Horstman Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horstman Bundle

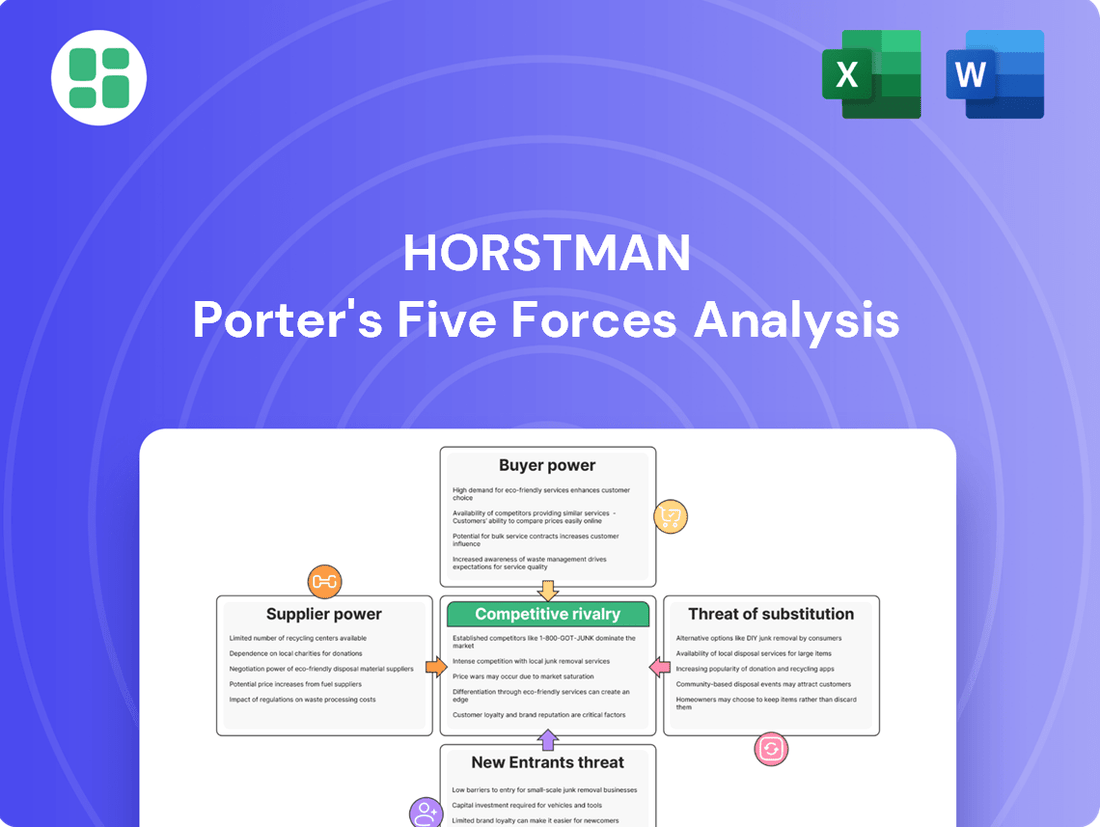

Understanding the competitive landscape is crucial for any business, and Horstman's Porter's Five Forces Analysis provides a powerful lens. This framework reveals the underlying forces shaping the industry, from the bargaining power of buyers and suppliers to the threat of new entrants and substitutes, all while assessing the intensity of rivalry.

The complete report reveals the real forces shaping Horstman’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Horstman's reliance on highly specialized components, like those for its advanced hydro-pneumatic systems, means it often depends on a small pool of niche suppliers. These suppliers possess unique manufacturing capabilities and intellectual property, giving them considerable sway over pricing and delivery schedules. For instance, in the defense sector, where Horstman operates, the demand for custom-engineered, high-performance materials can limit the available suppliers to just a handful globally.

