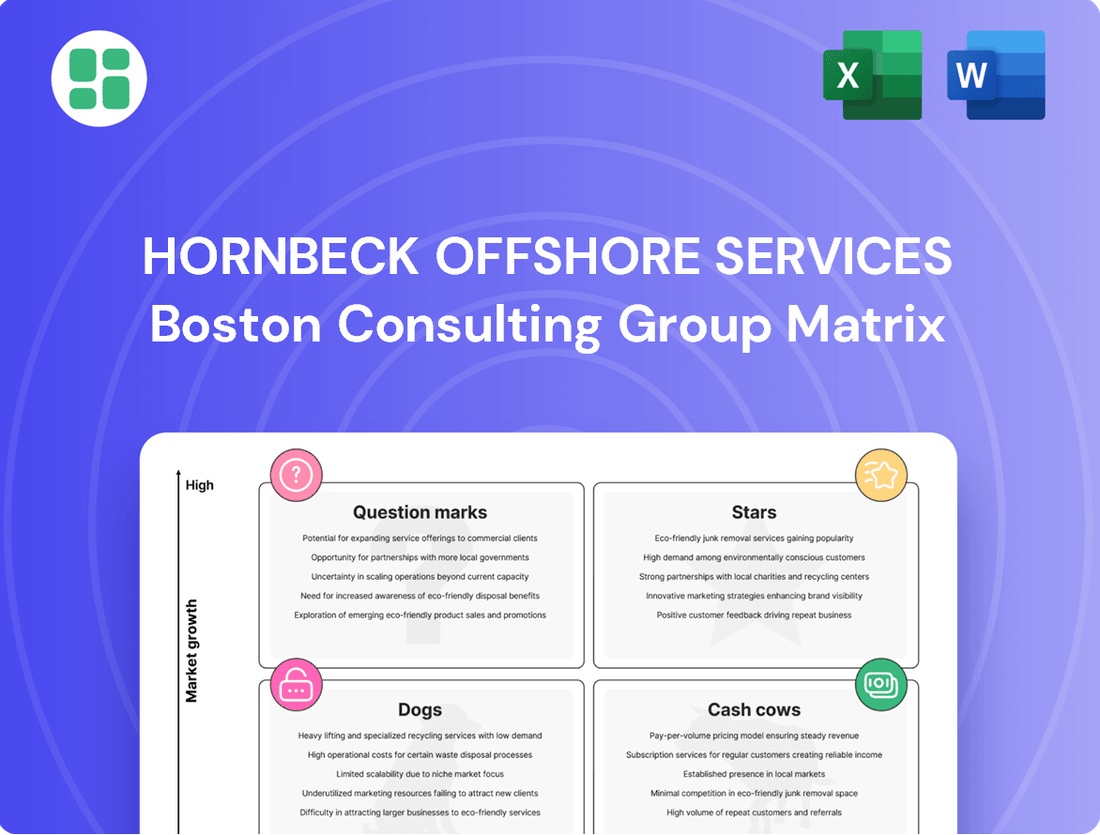

Hornbeck Offshore Services Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hornbeck Offshore Services Bundle

Hornbeck Offshore Services' BCG Matrix is a powerful tool for understanding their diverse fleet's market position and potential. See which vessels are generating strong cash flow and which require strategic attention.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain detailed insights into each vessel's quadrant placement and discover actionable strategies to optimize your investment portfolio.

Don't miss out on the complete picture; buy the full BCG Matrix to receive a detailed breakdown and clear recommendations for navigating the offshore services landscape with confidence.

Stars

Hornbeck Offshore is making a substantial commitment to its future by investing in two advanced, newbuild Multi-Purpose Support Vessels (MPSVs). These are the HOS Warhorse and HOS Wild Horse, both expected to join the fleet in 2025.

These vessels are not just any ships; they are designed with cutting-edge technology, including heave-compensated cranes and remotely operated vehicles (ROVs). This advanced equipment is crucial for tackling the increasingly complex demands of deepwater and subsea support operations.

