Hornbeck Offshore Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hornbeck Offshore Services Bundle

Navigating the complex offshore services industry requires a deep understanding of external forces. Our PESTLE analysis of Hornbeck Offshore Services reveals critical political, economic, social, technological, legal, and environmental factors shaping its trajectory. Gain a competitive advantage by understanding these influences.

Unlock actionable intelligence for Hornbeck Offshore Services. This PESTLE analysis dives deep into regulatory shifts, market volatility, and technological advancements impacting the sector. Equip yourself with the insights needed to make informed strategic decisions.

Don't let external factors catch you off guard. Our comprehensive PESTLE analysis for Hornbeck Offshore Services provides a clear roadmap of the opportunities and threats on the horizon. Purchase the full report now to secure your strategic advantage.

Political factors

Government policies significantly shape Hornbeck Offshore's operational environment. The Biden administration's approach, for instance, has included a ban on new offshore oil and gas drilling in the eastern Gulf of Mexico, while allowing activity in western and deepwater regions. This creates a nuanced regulatory landscape for offshore service providers.

Looking ahead, legislative proposals such as the Offshore Energy Security Act of 2025 are designed to foster greater stability by requiring more frequent lease sales. This predictability is crucial for companies like Hornbeck Offshore, as it supports long-term investment and planning in the offshore energy sector.

Hornbeck Offshore Services' operations in Latin America are directly tied to the region's geopolitical stability. Political shifts in key oil and gas producing nations can significantly impact the offshore sector.

For instance, instability in countries like Brazil, which is a major offshore producer, or emerging markets such as Guyana and Suriname, could lead to changes in regulatory frameworks or investment policies. These changes can directly affect exploration and production activities, consequently influencing the demand for Hornbeck's specialized offshore support vessels.

In 2024, Brazil's oil production reached approximately 3.1 million barrels per day, highlighting its importance. Any political disruptions in such a critical market could have ripple effects on the entire supply chain, including vessel services.

International trade relations and the imposition of tariffs directly impact Hornbeck Offshore Services by affecting the cost of essential materials and equipment, as well as influencing the demand for their offshore services. For example, trade disputes can lead to increased import duties on specialized components needed for vessel construction and maintenance, thereby raising operational expenses.

The offshore support vessel market, crucial for Hornbeck's operations, has seen its growth forecast for 2029 slightly reduced, with a portion of this adjustment attributed to the ripple effects of tariffs between major economic blocs like the U.S. and other nations. This suggests a cautious outlook where trade policy shifts can create uncertainty and potentially dampen investment in offshore exploration and production activities, impacting demand for Hornbeck's fleet.

U.S. Jones Act Compliance

The Jones Act significantly shapes Hornbeck Offshore Services' operational landscape by mandating that vessels engaged in U.S. domestic trade must be U.S.-built, owned, and crewed. This legislation is a cornerstone for companies like Hornbeck, particularly as they target the lucrative U.S. offshore market, which includes the burgeoning offshore wind sector.

Hornbeck Offshore's strategic investments, including fleet expansions and vessel conversions, are directly influenced by Jones Act requirements. This compliance ensures their ability to participate in critical domestic energy infrastructure projects.

For instance, the company's focus on U.S.-flagged vessels positions them to capitalize on the growing demand for Jones Act-compliant offshore support vessels (OSVs) needed for the construction and operation of offshore wind farms. As of early 2024, the U.S. offshore wind pipeline includes over 30 gigawatts of proposed capacity, all requiring compliant maritime support.

- Jones Act Impact: Mandates U.S. build, ownership, and crewing for domestic shipping.

- Market Access: Crucial for serving the U.S. offshore energy market, including wind.

- Fleet Strategy: Drives investment in U.S.-flagged and compliant vessels.

- Offshore Wind Demand: Supports the development of over 30 GW of proposed U.S. offshore wind capacity as of early 2024.

Government Support for Energy Transition

Government support for the energy transition is a critical political factor influencing companies like Hornbeck Offshore Services. While the company's core business remains in traditional oil and gas, evolving energy policies, particularly incentives for renewable energy sources like offshore wind, can significantly impact its future markets and demand for its services. This shift is already evident as Hornbeck Offshore has begun converting vessels to support the burgeoning U.S. offshore wind sector, a clear adaptation to these changing political landscapes.

The Inflation Reduction Act of 2022, for instance, provides substantial tax credits and incentives for renewable energy projects, including offshore wind development. This legislation is projected to drive significant investment in the sector through 2030 and beyond. Hornbeck Offshore’s strategic move to retool its fleet for offshore wind projects directly aligns with these government-backed initiatives, aiming to capture a share of this expanding market. This proactive approach positions the company to benefit from the political momentum behind decarbonization efforts.

- Government Incentives: The U.S. government, through legislation like the Inflation Reduction Act, offers significant tax credits and financial support for offshore wind projects, encouraging investment and vessel demand.

- Market Diversification: Hornbeck Offshore's investment in converting vessels for offshore wind signifies a strategic pivot to diversify its revenue streams beyond traditional oil and gas, responding to political shifts favoring renewables.

