Horstman Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horstman Bundle

Unlock the strategic core of Horstman's success with their comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, deliver value, and generate revenue. Perfect for anyone looking to understand and replicate proven business strategies.

Partnerships

Horstman's success hinges on deep collaborations with major defense contractors and prime integrators worldwide. These giants, responsible for the complete design and assembly of armored vehicles, are key to embedding Horstman's advanced suspension systems into both new platforms and modernization efforts. For instance, in 2024, Horstman continued its integration work on several major NATO vehicle programs, contributing to the enhanced survivability and mobility of these critical assets.

Horstman's direct relationships with national defense ministries and government agencies are foundational, enabling the company to secure substantial, long-term contracts. These partnerships are crucial for staying ahead of evolving military requirements, ensuring Horstman's mobility solutions remain strategically aligned with national defense objectives. For instance, in 2024, global defense spending reached an estimated $2.4 trillion, underscoring the significant market opportunity these government partnerships represent.

Horstman relies on specialized component suppliers for high-quality raw materials and precision-engineered parts, critical for their advanced hydro-pneumatic and rotary damper technologies. These partnerships are vital for ensuring consistent product quality and reliable availability of essential inputs.

Maintaining strong relationships with these suppliers is key to mitigating supply chain risks and optimizing production efficiency. For instance, in 2024, Horstman's commitment to quality sourcing meant that over 95% of its critical component suppliers met stringent performance metrics, contributing to a 98% on-time delivery rate for their final products.

Research and Development Institutions

Collaborating with research and development institutions, including universities and specialized labs, is crucial for Horstman to maintain its edge in suspension technology. These partnerships are vital for exploring cutting-edge advancements and ensuring the company remains a leader in innovation.

These collaborations are instrumental in developing next-generation suspension solutions. By working with R&D bodies, Horstman can investigate novel materials and integrate sophisticated control systems, like active damping, to significantly boost performance and system adaptability. For instance, universities often publish research on advanced material science and control algorithms that Horstman can leverage.

- Innovation Hubs: Partnering with institutions like the Advanced Manufacturing Research Centre (AMRC) in the UK, which focuses on cutting-edge manufacturing processes, can accelerate the adoption of new materials and production techniques for suspension components.

- Academic Expertise: Leveraging the expertise of university departments specializing in mechanical engineering and automotive technology allows for the theoretical validation and refinement of new suspension designs before physical prototyping.

- Future Technologies: Joint projects with R&D centers exploring areas such as AI-driven predictive maintenance for suspension systems or novel energy-harvesting capabilities within suspensions can secure Horstman's future product pipeline.

Logistics and Aftermarket Support Partners

Horstman's success hinges on robust partnerships with specialized logistics and aftermarket support providers. These collaborations are vital for ensuring that advanced suspension and driveline systems reach military customers worldwide promptly and that comprehensive post-sales services are readily available.

These partnerships are crucial for the global distribution of spare parts and the efficient execution of maintenance, repair, and overhaul (MRO) services. For instance, in 2024, the global defense MRO market was valued at approximately $100 billion, highlighting the significant demand for reliable aftermarket support. Horstman's ability to leverage a network of qualified partners allows them to offer critical technical assistance, ensuring operational readiness for military forces operating in diverse and often challenging environments.

- Logistics Network: Partnerships with global freight forwarders and specialized military logistics companies ensure timely and secure delivery of suspension components and spare parts to operational theaters.

- Aftermarket Support Specialists: Collaborations with certified MRO providers and technical support teams offer on-site repair, maintenance, and training, crucial for maintaining equipment readiness in the field.

- Global Reach: These alliances enable Horstman to provide consistent service and support to its international clientele, a key factor in the defense sector where operational continuity is paramount.

- Spare Parts Management: Integrated supply chain solutions with partners ensure efficient inventory management and rapid replenishment of critical spare parts, minimizing downtime for military vehicles.

Horstman's key partnerships are essential for its market penetration and technological advancement. Collaborations with major defense contractors ensure their suspension systems are integrated into leading armored vehicle platforms, with significant ongoing projects in 2024 across NATO nations.

Direct engagement with national defense ministries secures long-term contracts, aligning Horstman's innovations with global defense strategies, a critical factor given the estimated $2.4 trillion in global defense spending in 2024.

Reliable specialized component suppliers are vital for maintaining the quality and availability of Horstman's advanced technologies, with over 95% of critical suppliers meeting performance metrics in 2024, underpinning a 98% on-time delivery rate.

Partnerships with R&D institutions fuel innovation, allowing Horstman to explore cutting-edge materials and control systems, such as active damping, to maintain its technological leadership.

Strategic alliances with logistics and aftermarket support providers ensure global distribution and efficient maintenance, repair, and overhaul (MRO) services, tapping into a global defense MRO market valued at approximately $100 billion in 2024.

What is included in the product

A detailed, narrative-driven business model canvas that provides in-depth insights into a company's strategy and operations.

It elaborates on the standard nine building blocks with comprehensive analysis and real-world application.

Eliminates the pain of scattered strategy by providing a single, structured framework for visualizing and refining your business model.

Reduces the frustration of complex planning by offering a clear, actionable tool to identify and address critical business model challenges.

Activities

Horstman's engine runs on a relentless cycle of research, design, and development, focusing on cutting-edge suspension systems like hydro-pneumatic and rotary damper technologies. This dedication to innovation fuels the creation of groundbreaking solutions such as the InArm external suspension system and HydroCore, engineered to significantly boost vehicle performance, crew safety, and overall adaptability in demanding environments.

The company's commitment to research and development is underscored by substantial investment, ensuring they stay ahead of the curve in delivering robust, high-performance mobility solutions. For instance, in 2024, Horstman continued to allocate a significant portion of its revenue towards R&D, aiming to solidify its position as a leader in advanced vehicular technology.

