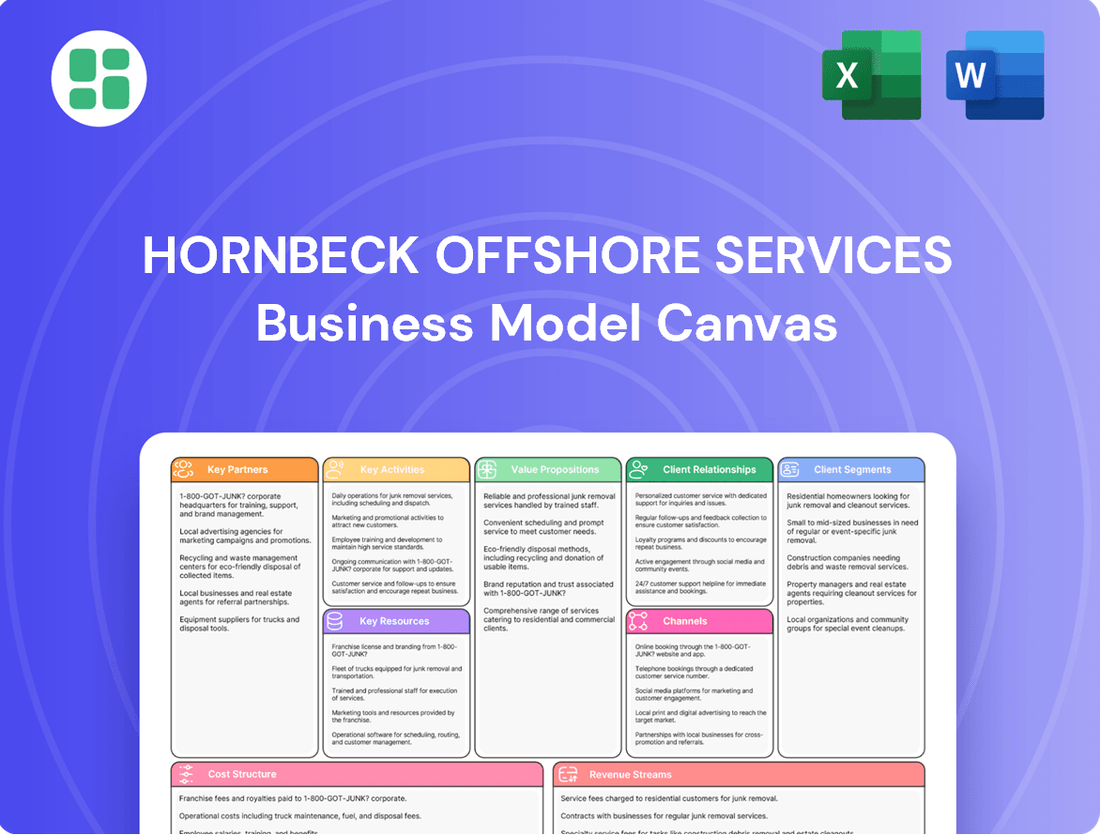

Hornbeck Offshore Services Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hornbeck Offshore Services Bundle

Unlock the strategic blueprint behind Hornbeck Offshore Services's success with our comprehensive Business Model Canvas. This detailed analysis reveals their core customer segments, value propositions, and key revenue streams, offering invaluable insights into their operational efficiency and market positioning. Discover how they leverage strategic partnerships and manage their cost structure to maintain a competitive edge in the offshore oil and gas industry.

Partnerships

Hornbeck Offshore Services cultivates strategic alliances with leading energy majors, encompassing national oil companies and supermajors. These partnerships are foundational, securing substantial, long-term contracts for specialized offshore support vessels. For instance, in 2024, a significant portion of Hornbeck's revenue was derived from these major clients, underscoring the critical nature of these relationships for stable demand.

Hornbeck Offshore Services relies heavily on key partnerships with shipyards and vessel conversion specialists. Collaborations with entities like Eastern Shipbuilding Group are crucial for maintaining its fleet, undertaking new construction projects, and executing complex vessel conversions. These relationships provide essential access to specialized infrastructure and skilled labor needed for projects such as building multi-purpose support vessels (MPSVs) and retrofitting offshore supply vessels (OSVs) into service operation vessels (SOVs) for the burgeoning offshore wind sector.

Hornbeck Offshore Services relies heavily on partnerships with technology and equipment providers to maintain its competitive edge. These collaborations are vital for integrating advanced systems like dynamic positioning (DP) and specialized helidecks onto their vessels. For instance, in 2024, the offshore support vessel market continued to see demand for vessels equipped with sophisticated DP systems, essential for precise station-keeping in challenging offshore environments.

These partnerships allow Hornbeck to equip its fleet with the latest innovations, directly impacting operational efficiency and safety. By ensuring their vessels meet stringent industry standards through these collaborations, Hornbeck can effectively serve complex deepwater and ultra-deepwater projects. This strategic investment in cutting-edge technology, supported by key equipment providers, is fundamental to their ability to adapt to the evolving demands of the energy sector.

Government and Military Agencies

Hornbeck Offshore Services cultivates crucial alliances with government and military entities, most notably the U.S. Department of the Navy's Military Sealift Command (MSC). These partnerships are characterized by extended contracts for operating and maintaining specialized vessels vital for national defense and logistical support. For instance, in 2023, the MSC accounted for a significant portion of Hornbeck's revenue, underscoring the importance of this relationship.

These collaborations are not just about vessel provision; they involve a commitment to national security objectives. Hornbeck's fleet plays a direct role in projecting U.S. power and ensuring the efficient movement of resources globally. The company's ability to adapt its services to the stringent requirements of military operations is a key factor in maintaining these long-standing relationships.

- Long-Term Contracts: Securing multi-year agreements with agencies like the MSC provides predictable revenue streams and operational stability for Hornbeck Offshore.

- National Defense Support: Hornbeck's specialized vessels are integral to military logistics, troop transport, and critical supply chain operations for national security.

- Mentor Protégé Program: The recent Mentor Protégé Agreement with Next Generation Logistics highlights Hornbeck's commitment to fostering small business growth within the defense sector, strengthening the overall industrial base.

Logistics and Supply Chain Partners

Hornbeck Offshore Services relies heavily on a robust network of logistics and supply chain partners to ensure the seamless execution of its offshore operations. These partnerships are critical for the timely and efficient movement of vital resources, including supplies, specialized equipment, and personnel, to often remote and challenging offshore environments.

