HORIBA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HORIBA Bundle

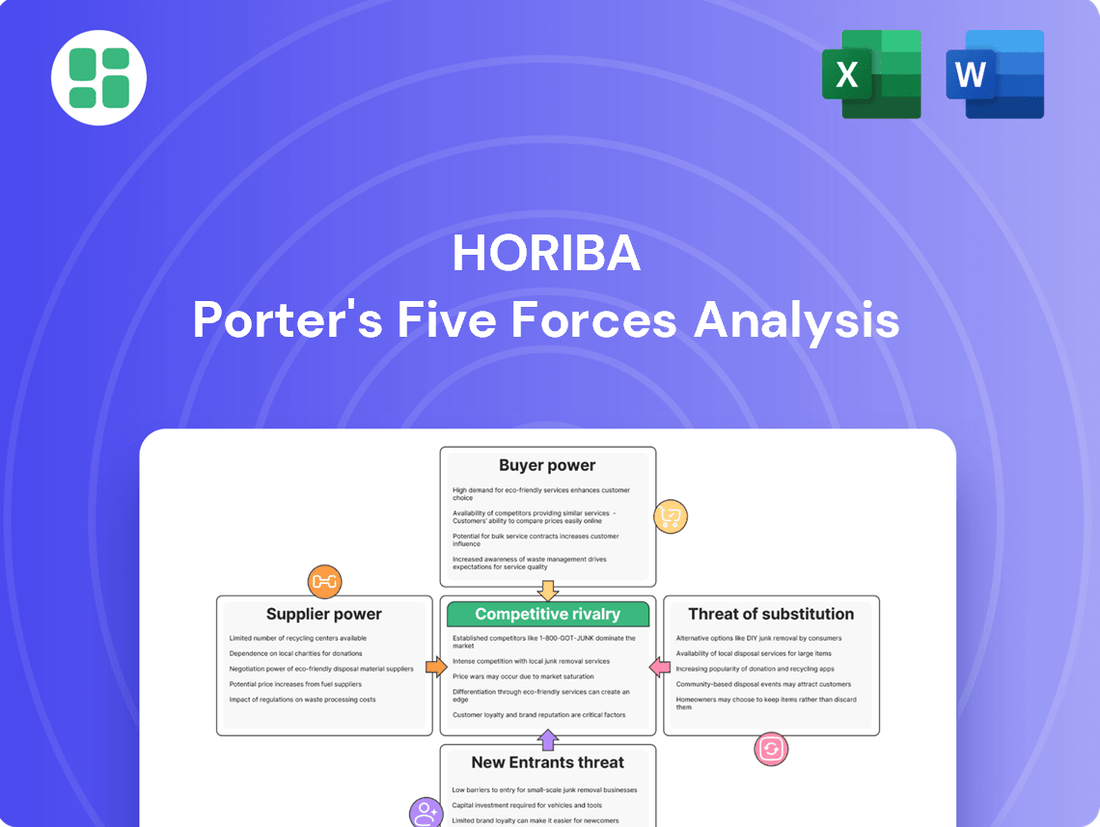

HORIBA's competitive landscape is shaped by the interplay of five key forces, revealing crucial insights into their market position. Understanding the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes is paramount for strategic success.

This brief overview only scratches the surface of the intricate dynamics at play. Unlock the full Porter's Five Forces Analysis to explore HORIBA’s competitive pressures and strategic advantages in detail, empowering you to make informed decisions.

Suppliers Bargaining Power

HORIBA's reliance on highly specialized components, such as precision optics and advanced sensors, significantly influences supplier bargaining power. The limited availability of suppliers possessing proprietary technologies for these critical inputs grants them considerable leverage.

For instance, in 2024, the semiconductor industry, a key supplier of advanced electronic modules, experienced ongoing supply chain constraints, driving up costs for specialized chips. This situation directly impacts HORIBA's procurement costs and production timelines.

