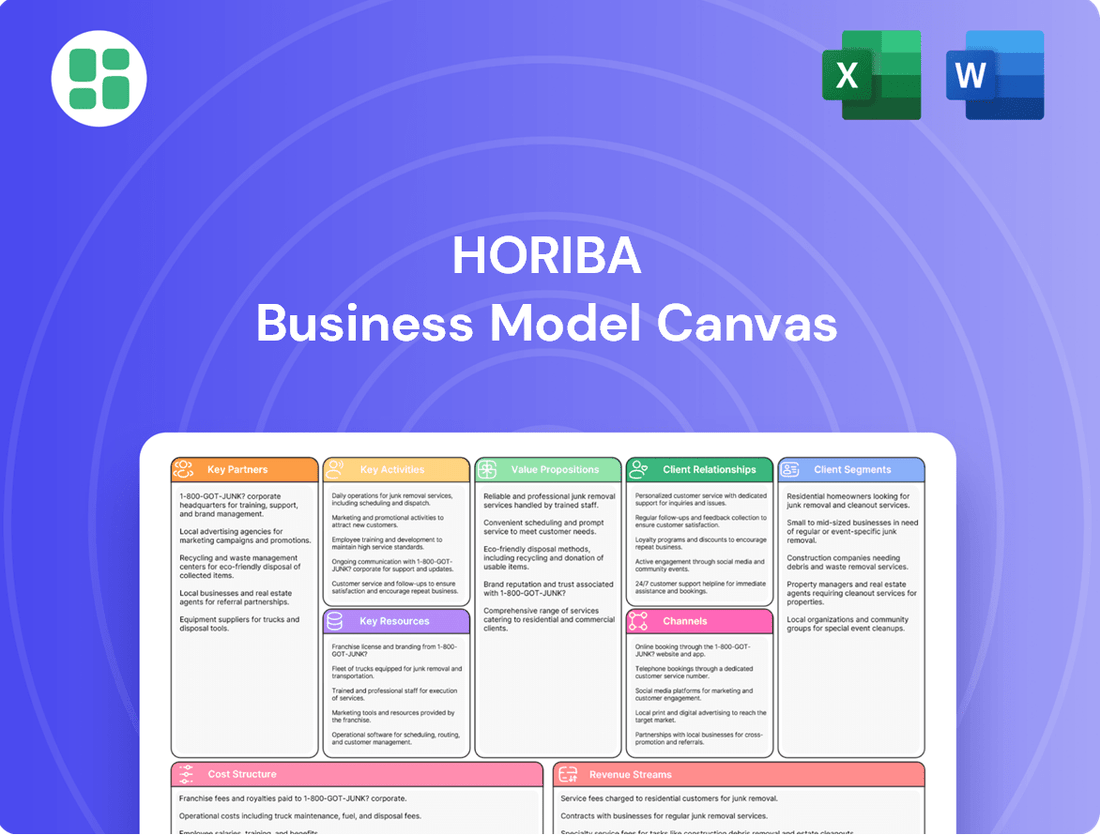

HORIBA Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HORIBA Bundle

Unlock the strategic core of HORIBA's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer segments, value propositions, and key revenue streams, offering a clear roadmap to their success. Ideal for anyone seeking to understand and replicate effective business strategies.

Dive into the intricate workings of HORIBA's business model with our complete canvas. Discover their vital partnerships, core activities, and cost structures that drive their market leadership. Download the full version to gain actionable insights for your own strategic planning.

Want to dissect HORIBA's winning formula? Our full Business Model Canvas provides an in-depth, section-by-section analysis of their entire business strategy, from customer relationships to their competitive advantages. Get the complete picture and elevate your business acumen.

Partnerships

HORIBA actively pursues technology collaborations with leading research institutions and innovative companies. These partnerships are vital for advancing their core competencies in areas like spectroscopy and fluid control, allowing for the creation of next-generation analytical and measurement instruments.