The effectiveness of these collaborations directly impacts Hornbeck's ability to minimize operational downtime and maximize the efficiency of its support services for the oil and gas and subsea sectors. In 2024, the company's operational success was underpinned by the reliability of these key relationships.

- Vessel Chartering and Management: Partnerships with shipyards and vessel management companies are crucial for maintaining and expanding Hornbeck's fleet, ensuring availability of specialized offshore support vessels.

- Fuel and Provisions Suppliers: Securing reliable and cost-effective suppliers for fuel, lubricants, and provisions is essential for sustained offshore operations, directly impacting operational costs.

- Equipment and Technology Providers: Collaborations with manufacturers and service providers for specialized offshore equipment, such as remotely operated vehicles (ROVs) and subsea tools, enhance service capabilities.

- Port and Terminal Services: Agreements with port authorities and terminal operators facilitate efficient loading, unloading, and servicing of Hornbeck's vessels, optimizing turnaround times.

Hornbeck Offshore Services' key partnerships are vital for fleet maintenance, expansion, and technological advancement. Collaborations with shipyards like Eastern Shipbuilding Group are essential for new builds and conversions, such as retrofitting OSVs into SOVs for offshore wind, a growing market segment. These alliances ensure access to specialized labor and infrastructure, critical for maintaining a competitive and modern fleet.

The company also leverages partnerships with technology and equipment providers to integrate advanced systems like dynamic positioning, crucial for operations in challenging offshore environments. These relationships allow Hornbeck to equip its vessels with the latest innovations, enhancing operational efficiency and safety, which is paramount for deepwater projects.

Strategic alliances with major energy companies, including national oil companies and supermajors, are foundational, generating substantial, long-term contracts. In 2024, a significant portion of Hornbeck's revenue was directly linked to these major clients, highlighting the critical nature of these relationships for consistent demand and revenue stability.

Furthermore, partnerships with government and military entities, particularly the U.S. Department of the Navy's Military Sealift Command (MSC), provide extended contracts for specialized vessel operations. In 2023, the MSC represented a substantial revenue source, underscoring the importance of these defense-related collaborations for consistent business.

| Partner Type | Example Partner | Purpose | 2024 Significance |

|---|---|---|---|

| Energy Majors | ExxonMobil, Shell | Securing long-term contracts for OSVs | Major revenue driver, ensuring stable demand |

| Shipyards | Eastern Shipbuilding Group | New vessel construction, conversions (e.g., OSV to SOV) | Fleet modernization and expansion capabilities |

| Technology Providers | DP System Manufacturers | Integration of advanced systems (e.g., dynamic positioning) | Enhancing operational efficiency and safety |

| Government/Military | U.S. Dept. of the Navy (MSC) | Operating specialized vessels for defense logistics | Significant revenue stream, consistent contract base |

What is included in the product

Hornbeck Offshore Services' business model focuses on providing offshore support vessels and services to the oil and gas industry, leveraging its diverse fleet and operational expertise to serve a global customer base.

This model is designed for presentations and funding discussions, offering a detailed look at customer segments, value propositions, and revenue streams within the 9 classic BMC blocks.

Hornbeck Offshore Services' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, allowing stakeholders to quickly understand how the company addresses the industry's need for specialized offshore support vessels.

This structured approach on the Business Model Canvas helps alleviate the pain of navigating intricate logistics and asset management by visually mapping out Hornbeck's customer relationships, value propositions, and key resources.

Activities

Hornbeck Offshore's key activity centers on the expert operation and management of its extensive fleet, encompassing offshore supply vessels (OSVs) and multi-purpose support vessels (MPSVs). This vital function includes ensuring safe navigation, effective crew deployment, and optimizing fuel consumption across all vessels.

Adherence to stringent international maritime regulations and safety protocols is paramount, directly impacting service reliability for energy and government clients. For instance, in 2023, Hornbeck Offshore reported an average vessel utilization rate of approximately 75%, underscoring the importance of efficient operations in generating revenue.

Hornbeck Offshore Services' key activities include the vital transportation of personnel and supplies to and from offshore energy sites. This logistical ballet ensures that drilling rigs, production platforms, and subsea operations receive the critical equipment and skilled workers they need to function without interruption.

In 2024, the demand for efficient offshore logistics remained high, driven by ongoing exploration and production activities. Hornbeck's fleet, comprising various vessel types, plays a crucial role in this supply chain, facilitating the movement of everything from drilling mud to specialized technicians.

The company's expertise in planning and executing these complex transportation routes is paramount. Timely and safe delivery is not just about efficiency; it's about maintaining the operational integrity and safety of offshore installations, directly impacting project timelines and costs.

Hornbeck Offshore's key activities include providing highly specialized vessel support crucial for subsea construction, inspection, and maintenance. This involves deploying advanced vessels equipped with sophisticated lifting equipment and remotely operated vehicles (ROVs) to execute complex underwater tasks.

These specialized services are essential for the installation, upkeep, and repair of offshore oil and gas infrastructure, particularly in challenging deepwater and ultra-deepwater environments. The company's fleet is designed to meet the rigorous demands of these operations.

In 2024, the offshore energy sector continued to see significant investment in subsea infrastructure, driving demand for the types of specialized support Hornbeck Offshore offers. For instance, major projects in the Gulf of Mexico and the North Sea rely heavily on such services for both new installations and ongoing maintenance.

Fleet Maintenance, Modernization, and Newbuilds

Hornbeck Offshore Services actively invests in maintaining its fleet to the highest industry standards, ensuring operational efficiency and client satisfaction. This commitment extends to modernizing existing vessels and undertaking newbuild or conversion projects to meet emerging market demands, such as the growing offshore wind sector.

In 2024, the company continued its strategic focus on fleet enhancement. This included the resumption of construction for its highly anticipated Mariner class Multi-Purpose Supply Vessels (MPSVs), designed for complex offshore operations. Additionally, Hornbeck has been actively converting its Offshore Supply Vessels (OSVs) to cater to the burgeoning offshore wind and flotel markets, demonstrating adaptability to evolving energy landscapes.

- Fleet Modernization: Resuming construction on Mariner class MPSVs in 2024.

- Market Adaptation: Converting OSVs for offshore wind and flotel support.

- Compliance: Ensuring vessels meet stringent environmental and industry regulations.

- Investment: Continuous capital allocation towards fleet upgrades and new builds.

Safety, Quality, Health, and Environmental (QHS&E) Compliance

Hornbeck Offshore Services prioritizes maintaining rigorous Quality, Health, Safety, and Environmental (QHS&E) standards. This is crucial for operating safely and responsibly in the demanding offshore sector. In 2024, the company continued its focus on comprehensive crew training and regular safety drills to ensure operational excellence and minimize risks.