- Regulatory Environment: Evolving environmental regulations and permitting processes for offshore wind farms, often influenced by political agendas, will continue to shape the pace of development and, consequently, the demand for specialized support vessels.

- Geopolitical Factors: National energy security policies and international climate agreements can also influence government support for domestic renewable energy production, indirectly affecting companies like Hornbeck Offshore.

Government policies, particularly those related to offshore energy development and the energy transition, are paramount for Hornbeck Offshore Services. The U.S. commitment to offshore wind, supported by legislation like the Inflation Reduction Act, is creating new market opportunities for Jones Act-compliant vessels, a segment where Hornbeck is strategically positioning itself. However, geopolitical instability in key producing regions like Brazil, which produced approximately 3.1 million barrels of oil per day in 2024, can disrupt demand for offshore services.

| Political Factor | Description | Impact on Hornbeck Offshore | Supporting Data/Trend |

| U.S. Offshore Wind Policy | Government incentives and support for renewable energy, especially offshore wind. | Drives demand for Jones Act-compliant vessels for construction and operations. | Over 30 GW of proposed U.S. offshore wind capacity as of early 2024. |

| Geopolitical Stability in Energy Markets | Political stability in major oil and gas producing nations. | Instability can reduce investment and demand for offshore support vessels. | Brazil's 2024 oil production of ~3.1 million bpd highlights market significance. |

| Trade Relations and Tariffs | International trade policies and their impact on costs and demand. | Increased costs for equipment and potential dampening of investment. | Growth forecasts for the offshore support vessel market adjusted due to trade policy effects. |

What is included in the product

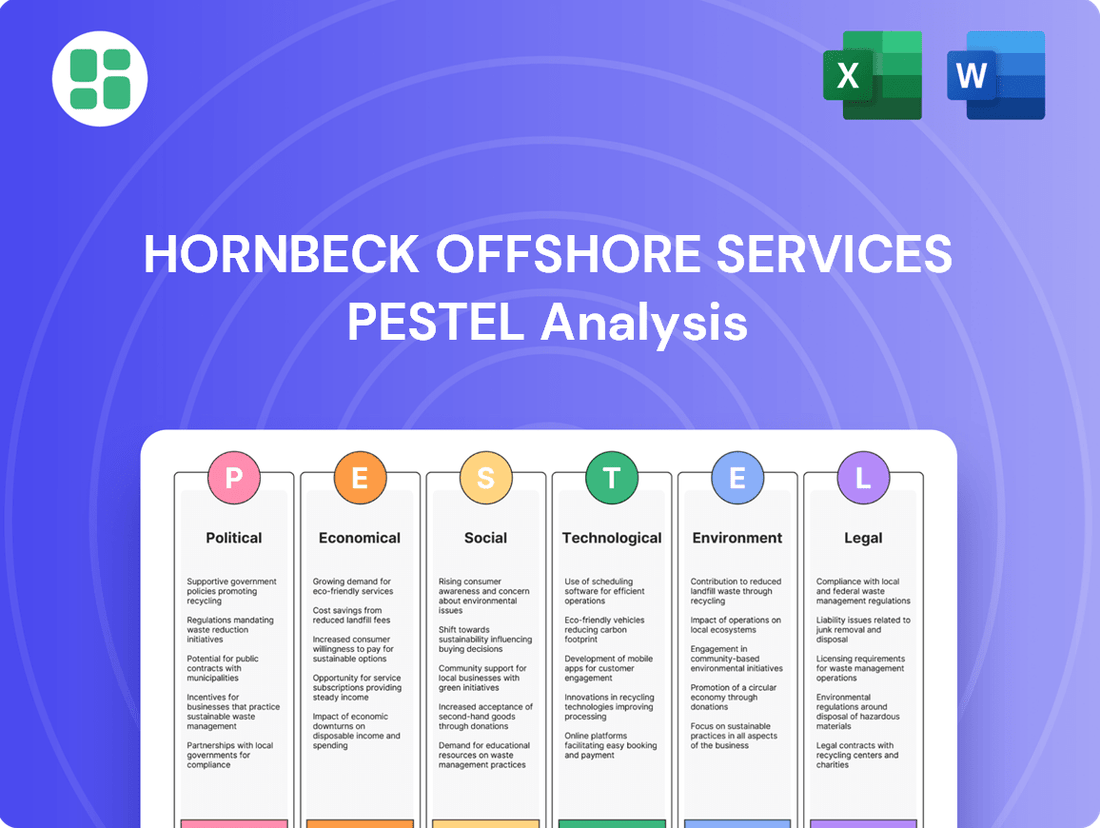

This PESTLE analysis examines the external macro-environmental factors influencing Hornbeck Offshore Services, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview to help stakeholders identify strategic opportunities and mitigate potential risks within the offshore services industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Hornbeck Offshore Services' external environment to alleviate concerns about market uncertainty.