This dependence on a select few specialized suppliers necessitates robust relationship management and proactive diversification strategies. Exploring alternative sourcing or developing in-house capabilities for certain components could mitigate the risks associated with concentrated supplier power.

Switching suppliers for HORIBA's key inputs, especially custom-designed components or specialized technologies, can involve significant expenses. These costs encompass re-tooling manufacturing lines, recalibrating existing equipment, and undergoing rigorous re-qualification procedures for new materials or parts.

These substantial switching costs effectively lock HORIBA in with its current suppliers, thereby enhancing the bargaining power of those suppliers. This diminished flexibility can translate into less favorable pricing and contract terms for HORIBA, potentially impacting its overall cost of goods sold.

When suppliers offer unique or patented materials and technologies that are crucial for differentiating HORIBA's products, their bargaining power increases significantly. For instance, if a key component in HORIBA's advanced semiconductor analysis equipment relies on a proprietary sensor technology only available from one supplier, HORIBA's ability to negotiate pricing or favorable terms becomes constrained. This is especially relevant in fields like advanced materials science where specialized inputs are common.

Supplier Industry Concentration

When the industries that supply HORIBA with critical raw materials or components are highly concentrated, meaning only a few large companies dominate those markets, these suppliers gain significant bargaining power. This concentration allows them to exert more influence over pricing and contract terms because HORIBA has fewer alternative sources. It's crucial for HORIBA to thoroughly analyze the competitive environment of its suppliers to understand this dynamic.

For instance, if a specific type of sensor crucial for HORIBA's analytical instruments is produced by only two or three global manufacturers, those suppliers are in a strong position. They can potentially raise prices or impose less favorable payment terms, knowing HORIBA has limited options to switch. This situation directly impacts HORIBA's cost of goods sold and overall profitability.

- Supplier Concentration Impact: High concentration among suppliers of key materials or sub-assemblies grants them increased leverage over pricing and terms.

- Competitive Landscape: HORIBA must evaluate the number and market share of its suppliers to gauge their bargaining power.

- Risk Factor: A few dominant suppliers can dictate terms, potentially increasing HORIBA's operational costs and reducing margins.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into instrument manufacturing, while less common, represents a potential risk for HORIBA. If a crucial supplier were to decide to compete directly, it could significantly disrupt HORIBA's established supply chains and the flow of proprietary technology. This scenario underscores the need for HORIBA to maintain a vigilant approach to assessing its supplier relationships and identifying any emerging competitive threats.

For instance, in the semiconductor equipment sector, where HORIBA is a significant player, a supplier of critical components like advanced sensors or specialized optics might possess the technical expertise and capital to develop their own analytical instruments. Such a move could directly challenge HORIBA's market position. Companies in this space, like ASML, which relies on highly specialized suppliers for its lithography systems, constantly monitor their supply chain for any signs of potential competitive encroachment.

- Supplier Forward Integration Risk: While not a frequent occurrence, the possibility of a key supplier entering HORIBA's instrument manufacturing market creates a potential competitive threat.

- Disruption Potential: Such a move by a supplier could lead to significant disruptions in HORIBA's supply chain and impact the security of its intellectual property.

- Strategic Evaluation: HORIBA must continually assess its supplier base, not only for reliability and cost but also for any indicators of potential future competition.

HORIBA's suppliers hold significant bargaining power due to the specialized nature of its components, such as precision optics and advanced sensors. The limited availability of suppliers with proprietary technologies for these critical inputs allows them to exert considerable leverage. For example, in 2024, the semiconductor industry faced ongoing supply chain issues, increasing costs for specialized chips, which directly impacts HORIBA's procurement expenses and production schedules.

The substantial costs associated with switching suppliers for HORIBA's key inputs, especially custom-designed parts or unique technologies, effectively lock the company into existing relationships. These switching costs include re-tooling, recalibration, and rigorous re-qualification processes, enhancing supplier leverage and potentially leading to less favorable pricing and contract terms for HORIBA.