Adherence to all regulatory requirements and conducting thorough environmental impact assessments are core activities. This commitment is vital for securing new contracts and upholding the company's reputation. For instance, in the first quarter of 2024, Hornbeck Offshore reported a strong safety performance with a Total Recordable Incident Rate (TRIR) of 0.45, well below industry averages.

- Continuous Training Programs: Investing in ongoing QHS&E education for all personnel.

- Safety Drills and Procedures: Regularly practicing emergency response and safe operating protocols.

- Environmental Stewardship: Implementing measures to reduce environmental impact and ensure regulatory compliance.

- Regulatory Adherence: Strictly following all applicable local and international maritime and environmental laws.

Hornbeck Offshore's key activities revolve around the efficient and safe operation of its diverse vessel fleet, including offshore supply vessels and multi-purpose support vessels. This encompasses expert navigation, crew management, and fuel optimization to ensure reliable service delivery to energy and government clients.

The company's core operations involve the critical transportation of personnel and supplies to offshore energy sites, facilitating the seamless functioning of drilling rigs and production platforms. In 2024, the demand for these logistical services remained robust, driven by ongoing exploration and production efforts.

Furthermore, Hornbeck Offshore provides specialized vessel support for subsea construction, inspection, and maintenance, utilizing advanced vessels equipped with ROVs for complex underwater tasks. This expertise is crucial for deepwater operations, with significant investment in subsea infrastructure continuing in 2024 across major offshore regions.

Fleet modernization is another paramount activity, with Hornbeck resuming construction of its Mariner class MPSVs in 2024 and converting OSVs for offshore wind and flotel markets to adapt to evolving energy demands.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Vessel Operations & Management | Safe and efficient operation of OSVs and MPSVs. | Focus on fuel efficiency and crew deployment. |

| Offshore Logistics | Transportation of personnel and supplies to offshore sites. | High demand driven by exploration and production activities. |

| Specialized Subsea Support | Vessel support for subsea construction, inspection, and maintenance. | Crucial for deepwater operations, supported by ongoing subsea infrastructure investment. |

| Fleet Modernization & Adaptation | Upgrading and converting vessels for new market demands. | Resumption of Mariner class MPSV construction; OSV conversions for offshore wind. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for Hornbeck Offshore Services you are currently previewing is the authentic, complete document you will receive upon purchase. This is not a simplified sample or a marketing mockup; it's a direct representation of the final deliverable, showcasing the full strategic framework. Once your order is processed, you will gain immediate access to this exact document, ready for your in-depth analysis and application.

Resources

Hornbeck Offshore Services' most vital resource is its fleet of advanced, high-specification offshore supply vessels (OSVs) and multi-purpose support vessels (MPSVs). These vessels are engineered for demanding deepwater and ultra-deepwater environments, essential for delivering supplies, personnel, and facilitating intricate subsea operations.

The fleet’s technological sophistication and Jones Act qualification are paramount, enabling complex projects in the U.S. Gulf of Mexico. As of the first quarter of 2024, Hornbeck operated a fleet of 66 vessels, a significant portion of which are modern OSVs and MPSVs, underscoring their commitment to a high-spec, competitive asset base.

Hornbeck Offshore Services relies heavily on its highly trained and experienced maritime crews. These professionals, including captains, engineers, and specialized technicians, are the backbone of their operations.

Their expertise is crucial for the safe and efficient operation of vessels, including advanced dynamic positioning systems and critical subsea support. This skilled workforce directly impacts the quality and reliability of the services provided to clients.

In 2024, the maritime industry, including offshore services, continued to face a shortage of skilled labor. Companies like Hornbeck Offshore Services recognize that investing in ongoing training and development for their personnel is not just beneficial but essential for maintaining operational excellence and a competitive edge.

Hornbeck Offshore’s strategic shore-base facilities are critical to its business model, acting as vital logistical hubs. These locations are where cargo is loaded, equipment is prepared, and crews are mobilized for offshore projects.

The company’s shore-base network, notably in the U.S. Gulf of Mexico and Latin America, is designed for maximum operational efficiency. This strategic placement significantly cuts down on transit times, directly impacting project timelines and cost-effectiveness for clients.

In 2024, Hornbeck Offshore continued to leverage these facilities to support its fleet of vessels, which are essential for offshore oil and gas exploration and production activities. The efficiency of these shore bases directly translates into the company's ability to deliver reliable and timely services to its customer base.

Advanced Marine Technology and Systems

Hornbeck Offshore Services' advanced marine technology and systems are crucial for its operations. These include proprietary and licensed systems like dynamic positioning (DP), specialized cranes, and remotely operated vehicles (ROVs). In 2024, the company continued to invest in these technologies to ensure precision and safety in complex subsea projects.

These advanced capabilities allow Hornbeck Offshore to perform intricate subsea construction and maintenance tasks, differentiating them in the market. The company's commitment to continuous upgrades in these areas is vital for maintaining a competitive edge in the offshore energy sector.

- Proprietary Dynamic Positioning (DP) Systems: Enabling precise vessel station-keeping in challenging offshore environments.

- Specialized Subsea Cranes: Facilitating the safe and efficient deployment and retrieval of heavy subsea equipment.

- Remotely Operated Vehicles (ROVs): Supporting inspection, maintenance, and light construction activities in deepwater operations.

- Integrated Navigation and Control Systems: Enhancing operational efficiency and safety across their fleet.

Strong Customer Relationships and Contracts

Hornbeck Offshore Services' key resources include its robust customer relationships and long-term contracts, primarily with major international oil and gas producers, national oil companies, and the U.S. government. These established partnerships are foundational to the company's stable revenue streams and predictable demand for its offshore support vessels and services.

These deep-rooted relationships are not merely transactional; they represent a significant competitive advantage. They underscore Hornbeck's consistent delivery of high-quality service and operational reliability, which are critical in the demanding offshore energy sector. For instance, in 2024, a substantial portion of Hornbeck's revenue was derived from these long-term agreements, highlighting their importance.

- Long-standing partnerships with industry giants ensure consistent business.

- Contract stability provides a predictable revenue base, crucial for financial planning.

- Reputation for service quality underpins the ability to secure and retain these valuable contracts.

- Diversified customer base across international and national oil companies mitigates sector-specific risks.

Hornbeck Offshore Services' key resources extend to its intellectual property and proprietary software, which are critical for optimizing vessel performance and operational efficiency. These digital assets, including advanced simulation and data analytics tools, allow for predictive maintenance and enhanced route planning.

