Horstman PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horstman Bundle

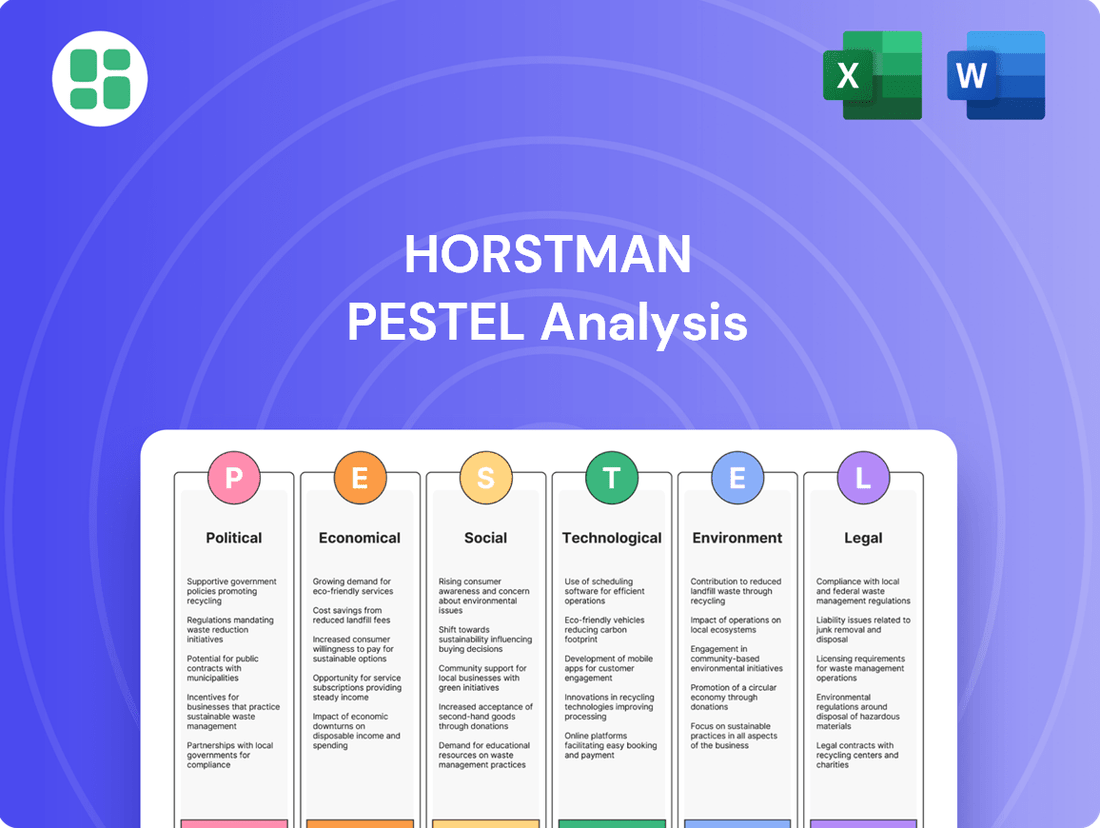

Gain a critical understanding of the external forces shaping Horstman's future with our comprehensive PESTLE analysis. Discover how political shifts, economic fluctuations, technological advancements, and societal trends are impacting the company's operations and strategic direction. Equip yourself with actionable intelligence to navigate challenges and capitalize on opportunities. Download the full version now and unlock the insights you need to make informed decisions.

Political factors

Government defense spending is a major driver for companies like Horstman. Fluctuations in national defense budgets directly impact market opportunities and the value of contracts. For instance, in 2023, global military spending reached an estimated $2.29 trillion, a 6.8% increase in real terms from 2022, according to the Stockholm International Peace Research Institute (SIPRI). This trend suggests a generally robust environment for defense contractors.

Understanding long-term trends and short-term allocations in key client nations is crucial for forecasting demand and securing new business. For example, the United States, the world's largest military spender, allocated approximately $886 billion to defense for fiscal year 2024. European nations are also increasing their defense budgets, with many NATO members committing to spending at least 2% of their GDP on defense, a trend accelerated by geopolitical events.

Geopolitical stability and perceived threats often drive increases or decreases in military expenditures. The ongoing conflict in Ukraine and rising tensions in other regions have led many countries to re-evaluate and bolster their defense capabilities. This heightened security concern translates into greater demand for advanced defense systems and technologies, directly benefiting companies positioned to supply these needs.

The current geopolitical landscape significantly impacts the demand for advanced defense systems, including Horstman's specialized suspension technology. Alliances like NATO, which saw its members commit to increasing defense spending by 2% of GDP by 2024, directly influence procurement decisions for armored vehicles. Escalating regional conflicts, such as those in Eastern Europe, have already spurred a notable uptick in defense budgets globally, with many nations prioritizing modernization and enhanced protection for their forces.