Suppliers offering unique or patented materials and technologies critical for HORIBA's product differentiation possess increased bargaining power. If a vital component relies on a proprietary sensor technology available from a single supplier, HORIBA's negotiation flexibility is constrained, particularly in advanced materials science sectors where such specialized inputs are prevalent.

The concentration within supplier industries, where a few dominant companies control markets for critical raw materials or components, significantly amplifies supplier bargaining power. This market structure limits HORIBA's alternative sourcing options, allowing concentrated suppliers to influence pricing and contract terms, thereby impacting HORIBA's cost of goods sold and overall profitability.

| Factor | Impact on HORIBA | Example/Data (2024) |

| Supplier Specialization | High leverage due to limited alternatives for critical components. | Precision optics and advanced sensors are key inputs. |

| Switching Costs | Lock-in effect, reducing HORIBA's flexibility in pricing negotiations. | Costs include re-tooling, recalibration, and re-qualification. |

| Supplier Concentration | Dominant suppliers can dictate terms, increasing HORIBA's operational costs. | Few global manufacturers for specific sensors used in analytical instruments. |

| Proprietary Technology | Suppliers with unique technologies gain significant bargaining power. | Reliance on a single supplier for a proprietary sensor in advanced analysis equipment. |

What is included in the product

Analyzes the five competitive forces impacting HORIBA's industry, revealing threats from new entrants, substitutes, buyer/supplier power, and competitive rivalry.

Instantly visualize competitive intensity with a dynamic, interactive dashboard that highlights key strategic pressures.

Customers Bargaining Power

HORIBA serves a broad range of industries, but in certain areas, such as automotive original equipment manufacturers (OEMs) or major semiconductor fabrication plants, a few key clients can account for a substantial portion of sales volume. This concentration means these large customers can wield significant influence.

These major buyers can leverage their substantial purchase volumes to negotiate more favorable pricing, request tailored product configurations, or secure extended payment schedules. For instance, if a single automotive OEM represents 15% of HORIBA's revenue in a specific product line, that customer's ability to influence terms is amplified.

The presence of a few dominant customers in specific market segments inherently increases their bargaining power. They can credibly threaten to shift their business to competitors if their demands are not met, forcing HORIBA to carefully manage these relationships and their associated pricing and service expectations.

The availability of alternative suppliers significantly impacts the bargaining power of customers for companies like HORIBA. When numerous manufacturers offer comparable analytical and measurement instruments, customers gain leverage. This is particularly true if HORIBA's products lack strong differentiation or if competitors provide similar quality at more attractive price points. For instance, in the semiconductor equipment market, where HORIBA has a presence, the landscape is competitive with players like Applied Materials and KLA Corporation, offering customers choices that can drive down prices or demand better terms.

Customer price sensitivity is a significant factor for HORIBA, especially when analytical instruments represent a substantial investment. In 2024, many industries are still navigating economic uncertainties, leading to tighter budgets. This heightened sensitivity means customers are more likely to compare prices rigorously and seek out the best value, potentially pressuring HORIBA to adopt more competitive pricing models.

For instance, in sectors like academic research or smaller manufacturing firms, where capital expenditure budgets are often limited, price becomes a primary decision driver. This can directly impact HORIBA's profit margins if they are forced to lower prices to secure sales against competitors. Therefore, understanding the prevailing economic climate and the financial health of their target industries is paramount for HORIBA's pricing strategies.

Customer Switching Costs

Customer switching costs are a significant factor in determining the bargaining power of clients for companies like HORIBA. When it becomes expensive or time-consuming for customers to move to a competitor, their ability to demand lower prices or better terms is diminished. For HORIBA, these costs can include the expense of retraining staff on new equipment, the validation processes required to ensure new instruments meet regulatory standards, and the integration of new systems with existing infrastructure. These hurdles create a natural stickiness for HORIBA's offerings.