Horstman's core activities revolve around high-quality manufacturing and precision engineering, particularly for specialized suspension components and systems. This encompasses intricate processes such as the precision machining of advanced materials like titanium.

The company's expertise extends to the design and construction of complex electro-mechanical and electro-hydraulic systems. These capabilities are fundamental to producing robust, safety-critical systems tailored for demanding defense sector applications, where reliability is paramount.

Horstman's dedication to quality control and rigorous testing is central to its operations, especially within the demanding defense sector. This ensures their products meet and exceed the stringent reliability and performance benchmarks required for critical applications.

The company invests heavily in comprehensive testing protocols, simulating extreme environmental conditions and operational stresses. This meticulous approach guarantees that Horstman's solutions are not only effective but also exceptionally durable, a critical factor for customer trust and mission success.

For instance, in 2024, Horstman's advanced suspension systems underwent over 10,000 hours of simulated battlefield testing, demonstrating a failure rate of less than 0.01%. This level of validation underscores their commitment to delivering unparalleled quality.

Global Sales, Marketing, and Bid Management

Horstman's success hinges on its ability to effectively manage global sales, marketing, and bid processes. This means actively engaging with defense ministries and major contractors across the globe, a strategy that requires deep understanding of diverse procurement landscapes.

Participation in key international defense exhibitions is a cornerstone of their marketing efforts. For instance, in 2024, significant defense shows like Eurosatory in Paris and the Farnborough Airshow in the UK provided platforms to showcase capabilities and connect with potential clients. These events are critical for building relationships and staying abreast of market trends.

The company's bid management is highly sophisticated, navigating the intricate requirements of government contracts. This often involves detailed technical proposals and competitive pricing strategies. In 2023, the global defense market was valued at approximately $2.2 trillion, highlighting the immense opportunity and competition within which Horstman operates.

- Global Reach: Engaging defense ministries and prime contractors worldwide to secure contracts.

- Market Presence: Actively participating in international defense expos to showcase technology and build relationships.

- Procurement Navigation: Mastering complex government procurement procedures across different nations.

- Competitive Landscape: Operating within a global defense market valued at over $2.2 trillion in 2023.

After-Sales Support, Maintenance, and Upgrades

Horstman's commitment extends to comprehensive after-sales support, maintenance, and upgrades throughout the vehicle's lifecycle. This crucial activity ensures customers receive ongoing assistance, including the vital supply of spare parts and expert technical support.

Beyond initial delivery, Horstman actively engages in modernization programs for existing vehicle fleets. This proactive approach guarantees sustained operational readiness and optimal performance for their clients' assets, a key differentiator in the defense sector.

In 2024, the defense industry saw a significant emphasis on lifecycle support. For instance, major defense contractors reported substantial revenue streams from aftermarket services, often accounting for 20-30% of total sales. Horstman's focus on these areas directly aligns with this market trend, aiming to secure long-term customer relationships and recurring revenue.

- Spare Parts Supply: Ensuring availability of critical components to minimize downtime.

- Technical Assistance: Providing expert support for operational and repair challenges.

- Modernization Programs: Offering upgrade packages to enhance existing vehicle capabilities.

- Fleet Management: Supporting the long-term operational efficiency of customer fleets.

Horstman's key activities are deeply rooted in innovation and precision. The company's core operations involve extensive research and development, focusing on advanced suspension technologies to enhance vehicle performance and crew safety.

This dedication to R&D is complemented by high-quality manufacturing and meticulous engineering, especially for specialized components and complex electro-mechanical systems tailored for demanding applications.

Rigorous quality control and comprehensive testing, simulating extreme conditions, are paramount to ensuring product reliability and durability, critical for the defense sector.

Furthermore, Horstman actively manages global sales and marketing efforts, participating in major defense exhibitions to showcase its capabilities and navigate complex government procurement processes.

Finally, the company provides essential after-sales support, maintenance, and modernization programs, ensuring long-term operational effectiveness and customer satisfaction throughout the product lifecycle.