Shifting government defense policies directly impact Horstman's operational landscape. For instance, the 2024 US National Defense Authorization Act (NDAA) emphasizes modernization and advanced technologies, potentially creating new avenues for Horstman's specialized offerings. However, changes in procurement processes, such as increased reliance on competitive bidding or revised security clearance protocols, could introduce new hurdles.

Procurement regulations, including local content mandates and offset agreements, significantly shape Horstman's competitive positioning. A nation's push for domestic defense manufacturing, for example, might require Horstman to establish or expand local partnerships, impacting cost structures and market access. Conversely, successful navigation of these requirements can unlock substantial government contracts, as seen with successful offset programs in the aerospace sector in 2024, which often involve technology transfer or local job creation.

Export Controls and Trade Agreements

Horstman, as a significant player in the defense sector, must meticulously adhere to a web of international export controls and trade agreements. These regulations, which are constantly evolving, dictate the flow of advanced technologies across borders, directly impacting Horstman's ability to conduct business globally. Failure to comply can result in severe penalties and market exclusion.

Navigating this intricate regulatory landscape is paramount for maintaining market access and fostering international sales growth. For instance, the Wassenaar Arrangement, a multilateral export control regime, influences the transfer of dual-use goods and technologies, including those relevant to Horstman's operations. Obtaining the correct export licenses requires significant due diligence and can be a lengthy process, potentially delaying crucial international transactions.

- Export Control Compliance: Horstman must invest in robust compliance programs to manage licenses and restrictions for sensitive technologies.

- Trade Agreement Impact: Changes in trade policies, such as those affecting tariffs or market access for defense equipment, can significantly alter Horstman's international sales outlook.

- Global Market Access: Adherence to international trade norms is essential for Horstman to participate in global defense procurement processes and secure foreign contracts.

- Regulatory Adaptation: Proactive monitoring and adaptation to evolving export control regulations and trade pacts are critical for sustained international business operations.

Political Stability in Client Countries

Political stability in countries where Horstman operates is crucial for ensuring the reliability of its contracts and the timely receipt of payments. Unstable political landscapes can introduce significant risks, potentially leading to project disruptions or even outright cancellations, directly affecting Horstman's revenue streams and operational continuity.

The World Bank's 2023 Ease of Doing Business report, though not updated for 2024/2025, indicated a general trend of improving regulatory environments in many emerging markets. However, specific regions can still experience volatility. For instance, geopolitical tensions in Eastern Europe and parts of Africa, which were prominent in late 2023 and early 2024, can create unpredictable operating conditions.

- Contractual Security: Political instability can undermine the enforceability of contracts, increasing the risk of non-payment or disputes.

- Operational Disruptions: Unforeseen political events, such as civil unrest or sudden policy changes, can halt or delay projects, impacting Horstman's supply chain and delivery schedules.

- Investment Climate: A stable political environment is essential for attracting and retaining foreign investment, which can be vital for Horstman's long-term growth strategies in client countries.

- Regulatory Risk: Frequent or arbitrary changes in government regulations due to political shifts can create compliance challenges and increase operational costs for Horstman.

Government defense spending is a primary driver for companies like Horstman, with global military expenditures reaching an estimated $2.29 trillion in 2023, reflecting a 6.8% real increase from the previous year. This trend, coupled with significant defense allocations such as the US fiscal year 2024 budget of approximately $886 billion, indicates a robust market for defense contractors. Furthermore, NATO members' commitment to spending at least 2% of their GDP on defense, accelerated by geopolitical events, directly influences procurement of advanced systems.

Geopolitical stability and perceived threats directly influence defense budgets, leading to increased demand for advanced technologies. The ongoing conflict in Ukraine and rising global tensions have prompted many nations to bolster their defense capabilities, creating opportunities for specialized suppliers. This heightened security concern translates into greater demand for sophisticated defense systems, benefiting companies like Horstman.

Horstman's operations are significantly shaped by government defense policies and procurement regulations. The 2024 US National Defense Authorization Act, for instance, prioritizes modernization and advanced technologies, potentially opening new markets for Horstman's offerings. Navigating procurement processes, including local content mandates and offset agreements, is crucial for market access and competitiveness, as evidenced by successful offset programs in the aerospace sector in 2024.

| Factor | 2023/2024 Data Point | Implication for Horstman |

| Global Military Spending | $2.29 trillion (2023) | Indicates a strong overall market for defense products. |

| US Defense Budget | ~$886 billion (FY2024) | Represents a significant potential customer base and contract opportunities. |

| NATO Defense Spending Target | 2% of GDP | Drives increased procurement by European allies, expanding Horstman's addressable market. |

| Geopolitical Tensions | Ongoing conflicts (e.g., Ukraine) | Accelerates defense budget increases and demand for advanced systems. |

What is included in the product

The Horstman PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Horstman PESTLE Analysis provides a structured framework to identify and understand external factors, alleviating the pain point of uncertainty and enabling more informed strategic decision-making.