HORIBA actively works to increase these switching costs, thereby strengthening its competitive position. By developing integrated software solutions that work seamlessly with their instruments, providing comprehensive service packages, and offering long-term technical support, HORIBA aims to make its ecosystem more valuable and harder to leave. This strategy fosters customer loyalty and reduces the likelihood of customers seeking alternative suppliers, even if competitor pricing is slightly lower.

For instance, in the analytical instrumentation market, the total cost of ownership often extends beyond the initial purchase price. A study by Gartner in 2023 highlighted that for enterprise-level software deployments, which often accompany sophisticated scientific instruments, the average cost of switching can represent 15-20% of the initial software investment due to data migration, customization, and retraining needs. While specific figures for HORIBA are proprietary, this general market trend underscores the importance of switching costs.

- High switching costs limit customer bargaining power by increasing the financial and operational burden of changing suppliers.

- Re-training staff, process re-validation, and system integration are key components of these costs for HORIBA's customers.

- HORIBA's strategy focuses on creating "sticky" solutions through integrated software, robust service, and ongoing support.

- This approach aims to build customer loyalty and reduce price sensitivity, enhancing HORIBA's market stability.

Threat of Backward Integration by Customers

In certain highly specialized niches within the analytical instruments market, large, R&D-intensive customers might possess the necessary technical expertise and financial clout to develop their own in-house solutions. This potential for backward integration, though uncommon, acts as a significant pressure point, encouraging HORIBA to maintain competitive pricing and continuously enhance its technological offerings and customer service. For instance, major pharmaceutical companies or advanced materials research institutions with substantial internal engineering capabilities could explore developing proprietary analytical tools if they perceive HORIBA's offerings as too costly or lacking specific functionalities.

The threat of customers developing their own analytical solutions can be particularly potent in sectors where intellectual property and proprietary data are paramount. Companies heavily invested in innovation might see in-house development as a way to gain a competitive edge and maintain greater control over their research processes. This is especially true for organizations that spend a significant portion of their revenue on R&D; for example, in 2024, the global R&D spending by the top 2,500 companies reached an estimated $1.3 trillion, indicating substantial resources available for such strategic moves.

- Customer Capability: Large, R&D-focused organizations may have the technical skills to develop in-house analytical instruments.

- Financial Resources: Significant R&D budgets, potentially in the billions for major corporations, can fund internal development projects.

- Competitive Pressure: This threat compels HORIBA to offer advanced technology and superior service to retain customers.

- Market Influence: The possibility of backward integration influences HORIBA's pricing strategies and product development roadmap.

The bargaining power of customers for HORIBA is moderate, influenced by factors like customer concentration, price sensitivity, and switching costs. While HORIBA serves diverse industries, a few large clients in sectors like automotive or semiconductors can exert significant pressure on pricing and terms due to their substantial order volumes.

Customers' ability to negotiate is also heightened by the availability of alternative suppliers and their own price sensitivity, especially in economically uncertain periods like 2024. HORIBA mitigates this by increasing switching costs through integrated solutions and comprehensive support, making it less attractive for clients to move to competitors.

The potential for large, R&D-intensive customers to develop in-house solutions also acts as a check on HORIBA's pricing power. This threat, underscored by significant global R&D spending, encourages HORIBA to maintain competitive offerings and superior customer service to retain its client base.

| Factor | Impact on HORIBA | Mitigation Strategy |

| Customer Concentration | High for key clients | Relationship management, value-added services |

| Availability of Alternatives | Moderate to High | Product differentiation, competitive pricing |

| Switching Costs | Moderate (increasing) | Integrated solutions, service & support packages |

| Price Sensitivity | Moderate (especially in 2024) | Value-based pricing, cost-efficiency communication |

| Threat of Backward Integration | Low to Moderate | Continuous innovation, superior performance |

Same Document Delivered

HORIBA Porter's Five Forces Analysis

This preview showcases the exact HORIBA Porter's Five Forces Analysis you will receive, offering a comprehensive evaluation of competitive forces within the industry. The document details the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, all presented in a professionally formatted and ready-to-use file. What you see here is the complete analysis, ensuring you get precisely the insights needed to understand HORIBA's strategic landscape.