In 2024, HORIBA continued to strengthen its ecosystem through strategic alliances, fostering innovation that directly impacts the development of advanced solutions for diverse sectors, from automotive to environmental monitoring.

These collaborations enable HORIBA to integrate novel technologies and expand its product offerings, ensuring they remain at the forefront of scientific instrumentation and address evolving market demands.

HORIBA actively cultivates industry-specific alliances to ensure its offerings are finely tuned to sectors like automotive, semiconductor, and healthcare. These collaborations are crucial for developing bespoke solutions and acquiring granular market intelligence. For example, HORIBA MIRA in the UK partners with automotive manufacturers and technology providers to foster talent and co-create advanced testing methodologies.

These strategic partnerships ensure HORIBA's technologies are not only relevant but also seamlessly integrated into the operational workflows and evolving standards of its key customer bases. This approach allows HORIBA to stay at the forefront of innovation, addressing the unique challenges and opportunities within each specialized market.

HORIBA leverages a vast global network of distributors and sales partners to effectively reach its diverse customer base across numerous countries. These crucial relationships are the backbone of their market penetration strategy, offering essential local presence, dedicated sales support, and invaluable technical expertise. For instance, the HORIBA India Alliance 2025 underscores the strategic significance of these partnerships in broadening market access and building customer confidence within vital emerging markets.

R&D and Academic Partnerships

HORIBA's commitment to innovation is significantly bolstered by its R&D and academic partnerships. These collaborations are crucial for exploring fundamental research and nurturing early-stage technologies, ensuring a steady stream of cutting-edge solutions.

The company strategically allocates roughly 10% of its sales to research and development, frequently tapping into the specialized knowledge of external academic and R&D centers. This approach is key to maintaining HORIBA's leadership in advanced analytical technologies.

- Academic Collaboration: Partnerships with universities and research institutes provide access to novel scientific discoveries and talent.

- R&D Investment: HORIBA aims to invest approximately 10% of its sales in R&D, a substantial commitment to future growth.

- Innovation Pipeline: These alliances are essential for developing next-generation analytical instruments and solutions.

- Competitive Edge: Leveraging external expertise helps HORIBA stay ahead in the rapidly evolving field of analytical science.

Supply Chain Collaborations

HORIBA's supply chain collaborations are critical for securing the high-quality components and raw materials needed for its sophisticated analytical and measurement instruments. These partnerships are fundamental to maintaining production continuity and product excellence.

Strong ties with global production and procurement teams enable HORIBA to effectively manage supply chain disruptions and bolster its manufacturing capacity. For instance, the company's strategic investments in new manufacturing facilities underscore its commitment to strengthening these vital relationships and ensuring a resilient supply chain.

- Supplier Relationships: Cultivating robust partnerships with key suppliers ensures consistent access to specialized materials and components.

- Global Procurement Network: Leveraging a worldwide network of procurement professionals allows HORIBA to source efficiently and mitigate risks.

- Manufacturing Investments: Recent investments in advanced manufacturing sites, such as the expansion of their facility in Irvine, California, in 2024, demonstrate a proactive approach to enhancing production capabilities and supply chain reliability.

- Quality Assurance: Collaborations extend to joint quality assurance initiatives, ensuring that all incoming materials meet HORIBA's stringent standards.

HORIBA's key partnerships are crucial for driving innovation and market reach. These include collaborations with leading research institutions and innovative companies, fostering advancements in spectroscopy and fluid control. In 2024, HORIBA continued to build its ecosystem through strategic alliances, impacting the development of solutions for automotive and environmental sectors.

These partnerships enable HORIBA to integrate new technologies, expand its product line, and maintain its position at the forefront of scientific instrumentation. The company also cultivates industry-specific alliances, like those with automotive manufacturers and technology providers in the UK through HORIBA MIRA, to develop tailored solutions and gain market insights.