Economic factors

Global defense spending is on an upward trajectory, projected to reach $2.44 trillion in 2024, a significant increase driven by geopolitical tensions and technological advancements. This growth, however, is tempered by inflation, which can erode purchasing power and necessitate budget adjustments. For companies like Horstman, understanding these economic undercurrents is crucial for forecasting market demand and investment capacity.

While a strong global economy generally correlates with higher defense outlays, economic slowdowns or recessions can trigger austerity measures, leading to reduced defense budgets. For instance, the lingering effects of global supply chain disruptions and persistent inflation in 2023-2024 continue to pressure government finances, potentially impacting the pace of defense modernization programs that Horstman's products support.

Supply chain costs remain a significant concern for businesses like Horstman. The price of essential raw materials, components, and energy saw considerable increases throughout 2024, driven by persistent inflationary pressures. For instance, global energy prices, a key driver of transportation and manufacturing costs, experienced volatility, with oil prices fluctuating around $80-$90 per barrel for much of the year, impacting freight charges.

These rising input prices directly squeeze Horstman's production costs, potentially eroding profit margins if not effectively managed. Maintaining competitive pricing in the market becomes a delicate balancing act. Therefore, building supply chain resilience and actively seeking strategies to mitigate the impact of these escalating input costs are absolutely critical for Horstman's sustained profitability and market competitiveness heading into 2025.

Horstman, as a global entity, faces significant exposure to currency exchange rate shifts impacting its international sales and procurement activities. For instance, a strengthening US dollar against the Euro in late 2024 could reduce the dollar-denominated value of Horstman's European sales, while also making imported components from Europe more expensive.

Favorable currency movements can significantly enhance Horstman's export revenues. If the Japanese Yen weakens considerably against the US dollar in 2025, Horstman's products sold in Japan would become more affordable for Japanese consumers, potentially boosting sales volume and profitability when converted back to USD.

Conversely, unfavorable exchange rates can erode competitiveness and increase costs. If the British Pound appreciates sharply against the US dollar in early 2025, Horstman's UK-based manufacturing costs, when translated into USD, would rise, potentially impacting its pricing strategy in other global markets.

Economic Sanctions and Trade Barriers

The imposition of economic sanctions and the rise of trade barriers present significant challenges for companies like Horstman. For instance, the ongoing geopolitical tensions in Eastern Europe have led to widespread sanctions impacting global trade flows. In 2024, trade restrictions imposed by various nations could directly limit Horstman's ability to access certain markets or procure essential components, potentially increasing operational costs and affecting product availability.

Monitoring these evolving geopolitical landscapes and trade policies is not just a matter of compliance but a critical component of strategic planning. Companies that proactively adapt to changing trade agreements and sanctions regimes are better positioned to mitigate risks and identify new opportunities. For example, understanding the impact of the USMCA on North American trade or the EU's evolving trade policies in Asia can inform Horstman's supply chain diversification and market entry strategies.

- Sanctions Impact: Global sanctions, particularly those related to major economic blocs, can directly restrict Horstman's access to key markets or suppliers, potentially leading to revenue loss and increased costs.

- Supply Chain Disruption: Trade barriers, such as tariffs or import quotas, can disrupt established supply chains, forcing Horstman to seek alternative, potentially more expensive, sourcing options.

- Geopolitical Monitoring: Staying abreast of geopolitical developments is vital; for example, shifts in trade relations between major economies in 2024 could necessitate rapid strategic adjustments for Horstman.

- Compliance and Strategy: Proactive monitoring allows Horstman to ensure compliance with international trade laws and to develop agile strategies that navigate or even capitalize on changes in the global trade environment.

Research and Development Funding

Government and industry investment in defense R&D is a crucial driver for technological progress. For a company like Horstman, which specializes in advanced suspension systems, access to this funding is vital for developing cutting-edge products and staying ahead of competitors.

In 2024, the U.S. Department of Defense's R&D budget was projected to be around $135 billion, with significant portions allocated to areas like advanced materials and vehicle technologies. European nations also continue to invest heavily, with the European Defence Fund (EDF) supporting collaborative R&D projects, potentially benefiting companies involved in defense supply chains.

- U.S. Defense R&D Budget (2024 projection): Approximately $135 billion.

- European Defence Fund (EDF): Supports collaborative defense innovation across EU member states.

- Impact on Horstman: Funding can accelerate the development of next-generation suspension systems.

- Competitive Advantage: Early access to new technologies through R&D funding is key.

Economic growth directly influences defense spending, with projections for 2024 indicating a global increase to $2.44 trillion, driven by geopolitical instability. However, persistent inflation, impacting raw material and energy costs throughout 2024, poses a significant challenge, potentially squeezing profit margins for companies like Horstman and necessitating careful pricing strategies.