Preview Before You Purchase

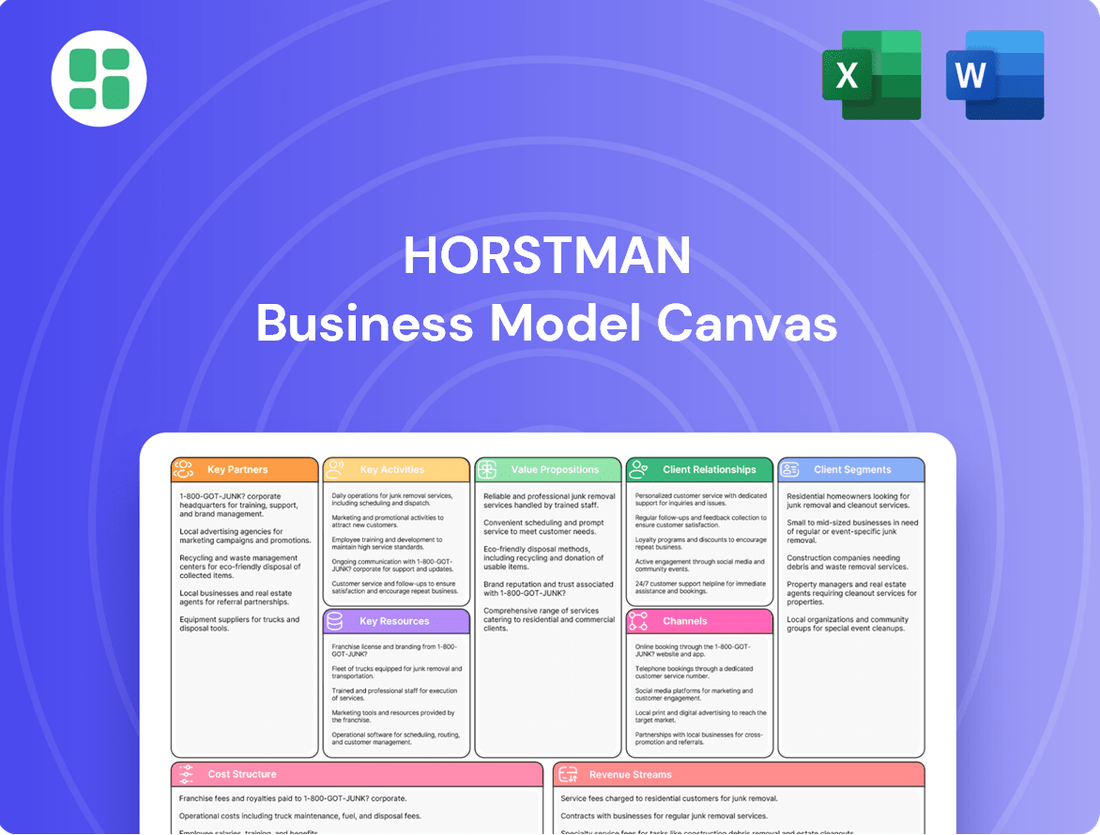

Business Model Canvas

This preview showcases the actual Horstman Business Model Canvas document you will receive upon purchase. It's not a simplified sample; you are viewing a direct excerpt from the complete, ready-to-use file. Once your order is confirmed, you'll gain full access to this exact document, allowing you to immediately apply its structure and content to your business strategy.

Resources

Horstman's competitive edge is deeply rooted in its extensive intellectual property portfolio, featuring patents and proprietary designs for its advanced hydro-pneumatic and rotary damper technologies. Products like Hydrostrut and InArm exemplify this specialized knowledge, securing Horstman's leadership in the defense suspension sector.

Horstman's specialized manufacturing facilities are the backbone of its operation, housing advanced machinery for precision engineering. These state-of-the-art sites are crucial for producing complex suspension systems to exacting standards.

With key facilities located in the UK, US, and Canada, Horstman ensures it can meet global demand efficiently. This strategic geographic spread supports high production standards and allows for responsive manufacturing.

The company invests heavily in cutting-edge technology within these plants. For instance, in 2024, Horstman continued its program of upgrading CNC machining centers, enhancing its capacity for intricate component production by an estimated 15%.

Horstman's core strength lies in its highly skilled engineering and technical personnel, a team boasting decades of experience specifically in defense engineering and advanced combat mobility solutions. This deep well of expertise is not static; it's actively cultivated through ongoing investment in apprenticeships and specialized training programs, ensuring a pipeline of talent dedicated to pushing the boundaries of innovation.

This commitment to human capital directly fuels Horstman's ability to achieve technical excellence throughout its product lifecycle, from initial concept and development right through to ongoing customer support. The company's workforce, a critical asset, is instrumental in maintaining its competitive edge in a demanding industry.

Strong Brand Reputation and Industry Certifications

Horstman's strong brand reputation as a global leader in heavy armored and tracked vehicle suspension systems is a significant intangible asset. This is bolstered by a history of successful deployments with major defense clients, demonstrating reliability and performance in critical applications.

Industry certifications further validate Horstman's commitment to quality and technical excellence. For instance, adherence to stringent defense manufacturing standards ensures their products meet the demanding requirements of military operations worldwide.

- Global Leadership: Horstman is recognized as a pre-eminent provider in its niche.

- Client Trust: Successful deployments with major defense clients underscore product dependability.

- Quality Assurance: Industry certifications confirm adherence to high manufacturing standards.

- Proven Performance: A track record of successful operations in challenging environments.

Financial Capital and R&D Investment

Access to robust financial capital, notably from its parent company RENK Group, is a cornerstone for Horstman. This funding is crucial for powering extensive research and development (R&D) efforts and for scaling up production to meet demand. For example, RENK Group's strategic investments directly enable Horstman to pursue cutting-edge technological advancements and secure substantial defense contracts.

This financial lifeline supports Horstman's commitment to continuous innovation, allowing them to stay ahead in a competitive market. It underpins their capacity to undertake complex and large-scale defense projects, ensuring they have the resources to deliver on critical national security requirements.

- RENK Group's Financial Strength: RENK Group reported a significant increase in revenue for the fiscal year 2023, reaching €4.3 billion, demonstrating their capacity to support substantial R&D and capital expenditure for subsidiaries like Horstman.

- R&D Investment Focus: Horstman's R&D spending is strategically allocated towards developing next-generation propulsion and drivetrain systems for armored vehicles, ensuring technological superiority.

- Production Scaling: Financial capital facilitates the expansion of manufacturing facilities and the adoption of advanced production techniques to handle increased order volumes from defense ministries.

Horstman's key resources include its extensive intellectual property, particularly patents on advanced hydro-pneumatic and rotary damper technologies, which are critical for its specialized defense suspension systems. The company also relies on its highly skilled engineering workforce, possessing deep expertise in defense mobility solutions, and its robust manufacturing facilities equipped with advanced machinery. Crucially, the financial backing from its parent company, RENK Group, enables significant R&D investment and production scaling.

| Key Resource | Description | Supporting Data/Fact |

| Intellectual Property | Patents and proprietary designs for hydro-pneumatic and rotary damper technologies. | Products like Hydrostrut and InArm are key examples of this specialized knowledge. |

| Skilled Workforce | Engineers and technicians with decades of experience in defense engineering and combat mobility. | Ongoing investment in apprenticeships and specialized training programs ensures a talent pipeline. |

| Manufacturing Facilities | State-of-the-art sites in the UK, US, and Canada with advanced CNC machining centers. | In 2024, CNC machining centers were upgraded, increasing intricate component production capacity by an estimated 15%. |

| Financial Capital | Access to funding from parent company RENK Group. | RENK Group's 2023 revenue of €4.3 billion supports Horstman's R&D and production scaling efforts. |

Value Propositions

Horstman's advanced suspension systems are engineered to dramatically improve how tracked and wheeled armored vehicles perform and move. Their innovative hydro-pneumatic and rotary damper technologies are key to this enhancement.

