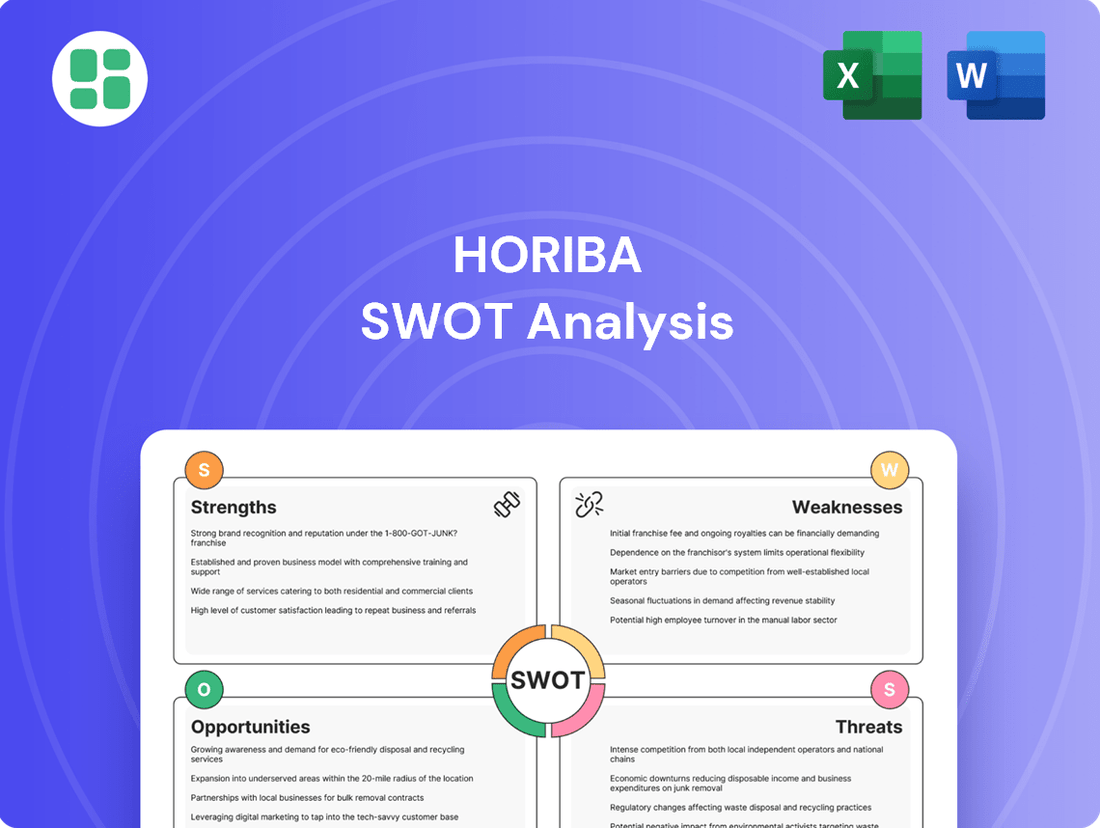

HORIBA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HORIBA Bundle

HORIBA's innovative product portfolio and strong R&D capabilities are key strengths, but they also face intense competition and evolving market demands. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

HORIBA's strength lies in its remarkably diverse product portfolio. They offer a broad range of analytical and measurement instruments essential for sectors like automotive testing, environmental monitoring, medical diagnostics, and semiconductor manufacturing. This wide reach is a significant advantage.

This diversification is key to HORIBA's stability. By not being overly dependent on any one market, the company can weather economic fluctuations in specific industries more effectively. For instance, in fiscal year 2023, HORIBA reported net sales of ¥245.6 billion, showcasing the broad revenue streams generated by its varied offerings.

HORIBA's strong global presence is a significant advantage, with operations spanning 29 countries and regions. This extensive international footprint, a cornerstone of their 'Our Future' vision outlined in 2024, enables them to effectively serve diverse markets and adapt to local needs.