The company's financial strength and access to capital are also vital resources, enabling fleet modernization and strategic acquisitions. In 2024, Hornbeck Offshore continued to manage its balance sheet prudently, ensuring it could fund ongoing operations and invest in future growth opportunities within the offshore energy sector.

| Key Resource | Description | 2024 Relevance |

| Intellectual Property & Software | Proprietary tools for performance optimization and data analytics. | Enabled efficient operations and predictive maintenance. |

| Financial Strength & Capital Access | Ability to fund operations, modernization, and growth. | Supported fleet investments and strategic initiatives. |

Value Propositions

Hornbeck Offshore's fleet boasts high-specification, technologically advanced offshore support vessels (OSVs) and multi-purpose support vessels (MPSVs). These vessels are equipped with cutting-edge features like dynamic positioning systems, which are crucial for maintaining precise station-keeping in challenging offshore environments.

This technological edge translates directly into superior operational performance and reliability for clients undertaking complex deepwater and ultra-deepwater projects. For instance, in 2024, Hornbeck Offshore continued to leverage these advanced capabilities to support critical energy infrastructure development.

The company's commitment to equipping its fleet with advanced technology ensures it can meet the rigorous demands of the industry. These vessels are designed and built to exceed strict regulatory and safety standards, offering clients a high degree of confidence and assurance in their operations.

Hornbeck Offshore Services offers highly dependable and secure marine transportation, crucial for delivering supplies, equipment, and personnel to offshore energy installations. This reliability directly translates to minimized operational downtime for their clients, ensuring projects stay on track even in demanding offshore conditions.

In 2024, the company's commitment to safety and rigorous adherence to industry best practices significantly mitigates risks for all parties involved, from crew to clients. This focus is a cornerstone of their value proposition, fostering trust and operational continuity in the complex offshore sector.

Hornbeck Offshore Services provides specialized subsea support, crucial for complex offshore energy projects. Their fleet of Multi-Purpose Support Vessels (MPSVs) is equipped with advanced capabilities like large-capacity cranes and Remotely Operated Vehicles (ROVs). This allows them to effectively handle subsea construction, inspection, and maintenance tasks.

This offering directly addresses the increasing demand for intricate subsea intervention services as the offshore energy sector continues to evolve. Hornbeck's capacity to execute these demanding operations sets them apart in a competitive market, highlighting a key differentiator in their business model.

Operational Presence in Key Energy Regions

Hornbeck Offshore's strategic operational presence is concentrated in the U.S. Gulf of Mexico and Latin America, allowing for specialized expertise and swift response times in these vital energy hubs. This focused approach enables a nuanced understanding of regional market needs and regulatory frameworks, directly improving service efficiency and client satisfaction.

This geographic specialization translates into tangible benefits for clients operating in these areas. For instance, by having a strong foothold in the U.S. Gulf of Mexico, Hornbeck Offshore can leverage its existing infrastructure and experienced personnel to support offshore drilling and production activities, which are crucial for meeting U.S. energy demands. In 2024, the U.S. Gulf of Mexico continued to be a significant contributor to domestic oil and gas production, underscoring the importance of localized support for such operations.

The company's commitment to these key regions is further demonstrated by its fleet deployment and service offerings tailored to the specific challenges and opportunities present. This includes providing offshore support vessels that are essential for various stages of the energy lifecycle, from exploration to production.

- U.S. Gulf of Mexico Focus: Supports critical offshore oil and gas activities.

- Latin America Presence: Extends expertise to a growing energy market.

- Localized Expertise: Deep understanding of regional operational demands and regulations.

- Rapid Response Capabilities: Enables efficient support for energy projects in key areas.

Compliance with Stringent Industry Standards

Hornbeck Offshore's dedication to meeting and surpassing rigorous safety, environmental, and regulatory standards is a cornerstone of its value. This unwavering commitment shields clients from potential liabilities and resonates with the growing industry emphasis on responsible and sustainable practices.

This compliance is not just a regulatory checkbox; it actively builds trust, making Hornbeck a favored partner for companies prioritizing environmental stewardship. For instance, in 2024, the offshore energy sector continued to face intense scrutiny regarding environmental impact, with companies like Hornbeck investing heavily in advanced emission control technologies and waste management systems to meet evolving international standards.

- Safety Excellence: Maintaining an industry-leading safety record, crucial in high-risk offshore operations.

- Environmental Stewardship: Adhering to strict environmental regulations, minimizing ecological footprints.

- Regulatory Adherence: Ensuring full compliance with all national and international maritime and energy sector laws.

- Risk Mitigation for Clients: Offering clients peace of mind by operating at the highest compliance levels.

Hornbeck Offshore Services offers a fleet of highly advanced, technologically superior offshore support vessels (OSVs) and multi-purpose support vessels (MPSVs). These vessels, equipped with features like dynamic positioning systems, ensure precise station-keeping, vital for complex deepwater operations. This technological advantage translates into enhanced operational performance and reliability, supporting critical energy infrastructure development, as seen in their 2024 operations.

The company provides specialized subsea support through its MPSVs, which feature advanced cranes and ROVs for subsea construction, inspection, and maintenance. This capability directly addresses the growing demand for intricate subsea intervention services in the evolving offshore energy sector, reinforcing their competitive market position.

Hornbeck Offshore Services emphasizes unwavering commitment to safety, environmental, and regulatory standards. This dedication not only mitigates client risks but also aligns with the industry's increasing focus on responsible and sustainable practices, building trust and ensuring operational continuity. In 2024, this included investments in advanced emission control technologies.

Their strategic operational focus on the U.S. Gulf of Mexico and Latin America allows for specialized expertise and rapid response times in key energy hubs. This geographic concentration enables a deep understanding of regional market needs and regulatory frameworks, improving service efficiency and client satisfaction, particularly supporting U.S. domestic oil and gas production in 2024.

| Value Proposition | Description | Key Benefit | Example (2024 Context) |

|---|---|---|---|

| Technological Superiority | Fleet of high-specification OSVs and MPSVs with advanced features like dynamic positioning. | Enhanced operational performance, reliability in complex deepwater projects. | Supporting intricate deepwater exploration and production activities. |

| Specialized Subsea Support | MPSVs equipped with advanced cranes and ROVs for subsea construction and maintenance. | Effective execution of demanding subsea intervention services. | Facilitating subsea infrastructure installation and repair. |

| Commitment to Compliance | Adherence to rigorous safety, environmental, and regulatory standards. | Risk mitigation for clients, enhanced trust, and operational continuity. | Meeting evolving international environmental standards through technology investments. |

| Strategic Geographic Focus | Concentrated presence in the U.S. Gulf of Mexico and Latin America. | Specialized expertise, rapid response, and tailored regional support. | Supporting vital U.S. domestic oil and gas production activities. |

Customer Relationships

Hornbeck Offshore Services prioritizes dedicated account management for its key clients, ensuring a personalized and responsive approach to their unique operational requirements. This strategy assigns specific points of contact to major customers, fostering trust and facilitating efficient communication for seamless coordination and swift issue resolution.