High switching costs significantly bolster supplier bargaining power for Horstman, particularly concerning critical suspension system components. These costs encompass not just the financial outlay for new parts but also the extensive testing, re-certification, and intricate integration required for complex armored vehicle designs.

The defense sector's inherently rigorous qualification processes amplify this challenge, making it both difficult and prohibitively expensive for Horstman to simply swap out suppliers. This deepens the dependency on established relationships, giving current suppliers considerable leverage.

Proprietary technologies and intellectual property (IP) held by Horstman's suppliers significantly bolster their bargaining power. For instance, suppliers of specialized hydraulic components or advanced sensor technology may possess patents or unique manufacturing processes that Horstman cannot easily replicate internally or find elsewhere.

This reliance on unique, often patented, inputs means Horstman faces limited alternatives when sourcing these critical parts. In 2024, the automotive and defense sectors, where Horstman operates, saw continued investment in R&D, with companies like Bosch reporting over €5 billion in R&D spending, highlighting the value placed on such proprietary advancements.

Consequently, suppliers with strong IP can command higher prices or more favorable terms, as Horstman's ability to switch vendors is constrained by the need for these specific, high-performance technologies for its advanced suspension systems.

Supply Chain Disruptions

Supply chain disruptions significantly impact the bargaining power of suppliers for companies like Horstman. Geopolitical tensions, labor disputes, and material shortages, which were particularly evident in 2024-2025, create an environment where suppliers can command higher prices and longer lead times. This directly translates to increased costs for Horstman as suppliers pass on their own elevated expenses.

The aerospace and defense sectors experienced notable disruptions in 2024. For instance, factory fires and labor-related issues affected the availability of critical components. These events underscore the fragility of the global defense supply chain, empowering suppliers who can reliably deliver in such challenging conditions.

- Increased Lead Times: Disruptions can extend the time it takes for suppliers to deliver essential parts, impacting Horstman's production schedules.

- Higher Material Costs: Shortages and logistical challenges force suppliers to increase their prices, which are then passed on to customers.

- Component Scarcity: Events like factory fires directly reduce the available supply of specific components, giving suppliers of those parts more leverage.

- Geopolitical Impact: International conflicts or trade disputes can disrupt the flow of raw materials and finished goods, benefiting suppliers in more stable regions.

Limited Supplier Concentration

The bargaining power of suppliers is a key consideration for Horstman, particularly within its specialized niche of advanced military vehicle suspension systems. While the broader defense supply chain can be intricate, the critical components for high-performance military vehicles often originate from a more limited set of highly specialized, technologically advanced sub-suppliers.

This concentration among these critical sub-suppliers can significantly enhance their bargaining power. With fewer alternatives available for these essential, high-tech components, Horstman faces a reduced ability to negotiate favorable pricing or contract terms. These suppliers hold considerable leverage because their specialized products are indispensable for maintaining the technological superiority and operational effectiveness of Horstman's advanced military vehicle offerings.

- Supplier Concentration in Advanced Niches: In specialized sectors like advanced military vehicle suspension, the number of suppliers capable of meeting stringent technical requirements is often limited.

- Impact on Negotiation: A concentrated supplier base reduces Horstman's leverage in price and terms negotiations, as these suppliers are essential for product development and production.

- Criticality of Components: The high-tech nature of these suspension systems means suppliers of key sub-components are vital for Horstman's competitive edge.

The bargaining power of Horstman's suppliers is amplified due to the specialized nature of components for advanced military vehicles. A limited number of highly capable suppliers for critical sub-components means Horstman has fewer options, giving these suppliers significant leverage over pricing and terms. This concentration is particularly acute in high-tech niches where suppliers possess unique manufacturing processes and intellectual property, making them indispensable for Horstman's product development and production.