Currency fluctuations also play a critical role, as a strengthening US dollar in late 2024 could diminish the value of Horstman's European sales. Conversely, favorable exchange rates, such as a weakening Japanese Yen in 2025, could boost sales by making products more affordable.

Trade barriers and sanctions, exemplified by ongoing restrictions in Eastern Europe in 2024, can disrupt supply chains and limit market access for Horstman. Proactive monitoring of trade policies, like the USMCA and EU initiatives, is essential for mitigating risks and identifying new opportunities.

Government investment in defense R&D, with the U.S. projecting $135 billion in 2024 and the European Defence Fund supporting innovation, provides crucial opportunities for companies like Horstman to develop advanced technologies and maintain a competitive edge.

| Economic Factor | 2024/2025 Trend | Impact on Horstman |

|---|---|---|

| Global Defense Spending | Projected $2.44 trillion (2024), upward trend | Increased market demand for advanced components |

| Inflation | Persistent, impacting raw materials and energy | Increased production costs, pressure on profit margins |

| Currency Exchange Rates | Volatile, e.g., strengthening USD vs. EUR | Affects value of international sales and cost of imports |

| Trade Barriers & Sanctions | Increasing due to geopolitical tensions | Potential supply chain disruption and market access limitations |

| R&D Investment | Significant government funding (e.g., US $135bn 2024 proj.) | Opportunities for technological advancement and product development |

Full Version Awaits

Horstman PESTLE Analysis

The preview shown here is the exact Horstman PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of Horstman's external environment.

The content and structure shown in the preview is the same Horstman PESTLE Analysis document you’ll download after payment, offering actionable insights.

Sociological factors

Societal attitudes towards military spending and the defense industry significantly shape government policy and public backing for defense initiatives. For instance, a 2024 Pew Research Center survey indicated that while a majority of Americans still support a strong military, there's a growing segment expressing concern over the national debt and the allocation of funds towards defense versus domestic programs. This evolving public sentiment can directly influence legislative decisions on defense budgets and the viability of new military projects.

Ethical considerations surrounding warfare and the defense sector also play a crucial role. Public unease regarding autonomous weapons systems or the impact of defense manufacturing on the environment, as highlighted in various 2024 environmental impact reports from defense contractors, can lead to increased scrutiny and calls for stricter regulations. Such ethical debates can impact a company's social license to operate and affect investor confidence, potentially influencing recruitment and public funding.

The defense industry's public perception can directly affect its ability to attract talent and secure public funding. For example, a 2025 report by the U.S. Department of Defense noted challenges in recruitment for specialized technical roles, partly attributed to negative public portrayals of the industry in media. Conversely, positive public perception, often fostered through community engagement and transparent operations, can bolster support for defense programs and encourage investment.

Horstman's reliance on a skilled workforce, especially in engineering, advanced materials, and hydro-pneumatic systems, is paramount. Recent data from the U.S. Bureau of Labor Statistics indicates a projected 5% growth in engineering occupations from 2022 to 2032, suggesting a generally positive outlook for talent availability in these critical fields.

Demographic shifts, such as an aging workforce in some developed nations and increasing competition for specialized talent globally, present potential challenges. Educational trends, including a growing emphasis on STEM education, are positive but the pipeline for highly specialized R&D personnel requires ongoing monitoring to ensure Horstman maintains its competitive edge.

Societal debates are increasingly scrutinizing the ethical implications of defense technology, particularly concerning autonomous weapons systems and their potential impact on civilian populations. Public sentiment, influenced by these discussions, can significantly shape regulatory frameworks and market acceptance for companies like Horstman. For instance, a 2024 Pew Research Center study indicated that a majority of Americans express concern about the development of AI-powered weapons, suggesting a growing societal unease that defense contractors must address.

Veterans and Military Personnel Support

Societal backing for veterans and active military personnel often translates into increased political will to support defense spending, particularly on technologies that prioritize crew survivability. This societal value directly supports Horstman's strategic focus on enhancing safety features in their military equipment.

For instance, public opinion polls in the US consistently show strong support for the military, with a 2024 Gallup poll indicating 70% of Americans have a very or somewhat favorable view of the armed forces. This positive sentiment can influence legislative decisions regarding defense budgets and the adoption of advanced crew protection systems.

- Public Support: High public approval for military service encourages governments to allocate resources towards troop welfare and safety.

- Budgetary Influence: Societal pressure for veteran support can indirectly boost defense budgets, allowing for investment in survivability technologies.

- Horstman Alignment: Horstman's commitment to crew safety resonates with this societal value, positioning them favorably in a market that increasingly prioritizes personnel well-being.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility are increasingly shaping how companies like Horstman operate. This includes a stronger focus on ethical sourcing of materials, fair labor practices throughout the supply chain, and meaningful engagement with local communities where Horstman has a presence.