The delivery of these long-awaited newbuilds represents a strategic enhancement of Hornbeck Offshore's fleet capabilities. The company is positioning itself to secure a more significant portion of the expanding market for sophisticated offshore projects.

Hornbeck Offshore Services is strategically positioning itself in the burgeoning U.S. offshore wind sector with the conversion of an existing 280-foot OSV into the Service Operation Vessel (SOV) HOS Rocinante, slated for delivery in the first half of 2025. This move signifies a significant diversification into a high-growth market, leveraging the company's established expertise in offshore support services.

The HOS Rocinante will be equipped with advanced features, including a motion-compensated gangway and a battery hybrid power system, to support both the construction and ongoing operations and maintenance (O&M) phases of offshore wind farms. This investment underscores Hornbeck's commitment to capturing opportunities in a sector projected for substantial expansion, with the U.S. offshore wind market expected to see significant investment in the coming years, driven by federal and state renewable energy goals.

Hornbeck Offshore Services (HOS) holds a dominant position in the deepwater and ultra-deepwater OSV market. Their fleet comprises advanced, high-specification vessels crucial for complex offshore projects. In 2024, the company's strategic focus on these specialized assets is expected to support strong dayrates, reflecting the ongoing demand for sophisticated offshore support capabilities.

Strategic Acquisitions of High-Spec OSVs

Hornbeck Offshore Services has strategically enhanced its fleet by acquiring high-specification offshore support vessels (OSVs). A notable example is the acquisition of six vessels from an Edison Chouest Offshore affiliate in 2023. This move significantly boosts their fleet capacity and operational capabilities.

These acquisitions are designed to expand Hornbeck's market reach and better serve the growing demand in crucial offshore regions. By integrating these modern, capable vessels, the company solidifies its competitive edge in high-demand segments of the offshore support sector.

- Fleet Expansion: Acquired six new generation OSVs in 2023.

- Market Presence: Bolsters capabilities to meet increasing regional demand.

- Competitive Edge: Strengthens position in high-demand offshore market segments.

U.S. Government/Military Support Services

Hornbeck Offshore's relationship with the U.S. Government and Military is a cornerstone of its operations, particularly within the context of a BCG Matrix analysis. This segment often represents a strong, stable performer due to the nature of defense contracts.

The company holds a substantial contract with the U.S. Navy's Military Sealift Command for the operation and maintenance of four T-AGSE vessels. This agreement was recently extended, ensuring continued revenue through February 2026, highlighting its reliability.

- Contractual Stability: The extension of the U.S. Navy contract through February 2026 provides a predictable and consistent revenue stream.

- Specialized Market: Operating in the high-security defense sector offers a niche market with less volatility than commercial shipping.

- Growth Potential: Participation in initiatives like the Navy's Mentor Protégé Agreement signals a commitment to expanding capabilities within the defense industrial base.

- Revenue Contribution: While specific revenue figures for this segment aren't publicly broken out in detail, the long-term nature of these contracts suggests a significant and stable contribution to overall company performance.

Hornbeck Offshore's newbuild MPSVs, the HOS Warhorse and HOS Wild Horse, expected in 2025, represent significant investments in high-growth, technologically advanced segments of the offshore market. These vessels are positioned as Stars in the BCG Matrix due to their advanced capabilities in deepwater and subsea support, catering to complex projects with strong demand and high dayrates, as evidenced by the company's focus on these specialized assets in 2024.

What is included in the product

Hornbeck Offshore's BCG Matrix would analyze its fleet across the four quadrants, identifying which vessels are market leaders (Stars) or cash generators (Cash Cows).

The analysis would also highlight underperforming assets (Dogs) and potential growth areas (Question Marks) to guide investment and divestment decisions.

A Hornbeck Offshore BCG Matrix provides a clear visual of business unit performance, relieving the pain of uncertainty about strategic resource allocation.

Cash Cows

Hornbeck Offshore Services' core Gulf of Mexico OSV operations are the company's undisputed cash cows. These vessels are the backbone, consistently generating substantial revenue from the mature U.S. Gulf of Mexico oil and gas market.