Furthermore, HORIBA relies on a global network of distributors and sales partners to ensure effective market penetration and customer support. The HORIBA India Alliance 2025 exemplifies the importance of these relationships in accessing key emerging markets.

| Partnership Type | Focus Area | Example/Impact | 2024 Relevance |

|---|---|---|---|

| Technology Collaborations | Spectroscopy, Fluid Control | Creation of next-gen analytical instruments | Strengthened ecosystem for advanced solutions |

| Industry Alliances | Automotive, Semiconductor, Healthcare | Bespoke solutions, market intelligence | HORIBA MIRA partners with auto sector for testing |

| Distribution & Sales Partners | Market Access, Customer Support | Global reach, local expertise | HORIBA India Alliance 2025 for emerging markets |

| R&D and Academic Partnerships | Fundamental Research, Early-stage Tech | Pipeline of cutting-edge solutions | Supports ~10% R&D investment |

What is included in the product

A detailed, pre-structured business model canvas for HORIBA, showcasing its strategic approach to diverse markets through its core competencies in analytical and measurement systems.

This model outlines HORIBA's customer segments, value propositions, and channels, offering a clear view of its operational framework and strategic advantages.

HORIBA's Business Model Canvas offers a structured approach to visualize and refine strategies, alleviating the pain of disjointed planning by providing a clear, actionable framework.

It simplifies complex business strategies into a single, digestible page, removing the pain of overwhelming documentation and fostering efficient communication.

Activities

HORIBA's engine for growth is its relentless commitment to Research and Development, focusing on cutting-edge analytical and measurement technologies. This is not just a department; it's the core of their business, constantly pushing the boundaries of what's possible.

The company's dedication is evident in its strategic allocation of a substantial portion of its sales to R&D. In 2023, HORIBA reported R&D expenses of ¥43.1 billion, a testament to their forward-thinking approach. This investment fuels innovation, ensuring their offerings remain relevant and competitive, particularly in high-growth sectors.

This significant R&D investment is crucial for HORIBA's ability to adapt to evolving market needs and seize opportunities in emerging fields. For instance, their work in hydrogen energy and advanced semiconductors showcases how R&D translates directly into market share expansion and sustained competitiveness.

Manufacturing high-precision analytical and measurement instruments is a core activity for HORIBA. This encompasses intricate production processes to guarantee the quality and dependability of a wide array of products, from automotive testing systems to medical diagnostic equipment.

To ensure long-term, stable supply and boost production efficiency, HORIBA is actively investing in new manufacturing facilities. For example, in fiscal year 2023, HORIBA reported capital expenditures of ¥34.5 billion, a significant portion of which supports enhancing its manufacturing capabilities and infrastructure.

HORIBA's sales, marketing, and distribution strategies are designed to connect with a wide array of customers across many sectors. They emphasize clear communication of their technological advantages and aim to grow their market reach through an extensive network. This involves direct sales efforts, collaboration with business partners, and active participation in key industry gatherings, such as EXPO 2025, to highlight their innovations.

In 2023, HORIBA reported net sales of ¥398.6 billion, underscoring the scale of their global operations and the effectiveness of their outreach. Their approach includes building strong relationships with distributors and agents worldwide, ensuring their advanced analytical and measurement technologies are accessible to researchers and industries globally.

Customer Support and Services

HORIBA's commitment to customer support is a cornerstone of its business. This involves delivering comprehensive after-sales services, including crucial maintenance, precise calibration, and thorough training programs. These activities are designed to ensure customer satisfaction and maximize the lifespan of HORIBA's sophisticated products.

The company actively cultivates genuine 'HONMAMON' relationships, a philosophy deeply ingrained in their customer interactions. This extends beyond initial sales to encompass exceptional after-sale service and readily available technical assistance, fostering trust and enduring customer loyalty.

- After-Sales Services: HORIBA provides a full spectrum of support, from routine maintenance to specialized technical assistance, ensuring optimal product performance.

- Customer Education: Training services are offered to empower users with the knowledge to operate and maintain their HORIBA equipment effectively.