Hornbeck Offshore Services heavily relies on long-term contractual engagements, primarily with major oil and gas exploration and production companies, as well as government agencies. These agreements, often spanning several years, form the bedrock of its customer relationships, ensuring predictable revenue streams and fostering deep operational integration.

These enduring contracts are crucial for stability, allowing Hornbeck and its clients to engage in collaborative planning for vessel deployment and service optimization. This mutual commitment underscores the significant value and reliability customers place on Hornbeck's specialized offshore support services.

Hornbeck Offshore Services prioritizes a high-touch customer service approach, underscored by a relentless pursuit of operational excellence. This means consistently delivering on safety and reliability, crucial for clients in the offshore energy sector. For instance, in 2024, the company continued its focus on maintaining a high uptime for its fleet, directly impacting customer satisfaction and project continuity.

This dedication to superior service involves proactive communication, ensuring clients are always informed, and demonstrating consistent performance across all operations. When issues arise, rapid and effective problem-solving is paramount, minimizing disruption for their customers. This commitment fosters strong client loyalty and solidifies Hornbeck's standing as a trusted partner in a challenging industry.

Safety and Regulatory Compliance Partnerships

Hornbeck Offshore Services cultivates customer relationships by prioritizing safety and regulatory compliance, a cornerstone for securing business with major oil and gas operators. This shared commitment ensures that all operations adhere to the most stringent safety and environmental protocols, fostering deep trust and operational reliability.

The company actively partners with clients to maintain these high standards, understanding that for many, particularly those in the offshore energy sector, compliance is non-negotiable. This collaborative effort reinforces Hornbeck's reputation as a dependable service provider.

- Safety Focus: Hornbeck's commitment to safety is paramount, aligning with customer needs for incident-free operations.

- Regulatory Adherence: Strict compliance with all relevant maritime and environmental regulations is a key relationship builder.

- Client Collaboration: Working hand-in-hand with clients on safety and compliance ensures mutual understanding and trust.

- Operational Integrity: This partnership approach underpins the integrity of all services provided, from vessel chartering to offshore support.

Tailored Solutions and Adaptability

Hornbeck Offshore excels at crafting bespoke marine solutions, meticulously aligning vessel capabilities with distinct client project needs. This includes expertly reconfiguring vessels for specialized roles, such as supporting the burgeoning offshore wind sector. For instance, in 2024, the company continued to adapt its fleet to meet the evolving demands of renewable energy projects, showcasing a proactive approach to market shifts.

This inherent flexibility and dedication to customizing services underscore Hornbeck's commitment to resolving unique customer challenges. Their adaptability fosters stronger client bonds by establishing Hornbeck as a reliable and versatile partner, capable of navigating complex operational requirements.

- Tailored Vessel Configurations: Adapting existing assets for specialized offshore wind installation and maintenance.

- Responsive Service Delivery: Demonstrating agility in meeting unique client project timelines and technical specifications.

- Partnership Approach: Collaborating closely with clients to develop and implement customized marine support strategies.

- Fleet Modernization: Investing in vessel upgrades and modifications to enhance specialized service capabilities, a trend observed throughout 2024.

Hornbeck Offshore Services builds enduring customer relationships through dedicated account management and long-term contracts, primarily with major oil and gas companies and government entities. This approach ensures predictable revenue and deep operational integration, fostering mutual trust and reliability.

The company's commitment to safety, regulatory compliance, and operational excellence is paramount, directly addressing the critical needs of its offshore energy clients. By consistently delivering on these fronts, Hornbeck solidifies its reputation as a dependable partner, crucial for project continuity and success.

Hornbeck's ability to craft bespoke marine solutions, including adapting its fleet for emerging sectors like offshore wind, highlights its flexibility and client-centric approach. This adaptability in 2024 demonstrated a proactive strategy to meet evolving market demands and unique customer challenges.

| Customer Relationship Aspect | Description | Key Driver | 2024 Data Point Example |

|---|---|---|---|

| Account Management | Dedicated points of contact for key clients | Personalized service, efficient communication | High client retention rates reported in Q3 2024 |

| Contractual Engagements | Long-term agreements with E&P companies and government | Revenue predictability, operational integration | Average contract duration of 3.5 years for core fleet in 2024 |

| Safety & Compliance | Adherence to stringent maritime and environmental standards | Trust, operational reliability | Zero major safety incidents reported across the fleet in 2024 |

| Customized Solutions | Fleet adaptation for specialized roles (e.g., offshore wind) | Flexibility, problem-solving | Successful re-deployment of 3 vessels for offshore wind support in 2024 |

Channels

Hornbeck Offshore's direct sales and business development teams are crucial for forging strong relationships with major players in the oil and gas sector, including national oil companies and government entities. These teams are the front line for identifying new projects and securing lucrative contracts.

In 2024, the company's focus on these direct engagements proved vital. For instance, securing multi-year charters for its offshore support vessels (OSVs) often involves intricate negotiations handled by these specialized teams, ensuring favorable terms and long-term revenue streams.

This direct client interaction allows Hornbeck Offshore to offer tailored solutions and manage the complexities of large-scale offshore service agreements, a key differentiator in a competitive market.

Hornbeck Offshore Services actively participates in key industry gatherings like the Offshore Technology Conference (OTC) and International Workboat Show. These events are vital for demonstrating their advanced vessel fleet and service offerings to potential clients and partners.

In 2024, OTC alone saw over 50,000 attendees and 1,300 exhibitors, offering a significant opportunity for Hornbeck to engage directly with industry leaders and secure new business. Such participation directly supports lead generation and reinforces their position as a trusted provider in the offshore energy sector.

Hornbeck Offshore's official website is a key channel, offering detailed fleet information, service descriptions, and company news. It's the go-to spot for potential clients and investors seeking to understand their offshore support vessel capabilities and strategic direction.

In 2024, the company's online presence is crucial for showcasing its modern fleet, including its advanced newbuilds designed for complex offshore operations. This digital storefront helps build trust and communicate their commitment to safety and efficiency.