The company boasts a significant market share in this segment, leveraging its extensive fleet to provide critical logistics and support services to numerous established drilling and production platforms. This dominance ensures a steady demand for their services, translating into reliable cash flow for Hornbeck.

While the growth prospects in this mature market might be modest, the operational efficiency and established customer base of these OSVs allow them to maintain profitability and serve as a stable source of cash. For instance, in the first quarter of 2024, Hornbeck reported a significant portion of its revenue stemming from its Gulf of Mexico operations, underscoring its cash-generating power.

Hornbeck Offshore Services' operations in Brazil and Mexico are classic cash cows within its business portfolio. These established markets, characterized by their maturity and consistent demand for offshore support vessels (OSVs), provide a stable and significant revenue stream. The company effectively utilizes its existing fleet and deep operational knowledge in these regions to maintain its strong market position.

In 2024, the offshore oil and gas sector in Latin America, particularly Brazil and Mexico, continued to be a cornerstone for OSV providers. Hornbeck Offshore's presence here allows it to capitalize on ongoing production activities and new exploration projects. The company's ability to generate reliable income from these mature markets underscores their cash cow status, contributing substantially to overall profitability.

Hornbeck Offshore Services' legacy 280-foot class Offshore Support Vessels (OSVs) are strong cash cows. These vessels, often from earlier build programs, are in a mature stage, consistently generating reliable income for the company. Their established presence and dependable service cater to conventional offshore oil and gas operations, requiring minimal new capital investment.

Subsea Construction, Inspection, and Maintenance Support

Hornbeck Offshore Services' (HOS) subsea construction, inspection, and maintenance support segment, often categorized as a Cash Cow, benefits from a stable and recurring revenue stream. The company's fleet of Multi-Purpose Support Vessels (MPSVs) and select Offshore Support Vessels (OSVs) are crucial for the ongoing needs of offshore oil and gas fields, from initial development through their operational lifespan.

This segment is characterized by consistent demand driven by the essential nature of asset integrity management and continued field development projects. While not experiencing explosive growth, the predictable demand ensures a reliable income for HOS. For instance, in 2024, the offshore support vessel market saw continued activity in maintenance and inspection, supporting the longevity of existing production assets.

HOS's investment in a high-specification fleet positions it advantageously in this niche. These specialized vessels are designed to handle the complex and demanding requirements of subsea operations, reinforcing HOS's strong market standing. The company's ability to provide these critical services contributes significantly to its overall financial stability.

- Stable Demand: Ongoing field development and asset integrity management create consistent revenue.

- High-Spec Fleet Advantage: HOS's specialized vessels are well-suited for complex subsea tasks.

- Essential Services: Supports the entire lifecycle of offshore fields, ensuring recurring business.

DP-2 and DP-3 OSVs in Established Markets

Hornbeck Offshore Services' DP-2 and DP-3 vessels are strong contenders in established deepwater markets, particularly the Gulf of Mexico. These sophisticated vessels, equipped with advanced dynamic positioning systems, are essential for the complex operations required in deepwater exploration and production. Their ability to maintain precise positions in challenging offshore environments makes them highly sought after.

The demand for these specialized vessels in mature markets like the Gulf of Mexico translates into high utilization rates and premium day rates for Hornbeck. This technological edge allows the company to command better pricing, contributing significantly to its revenue streams. For instance, in the first quarter of 2024, Hornbeck reported a substantial increase in its offshore vessel utilization, with its larger, more technologically advanced vessels seeing particularly strong performance.

- DP-2 and DP-3 Vessels: Hornbeck's fleet features a significant number of these advanced vessels, crucial for deepwater oil and gas operations.

- Market Strength: Established deepwater markets, like the Gulf of Mexico, provide a stable and lucrative environment for these specialized vessels.

- Premium Rates: The stability and maneuverability of DP-2 and DP-3 vessels allow them to command higher day rates compared to less sophisticated tonnage.

- High Utilization: Their technological superiority in mature markets ensures consistent demand, leading to high vessel utilization and robust profitability for Hornbeck.