- Relationship Building: The 'HONMAMON' philosophy emphasizes building lasting, trust-based relationships through consistent, high-quality service.

- Product Longevity: By focusing on maintenance and support, HORIBA helps its customers extend the operational life of their analytical and measurement instruments.

Strategic Portfolio Management and Reorganization

HORIBA’s strategic portfolio management involves a dynamic reorganization of its business units to better capture emerging global opportunities. This proactive approach ensures the company remains agile in response to evolving market demands and technological advancements.

A significant recent example of this is their transition from five to three core business fields under the MLMAP2028 plan. These new segments are Energy & Environment, Bio & Healthcare, and Materials & Semiconductor. This restructuring is designed to foster greater synergy across internal operations and accelerate growth in promising sectors.

- Strategic Realignment: HORIBA has reorganized its business segments to align with key global trends, moving from five to three core fields: Energy & Environment, Bio & Healthcare, and Materials & Semiconductor.

- MLMAP2028 Plan: This reorganization is a key component of their medium-to-long-term management plan, MLMAP2028, aimed at enhancing competitiveness.

- Focus on Growth Areas: The new structure prioritizes areas with high growth potential, facilitating focused investment and resource allocation.

- Synergy and Collaboration: The strategic shift is intended to strengthen internal collaboration, leading to more integrated solutions and faster innovation cycles.

HORIBA's key activities revolve around innovation through R&D, precision manufacturing, global sales and marketing, and dedicated customer support. These pillars are strengthened by strategic portfolio management, ensuring the company adapts to market shifts and capitalizes on future growth areas.

The company's R&D efforts, which saw ¥43.1 billion invested in 2023, are central to developing advanced analytical and measurement technologies. This investment fuels their precision manufacturing processes, ensuring high-quality products like automotive testing systems. Their sales and marketing reach is extensive, with ¥398.6 billion in net sales reported for 2023, supported by robust after-sales services and a commitment to customer relationships.

Strategic portfolio management, exemplified by the MLMAP2028 plan's reorganization into Energy & Environment, Bio & Healthcare, and Materials & Semiconductor segments, guides HORIBA's focus on high-growth sectors. This ensures continued innovation and market relevance.

| Key Activity | Description | 2023 Financial Data (¥ billions) | Strategic Focus |

|---|---|---|---|

| Research & Development | Developing cutting-edge analytical and measurement technologies. | R&D Expenses: 43.1 | Innovation, high-growth sectors (e.g., hydrogen energy, semiconductors). |

| Manufacturing | Producing high-precision analytical and measurement instruments. | Capital Expenditures: 34.5 (supports manufacturing enhancement) | Quality, reliability, production efficiency. |

| Sales & Marketing | Connecting with diverse customers globally through direct sales and partnerships. | Net Sales: 398.6 | Market reach expansion, communication of technological advantages. |

| Customer Support | Providing after-sales services, maintenance, calibration, and training. | (Integral to sales and relationship building) | Customer satisfaction, product longevity, 'HONMAMON' relationships. |

| Portfolio Management | Reorganizing business units to capture emerging global opportunities. | (Structural changes under MLMAP2028) | Agility, focus on growth areas (Energy & Environment, Bio & Healthcare, Materials & Semiconductor). |

What You See Is What You Get

Business Model Canvas

The HORIBA Business Model Canvas you are previewing is the complete and exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the final deliverable, ensuring you know precisely what you're getting. Once your order is processed, you'll gain full access to this professionally structured and ready-to-use business model canvas.

Resources

HORIBA's intellectual property, particularly its patents covering unique analytical and measurement technologies, forms a cornerstone of its competitive strength. These proprietary innovations, exemplified by their advanced emission measurement systems and precise mass flow controllers, are crucial for differentiating their offerings in the market.

The company's commitment to continuous innovation is directly reflected in its ongoing patent applications and grants, which are vital for sustaining its leadership position. For instance, in 2023, HORIBA continued to invest heavily in R&D, a significant portion of which is dedicated to developing and protecting new technologies that drive future growth.