Rivalry Among Competitors

The analytical and measurement instrument market is quite fragmented, meaning there are many companies vying for business across HORIBA's various sectors. This includes everything from automotive testing to medical diagnostics and semiconductor manufacturing equipment. For instance, in the semiconductor equipment space alone, HORIBA competes with giants like Applied Materials and KLA Corporation, alongside many smaller, specialized firms.

This intense competition comes from both large, global corporations with broad product portfolios and smaller, highly specialized niche players who excel in specific technologies. This dynamic means HORIBA must constantly differentiate itself and maintain a clear strategic focus to stand out in these diverse markets.

In mature segments of the analytical and measurement instrument market, where HORIBA has a significant presence, competitive rivalry is often intense. Companies vie for market share in slower-growing areas, leading to potential price pressures. For instance, in the automotive testing sector, a mature market, established players frequently compete on feature sets and service.

However, HORIBA also operates in rapidly expanding fields such as advanced semiconductor manufacturing equipment and cutting-edge medical diagnostic technologies. These emerging areas, characterized by high growth potential, can initially temper direct price-based competition as companies focus on innovation and capturing new market opportunities. For example, the demand for advanced metrology tools in semiconductor fabrication, a key area for HORIBA, saw substantial growth in 2024, driven by the ongoing chip shortage and the push for more sophisticated manufacturing processes.

HORIBA faces intense rivalry where technological innovation and product performance are key differentiators. Competitors are heavily investing in research and development to enhance accuracy, speed, and user-friendliness, as seen in the advanced analytical instruments market where HORIBA operates. For instance, in the semiconductor manufacturing sector, a significant market for HORIBA, the pace of innovation is incredibly rapid, with companies striving for nanometer-level precision and increased throughput.

Exit Barriers for Competitors

High exit barriers, like the specialized nature of HORIBA's advanced measurement and analysis equipment, mean competitors may stay in the market even when struggling. This can lead to persistent overcapacity and price competition, as seen in segments of the semiconductor testing equipment market where significant R&D investments create substantial sunk costs. HORIBA should closely track the financial performance of key rivals to anticipate potential market disruptions.

These barriers can trap less efficient players, prolonging periods of intense rivalry and potentially leading to price wars. For instance, companies heavily invested in proprietary manufacturing processes for scientific instruments may find it prohibitively expensive to exit, forcing them to continue competing even at reduced profit margins. Monitoring competitor financial health is crucial for HORIBA to navigate these dynamics.

- Specialized Assets: HORIBA's high-precision manufacturing facilities and testing equipment represent significant capital investments that are difficult to repurpose or sell.

- R&D Sunk Costs: Continuous innovation in areas like spectroscopy and particle analysis requires substantial and ongoing research and development expenditure, creating high sunk costs.

- Long-Term Contracts: Competitors may be bound by long-term supply or service agreements that make an immediate exit financially unviable.

- Brand Loyalty and Reputation: Building a strong reputation in scientific instrumentation takes years, and exiting the market would mean forfeiting this established goodwill.

Competitive Strategies and Pricing

Competitive rivalry within the scientific and analytical instrumentation sector, where HORIBA operates, is intense. Companies frequently employ aggressive pricing tactics to capture market share, alongside significant investments in research and development to foster innovation. For instance, in 2024, the global analytical instruments market saw continued R&D spending as companies raced to develop more sensitive and efficient technologies, with some reports indicating R&D as a substantial percentage of revenue for leading players.

Beyond pricing and R&D, firms like HORIBA face competition through the expansion of global distribution networks and a focus on superior customer service. Strategic alliances and mergers are also common, allowing companies to consolidate market power or acquire new technological capabilities. This dynamic environment necessitates that HORIBA continuously adapts its strategies to effectively counter the multifaceted competitive moves from rivals.