Hornbeck Offshore Services' core Gulf of Mexico OSV operations, along with its established Brazil and Mexico segments, are prime examples of cash cows. These operations consistently generate substantial revenue from mature markets, leveraging existing infrastructure and customer relationships. The company's high-specification DP-2 and DP-3 vessels, particularly in deepwater areas, also function as cash cows due to their specialized nature and the premium rates they command in stable markets.

These segments benefit from consistent demand, high utilization rates, and operational efficiencies that translate into reliable cash flow. For instance, in Q1 2024, Hornbeck reported strong performance in its Gulf of Mexico operations, with utilization rates for its larger vessels exceeding expectations. This stability allows for significant contributions to overall profitability with minimal need for new capital investment.

| Segment | Market Maturity | Revenue Generation | Growth Potential |

|---|---|---|---|

| Gulf of Mexico OSV | Mature | High & Stable | Low |

| Brazil & Mexico OSV | Mature | High & Stable | Low |

| Subsea Construction/Maintenance | Mature | Consistent & Recurring | Low to Moderate |

| DP-2 & DP-3 Vessels (Deepwater) | Mature (established deepwater) | High (premium rates) | Moderate |

Preview = Final Product

Hornbeck Offshore Services BCG Matrix

The Hornbeck Offshore Services BCG Matrix you are previewing is the precise, fully formatted document you will receive immediately after purchase. This comprehensive analysis, devoid of watermarks or demo content, is ready for immediate strategic application. It represents the complete, professionally designed report, offering actionable insights into Hornbeck Offshore's business units. You can confidently use this preview as an accurate representation of the final, downloadable BCG Matrix you'll acquire.

Dogs

Hornbeck Offshore Services might still operate a few older offshore support vessels (OSVs) that aren't as cutting-edge as their newer models. These older vessels, perhaps built before the widespread adoption of advanced deepwater technologies, are likely less versatile for today's demanding offshore projects.

These older OSVs probably come with higher upkeep expenses and might not be chartered out as frequently or at the same lucrative rates as their more modern counterparts. For instance, a vessel built in the early 2000s might struggle to compete with a 2020s-era vessel designed for ultra-deepwater drilling or complex subsea construction.

Considering the sale or even scrapping of these less efficient assets could be a strategic move. It would not only reduce the ongoing costs associated with maintaining them but also unlock capital that could be reinvested into upgrading the fleet or pursuing more profitable ventures. This aligns with a strategy to streamline operations and focus on higher-margin opportunities.

Vessels with limited regional flexibility, often tied to specific niche markets within the energy sector, can be viewed as question marks or potential dogs in the BCG matrix. If the demand in their designated sub-region declines, these assets face significant challenges in finding alternative employment. For instance, a specialized vessel designed for a particular type of offshore construction that is no longer active in a certain geographic area might struggle to secure work elsewhere.

Hornbeck Offshore Services, like many in the offshore support vessel industry, has to manage its fleet's adaptability. Vessels that are highly specialized or geographically restricted can become problematic if their primary market shrinks. In 2024, the offshore energy market continues to see shifts, with some regions experiencing increased activity while others face reduced investment, making fleet flexibility a critical factor for profitability.

Hornbeck Offshore Services (HOS) may have vessels from past cycles that are currently underutilized. During market downturns, like those experienced in some offshore sectors, older or less efficient vessels can become idle. For instance, as of early 2024, the offshore vessel market has seen periods of oversupply, potentially impacting utilization rates for certain vessel classes.

Non-Core or Divested Business Segments

Historically, Hornbeck Offshore Services (HOS) divested its tug and tank barge segment. This segment, characterized by its lower growth and market share compared to their core deepwater operations, represented a classic 'Dog' in the BCG matrix. The sale of these assets in prior years allowed HOS to concentrate resources on higher-potential areas.

While HOS no longer actively operates in the tug and tank barge market, any residual non-strategic assets or minor services that do not align with their deepwater and specialized vessel focus could be considered potential 'Dogs'. These would be segments where the company has a negligible market position and limited future growth opportunities, making them candidates for further divestment to streamline operations and enhance overall profitability.