HORIBA's commitment to advanced R&D is a significant strength, with the company consistently investing around 10% of its net sales into research and development. This dedication fuels the creation of cutting-edge solutions for critical sectors like quality control, scientific research, and environmental monitoring.

This focus on innovation allows HORIBA to maintain its technological edge and adapt swiftly to emerging market demands. For instance, their development of new solutions for the burgeoning hydrogen economy and the biopharmaceutical industry highlights their forward-thinking approach and ability to anticipate future growth areas.

Critical Industry Applications and Market Leadership

HORIBA's analytical instruments are indispensable across vital industries like automotive testing, semiconductor fabrication, and medical diagnostics. Many of their products have become the benchmark, setting industry standards due to their reliability and precision.

The company's dominance in the semiconductor sector, holding a leading global market share, underscores its deep integration and critical role in complex manufacturing processes. This leadership position is a testament to their technological prowess and the essential nature of their offerings.

- Industry Standard: HORIBA's emission measurement systems are often cited as de facto standards in automotive testing.

- Semiconductor Dominance: In 2023, HORIBA reported significant growth in its semiconductor segment, contributing substantially to its overall revenue, highlighting its top global share in critical areas like mass flow controllers.

- Medical Diagnostics: Their hematology analyzers are widely adopted in clinical laboratories worldwide, demonstrating their impact on healthcare.

Strategic Mid-Long Term Management Plan (MLMAP2028)

HORIBA's Strategic Mid-Long Term Management Plan (MLMAP2028), launched in 2024, is a significant strength. It clearly defines three core growth areas: Materials & Semiconductor, Energy & Environment, and Bio & Healthcare. This focused approach is designed to enhance corporate value by tackling pressing social issues with specialized solutions, paving the way for sustained business expansion.

This strategic plan positions HORIBA to capitalize on growing global demands in critical sectors. For instance, the semiconductor industry, a key focus, saw global revenue reach approximately $600 billion in 2023, with projections for continued growth. Similarly, the renewable energy market is expanding, with investments in clean energy technologies expected to exceed $2 trillion annually by 2030.

The MLMAP2028's emphasis on innovation and market responsiveness is crucial. By aligning business objectives with societal needs, HORIBA aims to differentiate itself and secure a competitive edge. This proactive strategy is evident in their commitment to developing advanced analytical and measurement technologies that address complex challenges in these vital fields.

Key strengths derived from MLMAP2028 include:

- Strategic Focus: Concentrates resources on high-growth, socially relevant sectors.

- Value Maximization: Aims to increase corporate value through targeted solutions.

- Market Expansion: Designed to drive growth and capture new market opportunities.

- Innovation Drive: Fosters the development of unique technologies to solve societal problems.

HORIBA's deep expertise and established reputation in analytical and measurement technologies are fundamental strengths. Their products are often considered industry benchmarks for precision and reliability, particularly in demanding sectors.

This leadership is evident in their strong market share within critical segments. For example, HORIBA holds a dominant position globally in mass flow controllers, essential components for semiconductor manufacturing. In fiscal year 2023, their semiconductor segment demonstrated robust performance, contributing significantly to overall sales of ¥245.6 billion.

Furthermore, HORIBA's commitment to research and development, consistently around 10% of net sales, fuels continuous innovation. This allows them to develop advanced solutions for emerging challenges, such as those in the growing hydrogen economy and the biopharmaceutical sector, ensuring their relevance in future growth markets.

| Key Strength Area | Description | Supporting Data/Example |

| Product Diversification | Broad portfolio across automotive, environmental, medical, and semiconductor industries. | Net sales of ¥245.6 billion in FY2023 from diverse revenue streams. |

| Industry Leadership | Benchmark products and strong market share in key segments. | Global leadership in mass flow controllers for semiconductor manufacturing. |

| Global Presence | Operations in 29 countries and regions. | Facilitates adaptation to local market needs and broad customer service. |

| R&D Investment | Consistent investment of ~10% of net sales. | Drives development of cutting-edge solutions for emerging markets like hydrogen and biopharma. |

What is included in the product

Delivers a strategic overview of HORIBA’s internal and external business factors, highlighting its competitive position and market challenges.

