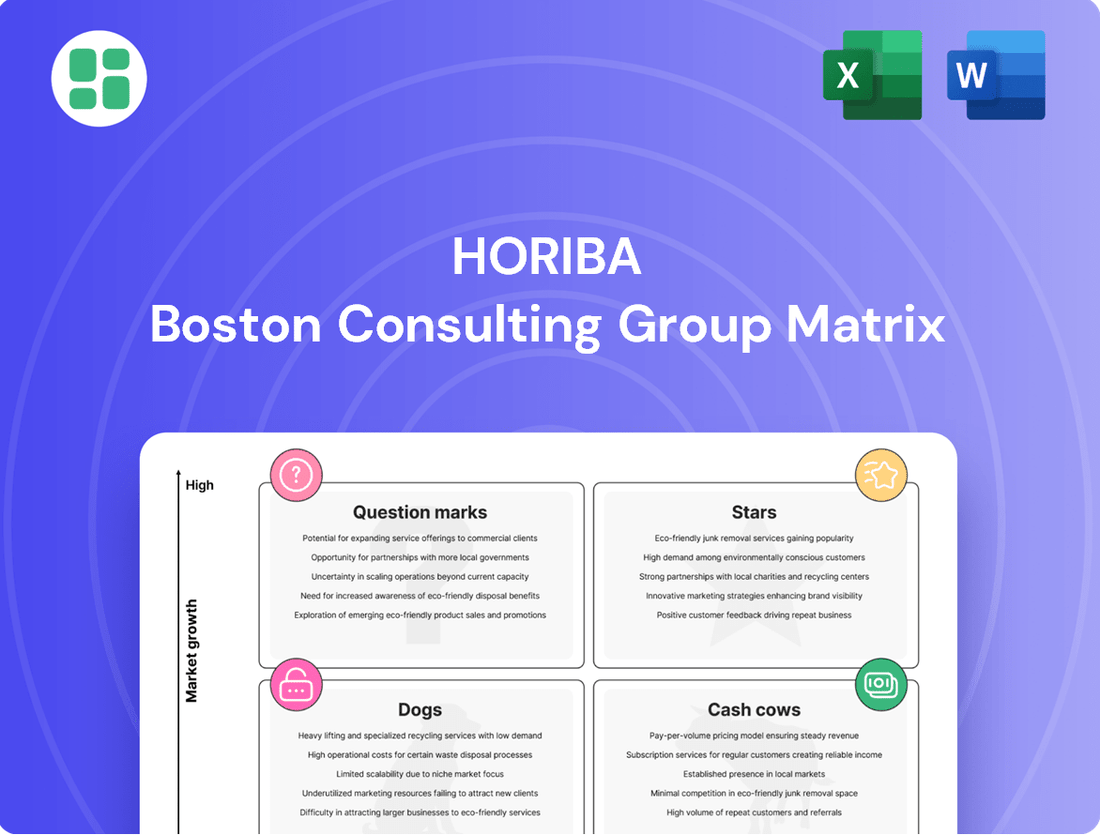

HORIBA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HORIBA Bundle

Unlock the strategic potential of HORIBA's product portfolio with a glimpse into their BCG Matrix. See which innovations are poised for growth and which are generating consistent returns, but this is just the beginning of understanding their market position.

Dive deeper into HORIBA's BCG Matrix to uncover the full story behind their product success. Purchase the complete report for detailed quadrant analysis and actionable strategies to optimize your investments and drive future growth.

Stars

HORIBA's semiconductor manufacturing equipment, particularly its mass flow controllers, represents a significant Star in its BCG Matrix. This segment is characterized by a high profit margin, fueled by robust demand from burgeoning sectors like data centers and generative AI.

The global market for semiconductor defect inspection equipment is anticipated to expand at an impressive Compound Annual Growth Rate (CAGR) of 8.9% between 2025 and 2034. North America is a key driver of this growth, bolstered by substantial investments in domestic semiconductor manufacturing capabilities.