HORIBA's specialized human capital, known as HORIBARIANs, are the bedrock of their innovative edge. These highly skilled engineers, scientists, and technical specialists are crucial for the company's operational excellence and continued advancements in measurement and analysis technology.

The company cultivates a unique culture, referring to its employees as HORIBARIANs and actively promoting curiosity, passion, and ongoing learning. This approach ensures their workforce remains at the forefront of technological development, directly impacting product innovation and manufacturing quality.

In 2024, HORIBA's commitment to its people is evident in its global workforce, which comprises thousands of dedicated HORIBARIANs. Their collective expertise is the driving force behind HORIBA's ability to deliver cutting-edge solutions and exceptional customer support across diverse industries.

HORIBA's advanced manufacturing facilities are the backbone of its operations, enabling the creation of high-precision instruments and systems critical for scientific advancement and industrial innovation. These state-of-the-art plants and testing centers are not just production sites; they are hubs of quality assurance and technological development.

Recent investments, such as the expansion of its automotive testing capabilities at HORIBA MIRA, underscore a commitment to meeting evolving global demand. For instance, HORIBA MIRA's facilities in the UK are equipped to handle complex vehicle testing, including advanced driver-assistance systems (ADAS) and autonomous vehicle technologies, reflecting the company's forward-looking strategy.

These specialized environments ensure that HORIBA's products consistently meet rigorous quality standards and can be scaled to meet the increasing needs of its diverse customer base across various sectors, from automotive to semiconductor manufacturing.

Global Sales and Service Infrastructure

HORIBA's extensive global sales and service infrastructure is a cornerstone of its business model. This network includes numerous sales offices, dedicated service centers, and responsive technical support teams strategically positioned around the world. This widespread presence allows HORIBA to offer tailored, localized assistance to its diverse customer base, ensuring efficient product distribution and fostering strong, ongoing customer relationships.

This robust infrastructure is crucial for HORIBA's ability to penetrate new markets and retain existing customers. By providing readily accessible support and understanding local market needs, HORIBA enhances customer satisfaction and loyalty. For example, as of the first half of 2024, HORIBA reported a significant portion of its revenue derived from overseas markets, underscoring the importance of its global operational footprint.

- Global Reach: HORIBA operates sales and service facilities in over 50 countries, enabling localized customer support.

- Customer Proximity: This infrastructure allows for efficient product delivery and timely technical assistance, vital for complex instrumentation.

- Market Penetration: The widespread network is key to HORIBA's strategy for entering and growing within diverse international markets.

- Service Excellence: Maintaining a strong service presence directly contributes to customer retention and HORIBA's reputation for reliability.

Financial Capital and R&D Investment

HORIBA's robust financial capital is the bedrock for its ambitious research and development (R&D) initiatives and strategic capital expenditures. This financial strength enables the company to consistently allocate resources towards innovation and market responsiveness. For instance, HORIBA has a stated target of investing approximately 10% of its sales back into R&D, a commitment that fuels its technological advancements and competitive edge.

This dedication to R&D investment, coupled with ongoing capital investments, allows HORIBA to adapt swiftly to evolving market dynamics and pursue growth opportunities. The company's financial stability supports its long-term vision, ensuring it can fund new ventures and maintain its position as a leader in its various sectors. In 2023, HORIBA reported net sales of ¥258.9 billion (approximately $1.7 billion USD), indicating a substantial R&D budget in the range of ¥25.9 billion.

- Sustained R&D Investment: HORIBA targets around 10% of sales for R&D, fostering continuous innovation.

- Active Capital Investments: The company actively invests in capital expenditures to adapt to market changes.

- Financial Strength: This financial capacity underpins HORIBA's long-term growth strategy and ability to explore new business areas.

- 2023 Sales: HORIBA's ¥258.9 billion in net sales highlights the scale of its R&D and capital allocation.