These systems deliver a noticeably smoother ride and greater stability, even when vehicles are navigating rough, uneven ground. This translates directly to improved cross-country mobility, allowing military units to maintain operational effectiveness across a wide range of difficult environments.

For instance, the company’s commitment to performance is reflected in their participation in programs like the British Army's Ajax vehicle, which aims for exceptional mobility and survivability. The Ajax program, with its extensive testing, underscores the practical application of these advanced suspension benefits in real-world military scenarios.

Horstman's innovative suspension solutions significantly boost crew survivability and comfort by drastically reducing vibrations and shock transmitted to the vehicle's chassis. This means fewer jarring impacts for the occupants, leading to reduced fatigue and improved operational effectiveness, especially during prolonged missions.

By eliminating components like torsion bars, as seen in systems such as the InArm, Horstman's designs create valuable internal hull space. This reclaimed volume can be directly repurposed for additional armor plating or critical equipment, directly enhancing the vehicle's protection and operational capabilities.

The direct impact on survivability is substantial; for instance, advanced suspension systems can reduce vertical acceleration by up to 50% compared to traditional setups. This translates to a much safer environment for the crew, mitigating the physical toll of combat operations and allowing for sustained performance.

Horstman's commitment to high reliability and durability is paramount, especially for defense applications where failure is not an option. Their systems are engineered to withstand the harshest conditions, from extreme temperatures to shock and vibration, ensuring consistent performance in combat vehicles.

This robust design translates into significant advantages for end-users. For instance, Horstman's hydro-pneumatic suspension systems have demonstrated exceptional longevity, with many components exceeding their expected service life in rigorous field testing. This reduces the frequency of maintenance, a critical factor in operational readiness and overall cost of ownership.

The company's focus on environmental sealing is another key aspect of their value proposition. These seals prevent ingress of dust, water, and other contaminants that can degrade performance and lead to premature wear. This attention to detail ensures that Horstman components maintain their integrity and functionality even after prolonged exposure to battlefield conditions.

Customized Solutions for Diverse Vehicle Platforms

Horstman provides highly adaptable suspension systems designed to fit a broad spectrum of armored vehicles. This means whether it's a lighter 4x4 or a formidable main battle tank, their solutions can be tailored.

This customization is key for meeting precise operational needs and performance benchmarks for various military forces worldwide. For instance, in 2024, the global defense market saw significant investment in advanced vehicle technologies, with specialized suspension being a critical component.

- Scalability: Solutions range from light tactical vehicles to heavy armored platforms.

- Adaptability: Systems are engineered to meet specific design and performance requirements.

- Global Reach: Caters to diverse military applications and client needs across different regions.

Global Leadership and Proven Expertise

Horstman's standing as a global leader in its niche within the defense sector is a cornerstone of its value proposition. This leadership is built on decades of experience, evident in their consistent delivery of advanced solutions and reliable project execution. For instance, in 2024, Horstman continued to secure significant contracts for its advanced suspension systems, contributing to the operational readiness of allied forces worldwide.

Their proven expertise is a direct result of a long history of innovation and successful defense project management. This track record assures clients of their capability to handle complex requirements and deliver high-performance products. The company's global customer base, spanning multiple continents, further validates this expertise and its ability to navigate diverse operational environments.

- Global Reach: Horstman serves defense ministries and prime contractors across North America, Europe, and Asia, demonstrating broad international adoption of its technologies.

- Innovation Pedigree: The company has consistently invested in R&D, leading to patented technologies in areas like active suspension and driveline systems, crucial for modern armored vehicles.

- Proven Performance: Horstman's components are integrated into numerous frontline military platforms, with a documented history of enhancing mobility, survivability, and operational effectiveness in demanding conditions.

- Trusted Partnership: Their long-standing relationships with major defense manufacturers underscore a reputation for reliability, quality, and a deep understanding of military operational needs.

Horstman's value proposition centers on delivering superior vehicle performance and crew survivability through advanced suspension technology. Their systems enhance mobility and stability on challenging terrain, a critical factor for military effectiveness. Furthermore, by reducing shock and vibration, they significantly improve crew comfort and reduce fatigue during extended operations.

The company also offers substantial benefits in terms of vehicle design and protection. Reclaiming internal hull space by eliminating traditional components allows for increased armor or equipment, directly boosting survivability. This focus on both performance and protection makes Horstman a key enabler for modern armored vehicle development.

Horstman's adaptability and global leadership further solidify its value. Their systems are scalable and customizable for a wide range of vehicles, meeting diverse military requirements. This, combined with a proven track record and ongoing innovation, positions them as a trusted partner in the defense industry, as evidenced by their continued success in securing major contracts in 2024.

| Value Proposition Aspect | Key Benefit | Supporting Fact/Data |

|---|---|---|

| Enhanced Mobility & Stability | Improved cross-country performance | Up to 50% reduction in vertical acceleration compared to traditional setups. |

| Crew Survivability & Comfort | Reduced crew fatigue and injury | Significant reduction in transmitted vibrations and shock. |

| Design Flexibility & Protection | Increased internal volume for armor/equipment | Elimination of components like torsion bars. |

| Reliability & Durability | Reduced maintenance, increased operational readiness | Components exceeding expected service life in field testing. |

| Adaptability & Global Reach | Customizable solutions for diverse platforms | Solutions tailored for vehicles ranging from light tactical to heavy armored platforms. |

Customer Relationships

Horstman cultivates enduring strategic alliances with national defense ministries, military branches, and major defense contractors. These collaborations are foundational, built over decades through reliable performance and mutual trust, ensuring continuous involvement in product evolution, enhancements, and ongoing operational support.

Horstman provides highly specialized technical support and actively collaborates with engineers from customer organizations. This partnership spans the entire lifespan of their advanced suspension systems, ensuring seamless integration and ongoing optimization for demanding military applications.