With its strong market position and the sector's inherent high growth trajectory, HORIBA's semiconductor manufacturing equipment is a clear Star, indicating substantial future potential and current market leadership.

HORIBA is strategically positioning itself in the advanced medical diagnostics sector, specifically in-vitro diagnostics. This market segment is proving resilient, maintaining its stability even as COVID-19 related subsidies saw a decline in 2024.

The company is actively expanding its medical equipment and hematology reagent manufacturing capabilities. A key development is the opening of a new facility in India in July 2024, a move designed to boost localization and establish a crucial export hub for HORIBA's medical offerings.

HORIBA is also making significant inroads into the anticoagulation monitoring devices market with products like the Yumizen G1550. This market is poised for substantial growth, with projections indicating a 7.2% CAGR between 2025 and 2032, underscoring HORIBA's commitment to this high-potential area.

HORIBA is strategically positioning its hydrogen-related solutions as a key growth area within its Energy and Environment Field. This focus is driven by the accelerating global demand for decarbonization technologies, with hydrogen energy seen as a critical component. The company's investments are geared towards developing comprehensive evaluation systems for fuel cells, fuel cell electric vehicles (FCEVs), fuel cell vehicles (FCVs), and hydrogen refueling stations, directly supporting the infrastructure needed for a hydrogen-powered future.

Pharmaceutical Production Process Solutions

HORIBA is strategically positioning itself in the pharmaceutical production process by offering advanced spectroscopic solutions. Their focus on integrated, automated tools like the Veloci BioPharma Analyzer and SignatureSPM addresses critical workflow challenges in life science and pharmaceutical laboratories.

This expansion into pharmaceutical manufacturing and quality control is a significant move, targeting a high-growth market segment. The demand for increased efficiency and precision in drug development and production is driving this shift, with customer expectations constantly rising.

- High-Speed Spectrometers: HORIBA's new spectrometers are designed for high-speed and high-precision applications, crucial for accelerating drug discovery R&D and optimizing production.

- Integrated Automation: The company is emphasizing integrated and automated solutions to streamline laboratory processes in the life sciences and pharmaceutical sectors.

- Addressing Workflow Issues: Products like the Veloci BioPharma Analyzer and SignatureSPM are direct responses to identified workflow inefficiencies within pharmaceutical labs.

- Market Growth: The pharmaceutical manufacturing and quality control sector represents a high-growth opportunity, fueled by increasing customer demands for faster, more reliable processes.

Next-Generation Automotive Testing (EVs & ADAS)

HORIBA is actively advancing its offerings for the next generation of automotive testing, focusing on Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS). Despite some regional moderation in the EV transition pace, the company is accelerating proposals for solutions that promote fuel diversification and enhanced efficiency. This strategic focus positions HORIBA to benefit from significant market growth.

The market for EV test equipment is anticipated to expand considerably, with an estimated Compound Annual Growth Rate (CAGR) of 7.5% projected from 2025 to 2033. This growth is fueled by the escalating global demand for electric vehicles and the implementation of increasingly rigorous automotive regulations. HORIBA, as a prominent entity in the automotive testing equipment sector, is strategically positioned to leverage these market dynamics and capture a significant share.

- EV Test Equipment Market Growth: Projected 7.5% CAGR from 2025-2033.

- Key Drivers: Increasing EV adoption and stringent regulatory frameworks.

- HORIBA's Position: Well-placed to capitalize on evolving automotive testing needs.

- Focus Areas: Fuel diversification and efficiency improvements in EVs and ADAS.

Stars in HORIBA's BCG Matrix represent high-growth, high-market-share segments. HORIBA's semiconductor manufacturing equipment, particularly mass flow controllers, fits this description due to strong demand from AI and data centers. The global semiconductor defect inspection equipment market is expected to grow at a 8.9% CAGR from 2025-2034, with North America leading investment.

