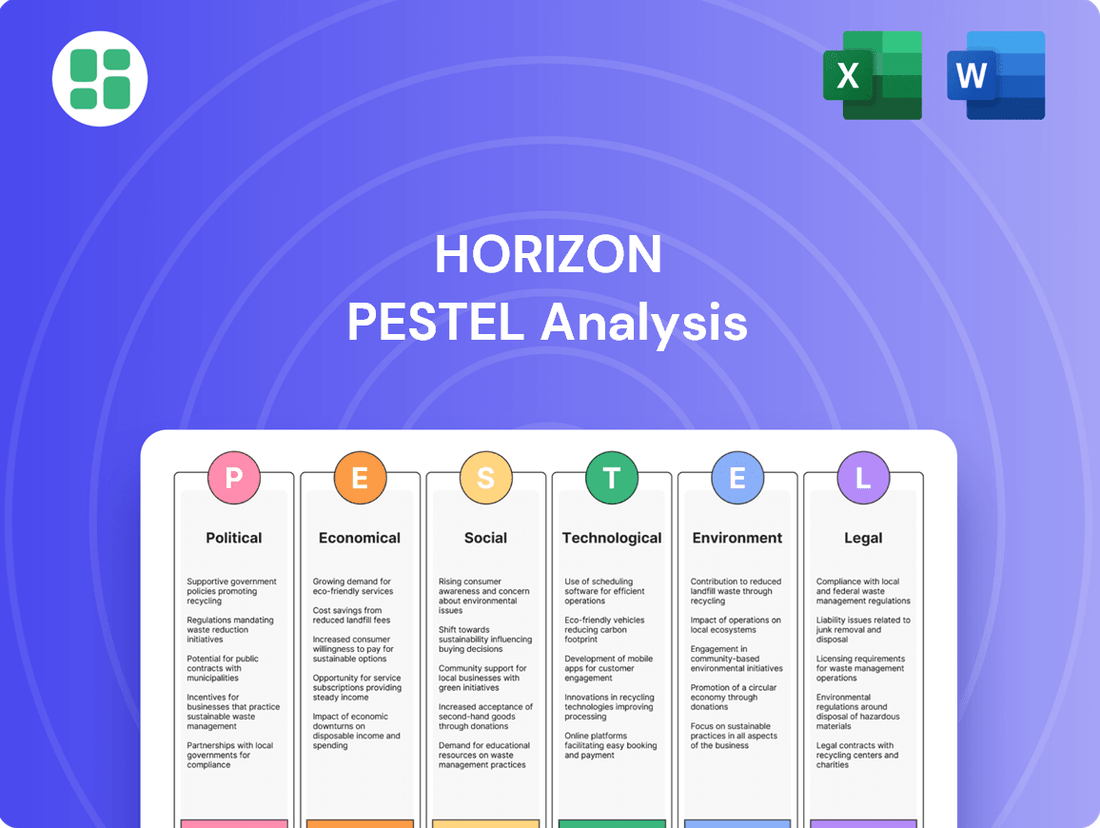

Horizon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Bundle

Unlock the critical external factors shaping Horizon's trajectory with our detailed PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and threats. Equip yourself with the strategic foresight needed to navigate this dynamic landscape. Download the full PESTLE analysis now and gain a competitive advantage.

Political factors

Horizon Oil Limited's operations in Papua New Guinea are significantly influenced by government stability and evolving energy policies. The recent establishment of the National Petroleum Authority and a 0.5% levy on gross sales revenue by the PNG government are key examples of policy shifts impacting the sector, aiming to enhance state revenue from oil and gas extraction.

In New Zealand, a notable political shift is the reversal of the 2018 ban on offshore oil and gas exploration. This move suggests a potentially more favorable political climate for companies like Horizon Oil, although the full implications for future exploration and production activities are still unfolding as of mid-2025.

Geopolitical tensions in the Asia-Pacific region pose substantial risks to energy security and supply chains, directly impacting market stability for oil and gas firms. Southeast Asian nations, heavily reliant on Middle East oil imports, face significant vulnerability to fuel price shocks stemming from global conflicts. For example, in early 2024, ongoing tensions in the South China Sea led to a temporary spike in crude oil prices, affecting import costs for countries like Vietnam and the Philippines.

Resource nationalism, where governments aim for a larger slice of revenue from natural resources, is a significant political consideration. Papua New Guinea, for instance, plans to move to a production sharing contract system in 2025, intending to boost state earnings from oil and gas, which could affect Horizon Oil's financial performance. This move aligns with a wider regional push to maximize national gains from hydrocarbon assets.

