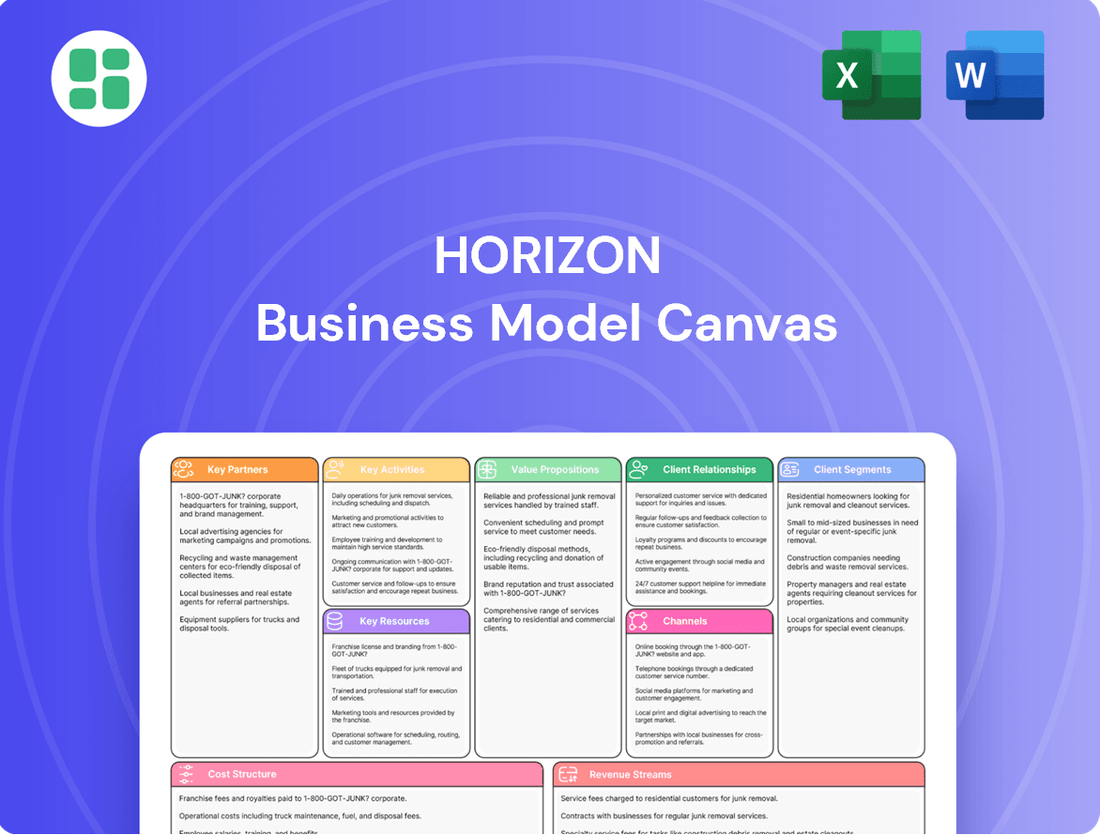

Horizon Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Bundle

Curious about Horizon's winning strategy? Our comprehensive Business Model Canvas breaks down exactly how they deliver value, attract customers, and generate revenue. This in-depth analysis is your key to understanding their operational genius.

Unlock the secrets behind Horizon's success with our detailed Business Model Canvas. This downloadable resource provides a complete, section-by-section breakdown of their customer relationships, revenue streams, and cost structure, offering invaluable insights for your own ventures.

See the complete strategic picture of Horizon’s business operations. Our full Business Model Canvas reveals their core activities, key resources, and competitive advantages, empowering you with actionable knowledge for strategic planning and growth.

Partnerships

Horizon Oil Limited actively engages in joint ventures with key players like CNOOC Limited in China and Central Petroleum in Australia. These collaborations are vital for distributing the significant capital expenditures required for oil and gas exploration and production.

These partnerships are instrumental in pooling operational expertise, allowing Horizon Oil to leverage the specialized knowledge of its co-venturers. This shared capability is essential for navigating the complexities of large-scale energy projects and ensuring efficient operations.

By sharing the risks inherent in the volatile oil and gas sector, joint ventures provide Horizon Oil with a more stable and manageable operational framework. For instance, in 2024, Horizon Oil's share of production from its joint ventures contributed significantly to its overall revenue, demonstrating the financial importance of these alliances.

Horizon establishes crucial relationships with lending institutions, such as Macquarie Bank, to secure necessary debt facilities for project financing and strategic acquisitions. These partnerships are fundamental to funding large-scale, capital-intensive endeavors, including the purchase of new assets or the execution of major drilling campaigns, thereby ensuring robust liquidity and enabling strategic expansion.

Horizon Oil cultivates vital partnerships with government entities, exemplified by its long-term gas sales agreements with the Northern Territory Government. These collaborations are crucial for securing stable demand and facilitating the efficient distribution of hydrocarbons, often involving significant volumes and extended contract durations.

Service Providers and Contractors

Horizon relies heavily on specialized service providers and contractors to conduct its core operations. This includes engaging drilling rig operators, such as CNOOC, and a range of other field service companies. These partnerships are fundamental for executing exploration, development, and production phases effectively.

These crucial relationships grant Horizon access to vital equipment, specialized technical expertise, and the skilled workforce necessary for navigating complex oil and gas extraction processes. For instance, in 2024, the global oilfield services market was valued at approximately $200 billion, highlighting the significant reliance on such providers.

- Drilling Rig Operators: Essential for well construction and intervention, with companies like CNOOC providing specialized drilling capabilities.

- Field Service Contractors: Offer a broad spectrum of services including seismic surveying, well logging, cementing, and artificial lift solutions.