- Aggressive Pricing: Competitors often engage in price wars to gain market share.

- R&D Investment: Continuous innovation through R&D is a key differentiator, with significant spending reported by industry leaders in 2024.

- Distribution & Service: Expanding global reach and enhancing customer support are crucial competitive strategies.

- Strategic Alliances & M&A: Partnerships and mergers are utilized to bolster market position and technological advantage.

HORIBA faces intense competition across its diverse product segments, driven by numerous players ranging from global conglomerates to specialized niche firms. This rivalry is particularly fierce in mature markets where companies often compete on price and feature sets. For example, in the automotive testing sector, established companies frequently engage in aggressive pricing strategies to maintain or grow their market share.

The rapid pace of technological advancement, especially in areas like semiconductor manufacturing equipment, fuels this rivalry. Companies are heavily investing in R&D to enhance product performance, accuracy, and efficiency. In 2024, significant R&D spending was observed across the analytical instruments market, with leading firms dedicating substantial portions of their revenue to innovation, aiming for advancements in areas like nanometer-level precision for semiconductor fabrication tools.

High exit barriers, such as specialized manufacturing assets and substantial R&D sunk costs, can prolong competitive intensity and lead to price pressures. Competitors may remain in the market even when facing financial challenges, contributing to overcapacity. Strategic alliances and mergers are also common tactics used by companies to consolidate market power and acquire new technologies, further intensifying the competitive landscape HORIBA navigates.

| Competitive Factor | Description | Impact on HORIBA |

|---|---|---|

| Market Fragmentation | Many competitors across diverse segments (automotive, medical, semiconductor) | Requires broad product strategy and differentiation |

| Technological Innovation | Rapid advancements in accuracy, speed, and functionality | Demands continuous R&D investment and agility |

| Pricing Pressure | Common in mature segments, exacerbated by overcapacity | Necessitates cost management and value-based pricing |

| Exit Barriers | High capital investment, R&D sunk costs, long-term contracts | Can lead to prolonged intense rivalry and price wars |

SSubstitutes Threaten

The threat of substitutes for HORIBA's measurement technologies is significant, as alternative methods can fulfill similar analytical needs. For instance, in environmental monitoring, the rise of advanced sensor networks and remote sensing techniques offers data collection capabilities that traditionally relied on fixed station analyzers, a core area for HORIBA. These emerging technologies can provide more distributed and real-time data, potentially reducing the demand for HORIBA's established product lines if they are not adapted.

Customers constantly weigh the performance of alternative solutions against their price. If a competitor offers a product that performs nearly as well but costs considerably less, or one that significantly outperforms at a similar price point, HORIBA faces a serious challenge. For instance, in the semiconductor industry, where HORIBA is active, the drive for cost efficiency is relentless. Companies might accept slightly lower precision in their testing equipment if it leads to substantial savings, impacting HORIBA's market share.

Evolving industry standards and regulations pose a significant threat. For example, the push for greener automotive emissions testing could favor new, less resource-intensive methods over traditional HORIBA equipment. In 2024, regulatory bodies globally continued to tighten environmental standards, potentially increasing the attractiveness of alternative compliance solutions.

Customer Perception and Adoption of New Methods

Customer willingness to embrace new measurement techniques significantly impacts the threat of substitutes. If alternative methods are seen as easier, faster, or greener, they can attract users even if their initial accuracy is lower. For instance, the rise of portable, handheld spectrometers, while sometimes less precise than laboratory-grade equipment, has gained significant traction in field applications due to their convenience.

HORIBA must actively demonstrate the superior value and reliability of its advanced solutions to counter this trend. Educating the market on the long-term benefits, such as improved data integrity and reduced operational costs, is crucial. For example, in the automotive emissions testing sector, while simpler on-board diagnostic tools exist, the precision and comprehensive data provided by HORIBA's systems are essential for regulatory compliance and in-depth analysis.