Economic factors

Global oil prices experienced significant volatility throughout 2024, with Brent crude averaging around $83 per barrel for the year, influenced by geopolitical tensions and OPEC+ production decisions. This fluctuation directly impacts Hornbeck's clients, as higher crude prices in late 2024 and early 2025 spurred renewed investment in offshore exploration and production, boosting demand for Hornbeck's vessel services.

The capital expenditure by oil and gas companies on offshore exploration and production (E&P) is a critical factor for Hornbeck Offshore Services. Higher E&P budgets directly translate to increased demand for offshore support vessels (OSVs) like those operated by Hornbeck. For instance, the projected offshore E&P spending for 2024 is expected to see a notable increase, driven by major players and emerging markets.

Positive indicators for Hornbeck's business are evident in the substantial investment plans of companies like Petrobras. Petrobras announced a significant capital expenditure program for its Brazilian offshore operations, signaling a robust demand environment for OSVs in that key region throughout 2024 and into 2025. This strategic spending by national oil companies is crucial for the offshore service sector.

The offshore support vessel (OSV) market is currently characterized by a favorable supply and demand equilibrium, directly benefiting companies like Hornbeck Offshore Services. Vessel utilization rates are robust, with many vessels actively engaged in projects, and day rates have seen a significant strengthening trend. This tightening capacity, coupled with sustained demand, paints a positive picture for OSV operators.

In early 2024, industry reports indicated OSV utilization rates in key regions like the North Sea and the Gulf of Mexico were consistently above 80% for many vessel classes. This high utilization is a direct driver of improved day rates, with certain vessel types experiencing double-digit percentage increases compared to the previous year. For instance, platform supply vessels (PSVs) and anchor handling tug supply (AHTS) vessels are seeing particularly strong demand from major oil and gas companies undertaking exploration and production activities.

Interest Rates and Access to Capital

Changes in interest rates directly impact Hornbeck Offshore Services' (HOS) cost of capital. Higher rates make borrowing more expensive, affecting decisions on acquiring new vessels, undertaking newbuild projects, or modernizing the existing fleet. For instance, a 1% increase in interest rates on a $500 million loan could add millions in annual interest expenses.

Access to capital is paramount for HOS to fund its strategic growth initiatives. This includes purchasing advanced offshore support vessels or converting existing ones to meet evolving market demands, such as those in the renewable energy sector. The company's ability to secure favorable financing terms is directly linked to prevailing interest rate environments and overall credit market conditions.

As of early 2024, benchmark interest rates like the Federal Funds Rate have remained elevated, influencing the cost of debt for companies like HOS. For example, if HOS were to issue new debt in mid-2024, they would likely face higher coupon payments compared to periods of lower interest rates. This financial pressure necessitates careful capital allocation and a focus on efficient operations to maintain profitability.

- Impact on Debt Financing: Higher interest rates increase the cost of borrowing for capital-intensive projects like vessel construction and acquisition.

- Strategic Investment Costs: Elevated rates can deter or delay strategic investments, potentially impacting HOS's competitive edge in fleet modernization and expansion.

- Access to Capital Markets: The overall economic climate, influenced by interest rate policies, affects HOS's ability to access equity and debt markets for funding.

- Operational Margins: Increased financing costs can squeeze profit margins, especially for companies with significant debt burdens.

Currency Fluctuations

Hornbeck Offshore Services' international operations, particularly in Latin America, mean it's exposed to currency exchange rate volatility. Fluctuations between Latin American currencies and the U.S. dollar can directly affect the company's reported revenues and the cost of its operations in those regions.

For instance, if a Latin American currency weakens significantly against the U.S. dollar, revenue earned in that local currency will translate to fewer U.S. dollars. Conversely, a stronger local currency could increase costs when repatriating profits or paying for U.S.-based services.

- Impact on Revenue: A 10% depreciation in a key Latin American currency against the USD could reduce reported revenue from that market by a similar percentage.

- Cost Management: Operating expenses incurred in local currencies become more expensive in USD terms if the local currency strengthens.

- Competitive Landscape: Currency shifts can also alter the competitive pricing of services offered by local versus international operators.

- Hedging Strategies: Companies like Hornbeck may employ financial instruments to hedge against these currency risks, though these strategies have their own costs and complexities.

Geopolitical events and global economic conditions significantly influence the demand for offshore services. Increased geopolitical instability in regions like the Middle East and Eastern Europe during 2024 contributed to oil price volatility, averaging around $83 per barrel for Brent crude. This volatility, coupled with strategic production decisions by OPEC+, directly impacts the capital expenditure of oil and gas companies on exploration and production (E&P).

A notable trend is the robust investment from national oil companies, such as Petrobras, which announced substantial capital expenditure programs for its Brazilian offshore operations through 2025. This signals a strong demand environment for offshore support vessels (OSVs) like those operated by Hornbeck. The overall OSV market in early 2024 showed high utilization rates, often exceeding 80% in key areas like the North Sea and Gulf of Mexico, leading to strengthened day rates for vessel classes such as PSVs and AHTS vessels.