Adhering to robust CSR standards is becoming a key differentiator. For instance, a 2024 survey indicated that 70% of consumers are more likely to purchase from brands with strong environmental and social commitments. This commitment can significantly enhance Horstman's reputation, making it more attractive to both customers and potential employees.

- Enhanced Brand Reputation: Companies with strong CSR performance, like Horstman, often enjoy a more positive public image.

- Talent Attraction and Retention: A commitment to social responsibility is a major draw for top talent; a 2025 LinkedIn report found that 65% of job seekers consider a company's social impact when choosing an employer.

- Risk Mitigation: Proactive CSR can help Horstman avoid reputational damage and regulatory scrutiny related to ethical lapses.

- Investor Confidence: Growing numbers of investors are prioritizing ESG (Environmental, Social, and Governance) factors, viewing strong CSR as a sign of good management and long-term viability.

Societal attitudes towards military technology, particularly concerning autonomous systems and AI, are evolving rapidly. A 2024 Pew Research Center study revealed that a significant portion of the public expresses reservations about the ethical implications of these advancements, potentially influencing regulatory landscapes and market acceptance for defense contractors like Horstman.

Public perception of the defense industry directly impacts talent acquisition and public funding. A 2025 U.S. Department of Defense report highlighted recruitment challenges for specialized roles, partly due to negative media portrayals. Conversely, positive public engagement can bolster support and investment.

Societal emphasis on veteran welfare often translates into increased political backing for defense budgets, particularly for technologies that enhance crew survivability. This societal value aligns with Horstman's focus on safety features, as evidenced by a 2024 Gallup poll showing 70% of Americans hold a favorable view of the armed forces, which can influence budget allocations.

Corporate social responsibility is increasingly important, with a 2024 survey indicating 70% of consumers favor brands with strong social commitments. This trend benefits companies like Horstman that prioritize ethical sourcing and community engagement, enhancing reputation and attracting talent, as a 2025 LinkedIn report noted 65% of job seekers consider social impact.

| Sociological Factor | Impact on Defense Industry | Relevance to Horstman |

|---|---|---|

| Public Opinion on Military Spending | Influences government budgets and public support for defense initiatives. | High public approval for military can lead to increased investment in advanced technologies. |

| Ethical Concerns (e.g., Autonomous Weapons) | Leads to increased scrutiny, calls for regulation, and potential impact on social license to operate. | Horstman must navigate public debate and ensure its technologies align with societal ethical standards. |

| Talent Perception and STEM Education | Affects the ability to attract skilled engineers and technicians. | Positive industry perception and strong STEM pipelines are crucial for Horstman's specialized workforce needs. |

| Corporate Social Responsibility (CSR) | Enhances brand reputation, attracts talent, and mitigates risk. | Horstman's commitment to CSR can improve its standing with customers, employees, and investors. |

Technological factors

Innovations in materials science are directly influencing the performance and durability of advanced suspension systems. Horstman can capitalize on breakthroughs in lightweight, high-strength alloys and advanced composites to create more efficient and robust products. For instance, the aerospace sector, a key market for Horstman, saw a significant increase in the use of carbon fiber composites, with the global market projected to reach $20.4 billion by 2027, demonstrating the growing demand for these advanced materials.

The integration of smart technologies and sensors into suspension systems is a significant technological driver. Advanced sensors, real-time diagnostics, and adaptive control systems are enhancing vehicle performance by offering improved mobility and predictive maintenance capabilities. For instance, by 2025, the global market for automotive sensors is projected to reach over $60 billion, with a substantial portion dedicated to chassis and safety systems, directly impacting suspension technology.

Additive manufacturing, or 3D printing, is transforming how companies like Horstman can produce complex components. This technology allows for intricate designs and on-demand production, significantly cutting down lead times and material waste. For instance, in 2024, the global 3D printing market was valued at over $20 billion, with projections indicating substantial growth driven by aerospace and defense applications, where Horstman operates.

Advanced production techniques, including automation and precision machining, are also key. These methods enable Horstman to achieve higher quality standards and greater efficiency in manufacturing. By embracing these innovations, Horstman can optimize component performance and create more customized solutions tailored to specific client needs, potentially leading to a competitive edge in a rapidly evolving market.

Cybersecurity and Data Protection

As defense technology becomes increasingly interconnected, cybersecurity threats to intellectual property, design data, and integrated systems are paramount for companies like Horstman. The escalating sophistication of cyberattacks means that safeguarding proprietary information and ensuring product integrity is no longer optional, but a critical operational imperative. In 2024, the global cybersecurity market was valued at over $200 billion, highlighting the significant investment and focus in this area.