- Customer perception of simplicity and efficiency: A shift towards user-friendly interfaces and faster analysis times can sway customer preference, even if initial precision is slightly compromised.

- Environmental friendliness as a driver: Growing environmental consciousness means substitutes offering greener alternatives, such as reduced energy consumption or fewer consumables, can gain market share.

- HORIBA's role in market education: Proactive communication highlighting the accuracy, reliability, and long-term cost-effectiveness of HORIBA's technologies is vital to retain customers.

Emergence of Integrated Solutions

The rise of integrated, multi-functional analytical platforms and software-centric solutions presents a significant threat of substitution. These comprehensive systems can potentially replace discrete, single-purpose instruments, offering customers a more streamlined and holistic approach to their analytical needs. For instance, in the automotive testing sector, a single integrated platform might combine emissions testing, durability analysis, and performance evaluation, thereby reducing the need for separate, specialized equipment.

HORIBA actively counters this threat by focusing on providing comprehensive solutions across its various business segments. By offering integrated systems that combine hardware and software capabilities, HORIBA aims to meet the evolving demands of customers who increasingly seek consolidated analytical workflows. This strategy is crucial in maintaining market share against emerging, all-encompassing alternatives.

- Integrated platforms offer a consolidated approach to analytical tasks, potentially replacing multiple standalone instruments.

- Software-centric solutions are increasingly capable of performing functions previously requiring dedicated hardware.

- Customers may opt for the convenience and efficiency of unified systems over managing individual components.

- HORIBA's strategy of developing and offering comprehensive, integrated solutions across its product lines is a key defense against this substitution threat.

The threat of substitutes for HORIBA's measurement technologies is substantial. Alternative methods, such as advanced sensor networks and remote sensing, can fulfill similar analytical needs, particularly in environmental monitoring. In 2024, the push for cost efficiency in industries like semiconductors meant some customers might accept slightly lower precision if it offered significant savings, impacting HORIBA's market share.

Evolving industry standards, especially in environmental regulations, can favor newer, less resource-intensive alternatives. For example, the automotive sector's focus on greener emissions testing might increase the appeal of methods that bypass traditional HORIBA equipment. Customer willingness to adopt simpler, faster, or more environmentally friendly techniques, even with slightly lower initial accuracy, further fuels this threat.

| Industry Segment | Potential Substitute Technologies | Impact on HORIBA |

|---|---|---|

| Environmental Monitoring | Advanced Sensor Networks, Remote Sensing | Reduced demand for fixed station analyzers |

| Semiconductor Testing | Lower-cost, slightly less precise equipment | Potential market share erosion due to cost sensitivity |

| Automotive Emissions Testing | On-board diagnostic tools, alternative compliance solutions | Shift away from traditional equipment if regulations favor new methods |

Entrants Threaten

The analytical and measurement instrument industry, particularly in high-tech areas like semiconductor manufacturing and medical diagnostics, demands significant upfront capital. Companies need substantial investments for cutting-edge research and development, building advanced manufacturing plants, and establishing robust global sales and support networks. These considerable financial hurdles effectively deter many potential new competitors from entering the market, thereby protecting existing players like HORIBA.

Established players like HORIBA benefit from significant economies of scale in manufacturing, procurement, and research and development. This allows them to achieve lower unit costs, making it difficult for new entrants to compete on price. For instance, in 2024, HORIBA's strong global presence and high production volumes likely translated into substantial cost advantages over smaller, emerging companies.

New entrants would face considerable challenges in matching these cost efficiencies without achieving a similar level of market volume. The experience curve in precision manufacturing, a core competency for HORIBA, is particularly steep. Companies that have been producing complex analytical instruments for decades, like HORIBA, have refined their processes and supply chains, leading to further cost reductions and quality improvements that are hard for newcomers to replicate quickly.