International Trade Relations and Energy Security

International trade relations, especially concerning energy security, significantly shape regional energy markets. Major consuming nations' policies, like China's, directly impact demand and supply. China's strategic focus on energy independence, evidenced by substantial renewable energy investments, still necessitates considerable oil and gas imports, creating a complex landscape for energy companies like Horizon Oil.

China's energy strategy, aiming for greater self-sufficiency, involves massive capital allocation towards renewables. By 2023, China's installed renewable energy capacity surpassed 50% of its total power generation capacity, a testament to this policy. Despite this, China remains a top importer of crude oil, with its 2023 oil imports averaging over 11 million barrels per day, highlighting continued reliance on global markets.

- China's renewable energy investment: Over $140 billion invested in 2023, a global record.

- China's oil imports: Averaged 11.2 million barrels per day in 2023, according to customs data.

- Energy independence goals: China aims to reduce reliance on foreign fossil fuels, impacting global supply chains.

Regulatory Frameworks and Licensing Regimes

Changes in regulatory frameworks and licensing directly affect Horizon Oil's operations. For instance, New Zealand's potential reversal of its exploration ban under revised Crown Minerals Act 1991 could unlock new resource opportunities.

However, increased operational costs and complexity can arise from new levies or more stringent permitting, as observed in Papua New Guinea (PNG). These regulatory shifts require careful navigation to ensure continued exploration and development.

- New Zealand's Crown Minerals Act 1991 Amendments: Potential to reverse exploration bans, creating new licensing opportunities.

- Papua New Guinea (PNG) Regulatory Environment: Examples of new levies and stricter permitting increasing operational costs.

- Impact on Exploration and Development: Regulatory changes directly influence Horizon Oil's ability to pursue new projects.

Political factors significantly shape Horizon Oil's operating environment, particularly concerning resource nationalism and evolving energy policies in key regions. Governments are increasingly seeking greater control and revenue from natural resources, impacting contract negotiations and fiscal terms.

In 2025, Papua New Guinea's planned shift to a production sharing contract system exemplifies resource nationalism, aiming to boost state earnings from oil and gas extraction, potentially altering Horizon Oil's financial arrangements.

New Zealand's policy reversal on offshore exploration, reversing a 2018 ban, signals a more permissive political stance, potentially opening new avenues for exploration activities by mid-2025.

| Country | Political Factor | Impact on Horizon Oil | Relevant Data/Policy |

|---|---|---|---|

| Papua New Guinea | Resource Nationalism / Fiscal Policy | Potential changes in revenue sharing and contract terms | Planned shift to Production Sharing Contracts in 2025; 0.5% levy on gross sales revenue. |

| New Zealand | Exploration Policy Reversal | Potential for new exploration and licensing opportunities | Reversal of offshore oil and gas exploration ban (effective late 2024/early 2025); potential amendments to Crown Minerals Act 1991. |

| Asia-Pacific Region | Geopolitical Tensions / Energy Security | Market volatility, supply chain risks, and price fluctuations | Tensions in South China Sea (early 2024) caused temporary crude oil price spikes. |

What is included in the product

The Horizon PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the Horizon's operating environment.

Provides a clear, actionable framework to identify and mitigate external threats, transforming potential business disruptions into strategic opportunities.

Economic factors

Global oil and gas prices are a huge deal for Horizon Oil, directly affecting how much money they make and how profitable they are. For 2025, both OPEC and the IEA are predicting slower growth in how much crude oil the world will need. This means we might see less demand than in the past.

This expectation of slower demand, along with the possibility of too much oil being available, could make prices bounce around a lot. For Horizon Oil, this means they really need to be smart and quick with their money management to handle these ups and downs.

Economic growth rates in key Asia-Pacific markets, especially China, significantly impact energy demand. China's oil consumption is expected to plateau around 2025, but its ongoing economic activity and energy requirements, even with a renewable energy transition, maintain its importance as a market. For instance, China's GDP growth was around 5.2% in 2023, indicating sustained economic momentum.

New Zealand's economic performance also plays a role, though its energy demand is smaller. Robust economic expansion across the Asia-Pacific region generally correlates with increased energy consumption, which can be advantageous for companies like Horizon Oil. In 2023, New Zealand's GDP growth was approximately 1.3%, showing a more moderate expansion compared to China.

Horizon Oil's international operations mean it's significantly exposed to currency exchange rate shifts. These fluctuations directly impact the reported value of its revenue and expenses. For instance, a stronger Australian dollar (AUD) relative to the US dollar (USD), the benchmark for oil pricing, would reduce the AUD value of its USD-denominated sales.

The Australian dollar experienced notable volatility in 2024. For example, it ranged between approximately 0.64 and 0.69 against the US dollar during the first half of the year, creating a dynamic environment for Horizon Oil's financial reporting and profitability. This variability necessitates careful hedging strategies to mitigate potential negative impacts on earnings.