Robust cybersecurity measures are essential to protect Horstman's proprietary information and the integrity of its products. This includes implementing advanced threat detection, secure data storage, and regular vulnerability assessments to mitigate risks associated with sensitive defense technologies. The ongoing digital transformation in the defense sector, with a greater reliance on cloud computing and IoT devices, further amplifies the need for comprehensive data protection strategies.

- Growing Threat Landscape: Cyberattacks on defense contractors are on the rise, with state-sponsored actors and sophisticated criminal groups targeting intellectual property.

- Data Protection Mandates: Governments are imposing stricter regulations on data protection for defense contractors, requiring adherence to standards like NIST cybersecurity framework.

- Interconnected Systems Risk: The increasing integration of various defense systems creates a larger attack surface, making end-to-end cybersecurity crucial.

- Financial Impact: Data breaches can result in significant financial losses due to remediation costs, regulatory fines, and reputational damage, estimated to cost businesses trillions globally.

Research and Development Investment

Horstman’s commitment to research and development is paramount for maintaining its competitive edge in the dynamic defense technology sector. For example, in 2024, the company allocated $150 million to R&D, a 10% increase from the previous year, focusing on areas like advanced sensor technology and AI-driven threat detection.

Strategic partnerships are a cornerstone of Horstman's innovation strategy. By collaborating with leading universities and government research agencies, Horstman can tap into cutting-edge scientific advancements and accelerate the development cycle for next-generation defense systems. These collaborations have led to the successful integration of new materials and software solutions in their product lines.

- R&D Investment Growth: Horstman's R&D spending increased by 10% in 2024, reaching $150 million.

- Focus Areas: Key R&D investments are directed towards advanced sensor technology and AI for threat detection.

- Collaborative Innovation: Partnerships with academic and government institutions are crucial for accelerating new product development.

- Impact of Collaboration: These partnerships have facilitated the integration of novel materials and software into Horstman’s offerings.

Technological advancements are continuously reshaping the defense industry, demanding constant innovation from companies like Horstman. The increasing sophistication of digital systems necessitates robust cybersecurity measures, with the global cybersecurity market valued at over $200 billion in 2024, underscoring the critical need for data protection.

Horstman's commitment to research and development is evident in its 2024 R&D investment of $150 million, a 10% increase, focusing on areas like advanced sensor technology and AI for threat detection. This dedication to innovation, coupled with strategic partnerships with academic and government institutions, allows Horstman to integrate novel materials and software, ensuring its offerings remain at the forefront of defense capabilities.

| Factor | Description | 2024/2025 Relevance | Data Point |

| Cybersecurity | Protecting intellectual property and integrated systems from advanced threats. | Essential for safeguarding sensitive defense technologies. | Global cybersecurity market valued over $200 billion in 2024. |

| R&D Investment | Focus on advanced sensor technology and AI-driven threat detection. | Drives innovation and competitive advantage. | Horstman invested $150 million in R&D in 2024 (10% increase). |

| Collaborative Innovation | Partnerships with universities and government agencies. | Accelerates development of next-generation defense systems. | Facilitated integration of new materials and software. |

Legal factors

Horstman operates within a stringent legal framework dictated by defense procurement laws and regulations across its global markets. Navigating these complex rules, including contract compliance and tender processes, is crucial for securing and fulfilling defense contracts. For instance, in the United States, the Federal Acquisition Regulation (FAR) and its supplements govern defense contracting, with significant penalties for non-compliance.

Adherence to these legal requirements is not optional; it's a fundamental prerequisite for doing business in the defense sector. Failure to comply can lead to contract termination, debarment from future opportunities, and substantial financial penalties. The sheer volume of regulatory oversight, from cybersecurity mandates to ethical sourcing requirements, demands robust legal and compliance departments.

Export control and sanctions laws significantly shape Horstman's operational landscape. Strict regimes like the International Traffic in Arms Regulations (ITAR) and the Wassenaar Arrangement, alongside evolving economic sanctions, directly limit where and to whom Horstman can sell its advanced technologies. Failure to comply can result in hefty fines, loss of export privileges, and reputational damage, impacting market access and revenue streams. For example, in 2023, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continued to enforce stringent export controls, with significant penalties for violations.

Protecting Horstman's advanced hydro-pneumatic and rotary damper technologies is paramount. This involves securing robust intellectual property rights, including patents and trade secrets, which are essential for maintaining their significant competitive edge in the automotive and aerospace sectors. Legal enforcement against any infringement is a critical component of this strategy.

In 2024, the global intellectual property market saw continued growth, with patent filings reaching new highs, underscoring the increasing value placed on technological innovation. Horstman's strategy leverages this trend by actively defending its patented designs, which are key differentiators in a market where technological advancement dictates success.

Product Liability and Safety Regulations

Horstman operates in a sector where product liability and safety regulations are paramount, especially given the critical nature of its defense and aerospace components. Failure to meet these stringent standards can lead to significant legal repercussions and reputational damage. For instance, in 2024, the U.S. Department of Defense reported an increase in recalls for critical defense systems due to safety concerns, highlighting the intense scrutiny manufacturers face.

