophisticated threats, driving a critical demand for enhanced crew protection and survivability. This includes robust defenses against blast effects and top-down attacks, making vehicle design paramount.

Horstman's advanced suspension systems directly address this opportunity. By optimizing internal space and delivering superior ride quality, these systems contribute significantly to crew safety and operational effectiveness.

The company's technology offers a compelling value proposition to defense clients prioritizing crew survivability. For instance, the global military vehicle market was valued at approximately USD 30.5 billion in 2023 and is projected to grow, indicating a strong market for protection-enhancing solutions.

- Heightened emphasis on crew protection against evolving battlefield threats.

- Horstman's suspension systems enhance survivability by optimizing internal space and ride quality.

- The global military vehicle market's continued growth underscores demand for advanced protection technologies.

The global defense spending surge, reaching an estimated $2,443 billion in 2023 according to SIPRI, creates a fertile ground for Horstman's advanced suspension systems in both vehicle modernization and new platform development.

Horstman's technological edge in hydro-pneumatic and rotary damper systems opens doors to new defense sectors, including naval applications, tapping into projected global naval defense spending exceeding $200 billion in 2024.

Strategic alliances, exemplified by the Textron HydroCore collaboration, allow Horstman to share R&D costs, access new markets, and offer integrated solutions, enhancing competitiveness in complex defense procurement.

The growing demand for crew survivability in modern warfare presents a significant opportunity, as Horstman's systems improve internal space utilization and ride quality, directly contributing to soldier safety within the expanding global military vehicle market.

Threats

Sudden and significant cuts in defense budgets by key client nations, a persistent concern in the defense sector, pose a substantial threat to Horstman. For example, during the 2024 fiscal year, several European nations announced reductions in their defense spending as a response to evolving geopolitical landscapes and domestic economic pressures. This directly impacts Horstman’s order book and financial stability.

A shift in military priorities away from land-based armored vehicle programs, Horstman's core business, presents another critical challenge. As nations re-evaluate their defense needs, focusing more on cyber warfare or naval capabilities, demand for traditional armored vehicles could decrease. This trend was observed in 2024 with a notable decline in new tank development programs initiated by some major powers.

These unpredictable changes can lead to contract cancellations or significantly reduced demand for Horstman’s products. The volatility in defense spending, exacerbated by global economic uncertainties, makes long-term forecasting and revenue planning particularly difficult for companies like Horstman.

The defense technology sector, including areas where Horstman operates, is seeing increased interest from both specialized startups and larger, established players. This trend, particularly evident in advanced materials and propulsion systems, could mean companies like Boeing and Lockheed Martin might invest more in developing their own competing technologies, rather than relying solely on specialized suppliers. For instance, the global defense market was projected to reach approximately $750 billion in 2024, a figure that attracts significant R&D investment from all participants.

This heightened competition poses a direct threat to Horstman by potentially driving down prices for critical components and systems. As larger defense contractors leverage their scale, they can absorb higher development costs, putting pressure on smaller, specialized firms to innovate rapidly. Failure to do so could erode Horstman's market share and profitability, necessitating substantial, ongoing investment in research and development to stay ahead.

The defense sector's rapid technological advancement presents a significant threat. Competitors introducing disruptive innovations could quickly diminish the market relevance of Horstman's existing product lines. For instance, the ongoing development in directed energy weapons and advanced drone swarming technologies, areas where significant R&D investment is occurring globally, could outpace Horstman's innovation cycle.

Failure to adapt to these swift changes means Horstman risks its offerings becoming outdated, requiring substantial, potentially disruptive, capital allocation towards research and development to regain a competitive edge. The global defense market saw R&D spending reach an estimated $200 billion in 2024, highlighting the intensity of this technological race.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical instability, a persistent concern, poses significant threats to Horstman's operations. Escalating global tensions and ongoing conflicts can severely disrupt the flow of critical components and raw materials, directly impacting production schedules and the ability to meet delivery commitments. For instance, the ongoing semiconductor shortage, exacerbated by geopolitical factors, has already affected numerous industries, and Horstman is not immune to these ripple effects.