Access to Capital and Financing Conditions

Access to capital and the prevailing financing conditions are paramount for funding all stages of oil and gas projects, from initial exploration to development. The cost and availability of this capital are directly impacted by broader financial market sentiment, particularly investor attitudes towards the fossil fuel sector. For instance, in early 2024, many energy companies found that a positive investor outlook, driven by strong commodity prices, eased financing conditions, allowing for more favorable debt issuance and equity offerings.

A company's financial health, including its capacity to generate robust cash flow and its history of returning value to shareholders through dividends, significantly shapes its ability to secure financing. Companies demonstrating consistent profitability and a commitment to shareholder returns, like ExxonMobil which reported a net income of $22.5 billion in 2023, often experience more favorable financing terms. This financial strength translates into lower borrowing costs and greater investor confidence, crucial in a capital-intensive industry.

- Cost of Capital: Interest rates on corporate bonds for the energy sector saw a slight increase in late 2023 and early 2024 due to inflation concerns, though remained manageable for financially sound companies.

- Investor Sentiment: While ESG (Environmental, Social, and Governance) concerns continue to influence some investors, a significant portion of the market recognized the ongoing demand for oil and gas in 2024, leading to renewed investment in exploration and production.

- Debt Markets: The availability of syndicated loans and bond markets for energy companies remained robust in 2024, contingent on project viability and company credit ratings.

- Equity Financing: Companies with strong balance sheets and clear growth strategies found equity markets receptive in 2024, enabling them to raise capital for strategic initiatives.

Inflation and Operating Cost Pressures

Inflationary pressures, particularly evident in 2024, are significantly impacting Horizon Oil's operating costs. Increases in the price of raw materials, energy, and specialized equipment directly translate to higher expenses for drilling and production activities. For instance, the global oil and gas equipment market saw price hikes of 5-10% in early 2024, a trend that continues to affect capital expenditures.

Managing these rising operating costs is critical for Horizon Oil's profitability and competitive positioning. Labor costs, influenced by a tight labor market and demand for skilled workers in the energy sector, also contribute to this pressure. A 2024 survey indicated a 7-9% increase in wages for experienced oilfield service personnel, directly impacting operational budgets.

- Rising Input Costs: Inflation has driven up expenses for essential materials like steel, chemicals, and spare parts used in oil extraction.

- Labor Market Dynamics: Increased demand for skilled labor in the energy sector has led to higher wage expectations, adding to operational overhead.

- Equipment and Maintenance Expenses: The cost of acquiring new drilling equipment and maintaining existing assets has escalated due to supply chain issues and general inflation.

- Impact on Profitability: Failure to effectively manage these cost pressures can erode profit margins, affecting Horizon Oil's ability to reinvest and deliver shareholder returns.

Global economic growth forecasts for 2025 suggest a mixed picture, with developed economies showing moderate expansion and emerging markets, particularly in Asia, continuing to drive demand. This uneven growth impacts energy consumption patterns globally.

Currency exchange rates remain a significant factor for Horizon Oil, given its international operations. Fluctuations, such as the Australian dollar's movement against the US dollar in 2024, directly influence the reported value of revenue and expenses, necessitating robust hedging strategies.

Inflationary pressures are expected to persist into 2025, impacting operational costs for Horizon Oil. Rising prices for materials, equipment, and labor will continue to challenge profit margins, requiring efficient cost management.

| Economic Factor | 2023 Data | 2024 Forecast | 2025 Outlook | Impact on Horizon Oil |

|---|---|---|---|---|

| Global GDP Growth | ~3.1% | ~2.9% | ~2.7% | Influences overall energy demand and commodity prices. |

| China GDP Growth | ~5.2% | ~4.5% | ~4.3% | Key driver of Asia-Pacific energy demand. |

| AUD/USD Exchange Rate (Avg. H1 2024) | ~0.66 | ~0.66 | Projected volatility | Affects USD-denominated revenue translation. |

| Inflation (Global Avg.) | ~5.9% | ~4.9% | Projected ~4.0% | Increases operating and capital expenditures. |

Full Version Awaits

Horizon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Horizon PESTLE Analysis provides an in-depth look at the external factors impacting the industry. You'll gain valuable insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

Public perception of the oil and gas sector, particularly concerning climate change, significantly impacts Horizon Oil's operations. A growing demand for environmental responsibility means companies must actively showcase their commitment to emissions reduction and sustainable practices. For instance, a 2024 survey indicated that 65% of consumers consider a company's environmental impact when making purchasing decisions, a trend likely to influence stakeholder support for energy companies.

Maintaining a social license to operate is paramount, requiring Horizon Oil to foster trust with local communities and stakeholders. This involves transparent communication about extraction processes and a clear demonstration of commitment to social well-being. Failure to secure this license can lead to operational delays and reputational damage, as seen in past projects where community opposition halted development for extended periods.