Streamlines complex strategic thinking by offering a clear, actionable framework for identifying and addressing market challenges.

Weaknesses

Despite a healthy 9.2% rise in net sales for fiscal year 2024, HORIBA faced a notable 16.7% decline in net income attributable to shareholders. This suggests that while the company is bringing in more revenue, its ability to translate that into profit is being hampered, pointing to potential issues with cost management or pricing power.

The trend continued into early 2025, with Q1 2025 sales up 2.3% year-over-year. However, a significant drop in comprehensive income for the same period compared to FY2024Q1 further underscores these profitability challenges.

HORIBA's commitment to maintaining technological leadership necessitates substantial and ongoing investment in research and development (R&D) and capital expenditures. This continuous need for innovation, while crucial for future growth and market position, places a significant strain on the company's financial resources.

These considerable financial outlays, such as the approximately 20 billion yen allocated for new semiconductor R&D and production facilities, can directly affect short-term profitability and cash flow. The pressure to innovate rapidly in competitive sectors means a large portion of capital is tied up in future-oriented projects, potentially limiting immediate returns.

HORIBA's reliance on the semiconductor manufacturing and automotive testing sectors, both known for their cyclical nature, presents a significant weakness. For instance, the semiconductor industry experienced a notable slowdown in capital expenditure in late 2023 and early 2024 due to inventory adjustments and softening demand for certain electronics. This directly impacts HORIBA's sales of critical testing and measurement equipment.

When these key customer industries enter downturns, they tend to cut back on capital investments. This reduction in spending by semiconductor foundries and automotive manufacturers directly translates to lower sales volumes for HORIBA's sophisticated analytical instruments and systems, consequently affecting its overall financial performance and revenue streams.

Supply Chain and Production Management Challenges

HORIBA's production management, particularly within its burgeoning hydrogen business in the Energy and Environment Field, presents a significant weakness that demands immediate attention. The complexity of scaling up these operations, coupled with the specialized nature of hydrogen technology, creates bottlenecks that can hinder timely delivery and market penetration.

As a global entity, HORIBA's extensive reliance on intricate supply chains exposes it to vulnerabilities. Disruptions, whether due to geopolitical events, natural disasters, or supplier issues, can have a cascading effect on production schedules and the ability to meet customer demand. For instance, a shortage of a critical component from a single supplier could halt the assembly of multiple product lines.

- Production Bottlenecks: The rapid growth in demand for hydrogen-related solutions strains HORIBA's current production capacity, leading to potential delays and unmet orders.

- Supply Chain Fragility: Reliance on a global network of suppliers makes HORIBA susceptible to disruptions, impacting manufacturing timelines and product availability.

- Inventory Management: Effectively managing inventory for a diverse product portfolio, especially with fluctuating demand for new technologies like hydrogen, poses a challenge.

- Logistical Hurdles: Coordinating the international shipment of specialized equipment and components can be complex and prone to delays, affecting overall delivery efficiency.

Intense Competitive Landscape

HORIBA operates in a fiercely competitive arena, facing a multitude of global and local rivals. This is particularly evident in key sectors such as hematology diagnostics and semiconductor defect inspection, where numerous companies vie for market dominance. The sheer number of players means pricing can become aggressive, forcing HORIBA to constantly invest in new technologies to stay ahead and protect its market position.

For instance, the global analytical instruments market, a sector where HORIBA is a significant player, was valued at approximately $50 billion in 2023 and is projected to grow, but this growth is shared among many. Companies like Thermo Fisher Scientific, Agilent Technologies, and Danaher are major competitors, often with broader product portfolios or deeper market penetration in specific niches. This intense rivalry necessitates continuous R&D spending and strategic pricing to maintain and expand market share.

- High Rivalry: Numerous global and local competitors exist across HORIBA's product lines.