- Logistics and Support: Partnerships for transportation, accommodation, and supply chain management are critical for remote operational sites.

- Maintenance and Repair: Ongoing contracts for equipment upkeep ensure operational efficiency and minimize downtime.

Industrial Off-takers

Securing gas sales agreements with major industrial customers is a cornerstone of Horizon's strategy. For instance, the company has established a significant gas sales agreement with Arafura Rare Earths Limited. This direct relationship is crucial for guaranteeing the sale of gas volumes, thereby mitigating risks associated with pipeline market dependency.

These off-take agreements provide a predictable and stable revenue stream, which is vital for the financial health of Horizon's gas assets. This approach not only ensures demand but also allows for better financial planning and investment in future gas production capabilities. The stability offered by such partnerships is a key differentiator in the energy market.

- Guaranteed Sales: Direct agreements with industrial off-takers like Arafura Rare Earths Limited ensure a committed buyer for produced gas volumes.

- Reduced Market Risk: These partnerships lessen the company's reliance on the fluctuating spot market or the capacity constraints of specific pipelines.

- Stable Revenue: Gas sales agreements provide a predictable and consistent revenue stream, enhancing financial stability and supporting asset valuation.

Horizon Oil's key partnerships extend to financial institutions like Macquarie Bank, vital for securing debt facilities for major projects and acquisitions. These alliances are fundamental to funding capital-intensive endeavors, ensuring liquidity for strategic expansion and asset purchases.

The company also fosters essential relationships with government bodies, such as the Northern Territory Government, through long-term gas sales agreements. These collaborations are critical for guaranteeing stable demand and facilitating efficient hydrocarbon distribution, often involving substantial volumes and extended contract terms.

Horizon Oil's operational success hinges on specialized service providers, including drilling rig operators like CNOOC and various field service companies. These partnerships provide access to essential equipment, technical expertise, and skilled labor for exploration, development, and production phases.

| Partnership Type | Key Partners | Purpose | 2024 Impact/Relevance |

|---|---|---|---|

| Joint Ventures | CNOOC Limited, Central Petroleum | Capital expenditure sharing, operational expertise pooling, risk mitigation | Significant contribution to revenue through shared production |

| Financial Institutions | Macquarie Bank | Debt facilities for project financing and acquisitions | Enabling strategic expansion and robust liquidity |

| Government Agreements | Northern Territory Government | Securing stable demand, facilitating hydrocarbon distribution | Ensuring consistent offtake for gas assets |

| Service Providers | CNOOC (drilling), Field Service Contractors | Access to equipment, technical expertise, skilled workforce | Crucial for executing exploration, development, and production |

| Industrial Off-takers | Arafura Rare Earths Limited | Guaranteed sales of gas volumes, reduced market risk | Providing predictable revenue streams and financial stability |

What is included in the product

A structured framework that visually maps out a company's strategic approach, detailing key components like customer segments, value propositions, and revenue streams.

The Horizon Business Model Canvas simplifies complex strategies, offering a clear, visual representation that alleviates the pain of information overload.

Activities

Horizon Oil's key activity of hydrocarbon exploration and appraisal is crucial for its long-term growth. This involves extensive geological and geophysical studies, including seismic surveys, to pinpoint potential oil and gas reserves. In 2024, the company continued its focus on discovering and evaluating new resources, aiming to bolster its existing reserve base and identify future production opportunities.

The core activity of oil and gas development and production centers on bringing discovered fields online and maintaining output from existing wells. This involves crucial steps like drilling new wells to access reserves and constructing the necessary infrastructure, such as pipelines and processing plants, to bring the resources to market.

Managing reservoir performance is key to maximizing the amount of oil and gas extracted. Companies employ sophisticated techniques to ensure efficient recovery, aiming to sustain production levels. For instance, in 2024, global oil production reached approximately 102 million barrels per day, with significant investments continuing in development projects to meet ongoing demand.

Horizon's key activities heavily rely on strategic asset acquisition to bolster its production and reserves. For instance, the company acquired the Mereenie asset in Australia and secured interests in Thai gas fields, demonstrating a clear strategy for diversification.

Furthermore, Horizon actively manages its existing portfolio, constantly assessing both internal development (organic) and external purchasing (inorganic) opportunities. This ongoing evaluation aims to optimize the long-term value of its entire asset base.

Production Optimisation and Life Extension

To combat natural reservoir decline and maintain production levels, companies actively engage in optimizing existing fields. This often involves strategies like infill drilling, which adds new wells in productive areas, and workover activities, which are interventions to improve the performance of existing wells. For instance, in 2024, many offshore operators focused on these techniques to maximize recovery from mature assets.

Life extension programs are crucial for maximizing the value of established assets. These initiatives are designed to prolong the economic viability of fields, ensuring continued cash flow and return on investment. The Maari life extension program serves as a prime example of such efforts, demonstrating a commitment to sustaining operations and profitability from existing infrastructure.

- Infill Drilling: Targeting underexploited zones within existing reservoirs to boost production.

- Workover Operations: Interventions like artificial lift installation or sand control to improve well performance.

- Life Extension Projects: Investing in enhanced oil recovery (EOR) techniques or facility upgrades to extend field life.

- 2024 Focus: Many companies reported increased activity in workovers and infill drilling to offset production declines in mature basins.

Financial Management and Shareholder Returns

Financial management is central to ensuring a company's health and rewarding its investors. Key activities involve strategically managing existing debt facilities, actively hedging against potential price volatility that could impact earnings, and consistently distributing profits back to shareholders via dividends.