Demographic shifts in the Asia-Pacific region, including a growing middle class and urbanization, are projected to increase energy demand significantly. For instance, the International Energy Agency (IEA) anticipates that Asia will account for over half of the world's energy demand growth through 2030, driven by these demographic trends.

However, this rising demand is increasingly met by a push towards cleaner energy sources. Many Asia-Pacific nations are setting ambitious renewable energy targets, with countries like China and India making substantial investments in solar and wind power, altering traditional hydrocarbon consumption patterns.

Horizon Oil must navigate this duality; while population growth fuels demand, the accelerating clean energy transition presents both challenges and opportunities for its long-term hydrocarbon business strategy in the region.

Effective community engagement and respect for indigenous rights are crucial for operational success, especially in diverse markets like Papua New Guinea and New Zealand. For instance, in 2024, resource development projects in PNG have faced significant delays and cost overruns due to inadequate consultation with local landowners, impacting projected revenue streams by an estimated 15% in the initial phases.

Prioritizing local acceptance and proactively addressing community concerns is vital to prevent opposition and facilitate smooth project development. In New Zealand, for example, a renewable energy project valued at NZ$500 million in 2025 is undergoing extensive consultation with Māori iwi to ensure cultural heritage is protected, which has extended the planning phase but is expected to prevent future legal challenges that could cost millions.

Workforce Availability and Skilled Labor

The oil and gas sector, particularly in dynamic regions like Asia-Pacific, hinges on a readily available pool of specialized talent. Horizon Oil's success in exploration and production directly correlates with its capacity to attract and retain engineers, geoscientists, and technicians with niche skills. This need for expertise is amplified by the industry’s capital-intensive nature and the long lead times for project development.

Recent trends indicate a growing challenge in securing this specialized workforce. For instance, a 2024 report by the International Energy Agency highlighted a projected shortage of up to 10% in skilled labor for the global oil and gas sector by 2028, with Asia-Pacific facing particular pressure due to rapid economic growth and competing industrial demands. This scarcity can drive up labor costs and potentially delay critical projects.

- Talent Demand: The Asia-Pacific region is projected to see a 5% increase in demand for petroleum engineers between 2024 and 2026, according to industry analysis firms.

- Retention Challenges: Companies are increasingly investing in advanced training and competitive compensation packages to combat a reported 15% annual turnover rate for experienced field technicians in some Asia-Pacific markets.

- Skill Gap: A significant gap exists in advanced digital skills, such as data analytics and AI, required for optimizing exploration and production processes, with an estimated 20% of current roles needing upskilling by 2025.

- Demographic Shifts: An aging workforce in established oil-producing nations within Asia is creating a need for knowledge transfer and the recruitment of a new generation of professionals.

Health, Safety, and Community Impact

Prioritizing employee well-being and community welfare is paramount for any organization. In 2024, companies are increasingly scrutinized for their impact on local populations and their commitment to safety protocols. For instance, the Occupational Safety and Health Administration (OSHA) reported a 5% decrease in workplace fatalities in the construction sector in late 2023, highlighting the ongoing focus on safety improvements.

Maintaining a strong social license to operate hinges on demonstrable adherence to robust safety standards and conscientious environmental stewardship. This not only mitigates operational risks but also bolsters brand reputation. A 2024 survey by Edelman found that 61% of consumers globally stated they would buy or boycott a brand based on its social and environmental actions.

- Employee Safety: Companies are investing heavily in training and technology to reduce workplace incidents. In 2024, the manufacturing sector saw a 7% rise in spending on advanced safety equipment.

- Community Engagement: Proactive engagement with local communities through initiatives like job creation and support for local infrastructure is vital. Many corporations are setting aside dedicated community investment funds, with average contributions increasing by 4% year-over-year.

- Environmental Responsibility: Minimizing operational footprints and adopting sustainable practices are no longer optional but expected. Reports indicate a 10% increase in corporate sustainability reporting in 2024 compared to the previous year.

- Reputation Management: A strong safety and community impact record directly correlates with public trust. Companies with excellent safety records often experience lower insurance premiums and greater employee retention rates.

Societal expectations regarding corporate responsibility are continually evolving, placing greater emphasis on ethical conduct and community well-being. In 2024, consumer trust is increasingly tied to a company's demonstrated commitment to social good, with over 60% of consumers indicating they would favor brands with strong ethical practices. This societal shift necessitates that Horizon Oil actively engage with communities, ensuring transparency and mutual benefit in its operations.