| Supplier Characteristic | Impact on Horstman | Supporting Data/Context (2024-2025) |

|---|---|---|

| Supplier Concentration in Advanced Niches | Reduced negotiation leverage for Horstman; essential suppliers hold sway. | Defense sector R&D spending continues to grow, with companies investing heavily in proprietary technologies, limiting alternative suppliers. |

| High Switching Costs | Significant financial and operational barriers to changing suppliers. | Re-certification and integration of specialized components in armored vehicles can take years and cost millions. |

| Proprietary Technologies & IP | Suppliers with patents or unique processes can command higher prices. | In 2024, key defense component manufacturers reported substantial IP portfolios, protecting their market position. |

| Supply Chain Disruptions | Suppliers can increase prices and lead times due to external pressures. | Geopolitical events and labor disputes in 2024-2025 led to component shortages, increasing supplier power. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Horstman's specific industry position.

Quickly identify and mitigate competitive threats with a visual representation of all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Horstman's customer base is exceptionally concentrated, primarily consisting of defense ministries and major prime contractors globally. This limited group of buyers wields considerable power due to their substantial purchasing volumes and strategic importance in military procurement.

These powerful entities, such as national defense departments and large aerospace and defense corporations, can negotiate favorable pricing and contract terms. Their ability to influence product specifications and delivery schedules is a direct result of their significant leverage in the market.

Horstman's advanced suspension systems are vital for military vehicles, making them a critical product. However, the customers, primarily defense organizations, wield significant bargaining power due to intense scrutiny and competitive bidding processes common in defense procurement. This scrutiny, coupled with long acquisition cycles, allows these concentrated buyers to demand favorable terms and robust performance guarantees.

The sheer scale of global military spending underscores this power. In 2024, worldwide military expenditure hit $2718 billion, indicating a substantial capacity for customers to negotiate. This financial muscle, combined with the critical nature of Horstman's technology, means customers can effectively push for competitive pricing and stringent compliance with military standards, influencing Horstman's profit margins and market position.

Defense customers frequently require standardization and interoperability for their vehicle fleets. This requirement can restrict Horstman's ability to create highly unique products unless they align with specific military needs. For instance, the global defense market for military vehicles was valued at approximately $150 billion in 2023, with a significant portion dedicated to upgrades and fleet management.

This emphasis on established standards and long-term support for existing systems can give customers considerable leverage. They can influence terms concerning maintenance, upgrades, and overall lifecycle expenses, effectively dictating pricing and service agreements.

While the market for military vehicle suspension systems is expected to expand, with projections indicating a compound annual growth rate of around 4% through 2028, stringent regulatory mandates remain a significant constraint. These regulations often mandate adherence to specific performance and safety benchmarks, which can limit pricing flexibility for suppliers like Horstman.

Backward Integration Potential

Large defense prime contractors, as sophisticated engineering entities, theoretically possess the capability for some backward integration. However, the highly specialized nature of certain suspension systems might render this impractical for them to develop entirely in-house.

The possibility of customers developing their own less advanced or integrated solutions, or opting for competitors with more comprehensive in-house capabilities, significantly strengthens their bargaining position. This reduces Horstman's unique leverage in negotiations.

For instance, a prime contractor might decide to develop a less complex, but still functional, suspension system internally if the cost and complexity of Horstman's specialized offering become prohibitive. In 2024, the defense industry saw continued pressure on supply chains, leading some primes to explore greater vertical integration for critical components, even if it meant sacrificing some technological edge for cost control.

- Customer Integration Capability: Defense primes often have extensive R&D and manufacturing arms, allowing for potential in-house development of certain components.

- Sourcing Diversification: The threat of customers sourcing from competitors with broader in-house capabilities or alternative suppliers provides a powerful negotiation tool.

- Cost-Benefit Analysis: Customers weigh the cost and complexity of specialized components against the benefits, potentially opting for simpler, internally developed solutions if the premium is too high.

- Market Dynamics: Increased focus on cost efficiency in defense procurement throughout 2024 has amplified the bargaining power of large buyers seeking to control expenditures.