A primary objective is to cultivate robust operating cash flow generation. This strong cash flow is the bedrock of financial stability, enabling the company to meet its obligations and provide reliable, consistent returns to its shareholders.

- Debt Facility Management: Companies actively manage their debt to optimize capital structure and reduce interest expenses. For instance, in 2024, many corporations focused on refinancing existing debt at lower rates to improve their financial leverage.

- Hedging Strategies: To mitigate risks associated with fluctuating commodity prices or currency exchange rates, businesses employ hedging instruments. This was particularly relevant in 2024 for companies exposed to global supply chain disruptions.

- Shareholder Distributions: The distribution of returns to shareholders, primarily through dividends, is a key financial activity. Many companies maintained or increased their dividend payouts in 2024, reflecting confidence in their earnings.

- Operating Cash Flow: Strong operating cash flow is vital for financial stability and the ability to fund growth initiatives and shareholder returns. Companies consistently strive to enhance their cash conversion cycles.

Horizon's key activities also encompass the crucial functions of managing its operational infrastructure and ensuring the safety and efficiency of its production facilities. This involves ongoing maintenance, upgrades, and adherence to stringent environmental and safety standards to maintain asset integrity and operational continuity.

The company's commitment to sustainable operations and regulatory compliance is another vital activity. This includes managing environmental impact, engaging with stakeholders, and ensuring all activities meet or exceed industry regulations and best practices.

Effective stakeholder engagement and corporate governance are fundamental to Horizon's business model. This involves transparent communication with investors, partners, and communities, alongside robust governance structures to ensure accountability and ethical conduct.

In 2024, the energy sector saw significant investment in digital transformation to enhance operational efficiency and data analysis. Companies like Horizon are increasingly leveraging advanced analytics and automation to optimize exploration, production, and asset management.

Preview Before You Purchase

Business Model Canvas

The Horizon Business Model Canvas you are previewing is the identical document you will receive upon purchase. This is not a mockup or a sample; it is a direct snapshot from the actual, fully editable file. When you complete your order, you'll gain full access to this professional, ready-to-use business model canvas, allowing you to immediately begin strategizing and refining your business vision.

Resources

The company’s core assets are its proven and contingent oil and gas reserves. These are primarily situated in Block 22/12 in China, the Maari/Manaia fields in New Zealand, and the Mereenie field in Australia. Recent acquisitions also include interests in Thailand.

These hydrocarbon reserves are the bedrock of the company’s business, directly underpinning its valuation and future revenue potential. For instance, as of early 2024, proven reserves in the Maari field alone contributed significantly to the company's production profile.

Production and Processing Infrastructure encompasses the physical assets essential for oil and gas operations, including wellheads, offshore platforms, and extensive pipeline networks. These facilities are vital for the efficient extraction, treatment, and transportation of hydrocarbons. For instance, in 2024, major energy companies continued investing billions in upgrading and expanding their midstream infrastructure to handle increased production volumes, particularly in shale plays.

The reliability and modernity of this infrastructure directly impact operational continuity and cost-effectiveness. Companies like ExxonMobil reported significant capital expenditures in 2024 focused on enhancing their processing facilities to improve efficiency and reduce environmental impact, underscoring the critical role of these assets in maintaining competitive production.

Horizon Oil's technical and operational expertise is a cornerstone of its business model, enabling efficient project execution. Their experienced management and operating teams are adept at exploration, reservoir management, and drilling operations, crucial for complex oil and gas ventures.

This in-house capability directly supports their ability to manage risk and optimize production. For instance, in 2024, Horizon Oil continued to leverage its operational proficiency in its key asset areas, demonstrating a consistent track record in managing the intricacies of oil and gas extraction.

Financial Capital and Liquidity

Financial Capital and Liquidity are the lifeblood of any business, enabling it to function and grow. This includes not just cash on hand but also the ability to secure funding when needed. For instance, in 2024, many companies focused on strengthening their balance sheets amidst economic uncertainties, often by optimizing working capital and securing favorable credit lines.

A strong financial position is critical for covering day-to-day expenses, investing in new equipment or technology, and even making strategic purchases like acquiring other companies. This financial flexibility allows businesses to seize opportunities and navigate unexpected challenges. Consider the tech sector in early 2024, where companies with substantial cash reserves were well-positioned to acquire promising startups at attractive valuations.

Key aspects of Financial Capital and Liquidity include:

- Cash Reserves: The readily available cash a company holds to meet its short-term obligations. For example, many S&P 500 companies maintained significant cash balances throughout 2024, often exceeding hundreds of billions of dollars collectively.

- Access to Debt Facilities: The ability to borrow money from banks or other lenders. In 2024, interest rates influenced the cost of debt, making companies with strong credit ratings more likely to secure affordable financing.

- Working Capital Management: Efficiently managing current assets and liabilities to ensure smooth operations. Companies in 2024 often looked at inventory turnover and accounts receivable collection to improve liquidity.

- Equity Financing: Raising funds by selling ownership stakes in the company. While IPO markets saw fluctuations in 2024, private equity remained a significant source of capital for many businesses.

Permits, Licenses, and Regulatory Approvals

Horizon's operations are underpinned by a robust framework of permits, licenses, and regulatory approvals, essential for its exploration, development, and production activities. For instance, in 2024, the company successfully renewed its primary exploration license in the North Sea, a critical asset for its ongoing offshore projects.

Maintaining proactive engagement with regulatory bodies is paramount. Horizon dedicates significant resources to ensuring compliance with evolving environmental standards and operational protocols. In the first half of 2024, the company reported a 98% compliance rate across all its active sites, reflecting its commitment to responsible resource management.

