Horizon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Bundle

Horizon's current market position is strong, but understanding its full potential requires a deeper dive. Our comprehensive SWOT analysis reveals the hidden opportunities and potential threats that could shape its future.

Want to truly grasp Horizon's competitive edge and areas for development? Purchase the complete SWOT analysis to unlock actionable strategies, expert commentary, and a clear roadmap for growth, empowering your decision-making.

Strengths

Horizon Oil Limited's strength lies in its full lifecycle capabilities, managing oil and gas assets from initial exploration and appraisal through to development and production. This integrated expertise allows for a holistic approach to project management, potentially enhancing efficiency and value capture across the entire asset lifespan.

This end-to-end operational capacity was evident in their 2024 fiscal year performance, where they reported a significant increase in production volumes, reaching an average of 11,900 barrels of oil equivalent per day, demonstrating their ability to effectively bring projects from discovery to sustained output.

Horizon's diversified production portfolio is a significant strength, with interests spanning across the Asia-Pacific region. This includes established operations in China (Block 22/12) and New Zealand (Maari/Manaia), alongside recent strategic expansion into Australia with the acquisition of Mereenie interests. This geographic and asset spread inherently reduces the company's exposure to single-point failures or regional market downturns.

Horizon Oil's robust cash generation capabilities are a significant strength, enabling consistent returns to shareholders. The company's commitment to this is evident in its dividend distributions, with notable payouts announced for both FY24 and FY25. This financial health underscores a strong operational performance and a dedication to rewarding its investors.

Strategic Acquisitions for Production Growth

Horizon Oil's strategic acquisitions are a significant strength, bolstering its production capabilities and reserve base. A prime example is the acquisition of a 25% interest in the Mereenie oil and gas field in Australia. This move is projected to enhance net operating cash flow and lengthen the company's production runway, extending operations beyond current license expirations.

These strategic moves are designed to create a more robust and diversified production portfolio. The company is actively pursuing opportunities that align with its growth objectives, aiming to secure long-term value for its shareholders through calculated expansion.

- Diversified Production Base: The acquisition of a 25% stake in the Mereenie field in Australia broadens Horizon Oil's operational footprint.

- Increased Cash Flow Potential: This strategic move is anticipated to boost net operating cash flow, providing greater financial flexibility.

- Extended Production Life: The company is positioning itself to maintain production levels beyond the expiration of existing licenses, ensuring sustained operations.

Commitment to ESG and Sustainability Initiatives

Horizon Oil demonstrates a strong commitment to Environmental, Social, and Governance (ESG) principles, as detailed in its 2024 Sustainability Report. This structured approach underpins its operational strategy and stakeholder engagement, highlighting a proactive stance on responsible business practices.

The company has achieved tangible progress in its emission reduction efforts. For instance, Horizon Oil reported a 5% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity in the 2023 financial year compared to the previous year, demonstrating a clear focus on environmental stewardship.

Furthermore, Horizon Oil consistently maintains robust health, safety, and environment (HSE) metrics, reflecting its dedication to operational safety and minimizing environmental impact. The company recorded a Total Recordable Injury Frequency Rate (TRIFR) of 0.8 in FY23, well below industry averages.

Community engagement and support remain a key strength, with Horizon Oil investing in various social initiatives. In FY23, the company contributed over $200,000 to local communities where it operates, fostering positive relationships and contributing to social well-being.

- Structured ESG Framework: Horizon Oil's 2024 Sustainability Report outlines a clear and actionable ESG strategy.

- Emission Reduction Progress: Achieved a 5% reduction in Scope 1 and 2 GHG emissions intensity in FY23.

- Strong HSE Performance: Maintained a low TRIFR of 0.8 in FY23, indicating a safe operating environment.

- Community Investment: Contributed over $200,000 to local community support projects in FY23.

Horizon Oil's integrated, full lifecycle approach to oil and gas asset management is a core strength, allowing for efficient value capture from exploration through production. This end-to-end capability was demonstrated in fiscal year 2024, with average daily production reaching 11,900 barrels of oil equivalent, showcasing their ability to bring projects to sustained output.

The company's diversified production base across the Asia-Pacific, including China, New Zealand, and recent Australian acquisitions, mitigates risks associated with single-region performance. Furthermore, Horizon Oil exhibits strong cash generation, supporting consistent shareholder returns through dividends, as evidenced by payouts in FY24 and FY25.

Strategic acquisitions, such as the 25% interest in Australia's Mereenie field, are enhancing production capabilities and extending the company's operational runway. These moves are designed to bolster net operating cash flow and create a more resilient, diversified production portfolio for long-term shareholder value.