- Pricing Pressure: Intense competition often leads to downward pressure on prices.

- Innovation Imperative: Continuous investment in research and development is crucial to maintain market share.

HORIBA's profitability is a key concern, with net income attributable to shareholders declining by 16.7% in fiscal year 2024, despite a 9.2% rise in net sales. This trend persisted into early 2025, where Q1 2025 saw a significant drop in comprehensive income year-over-year, indicating challenges in converting revenue into profit, likely due to cost management or pricing pressures.

The company's reliance on cyclical industries like semiconductors and automotive testing poses a weakness, as downturns in these sectors directly reduce demand for HORIBA's equipment. For example, the semiconductor industry's capital expenditure slowdown in late 2023 and early 2024 impacted HORIBA's sales of testing and measurement instruments.

Production bottlenecks, particularly in the growing hydrogen business, and fragile global supply chains are significant operational weaknesses. These factors can lead to delivery delays and an inability to meet market demand, exacerbated by the complexity of scaling new technologies and the inherent risks in international logistics.

Intense competition across its product lines, including hematology diagnostics and semiconductor defect inspection, forces continuous R&D investment and can lead to pricing pressure. Competitors like Thermo Fisher Scientific and Agilent Technologies maintain strong market positions, requiring HORIBA to constantly innovate to preserve its market share.

What You See Is What You Get

HORIBA SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual HORIBA SWOT analysis, ensuring transparency and quality. Upon purchase, you'll gain access to the complete, detailed report, exactly as presented here.

Opportunities

The intensifying global commitment to environmental protection and climate change mitigation is a significant tailwind for HORIBA. This translates into a surging demand for sophisticated monitoring and analysis instruments, especially within burgeoning sectors like hydrogen energy, carbon capture technologies, and advanced water quality management.

HORIBA's strategic alignment with its MLMAP2028 mid-term plan, which emphasizes solutions for a sustainable environment, positions it to capitalize on this trend. The company's investments in these critical areas directly address the market's need for technologies that support carbon neutrality goals and environmental stewardship.

The global healthcare market is projected to reach $11.2 trillion by 2025, fueled by an aging demographic and escalating demand for advanced diagnostics. HORIBA’s expertise in areas like hematology and point-of-care testing directly aligns with these growth drivers, offering significant opportunities for market penetration.

Advancements in medical technology, particularly in personalized medicine and AI-driven diagnostics, are creating new avenues for HORIBA’s innovative solutions. The company's established presence in the medical diagnostics sector positions it to benefit from increased R&D spending and the adoption of cutting-edge analytical instruments.

HORIBA can capitalize on the growing demand for intelligent analytical solutions by integrating AI and IoT into its advanced instrumentation. This fusion allows for enhanced capabilities in areas like semiconductor defect inspection, where AI can identify subtle anomalies with greater accuracy, and automotive functional safety, where IoT sensors can provide real-time diagnostics. For instance, the global AI in manufacturing market was valued at approximately $2.5 billion in 2023 and is projected to reach over $25 billion by 2030, indicating a significant opportunity for smart instrument adoption.

Strategic Growth in Emerging Markets

Developing economies are experiencing significant industrialization and boosting investments in crucial sectors like healthcare, manufacturing, and environmental infrastructure. This presents a prime opportunity for HORIBA to broaden its reach in these dynamic regions.

HORIBA's strategic move to establish a new medical equipment production facility in India, specifically designed to serve local and surrounding markets, underscores this growth potential. This expansion aligns with the increasing demand for advanced analytical and measurement technologies in these burgeoning economies.

The global market for analytical instruments, a key area for HORIBA, is projected to grow substantially. For instance, the global laboratory analytical instruments market was valued at approximately USD 54.5 billion in 2023 and is expected to reach around USD 81.2 billion by 2028, growing at a CAGR of 8.3% during the forecast period. This growth is largely driven by increasing R&D activities and stringent regulatory requirements across various industries in emerging markets.

- Expanding Market Presence: Capitalizing on rapid industrialization in developing nations.