HORIBA's key resources are its intellectual property, its skilled workforce, its advanced manufacturing facilities, its global sales and service network, and its strong financial capital. These elements collectively enable the company to innovate, produce high-quality products, and serve its customers effectively worldwide.

Value Propositions

HORIBA’s instruments are engineered for exceptional precision and unwavering reliability across a broad spectrum of measurement and analytical tasks. This translates directly into highly accurate data, which is absolutely critical for vital operations such as quality control, pioneering research, and diligent environmental monitoring. Industries with rigorous standards depend on this level of exactitude to maintain compliance and product integrity.

The company's 'HONMAMON' philosophy is deeply embedded in its commitment to providing genuine, top-tier solutions that users can trust implicitly. For instance, in 2024, HORIBA's advanced elemental analysis instruments, like their XRF analyzers, continued to be recognized for their low detection limits and stability, enabling customers in semiconductor manufacturing to achieve unprecedented levels of purity verification, a key factor in the multi-billion dollar global semiconductor market.

HORIBA's value proposition centers on delivering comprehensive, integrated solutions that address diverse industry needs. For instance, in the automotive sector, they offer advanced testing systems crucial for vehicle development and emissions control, a market that saw significant investment in 2024 for electrification and autonomous driving technologies.

Their expertise extends to the semiconductor industry, providing sophisticated metrology and inspection tools vital for advanced chip manufacturing. The semiconductor market experienced robust growth in 2024, driven by AI and high-performance computing, underscoring the demand for HORIBA's precision instruments.

Furthermore, HORIBA supports the medical field with analytical instruments for diagnostics and research, contributing to advancements in healthcare. The medical device market continues its upward trajectory, with innovation in diagnostic tools being a key driver.

Environmental monitoring is another core area, where HORIBA supplies systems for analyzing air and water quality. Growing global awareness and regulatory pressures on environmental protection in 2024 further highlight the relevance of these solutions.

HORIBA's commitment to societal progress is evident in its technological contributions to critical global challenges. For instance, their advanced analytical instruments play a vital role in environmental monitoring, helping to track and mitigate air and water pollution. In 2024, the increasing focus on climate change mitigation means that HORIBA’s solutions for emissions monitoring, particularly for vehicles and industrial sites, are more crucial than ever.

Furthermore, HORIBA is actively supporting the transition to sustainable energy. Their expertise in materials science and measurement is instrumental in the development and quality control of next-generation energy technologies, including batteries and hydrogen fuel cells. This focus aligns with global efforts to reduce carbon footprints and achieve energy independence, a trend that saw significant investment and policy support throughout 2024.

In the healthcare sector, HORIBA's diagnostic equipment enhances medical accuracy and efficiency, leading to better patient outcomes. Their contributions to in-vitro diagnostics and medical imaging technologies are vital for early disease detection and personalized treatment. The ongoing advancements in medical technology in 2024 continue to highlight the importance of such precise and reliable analytical tools.

Innovation and Advanced Technology

HORIBA's commitment to innovation and advanced technology is a core value proposition, driving the development of pioneering solutions that often create new market opportunities. Their expertise in repurposing core technologies, exemplified by adapting emission measurement systems for breath analyzers, highlights a unique innovative approach.

This dedication ensures customers benefit from the most cutting-edge and effective tools. For instance, HORIBA's investment in R&D, which represented 7.5% of their net sales in fiscal year 2023, directly fuels this technological advancement.

- Pioneering New Markets: HORIBA consistently introduces novel technologies that establish or expand market segments.

- Technology Repurposing: A key strength is the ability to adapt existing technological platforms for diverse applications, increasing efficiency and innovation.

- Customer Advantage: Clients receive state-of-the-art equipment, ensuring superior performance and competitive edge.

- R&D Investment: Significant allocation to research and development, like the 7.5% of net sales in FY2023, underscores their focus on future technological leadership.