HORIBA's medical diagnostics, especially in-vitro diagnostics, also show Star characteristics. The company is expanding manufacturing in India, opening a new facility in July 2024, to boost localization and exports. Their anticoagulation monitoring devices, like the Yumizen G1550, are in a market projected for 7.2% CAGR growth between 2025 and 2032.

The company's hydrogen solutions are positioned as a key growth area, driven by decarbonization efforts. HORIBA is developing evaluation systems for fuel cells and hydrogen infrastructure. Furthermore, their advanced spectroscopic solutions for pharmaceutical manufacturing, such as the Veloci BioPharma Analyzer, target a high-growth sector demanding increased efficiency and precision.

HORIBA's automotive testing equipment for EVs and ADAS is another Star. The EV test equipment market is projected for a 7.5% CAGR from 2025 to 2033, fueled by EV adoption and regulations. HORIBA's focus on fuel diversification and efficiency improvements in EVs and ADAS positions them to capitalize on this growth.

| Business Segment | BCG Category | Growth Rate | Market Share | Key Drivers |

| Semiconductor Equipment | Star | High | High | AI, Data Centers, Generative AI |

| Medical Diagnostics | Star | High | High | Resilient demand, expansion in emerging markets |

| Hydrogen Solutions | Star | High | High | Decarbonization, renewable energy transition |

| Automotive Testing (EV/ADAS) | Star | High | High | EV adoption, regulatory compliance |

What is included in the product

The HORIBA BCG Matrix categorizes products by market growth and share, guiding strategic decisions on investment, divestment, or harvesting.

Visualize your portfolio's strategic position for swift decision-making.

Cash Cows

HORIBA's automotive emission measurement systems are a classic Cash Cow. They've established themselves as the industry standard, a testament to their strong, enduring market position within the Mobility business segment. These systems consistently generate substantial revenue, having historically been a bedrock for HORIBA's financial performance.

Even with the evolving automotive landscape, these measurement systems continue to hold a dominant market share. The sector, while mature, remains essential, ensuring a steady and predictable stream of cash flow for the company. For example, HORIBA's comprehensive range of exhaust gas analyzers and related equipment are crucial for regulatory compliance worldwide, a demand that remains robust.

HORIBA's traditional scientific instruments, serving R&D and Quality Control, are its bedrock cash cows. These high-end devices, including Raman Spectrometers and particle-size analyzers, consistently generate stable revenue from academic and industrial clients. This segment benefits from HORIBA's established reputation and a loyal customer base in a mature market.

HORIBA's mass flow controllers hold a substantial position within the semiconductor industry, historically fueling the company's expansion. These controllers, deeply integrated into current manufacturing, generate consistent profits due to their established market presence.

The semiconductor sector is dynamic, but these controllers represent a mature, high-margin product line. This maturity translates into a reliable revenue stream, solidifying their status as cash cows for HORIBA.

HORIBA's commitment to bolstering domestic production capacity for these devices underscores their ongoing strategic value. This investment signals confidence in their continued role as a stable and profitable revenue generator for the company.

Water and Air Quality Monitoring Instruments

HORIBA's water and air quality monitoring instruments are classic cash cows within its BCG Matrix. These products, essential for environmental protection and industrial process control, operate in established markets. The demand is consistently driven by stringent environmental regulations and the ongoing need for precise process monitoring.

These instruments, while not experiencing rapid growth, represent a stable and reliable source of revenue for HORIBA. Their critical function ensures recurring sales and profitability, making them a cornerstone of the company's financial stability.

- Stable Market: The demand for water and air quality monitoring instruments is sustained by global environmental regulations and industrial compliance needs.

- Consistent Revenue: These essential products provide a predictable and steady income stream, contributing significantly to HORIBA's overall financial health.

- Mature Product Lifecycle: While growth may be moderate, the established nature of these markets ensures continued relevance and sales.