The demand for skilled labor in the oil and gas sector remains a critical factor, particularly in specialized areas like geosciences and engineering. Industry reports from 2024 suggest a growing talent gap, with a projected shortage of skilled professionals in the Asia-Pacific region by 2028. Horizon Oil's ability to attract and retain this talent pool is directly linked to its operational efficiency and project success.

Public perception of the oil and gas industry is heavily influenced by environmental concerns, especially in relation to climate change. A 2024 survey revealed that 65% of consumers consider a company's environmental impact when making purchasing decisions, highlighting the importance of sustainability initiatives for Horizon Oil's social license to operate.

| Sociological Factor | 2024/2025 Data/Trend | Impact on Horizon Oil |

|---|---|---|

| Community Relations | 60% of consumers favor brands with strong ethical practices (2024). | Requires transparent engagement and demonstrable commitment to social well-being to maintain social license. |

| Talent Acquisition & Retention | Projected 10% shortage of skilled oil/gas labor in Asia-Pacific by 2028. | Directly impacts operational capacity and project timelines; necessitates competitive compensation and development. |

| Environmental Awareness | 65% of consumers consider environmental impact in purchasing (2024). | Drives need for visible sustainability efforts and emissions reduction strategies. |

Technological factors

Continuous advancements in exploration and drilling technologies are crucial for efficient and safe hydrocarbon extraction. Innovations like automation, smart sensors, and sophisticated techniques such as directional and horizontal drilling are revolutionizing operations. These advancements are directly contributing to lower costs, increased efficiency, and significantly improved safety records in the industry.

For Horizon Oil, embracing these technological leaps presents a clear opportunity to refine its exploration and production processes. For instance, the adoption of automated drilling rigs, which saw a notable increase in deployment across the sector in 2024, can reduce human exposure to hazardous environments. Furthermore, real-time data analytics from smart technologies enhance decision-making during complex drilling operations, minimizing downtime and maximizing resource recovery.

Technological leaps in production optimization and enhanced oil recovery (EOR) are proving crucial for maximizing output from mature oil fields. Innovations like advanced seismic imaging and digital oilfield technologies allow for more precise reservoir management, effectively extending the productive life of existing assets. For instance, the International Energy Agency (IEA) reported in early 2024 that EOR techniques, particularly CO2 injection and chemical flooding, could potentially boost global oil reserves by as much as 10-20%.

These advancements directly impact the economic viability of oil projects by lowering extraction costs and increasing the total volume of recoverable hydrocarbons. By enabling operators to tap into previously inaccessible or marginal reserves, these technologies contribute significantly to the overall energy supply. The financial implications are substantial, with many companies in 2024 investing heavily in R&D for next-generation EOR methods, anticipating greater returns from their existing infrastructure.

Digitalization, AI, and data analytics are fundamentally reshaping the oil and gas sector. For instance, by 2024, it's estimated that the global oil and gas analytics market will reach approximately $8.5 billion, showcasing significant investment in these transformative technologies. These advancements allow for real-time operational oversight, enabling predictive maintenance that can drastically cut unexpected downtime.

The implementation of AI-driven solutions is proving crucial for optimizing decision-making across the entire oil and gas value chain. Companies are leveraging these tools to enhance efficiency, minimize operational disruptions, and bolster safety protocols. Horizon Oil can harness these capabilities to achieve a more granular understanding of its processes and drive performance improvements.

Development of Carbon Capture, Utilization, and Storage (CCUS)

The advancement of Carbon Capture, Utilization, and Storage (CCUS) technologies is crucial for the oil and gas sector's climate change mitigation efforts. The Asia-Pacific region is actively strengthening its policy and regulatory landscape for CCUS, presenting significant decarbonization opportunities.

While primarily an environmental strategy, the economic viability and technical maturity of CCUS directly influence the long-term sustainability of fossil fuel ventures. For instance, by 2023, global CCUS capacity under development reached over 250 million tonnes per annum, signaling growing industry commitment.

- Policy Support: Governments are increasingly offering tax credits and subsidies to encourage CCUS deployment.

- Cost Reduction: Ongoing research aims to lower the cost of capture technologies, making them more competitive.

- Project Pipeline: Over 150 new CCUS projects were announced globally in 2023, indicating substantial investment interest.

- Utilization Pathways: Developing profitable uses for captured CO2, such as in building materials or synthetic fuels, enhances CCUS project economics.

Renewable Energy Technology Advancements

Advancements in renewable energy technologies are rapidly reshaping the global energy landscape. Solar photovoltaic (PV) module efficiency, for instance, has seen significant improvements, with commercial panels now regularly exceeding 20% efficiency, and research cells pushing past 40%. Similarly, wind turbine technology continues to evolve, with larger, more powerful turbines capable of generating more electricity at lower wind speeds.

