Horizon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Bundle

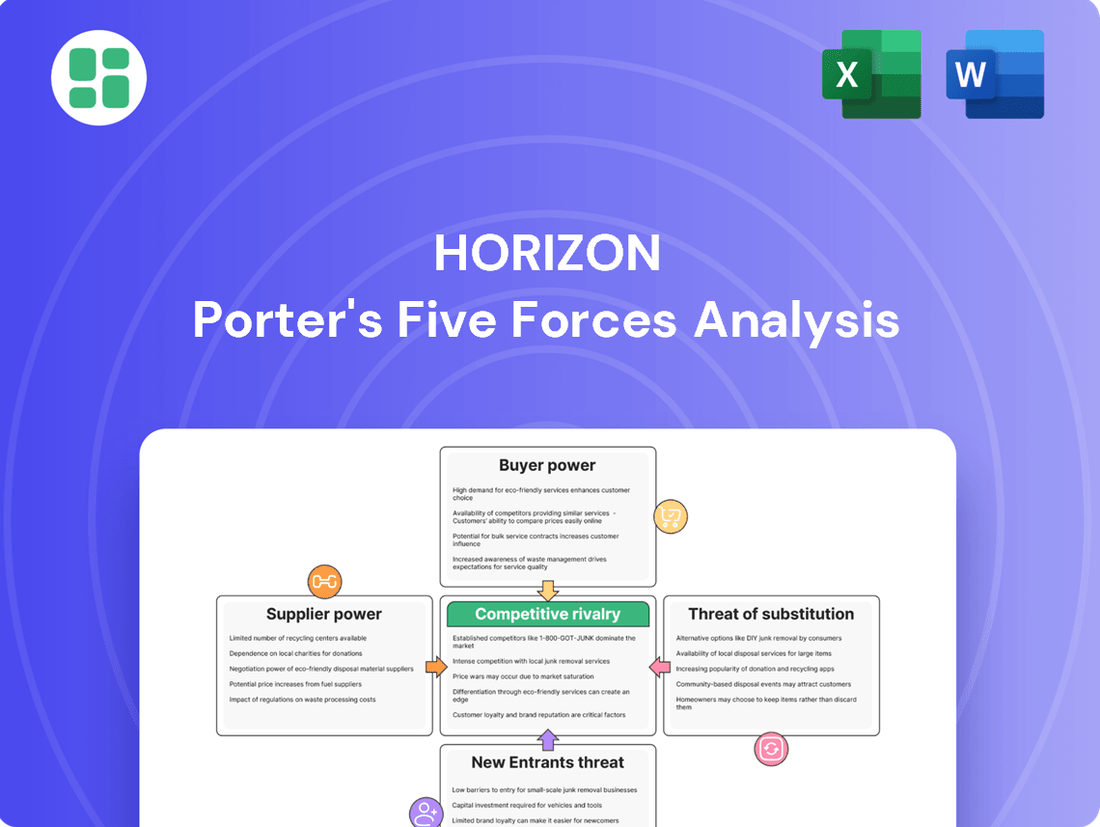

Horizon's competitive landscape is shaped by five key forces: the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for any business operating within or looking to enter Horizon's market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Horizon’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Horizon Oil, operating in the upstream oil and gas sector, faces significant bargaining power from specialized equipment and IoT sensor manufacturers. This reliance on a concentrated group of technology providers means fewer alternatives for essential, high-quality hardware components.

The global IoT sensor market, a critical area for upstream operations, is expected to reach $60 billion by 2026. This robust growth underscores the high demand for advanced solutions, granting these suppliers considerable pricing leverage over exploration and production companies like Horizon Oil.

Access to a highly skilled workforce, including geologists, engineers, and drilling specialists, is critical in oil and gas exploration and production. These specialized human resources, particularly in remote or challenging operating environments, can command significant wages and benefits.

The scarcity of such expertise can increase the bargaining power of the labor pool. For instance, in 2024, the average salary for a petroleum engineer in Australia, where Horizon Oil operates, was approximately AUD 150,000, reflecting the demand for specialized skills.