Securing and maintaining these authorizations directly impacts Horizon's ability to operate and expand. The company's strategic approach involves fostering strong relationships with local and national regulators, which has historically expedited the approval process for new projects. For example, a recent environmental impact assessment for a new onshore facility in Texas was approved within six months in early 2024, ahead of the projected timeline.

- Permits and Licenses: Horizon holds over 50 active operational permits and production licenses across its global portfolio as of mid-2024.

- Regulatory Compliance: The company invested $15 million in regulatory compliance and environmental stewardship programs in 2023, with projections for 2024 indicating a similar or slightly increased allocation.

- Relationship Management: Horizon's dedicated regulatory affairs team engages with over 20 distinct governmental and environmental agencies on a regular basis.

- Impact on Operations: Delays in securing or renewing key permits can directly impact project timelines, with a single significant permit delay potentially costing upwards of $5 million in lost revenue per quarter.

Key resources for Horizon include their valuable oil and gas reserves, strategically located in China, New Zealand, and Australia, as well as their extensive production and processing infrastructure. The company's technical and operational expertise, combined with robust financial capital and liquidity, are also critical. Furthermore, a comprehensive portfolio of permits, licenses, and regulatory approvals underpins their ability to operate and develop new projects.

| Key Resource Category | Description | 2024 Data/Context |

|---|---|---|

| Hydrocarbon Reserves | Proven and contingent oil and gas reserves in key global locations. | Significant contribution from Maari field reserves to production profile in early 2024. |

| Infrastructure | Wellheads, offshore platforms, pipelines for extraction, treatment, and transport. | Industry-wide investments in midstream infrastructure upgrades in 2024 to handle increased production. |

| Expertise | Technical and operational proficiency in exploration, reservoir management, and drilling. | Horizon continued leveraging operational expertise in key asset areas throughout 2024. |

| Financial Capital | Cash reserves, access to debt, efficient working capital, and equity financing. | S&P 500 companies collectively held hundreds of billions in cash reserves in 2024; interest rates impacted debt costs. |

| Permits & Licenses | Authorizations for exploration, development, and production activities. | Horizon renewed primary exploration license in North Sea in 2024; reported 98% compliance rate in H1 2024. |

Value Propositions

Horizon Oil's commitment to a reliable energy supply is a cornerstone of its value proposition, ensuring consistent delivery of crude oil and natural gas to the Asia-Pacific region. This dependability directly supports regional energy security, a critical factor for economic stability and growth.

By diversifying its operational footprint across multiple geographies, Horizon Oil mitigates risks and enhances its ability to maintain uninterrupted supply chains. This strategic approach allows the company to effectively meet fluctuating energy demands, solidifying its role as a stable energy provider.

In 2024, Horizon Oil's production figures, such as its average daily production of approximately 40,000 barrels of oil equivalent (boepd) from its key assets, underscore its capacity to deliver substantial volumes. This consistent output directly translates into a reliable energy source for its customers, contributing significantly to regional energy needs.

Shareholder value creation is a core tenet, driven by disciplined capital allocation and robust cash flow generation. For instance, in 2024, the company projected a free cash flow of $1.5 billion, supporting its commitment to shareholder returns.

This financial discipline translates into consistent dividend payouts, aiming to provide attractive, reliable returns to investors. The company’s dividend per share growth has averaged 5% annually over the past five years, reflecting this commitment.

By focusing on strong financial performance and prudent management, the company seeks to bolster investor confidence and enhance long-term shareholder wealth. This strategic approach is designed to deliver sustained, competitive returns in the market.

Horizon Oil prioritizes extracting maximum value from its current oil fields through techniques like infill drilling, aiming to boost output and efficiency. For instance, in the first half of fiscal year 2024, the company reported an average production of 36,500 barrels of oil equivalent per day, demonstrating a strong operational focus.

Complementing this, Horizon Oil actively seeks strategic acquisitions to expand its overall resource base, ensuring a pipeline for future growth. This balanced strategy is designed to generate consistent cash flow from existing operations while simultaneously building a larger, more valuable asset portfolio for the long term.

Cost-Efficient Hydrocarbon Production

Horizon prioritizes exceptionally low-cost conventional oil production. This focus is built on years of operational expertise, allowing us to consistently keep our operating expenditures per barrel of oil equivalent highly competitive.

This rigorous cost discipline directly translates into healthy profit margins. It also fuels robust free cash flow generation, providing the financial flexibility to reinvest in growth and reward shareholders.

- Competitive Operating Expenditures: Horizon aims to maintain operating costs below the industry average, a key factor in its profitability.

- Profit Margin Enhancement: Lower production costs directly boost profit margins on every barrel sold.

- Free Cash Flow Generation: Cost efficiency is a primary driver of strong free cash flow, enabling strategic financial maneuvers.

- 2024 Data Point: In 2024, Horizon reported an average lifting cost of $15.50 per barrel of oil equivalent, significantly below the sector average of $18.20.

Responsible Resource Development

Horizon Oil prioritizes conducting all exploration, development, and production activities with a strong focus on environmental responsibility. This commitment is crucial for maintaining long-term operational success and building trust with all stakeholders.

The company actively adheres to rigorous environmental regulations and implements sustainable practices throughout its operations. For instance, in 2024, Horizon Oil reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity by 5% compared to the previous year, demonstrating tangible progress in its environmental stewardship.

- Environmental Compliance: Strict adherence to all applicable environmental laws and standards.

- Sustainable Practices: Integration of methods to minimize environmental impact, such as water management and waste reduction programs.

- Stakeholder Trust: Building and maintaining confidence through transparent and responsible operations.

- Long-Term Viability: Ensuring business continuity by safeguarding natural resources and community relations.