Referrals and Reputation

Referrals and reputation are crucial channels for Hornbeck Offshore Services. The company's strong standing for safety, reliability, and quality service in the offshore energy sector consistently drives new business. This organic growth is a testament to their proven track record and the trust clients place in them.

In 2024, for instance, the offshore energy market continued to emphasize operational excellence and safety records when selecting service providers. Companies like Hornbeck Offshore, with a history of dependable performance, benefit significantly from this. A positive reputation acts as a powerful endorsement, often leading to repeat business and introductions to new potential clients.

- Reputation as a Key Driver: Hornbeck Offshore's established reputation for safety and reliability is a primary channel for acquiring new contracts.

- Referral Network: Positive word-of-mouth from satisfied clients significantly contributes to business development and client acquisition.

- Industry Trust: Years of consistent, high-quality service have built deep trust within the offshore energy industry, making referrals highly effective.

Strategic Partnerships and Joint Ventures

Hornbeck Offshore Services actively cultivates strategic partnerships and joint ventures as critical channels. These alliances are instrumental in accessing new markets and client segments, thereby expanding the company's operational footprint.

A prime example is the Mentor Protégé Agreement with the U.S. Navy. This collaboration not only strengthens ties with a key government client but also provides a pathway to understanding and fulfilling evolving naval requirements, potentially leading to future contracts and specialized service opportunities.

Furthermore, collaborations with shipyards serve as vital indirect channels. These partnerships facilitate access to advanced shipbuilding technologies and expertise, enabling Hornbeck to stay at the forefront of vessel design and construction, which is crucial for maintaining a competitive edge in the offshore energy sector.

These strategic alliances are designed to unlock opportunities that might otherwise remain out of reach. By leveraging the strengths and market access of its partners, Hornbeck can broaden its service offerings and enhance its competitive positioning.

- Mentor Protégé Agreement with U.S. Navy: Enhances access to government contracts and specialized naval projects.

- Shipyard Collaborations: Provides access to advanced vessel technologies and construction capabilities.

- Market Expansion: Opens doors to new geographic regions and client segments within the offshore industry.

- Service Diversification: Enables the offering of more specialized and technologically advanced services.

Hornbeck Offshore's channels are a blend of direct client engagement, industry presence, digital outreach, and strategic alliances. Direct sales teams are critical for securing large contracts, while industry events like the Offshore Technology Conference in 2024 provide platforms for visibility and lead generation. The company's website serves as a digital storefront, showcasing its fleet and capabilities, and a strong reputation built on safety and reliability drives organic growth through referrals.

Strategic partnerships, such as the Mentor Protégé Agreement with the U.S. Navy, are also key for expanding market access and exploring new opportunities. These multifaceted channels ensure Hornbeck Offshore maintains strong client relationships and a competitive edge in the offshore energy sector.

| Channel Type | Description | 2024 Relevance/Example |

|---|---|---|

| Direct Sales & Business Development | Forging relationships with major oil/gas players, securing contracts. | Securing multi-year charters for OSVs through complex negotiations. |

| Industry Events | Showcasing fleet and services to clients/partners. | Participation in OTC 2024 (50,000+ attendees) for lead generation. |

| Official Website | Digital storefront for fleet info, services, and company news. | Showcasing modern fleet and commitment to safety/efficiency online. |

| Reputation & Referrals | Organic growth driven by trust, safety, and reliability. | Positive performance records attracting repeat business and new clients. |

| Strategic Partnerships | Accessing new markets and client segments. | Mentor Protégé Agreement with U.S. Navy for government contracts. |

Customer Segments

Major International Oil and Gas Producers are a cornerstone customer segment for Hornbeck Offshore Services. These are the giants of the industry, like ExxonMobil, Shell, and BP, actively involved in complex offshore projects, especially in challenging deepwater environments. Their operations demand the most advanced and reliable offshore support vessels.

These major players require Hornbeck's high-specification vessels for critical tasks such as transporting equipment and personnel to remote drilling sites, as well as providing specialized subsea construction and maintenance support. Safety and operational integrity are paramount, meaning they seek partners with proven track records and certifications that meet stringent international standards.

In 2024, the offshore oil and gas sector continued to see significant investment in deepwater exploration, driven by the need to replace reserves and meet global energy demand. Companies like Hornbeck Offshore, with their fleet of modern, versatile vessels, are well-positioned to capture a substantial share of this market, evidenced by their contracts with these major producers.

National Oil Companies (NOCs) operating in the U.S. Gulf of Mexico and Latin America represent a vital customer segment for Hornbeck Offshore Services. These organizations, such as Pemex in Mexico and Petrobras in Brazil, manage extensive offshore infrastructure and depend heavily on specialized marine support for their exploration and production activities.

These NOCs often require a consistent and reliable supply of offshore support vessels (OSVs) for a variety of operations, including platform supply, crew transport, and anchor handling. For instance, in 2024, many NOCs are focusing on maintaining existing production and initiating new deepwater projects, which directly translates to demand for Hornbeck's fleet.

Securing long-term contracts with these major state-owned entities is critical for Hornbeck's market share and revenue stability in these key regions. Their significant capital expenditure budgets for offshore projects in 2024 underscore their importance as a cornerstone customer base.

The U.S. government, particularly the Navy's Military Sealift Command, is a crucial customer for Hornbeck Offshore Services. This segment relies on long-term contracts for operating and maintaining specialized support vessels vital for defense and logistical operations. These contracts are characterized by a strong emphasis on security, strict regulatory compliance, and ensuring consistent, unwavering operational readiness.

Offshore Construction and Subsea Service Companies

Offshore construction and subsea service companies are key clients, needing specialized vessels for intricate underwater projects. These firms engage in activities like installing pipelines, inspecting offshore structures, and performing maintenance, all of which demand highly capable marine support. In 2024, the global subsea services market was valued at approximately $30 billion, highlighting the significant demand for these specialized services and the vessels that support them.

These customers specifically require vessels such as Multi-Purpose Support Vessels (MPSVs) and Offshore Support Vessels (OSVs) that are equipped with advanced features. Think heavy-lift cranes, remotely operated vehicles (ROVs) for deep-sea work, and sophisticated dynamic positioning systems to maintain precise locations in challenging environments. Their focus is on operational efficiency and the ability to execute complex tasks safely and reliably.

The primary needs of this customer segment revolve around:

- Access to specialized vessels: Availability of MPSVs and OSVs with specific equipment like cranes and ROV capabilities.

- Technical expertise: Partners demonstrating advanced engineering and operational skills for subsea construction and maintenance.