This scarcity impacts operational costs for companies like Horizon Oil, as they must compete to attract and retain top talent. The ability of skilled labor to negotiate favorable terms can therefore significantly influence the profitability and operational efficiency of exploration and production activities.

Drilling and well services contractors hold significant sway due to the high capital investment and specialized expertise required for their services. This specialization means fewer companies can offer these critical functions, giving them leverage in negotiations.

Horizon Oil's reliance on these contractors for its early 2025 infill drilling in China's Block 22/12 underscores this dependency. The availability and cost of these specialized services directly impact Horizon's project schedules and overall financial outcomes.

Logistics and Infrastructure Providers

Horizon Oil's reliance on logistics and infrastructure providers in regions like Papua New Guinea, China, and New Zealand highlights a key area of supplier bargaining power. When infrastructure is limited or underdeveloped, these suppliers can command higher prices or restrict access to essential services. For instance, in 2024, the ongoing discussions in New Zealand regarding energy security and the potential streamlining of regulations for LNG import facilities underscore the critical role of infrastructure development and the leverage held by those who control it.

- Limited Infrastructure: Regions with sparse or aging logistics networks grant significant power to existing providers.

- Essential Services: The need for specialized transport and handling of hydrocarbons means few alternatives exist for Horizon Oil.

- Regulatory Environment: Government policies impacting infrastructure, such as those in New Zealand, can amplify supplier influence.

Government Regulations and Licensing Bodies

Governments across the Asia-Pacific region wield significant influence as suppliers of crucial exploration and production licenses and regulatory approvals. Their policy decisions, such as New Zealand's 2023 decision to lift its offshore oil and gas exploration ban, directly shape the operational landscape and associated costs for energy companies. This move aimed to bolster investor confidence and unlock new energy resources.

These regulatory actions have a tangible impact on companies like Horizon Oil. For instance, changes in taxation, environmental standards, or licensing fees can dramatically alter project feasibility and introduce substantial compliance costs. In 2024, the energy sector globally experienced increased scrutiny on environmental, social, and governance (ESG) factors, leading to more stringent regulatory frameworks in many Asia-Pacific nations.

- Government as a Supplier: Governments grant essential licenses and approvals, acting as a critical supplier to the energy industry.

- Policy Impact: Regulatory shifts, like New Zealand's exploration ban reversal, directly affect operational viability and investor sentiment.

- Cost Implications: Evolving environmental standards and tax regimes in 2024 have increased compliance burdens and project expenses for companies operating in the region.

Suppliers of specialized equipment and critical services, like drilling contractors, possess significant bargaining power when alternatives are scarce and their offerings are essential for operations. This leverage can lead to higher costs and influence project timelines for companies such as Horizon Oil.

The high capital investment and specialized expertise required for services such as drilling and well completion mean that the pool of capable suppliers is limited. This concentration of expertise grants these suppliers considerable pricing power, directly impacting the profitability of exploration and production activities.

Governments also act as powerful suppliers by granting exploration licenses and regulatory approvals. Their policy decisions, including changes in taxation and environmental standards, can significantly alter operational costs and feasibility for companies in the sector.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Horizon Oil | Example Data (2024) |

|---|---|---|---|

| Specialized Equipment Manufacturers (IoT) | Concentration of providers, high demand, technological sophistication | Higher component costs, potential supply chain delays | Global IoT sensor market projected to reach $60 billion by 2026 |

| Drilling & Well Services Contractors | High capital investment, specialized expertise, limited alternatives | Increased project costs, impact on drilling schedules | Average petroleum engineer salary in Australia: ~AUD 150,000 |

| Governments (Licenses & Regulations) | Control over resource access, policy changes, ESG scrutiny | Compliance costs, project viability, operational restrictions | Increased ESG focus globally impacting regulatory frameworks |

What is included in the product

This analysis dissects the competitive forces impacting Horizon, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force.

Gain immediate clarity on market vulnerabilities and opportunities with a dynamic, interactive analysis.