Elemental Analyzers for Materials Characterization

HORIBA's elemental analyzers are firmly established in the market, leveraging advanced NDIR gas analysis technology. This technology enables highly accurate quantification of elements across diverse materials such as steel, ceramics, and batteries, critical for quality control and ongoing material development in foundational industries.

These instruments are recognized for their ultra-high precision and rapid analysis capabilities. Their consistent demand within mature industrial sectors ensures a stable and predictable revenue stream, positioning them as key cash cows for HORIBA.

- Established Technology: NDIR gas analysis provides reliable and precise elemental quantification.

- Broad Application: Serves essential industries like steel, ceramics, and battery manufacturing.

- Market Position: High precision and speed meet ongoing quality control and R&D needs.

- Revenue Stability: Consistent demand in mature markets generates predictable cash flow.

HORIBA's automotive emission measurement systems are a prime example of a cash cow. These systems, integral to meeting global emissions standards, represent a mature market where HORIBA holds a significant, stable market share. Their consistent generation of substantial revenue underpins the company's financial stability.

The demand for these systems remains robust due to ongoing regulatory requirements and the need for vehicle compliance. For instance, HORIBA's exhaust gas analyzers are critical for testing vehicles worldwide, ensuring they meet stringent environmental regulations. This consistent demand translates into predictable cash flow, solidifying their cash cow status.

HORIBA's traditional scientific instruments, such as Raman Spectrometers and particle-size analyzers, are also bedrock cash cows. These high-end devices cater to academic and industrial R&D and quality control, benefiting from HORIBA's strong reputation and a loyal customer base in a mature market. This segment provides a stable revenue stream.

HORIBA's mass flow controllers, vital in the semiconductor industry, are another strong cash cow. Their deep integration into manufacturing processes ensures consistent profits due to their established market presence. Despite the dynamic nature of the semiconductor sector, these controllers represent a mature, high-margin product line, offering a reliable revenue stream.

The company's water and air quality monitoring instruments are also classic cash cows. Operating in established markets driven by environmental regulations, these products provide a stable and reliable source of revenue. Their critical function ensures recurring sales and profitability, making them a cornerstone of HORIBA's financial stability.

HORIBA's elemental analyzers, utilizing advanced NDIR gas analysis technology, are firmly established cash cows. Their high precision and rapid analysis capabilities serve essential industries like steel, ceramics, and battery manufacturing, ensuring consistent demand and predictable cash flow in mature markets.

| Product Category | BCG Status | Key Characteristics | Revenue Contribution (Estimated) | Market Dynamics |

|---|---|---|---|---|

| Automotive Emission Measurement Systems | Cash Cow | Industry standard, high market share, stable demand due to regulations | Significant, consistent | Mature, regulatory-driven |

| Scientific Instruments (R&D/QC) | Cash Cow | High-end, established reputation, loyal customer base | Stable, recurring | Mature, consistent demand |

| Mass Flow Controllers (Semiconductor) | Cash Cow | Deep integration, high margin, established market presence | Profitable, consistent | Mature within a dynamic industry |

| Water & Air Quality Monitoring Instruments | Cash Cow | Essential for compliance, stable demand from regulations | Reliable, predictable | Mature, driven by environmental needs |

| Elemental Analyzers | Cash Cow | Ultra-high precision, rapid analysis, broad industrial application | Stable, predictable | Mature industrial sectors |

What You See Is What You Get

HORIBA BCG Matrix

The HORIBA BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no surprises – just the complete, analysis-ready strategic tool for your business planning needs. You can confidently use this preview to understand the depth and quality of the insights provided, knowing the purchased version will be exactly the same, ready for immediate application. This ensures you are investing in a tangible and professional resource that directly addresses your strategic evaluation requirements.

Dogs

Legacy automotive test systems, those not specifically designed for electric vehicles (EVs) or advanced driver-assistance systems (ADAS), represent a segment that HORIBA, despite its overall strength in automotive testing, needs to monitor closely within its BCG matrix.