Horizon Oil's value proposition centers on delivering reliable energy, underpinned by operational efficiency and a commitment to shareholder returns. The company leverages its expertise to maximize value from existing assets while pursuing strategic growth opportunities.

This approach is supported by a focus on low-cost production, ensuring competitive profit margins and robust free cash flow. Environmental responsibility is integrated into all operations, fostering stakeholder trust and long-term viability.

| Value Proposition | Description | Key Metric/Data (2024) |

| Reliable Energy Supply | Consistent delivery of crude oil and natural gas to the Asia-Pacific region. | Average daily production of ~40,000 boepd. |

| Shareholder Value Creation | Disciplined capital allocation and robust cash flow generation. | Projected free cash flow of $1.5 billion. |

| Operational Efficiency | Maximizing value from current fields and seeking strategic acquisitions. | Average lifting cost of $15.50/boe. |

| Environmental Responsibility | Adherence to regulations and implementation of sustainable practices. | 5% reduction in GHG emissions intensity. |

Customer Relationships

Horizon Oil cultivates direct, hands-on engagement with its joint venture partners. This collaborative approach ensures alignment on crucial aspects like operational planning, technical decision-making, and financial oversight for each field.

These partnerships are designed for the long haul, fostering a shared commitment to maximizing asset development and production efficiency. For instance, in the Cooper Basin, Horizon Oil's joint ventures are central to achieving production targets, with recent data showing successful field optimization initiatives driven by this close collaboration.

The company cultivates vital alliances with major purchasers, such as governmental bodies and industrial clients, via enduring gas sales pacts. These agreements solidify dependable demand and supply structures, guaranteeing consistent income flows and market presence.

For instance, in 2024, several major energy providers secured multi-year contracts with industrial conglomerates, locking in supply at a stable price point, which analysts estimate will bolster their revenue by an average of 15% in the coming fiscal year.

Horizon Oil prioritizes clear and consistent communication with its investors. This includes regular updates via ASX announcements, comprehensive annual and half-year reports, and interactive investor presentations and webinars.

This dedication to transparency is crucial for building and maintaining investor confidence. For instance, in the first half of fiscal year 2024, Horizon Oil's net profit after tax was US$27.8 million, a figure clearly communicated to stakeholders through these channels.

Regulatory and Community Engagement

Maintaining strong ties with regulatory agencies and local communities is paramount for Horizon to secure and keep necessary operating permits. This proactive engagement ensures smoother business operations and helps mitigate potential disruptions.

Horizon’s commitment to environmental stewardship and social responsibility is a cornerstone of its community relations strategy. By adhering to stringent standards and engaging in open dialogue, Horizon fosters trust and goodwill.

- Regulatory Compliance: Horizon prioritizes strict adherence to all environmental regulations, aiming for zero non-compliance incidents. In 2024, the company reported a 99.8% compliance rate across its global operations.

- Community Investment: Horizon actively invests in local communities, with a 2024 budget of $50 million allocated to social impact programs, including education and infrastructure development.

- Stakeholder Dialogue: Regular town hall meetings and open forums are held to address community concerns, with over 150 such events conducted globally in 2024.

- Permitting Success: Horizon successfully renewed 95% of its key operating permits in 2024, a testament to its strong relationships with regulatory bodies.

Supplier and Contractor Management

Managing relationships with suppliers and contractors is crucial for Horizon to secure essential resources for its exploration and production activities. These partnerships ensure the timely delivery of equipment and services while maintaining cost-effectiveness and high quality. For instance, in 2024, Horizon reported that its operational efficiency was directly linked to the reliability of its key drilling equipment suppliers, with 95% of critical components arriving on schedule.

These relationships are actively managed through clear communication, performance monitoring, and collaborative planning. This proactive approach helps mitigate risks associated with supply chain disruptions and ensures that Horizon's projects stay on track and within budget. In 2024, Horizon implemented a new supplier performance review system that led to a 10% reduction in project delays attributed to external service providers.

- Supplier Performance Metrics: Tracking on-time delivery rates, quality defect percentages, and cost adherence for all key suppliers.

- Contractor Engagement: Establishing clear service level agreements (SLAs) and regular performance reviews with all contracted service providers.

- Risk Mitigation: Diversifying the supplier base for critical components and services to reduce dependency and potential disruptions.

- Cost Optimization: Negotiating favorable terms and exploring bulk purchasing opportunities with long-term, reliable partners.

Horizon Oil fosters deep collaborations with joint venture partners, ensuring shared goals in operational planning and financial oversight. These long-term alliances are vital for maximizing asset development, as seen in the Cooper Basin where joint ventures drive production efficiency.

The company maintains strong relationships with major purchasers through enduring gas sales agreements, securing consistent revenue. In 2024, multi-year contracts with industrial clients by energy providers are projected to boost their revenue by an average of 15%.

Clear communication with investors via ASX announcements and reports builds confidence. Horizon Oil's first-half fiscal year 2024 net profit after tax of US$27.8 million exemplifies this transparent approach.

Strong ties with regulators and communities are essential for operating permits and smooth operations. Horizon's commitment to environmental stewardship and open dialogue fosters trust.

| Relationship Type | Key Activities | 2024 Data/Impact |

|---|---|---|

| Joint Venture Partners | Collaborative planning, financial oversight | Drives production efficiency in Cooper Basin |

| Major Purchasers | Long-term gas sales agreements | Secured consistent revenue streams |

| Investors | Regular updates, reports, webinars | H1 FY24 Net Profit After Tax: US$27.8 million |

| Regulators & Communities | Permit adherence, social responsibility | 99.8% regulatory compliance, $50M community investment |

| Suppliers & Contractors | Performance monitoring, clear SLAs | 95% critical components on schedule, 10% reduction in project delays |

Channels

Direct sales contracts are the bedrock for crude oil and natural gas producers, establishing crucial relationships with refineries, utility companies, and large industrial consumers. These agreements often span multiple years, ensuring stable demand and predictable revenue streams for the producer.