Customers Bargaining Power

Horizon Oil's customers, primarily refiners and industrial users, face a market where crude oil and natural gas are globally traded commodities. Prices are largely set by international benchmarks, such as Brent crude, which saw stability between US$74 and US$90 per barrel in 2024. This means individual buyers have minimal power to negotiate prices down with Horizon Oil.

The bargaining power of these customers is significantly constrained by the commodity nature of Horizon's products. Their purchasing decisions are influenced more by global supply-demand balances, geopolitical events, and overarching macroeconomic trends rather than their individual leverage over Horizon Oil.

Horizon Oil's customers, primarily large energy utility companies, refiners, and trading houses, buy substantial quantities of oil and gas. This scale gives these buyers some negotiating power, especially when discussing long-term supply agreements or specific delivery conditions.

While oil and gas are commodities, the sheer size of these purchasers means they can influence pricing and contract terms. For instance, China's crude oil imports are expected to see a modest 1% increase in 2025, highlighting the significant demand from major global consumers and their potential to exert leverage.

The growing shift towards sustainability is empowering customers, increasing their bargaining power. As renewable energy sources become more viable, consumers have more choices, which can put pressure on traditional energy providers.

By 2050, fossil fuels will still be important, but renewables are gaining ground. For instance, China is a major player in electric vehicle adoption, which directly impacts demand for traditional fuels and strengthens customer leverage.

Regional Market Dynamics and Energy Security

In certain regional markets, local supply-demand conditions and government energy security objectives can significantly shift buyer power. For example, in New Zealand, a notable decline in domestic natural gas production has heightened concerns about energy shortages. This situation, with production dropping by 12.5% in 2023 and continuing into early 2024, can increase the urgency for gas supply, thereby influencing contractual terms and empowering buyers in the local market.

The bargaining power of customers is influenced by these regional dynamics. When local supply becomes constrained, buyers might have less leverage, especially if alternative energy sources are limited or costly. This can lead to less favorable contract terms for customers, as suppliers face less pressure to compete on price or service due to guaranteed demand driven by security concerns.

- Regional Supply-Demand Imbalances: Local production issues, like New Zealand's natural gas output decline, can reduce buyer leverage.

- Government Energy Security Priorities: National strategies to ensure energy availability can override market forces, potentially strengthening supplier positions.

- Impact on Contractual Terms: Urgency for supply in shortage-prone regions can lead to less favorable terms for buyers.

- Limited Alternative Sources: The availability and cost of alternative energy options directly impact how much power customers wield.

Customer Diversification and Portfolio Management

Horizon Oil's strategy of diversifying its customer base and managing its asset portfolio across diverse regions like Papua New Guinea, China, and New Zealand is crucial in reducing the leverage any single customer holds. This geographic and market spread allows the company to absorb the impact of changes in demand or pricing from one area by leveraging its presence in others.

The company's proactive approach to managing its sales channels is evident in its strategic decisions, such as re-marketing gas production slated to commence in 2028 following the lapse of a previous gas supply agreement. This move showcases Horizon Oil's commitment to optimizing its revenue streams and maintaining flexibility in its customer relationships.

- Geographic Diversification: Operations in Papua New Guinea, China, and New Zealand reduce reliance on any single market.

- Asset Portfolio Management: Balancing different types of energy assets can smooth out revenue volatility.

- Contract Renegotiation/Re-marketing: Proactive management of supply agreements, like the 2028 gas production re-marketing, directly addresses potential customer power shifts.

- Customer Relationship Management: Building relationships across multiple customer segments limits the ability of any one customer to dictate terms.

Horizon Oil's customers, primarily large refiners and industrial users, generally have limited bargaining power due to the commodity nature of oil and gas. Global price benchmarks, like Brent crude which averaged around US$80 per barrel in early 2024, dictate terms more than individual buyer leverage.

However, significant buyers can exert influence, especially on long-term contracts. For instance, major importers like China, whose crude oil imports were projected to increase by 1% in 2025, possess considerable sway due to their sheer demand volume.

The growing emphasis on sustainability also empowers customers, as alternative energy sources become more prevalent, potentially reducing reliance on traditional fossil fuels and increasing buyer leverage.