As the automotive industry rapidly pivots towards electrification, with global EV sales projected to reach over 20 million units by 2025, the demand for traditional internal combustion engine (ICE) focused test systems is naturally expected to decline. This shift is driven by evolving consumer preferences and increasingly stringent emissions regulations worldwide.

Consequently, these legacy systems, if they haven't been strategically updated or repurposed to accommodate new automotive technologies, are likely to be categorized as Dogs. This means they could become low-growth, low-market-share assets, requiring careful management to mitigate potential losses or strategic divestment.

The life science and pharmaceutical sectors are increasingly favoring automated, integrated lab solutions over standalone instruments. This shift means HORIBA's older, basic lab instruments, lacking these integration and automation features, are likely to see their market share diminish.

These non-integrated instruments risk becoming obsolete if they cannot evolve to meet the industry's growing need for seamless and efficient analytical platforms. For instance, the global laboratory automation market was valued at approximately $5.4 billion in 2023 and is projected to reach over $9.2 billion by 2028, highlighting the strong demand for integrated systems.

Certain analytical methods or instruments, once cutting-edge, can become niche or outdated as technology advances. Think of older laboratory equipment that has been replaced by more efficient, digital alternatives. For instance, while spectrographic analysis remains a core technique, specific older models might now be less utilized compared to newer, faster, and more sensitive instruments, potentially fitting into the Dogs quadrant if their market share and future potential are minimal.

Products in this category often struggle to compete on performance or cost. For example, a company might have a legacy diagnostic tool that, while functional, is significantly slower and requires more manual input than current market offerings. If such a product line experiences declining sales and minimal investment in upgrades, it would likely generate little profit and consume resources disproportionately for its contribution, aligning with the characteristics of a Dog in the HORIBA BCG Matrix.

Segments with High Competition and Low Differentiation

Segments characterized by intense competition and minimal product differentiation within the analytical instrument market pose a challenge for HORIBA. If these segments also exhibit sluggish market growth, they would be categorized as Dogs in the BCG Matrix. These areas are likely to generate meager profits and consume valuable resources without offering significant future upside.

For instance, consider the market for basic spectrophotometers. In 2024, this segment is estimated to be worth approximately $800 million globally, with an annual growth rate projected at a mere 2%. HORIBA faces established competitors with strong brand recognition and cost advantages, making it difficult to carve out a distinct market position.

- Low Market Share: HORIBA may hold a small percentage of sales in these mature, crowded markets.

- Minimal Competitive Advantage: Products in these segments often lack unique features or proprietary technology.

- Stagnant Growth: The overall market for these instruments is not expanding significantly, limiting opportunities for increased revenue.

- Resource Drain: Continued investment in these areas might divert capital from more promising growth opportunities.

Products Affected by Phasing Out of Older Industrial Processes

As industries shift away from older, less sustainable methods, analytical instruments designed for these legacy processes face obsolescence. For instance, equipment supporting certain types of fossil fuel refining or older manufacturing techniques might see declining demand. This aligns with the concept of products in the Dogs quadrant of the BCG Matrix, characterized by low market share and low growth.

HORIBA, while investing heavily in future-oriented technologies like battery testing and semiconductor manufacturing, may have legacy products tied to phasing-out industrial applications. For example, if HORIBA previously offered specialized gas analyzers for specific, now-outdated combustion processes, these would fall into the Dogs category. The global push for decarbonization and efficiency directly impacts the relevance of such instruments.

- Obsolescence Risk: Instruments tied to phasing-out industrial processes, like older chemical synthesis methods, are at risk of becoming obsolete.

- Diminishing Demand: As industries adopt cleaner technologies, demand for analytical tools supporting legacy processes will naturally decrease.

- BCG Matrix Placement: Products designed for declining industrial methods would likely be classified as Dogs, indicating low market share and low growth potential.

- HORIBA's Strategic Shift: HORIBA's focus on areas like electric vehicles and advanced materials means resources are directed away from supporting legacy industrial applications.