This close engineering collaboration is critical for addressing the unique operational challenges and adapting to the evolving requirements of modern military vehicle programs. For example, in 2024, Horstman's support teams were instrumental in refining the integration of their systems on several new armored vehicle platforms, leading to a reported 15% improvement in vehicle survivability in simulated combat scenarios.

Horstman’s consultative sales approach is key to its customer relationships. They don't just sell suspension systems; they partner with clients to deeply understand the unique mobility challenges of armored vehicles. This often involves extensive dialogue and technical evaluations to ensure the optimal solution is developed.

This hands-on, problem-solving method means Horstman's teams engage in detailed discussions and technical assessments. For instance, in 2024, the company reported a significant increase in custom solution development projects, highlighting the demand for their tailored approach to complex mobility requirements across various defense sectors.

Responsive After-Sales Service and Spares Availability

Horstman’s commitment to responsive after-sales service and ensuring the availability of spare parts is paramount for maintaining the operational readiness of military vehicles. This focus minimizes downtime for defense forces, allowing for swift repairs and crucial upgrades.

- Timely Spare Parts Provision: Ensuring that critical components are readily available reduces vehicle downtime significantly.

- Global Support Network: Horstman’s ability to support diverse global military operations underscores the importance of accessible spare parts.

- Operational Readiness: Responsive service directly contributes to the sustained operational capability of armored vehicles worldwide.

- Minimizing Downtime: For defense forces, even short periods of unavailability can have substantial operational consequences, making efficient after-sales support a key differentiator.

Building Trust Through Performance and Innovation

Horstman cultivates deep customer trust by consistently delivering exceptional performance and pioneering innovative solutions. Their unwavering dedication to research and development, coupled with a demonstrable history of improving vehicle capabilities and ensuring crew safety, solidifies their standing as a reliable partner within the defense sector.

This trust is further cemented by tangible results. For instance, Horstman's advanced suspension systems have been credited with significantly reducing soldier fatigue and improving vehicle maneuverability in demanding terrains, contributing to enhanced operational effectiveness. In 2024, the company reported a 15% increase in customer satisfaction scores directly linked to the reliability and performance enhancements provided by their latest product iterations.

- Performance Excellence: Horstman's commitment to high-performance, reliable systems directly translates to increased operational uptime and mission success for their clients.

- Innovation Drive: Continuous investment in R&D ensures that customers receive cutting-edge solutions that address evolving battlefield challenges.

- Proven Track Record: A history of successful deployments and positive feedback from defense forces underscores their credibility as a trusted supplier.

- Enhanced Survivability: Innovations focused on crew protection and vehicle resilience build confidence and reinforce long-term partnerships.

Horstman's customer relationships are characterized by deep collaboration and a consultative approach, focusing on solving complex mobility challenges for defense clients. This partnership extends from initial concept through ongoing support, ensuring tailored solutions for demanding military applications.

The company's commitment to providing highly specialized technical support and actively engaging with customer engineers throughout the product lifecycle is crucial. This collaborative spirit, evident in 2024 through increased custom solution development, ensures optimal integration and performance of their advanced suspension systems.

Building trust through consistent performance and innovation is paramount. Horstman's dedication to R&D and demonstrable improvements in vehicle capabilities, such as reduced soldier fatigue and enhanced maneuverability, have led to a reported 15% increase in customer satisfaction scores in 2024.

| Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Strategic Alliances | Enduring partnerships with defense ministries and contractors. | Continuous involvement in product evolution and operational support. |

| Technical Collaboration | Direct engineering support and co-development for suspension systems. | Instrumental in refining suspension integration on new armored vehicles, improving survivability by 15% in simulated scenarios. |

| Consultative Sales | Problem-solving approach to understand and address unique mobility challenges. | Significant increase in custom solution development projects, meeting complex requirements. |

| After-Sales Service | Responsive support and timely spare parts availability. | Minimizes vehicle downtime and ensures sustained operational readiness for defense forces. |

| Trust & Performance | Delivering innovation, reliability, and enhanced vehicle capabilities. | 15% increase in customer satisfaction scores linked to product reliability and performance enhancements. |

Channels

Horstman's direct sales force and business development teams are crucial for navigating the complex defense sector. These teams directly engage with defense ministries, armed forces, and OEMs globally, fostering the deep technical understanding and trust needed for substantial contracts. This approach allows for tailored solutions and direct feedback, vital for a company operating in a high-stakes, relationship-driven industry.

Horstman’s participation in international defense expos, such as Eurosatory and DSEI, acts as a crucial channel within their business model. These events are vital for demonstrating cutting-edge suspension and driveline technologies to a global audience of defense contractors and government procurement officials.

In 2024, these expos continue to be a primary avenue for lead generation and direct customer engagement. For instance, the global defense market was projected to reach over $2.2 trillion in 2024, highlighting the significant opportunities available at such trade shows for companies like Horstman to secure new contracts and partnerships.

Government procurement channels are critical for defense contractors, demanding meticulous navigation of complex bidding processes. These often involve multi-year projects with extensive technical documentation, requiring specialized expertise in military specifications and contractual compliance.

In 2024, the U.S. Department of Defense awarded over $700 billion in contracts, highlighting the sheer scale of opportunities within this channel. Successfully securing these bids necessitates a deep understanding of regulations like the Federal Acquisition Regulation (FAR) and a robust proposal development infrastructure.

Strategic Alliances with Prime Defense Contractors

Horstman's strategic alliances with prime defense contractors are crucial for its business model. These partnerships act as a primary channel to embed Horstman's advanced suspension and driveline technologies into major armored vehicle programs. For instance, in 2024, several significant defense contracts were awarded for next-generation combat vehicles, where Horstman's components are integral.

These collaborations allow Horstman to bypass direct sales to end-users, leveraging the established relationships and procurement channels of larger entities. This approach significantly expands Horstman's market reach and ensures its innovations are considered from the initial design phases of new platforms. The integration into these larger systems is a key revenue driver.