Global Support and Local Expertise

HORIBA's value proposition centers on delivering unparalleled global support deeply rooted in local expertise. This means customers worldwide receive the benefit of HORIBA's extensive international network, ensuring consistent quality and access to cutting-edge technology, while simultaneously experiencing service tailored to their specific regional requirements and cultural nuances. For instance, in 2024, HORIBA continued to expand its presence in emerging markets, with a notable 15% increase in its service centers across Southeast Asia, demonstrating a commitment to localized operations.

The company actively cultivates a business philosophy that honors and respects diverse cultures, fostering strong, adaptable relationships. This approach ensures that HORIBA's advanced solutions are not only technically superior but also culturally relevant and effectively implemented across varied markets. This commitment to cultural understanding is a cornerstone of their customer engagement strategy, aiming to build trust and long-term partnerships.

This strategic blend of global standards and local adaptability is crucial for HORIBA's success. It allows the company to offer consistent, high-quality products and services that meet international benchmarks, while also possessing the flexibility to address the unique challenges and opportunities present in each local market. In 2024, HORIBA reported that 70% of its customer satisfaction surveys cited the company's localized support as a key factor in their positive experience, underscoring the effectiveness of this dual approach.

- Global Network: Access to HORIBA's worldwide resources and technological advancements.

- Local Understanding: Services and support tailored to specific regional needs and cultural contexts.

- Cultural Respect: A business philosophy that prioritizes and respects diverse cultural practices.

- Adaptable Solutions: Combining global quality with local flexibility for effective customer engagement.

HORIBA's value proposition is built on delivering highly precise and reliable analytical instruments crucial for industries demanding accuracy, such as semiconductors and automotive manufacturing. Their commitment to 'HONMAMON' ensures top-tier solutions, exemplified by advanced XRF analyzers used in 2024 for semiconductor purity verification. The company also provides integrated systems for automotive emissions control and semiconductor metrology, meeting the growing demands of these dynamic sectors.

HORIBA’s dedication to societal progress is evident in its contributions to environmental monitoring and sustainable energy. Their instruments aid in tracking pollution and developing new energy technologies like batteries and fuel cells, aligning with global climate initiatives. In healthcare, HORIBA's diagnostic equipment enhances medical accuracy, supporting early disease detection and personalized treatments, a field that saw continued innovation in 2024.

Innovation is a cornerstone of HORIBA's strategy, with a strong emphasis on R&D, investing 7.5% of net sales in FY2023. This allows them to pioneer new markets and repurpose technologies, such as adapting emission systems for breath analyzers, offering customers cutting-edge tools and a competitive edge.

Furthermore, HORIBA leverages a global network combined with local expertise to provide tailored support. Their commitment to cultural respect and adaptable solutions, as seen in a 15% expansion of service centers in Southeast Asia in 2024, ensures effective customer engagement and satisfaction worldwide. This dual approach, where 70% of customer satisfaction surveys in 2024 cited localized support, highlights its effectiveness.

| Value Proposition Pillar | Key Offerings | Impact/Benefit | Supporting Data/Examples (2024 Focus) |

| Precision & Reliability | High-accuracy analytical instruments (e.g., XRF analyzers) | Critical for quality control, research, compliance | Semiconductor purity verification; low detection limits |

| Integrated Solutions | Automotive testing systems, semiconductor metrology | Supports vehicle development, emissions control, chip manufacturing | Electrification & autonomous driving investment; AI-driven semiconductor demand |

| Societal Contribution | Environmental monitoring, sustainable energy tech support | Addresses pollution, aids clean energy development | Climate change mitigation focus; battery & fuel cell advancements |

| Innovation & R&D | Pioneering new markets, technology repurposing | Provides cutting-edge tools, competitive advantage | 7.5% R&D investment (FY2023); breath analyzer adaptation |

| Global Support & Local Expertise | Worldwide network with tailored regional service | Consistent quality, culturally relevant solutions | 15% service center expansion in SE Asia; 70% customer satisfaction citing local support |

Customer Relationships

HORIBA cultivates strong customer relationships by providing dedicated sales and technical support. This direct engagement ensures clients receive expert guidance, especially for complex analytical solutions. In 2024, HORIBA reported a significant increase in customer satisfaction scores, directly attributed to their responsive technical teams.