Global Defense Spending Trends

The significant increase in global defense spending, hitting an estimated $2.3 trillion in 2024 and expected to continue its upward trajectory into 2025, creates a strong demand for military hardware and related technologies. This surge empowers customer nations, as they possess larger budgets and consequently can exert greater pressure on suppliers to deliver cutting-edge, reliable solutions.

With countries actively shortening procurement timelines and upgrading their existing military fleets, the competitive landscape for defense contractors intensifies. Customers can leverage this environment to negotiate more favorable terms and demand higher specifications, as suppliers vie for these expanded defense budgets.

- Increased Customer Leverage: Larger defense budgets allow nations to be more selective and demanding.

- Accelerated Procurement Cycles: Faster buying processes mean more opportunities, but also more pressure to meet immediate needs.

- Demand for Advanced Technology: Modernization efforts drive customer expectations for the latest and most effective military systems.

- Supplier Competition: The robust spending environment fuels competition among companies to secure these valuable government contracts.

Horstman's customer base is highly concentrated, primarily comprising defense ministries and major prime contractors. This limited group of buyers wields considerable power due to their substantial purchasing volumes and strategic importance in military procurement, allowing them to negotiate favorable pricing and contract terms.

These powerful entities, such as national defense departments and large aerospace and defense corporations, can influence product specifications and delivery schedules due to their significant market leverage. The global defense market for military vehicles was valued at approximately $150 billion in 2023, highlighting the financial capacity of these customers.

The sheer scale of global military spending underscores this power. In 2024, worldwide military expenditure hit $2718 billion, indicating a substantial capacity for customers to negotiate. This financial muscle, combined with the critical nature of Horstman's technology, means customers can effectively push for competitive pricing and stringent compliance with military standards.

| Customer Type | Bargaining Power Factors | Impact on Horstman |

|---|---|---|

| Defense Ministries | Concentrated buyers, large order volumes, critical need for advanced tech | Ability to dictate pricing, demand specific performance, influence contract terms |

| Prime Contractors | Significant R&D/manufacturing capabilities, potential for backward integration, sourcing diversification | Can negotiate for lower costs, threaten to develop alternatives, leverage competitor offerings |

| Global Defense Market | $150 billion (2023) for military vehicles, $2.718 trillion global military spend (2024) | Customers can leverage market size and competition to secure better deals |

Same Document Delivered

Horstman Porter's Five Forces Analysis

The document you see here is the complete, ready-to-use Horstman Porter's Five Forces analysis, providing a thorough examination of competitive pressures within the industry. What you're previewing is precisely the same professionally formatted document that will be available to you instantly after purchase, ensuring no surprises and immediate applicability for your strategic planning needs.

Rivalry Among Competitors

Horstman's specialization in advanced hydro-pneumatic and rotary damper suspension systems for armored vehicles creates a unique competitive landscape. While this niche narrows the field of direct rivals, those remaining are formidable, often possessing decades of experience and deep technological expertise. For instance, in 2024, the global defense suspension systems market, though specialized, saw significant investment from established players and emerging innovators alike, highlighting the ongoing battle for technological supremacy.

The intensity of rivalry within this niche stems from the critical nature of suspension systems in armored vehicle performance and survivability. Competition is not just about price but heavily weighted towards demonstrated reliability, cutting-edge technological innovation, and seamless integration with major defense prime contractors. Companies like Horstman must continually invest in research and development to maintain their edge, as evidenced by the significant R&D expenditures reported by leading defense technology firms in the 2024 fiscal year, often exceeding 10% of revenue.

Horstman, a key player in advanced military suspension systems, faces intense rivalry due to substantial fixed costs and ongoing R&D. Developing and manufacturing these sophisticated systems requires massive upfront capital and a relentless commitment to innovation. This financial burden makes exiting the market extremely difficult for established companies.