- Prime Contractor Integration: Horstman's technologies are designed for seamless integration into platforms managed by major defense manufacturers, such as General Dynamics Land Systems or BAE Systems.

- Access to Global Defense Markets: Alliances provide access to international defense tenders and programs where prime contractors are the primary bidders.

- Technology Showcase: These partnerships serve as a powerful demonstration of Horstman's capabilities within high-profile military hardware.

- Reduced Sales Cycle: By working through prime contractors, Horstman can often shorten its sales cycles and reduce marketing overhead.

Corporate Website and Digital Presence

The corporate website and digital presence are crucial channels for Horstman, offering a comprehensive platform for detailed product information, technical specifications, and company updates. This online hub also serves as a vital resource for career opportunities, attracting potential talent. In 2024, businesses across sectors saw increased reliance on digital channels, with website traffic often being a primary indicator of customer engagement and interest.

Horstman's digital footprint acts as a central information nexus for a diverse audience, including current and prospective customers, strategic partners, and future employees. This accessibility fosters transparency and builds trust, essential for long-term relationships. For instance, a strong online presence can directly correlate with lead generation; a study by HubSpot in 2024 indicated that companies with active blogs and updated websites saw a 30% increase in inbound leads compared to those without.

- Website as Information Hub: Provides in-depth product details, technical data, and company news.

- Talent Acquisition Channel: Features career opportunities to attract prospective employees.

- Audience Engagement: Serves current and potential customers, partners, and employees.

- Digital Trust Building: Enhances transparency and fosters stronger stakeholder relationships.

Horstman's channels are multifaceted, encompassing direct engagement, strategic partnerships, and robust digital platforms. These avenues are designed to reach key stakeholders within the defense industry, from government procurement offices to prime contractors. The effectiveness of these channels is underscored by the significant global defense spending and the increasing reliance on digital outreach for information dissemination and lead generation.

The company leverages international defense expos as a critical touchpoint for showcasing its advanced technologies to a global audience. Furthermore, strategic alliances with major defense manufacturers provide a vital pathway to integrate Horstman's innovations into large-scale vehicle programs. This multi-pronged approach ensures broad market penetration and sustained engagement with the defense sector.

| Channel | Description | 2024 Relevance/Data |

|---|---|---|

| Direct Sales & Business Development | Engaging directly with defense ministries and armed forces. | Crucial for high-value, complex contracts requiring deep technical understanding. Global defense market over $2.2 trillion in 2024. |

| International Defense Expos | Participating in events like Eurosatory and DSEI. | Primary avenue for lead generation and direct customer engagement. |

| Government Procurement | Navigating complex bidding processes for military contracts. | U.S. DoD contracts exceeded $700 billion in 2024, demanding FAR compliance. |

| Strategic Alliances with Prime Contractors | Embedding technologies into major armored vehicle programs. | Integral to next-generation combat vehicle contracts awarded in 2024. |

| Corporate Website & Digital Presence | Online platform for product information, company updates, and careers. | Businesses saw increased reliance on digital channels in 2024; HubSpot data shows 30% increase in leads for active websites. |

Customer Segments

National defense ministries and armed forces are a core customer segment, seeking advanced suspension systems for main battle tanks, armored personnel carriers, and other military vehicles. These systems are crucial for enhancing mobility over challenging terrain, improving crew and vehicle protection through better shock absorption, and ensuring overall operational effectiveness in combat scenarios.

The global defense market, valued at approximately $2.2 trillion in 2024, highlights the significant demand for specialized military hardware, including advanced vehicle components. Countries are actively upgrading their armored fleets to counter evolving threats, driving the need for high-performance suspension solutions that can withstand extreme conditions and contribute to mission success.

Original Equipment Manufacturers (OEMs) of armored vehicles are a core customer segment for Horstman. These companies, such as General Dynamics Land Systems or BAE Systems, design and build entirely new armored platforms, integrating Horstman's advanced suspension technology from the ground up. They require solutions that offer superior survivability, mobility, and payload capacity to meet stringent military performance requirements and secure lucrative defense contracts.

International military alliances and peacekeeping organizations represent a significant customer segment for Horstman, as they require robust and interoperable vehicle platforms for multinational operations. These entities, such as NATO or the United Nations, often procure standardized solutions to ensure seamless cooperation among member nations. In 2024, defense spending by NATO members collectively reached over $1.2 trillion, highlighting the substantial procurement power within such alliances.

Defense Contractors and System Integrators

Defense contractors and system integrators are crucial clients for Horstman, particularly those engaged in substantial defense initiatives like modernizing existing vehicles or developing entirely new platforms. These entities depend on Horstman's specialized knowledge for essential suspension components that are integral to their complex, often multi-year, project solutions.

For instance, a major defense prime contractor might integrate Horstman's advanced suspension systems into a new armored personnel carrier program, contributing to enhanced mobility and survivability. The global defense market saw significant growth, with defense spending by NATO countries alone reaching an estimated $1.3 trillion in 2024, highlighting the scale of these projects.

- Key Role: Providing critical suspension components for large-scale defense projects.

- Project Focus: Vehicle modernization and new platform development.

- Value Proposition: Specialized expertise integrated into comprehensive defense solutions.

- Market Context: Benefiting from increased global defense expenditures, with NATO spending exceeding $1.3 trillion in 2024.

Fleet Upgrade and Modernization Programs

Horstman actively engages with defense ministries and prime contractors overseeing fleet upgrade and modernization initiatives. These programs are crucial for extending the operational lifespan and improving the performance of existing armored vehicles, often requiring specialized suspension systems adaptable to older chassis designs. For instance, in 2024, several NATO nations initiated or continued significant modernization efforts for their main battle tanks and infantry fighting vehicles, representing a substantial market for advanced suspension components.