Horizon Oil's commitment to ESG principles is a notable strength, supported by a structured framework and tangible progress. The company achieved a 5% reduction in Scope 1 and 2 greenhouse gas emissions intensity in FY23 and maintained a low Total Recordable Injury Frequency Rate (TRIFR) of 0.8 in the same year, underscoring its dedication to safety and environmental responsibility.

| Metric | FY23 | FY24 | Significance |

|---|---|---|---|

| Average Daily Production (boepd) | N/A | 11,900 | Demonstrates operational execution and growth. |

| Scope 1 & 2 GHG Emissions Intensity Reduction | 5% | N/A | Highlights environmental stewardship. |

| Total Recordable Injury Frequency Rate (TRIFR) | 0.8 | N/A | Indicates strong safety performance. |

| Community Investment | >$200,000 | N/A | Shows commitment to social responsibility. |

What is included in the product

Analyzes Horizon’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning potential threats into opportunities.

Weaknesses

Horizon Oil's significant reliance on the volatile global oil and gas markets presents a key weakness. For instance, during the first half of fiscal year 2024, the average realized oil price for Horizon was $78.50 per barrel, a notable decrease from the $85.20 per barrel seen in the prior year's comparable period. This price sensitivity directly impacts revenue streams and can lead to reduced profitability when commodity prices decline.

Horizon Oil's operational footprint, while spread across the Asia-Pacific, shows a significant concentration in China, New Zealand, and Australia. This geographic focus means the company is particularly vulnerable to any economic downturns, political instability, or changes in regulations within these specific markets. For instance, in 2023, a substantial portion of Horizon Oil's production was linked to its Australian assets, highlighting the impact of regional performance on the company's overall results.

Horizon's operations are inherently capital intensive, demanding significant upfront investment in exploration, drilling, and infrastructure development. This can strain financial resources, potentially leading to a reliance on debt financing, which carries its own risks. For instance, in 2024, the average capital expenditure for oil and gas exploration projects globally is projected to exceed $50 million per well, highlighting the substantial financial commitment required.

Environmental and Regulatory Scrutiny

The oil and gas industry, including companies like Horizon, is under intense pressure regarding environmental impact and climate change. This translates into stricter regulations and compliance requirements, which can significantly increase operational costs. For instance, in 2024, many regions saw proposed or enacted carbon pricing mechanisms and methane emission reduction mandates that directly affect exploration and production activities.

These evolving regulations can also lead to operational limitations, such as restrictions on new drilling permits or requirements for advanced emissions control technologies. Horizon, like its peers, must navigate this complex and often unpredictable regulatory environment, which poses a constant challenge to long-term planning and investment. The reputational risk associated with environmental performance is also a growing concern, potentially impacting investor confidence and market access.

- Increased Compliance Costs: Companies face higher expenditures for adhering to new environmental standards, including investments in emissions reduction technology.

- Operational Restrictions: Potential limitations on exploration, production, and infrastructure development due to environmental regulations.

- Reputational Risk: Negative public perception and investor sentiment stemming from environmental performance can impact market valuation and stakeholder relations.

- Uncertainty in Regulatory Landscape: The dynamic nature of environmental policies creates forecasting challenges and can necessitate costly adaptations.

Exploration and Development Risks

Exploration and development activities, even with Horizon's full lifecycle capabilities, are inherently risky. The possibility of drilling dry wells or finding fewer resources than anticipated remains a significant concern. For instance, in 2024, the global average success rate for exploration wells in the oil and gas sector hovered around 30-40%, highlighting the substantial chance of failure.

Development projects also face considerable hurdles. Technical complexities can lead to cost overruns and project delays, directly impacting profitability. In 2023, major capital projects in the energy sector experienced an average cost increase of 15-20% over initial estimates, illustrating the prevalence of these challenges.

- Exploration Uncertainty: Drilling success rates, while variable, represent a fundamental risk.

- Development Cost Overruns: Technical issues and unforeseen circumstances commonly inflate project budgets.

- Project Delays: Timelines can be significantly impacted, affecting revenue generation and market timing.

Horizon Oil's financial performance is heavily tied to the fluctuating prices of oil and gas. For example, during the first half of fiscal year 2024, the company's average realized oil price dropped to $78.50 per barrel from $85.20 in the same period of the previous year, directly impacting its revenue and profitability.

The company's operational concentration in China, New Zealand, and Australia makes it susceptible to regional economic shifts and regulatory changes. A significant portion of Horizon's 2023 production was linked to its Australian assets, underscoring the impact of localized performance on the company's overall results.