- Healthcare Investment Growth: Leveraging increased spending on medical infrastructure and diagnostics.

- Manufacturing Sector Demand: Meeting the needs of growing manufacturing bases for quality control and process optimization.

- Environmental Infrastructure Development: Providing solutions for pollution monitoring and environmental compliance.

Development of New Technologies and Applications

HORIBA's strategic focus on adapting its core technologies to novel applications presents a significant opportunity for market expansion. For instance, the company's expertise in spectroscopy is being leveraged for advanced semiconductor inspection, a rapidly growing sector. This diversification into high-tech fields like semiconductor manufacturing, alongside emerging markets such as hydrogen energy and biopharmaceuticals, positions HORIBA for substantial future growth.

The company's commitment to developing 'HONMAMON' solutions, which signifies authentic and high-class products, is a key driver in this strategy. This dedication to quality and innovation allows HORIBA to create unique value propositions in new markets.

For example, in the semiconductor industry, HORIBA's advanced analytical instruments are crucial for quality control and process optimization. The global semiconductor market was valued at approximately $600 billion in 2023 and is projected to continue its upward trajectory, offering a substantial revenue stream for HORIBA's specialized offerings.

Furthermore, the burgeoning hydrogen economy, driven by global decarbonization efforts, represents another promising avenue. HORIBA's technologies are applicable to hydrogen production, storage, and fuel cell development. Similarly, the biopharmaceutical sector, with its increasing demand for precise analytical tools in drug discovery and quality assurance, aligns well with HORIBA's capabilities.

HORIBA is well-positioned to benefit from the global push towards sustainability and decarbonization, with increasing demand for environmental monitoring and analysis tools. Its strategic focus on hydrogen energy, carbon capture, and water management aligns perfectly with these trends.

The company's expansion into developing economies, particularly with its new medical equipment facility in India, taps into significant growth potential fueled by industrialization and rising healthcare investments. HORIBA's expertise in medical diagnostics, including hematology and point-of-care testing, directly addresses the projected $11.2 trillion global healthcare market by 2025.

Leveraging AI and IoT in its advanced instrumentation offers substantial opportunities, especially in sectors like semiconductor manufacturing and automotive functional safety. The global AI in manufacturing market, valued at approximately $2.5 billion in 2023, is expected to exceed $25 billion by 2030, highlighting the demand for smart analytical solutions.

HORIBA's diversification into high-tech fields such as semiconductor inspection, where its spectroscopy expertise is vital for quality control in a market valued around $600 billion in 2023, further strengthens its growth prospects. The company's commitment to authentic, high-class 'HONMAMON' solutions ensures its ability to create unique value in these expanding markets.

| Opportunity Area | Market Projection/Data Point | HORIBA Relevance |

|---|---|---|

| Sustainability & Decarbonization | Global environmental monitoring market growth | Demand for HORIBA's analysis instruments in hydrogen energy, carbon capture. |

| Developing Economies | India medical equipment facility expansion | Capitalizing on industrialization and healthcare spending in emerging markets. |

| AI & IoT Integration | AI in manufacturing market: $2.5B (2023) to $25B (2030) | Enhancing semiconductor inspection and automotive diagnostics with smart solutions. |

| High-Tech Diversification | Global Semiconductor Market: ~$600B (2023) | Applying spectroscopy expertise for crucial quality control in a growing sector. |

Threats

Global economic volatility, including slowdowns and potential recessions, poses a significant threat to HORIBA. A widespread economic downturn could dampen capital expenditure among its key industrial clients, especially in the automotive and semiconductor industries. This reduced spending directly translates to lower demand for HORIBA's advanced analytical and measurement instruments, impacting its revenue streams and overall profitability.

For instance, the International Monetary Fund (IMF) projected a global growth slowdown to 2.9% in 2024, down from 3.1% in 2023, signaling potential headwinds for industrial investment. Historically, periods of economic contraction have seen a noticeable dip in demand for capital goods, which includes the sophisticated equipment HORIBA provides.