Consequently, these firms are driven to fiercely compete for contracts, aiming to spread their high fixed costs over larger production volumes and recoup their significant R&D expenditures. For instance, the defense sector's R&D spending for advanced vehicle components can easily run into tens or hundreds of millions of dollars annually, making every contract win critical.

The need for continuous technological advancement, such as in active suspension or intelligent damping, further fuels this rivalry. Companies must consistently invest in new technologies to remain competitive, creating a dynamic environment where innovation and market share are intrinsically linked.

Horstman operates in a highly competitive landscape, facing off against established giants like Hendrickson and RENK, its own parent company, alongside key players such as Oshkosh in the crucial military vehicle suspension system sector. This intense rivalry is significantly shaped by deeply entrenched, long-standing relationships with defense ministries and major prime contractors.

These vital connections are built on a foundation of trust, demonstrated performance, and robust support services, making it exceedingly challenging for newer or smaller competitors to penetrate the market and replicate the established rapport Horstman and its peers enjoy. For instance, in 2023, the global defense market saw significant investment, with the top five defense contractors alone reporting revenues exceeding $200 billion, underscoring the scale of the relationships Horstman navigates.

Technological Differentiation and Performance

Competitive rivalry in the armored vehicle sector is intensely driven by technological differentiation, focusing on enhanced mobility, superior ride quality, and critical crew survivability, especially in challenging operational theaters. Companies are locked in a race to innovate, with advancements like active protection systems (APS) and hybrid-electric powertrains becoming key differentiators.

This technological arms race directly impacts suspension system manufacturers, who are compelled to integrate advanced features to meet the evolving demands of modern warfare. The ability of these companies to adapt their offerings to new combat scenarios is paramount to maintaining a competitive edge. For instance, the integration of modular armor systems requires sophisticated suspension solutions capable of handling increased weight and dynamic loads.

- Technological Focus: Companies compete on features like active protection systems, hybrid-electric powertrains, and modular armor.

- Performance Metrics: Superior mobility, ride quality, and crew survivability are key battlegrounds for differentiation.

- Market Adaptation: The ability to integrate advanced suspension features to meet evolving warfare scenarios is crucial for competitiveness.

Market Growth and Modernization Efforts

The global military vehicle market is booming, with an impressive CAGR of 10.8% expected between 2025 and 2031. This growth is fueled by increased defense spending worldwide and a strong push for fleet modernization, creating a dynamic environment for competitive rivalry.

As the market expands, so does the intensity of competition. Companies are actively competing for lucrative new contracts and essential fleet upgrade programs, especially in areas like armored vehicle enhancements. For instance, improvements to suspension systems are a key segment where manufacturers are innovating to gain an edge.

- Market Growth: Global military vehicle market projected to grow at a 10.8% CAGR from 2025–2031.

- Drivers: Rising defense expenditures and fleet modernization efforts are key growth catalysts.

- Competitive Impact: Market expansion intensifies rivalry as firms compete for new contracts and upgrade programs.

- Key Segment: Armored vehicle upgrades, including suspension improvements, represent a significant area of competition.

Competitive rivalry in Horstman's niche is fierce, driven by the critical need for advanced suspension systems in armored vehicles. Established players like Hendrickson and RENK, along with major defense contractors such as Oshkosh, are formidable competitors, leveraging deep technological expertise and long-standing relationships with defense ministries.

The intensity of this rivalry is amplified by high fixed costs and substantial R&D investments, making market exit difficult and contract wins essential for recouping expenditures. Companies must continuously innovate to offer superior mobility, ride quality, and crew survivability, integrating features like active protection systems and advanced damping technologies.