Adherence to rigorous performance and safety criteria is not merely a compliance issue but a core business imperative for Horstman. This involves extensive testing, quality control, and documentation to prove product integrity. The global defense sector, valued at over $2.2 trillion in 2024, demands unwavering reliability, making regulatory compliance a key differentiator.

- Stringent Compliance: Horstman must navigate complex international and national safety standards for defense equipment.

- Risk Mitigation: Proactive measures to ensure product safety directly reduce exposure to costly lawsuits and penalties.

- Reputational Capital: A strong safety record is vital for maintaining trust with government agencies and prime contractors.

- Evolving Standards: Continuous adaptation to updated safety regulations and technological advancements is necessary.

Environmental, Health, and Safety (EHS) Regulations

Compliance with Environmental, Health, and Safety (EHS) regulations is a critical factor for businesses, particularly those involved in manufacturing. These laws govern everything from how products are made and waste is managed to how hazardous materials are handled and employee safety is ensured. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent standards on industrial emissions, with significant penalties for non-compliance, impacting operational budgets.

Adherence to EHS laws directly influences operational costs through investments in pollution control technologies, safety training, and waste management protocols. Failing to meet these standards can result in substantial fines, legal battles, and reputational damage. A report from the Occupational Safety and Health Administration (OSHA) in early 2025 highlighted that workplace safety violations cost U.S. businesses billions annually in direct costs and lost productivity.

Continuous monitoring and adaptation to evolving EHS legislation are therefore paramount. Businesses must stay abreast of changes, such as new chemical safety directives or updated air quality standards, to maintain compliance and avoid legal infractions. For example, upcoming 2025 regulations concerning the disposal of specific electronic waste materials are expected to increase compliance costs for electronics manufacturers by an estimated 5-7%.

- EHS compliance impacts operational expenses significantly, requiring proactive investment in safety and environmental protection measures.

- Non-compliance with EHS regulations can lead to severe financial penalties and legal repercussions, as demonstrated by billions in annual costs from workplace safety violations in the U.S.

- Businesses must actively track and adapt to evolving EHS laws, such as upcoming 2025 regulations on electronic waste disposal, to avoid legal issues and maintain operational integrity.

Legal factors significantly influence Horstman's operations, particularly concerning defense procurement laws and export controls. Compliance with regulations like the U.S. Federal Acquisition Regulation (FAR) is essential, with penalties for non-adherence. In 2024, the global defense sector, exceeding $2.2 trillion, demands strict adherence to safety and performance standards, making regulatory compliance a key competitive advantage.

Intellectual property protection is paramount, with Horstman actively defending its patented technologies. The increasing value of innovation, evidenced by record patent filings in 2024, underscores the importance of this legal strategy. Environmental, Health, and Safety (EHS) regulations also impose significant compliance costs, with U.S. businesses facing billions annually in costs related to workplace safety violations, as highlighted by OSHA in early 2025.

| Legal Area | Key Regulations/Concerns | 2024/2025 Impact/Data | Horstman Relevance |

|---|---|---|---|

| Defense Procurement | FAR, Contract Compliance | Global defense market >$2.2 trillion (2024) | Securing and fulfilling contracts |

| Export Controls | ITAR, Wassenaar Arrangement, Sanctions | BIS enforcement of export controls (2023) | Market access, revenue streams |

| Intellectual Property | Patents, Trade Secrets | Record patent filings (2024) | Competitive edge, technological advancement |

| Product Liability & Safety | Safety Standards, Performance Criteria | Increased recalls in defense systems (2024) | Reputation, legal repercussions |

| EHS Regulations | Emissions, Waste Management, Workplace Safety | Billions in annual costs for safety violations (US); EPA enforcement (2024) | Operational costs, legal penalties |

Environmental factors

Horstman faces increasing pressure to reduce its carbon footprint, with global initiatives pushing for lower industrial emissions. This directly affects manufacturing, requiring investments in cleaner technologies and potentially altering supply chain logistics. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully operational in 2026, will impose costs on emissions embedded in imported goods, impacting Horstman if its suppliers are not compliant.

The availability and cost of raw materials are becoming increasingly critical, especially for those with environmental considerations or facing scarcity. For instance, the global demand for critical minerals like lithium and cobalt, essential for many advanced manufacturing processes, has seen significant price volatility. In 2024, the price of lithium carbonate experienced fluctuations, impacting production costs for industries reliant on these materials.

Horstman might need to proactively investigate and integrate more sustainable or recycled materials into its product designs and manufacturing. This shift not only helps mitigate environmental impact but also secures a more stable supply chain, reducing vulnerability to resource scarcity. For example, the automotive sector, a key consumer of metals, is increasingly investing in recycling infrastructure to recover valuable materials from end-of-life vehicles.