- Divested Tug and Tank Barge Segment: Formerly a part of HOS, this business line was sold off, signifying its 'Dog' status due to lower growth and market share relative to core operations.

- Potential Future Divestments: Any remaining minor, non-strategic assets or services that don't fit the company's deepwater and specialized vessel strategy could be considered for divestment.

- Characteristics of 'Dogs': These segments typically exhibit low market share and minimal growth prospects, making them inefficient uses of capital and management attention.

Vessels Requiring Significant Unjustified Upgrades

Vessels requiring significant unjustified upgrades, under the Hornbeck Offshore Services BCG Matrix, represent assets where the cost of modernization to meet current high-spec demands far exceeds the projected return on investment. These are ships that would need substantial, expensive overhauls but are unlikely to generate sufficient future earnings to justify the expenditure. For instance, older platform supply vessels (PSVs) or offshore supply vessels (OSVs) that lack advanced dynamic positioning systems or environmentally friendly propulsion might fall into this category if the upgrade costs are prohibitive.

The financial viability of such vessels is questionable. Bringing them up to competitive standards could involve millions of dollars in retrofitting. If the market demand for their specific capabilities, even after upgrades, is weak or if newer, more efficient vessels dominate, the investment simply wouldn't pay off. Hornbeck Offshore Services, like other operators, must continually assess fleet economics. In 2023, the offshore support vessel market saw fluctuating day rates, with older tonnage often commanding lower prices, making significant capital outlays on such assets a risky proposition.

- High Upgrade Costs: Significant capital expenditure needed to meet modern operational and environmental standards.

- Low Potential ROI: Projected future earnings are insufficient to cover upgrade costs and provide a profitable return.

- Market Obsolescence: Vessels may be outdated in terms of technology or capability compared to newer fleet additions.

- Financial Unviability: The cost-benefit analysis indicates that extensive refurbishment is not a sound financial decision.

Hornbeck Offshore Services' "Dogs" in the BCG matrix typically represent older, less efficient vessels or divested segments with low market share and limited growth prospects. These assets often require substantial, uneconomical upgrades or operate in niche markets with declining demand. For instance, the company's historical divestment of its tug and tank barge segment exemplifies a classic "Dog" due to its lower growth profile compared to core deepwater operations. As of early 2024, the offshore market's oversupply can exacerbate the challenges for such vessels, impacting their utilization and profitability.

| BCG Category | Hornbeck Offshore Services Example | Characteristics | 2024 Market Context |

|---|---|---|---|

| Dogs | Divested Tug and Tank Barge Segment; Older, inefficient OSVs | Low market share, low growth, high maintenance costs, limited versatility | Potential oversupply impacting utilization; fluctuating day rates for older tonnage |

Question Marks

Expanding into new international regions for Hornbeck Offshore Services, particularly in areas where their current market share is minimal, would likely place them in the 'Question Marks' category of the BCG matrix. This strategy involves high investment for potentially high rewards but carries significant risk due to the need for substantial upfront capital in logistics and establishing local alliances.

For instance, entering a nascent offshore market in Southeast Asia in 2024 would demand considerable expenditure on port facilities, specialized vessel crewing, and navigating complex regulatory environments. The success of such a move depends heavily on Hornbeck's capacity to quickly build brand recognition and secure substantial, long-term contracts in these unfamiliar and competitive landscapes, mirroring the challenges faced by companies entering emerging markets.

Hornbeck Offshore Services might consider early-stage investments in vessels and services for emerging energy sectors beyond offshore wind, such as carbon capture and storage (CCS) or offshore hydrogen transport. These markets, while high-growth potential, currently exhibit low demand for specialized marine support, placing Hornbeck in a position of low initial market share.

Significant capital investment would be necessary to establish a strong presence and capitalize on future expansion as these technologies mature. For instance, the global CCS market is projected to grow substantially, with estimates suggesting a value of over $10 billion by 2030, indicating a significant future opportunity for specialized maritime services.

Investing in autonomous or advanced hybrid/electric vessel technology for Hornbeck Offshore Services would position them in a high-growth maritime sector. While this area promises significant future returns, Hornbeck's current market share in these cutting-edge technologies is notably low, placing it in the question mark category of the BCG matrix.