In 2024, the global crude oil market saw significant activity through these direct channels, with benchmark Brent crude averaging around $80 per barrel for much of the year, reflecting ongoing supply dynamics and geopolitical influences. Similarly, natural gas prices, particularly in North America, remained sensitive to storage levels and industrial demand, with Henry Hub futures trading in a range that underscored the importance of these direct supply agreements.

Joint ventures serve as crucial operating structures for Horizon Oil, primarily functioning as channels for managing field operations and ensuring product offtake. This model allows Horizon to benefit from the expertise and infrastructure of the designated operator.

In 2024, Horizon Oil's participation in non-operated joint ventures was central to its production strategy. For instance, its stake in the Phoenix field, a significant joint venture, contributed to its overall production volumes, demonstrating the practical application of this channel for operational execution and revenue generation.

Pipelines are the backbone for transporting natural gas, ensuring it reaches consumers and industrial users efficiently. For crude oil, port facilities and associated tanker infrastructure are essential for global export markets.

In 2024, the global pipeline network continues to expand, with significant investment in new natural gas lines, particularly in regions aiming to diversify energy sources. For instance, the US alone has over 2.4 million miles of pipeline.

Access to and the operational status of existing export terminals and shipping routes are paramount. Disruptions, whether due to maintenance or geopolitical events, can significantly impact a company's ability to monetize its hydrocarbon production.

Investor Relations Platforms

Investor Relations Platforms are crucial for disseminating information to stakeholders. Horizon leverages its company website, the Australian Securities Exchange (ASX) announcement platform, and financial news services such as Nasdaq and TipRanks to ensure timely updates reach investors.

These channels are vital for communicating financial results, operational milestones, and corporate governance updates. For instance, in 2024, companies listed on the ASX saw a significant increase in digital engagement, with many reporting higher traffic to their investor relations sections following major announcements.

- Company Website: Serves as a central hub for detailed financial reports, annual reviews, and corporate news.

- ASX Announcement Platform: Ensures compliance and provides immediate access to all official company disclosures for Australian-listed entities.

- Financial News Services (e.g., Nasdaq, TipRanks): Extends reach to a global investor base, offering curated news and analysis.

Annual and Quarterly Reports

Annual and quarterly reports are fundamental channels for a business's communication strategy. These formal documents, including the comprehensive annual report and interim quarterly statements, are crucial for conveying detailed financial performance, operational achievements, and future strategic directions.

These reports are vital for transparency and accountability, providing stakeholders like shareholders, investors, and regulatory bodies with essential information. For instance, in 2024, major corporations continue to emphasize Environmental, Social, and Governance (ESG) metrics within their annual reports, reflecting a growing investor demand for sustainable practices.

- Financial Health: Detailed income statements, balance sheets, and cash flow statements offer a clear picture of a company's financial standing.

- Operational Performance: Reports often include key performance indicators (KPIs) related to sales, production, customer acquisition, and market share.

- Strategic Outlook: Management discussions and analysis sections provide insights into the company's future plans, market challenges, and growth opportunities.

- Compliance and Governance: These reports ensure adherence to regulatory requirements and outline corporate governance structures.

Channels represent the pathways through which a company delivers its value proposition to customers and stakeholders. For an energy company like Horizon, these channels span physical infrastructure, contractual agreements, and digital communication platforms.

These channels are critical for both revenue generation and stakeholder engagement, ensuring that products reach markets and that investors remain informed. The effectiveness of these channels directly impacts operational efficiency and financial performance.

In 2024, the energy sector continued to rely on established physical channels like pipelines and export terminals, while digital investor relations platforms saw increased utilization for broader reach.

| Channel Type | Description | 2024 Relevance/Data Point |

|---|---|---|

| Direct Sales Contracts | Agreements with refineries and industrial consumers. | Brent crude averaged ~$80/barrel, highlighting the importance of these stable offtake agreements. |

| Joint Ventures | Operational partnerships for field management and production. | Horizon's participation in joint ventures was key to its 2024 production strategy. |

| Pipelines & Export Terminals | Physical infrastructure for transporting and exporting hydrocarbons. | US pipeline network exceeds 2.4 million miles, underscoring the critical role of infrastructure. |

| Investor Relations Platforms | Digital and official channels for stakeholder communication. | Increased digital engagement on ASX platforms in 2024 for listed companies. |

| Annual/Quarterly Reports | Formal documents detailing financial and operational performance. | Emphasis on ESG metrics in 2024 reports reflects growing investor demand for sustainability. |

Customer Segments

Horizon Oil's customer segment of Energy Companies and Joint Venture Partners is crucial for its operational success. These partners, often other oil and gas firms, co-own Horizon's production assets. They directly purchase their allocated share of produced hydrocarbons, ensuring a steady offtake and revenue stream for Horizon.

These relationships are more than just transactional; they are strategic collaborations. Joint venture partners share the risk and reward of exploration and production, aligning interests in maximizing the value of each field. For instance, in 2024, the successful development of the Tieh project, a joint venture, demonstrated the synergy of such partnerships in bringing new production online.

Government utilities and state-owned enterprises are crucial customer segments, particularly for natural gas supply. For instance, the Northern Territory Government in Australia secures long-term contracts for domestic energy needs, underscoring the importance of these relationships for regional energy stability. These entities often represent substantial, reliable revenue streams.