The global military vehicle market's projected 10.8% CAGR from 2025–2031, fueled by increased defense spending and modernization, further intensifies competition for new contracts and upgrades, particularly in armored vehicle enhancements where suspension systems are a key battleground.

| Competitor | Key Strengths | 2024 Focus Areas |

| Hendrickson | Extensive experience, broad product portfolio | Lightweighting, integrated electronic controls |

| RENK (Parent Company) | Synergies with powertrain, robust R&D | Hybrid suspension solutions, durability testing |

| Oshkosh | Prime contractor relationships, system integration | Modular suspension designs, survivability enhancements |

SSubstitutes Threaten

For the specialized needs of tracked and wheeled armored vehicles in tough defense scenarios, Horstman's advanced suspension systems face few direct functional replacements. These systems are engineered for superior mobility and crew protection, qualities not easily matched by simpler suspension types.

Conventional spring or torsion bar suspensions, while present, typically fall short in delivering the critical shock absorption and dynamic response required for modern combat operations. This limitation reinforces the unique position of Horstman's offerings in high-stakes military applications.

The global military vehicle suspension market is projected for significant expansion, with estimates suggesting a compound annual growth rate (CAGR) of around 5.5% through 2028, driven by the ongoing demand for advanced, high-performance platforms. This growth underscores the importance of specialized systems like Horstman's.

The threat of substitutes for traditional complex suspension systems in military vehicles is growing, driven by evolving mobility technologies. New vehicle design philosophies, such as those focusing on radical lightweighting through advanced composite materials, could bypass the need for conventional suspension altogether. For instance, a 2024 report indicated that advanced composites could reduce vehicle weight by up to 30%, potentially altering design priorities.

Furthermore, the rise of autonomous ground vehicles (UGVs) with different operational paradigms presents another significant substitution threat. UGVs might operate with entirely different mobility solutions, such as advanced track systems or even novel locomotion methods, diminishing the importance of traditional wheeled vehicle suspension. The ongoing integration of hybrid and electric drivetrains in military applications also signals a broader shift in vehicle architecture, which could indirectly impact suspension system design and reliance.

The rise of modular and upgradeable vehicle platforms, exemplified by the US Army's XM30, presents a potential threat to specialized suspension system providers. While Horstman's HydroCore system offers adaptable mobility, future armored vehicle designs might integrate suspension solutions directly into the chassis or opt for alternative propulsion systems that necessitate different structural and power management approaches. This trend could diminish the market for standalone, advanced suspension components as vehicle manufacturers prioritize holistic system integration.

Cost-Benefit Trade-offs for Less Demanding Applications

For military vehicles with less demanding performance needs or tighter budgets, simpler, less advanced, and more affordable suspension systems can emerge as viable substitutes. These alternatives, while not matching Horstman's high-end features, can still attract market share in segments where extreme off-road capability or crew survivability isn't the paramount concern.

This dynamic establishes a market tier where cost-effectiveness takes precedence over peak performance. For instance, in 2024, the global defense budget saw significant increases, with NATO members committing to higher spending targets, creating opportunities for a wider range of suppliers catering to varied budget constraints within military procurement.

- Lower Cost: Simpler systems can be 20-30% cheaper to manufacture and maintain.

- Adequate Performance: Sufficient for many non-combat or logistics roles.

- Market Segmentation: Captures segments prioritizing budget over extreme capabilities.

- Reduced R&D Burden: Less complex designs require less investment in advanced technology.

Emerging Technologies in Survivability

The threat of substitutes for Horstman's advanced suspension systems, designed for enhanced vehicle performance and crew survivability, is significant. Emerging technologies that offer comparable survivability benefits could diminish the reliance on sophisticated suspension. For instance, advanced active protection systems (APS) are increasingly being integrated into modern armored vehicles, providing a direct layer of defense against threats.

These APS, which detect and neutralize incoming projectiles, offer an alternative means of mitigating impact and improving crew safety. The growing adoption of APS, with global defense spending on these systems projected to rise substantially in the coming years, could reduce the perceived necessity of advanced suspension solutions to absorb shock.

- Active Protection Systems (APS): These systems are designed to detect, track, and intercept threats before they reach the vehicle, offering a different approach to survivability.

- Ballistic Armor Advancements: Improvements in passive armor materials and designs can also enhance a vehicle's protection without relying on suspension for impact mitigation.