Interest rate policies also play a crucial role, impacting Hornbeck's cost of capital for fleet expansion and modernization. Elevated benchmark rates, such as the Federal Funds Rate in early 2024, increase borrowing costs, potentially affecting strategic investment decisions. Furthermore, currency exchange rate volatility, particularly in Latin America, can influence Hornbeck's reported revenues and operational costs when transactions are made in local currencies against the U.S. dollar.

| Economic Factor | 2024/2025 Data/Trend | Impact on Hornbeck Offshore Services |

|---|---|---|

| Global Oil Prices (Brent Crude) | Averaged ~$83/barrel in 2024; volatile due to geopolitics & OPEC+ | Higher prices spur E&P investment, increasing demand for OSVs. |

| Offshore E&P Capital Expenditure | Projected increase in 2024 driven by major players and emerging markets. | Directly correlates with demand for Hornbeck's vessel services. |

| Key Client Investment (e.g., Petrobras) | Significant CAPEX announced for Brazilian offshore operations through 2025. | Indicates robust demand for OSVs in key regions. |

| OSV Utilization Rates | Consistently above 80% in key regions (North Sea, Gulf of Mexico) in early 2024. | Supports stronger day rates and improved profitability for OSV operators. |

| Interest Rates (e.g., Federal Funds Rate) | Remained elevated in early 2024. | Increases cost of debt financing for vessel acquisition and capital projects. |

| Currency Exchange Rates (Latin America vs. USD) | Volatility impacts revenue translation and operational costs. | Weakening local currencies reduce USD-equivalent revenue; strengthening increases USD costs. |

What You See Is What You Get

Hornbeck Offshore Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hornbeck Offshore Services covers all critical external factors impacting the company's operations and strategic planning. You'll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape relevant to Hornbeck Offshore Services.

Sociological factors

Public perception of fossil fuels is increasingly negative, driven by growing environmental activism and concerns about climate change. This societal pressure directly influences government policies, pushing for stricter regulations and a faster transition to renewable energy sources, which could impact investment trends in the oil and gas sector.

While Hornbeck Offshore Services primarily supports the traditional energy industry, this negative sentiment can indirectly affect its long-term demand. If the accelerated energy transition leads to a significant decline in hydrocarbon exploration and production, the need for offshore support vessels like those operated by Hornbeck could diminish. For instance, a significant portion of global investment is shifting towards renewables; in 2024, renewable energy investments are projected to reach over $2 trillion, a stark contrast to declining fossil fuel capital expenditures.

Hornbeck Offshore Services relies heavily on a readily available pool of skilled mariners and offshore personnel to manage its fleet. A significant factor influencing this is the global maritime labor market, which has seen persistent shortages of experienced seafarers in recent years. For instance, reports from 2024 indicated that the demand for qualified officers and engineers often outstripped supply, leading to increased recruitment challenges and higher wage pressures.

The need for continuous training and upskilling is paramount, especially with evolving industry standards and the introduction of new technologies in offshore vessel operations. In 2025, the International Maritime Organization (IMO) continues to emphasize decarbonization and digitalization, requiring personnel to adapt to new protocols and equipment. This ongoing training necessity can directly impact operational efficiency and can contribute to rising labor costs for companies like Hornbeck.

Societal expectations for rigorous safety and occupational health standards in the offshore energy sector are exceptionally high, a critical consideration for companies like Hornbeck Offshore Services due to the inherent risks involved.

Hornbeck's demonstrated commitment to these standards, often detailed in their annual sustainability and ESG reports, directly impacts their brand reputation, ability to attract and retain skilled personnel, and overall regulatory standing. For instance, in 2023, the company reported a Total Recordable Incident Rate (TRIR) of 0.36, significantly below the industry average, underscoring their focus.

Community Relations and Local Impact

Hornbeck Offshore Services' operations, particularly in the U.S. Gulf of Mexico, directly influence coastal communities. The company's commitment to environmental stewardship and community engagement is crucial for maintaining its social license to operate. For instance, during 2024, the offshore support vessel industry, which Hornbeck is a part of, continued to navigate the balance between economic activity and environmental protection, with ongoing discussions around spill response readiness and local economic contributions from port services and crew changes.

Positive community relations are paramount. This involves transparent communication about operations, addressing local concerns regarding potential environmental impacts, and actively contributing to the economic well-being of the areas where it operates. In 2024, many coastal regions reliant on the offshore industry saw continued investment in local infrastructure and workforce development initiatives, often supported by companies like Hornbeck through direct employment and procurement from local suppliers.

- Environmental Stewardship: Continued focus on minimizing operational footprint and robust spill prevention measures in 2024, reflecting community expectations.

- Local Economic Contribution: Supporting local economies through vessel services, crew employment, and procurement, a key factor in community acceptance.

- Stakeholder Engagement: Proactive engagement with local authorities and community groups to address concerns and build trust.

- Workforce Development: Investing in training and development for local talent, fostering long-term community benefits.