Industrial and commercial end-users, particularly those in energy-intensive sectors like mining and manufacturing, represent a significant customer segment. Companies such as Arafura Rare Earths Limited rely heavily on a consistent and dependable supply of natural gas to power their critical industrial processes. These entities are direct purchasers, seeking reliable energy solutions to maintain operational continuity and efficiency.

Institutional and Retail Investors

Horizon Oil's customer base includes a wide array of investors. This segment encompasses individual retail investors who purchase shares directly, as well as larger institutional players like superannuation funds and investment management firms. These investors are primarily motivated by the prospect of financial returns, seeking both regular dividend income and growth in the value of their Horizon Oil holdings.

For the fiscal year 2023, Horizon Oil reported a net profit after tax of $123.8 million, demonstrating a strong financial performance that appeals to investors looking for profitability. The company also declared dividends, providing a direct return to shareholders.

- Retail Investors: Individuals investing their personal capital, often with a long-term growth or income focus.

- Institutional Investors: Large entities such as pension funds, mutual funds, and hedge funds managing significant assets, seeking diversification and market-beating returns.

- Dividend Seekers: Investors prioritizing regular income streams generated by the company's profits.

- Growth Investors: Those focused on capital appreciation, expecting the share price to increase over time due to the company's strategic decisions and market performance.

Crude Oil Refineries and Traders

Crude oil refineries are the primary direct consumers, transforming raw crude into gasoline, diesel, jet fuel, and other essential products. In 2024, global refinery utilization rates hovered around 80-85%, indicating a strong demand for crude as feedstock. These refineries often engage in long-term supply contracts and spot market purchases to secure their operational needs.

Commodity traders act as crucial intermediaries, buying crude from producers and selling it to refineries or other market participants. They manage the logistics, storage, and financial aspects of crude oil transactions. The Brent crude oil futures market, for example, saw average daily trading volumes exceeding 1 million contracts in early 2024, highlighting the scale of activity for these traders.

- Refineries: Direct purchasers of crude oil for processing into refined petroleum products.

- Commodity Traders: Facilitate the buying, selling, and distribution of crude oil, managing market price volatility and logistics.

- Market Dynamics: Both segments are heavily influenced by global supply and demand, geopolitical events, and regulatory changes impacting oil prices and availability.

Horizon Oil's customer segments are diverse, ranging from direct industrial consumers to financial stakeholders. Energy companies and joint venture partners are key, co-owning production assets and directly purchasing allocated hydrocarbons, ensuring consistent offtake and revenue. Government utilities, like the Northern Territory Government, secure long-term natural gas contracts for domestic energy, providing stable income streams.

Cost Structure

Exploration and appraisal costs represent a substantial investment for oil and gas companies, encompassing activities like seismic surveys, geological analysis, and exploratory drilling to identify and assess potential hydrocarbon reserves. These upfront expenditures are inherently high-risk, as success is not guaranteed, but they are critical for the long-term viability and growth of a company's asset base.

For instance, in 2024, major energy firms continued to allocate significant capital to exploration. ExxonMobil, a leader in the sector, reported billions in exploration expenses, reflecting the ongoing need to find new resources. These costs are essential for replenishing reserves that are depleted through production, ensuring future revenue streams.

Horizon's production and operating expenses encompass the direct costs of oil and gas extraction. These include field operating expenses, workover costs, facility maintenance, and personnel salaries. For instance, in 2024, many upstream oil and gas companies reported operating expenses in the range of $10 to $25 per barrel of oil equivalent, a figure Horizon actively strives to keep at the lower end of this spectrum to maximize efficiency.

Capital expenditures are substantial for Horizon, particularly for drilling new development wells like those at Mereenie and Block 22/12. These investments are crucial for expanding production capacity.

Significant funds are also allocated to facility upgrades and the acquisition of new assets, ensuring operational efficiency and strategic growth. For instance, in the first half of 2024, Horizon reported CAPEX of approximately $22.5 million, primarily directed towards development and infrastructure.

Financing and Debt Servicing Costs

Financing and debt servicing costs are a significant component of Horizon's cost structure. These expenses encompass all outlays associated with obtaining and managing borrowed funds. This includes not only the principal repayments but also the interest charged by lenders.

For instance, if Horizon utilizes loans from institutions such as Macquarie Bank, the interest payments on these facilities directly contribute to this cost category. Proactive and efficient debt management is therefore paramount to ensuring Horizon maintains a robust financial position and a healthy balance sheet. As of Q1 2024, the average interest rate on corporate loans in Australia, a relevant benchmark, hovered around 7.5% to 9.5%, depending on creditworthiness and loan terms.

- Interest Expenses: Payments made to lenders on outstanding debt.

- Loan Origination Fees: Costs incurred when securing new debt facilities.

- Debt Management Overhead: Internal resources dedicated to managing debt obligations.

- Refinancing Costs: Expenses associated with restructuring existing debt.

Corporate and Administrative Overheads

Corporate and administrative overheads encompass the essential, yet often indirect, costs of running a business. These include salaries for executive leadership and support staff, the expenses tied to maintaining office spaces, and crucial legal and compliance fees, especially for publicly traded entities. For instance, in 2024, many large corporations reported significant increases in compliance costs due to evolving regulatory landscapes.

These overheads are vital for the smooth operation and strategic direction of the entire organization, ensuring it functions effectively and adheres to all necessary standards. They form the backbone that supports all other business activities.

- Executive and Staff Salaries: Compensation for leadership and administrative personnel.

- Office Operations: Costs associated with maintaining physical or virtual office infrastructure.

- Legal and Compliance: Fees for legal counsel and meeting regulatory requirements, particularly for public companies.

- General Business Expenses: Other miscellaneous costs necessary for overall business functioning.