The analytical instrument market is a hotbed of competition, with both long-standing companies and emerging players constantly pushing the boundaries of innovation. This intense environment means HORIBA must remain agile to maintain its edge.

The rapid pace of technological change, particularly with the integration of AI and advanced inspection systems by rivals, poses a significant threat. HORIBA's existing product lines could face obsolescence, and the company might experience increased pressure on its pricing strategies and overall market share if it doesn't keep pace.

Geopolitical instability and escalating trade tensions present significant threats to HORIBA's global operations. For instance, the ongoing trade disputes between major economies could lead to increased tariffs on components or finished goods, directly impacting HORIBA's cost of sales and potentially reducing profit margins.

Supply chain vulnerabilities are also a major concern, as demonstrated by the widespread disruptions experienced in 2021-2022 due to the pandemic and subsequent logistical challenges. Any further disruptions, perhaps from regional conflicts or natural disasters affecting key manufacturing hubs, could delay the delivery of essential materials and components, thereby hindering HORIBA's production schedules and ability to meet customer demand, potentially affecting revenue streams.

Stringent and Evolving Regulatory Landscape

HORIBA's operations span critical sectors like medical diagnostics, automotive emissions, and environmental monitoring, each subject to a complex web of international regulations. This intricate regulatory environment is not static; it's constantly evolving, requiring continuous adaptation. For instance, in 2024, new emissions standards for vehicles are being implemented in various regions, demanding significant R&D investment from companies like HORIBA to ensure their testing equipment remains compliant and competitive. Failure to keep pace with these changes or the substantial costs associated with adapting to new mandates could directly impact HORIBA's market access and operational efficiency.

The financial implications of non-compliance are substantial. For example, a significant regulatory shift in the medical diagnostics sector, such as stricter data privacy requirements for connected devices, could necessitate costly software upgrades and compliance audits. In 2025, we anticipate increased scrutiny on environmental monitoring data accuracy, potentially leading to penalties for companies whose equipment does not meet the latest precision standards. These regulatory pressures represent a tangible threat that requires proactive management and strategic investment in compliance technologies.

- Evolving Emissions Standards: New regulations in 2024 and 2025, such as Euro 7, are increasing the complexity of emissions testing, requiring advanced measurement solutions.

- Medical Device Regulations: Stricter data security and privacy laws, like those being enhanced globally in 2024, impact HORIBA's medical diagnostic equipment.

- Environmental Monitoring Compliance: Increased demand for real-time, highly accurate environmental data in 2025 could lead to penalties for non-compliant measurement systems.

- Global Regulatory Divergence: Navigating differing standards across key markets like the EU, US, and Asia presents ongoing challenges and potential for compliance costs.

Cybersecurity and Data Security Concerns

As a company deeply invested in advanced technology and handling proprietary information, HORIBA is particularly vulnerable to escalating cybersecurity threats. The increasing sophistication of cyberattacks poses a significant risk to its intellectual property and sensitive customer data. A successful breach could lead to substantial financial penalties, operational disruptions, and a severe blow to its hard-earned reputation.

In 2023, global cybersecurity spending was projected to reach over $200 billion, highlighting the growing threat landscape that companies like HORIBA must navigate. The potential for intellectual property theft is a major concern, as it could undermine HORIBA's competitive edge in its specialized markets.

- Increased risk of cyberattacks due to sensitive data and IP.

- Potential for significant financial losses and operational disruptions from breaches.

- Erosion of customer trust and damage to brand reputation.

- The global cybersecurity market is expanding rapidly, indicating a heightened threat environment.

HORIBA faces significant threats from intense competition, rapid technological advancements, and the constant need to innovate to avoid product obsolescence. The company must also navigate the complexities of global economic volatility, geopolitical instability, and supply chain disruptions, all of which can impact demand and operational efficiency.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including HORIBA's official financial reports, comprehensive market research from leading industry analysts, and expert opinions from seasoned professionals in the scientific and industrial sectors.