Regional supply-demand dynamics can also shift power. In New Zealand, a 12.5% drop in natural gas production during 2023, continuing into 2024, has created supply concerns, potentially strengthening the bargaining position of buyers in that specific market.

| Factor | Impact on Customer Bargaining Power | Example/Data Point (2024/2025) |

|---|---|---|

| Commodity Nature of Product | Lowers power | Brent crude prices stable between US$74-US$90/barrel in 2024 |

| Buyer Scale | Increases power (for large buyers) | China's crude oil imports projected 1% increase in 2025 |

| Sustainability Trends | Increases power | Growing EV adoption impacting fossil fuel demand |

| Regional Supply Constraints | Can increase power (for buyers) | New Zealand natural gas production down 12.5% in 2023 |

Preview the Actual Deliverable

Horizon Porter's Five Forces Analysis

The document you see here is the complete, ready-to-use Horizon Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. What you're previewing is precisely the same professionally formatted analysis that will be available to you instantly after completing your purchase. This ensures you receive the exact, high-quality content you need for your strategic decision-making without any discrepancies or placeholder information.

Rivalry Among Competitors

The Asia-Pacific oil and gas exploration and production (E&P) landscape features a dynamic mix of major international oil companies (IOCs) and numerous smaller, independent operators, including firms like Horizon Oil. This diverse competitive environment significantly heightens rivalry as entities compete fiercely for prime exploration licenses and development prospects across the region.

In 2024, the pursuit of new reserves and production assets remains intense, with companies like Shell, ExxonMobil, and Chevron actively participating alongside regional players. This competition is further fueled by fluctuating oil prices and the ongoing energy transition, which creates both opportunities and challenges for market share acquisition.

The oil and gas sector is characterized by immense upfront capital requirements for exploration, drilling, and infrastructure, resulting in very high fixed costs. These substantial sunk costs act as significant exit barriers.

Because companies have so much invested, they are compelled to keep operating and generating revenue, even in challenging market conditions. This pressure to maintain production and cash flow intensifies competition among existing players.

Indeed, the industry's capital expenditures saw a notable increase of 53% over the past four years, underscoring the ongoing commitment to these high-cost assets and the resulting pressure to compete fiercely.

In the oil and gas sector, products are largely undifferentiated commodities, meaning competition frequently centers on price. Horizon Oil, like its peers, must prioritize cost efficiency, optimize production processes, and ensure robust reserve replacement to maintain its competitive edge.

The market dynamics in 2024, with Brent crude oil prices fluctuating between US$74 and US$90 per barrel, underscore a highly competitive pricing landscape. This environment necessitates a sharp focus on operational efficiency as a primary driver for success and profitability.

Exploration Success and Reserve Replacement

The competitive rivalry in the oil and gas sector is significantly shaped by the imperative for exploration success and reserve replacement. Companies must continually find and develop new resources to counteract the natural decline of existing fields and secure their future operations. This drive is evident in Horizon Oil's strategic emphasis on appraisal and development activities.

Horizon Oil's commitment to this area is demonstrated by concrete actions. For instance, a successful four-well infill drilling campaign was completed in the first half of fiscal year 2025. Furthermore, the company commenced a new infill drilling operation in Block 22/12 in 2025. These initiatives directly address the industry's competitive need to boost production and preserve the value of their asset base.

- Exploration Success: The ability to discover commercially viable new reserves is a key differentiator.

- Reserve Replacement Ratio: Maintaining a ratio above 100% is crucial for long-term sustainability and investor confidence.

- Field Decline Management: Offsetting natural production declines from mature fields necessitates continuous investment in new development.

- Appraisal and Development Focus: Horizon Oil's strategy highlights the importance of bringing discovered resources to production efficiently.

Geopolitical Factors and Regulatory Environment

Geopolitical shifts and evolving regulations profoundly influence competitive dynamics. For instance, New Zealand's 2024 decision to lift its ban on offshore oil and gas exploration potentially broadens the competitive field by encouraging new entrants and stimulating domestic activity. This policy change directly impacts the industry's structure, creating new opportunities while also intensifying competition among existing and prospective players.