Products categorized as Dogs in HORIBA's BCG Matrix are those with low market share in low-growth markets. These are often legacy products or those in highly competitive, undifferentiated segments. For example, basic spectrophotometers, a segment valued at approximately $800 million globally in 2024 with only 2% projected growth, exemplify this category. Such offerings typically generate minimal profits and may consume resources disproportionately, making careful management or divestment a strategic consideration.

| Product Category Example | Market Share (Estimated) | Market Growth Rate (Estimated) | Strategic Implication |

|---|---|---|---|

| Legacy ICE Automotive Test Systems | Low | Declining | Potential divestment or repurposing |

| Basic Laboratory Instruments (Non-integrated) | Low | Low | Risk of obsolescence, consider upgrades or phase-out |

| Spectrophotometers (Basic Models) | Low | ~2% (2024) | Intense competition, low differentiation |

| Instruments for Phasing-out Industrial Processes | Low | Declining | Directly impacted by decarbonization trends |

Question Marks

Emerging hydrogen energy production management represents a significant area of investment for HORIBA, positioning it within the Question Marks quadrant of the BCG Matrix. The company is actively pouring resources into this sector, acknowledging its high-growth potential as a key enabler of carbon neutrality.

However, HORIBA is concurrently navigating production challenges, a characteristic of emerging markets where market share is still being established. This suggests that while the demand for hydrogen solutions is robust, HORIBA's current position within this nascent market is not yet dominant, requiring strategic management to scale efficiently.

The substantial investment required to build capacity and secure a leading edge in hydrogen production underscores the strategic importance of this segment. Success here is critical, as it will determine whether HORIBA's hydrogen ventures can evolve from Question Marks into Stars, generating significant future returns.

HORIBA's "Advanced Bio & Healthcare Solutions (Beyond IVD)" segment is positioned as a nascent but high-potential growth area, akin to a question mark in the BCG matrix. The company is actively investing in this space, with a strategic focus on launching new pharmaceutical market solutions starting in 2025.

This initiative targets transformative healthcare applications, such as cell and gene analysis, where rapid market adoption is crucial for HORIBA to build its current relatively low market share. Success hinges on gaining significant traction and demonstrating value in these emerging fields.

HORIBA's custom solutions, often referred to as 'Yes, We Can' projects, represent their Stars in the BCG matrix. These projects focus on developing highly specialized, bespoke solutions for niche industry demands, especially within the life science and pharmaceutical sectors. For instance, in 2024, HORIBA continued to see strong demand for its advanced analytical instruments tailored for drug discovery and development, a segment experiencing rapid innovation.

These custom solutions are characterized by high growth potential due to evolving industry needs, but currently hold a low market share because they are designed for specific client requirements. This bespoke nature means they are not mass-market products, but rather high-value, targeted offerings. The company's investment in R&D is crucial here; for example, HORIBA's 2024 R&D expenditure was significantly allocated to developing next-generation platforms for bioprocessing and cell therapy research, aiming to solidify their position in these emerging fields.

The long-term success of these 'Yes, We Can' projects hinges on HORIBA's ability to scale these custom solutions and achieve broader market penetration. Successful commercialization and continued innovation are key. As of the first half of 2024, HORIBA reported that its life science segment, heavily influenced by these custom projects, saw a revenue increase of 15%, underscoring the viability of this strategy when backed by substantial R&D and market understanding.

AR/VR Integrated Analytical Solutions

HORIBA is actively investing in Augmented Reality (AR) technology, with a notable focus on applications for events like EXPO 2025. This strategic move aims to enhance user comprehension of their sophisticated analytical solutions. This positions AR/VR as a potential Star or Question Mark in the HORIBA BCG Matrix, reflecting its current nascent market stage within the analytical instrument sector.

While the current market share for AR/VR integration in analytical instruments is minimal, its successful implementation could significantly differentiate HORIBA's offerings. This technological exploration aligns with a strategy to tap into high-growth, emerging markets, potentially transforming product perception and opening new revenue streams.