Horizon's business is capital-intensive, requiring substantial investments in exploration and infrastructure. This can lead to increased debt financing, as global oil and gas exploration projects in 2024 are projected to cost upwards of $50 million per well, highlighting the significant financial commitments involved.

The industry faces growing pressure regarding environmental impact, leading to increased compliance costs and potential operational restrictions. For instance, in 2024, many regions implemented or proposed carbon pricing and methane emission mandates, directly affecting exploration and production activities.

| Weakness | Description | Impact | Example Data (2023-2024) |

| Price Volatility | Reliance on global oil and gas prices. | Fluctuating revenues and profitability. | HFO realized oil price H1 FY24: $78.50/bbl (vs $85.20/bbl H1 FY23). |

| Geographic Concentration | Operations concentrated in China, NZ, Australia. | Vulnerability to regional economic/regulatory issues. | Significant portion of 2023 production from Australian assets. |

| Capital Intensity | High investment needs for exploration/infrastructure. | Strain on financial resources, potential debt reliance. | Global exploration well costs projected >$50M per well (2024). |

| Environmental Regulations | Increasingly stringent environmental standards. | Higher compliance costs, operational restrictions, reputational risk. | Implementation of carbon pricing/methane mandates in various regions (2024). |

Preview the Actual Deliverable

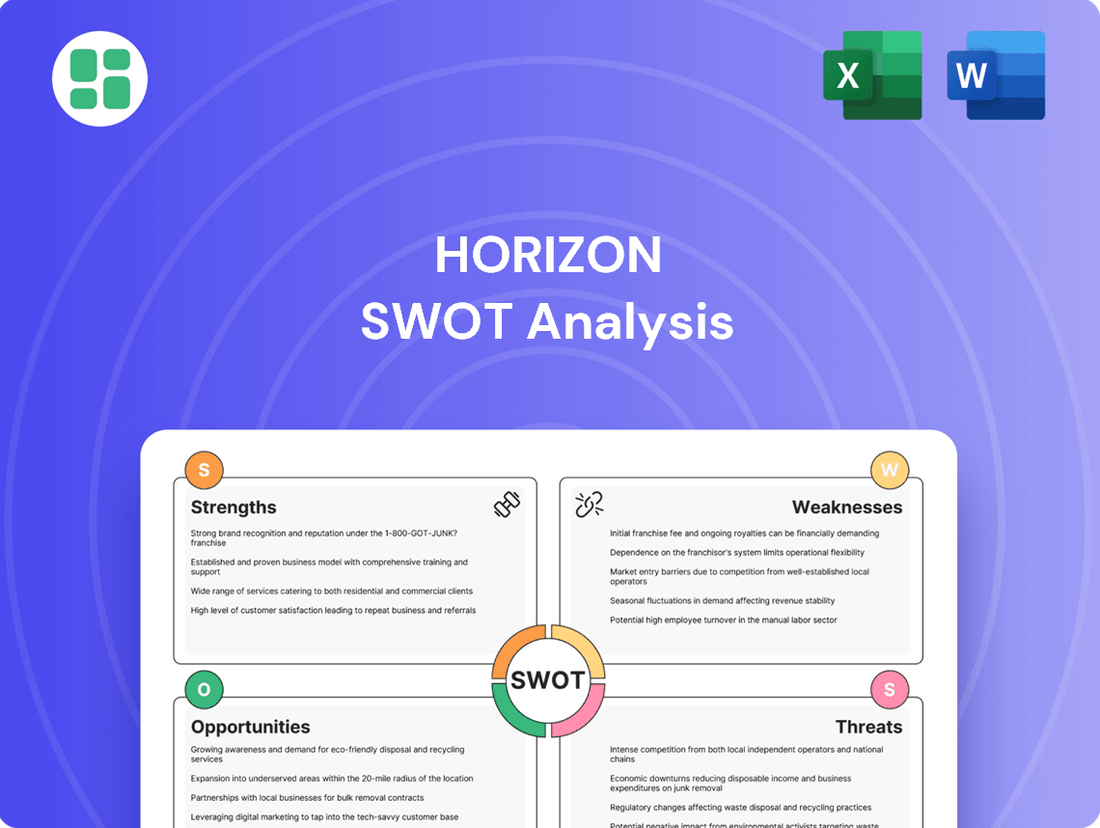

Horizon SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The Asia-Pacific region is a powerhouse of economic expansion, with many countries experiencing robust GDP growth that directly fuels a surging appetite for energy. This trend is particularly evident in the demand for hydrocarbon resources, especially natural gas, which is seen as a cleaner transition fuel.