Diversity and Inclusion in the Workforce

Societal expectations are increasingly pushing for greater diversity and inclusion across all industries, and the maritime sector is no exception. This growing emphasis directly impacts how companies like Hornbeck Offshore Services approach recruitment, employee retention, and overall corporate governance. A diverse workforce often brings a wider range of perspectives, which can lead to more innovative problem-solving and better decision-making.

Hornbeck Offshore Services has publicly acknowledged the importance of developing its workforce and fostering diversity as critical components of its sustainability strategy. This commitment suggests a proactive approach to aligning its human capital practices with evolving societal values. For instance, in 2023, the maritime industry saw a continued push for gender equality, with organizations like the International Maritime Organization highlighting efforts to increase female representation in seafaring roles, though specific Hornbeck data for 2024/2025 on this metric is not yet widely publicized.

- Societal Pressure: Growing public demand for equitable workplaces influences HR policies and corporate social responsibility reporting.

- Talent Acquisition: Companies prioritizing diversity often have a broader talent pool to draw from, enhancing recruitment effectiveness.

- Corporate Governance: Inclusion is becoming a key metric for investors and stakeholders evaluating a company's ethical standing and long-term viability.

- Workforce Development: Investments in training and development programs that support diverse employees are crucial for retention and skill enhancement.

Societal expectations regarding environmental responsibility and climate change continue to shape the energy sector, impacting demand for services like those provided by Hornbeck Offshore Services. Public sentiment increasingly favors renewable energy, with global investments in this area projected to exceed $2 trillion in 2024, a trend that could reduce long-term reliance on fossil fuels and, consequently, offshore support vessels.

The availability of skilled labor is a critical sociological factor for Hornbeck. Persistent shortages of experienced mariners, particularly qualified officers and engineers, were noted in 2024, driving up recruitment costs and wage pressures within the maritime industry.

Moreover, a strong emphasis on safety and occupational health is paramount, directly affecting Hornbeck's operational standards and reputation. The company's commitment to these principles, evidenced by a low Total Recordable Incident Rate (TRIR) of 0.36 in 2023, is crucial for attracting talent and maintaining regulatory compliance.

Finally, diversity and inclusion are becoming key performance indicators, influencing HR practices and corporate governance. Hornbeck's focus on developing a diverse workforce aligns with evolving societal values and enhances its ability to attract a broader talent pool.

Technological factors

Ongoing advancements in vessel design are crucial for competitive advantage in the offshore services sector. Hornbeck Offshore Services, for instance, is focusing on 'new generation' vessels and conversions that incorporate fuel-efficient and eco-friendly technologies.

The integration of advanced dynamic positioning systems also plays a vital role in enhancing operational reliability and cost-effectiveness. These technological upgrades allow vessels to maintain precise positions, reducing the need for traditional anchoring and improving safety and efficiency in complex offshore environments.

Hornbeck Offshore Services is actively embracing automation and digitalization to boost operational effectiveness. The company's investment in new Dynamic Positioning (DP) simulators underscores a commitment to integrating advanced technologies for navigation and vessel control.

These advancements, including remote monitoring and sophisticated data analytics, are designed to improve efficiency, enhance safety protocols, and enable predictive maintenance on their offshore vessels. This strategic adoption of technology is crucial for staying competitive in the evolving energy sector.

Hornbeck Offshore Services' ability to support subsea construction, inspection, and maintenance hinges directly on the pace of subsea technology advancements. Innovations in areas like remotely operated vehicles (ROVs) and subsea robotics are crucial, as they enable more complex and deeper operations.

For instance, the increasing sophistication of autonomous underwater vehicles (AUVs) and advanced intervention tools allows for tasks previously requiring human divers, potentially reducing costs and risks for clients. The subsea sector saw significant investment in new technologies throughout 2024, with companies reporting increased demand for vessels capable of supporting these evolving subsea operations.

Renewable Energy Vessel Technology

The offshore wind industry is seeing a significant technological evolution with the development of specialized vessels like Service Operation Vessels (SOVs). These ships are designed to support the maintenance and operation of wind farms, a departure from traditional offshore support vessels. This shift requires advanced capabilities in vessel design and propulsion.

Hornbeck Offshore Services (HOS) is actively adapting to these technological demands. A prime example is their strategic conversion of an existing Offshore Support Vessel (OSV) into an SOV. This conversion includes the integration of a battery-hybrid power system, showcasing a commitment to more sustainable and efficient operations within the renewable energy sector.

This technological adaptation by HOS is crucial for several reasons:

- Enhanced Operational Efficiency: Hybrid systems can reduce fuel consumption and emissions during vessel operations.

- Meeting Industry Standards: The renewable sector increasingly demands vessels with lower environmental footprints.

- Strategic Market Positioning: By investing in SOV technology, HOS positions itself to capture a growing share of the offshore wind support market.

Cybersecurity in Maritime Operations

The increasing digitalization of maritime operations, including those of Hornbeck Offshore Services, presents significant cybersecurity challenges. As vessels and shore-based systems become more interconnected, the attack surface for cyber threats expands dramatically. This trend is amplified by the adoption of IoT devices and advanced navigation systems, making robust protection paramount.