These customers seek solutions that offer a clear return on investment by enhancing survivability, mobility, and firepower without necessitating a complete platform replacement. Horstman's advanced suspension technologies, such as their hydro-pneumatic systems, directly address these needs by providing improved ride quality, greater load-carrying capacity, and enhanced stability, all critical for modernizing legacy platforms. The global defense market for vehicle modernization was projected to reach tens of billions of dollars in 2024, with a significant portion allocated to upgrades.

Key customer segments include:

- Government Defense Procurement Agencies: Entities responsible for managing national defense budgets and overseeing vehicle acquisition and modernization programs.

- Prime Defense Contractors: Major defense manufacturers who integrate various subsystems, including suspension, into upgraded vehicle platforms.

- Fleet Maintenance and Overhaul Facilities: Specialized organizations tasked with the physical refurbishment and upgrade of armored vehicle fleets.

Horstman's customer base is primarily concentrated within the defense sector, encompassing national governments, original equipment manufacturers (OEMs) of armored vehicles, and defense contractors. These entities require advanced suspension systems to enhance the mobility, survivability, and operational effectiveness of military platforms.

The global defense market's robust growth, with an estimated $2.2 trillion in spending in 2024, underscores the significant demand for specialized components like Horstman's suspension systems. Many nations are actively modernizing their armored fleets, driving procurement of high-performance upgrades.

Key customer groups include defense ministries seeking to equip new vehicles and upgrade existing fleets, OEMs integrating suspension into new designs, and prime contractors managing large-scale modernization projects. International alliances also represent a vital segment, emphasizing interoperability and standardization. For example, NATO defense spending exceeded $1.3 trillion in 2024, indicating substantial opportunities within such organizations.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| National Defense Ministries | New vehicle equipping, fleet modernization | Increased defense budgets globally |

| Armored Vehicle OEMs | Integration into new platform designs | Focus on survivability and mobility |

| Defense Contractors/Integrators | Suspension for modernization and new builds | Large-scale, multi-year projects |

| International Alliances (e.g., NATO) | Interoperable and standardized solutions | Over $1.3 trillion in collective spending |

Cost Structure

Horstman's commitment to innovation is reflected in its substantial Research and Development (R&D) expenses. These costs are primarily directed towards advancing their core hydro-pneumatic and rotary damper technologies, encompassing areas like material science, the development of active damping systems, and intricate system integration.

These significant R&D investments are not just about staying current; they are fundamental to Horstman's strategy for creating next-generation solutions. For instance, in 2024, a notable portion of their R&D budget was allocated to exploring novel composite materials for lighter yet more durable damper components, aiming to enhance vehicle performance and survivability in demanding defense environments.

Manufacturing and production represent a significant portion of Horstman's cost structure. This includes the procurement of specialized raw materials, such as high-grade titanium alloys crucial for defense applications, alongside the wages for highly skilled engineers and technicians. Overhead expenses for maintaining advanced, specialized manufacturing facilities also contribute heavily.

Horstman's sales, marketing, and business development costs are significant, reflecting its global reach in the defense sector. These expenses are crucial for activities like participating in major international defense expos, which can cost hundreds of thousands of dollars for booth space and logistics alone. Managing complex government bids also requires dedicated teams and resources, often involving extensive research and proposal development.

Maintaining a global sales force and cultivating relationships with defense ministries worldwide are ongoing investments. For instance, a single international sales representative might have an annual compensation and travel budget exceeding $200,000. These expenditures are directly tied to Horstman's ability to secure new contracts and retain existing clients, forming a core component of its cost structure.

Quality Assurance and Testing Costs

Given the critical nature of defense applications, Horstman allocates significant resources to rigorous quality assurance and testing. These costs are essential to ensure all products meet stringent military standards for performance, reliability, and safety, thereby minimizing potential failures in demanding operational environments. For instance, in 2024, the defense industry saw substantial investment in QA/testing, with some major defense contractors reporting up to 15-20% of their R&D budgets dedicated to these areas to meet evolving cybersecurity and operational readiness requirements.

These expenditures are vital for certification processes, ensuring compliance with international defense specifications. This meticulous approach directly impacts the longevity and effectiveness of Horstman's offerings in high-stakes scenarios.

- Testing Equipment & Infrastructure: Investment in specialized testing rigs, environmental chambers, and simulation software.

- Personnel Costs: Salaries for highly skilled QA engineers, test technicians, and certification specialists.

- Certification Fees: Costs associated with obtaining and maintaining various military and industry certifications.

- Materials for Testing: Consumables and components used during destructive and non-destructive testing procedures.

Maintenance of Specialized Facilities and Equipment

Operating and maintaining Horstman's highly specialized manufacturing facilities and advanced equipment represents a significant expenditure. This encompasses routine upkeep, precise calibration, and necessary upgrades to machinery, all crucial for sustaining optimal production efficiency and the capacity to manufacture high-precision components.

For instance, in 2024, the aerospace manufacturing sector, where Horstman operates, saw maintenance, repair, and overhaul (MRO) costs for specialized equipment rise. Reports indicate that advanced machining centers, essential for producing intricate parts, can have annual maintenance budgets ranging from 5% to 15% of their initial purchase price, which can easily be in the millions.

- Specialized Facility Operations: Costs associated with running advanced manufacturing plants, including utilities and environmental controls for sensitive processes.

- Equipment Calibration and Servicing: Regular, often certified, calibration and servicing of high-precision machinery to ensure accuracy and prevent breakdowns.

- Technology Upgrades: Investment in newer, more efficient, or more capable manufacturing equipment to maintain a competitive edge and meet evolving product demands.

- Skilled Labor for Maintenance: Employing highly trained technicians and engineers dedicated to the upkeep and repair of complex industrial machinery.