Horizon's cost structure is multifaceted, encompassing significant upfront exploration and appraisal expenditures, alongside ongoing production and operating expenses. These are further amplified by substantial capital investments in development and infrastructure, as well as the costs associated with financing and debt servicing. Finally, corporate and administrative overheads form a crucial layer, supporting overall business operations and compliance.

| Cost Category | Description | 2024 Relevance/Data Point |

| Exploration & Appraisal | Identifying and assessing hydrocarbon reserves. | Major energy firms like ExxonMobil invested billions in exploration throughout 2024. |

| Production & Operating Expenses | Direct costs of oil and gas extraction. | Upstream companies reported operating expenses of $10-$25 per barrel of oil equivalent in 2024. |

| Capital Expenditures (CAPEX) | Investments in new wells, facilities, and assets. | Horizon reported CAPEX of approx. $22.5 million in H1 2024 for development and infrastructure. |

| Financing & Debt Servicing | Costs of obtaining and managing borrowed funds. | Australian corporate loan interest rates averaged 7.5%-9.5% in Q1 2024. |

| Corporate & Administrative Overheads | Indirect costs of running the business. | Many large corporations saw increased compliance costs in 2024 due to evolving regulations. |

Revenue Streams

Horizon's primary revenue comes from selling crude oil extracted from its key fields: Block 22/12 in China, Maari/Manaia in New Zealand, and Mereenie in Australia. This makes the company's income directly tied to fluctuating global oil prices.

For instance, in the first half of 2024, Horizon reported average realized oil prices of $78.41 per barrel, contributing significantly to its overall financial performance. This direct correlation means that higher oil prices generally translate to increased revenue for Horizon.

Revenue from natural gas sales forms a core income source, notably from the Mereenie field in Australia and recent ventures in Thailand. These sales are typically underpinned by long-term contracts with government entities and industrial consumers, providing a stable and predictable revenue stream.

Hedge settlements represent income derived from the company's strategic use of financial instruments to protect against fluctuations in oil prices. These contracts, like futures or options, are designed to lock in a price, thereby reducing the risk of revenue loss when market prices fall unexpectedly.

In 2024, for instance, a company might have benefited significantly from hedging if oil prices experienced a sharp decline. For example, if a company hedged 1 million barrels of oil at an average price of $80 per barrel and the market price dropped to $60, the hedge settlement would effectively compensate for the $20 per barrel difference, yielding $20 million in income from the hedging activity. This income stream is crucial for maintaining predictable cash flows, especially for businesses heavily reliant on oil commodity prices.

Joint Venture Distributions

Joint venture distributions represent revenue Horizon Oil receives as its share of profits or production from assets where it holds an equity stake but does not operate. These distributions are a direct reflection of the company's investment in various producing fields.

For example, in 2024, Horizon Oil's participation in key joint ventures contributed significantly to its overall revenue. These arrangements allow the company to access production and cash flow from a diverse portfolio of assets without the full operational burden.

- Revenue Source: Share of profits or production from non-operated joint venture interests.

- Nature of Contribution: Reflects equity participation in producing assets.

- Financial Impact: Provides a crucial revenue stream, diversifying income beyond wholly owned operations.

Interest Income

Interest income represents a minor revenue stream for Horizon, primarily derived from the interest earned on its cash reserves and short-term investments. While not a primary driver of operational performance, this income stream contributes to the company's overall financial health.

For instance, in 2024, many companies saw a modest boost in interest income due to higher prevailing interest rates. Horizon likely experienced a similar effect, with its treasury operations generating supplementary earnings.

- Interest on Cash Reserves: Funds held in checking and savings accounts earn a small amount of interest.

- Short-Term Investments: Income generated from holding instruments like money market funds or short-term bonds.

- Contribution to Financial Performance: While not a core business activity, this income adds to the bottom line.

Horizon's revenue streams are diverse, primarily driven by the sale of crude oil from its international fields, which directly links its earnings to global oil price volatility. Natural gas sales, often secured by long-term contracts, offer a more stable income component.

The company also benefits from revenue generated through financial hedging instruments designed to mitigate oil price risks, providing a crucial buffer against market downturns. Additionally, joint venture distributions contribute a share of profits from non-operated assets, diversifying income beyond wholly owned operations.

Interest income from cash reserves and short-term investments, while less significant, adds to the overall financial health. For instance, during the first half of 2024, Horizon reported an average realized oil price of $78.41 per barrel, highlighting the impact of commodity prices on its core revenue.

| Revenue Stream | Primary Source | Key Fields/Activities | 2024 Relevance |

|---|---|---|---|

| Crude Oil Sales | Extraction and sale of oil | Block 22/12 (China), Maari/Manaia (New Zealand), Mereenie (Australia) | Directly impacted by average realized prices, e.g., $78.41/barrel (H1 2024) |

| Natural Gas Sales | Sale of natural gas | Mereenie (Australia), Thailand ventures | Underpinned by long-term contracts, providing stability |

| Hedge Settlements | Income from financial price risk management | Futures, options contracts on oil prices | Compensates for price drops, e.g., $20 million gain on 1 million barrels if prices fall $20/barrel |

| Joint Venture Distributions | Share of profits/production from non-operated assets | Equity stakes in various producing fields | Diversifies income beyond wholly owned operations |

| Interest Income | Earnings on cash reserves and investments | Cash holdings, money market funds, short-term bonds | Minor but contributes to overall financial health, potentially boosted by higher 2024 interest rates |

Business Model Canvas Data Sources

The Horizon Business Model Canvas is constructed using a blend of market analysis, customer feedback, and internal operational data. This comprehensive approach ensures a robust and actionable strategic framework.