Protecting operational technology (OT) and sensitive data is no longer optional but a critical strategic imperative. A breach could disrupt operations, compromise safety, and lead to substantial financial losses. For instance, the International Maritime Organization (IMO) has recognized these risks, issuing guidelines to enhance maritime cybersecurity, underscoring the industry-wide focus on this technological factor.

The need for advanced cybersecurity measures is highlighted by the growing sophistication of cyberattacks targeting critical infrastructure. Companies like Hornbeck must invest in:

- Advanced threat detection and prevention systems

- Regular vulnerability assessments and penetration testing

- Employee training on cybersecurity best practices

- Secure remote access solutions for vessel management

Technological advancements are reshaping the offshore services landscape, with companies like Hornbeck Offshore Services (HOS) investing in next-generation vessels and digital solutions. The company's focus on fuel-efficient designs and advanced navigation systems, such as dynamic positioning, enhances operational efficiency and safety. HOS's strategic conversion of vessels for the offshore wind sector, including the integration of battery-hybrid systems, demonstrates an adaptation to evolving industry demands for sustainability and specialized capabilities.

The increasing digitalization of maritime operations, however, necessitates robust cybersecurity measures. HOS must address the expanded attack surface created by interconnected systems and IoT devices. Protecting operational technology and data is critical, as highlighted by IMO guidelines on maritime cybersecurity, to prevent operational disruptions and financial losses.

Subsea technology innovation, including advanced ROVs and AUVs, is also a key driver. The demand for vessels supporting these complex operations saw an increase in 2024, with technological upgrades enabling deeper and more intricate subsea tasks, potentially reducing client costs and risks.

| Technological Factor | Impact on HOS | Industry Trend (2024-2025) |

|---|---|---|

| Vessel Design & Fuel Efficiency | Focus on 'new generation' and converted vessels for improved performance and reduced emissions. | Increased adoption of hybrid and alternative fuel systems in new builds and retrofits. |

| Automation & Digitalization | Investment in DP simulators and remote monitoring for enhanced operational control and predictive maintenance. | Growing integration of AI and data analytics for optimizing vessel performance and logistics. |

| Subsea Technology Support | Need for vessels capable of supporting advanced ROVs and AUVs for complex subsea operations. | Continued investment in subsea robotics and autonomous systems, driving demand for specialized support vessels. |

| Cybersecurity | Critical need to protect interconnected systems from cyber threats to ensure operational integrity and safety. | Heightened focus on maritime cybersecurity, with regulatory bodies issuing stricter guidelines and companies investing in advanced protection. |

Legal factors

Hornbeck Offshore Services navigates a stringent regulatory environment dictated by maritime and international shipping laws. Compliance with standards from the International Maritime Organization (IMO) and specific flag states is paramount, impacting everything from vessel design to crew qualifications.

These regulations encompass critical areas like vessel safety equipment, environmental protection measures, and operational protocols. For instance, the IMO’s Ballast Water Management Convention, fully in force since 2017, requires significant investment in ballast water treatment systems for vessels operating internationally, a cost factor for companies like Hornbeck.

Hornbeck Offshore Services, like all maritime operators, faces stringent environmental regulations. These rules, such as the International Maritime Organization's (IMO) 2020 sulfur cap, mandate cleaner fuels and impact operational costs. Future greenhouse gas (GHG) reduction targets will necessitate further investments in more sustainable vessel technologies.

Non-compliance with emissions standards or discharge regulations can lead to significant financial penalties and jeopardize operational licenses. For instance, a single violation could incur fines in the tens of thousands of dollars, directly affecting profitability and the company's ability to secure contracts.

Labor laws, encompassing regulations on working hours, wages, and crew welfare, directly influence Hornbeck Offshore Services' operational expenses and human resource management. For instance, the U.S. Jones Act mandates that vessels operating between U.S. ports be built, crewed, and owned by Americans, impacting crewing strategies and labor costs.

Compliance with these diverse national labor laws, including those in Latin America where Hornbeck also operates, is critical for avoiding penalties and ensuring smooth operations. In 2024, the maritime industry continues to grapple with evolving labor standards and the need to attract and retain skilled seafarers amidst global competition, a factor that will likely persist into 2025.

Offshore Safety Regulations

Offshore safety regulations, like those enforced by the Bureau of Safety and Environmental Enforcement (BSEE) in the United States, are absolutely critical for companies like Hornbeck Offshore Services. These rules are designed to prevent catastrophic accidents and ensure the well-being of workers. For 2024, the BSEE continues to emphasize rigorous inspection protocols and performance-based standards to mitigate risks in the offshore energy sector.

Compliance with these stringent safety standards directly impacts operational continuity and financial performance. Non-compliance can lead to significant fines, operational shutdowns, and severe reputational damage. In 2023, the BSEE reported a continued focus on reducing incidents, with data indicating a sustained effort to maintain low rates of major accidents through enhanced oversight.