HORIBA's robust portfolio of proprietary technology and patents presents a significant hurdle for potential new entrants. The company holds numerous patents covering its specialized measurement technologies and sophisticated algorithms, making it challenging for others to develop comparable products. This intellectual property not only deters imitation but also exposes new entrants to potential legal challenges, requiring substantial R&D investment and time to overcome.

Access to Distribution Channels

The threat of new entrants concerning access to distribution channels for technical instruments like HORIBA's is significant. Building a global network for sales and servicing is a substantial undertaking, requiring considerable time and financial investment. New players would struggle to gain the trust and reach that HORIBA currently commands.

HORIBA's existing, well-established sales infrastructure and deep customer relationships present a formidable barrier. For instance, in 2023, HORIBA reported revenue of ¥243.7 billion (approximately $1.6 billion USD at an average 2023 exchange rate), a testament to its extensive market penetration and the strength of its distribution. This established network makes it difficult for newcomers to effectively compete.

- High Capital Investment: Establishing a comparable global distribution and service network requires billions in investment, a hurdle for most new entrants.

- Brand Recognition and Trust: HORIBA's long-standing reputation for quality and reliability in technical instrumentation is a significant advantage that new entrants would find hard to replicate quickly.

- Customer Relationships: Decades of interaction and support have fostered strong ties between HORIBA and its clientele, creating loyalty that is difficult for new companies to break into.

Brand Loyalty and Reputation

Brand loyalty and reputation significantly deter new entrants, particularly in sectors where precision and reliability are non-negotiable. In critical fields such as medical diagnostics or automotive quality control, customers place immense value on trust and proven performance. HORIBA's established reputation for delivering accurate and dependable instruments acts as a substantial barrier.

For instance, in the automotive sector, where HORIBA provides emissions testing equipment, a malfunction can lead to costly recalls or regulatory penalties. This risk aversion means that established players with a track record of excellence, like HORIBA, are favored over newcomers who lack a comparable history. By 2024, the global market for automotive testing, inspection, and certification (TIC) services was valued at approximately $30 billion, with reliability being a key purchasing factor.

- High switching costs: In sensitive applications, the cost and disruption associated with switching to an unproven new supplier can be prohibitive.

- Risk aversion in critical applications: Industries like healthcare and automotive cannot afford the potential consequences of equipment failure.

- HORIBA's established trust: Decades of consistent quality and performance have built a strong, defensible brand reputation.

- Barriers to market entry: New entrants must invest heavily in building a comparable level of trust and demonstrating equivalent reliability to compete.

The threat of new entrants for HORIBA is generally low due to substantial barriers. High capital requirements for R&D, manufacturing, and global distribution networks are significant deterrents. Furthermore, HORIBA's established brand reputation, proprietary technology, and strong customer relationships create a formidable competitive moat.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024/2025 Estimates) |

|---|---|---|---|

| Capital Investment | High costs for advanced R&D, manufacturing facilities, and global sales/service infrastructure. | Prohibitive for many potential entrants. | Estimated billions required to establish a comparable global presence. |

| Proprietary Technology & IP | Extensive patent portfolio and unique technological know-how. | Difficult to replicate, risk of legal challenges. | HORIBA holds numerous patents in areas like spectroscopy and particle analysis. |

| Brand Reputation & Trust | Long-standing history of quality, reliability, and performance. | New entrants struggle to build comparable trust, especially in critical applications. | Industries like healthcare and automotive prioritize proven suppliers. |

| Economies of Scale | Lower unit costs due to high production volumes and efficient supply chains. | New entrants face higher per-unit costs, impacting price competitiveness. | HORIBA's 2023 revenue of ¥243.7 billion indicates significant scale. |

Porter's Five Forces Analysis Data Sources

Our HORIBA Porter's Five Forces analysis is built upon a robust foundation of data, incorporating financial reports, industry-specific market research from firms like Gartner and IDC, and public company filings. This ensures a comprehensive understanding of competitive dynamics.