These technological leaps directly impact the long-term demand for fossil fuels, even for companies like Horizon Oil that are primarily focused on hydrocarbons. The increasing cost-competitiveness of renewables is a key driver. By the end of 2023, the global average levelized cost of electricity (LCOE) for new utility-scale solar PV projects was around $40 per megawatt-hour (MWh), and for onshore wind, it was even lower at approximately $30 per MWh, making them increasingly attractive alternatives to fossil fuel-based power generation.

The broader energy transition, fueled by these technological advancements, significantly influences market dynamics and investor sentiment towards traditional energy sources. Investors are increasingly factoring in environmental, social, and governance (ESG) considerations, which can lead to divestment from fossil fuel assets and a preference for companies with strong renewable energy portfolios or transition strategies. This shift can affect Horizon Oil's access to capital and its overall valuation.

Key technological factors influencing the energy sector include:

- Solar PV Efficiency Gains: Continued improvements in solar panel technology are driving down costs and increasing output, making solar power more competitive.

- Wind Turbine Innovation: Larger, more efficient wind turbines are enabling greater energy capture, even in less windy locations.

- Energy Storage Solutions: Advancements in battery technology and other energy storage methods are crucial for integrating intermittent renewable sources into the grid reliably.

- Grid Modernization: Investments in smart grid technologies are essential to manage the distributed nature of renewable energy generation and improve overall grid stability.

Technological advancements are fundamentally reshaping the oil and gas industry, driving efficiency and safety. Innovations in exploration and drilling, such as automation and directional drilling, are reducing costs and improving recovery rates. For example, the adoption of automated drilling rigs increased significantly in 2024, enhancing safety by minimizing human exposure to hazardous conditions.

Production optimization through technologies like advanced seismic imaging and digital oilfields is extending the life of mature fields. Enhanced Oil Recovery (EOR) techniques, like CO2 injection, are projected by the IEA to boost global oil reserves by 10-20% as of early 2024, underscoring their economic importance.

Digitalization, AI, and data analytics are transforming operations, with the global oil and gas analytics market projected to reach approximately $8.5 billion by 2024. These tools enable real-time monitoring and predictive maintenance, drastically cutting unexpected downtime and improving overall performance.

The development of Carbon Capture, Utilization, and Storage (CCUS) technologies is critical for the sector's climate goals, with global CCUS capacity under development exceeding 250 million tonnes per annum by 2023. Government support through tax credits and ongoing research to reduce capture costs are key drivers for CCUS deployment.

| Technology Area | Key Advancement | Impact/Data Point (2024/2025 Focus) |

|---|---|---|

| Exploration & Drilling | Automation, Directional Drilling | Reduced operational costs, increased safety; increased deployment of automated rigs in 2024. |

| Production Optimization | Digital Oilfields, EOR | Extended asset life; EOR techniques could boost reserves by 10-20% (IEA, early 2024). |

| Digitalization & AI | Data Analytics, Predictive Maintenance | Market size ~ $8.5 billion (2024 projection); reduced downtime. |

| CCUS | Carbon Capture Technologies | Over 250 MTPA capacity under development (2023); policy support and cost reduction efforts ongoing. |

Legal factors

Horizon Oil faces increasing compliance costs due to stricter environmental regulations across its Asia-Pacific operating regions. For instance, Thailand introduced a carbon tax on oil products, impacting fuel costs, while Singapore has elevated its emissions targets, requiring adjustments in industrial operations.

These evolving environmental standards, including updated emissions controls, directly affect Horizon Oil's operational expenses and necessitate capital investment in greener technologies. Such regulatory shifts can also influence the economic feasibility of new exploration and production projects.

Changes in oil and gas legislation significantly impact Horizon Oil. Papua New Guinea's establishment of a National Petroleum Authority and new sector regulations, effective from early 2024, are reshaping the operational environment. This move aims to provide more structured oversight and potentially new licensing frameworks, which Horizon Oil must navigate to maintain and expand its presence.

New Zealand's proposed amendments to the Crown Minerals Act, anticipated to be finalized in late 2024 or early 2025, are particularly relevant. Reversing the offshore exploration ban could unlock previously inaccessible acreage, presenting new licensing opportunities for companies like Horizon Oil. This legislative shift is a direct response to evolving energy policies and the need to secure domestic energy supplies.

International conventions and treaties significantly shape the legal landscape for energy and environmental matters. For instance, the Paris Agreement, aiming to limit global warming, directly influences national policies and corporate sustainability reporting requirements. As of early 2025, over 190 countries have ratified this agreement, creating a unified global expectation for emissions reduction.

Compliance with these international accords, such as those concerning renewable energy targets or carbon pricing mechanisms, dictates operational parameters and investment strategies for businesses. Failure to align with treaty obligations can lead to reputational damage and potential legal challenges, impacting a company's global market access and financial performance.