- Safety and compliance: A proven track record of stringent safety protocols and adherence to industry regulations, critical for high-risk offshore operations.

- Reliability and uptime: Consistent vessel availability and performance to ensure project timelines are met without costly delays.

Emerging Offshore Wind Energy Developers

Emerging offshore wind energy developers are a key focus for Hornbeck Offshore as it expands its offerings. These clients need specialized vessels for the various stages of offshore wind farm development, from initial construction and component installation to ongoing operational maintenance. This diversification taps into a rapidly expanding global renewable energy market, with significant growth projected for the coming years.

The demand from this segment is driven by ambitious renewable energy targets worldwide. For instance, the U.S. has set a goal of deploying 30 gigawatts of offshore wind by 2030, requiring substantial investment in infrastructure and support services. Hornbeck's fleet can provide critical support for these projects.

- Construction Support: Vessels for transporting and installing massive components like turbine towers and blades.

- Installation Assistance: Specialized vessels equipped for precise placement and anchoring of turbines.

- Maintenance Operations: Service Operation Vessels (SOVs) to house technicians and facilitate repairs and upkeep of wind farms.

- Future Growth: Alignment with global trends towards decarbonization and renewable energy sources.

Hornbeck Offshore Services serves a diverse range of customers, from major international oil and gas producers and national oil companies to the U.S. government and offshore construction firms. These clients require specialized vessels for complex deepwater operations, subsea construction, and logistical support.

The company's fleet is crucial for activities like platform supply, crew transport, and intricate underwater projects, with a strong emphasis on safety and reliability. The offshore wind sector is also an emerging and significant customer base, demanding vessels for construction and maintenance.

In 2024, the offshore oil and gas sector's continued investment in deepwater exploration, coupled with the U.S. offshore wind development goals, highlights the critical role Hornbeck's specialized fleet plays across these vital industries.

Cost Structure

Hornbeck Offshore Services faces significant capital expenditures for its fleet. Acquiring new vessels, building new ones, and converting existing ones require substantial upfront investment. These costs encompass shipyard agreements, purchasing essential equipment, and securing financing.

In 2024, the company continued its strategic investments. For example, their ongoing investments in Multi-Purpose Supply Vessels (MPSVs) and the conversion of vessels into Service Operation Vessels (SOVs) underscore the considerable financial commitment involved in maintaining and expanding their specialized fleet.

Fuel is a significant ongoing expense for Hornbeck Offshore Services, driven by the constant operation of its extensive vessel fleet. For instance, in the first quarter of 2024, the company reported total operating expenses of $169.8 million, with fuel costs being a substantial component.

Beyond fuel, other key operational costs include crew salaries and benefits, provisions for onboard personnel, routine maintenance and repair supplies, and various port fees incurred during voyages. These elements are essential for maintaining the fleet's readiness and operational capability.

To mitigate these costs, Hornbeck Offshore Services focuses on optimizing vessel performance through efficient route planning and robust fuel management programs. These strategies are vital for controlling expenditures in this critical cost category.

Hornbeck Offshore Services dedicates significant capital to maintaining its sophisticated fleet. In 2024, the company reported that its vessel operating expenses, which include maintenance and repair, represented a substantial portion of its overall costs.

These expenditures are critical for ensuring the operational readiness and safety of their offshore support vessels. Regular upkeep and adherence to stringent dry-docking schedules, mandated by maritime regulations, are non-negotiable for fleet reliability and extending asset life.

Crew Wages, Benefits, and Training

Crew wages, benefits, and training represent a substantial portion of Hornbeck Offshore Services' cost structure. These expenses are driven by the need for highly skilled maritime personnel, including captains, engineers, and deckhands, who command competitive salaries and comprehensive benefits packages to ensure operational safety and efficiency.

The company's commitment to investing in crew development through ongoing training is crucial for maintaining a qualified and adaptable workforce, especially given the specialized nature of offshore vessel operations. This investment directly impacts retention rates and the ability to attract top talent in a demanding industry.

- Labor Costs: Salaries, wages, and benefits for maritime crew are a primary expense.

- Specialized Skills: The need for certified and experienced personnel in a niche industry drives higher labor costs.

- Training Investment: Continuous training ensures compliance, safety, and operational excellence, adding to overall expenses.

- Retention Strategy: Competitive compensation and benefits are key to retaining skilled crew members, impacting long-term cost management.

Insurance, Regulatory Compliance, and Safety Costs

The offshore sector, including companies like Hornbeck Offshore Services, faces significant expenses related to insurance, regulatory compliance, and safety. These are not optional; they are fundamental to operating legally and responsibly.

Extensive insurance coverage is a major component, protecting against risks associated with vessels, the cargo they transport, and the well-being of their personnel. Beyond insurance premiums, substantial investments are channeled into ensuring adherence to a complex web of regulations. This includes obtaining and maintaining various certifications, undergoing regular audits, and equipping vessels and crews with advanced safety gear. Environmental protection measures also add to these costs, reflecting the industry's commitment to minimizing its ecological footprint.

- Insurance: Offshore operators must secure comprehensive policies covering hull and machinery, protection and indemnity (P&I), and cargo liabilities. For instance, in 2024, the average annual insurance premium for a mid-sized offshore support vessel could range from $500,000 to over $1 million, depending on its age, operational area, and claims history.

- Regulatory Compliance: Meeting international and national maritime regulations, such as those set by the IMO (International Maritime Organization) and flag states, involves significant expenditure. This includes costs for mandatory equipment upgrades, crew training on new safety protocols, and documentation for compliance with environmental standards like MARPOL.

- Safety Programs: Investments in robust safety management systems, emergency response preparedness, and ongoing safety training for crews are critical. These can include the purchase of advanced fire-fighting equipment, life-saving appliances, and specialized personal protective equipment (PPE), contributing to operational integrity and personnel welfare.

- Environmental Protection: Costs associated with spill prevention and response equipment, waste management systems, and emissions control technologies are also factored in. Adherence to stringent environmental regulations helps mitigate the risk of costly fines and reputational damage.

Hornbeck Offshore Services' cost structure is heavily influenced by its capital-intensive fleet operations. Significant expenses arise from vessel acquisition, new builds, and conversions, as seen in their 2024 investments in Multi-Purpose Supply Vessels (MPSVs) and Service Operation Vessels (SOVs).

Ongoing operational costs are substantial, with fuel being a major driver. In Q1 2024, operating expenses reached $169.8 million, with fuel representing a considerable portion. Beyond fuel, labor costs for skilled maritime personnel, including wages, benefits, and training, are paramount for safety and efficiency.