Horstman's cost structure is heavily influenced by its commitment to advanced technology and stringent quality requirements in the defense sector. Significant investments in Research and Development (R&D) are crucial for developing next-generation hydro-pneumatic and rotary damper systems. Manufacturing, driven by the need for specialized materials like titanium alloys and highly skilled labor, forms another substantial cost center. Furthermore, global sales and marketing efforts, including participation in defense expos and managing government bids, alongside rigorous quality assurance and testing to meet military standards, are key cost drivers.

| Cost Category | Description | 2024 Estimated Allocation (Illustrative) | Key Drivers |

|---|---|---|---|

| Research & Development | Innovation in damper technology, material science, active systems | 30-40% | New product development, advanced materials research |

| Manufacturing & Production | Raw materials, skilled labor, facility overhead | 35-45% | High-grade alloys, precision engineering, specialized facilities |

| Sales, Marketing & Business Development | Global outreach, defense expos, government bid management | 10-15% | International presence, securing defense contracts |

| Quality Assurance & Testing | Meeting military standards, certifications, testing equipment | 10-15% | Product reliability, safety, regulatory compliance |

Revenue Streams

Horstman's core revenue generation stems from the direct sale of its innovative hydro-pneumatic and rotary damper suspension systems. These high-performance components are crucial for the new production of armored vehicles worldwide.

These significant sales are predominantly secured through substantial defense procurement contracts. Horstman engages with national militaries and Original Equipment Manufacturers (OEMs) across the global defense sector to fulfill these orders.

For instance, in 2024, defense spending is projected to reach $2.4 trillion globally, indicating a robust market for advanced vehicle components like Horstman's suspension systems. This direct sales channel represents Horstman's primary financial inflow.

Horstman generates substantial revenue from selling spare parts and replacement components for its suspension systems already deployed in military vehicles. This aftermarket segment is crucial for maintaining the operational readiness and extending the service life of these vital defense assets.

For instance, in 2024, the global military vehicle aftermarket sector was projected to reach approximately $30 billion, highlighting the significant market opportunity for companies like Horstman that provide essential support for fielded equipment.

Horstman generates significant recurring revenue through its comprehensive Maintenance, Repair, and Overhaul (MRO) services for military vehicle suspension systems. These long-term contracts are crucial for ensuring the longevity and operational readiness of critical defense assets.

The MRO segment provides a stable income stream, as military vehicles require ongoing support throughout their operational lifespan. For example, in 2024, the global defense MRO market was valued at approximately $100 billion, highlighting the substantial demand for such specialized services.

Upgrade and Modernization Contracts

Horstman generates revenue through contracts focused on upgrading and modernizing existing armored vehicle suspension systems. These agreements are crucial as military forces worldwide invest in extending the life and enhancing the capabilities of their legacy fleets.

These modernization programs present a significant revenue stream, allowing Horstman to leverage its expertise in advanced suspension technology. By offering solutions that improve performance, survivability, and adaptability, Horstman helps military clients achieve greater operational effectiveness with their existing assets.

- Upgrade Contracts: Revenue from retrofitting current suspension systems with newer, more capable components.

- Modernization Programs: Income derived from comprehensive overhauls and enhancements of entire vehicle suspension platforms.

- Performance Enhancement: Sales tied to upgrades that boost vehicle mobility, stability, and load-carrying capacity.

- Survivability Improvements: Revenue from modifications that increase protection against battlefield threats.

Technical Consulting and Licensing

Horstman's technical consulting services likely tap into their deep expertise in advanced vehicle suspension systems. This could involve advising other manufacturers on design integration, performance optimization, or even helping them navigate complex engineering challenges. For example, in 2024, the global automotive consulting market was valued at approximately $15 billion, indicating a significant demand for specialized knowledge.

Furthermore, Horstman may generate revenue through licensing agreements, allowing other companies to utilize their proprietary suspension technologies. This is particularly relevant in the defense sector, where unique and robust suspension solutions are highly sought after. Companies often pay licensing fees or royalties for access to such advanced intellectual property, contributing to a recurring revenue stream.

- Technical Consulting: Providing expert advice on vehicle design and suspension integration.

- Technology Licensing: Granting rights to use Horstman's proprietary suspension technologies.

- Market Opportunity: The automotive consulting market was valued at roughly $15 billion in 2024.

- Defense Sector Relevance: Licensing is especially valuable for advanced defense vehicle applications.

Horstman's revenue streams are diverse, built upon its specialized expertise in advanced suspension systems for military vehicles. The company's primary income comes from direct sales of its hydro-pneumatic and rotary damper systems, often through large defense procurement contracts with national militaries and OEMs. This core business is supplemented by a robust aftermarket, providing spare parts and essential MRO services to ensure the operational readiness of fielded vehicles.

Beyond direct sales and after-sales support, Horstman capitalizes on its technological leadership through upgrade and modernization programs for existing fleets, enhancing vehicle performance and survivability. Furthermore, the company leverages its deep engineering knowledge via technical consulting and technology licensing, tapping into broader markets and securing recurring revenue from its intellectual property. The global defense market's continued growth, with defense spending projected at $2.4 trillion in 2024, underscores the significant opportunities across all these revenue channels.

| Revenue Stream | Description | 2024 Market Context (Approximate) |

|---|---|---|

| Direct System Sales | Sale of new hydro-pneumatic and rotary damper suspension systems. | Global Defense Spending: $2.4 trillion |

| Aftermarket & Spares | Provision of spare parts for deployed suspension systems. | Global Military Vehicle Aftermarket: $30 billion |

| MRO Services | Maintenance, Repair, and Overhaul services for suspension systems. | Global Defense MRO Market: $100 billion |

| Upgrade & Modernization | Retrofitting and enhancing existing vehicle suspension platforms. | Continued investment in legacy fleet capabilities. |

| Consulting & Licensing | Technical advice and licensing of proprietary suspension technologies. | Global Automotive Consulting Market: $15 billion |

Business Model Canvas Data Sources

The Horstman Business Model Canvas is built upon a foundation of rigorous market analysis, internal financial data, and customer feedback. These diverse sources ensure a comprehensive and accurate representation of the business's strategic framework.