Conversely, political instability and security concerns can act as significant deterrents, shaping the competitive landscape by limiting operational scope and investment. Papua New Guinea's ongoing security challenges serve as a prime example, potentially reducing the number of active competitors and impacting the overall attractiveness of the market for new investments.

- Policy Impact: New Zealand's 2024 offshore exploration ban reversal is expected to increase competition.

- Risk Mitigation: Political instability in regions like Papua New Guinea can deter investment, reducing the number of competitors.

- Regulatory Influence: Government policies directly shape market entry and operational strategies for all players.

Intense competition characterizes the Asia-Pacific oil and gas E&P sector, driven by high capital intensity and undifferentiated products. Companies like Horizon Oil face pressure to constantly secure new reserves and manage production declines, with 2024 seeing significant capital expenditure increases across the industry, reflecting this drive.

| Metric | 2023 Value (Approx.) | 2024 Projection/Trend | Impact on Rivalry |

|---|---|---|---|

| Industry CapEx Growth | ~10% YoY | Continued growth, potentially >15% | Increased investment fuels competition for assets and talent. |

| Brent Crude Price Range (2024) | US$74-US$90/bbl | Volatile, with potential for upward pressure | Price fluctuations necessitate cost leadership and efficiency gains. |

| Reserve Replacement Ratio Goal | >100% | Key focus for all players | Drives aggressive exploration and development activity. |

SSubstitutes Threaten

The most substantial long-term threat of substitutes for traditional energy sources stems from the rapid advancement and adoption of renewable energy. Solar, wind, and hydropower are increasingly cost-competitive and environmentally attractive alternatives.

Renewable energy's growing market share is a clear indicator of this threat, with renewables making up 29% of global electricity generation in 2022. This trend suggests a diminishing long-term demand for fossil fuels as these cleaner options capture a larger portion of the energy market.

The burgeoning electric vehicle (EV) market presents a significant threat of substitution for traditional gasoline and diesel-powered vehicles. This shift directly impacts the demand for oil and gas, particularly in the transportation sector. For instance, China's EV sales exceeded internal combustion engine vehicle sales for the first time in 2024, a clear indicator of this substitution trend.

Furthermore, government policies, such as those doubling EV subsidies in certain markets, accelerate this transition. This increased adoption of EVs, coupled with broader energy efficiency gains across industries, effectively erodes the market share and future demand for fossil fuels used in transportation, thereby posing a substantial threat to oil and gas companies.

Governments worldwide are increasingly implementing policies to combat climate change, directly impacting industries reliant on traditional energy sources. For instance, the European Union's Fit for 55 package aims to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, spurring the adoption of renewable energy and electric vehicles.

These decarbonization goals translate into tangible support for alternative energy technologies, making them more competitive. In 2024, global investment in the energy transition reached an estimated $2 trillion, a significant portion of which flowed into solar, wind, and battery storage, thereby strengthening the threat of substitutes for fossil fuels.

Furthermore, mandates for energy efficiency and the phasing out of internal combustion engine vehicles in various countries by the mid-2030s create a clear and accelerating market shift. This policy-driven demand for cleaner alternatives directly erodes the market share and profitability potential of industries offering conventional, carbon-intensive products.

Technological Advancements in Alternatives

Ongoing technological advancements are significantly boosting the efficiency and affordability of alternative energy sources. Innovations in battery storage, for instance, are making intermittent renewables like solar and wind more reliable. By 2024, the global energy storage market was projected to reach hundreds of billions of dollars, reflecting substantial investment and progress.

These advancements directly challenge traditional energy sectors by making substitutes more competitive. Developments in non-conventional drilling, such as enhanced geothermal systems, are also expanding the viability of alternative energy production. This escalating technological maturity means demand for established energy sources could decline more rapidly than previously anticipated.

- Increased Efficiency: Solar panel efficiency has steadily climbed, with commercial panels exceeding 22% efficiency in 2024.

- Reduced Costs: The levelized cost of electricity for solar PV fell by over 80% between 2010 and 2023.