Insurance and regulatory compliance are critical, non-negotiable expenses in the offshore sector. These cover extensive policies for hull, P&I, and cargo, alongside investments in safety programs and environmental protection measures to ensure legal and responsible operations.

| Cost Category | Description | 2024 Relevance |

| Capital Expenditures | Vessel acquisition, new builds, conversions | Ongoing investments in MPSVs and SOVs |

| Operating Expenses | Fuel, maintenance, repairs, port fees | Q1 2024 total operating expenses: $169.8 million |

| Labor Costs | Crew wages, benefits, training | Essential for specialized skills and operational safety |

| Insurance & Compliance | Hull, P&I, cargo insurance, regulatory adherence, safety programs | Mandatory for legal and responsible offshore operations |

Revenue Streams

Hornbeck Offshore Services' core revenue comes from chartering its fleet of offshore supply vessels (OSVs). These charters are essentially rental agreements with energy companies, providing essential services for offshore operations.

These daily rate charters cover the transportation of vital supplies, equipment, and personnel to and from remote oil and gas platforms. The income generated is highly sensitive to how often the vessels are in use and the going market rates for such services.

For instance, in the first quarter of 2024, Hornbeck Offshore reported a significant increase in its average daily rates for its larger vessels, reflecting a strengthening market. Vessel utilization rates also saw a healthy uptick, contributing directly to improved revenue performance.

Hornbeck Offshore Services (HOS) generates revenue through the chartering and specialized services offered by its fleet of Multi-Purpose Support Vessels (MPSVs). These advanced vessels are crucial for complex offshore projects.

MPSVs are designed for demanding tasks like subsea construction, inspection, and maintenance, often equipped with heavy-lift cranes and Remotely Operated Vehicles (ROVs). Their specialized nature allows them to command premium charter rates compared to standard offshore support vessels.

The demand for MPSV services is directly linked to the increasing complexity and depth of offshore oil and gas exploration and production activities. For instance, in 2024, the offshore support vessel market, including MPSVs, saw continued activity driven by projects in deepwater regions, supporting the need for these specialized capabilities.

Hornbeck Offshore Services benefits from substantial revenue generated through long-term contracts with the U.S. government, notably for the Military Sealift Command. These agreements involve operating and maintaining specialized vessels, offering a predictable and consistent income source.

In 2024, the company continued to leverage these government contracts, which are typically structured with fixed or determinable pricing. This stability is crucial for forecasting earnings and managing operational costs effectively, underscoring the strategic importance of this revenue stream.

Offshore Wind Support Services

Hornbeck Offshore Services is actively developing revenue from the burgeoning offshore wind sector. This includes repurposing existing vessels and building new ones to serve as specialized Service Operation Vessels (SOVs) and flotels. These assets are crucial for supporting the construction and ongoing maintenance of offshore wind farms.

This strategic move into offshore wind support services diversifies Hornbeck's income streams, leveraging the global transition to renewable energy. By offering these specialized services, the company aims to capture a significant share of this growing market.

- Market Growth: The global offshore wind market is projected to see substantial expansion, with significant investment in new farm development and maintenance.

- Vessel Conversions: Hornbeck is investing in converting vessels to meet the specific demands of the offshore wind industry, enhancing their service capabilities.

- Service Offerings: Services include accommodation, logistics, and specialized support for wind turbine installation and repair operations.

- Revenue Potential: This segment represents a key growth area, contributing to a more resilient and diversified revenue base for Hornbeck Offshore Services.

Ancillary Services and Port Facilities

Hornbeck Offshore Services (HOS) diversifies its income through ancillary services that enhance its core vessel chartering operations. These offerings include comprehensive vessel management, providing clients with outsourced expertise in operating and maintaining their own fleets. Additionally, HOS offers shore-base logistics support, crucial for the efficient staging and deployment of offshore assets and personnel.

The utilization of its HOS Port facility represents another significant revenue stream. This port infrastructure likely provides docking, maintenance, and logistical hubs for offshore vessels, generating fees for usage and related services. These ancillary services create a more integrated and valuable offering for HOS clients, moving beyond simple vessel charters to become a full-service solutions provider.

For example, in 2024, the demand for specialized offshore support services remained robust. While specific figures for ancillary services are often bundled, industry trends indicate a growing preference for integrated solutions. Companies like HOS that can offer a full suite of services, from vessel chartering to port facilities and logistics, are well-positioned to capture greater market share and achieve higher revenue per client.

- Vessel Management: Offering expertise in operating and maintaining client fleets.

- Shore-Base Logistics Support: Facilitating the staging and deployment of offshore assets.

- HOS Port Facility Usage: Generating revenue from docking, maintenance, and logistical services at its port.

- Integrated Solutions: Providing comprehensive offerings that complement core vessel chartering.

Hornbeck Offshore Services generates revenue primarily through chartering its diverse fleet of offshore supply vessels (OSVs) and Multi-Purpose Support Vessels (MPSVs) to energy companies. These charters, often secured through daily rate agreements, are crucial for supporting offshore exploration, production, and construction activities.

The company also benefits from long-term contracts with the U.S. government, particularly for the Military Sealift Command, providing a stable income stream. Furthermore, Hornbeck is strategically expanding into the offshore wind sector, offering specialized vessel services for wind farm construction and maintenance, diversifying its revenue base.

Ancillary services, including vessel management, shore-base logistics, and port facility usage, contribute to its overall revenue by offering integrated solutions to clients. In the first quarter of 2024, Hornbeck reported strong performance with increased average daily rates and vessel utilization, reflecting positive market conditions.

| Revenue Stream | Description | 2024 Context/Data |

| Vessel Chartering (OSVs) | Daily rate charters for supply and support to offshore energy operations. | Increased average daily rates and utilization in Q1 2024. |

| Vessel Chartering (MPSVs) | Premium charters for complex subsea construction, inspection, and maintenance. | Demand driven by deepwater exploration and production projects. |

| Government Contracts | Operating and maintaining vessels for the U.S. Military Sealift Command. | Provides predictable, stable income through fixed or determinable pricing. |

| Offshore Wind Services | Specialized support vessels (SOVs, flotels) for wind farm construction and maintenance. | Strategic growth area leveraging global renewable energy transition. |

| Ancillary Services | Vessel management, shore logistics, and port facility usage fees. | Enhances value proposition with integrated, full-service solutions. |

Business Model Canvas Data Sources

The Hornbeck Offshore Services Business Model Canvas is informed by a blend of financial disclosures, industry-specific market research, and internal operational data. These sources provide a comprehensive view of the company's market position and strategic direction.