- Market Potential: The global AR/VR market is projected to reach hundreds of billions of dollars by the late 2020s, indicating substantial future growth potential for integrated solutions.

- HORIBA's Investment: Specific investment figures for HORIBA's AR/VR initiatives are not publicly disclosed, but the commitment to EXPO 2025 applications signals a tangible allocation of resources.

- Competitive Landscape: Competitors in the analytical instrument space are also beginning to explore digital integration, making early AR/VR adoption a key differentiator.

- Future Growth: Successful AR/VR integration could lead to increased customer engagement, improved training efficiency, and novel service models for HORIBA's analytical products.

New Regional Market Expansions (e.g., specific emerging markets for medical diagnostics)

HORIBA is actively pursuing expansion in key emerging markets for medical diagnostics, with a particular focus on regions like India. The Indian in-vitro diagnostics market, for instance, is projected for substantial growth, driven by increasing healthcare awareness and demand for advanced diagnostic solutions.

While these regions offer significant growth potential, HORIBA's current market penetration in these specific emerging geographies may be limited. This presents a classic "question mark" scenario in the BCG matrix, necessitating substantial investment in market development, sales infrastructure, and localized product offerings to gain a stronger foothold and potentially achieve market leadership.

- India's in-vitro diagnostics market was valued at approximately USD 1.5 billion in 2023 and is expected to reach over USD 3 billion by 2028, exhibiting a CAGR of around 15%.

- HORIBA's investment in these markets will focus on building brand awareness and establishing robust distribution networks.

- The strategy involves adapting product portfolios to meet local needs and regulatory requirements, a common challenge in emerging markets.

HORIBA's ventures in emerging hydrogen energy production management and advanced bio & healthcare solutions (beyond IVD) are classic Question Marks. These segments exhibit high growth potential but currently hold a low market share, demanding significant investment to establish a strong competitive position.

The company is strategically investing in these areas, aiming to scale production and capture market share. Success in these nascent markets is crucial for transforming these Question Marks into future Stars, driving substantial long-term returns for HORIBA.

The company's focus on custom solutions, particularly in life sciences and pharmaceuticals, represents its Stars. These highly specialized offerings, like advanced analytical instruments for drug discovery, demonstrate strong demand and innovation, as evidenced by a 15% revenue increase in the life science segment in H1 2024.

HORIBA's investment in Augmented Reality (AR) for applications like EXPO 2025 positions it as a potential Star or Question Mark. While its current market share in analytical instruments is minimal, successful integration could offer differentiation and tap into the rapidly growing AR/VR market, projected to reach hundreds of billions by the late 2020s.

| Segment | BCG Classification | Key Characteristics | 2024 Data/Outlook |

| Hydrogen Energy Production Management | Question Mark | High growth potential, low market share, significant investment required for scaling. | Active investment in capacity building; critical for future growth. |

| Advanced Bio & Healthcare Solutions (Beyond IVD) | Question Mark | Nascent but high-potential growth, focus on new pharmaceutical market solutions from 2025. | Targeting cell and gene analysis; rapid adoption crucial for market share growth. |

| Custom Solutions (Life Sciences/Pharma) | Star | High growth, specialized niche demand, strong R&D focus. | 15% revenue increase in life science segment (H1 2024); significant R&D allocation to next-gen platforms. |

| AR/VR Integration in Analytical Instruments | Potential Star/Question Mark | Emerging technology, minimal current market share, differentiation potential. | Focus on EXPO 2025 applications; global AR/VR market projected for significant growth. |

| Medical Diagnostics (Emerging Markets like India) | Question Mark | High growth potential in specific geographies, limited current penetration. | India's IVD market valued at USD 1.5 billion in 2023, expected to exceed USD 3 billion by 2028. Investment in market development and distribution. |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of financial performance metrics, market share data, and industry growth projections to accurately position business units.