- Scalability: Innovations in grid infrastructure and smart grid technologies are enabling greater integration of renewable energy at scale.

- Battery Storage: Lithium-ion battery costs have decreased by approximately 90% since 2010, making grid-scale storage more economically feasible.

Public Perception and ESG Pressures

Growing public awareness and increasing pressure from environmental, social, and governance (ESG) factors are significantly influencing investment decisions and consumer preferences, leading to a noticeable shift away from fossil fuels. This trend directly impacts the threat of substitutes for oil and gas companies.

Oil and gas firms are confronting substantial reputational risks and mounting calls for divestment from new exploration projects. For instance, the global sustainable investment market reached an estimated $35.3 trillion in 2024, with a significant portion actively avoiding fossil fuel assets. This diversion of capital and talent towards cleaner energy alternatives directly challenges the long-term viability of hydrocarbon-focused businesses.

- ESG Investment Growth: Global ESG assets are projected to surpass $50 trillion by 2025, indicating a strong investor preference for sustainable options.

- Renewable Energy Adoption: Renewable energy sources accounted for over 80% of new global power capacity additions in 2023, demonstrating a clear substitution trend.

- Divestment Campaigns: Major institutional investors, managing trillions in assets, have committed to divesting from fossil fuel companies, further limiting capital availability.

- Consumer Behavior Shifts: Consumer demand for electric vehicles and sustainable products is rising, directly impacting the market share of traditional petroleum-based goods.

The threat of substitutes is amplified by technological advancements that make alternatives more efficient and cost-effective. For example, the levelized cost of electricity for solar PV has dropped by over 80% since 2010, and lithium-ion battery costs have seen a similar steep decline. These improvements are making renewable energy sources increasingly competitive against traditional power generation.

Government policies and growing public demand for sustainability are also accelerating the adoption of substitutes. Initiatives like the EU's Fit for 55 package and the global rise in ESG investing, which surpassed $35.3 trillion in 2024, are channeling capital and consumer preference towards cleaner alternatives, directly impacting industries reliant on fossil fuels.

The burgeoning electric vehicle market is a prime example of substitution, with China's EV sales surpassing traditional vehicle sales in 2024. This trend, supported by government subsidies and increasing consumer adoption, directly erodes the demand for gasoline and diesel, posing a significant threat to the automotive and oil industries.

| Technology | Efficiency Improvement (2010-2024) | Cost Reduction (2010-2024) | Market Penetration Indicator |

|---|---|---|---|

| Solar PV | Steady increase, panels exceeding 22% efficiency | Over 80% reduction in Levelized Cost of Electricity | 29% of global electricity generation (2022) |

| Lithium-ion Batteries | Significant advancements in energy density and lifespan | Approximately 90% cost reduction | Enabling grid-scale storage viability |

| Electric Vehicles (EVs) | Increased range and charging speed | Decreasing battery costs, comparable running costs | China EV sales surpassed ICE sales (2024) |

Entrants Threaten

The oil and gas exploration and production sector presents a formidable barrier to new entrants due to its exceptionally high capital requirements. Companies venturing into this industry must be prepared for massive upfront investments, often running into billions of dollars, for exploration activities, drilling operations, and the development of essential infrastructure. For instance, a single offshore oil platform can cost upwards of $1 billion to construct and deploy.

These substantial financial hurdles significantly limit the threat of new entrants. Potential newcomers find it exceedingly difficult to secure the necessary funding to compete with established players who already possess the capital, expertise, and operational scale. In 2024, the average cost for drilling a single oil well in the United States, depending on depth and location, could range from $1 million to $10 million, further underscoring the capital intensity.

A significant hurdle for new companies entering the oil and gas sector is the difficulty in securing access to proven reserves and promising exploration acreage. Established players, such as Horizon Oil, already possess interests in numerous permits and production licenses, giving them a substantial advantage.

The global landscape of hydrocarbon reserves is largely dominated by national oil companies, which often maintain tight control over commercially viable assets. This concentration of resources makes it exceptionally challenging for new entrants to acquire the necessary land and reserves to establish a competitive presence.