The evolving regulatory landscape means companies must invest continuously in safety technology and training. This proactive approach is essential not only for legal adherence but also for maintaining a competitive edge and attracting investment. Hornbeck Offshore Services, like its peers, navigates these requirements to ensure safe and efficient operations in a demanding environment.

- BSEE Oversight: The Bureau of Safety and Environmental Enforcement sets and enforces safety and environmental regulations for offshore oil and gas operations in the U.S.

- Incident Prevention: Strict adherence to safety standards is paramount to prevent accidents, protect lives, and avoid costly legal liabilities.

- Operational Impact: Non-compliance can result in substantial fines and operational disruptions, directly affecting profitability.

- Investment in Safety: Ongoing investment in advanced safety equipment and comprehensive training programs is a necessity for regulatory compliance and operational excellence.

Contract Law and Litigation Risks

Hornbeck Offshore Services operates under the pervasive umbrella of contract law, which dictates its relationships with a wide array of stakeholders, including customers, vendors, and shipbuilders. These agreements are crucial for securing contracts for its offshore support vessels and managing supply chain operations. The company's financial health and operational continuity are directly tied to the enforceability and clarity of these contractual obligations.

Past legal entanglements, such as the disputes surrounding the construction of Multi-Purpose Supply Vessels (MPSVs), underscore the significant litigation risks inherent in the industry. For instance, in 2023, Hornbeck Offshore was involved in ongoing arbitration proceedings related to vessel construction, which can lead to substantial financial penalties and delays in asset deployment. Such legal battles highlight the critical need for meticulous contract drafting and proactive dispute resolution to mitigate potential disruptions to vessel delivery schedules and overall financial performance.

- Contractual Compliance: Ensuring all agreements with clients for vessel chartering, and with suppliers for equipment and services, adhere strictly to relevant contract laws.

- Litigation Costs: In 2023, legal expenses for companies in the offshore services sector can range from hundreds of thousands to millions of dollars, depending on the complexity and duration of disputes.

- Impact on Vessel Delivery: Disputes with shipyards, as seen in past MPSV construction issues, can delay the commissioning of new vessels, impacting revenue generation.

- Reputational Risk: Frequent or high-profile litigation can negatively affect Hornbeck Offshore's reputation, potentially deterring new clients and partners.

Legal factors significantly shape Hornbeck Offshore Services' operations, demanding strict adherence to maritime, labor, and safety regulations. For 2024, the company must continue to navigate evolving environmental mandates, such as those from the IMO, which require ongoing investment in cleaner technologies and impact operational costs. The U.S. Jones Act, for instance, continues to influence crewing strategies and associated expenses.

Contract law is fundamental to Hornbeck's business, governing its relationships with clients and suppliers. Past litigation, such as disputes over vessel construction in 2023, highlights the substantial financial and operational risks associated with contract breaches and the critical need for robust dispute resolution mechanisms. These legal entanglements can directly affect asset deployment and revenue streams, underscoring the importance of meticulous contract management.

The Bureau of Safety and Environmental Enforcement (BSEE) plays a crucial role in offshore safety. In 2024, BSEE's focus on rigorous inspections and performance-based standards aims to mitigate risks in the offshore energy sector. Compliance with these safety regulations is non-negotiable, as violations can lead to significant fines, operational shutdowns, and reputational damage, directly impacting profitability and the ability to secure new contracts.

Environmental factors

Global initiatives to curb climate change are accelerating a shift from fossil fuels, potentially affecting the sustained demand for conventional offshore oil and gas services. This environmental imperative is a significant factor for companies like Hornbeck Offshore Services.

Hornbeck's proactive investment in supporting the offshore wind sector, as evidenced by their fleet expansion and service offerings, demonstrates a strategic adaptation to this evolving energy landscape. For instance, in 2024, Hornbeck announced plans to further integrate its vessels into offshore wind farm construction and maintenance projects.

The International Energy Agency (IEA) reported in its 2024 outlook that renewable energy sources, including offshore wind, are expected to see substantial growth, driven by government targets and technological advancements. This trend underscores the strategic importance of Hornbeck's pivot towards renewable energy infrastructure support.

The specter of oil spills looms large over offshore operations, posing significant environmental risks. Hornbeck Offshore Services, like its peers, faces intense scrutiny and regulatory pressure to prevent such incidents. In 2024, the industry continued to grapple with the aftermath of past spills and the ongoing need for advanced containment technologies.

Adherence to stringent prevention protocols is non-negotiable. This includes rigorous equipment maintenance, comprehensive crew training, and the implementation of state-of-the-art spill detection systems. For instance, regulations often mandate specific response times and the availability of containment booms and skimmers, with fines for non-compliance reaching millions of dollars.

Robust response capabilities are equally critical. Hornbeck must demonstrate readiness to manage spills effectively, minimizing ecological damage and operational downtime. The company's investment in spill response equipment and partnerships with specialized response organizations underscores its commitment to environmental stewardship and regulatory compliance, a crucial factor in maintaining its operating licenses and public trust.