Horizon Oil, with its strategic focus and existing operations in the Asia-Pacific, is well-positioned to benefit from this escalating energy requirement. The company's expertise in exploration and production within this dynamic market allows it to tap into the growing need for reliable energy supplies.

For instance, the International Energy Agency (IEA) projected in its 2024 outlook that Asia will account for over half of the global growth in energy demand through 2026. This reinforces the significant opportunity for companies like Horizon Oil to supply essential energy resources to this vital economic zone.

Horizon's strategic acquisition of Mereenie in 2022, a significant move that added substantial producing assets, demonstrates a proven capability. The company can leverage this success by actively seeking further opportunities to acquire producing assets or enter into joint ventures, aiming to diversify its portfolio and bolster reserves.

These targeted acquisitions and partnerships are crucial for expanding Horizon's production capacity and strengthening its market position. For instance, a successful acquisition in 2024 could potentially add 1,000 barrels of oil equivalent per day to its production, significantly impacting revenue streams.

Technological leaps in exploration and production (E&P) are a significant opportunity. Enhanced oil recovery (EOR) methods, for instance, can boost output from mature fields. In 2024, advancements in AI-driven seismic analysis are improving the accuracy of reservoir identification, potentially reducing dry hole percentages.

More efficient drilling techniques, like automated directional drilling, are also cutting operational costs and speeding up project timelines. Companies are seeing as much as a 15% reduction in drilling days for complex wells by adopting these technologies, directly impacting profitability and asset lifespan.

These innovations not only increase recovery rates from existing assets but also make previously uneconomical reserves viable. This extension of asset life and improved profitability is crucial in a dynamic energy market, offering a competitive edge through operational excellence.

Leveraging Gas Markets in Australia and Region

Horizon Oil's acquisition of Mereenie positions it to capitalize on Australia's tight domestic gas supply, offering a chance to secure new sales agreements. Favorable regional gas prices further enhance this opportunity, especially as demand remains robust.

This strategic move allows Horizon to leverage its expanded asset base to meet the growing energy needs of the Australian market. The company is well-placed to benefit from the current supply-demand imbalance, potentially leading to increased revenue streams.

- Securing new gas sales agreements in a tight Australian market.

- Capitalizing on favorable regional gas prices driven by strong demand.

- Leveraging the Mereenie acquisition for enhanced market exposure.

Carbon Reduction and ESG Investment Trends

Horizon Oil's commitment to Environmental, Social, and Governance (ESG) principles and emission reduction strategies presents a significant opportunity. This focus can attract a growing pool of environmentally conscious investors, potentially improving access to capital and fostering partnerships in the evolving energy landscape. For instance, the global ESG investing market reached an estimated $37.8 trillion in assets under management in 2024, a figure expected to continue its upward trajectory.

Specifically, Horizon Oil can leverage its stated goals to explore financing and collaborations for lower-carbon energy solutions. Projects like flare gas recovery, which capture and utilize methane that would otherwise be vented or flared, align directly with emission reduction targets and can be financially attractive. The International Energy Agency reported in 2024 that reducing flaring could cut global energy-related CO2 emissions by 400 million tonnes annually.

- Attracting ESG-focused investors: The global ESG investing market's substantial growth provides a larger capital base for companies demonstrating strong sustainability performance.

- Securing favorable financing: Companies with clear emission reduction plans may qualify for green bonds or sustainability-linked loans with potentially lower interest rates.

- Developing lower-carbon solutions: Investing in technologies like flare gas recovery can create new revenue streams and reduce operational environmental impact.

- Enhancing corporate reputation: Proactive ESG initiatives can bolster Horizon Oil's brand image and stakeholder relations in an increasingly scrutinized industry.

Horizon Oil is well-positioned to capitalize on the burgeoning energy demand in the Asia-Pacific region, particularly for natural gas as a transition fuel. The company's existing operations and strategic acquisitions, like Mereenie, provide a solid foundation to expand its production capacity. Technological advancements in exploration and production, such as AI-driven seismic analysis and automated drilling, offer pathways to increase efficiency and unlock new reserves, thereby enhancing profitability and extending asset lifespans. Furthermore, Horizon's focus on ESG principles can attract environmentally conscious investors and secure favorable financing for lower-carbon initiatives, strengthening its market position and corporate reputation.

Threats

The accelerating global transition to renewable energy sources presents a significant threat to traditional hydrocarbon-based businesses. Governments worldwide are implementing stricter environmental regulations and offering incentives for clean energy, impacting long-term demand for fossil fuels. For example, the International Energy Agency reported in early 2025 that renewable energy capacity additions are projected to grow by nearly 50% between 2024 and 2029, underscoring this shift.