Furthermore, the imposition of export controls and international sanctions presents complex challenges for companies with a global footprint. These measures can complicate international trade, restrict market access, and necessitate costly adjustments to supply chain strategies. In 2024, the implementation of new trade restrictions by major economic blocs highlights the increasing volatility Horstman must navigate.

- Supply Chain Vulnerability: Reliance on specific regions for key materials makes Horstman susceptible to disruptions caused by political unrest or trade disputes.

- Market Access Restrictions: Sanctions or tariffs imposed on certain countries could limit Horstman's sales opportunities and revenue streams.

- Increased Operational Costs: Navigating complex geopolitical landscapes often leads to higher logistics, compliance, and sourcing costs.

- Production Delays: Shortages of essential inputs due to geopolitical events can directly translate into delayed product launches and missed sales targets.

Regulatory Changes and Compliance Burdens

Horstman operates in the defense sector, a field heavily influenced by evolving government regulations. Changes in export controls, for instance, could directly impact Horstman's ability to sell its products internationally, potentially reducing revenue streams. Compliance with these rules often requires significant investment in legal and administrative resources, adding to operational overhead.

The defense industry is subject to a complex web of national and international laws. For example, in 2024, the US Department of Defense continued to emphasize cybersecurity compliance, requiring defense contractors to meet specific standards like the Cybersecurity Maturity Model Certification (CMMC). Failure to adhere to such evolving mandates could lead to contract disqualification or penalties, posing a direct threat to Horstman's business.

- Increased Compliance Costs: New regulations can necessitate significant investment in technology, personnel, and legal counsel to ensure adherence.

- Market Access Restrictions: Changes in export control laws or trade policies can limit Horstman's ability to engage with international clients.

- Potential for Fines and Penalties: Non-compliance with defense industry regulations can result in substantial financial penalties and reputational damage.

- Intellectual Property Protection: Stringent IP laws in the defense sector require constant vigilance and investment to safeguard proprietary technologies.

The defense sector's intense competition, fueled by larger players and specialized startups, threatens Horstman's market share and profitability. For instance, the global defense market, projected around $750 billion in 2024, attracts substantial R&D from all participants, potentially driving down prices for critical components and systems.

Rapid technological advancements, such as directed energy weapons and drone swarming, could render Horstman's current offerings obsolete if the company fails to innovate at a comparable pace. The estimated $200 billion in global defense R&D spending for 2024 underscores the urgency of keeping pace with these disruptive innovations.

Geopolitical instability and evolving government regulations, including export controls and cybersecurity mandates like CMMC, pose significant threats. These factors can disrupt supply chains, restrict market access, and incur substantial compliance costs, as seen with new trade restrictions implemented by major economic blocs in 2024.

| Threat Category | Specific Threat | Impact on Horstman | Example/Data Point (2024/2025) |

| Competition | Increased R&D by larger defense contractors | Erosion of market share, reduced profitability | Global defense market R&D spending estimated at $200 billion in 2024 |

| Technological Obsolescence | Emergence of disruptive technologies (e.g., directed energy) | Diminished relevance of existing product lines | Significant global investment in advanced drone swarming technologies |

| Geopolitical Instability | Supply chain disruptions due to political unrest | Production delays, inability to meet delivery commitments | Ongoing semiconductor shortages exacerbated by geopolitical factors |

| Regulatory Changes | Stricter cybersecurity compliance (e.g., CMMC) | Contract disqualification, financial penalties | US DoD emphasis on CMMC for defense contractors |

SWOT Analysis Data Sources

This Horstman SWOT analysis is built upon a robust foundation of information, drawing from detailed financial reports, comprehensive market research, and expert industry insights to provide a well-rounded strategic perspective.