- Cost-Benefit Analysis: Decision-makers may opt for APS or improved armor if they are perceived as a more cost-effective or technologically superior method of achieving survivability goals compared to advanced suspension.

The threat of substitutes for specialized suspension systems like Horstman's is multifaceted. While direct functional replacements are scarce for extreme defense scenarios, broader technological shifts and market segmentation introduce viable alternatives. Emerging mobility concepts and cost-driven solutions present the most significant substitution risks.

Advancements in materials science and vehicle design, such as the increasing use of composites for lightweighting, could fundamentally alter suspension requirements. Furthermore, the rise of autonomous vehicles may necessitate entirely different locomotion strategies, bypassing traditional suspension needs. The market also segments, with simpler, less expensive suspension systems serving as substitutes where peak performance is not the primary driver.

The growing adoption of Active Protection Systems (APS) also presents an indirect substitution threat by enhancing survivability through threat neutralization rather than solely relying on suspension to absorb impacts. This strategic shift in defense vehicle design could diminish the emphasis on advanced suspension as the sole means of crew protection.

| Substitution Threat | Description | Impact on Horstman | 2024 Market Data/Projections |

|---|---|---|---|

| Simpler, Lower-Cost Suspensions | Standard spring or torsion bar systems | Captures budget-conscious segments; reduces demand for high-end features. | Global defense budget increases in 2024 suggest continued demand across all tiers, but cost remains a key factor. |

| Advanced Composites & Lightweighting | New materials potentially reducing need for traditional suspension. | Could necessitate redesign or integration of suspension into new chassis architectures. | Reports in 2024 indicated potential weight reductions of up to 30% with advanced composites, influencing future vehicle design. |

| Autonomous Ground Vehicles (UGVs) | Different mobility paradigms may emerge. | Potential obsolescence of traditional suspension if UGVs adopt novel locomotion. | Investment in UGV technology continues to grow, signaling a long-term shift in military mobility. |

| Active Protection Systems (APS) | Enhance survivability via threat neutralization. | Reduces reliance on suspension for shock absorption and crew safety. | Global spending on APS is projected for substantial growth, indicating a strategic shift towards direct threat mitigation. |

Entrants Threaten

The advanced military vehicle suspension systems market presents a significant threat of new entrants due to the substantial capital and research and development (R&D) investment required. Establishing operations necessitates specialized manufacturing facilities, extensive testing infrastructure, and deep engineering expertise, particularly for complex technologies like hydro-pneumatic and rotary dampers.

While venture capital investment in defense tech reached an all-time high of $27.5 billion in 2023, a significant portion of this funding is directed towards software and artificial intelligence rather than heavy manufacturing sectors like advanced suspension systems, further solidifying existing players' positions.

The defense industry is characterized by exceptionally stringent regulatory and certification processes, particularly for components used in military vehicles. New entrants face a significant hurdle in meeting rigorous military specifications, safety protocols, and performance validation requirements. For instance, in 2024, the average time for a new defense contractor to achieve full certification for a critical component could extend to 18-24 months, often involving extensive testing and documentation that can cost millions of dollars.

This demanding regulatory landscape acts as a powerful deterrent, effectively raising the barriers to entry. Established players, possessing existing certifications and a proven history of compliance, naturally benefit from this environment. The sheer cost and time investment required to navigate these processes favor companies with deep pockets and established relationships within the defense procurement ecosystem, making it difficult for newcomers to compete effectively.

The defense sector is characterized by exceptionally long procurement cycles, frequently taking several years from initial concept to final deployment. This extended timeline is deeply intertwined with the reliance on established, often decades-old, relationships between incumbent manufacturers and defense ministries or prime contractors.

New entrants face a significant hurdle in penetrating this market, as building the requisite trust, securing access to critical, often classified, programs, and successfully navigating the labyrinthine bidding processes are substantial challenges. For instance, in 2024, the average defense contract award process in major Western nations often exceeded 36 months, underscoring the entrenched nature of existing supplier networks.