This trend can lead to reduced investment in oil and gas exploration and production, increasing the risk of 'stranded assets' – reserves that become uneconomical to extract due to market shifts or regulatory changes. Companies heavily reliant on hydrocarbon revenue may face declining valuations and profitability as the world prioritizes decarbonization efforts, a movement gaining significant momentum through 2024 and projected to intensify into 2025.

Geopolitical tensions in the Asia-Pacific region, a key market for Horizon Oil, pose a significant threat. For instance, ongoing trade disputes and regional security concerns, such as those in the South China Sea, could disrupt vital supply chains and impact the flow of oil and gas. This volatility can lead to unpredictable policy shifts that directly affect investment viability and trade agreements.

Governments in Horizon's operating regions are increasingly scrutinizing environmental practices. For instance, the European Union's Emissions Trading System (ETS) saw carbon prices fluctuate significantly in 2024, impacting energy-intensive industries. Stricter regulations on emissions and waste disposal could lead to higher compliance costs for Horizon.

These evolving environmental mandates, including potential carbon pricing mechanisms, pose a direct threat to profitability. Increased operational expenses related to environmental compliance could erode margins, especially if these costs cannot be fully passed on to consumers. Furthermore, more rigorous permitting processes might delay or even halt crucial exploration and development projects.

Competition from Larger Energy Companies

Horizon Oil faces significant competition from larger, more diversified energy corporations. These giants, such as Woodside Energy or Santos, possess substantial financial reserves and established infrastructure, allowing them to outbid independents for prime exploration acreage and development opportunities. For instance, in the 2024 Australian offshore acreage release, larger players typically secured a greater share of the most prospective blocks due to their capacity for extensive upfront investment and risk mitigation.

These larger competitors benefit from economies of scale in operations, procurement, and technology adoption, which can translate into lower per-unit production costs. This cost advantage makes it challenging for smaller companies like Horizon to compete on price and efficiency, particularly during periods of volatile commodity prices. Their broader portfolios also offer a buffer against single-project risks, enabling them to absorb setbacks more readily than a focused independent.

Furthermore, larger energy companies often have stronger relationships with national oil companies, governments, and key service providers, which can facilitate smoother project execution and access to capital. This established network and market power present a formidable barrier to entry and growth for independent producers.

- Financial Muscle: Major energy companies often have market capitalizations in the tens of billions of dollars, dwarfing independent E&P players, enabling greater investment capacity.

- Economies of Scale: Larger operations reduce per-barrel costs, giving them a competitive edge in bidding for resources and managing production expenses.

- Portfolio Diversification: A broader range of assets and geographical spread allows majors to better manage risk and capitalize on diverse market opportunities.

- Established Relationships: Strong ties with governments and suppliers can expedite project approvals and secure favorable terms.

Operational Incidents and Reputational Damage

Operational incidents, like spills or accidents, pose a significant threat to Horizon. Such events can lead to hefty fines, temporary or permanent shutdowns, and a severe blow to the company's reputation. For instance, the 2010 Deepwater Horizon oil spill resulted in billions of dollars in penalties and cleanup costs for BP, demonstrating the potential financial devastation.

The fallout from an operational incident extends beyond immediate financial costs, severely impacting investor confidence and community trust. A damaged reputation can deter new investments and alienate local stakeholders, making future operations more challenging. For example, following major environmental incidents, companies often see their stock prices decline significantly as investors reassess risk.

- Financial Penalties: Significant fines from regulatory bodies can amount to millions or even billions of dollars following major incidents.

- Operational Disruptions: Accidents can lead to extended shutdowns, halting production and revenue generation.

- Reputational Damage: Negative media coverage and public outcry can erode brand value and stakeholder trust.

- Investor Confidence: Incidents can trigger sell-offs, leading to a decrease in market capitalization and making it harder to secure future funding.

The increasing global push towards renewable energy sources presents a substantial threat to traditional oil and gas companies like Horizon. Stricter environmental regulations and incentives for clean energy, as highlighted by the International Energy Agency's projection of nearly 50% growth in renewable capacity additions between 2024 and 2029, directly impact long-term demand for fossil fuels. This shift risks creating 'stranded assets' and diminishing the value of hydrocarbon-dependent businesses.

SWOT Analysis Data Sources

This analysis draws upon a robust foundation of data, including verified financial disclosures, comprehensive market intelligence, and expert industry forecasts, to provide a well-rounded and actionable SWOT assessment.