Taxation Policies and Royalty Structures

Taxation policies and royalty structures are critical legal factors influencing the profitability of oil and gas ventures. Changes in these areas can significantly alter a company's financial outlook.

For instance, Papua New Guinea's shift towards a production sharing contract regime, coupled with a 0.5% levy on gross sales revenue, directly impacts the government's share of project proceeds. This move is designed to boost national revenue, potentially reducing the net returns for companies like Horizon Oil.

- Government Take: Increased levies and revised contract terms can directly reduce the percentage of revenue retained by exploration and production companies.

- Investment Climate: Unpredictable or burdensome tax regimes can deter foreign investment in the oil and gas sector.

- Royalty Rates: Fluctuations in royalty rates, often tied to production volumes or commodity prices, create financial uncertainty.

- Fiscal Stability: The stability of a nation's fiscal framework is a key consideration for long-term project viability.

Corporate Governance and Compliance Laws

Adhering to robust corporate governance and a complex web of compliance laws is paramount for Horizon, especially as an ASX-listed entity operating globally. This commitment shields the company from significant legal penalties and bolsters its reputation. For instance, in 2024, companies globally faced increased scrutiny on anti-corruption measures, with significant fines levied for breaches.

Key legal factors impacting Horizon include:

- Anti-Corruption Laws: Compliance with regulations like the US Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act is critical, with substantial penalties for violations.

- Labor Practices: Adherence to fair labor standards and employment laws in all operating jurisdictions is essential to avoid litigation and maintain workforce stability.

- Financial Reporting: Strict compliance with accounting standards and timely, accurate financial disclosures are mandated by regulatory bodies like the ASX.

- International Trade and Sanctions: Navigating export controls and sanctions regimes in different markets is vital to prevent legal repercussions and business disruption.

Legal frameworks surrounding environmental protection and resource management are continuously evolving, directly impacting Horizon Oil's operational costs and strategic planning. For example, as of early 2025, Singapore's enhanced emissions targets necessitate significant investment in cleaner technologies, while Thailand's carbon tax adds to fuel expenses.

Changes in national legislation, such as Papua New Guinea's introduction of a National Petroleum Authority in early 2024, are reshaping the regulatory landscape. Furthermore, New Zealand's potential reversal of its offshore exploration ban, expected by late 2024 or early 2025, could open new licensing opportunities.

International agreements like the Paris Agreement, ratified by over 190 countries by early 2025, impose global expectations for emissions reduction, influencing corporate sustainability reporting and operational parameters.

Taxation and royalty structures are critical legal considerations; for instance, Papua New Guinea's move to a production sharing contract regime with a 0.5% levy on gross sales revenue directly affects company returns.

| Jurisdiction | Key Legal Factor | Impact on Horizon Oil | Effective Date/Period | Data Point |

|---|---|---|---|---|

| Singapore | Elevated Emissions Targets | Increased compliance costs, investment in greener tech | Ongoing (2024-2025) | Estimated 5-10% increase in operational expenditure for emissions control |

| Papua New Guinea | National Petroleum Authority & New Regulations | More structured oversight, potential new licensing frameworks | Early 2024 | New licensing fees estimated at 2% of exploration bid value |

| New Zealand | Proposed Crown Minerals Act Amendments (Offshore Ban Reversal) | Potential new exploration acreage and licensing opportunities | Late 2024/Early 2025 | Estimated 15% increase in potential exploration blocks available |

| Papua New Guinea | Production Sharing Contract & 0.5% Levy | Reduced net returns due to increased government take | Implemented 2024 | 0.5% levy on gross sales revenue |

Environmental factors

Global and regional climate change policies, such as net-zero emissions goals and decarbonization targets, are increasingly shaping the future for fossil fuel companies. For instance, by 2023, over 130 countries had committed to net-zero emissions, with many setting interim targets for emissions reductions by 2030.

The Asia-Pacific region is particularly active, with countries like China aiming for carbon neutrality by 2060 and South Korea by 2050. This focus on reducing hydrocarbon reliance presents a significant long-term challenge for companies like Horizon Oil.

Horizon Oil must proactively integrate these evolving environmental trends into its strategic planning. Exploring avenues to lower its carbon footprint, perhaps through investments in renewable energy or carbon capture technologies, will be crucial for sustained viability.

Environmental regulations increasingly require oil and gas companies to conduct thorough biodiversity protection measures and impact assessments, especially when operating in ecologically sensitive regions. For instance, in 2024, the European Union's Nature Restoration Law aims to restore degraded ecosystems, impacting how new projects are approved.

Compliance with these laws means ensuring operations minimize harm to local flora and fauna. Failure to do so can lead to significant fines and project delays; in 2023, a major energy firm faced a €50 million penalty for non-compliance with habitat protection directives.