Incumbent firms, such as Horstman, leverage this environment by benefiting from years of proven performance, deep-seated client relationships, and a demonstrated track record of reliability, making it exceedingly difficult for newcomers to compete effectively on anything other than price, which is rarely the primary driver in defense acquisitions.

Intellectual Property and Proprietary Technology

The threat of new entrants into the hydro-pneumatic and rotary damper systems market, particularly for military applications, is significantly mitigated by the substantial intellectual property and proprietary technologies held by incumbents like Horstman. These established players have invested decades in research and development, resulting in a robust portfolio of patents and specialized manufacturing processes. For instance, Horstman's expertise in designing advanced suspension systems for demanding environments represents a considerable barrier to entry.

New companies would face immense hurdles in replicating this level of technological sophistication, requiring massive capital outlays for R&D and facing potential legal challenges related to patent infringement. The complexity of these systems means that simply acquiring existing technology is often not feasible or cost-effective. The market is not one where off-the-shelf components can easily substitute for deeply integrated, proprietary solutions.

- Intellectual Property Barrier: Horstman and competitors hold numerous patents protecting their unique designs and manufacturing methods for hydro-pneumatic and rotary damper systems.

- R&D Investment: New entrants would need to commit substantial resources to develop comparable proprietary technology, a significant financial undertaking.

- Technical Sophistication: The specialized nature of military-grade suspension systems requires deep engineering expertise, which is difficult for newcomers to quickly acquire.

- Legal and Circumvention Challenges: Navigating existing intellectual property rights presents a major legal and technical obstacle for potential new market participants.

Niche Market Expertise and Talent

The specialized nature of advanced military suspension systems requires a highly skilled workforce. Expertise in fluid dynamics, materials science, and mechanical engineering for extreme environments is crucial. This demand for niche talent acts as a significant barrier to entry for new companies in the defense sector.

Attracting and retaining this specialized talent is a considerable challenge, further impeding new entrants. The defense industry, particularly in advanced manufacturing, has been experiencing talent and production shortages, making it even harder for newcomers to establish a foothold.

- Niche Talent Acquisition: Companies need engineers proficient in areas like advanced materials and extreme environment mechanics.

- Retention Challenges: High demand for specialized skills leads to competitive recruitment and retention efforts.

- Industry Shortages: The defense sector faces ongoing shortages in skilled labor and production capacity.

- Barrier to Entry: The difficulty in acquiring and retaining specialized talent significantly raises the cost and complexity for new market participants.

The threat of new entrants in the advanced military vehicle suspension systems market is low due to high capital requirements, stringent regulations, and established customer relationships. Significant R&D investment and specialized manufacturing capabilities are essential, creating a substantial financial hurdle. Furthermore, the lengthy defense procurement cycles and the need for deep trust with defense ministries favor incumbent firms.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High investment in specialized manufacturing, R&D, and testing facilities. | Significant financial barrier. | Estimated $50M+ for a new, compliant facility. |

| Regulatory Hurdles | Strict military specifications, safety protocols, and certification processes. | Time-consuming and costly compliance. | 18-24 months for critical component certification. |

| Established Relationships | Long-standing trust and procurement cycles with defense ministries. | Difficult market penetration for newcomers. | Average defense contract award process exceeds 36 months. |

| Intellectual Property | Proprietary technologies and patents held by incumbents. | Requires significant R&D to replicate or circumvent. | Incumbents hold numerous patents on hydro-pneumatic and rotary damper designs. |

Porter's Five Forces Analysis Data Sources

Our Horstman Porter's Five Forces analysis is built upon a comprehensive review of industry-specific market research reports, company annual filings, and expert interviews. We also incorporate data from trade associations and economic indicators to provide a robust assessment of competitive dynamics.