The oil and gas industry presents significant barriers to entry due to stringent regulatory requirements and complex licensing procedures. For instance, obtaining the necessary permits, environmental clearances, and operational licenses can be an arduous and lengthy undertaking, often requiring specialized knowledge and considerable investment. In 2024, the average time to secure all necessary approvals for new upstream oil and gas projects in countries like Australia was estimated to be over 18 months, a testament to the bureaucratic labyrinth new players must navigate.

Technological Expertise and Operational Complexity

The oil and gas sector presents a significant barrier to entry due to the immense technological expertise and operational complexity required. Successful exploration and production (E&P) demand highly specialized engineering skills, advanced drilling technologies, and a profound understanding of geological formations. New entrants often struggle to match the decades of accumulated knowledge and proprietary technologies held by established companies, making it challenging to compete effectively.

This high barrier is underscored by the substantial capital investment needed for advanced seismic imaging, directional drilling, and sophisticated extraction techniques. For instance, the average cost of drilling an offshore exploratory well can range from $50 million to over $100 million, a figure that deters many smaller or less capitalized entities. Furthermore, the inherent risks associated with E&P, including potential dry holes and environmental liabilities, necessitate robust risk management frameworks and deep operational experience that new players typically lack.

- High Capital Requirements: The cost of entry for exploration and production activities is substantial, with offshore projects often exceeding $100 million per well.

- Proprietary Technology and Know-How: Established firms possess patented technologies and decades of operational experience, creating a knowledge gap for newcomers.

- Operational Risks and Expertise: The complex and hazardous nature of E&P requires specialized skills and proven risk mitigation strategies, which are difficult for new entrants to replicate quickly.

Established Infrastructure and Distribution Networks

New entrants face a formidable challenge due to the extensive infrastructure and distribution networks already in place. Building or acquiring access to vital assets like pipelines, processing plants, and export terminals demands colossal capital investment and considerable time. For instance, the energy sector often sees new entrants needing billions of dollars to establish even a fraction of the logistical capabilities of incumbents.

These established networks represent a significant barrier, as newcomers must overcome substantial costs and complex logistical hurdles to compete effectively. In 2024, the cost of building a new LNG export terminal, for example, can easily exceed $10 billion, making it prohibitive for many potential market entrants.

- Capital Intensity: Significant upfront investment is required to replicate existing infrastructure.

- Logistical Complexity: Navigating established distribution channels and securing access is a major hurdle.

- Time to Market: Long lead times for infrastructure development delay competitive entry.

- Economies of Scale: Incumbents benefit from lower per-unit costs due to their scale, further disadvantaging new entrants.

The threat of new entrants in the oil and gas exploration and production sector is significantly mitigated by the immense capital required for operations, with new wells costing millions and infrastructure projects billions. Established players benefit from proprietary technology and extensive operational experience, creating a substantial knowledge gap for newcomers. Furthermore, the complex regulatory environment and the difficulty in securing access to proven reserves and vital infrastructure like pipelines present formidable barriers, effectively limiting new competition.

| Barrier Type | Description | 2024 Data/Example |

|---|---|---|

| Capital Requirements | Extremely high upfront investment for exploration, drilling, and infrastructure. | Offshore oil platform construction can exceed $1 billion; US oil well drilling costs range from $1M-$10M. |

| Access to Reserves & Acreage | Dominance of national oil companies and established players in securing viable assets. | Limited availability of undeveloped, commercially attractive reserves for new entrants. |

| Regulatory & Licensing | Complex, time-consuming, and costly procedures for permits and clearances. | Obtaining new upstream oil/gas project approvals in Australia averaged over 18 months in 2024. |

| Technology & Expertise | Need for specialized engineering skills, advanced drilling tech, and geological knowledge. | New entrants struggle to match decades of accumulated proprietary knowledge and experience. |

| Infrastructure & Distribution | Requirement for massive investment in pipelines, processing plants, and terminals. | Building a new LNG export terminal can cost over $10 billion. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from industry-specific market research reports, company financial statements, and government economic indicators to provide a comprehensive view of competitive intensity.