Hornbeck Offshore's operations, particularly in the Gulf of Mexico, face scrutiny regarding their impact on marine biodiversity. Regulations aimed at protecting endangered species, like the critically endangered Rice's whale, require rigorous environmental impact assessments and careful planning to minimize disruption to sensitive ecosystems. The US Fish and Wildlife Service continues to monitor and implement protections for this species, impacting offshore activities.

Waste Management and Pollution Control

Hornbeck Offshore Services' operations, like those of many in the maritime sector, face increasing scrutiny regarding waste management and pollution control. Effective handling of waste generated on vessels and offshore platforms, alongside stringent control of air and water emissions, is paramount for maintaining regulatory compliance and a positive environmental reputation. The company's commitment to these principles is a significant aspect of its operational strategy.

Hornbeck's sustainability reporting highlights its dedication to responsible practices. For instance, in their 2023 sustainability report, they detailed initiatives aimed at reducing their environmental footprint. This includes investments in technologies to minimize discharges and improve waste processing capabilities. The company recognizes that robust environmental stewardship is not just a compliance issue but a core component of long-term business viability.

Key areas of focus for Hornbeck and the industry include:

- Marine Pollution Prevention: Implementing advanced systems to prevent oil spills and manage bilge water and sewage effectively.

- Air Emission Control: Utilizing technologies to reduce sulfur oxides (SOx) and nitrogen oxides (NOx) emissions from vessel engines, aligning with global maritime regulations.

- Waste Stream Management: Developing comprehensive strategies for the segregation, treatment, and disposal of solid and hazardous waste generated offshore.

- Environmental Performance Monitoring: Continuously tracking key environmental metrics to identify areas for improvement and ensure adherence to performance targets.

Impact of Extreme Weather Events

The Gulf of Mexico, a critical operational area for Hornbeck Offshore Services, is inherently susceptible to hurricanes and other severe weather phenomena. These events present substantial environmental risks, including the potential for significant damage to offshore infrastructure and vessels. For instance, the 2020 hurricane season saw a record-breaking 30 named storms in the Atlantic, with many impacting the Gulf, leading to operational disruptions and heightened safety protocols for offshore service providers.

Such extreme weather can directly lead to environmental incidents like oil spills or the release of other hazardous materials from damaged facilities. The aftermath of Hurricane Ida in 2021, which made landfall in Louisiana, highlighted the vulnerability of offshore platforms and the complex response required to mitigate environmental damage. Hornbeck Offshore's operational resilience and robust preparedness strategies are therefore paramount to navigating these environmental challenges and minimizing their impact.

Key considerations for Hornbeck Offshore Services in managing these environmental factors include:

- Infrastructure Protection: Implementing advanced weather forecasting and early warning systems to secure assets and personnel ahead of severe weather.

- Emergency Response: Maintaining well-trained crews and readily available equipment for rapid response to spills or other environmental incidents.

- Regulatory Compliance: Adhering to stringent environmental regulations set forth by bodies like the Bureau of Safety and Environmental Enforcement (BSEE) to prevent and manage pollution.

- Operational Continuity: Developing contingency plans to ensure the continuity of essential services while prioritizing safety and environmental stewardship during and after extreme weather events.

The global push towards decarbonization is reshaping the energy sector, directly impacting demand for traditional offshore oil and gas services. Hornbeck Offshore Services is strategically adapting by expanding its fleet and services to support the burgeoning offshore wind industry. The International Energy Agency's 2024 outlook projects significant growth in renewables, underscoring the strategic advantage of Hornbeck's pivot.

Environmental risks, particularly the potential for oil spills, remain a critical concern for offshore operators. Hornbeck, like its peers, faces stringent regulations and public scrutiny, necessitating advanced spill prevention and response capabilities. The company's investments in technology and partnerships reflect a commitment to mitigating these risks and ensuring regulatory compliance.

Operations in sensitive marine environments, such as the Gulf of Mexico, require careful management to protect biodiversity. Hornbeck must adhere to regulations protecting endangered species, like the Rice's whale, through thorough environmental impact assessments and careful operational planning. Waste management and emission controls are also paramount for maintaining compliance and a positive environmental record.

The company's sustainability reporting, including initiatives detailed in its 2023 report, demonstrates a focus on reducing its environmental footprint through technological investments and improved waste processing. This commitment to environmental stewardship is increasingly vital for long-term business viability and maintaining stakeholder trust.

Extreme weather events, such as hurricanes in the Gulf of Mexico, pose significant environmental risks to offshore infrastructure. The 2020 Atlantic hurricane season, with a record 30 named storms, highlights the vulnerability of offshore operations and the need for robust preparedness. Hornbeck's focus on infrastructure protection, emergency response, and operational continuity is crucial for navigating these environmental challenges.

PESTLE Analysis Data Sources

Our Hornbeck Offshore Services PESTLE Analysis is built on a foundation of credible data from industry-specific publications, financial market reports, and government regulatory bodies. We analyze trends in energy policy, economic indicators, and technological advancements impacting the offshore services sector.