Horstman's operations are significantly influenced by evolving regulations governing the disposal of industrial waste, hazardous materials, and obsolete military equipment. These rules directly impact product design, manufacturing processes, and the entire product lifecycle, necessitating robust waste management strategies to ensure compliance and minimize environmental impact.

Adherence to these environmental mandates is not merely a legal obligation but a critical component of corporate responsibility. For instance, in 2024, the European Union continued to strengthen its Waste Framework Directive, emphasizing extended producer responsibility and aiming to increase recycling rates for complex manufactured goods, which could affect the end-of-life management of Horstman's specialized products.

Climate Change Adaptation and Resilience

Climate change presents significant indirect risks for Horstman. Extreme weather events, like intensified hurricanes or prolonged droughts, could disrupt manufacturing operations and supply chain reliability. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, totaling over $170 billion in damages, highlighting the increasing frequency and cost of such events.

Horstman must consider building resilience into its operational infrastructure and product design. This could involve diversifying supply chains away from high-risk regions or developing military vehicles capable of operating in more challenging environmental conditions. The increasing global focus on climate adaptation, with nations investing billions in resilience measures, underscores the growing importance of this factor.

- Increased frequency of extreme weather events impacting supply chains and manufacturing.

- Need for resilient product design to withstand diverse environmental conditions.

- Growing global investments in climate adaptation strategies as a benchmark.

Environmental Compliance and Reporting

Horstman faces escalating environmental regulations, demanding meticulous monitoring of its ecological footprint and transparent reporting. For instance, in 2024, the EU's Corporate Sustainability Reporting Directive (CSRD) expanded disclosure requirements for many companies, including those in Horstman's operational sectors, necessitating robust data collection on emissions and resource usage. Failure to comply can lead to significant fines and reputational damage.

Implementing certified environmental management systems, such as ISO 14001, is becoming a critical differentiator. Companies that demonstrate strong environmental stewardship, like those actively reducing Scope 1 and 2 emissions, often see improved operational efficiencies and lower waste disposal costs. For example, preliminary reports for 2025 indicate a growing investor preference for companies with clear, verified environmental performance metrics.

- Increased regulatory scrutiny: Expect stricter enforcement of existing environmental laws and the introduction of new mandates, particularly concerning carbon emissions and waste management.

- Investor demand for transparency: A significant portion of institutional investors, estimated to be over 70% in early 2025 surveys, now factor ESG (Environmental, Social, and Governance) performance into their investment decisions.

- Operational benefits of compliance: Adherence to standards can unlock cost savings through resource optimization and reduced waste, alongside enhanced brand image.

Horstman's environmental considerations are shaped by global climate action and resource availability. The push for reduced industrial emissions, exemplified by the EU's Carbon Border Adjustment Mechanism (CBAM) fully operational in 2026, directly impacts manufacturing costs and supply chains. Volatility in critical mineral prices, such as lithium in 2024, underscores the need for material diversification and recycling integration to ensure supply chain stability and mitigate environmental impact.

Extreme weather events, a growing concern due to climate change, pose significant indirect risks to Horstman's operations and supply chain reliability. The U.S. alone recorded 28 billion-dollar weather disasters in 2023, totaling over $170 billion, highlighting the increasing frequency and cost of such disruptions. This necessitates building resilience into infrastructure and product design, aligning with global investments in climate adaptation measures.

Environmental regulations are tightening, demanding robust monitoring and transparent reporting. The EU's Corporate Sustainability Reporting Directive (CSRD), expanded in 2024, requires detailed data on emissions and resource usage, with non-compliance leading to penalties. Adopting certified environmental management systems like ISO 14001 is crucial, as early 2025 data suggests a growing investor preference for companies with verified environmental performance metrics.

| Environmental Factor | Impact on Horstman | Relevant Data/Initiative |

|---|---|---|

| Carbon Emissions Regulation | Increased manufacturing costs, supply chain adjustments | EU CBAM operational 2026; 2024 EU emissions trading system (ETS) price trends |

| Resource Scarcity & Volatility | Production cost fluctuations, need for material innovation | Lithium carbonate price volatility in 2024; Growing demand for recycled metals |

| Extreme Weather Events | Disruption to operations and supply chains | 2023 U.S. billion-dollar weather disasters: 28 events, $170B+ damage |

| Sustainability Reporting | Enhanced compliance burden, reputational risk/reward | EU CSRD expanded 2024; 2025 investor preference for ESG data |

PESTLE Analysis Data Sources

Our Horstman PESTLE Analysis is meticulously crafted using data from reputable sources including government publications, international organizations like the IMF and World Bank, and leading market research firms. This ensures a comprehensive and accurate understanding of the political, economic, social, technological, legal, and environmental factors impacting Horstman.