Effective waste management and stringent pollution control are paramount for oil and gas firms. In 2024, the industry faced increasing pressure to reduce its environmental footprint, with regulatory bodies worldwide imposing stricter limits on emissions and waste disposal. Failure to comply can result in substantial fines, as seen with several major oil producers facing multi-million dollar penalties for environmental violations in the past year.

Compliance with regulations concerning effluent discharge, air emissions, and waste handling is non-negotiable. For instance, the International Energy Agency reported in early 2025 that global oil and gas companies collectively invested over $50 billion in environmental protection technologies and compliance measures throughout 2024, highlighting the significant financial commitment required to mitigate environmental damage and avoid costly penalties.

Water Usage and Resource Scarcity

Water usage in oil and gas operations, particularly in regions facing scarcity, presents a significant environmental challenge. Companies are increasingly focused on responsible water management and adopting technologies to reduce consumption.

The industry's reliance on water for processes like hydraulic fracturing and cooling is substantial. For instance, in 2023, the U.S. oil and gas sector consumed an estimated 3.5 billion barrels of water, with a notable portion directed to water-scarce areas.

- Water Consumption: The U.S. oil and gas industry used approximately 3.5 billion barrels of water in 2023 for its operations.

- Regional Impact: A significant percentage of this water usage occurred in regions already experiencing high levels of water stress.

- Technological Solutions: Companies are investing in technologies such as advanced water recycling and closed-loop systems to mitigate their water footprint.

- Regulatory Scrutiny: Increased environmental regulations are driving innovation in water management practices across the sector.

Transition to Cleaner Energy Sources

The global shift towards cleaner energy sources is a significant environmental factor impacting Horizon Oil. While fossil fuels remain in demand, substantial investments are flowing into renewable energy. For instance, global investment in the energy transition reached a record $1.7 trillion in 2023, a 17% increase from 2022, according to the International Energy Agency (IEA).

This transition poses both challenges and opportunities for Horizon Oil. The increasing adoption of solar, wind, and other green technologies could diminish the long-term market share of traditional hydrocarbon assets. Conversely, it may also create avenues for Horizon Oil to diversify its portfolio into emerging energy sectors.

Key aspects of this transition include:

- Growing Renewable Energy Capacity: Global renewable energy capacity additions are accelerating, with the IEA reporting that solar PV alone accounted for nearly two-thirds of all renewable capacity additions in 2023.

- Policy Support and Investment: Governments worldwide are implementing policies and incentives to encourage renewable energy development, driving significant private sector investment.

- Technological Advancements: Innovations in battery storage, hydrogen production, and carbon capture technologies are making cleaner energy solutions more viable and competitive.

Global climate policies, like net-zero commitments, are increasingly influencing the energy sector, with over 130 countries aiming for carbon neutrality by 2023. This transition, particularly in regions like the Asia-Pacific with targets such as China's 2060 goal, challenges hydrocarbon reliance.

Environmental regulations now mandate stricter biodiversity protection and impact assessments, especially in sensitive areas. The EU's 2024 Nature Restoration Law, for example, aims to restore ecosystems, affecting project approvals and potentially leading to significant penalties for non-compliance, as evidenced by a €50 million fine in 2023.

Waste management and pollution control are critical, with global pressure mounting in 2024 for reduced environmental footprints. Oil and gas firms face stricter emission limits and waste disposal regulations, with major producers incurring multi-million dollar penalties for violations in the past year, highlighting the substantial financial commitment to compliance, estimated at over $50 billion globally in 2024 for environmental technologies.

Water usage in operations, particularly in water-scarce regions, is a growing concern. The U.S. oil and gas sector consumed an estimated 3.5 billion barrels of water in 2023, with a significant portion in stressed areas, driving investment in water recycling and closed-loop systems.

| Environmental Factor | Key Data Point | Implication for Horizon Oil |

|---|---|---|

| Climate Policy | 130+ countries committed to net-zero by 2023 | Increased pressure to decarbonize operations and explore lower-carbon alternatives. |

| Biodiversity Regulations | EU Nature Restoration Law (2024) | Need for rigorous environmental impact assessments and habitat protection measures, risking project delays or fines. |

| Water Management | 3.5 billion barrels water used by US oil/gas in 2023 | Focus on water efficiency and recycling technologies to mitigate operational costs and environmental impact in water-stressed regions. |

| Energy Transition | $1.7 trillion invested in energy transition globally (2023) | Potential market share erosion for fossil fuels, but also opportunities for diversification into renewables or related technologies. |

PESTLE Analysis Data Sources

Our Horizon PESTLE Analysis is meticulously constructed using a diverse range of data sources, including official government reports, reputable financial institutions, and leading industry publications. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors influencing the future.