The development and deployment of such vessels demand substantial upfront research and development (R&D) investment with extended timelines and uncertain commercial success. For instance, the global maritime industry is projected to see significant growth in green shipping technologies, with investments in alternative fuels and electric propulsion expected to reach tens of billions by 2030, according to various industry reports from 2024.

However, the potential rewards, if these initiatives prove successful, could be substantial, offering a competitive edge and opening new market opportunities for Hornbeck. The company’s strategic decision regarding these investments will heavily influence its future market position and profitability in an evolving industry landscape.

New Niche Subsea Services (e.g., advanced robotics)

New niche subsea services, such as those utilizing advanced robotics, represent potential question marks for Hornbeck Offshore Services within a BCG Matrix framework. These ventures are characterized by high growth potential due to technological advancements, but Hornbeck currently lacks a dominant market position. For example, the global subsea robotics market was valued at approximately $4.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 10% through 2030, indicating a strong demand for such specialized services.

To capture significant market share in these nascent areas, Hornbeck would need substantial investment in cutting-edge robotic equipment and highly skilled personnel. This strategic move could position the company to capitalize on emerging opportunities in complex subsea interventions and maintenance. The increasing complexity of offshore projects, including deepwater exploration and renewable energy infrastructure, fuels this demand.

- High Growth Potential: The subsea robotics market is expanding rapidly, driven by demand for efficiency and safety in offshore operations.

- Investment Required: Significant capital outlay for specialized robotics and trained technicians is necessary to enter and compete effectively.

- Market Uncertainty: Hornbeck's current lack of a dominant position means these new ventures carry inherent risks and require careful market penetration strategies.

- Strategic Importance: Success in these niches could diversify Hornbeck's service offerings and provide a competitive edge in future offshore developments.

Diversification into Non-Energy Maritime Markets

Diversifying into non-energy maritime markets presents a strategic opportunity for Hornbeck Offshore Services, moving beyond its established military support operations. This expansion could target areas like specialized cargo transport or support for scientific research vessels, sectors with potential for high growth. However, Hornbeck would likely enter these new markets with a low initial market share, necessitating substantial adaptation of its existing fleet and the development of new expertise.

Success in these diversified ventures hinges on Hornbeck's ability to pinpoint lucrative niches and effectively compete against established companies already operating in those sectors. For instance, the global specialized cargo market is projected to grow, with segments like project cargo and heavy-lift transport showing strong demand. By 2024, the maritime logistics market was valued at over $2.5 trillion, indicating the scale of opportunity, though Hornbeck would need to carve out its specific segment.

- Market Entry Challenges: Hornbeck would face initial low market share in new non-energy maritime sectors.

- Fleet Adaptation: Significant investment and modification of existing vessels or acquisition of new ones would be required.

- Expertise Development: Building specialized knowledge for cargo handling or scientific support operations is crucial.

- Competitive Landscape: Competing against established players in specialized cargo or research vessel support demands a clear value proposition.

Question Marks for Hornbeck Offshore Services represent ventures with high growth potential but currently low market share, demanding significant investment. These include expanding into new international regions, investing in emerging energy sectors like CCS, and developing advanced vessel technologies. Success hinges on strategic capital allocation and effective market penetration.

| Venture Area | Market Growth Potential | Current Market Share | Investment Need | Risk Level |

|---|---|---|---|---|

| New International Regions | High | Low | High | High |

| Emerging Energy Sectors (CCS, Hydrogen) | Very High | Very Low | Very High | Very High |

| Advanced Vessel Tech (Autonomous, Hybrid) | High | Low | High | High |

| Niche Subsea Services (Robotics) | High (10%+ CAGR projected) | Low | High | High |

| Non-Energy Maritime Markets | Moderate to High | Low | Moderate to High | Moderate to High |

BCG Matrix Data Sources

Our Hornbeck Offshore BCG Matrix leverages financial disclosures, industry growth rates, and operational performance data to accurately assess market position and potential.