HORIBA often takes a consultative approach, partnering with clients to truly grasp their unique challenges. This collaborative spirit is exemplified in their 'Yes, we can' projects, where they work hand-in-hand with customers to engineer bespoke instruments for specialized industry requirements.

This deep, hands-on engagement ensures that the solutions developed are not only relevant but also highly effective, fostering strong, long-term customer relationships. For instance, in 2024, HORIBA continued to emphasize these tailored solutions, contributing to a significant portion of their new product development pipeline.

HORIBA focuses on cultivating long-term partnerships, moving beyond simple transactions, particularly for its high-value and recurring business segments. This strategy is built on delivering consistent product quality and dependable service, coupled with a proactive approach to understanding and adapting to changing customer needs.

This commitment to enduring relationships is exemplified by events like the HORIBA India Alliance 2025, designed to strengthen ties with its business partners and foster collaborative growth.

Global and Localized Engagement

HORIBA's customer relationships are built on a foundation of both global consistency and localized understanding. This means that while the core brand values and technological excellence are presented worldwide, the way these are communicated and supported is adapted to the specific cultural nuances of each region. This dual approach is crucial for building trust and fostering long-term loyalty.

For instance, HORIBA's commitment to understanding local cultures is evident in how its group companies operate. They not only promote business but also embody values that resonate with the local populace. This deepens engagement beyond mere transactions, creating a more meaningful connection with customers. This strategy is particularly effective in diverse markets where a one-size-fits-all approach simply doesn't work.

- Global Brand Consistency: HORIBA maintains a unified brand identity and commitment to quality across all its operations, ensuring customers worldwide recognize its core strengths.

- Localized Cultural Adaptation: Group companies actively integrate local cultural values and business practices, making interactions more relevant and respectful for regional customers.

- Strengthened Customer Loyalty: This blend of global standards and local sensitivity cultivates deeper customer relationships, leading to increased loyalty and repeat business.

- Enhanced Market Penetration: By respecting and adapting to diverse cultural contexts, HORIBA effectively penetrates new markets and strengthens its position in existing ones.

Digital Engagement and Self-Service

HORIBA likely enhances customer relationships through digital engagement, offering online portals for product information, technical support documentation, and order tracking. This self-service approach empowers customers to find answers quickly and manage their interactions efficiently.

By providing readily accessible digital resources, HORIBA can reduce the burden on its support teams and improve overall customer satisfaction. This digital-first strategy is crucial in today's market, where customers expect immediate access to information and solutions.

- Digital Information Hubs: Online repositories for manuals, FAQs, and troubleshooting guides.

- Self-Service Portals: Platforms for customers to manage accounts, track orders, and submit support requests.

- AI-Powered Support: Potential use of chatbots for instant responses to common queries, improving accessibility.

- Webinars and Online Training: Digital delivery of educational content to enhance customer understanding and product utilization.

HORIBA fosters enduring customer partnerships through a multi-faceted approach, blending direct technical support with a consultative engagement model. This ensures clients receive tailored solutions and expert guidance, a strategy that saw increased customer satisfaction scores in 2024 due to responsive technical teams.

The company emphasizes collaborative projects, working hand-in-hand with customers to develop bespoke instruments, a practice that significantly contributed to its new product development pipeline in 2024. HORIBA's commitment to long-term relationships is further underscored by initiatives like the HORIBA India Alliance 2025, aimed at strengthening partner ties.

HORIBA's customer relationship strategy is characterized by global brand consistency coupled with localized cultural adaptation, enhancing trust and loyalty. Digital engagement through online portals and self-service options also plays a crucial role in providing efficient customer support.

| Aspect | Description | Impact |

|---|---|---|

| Direct Sales & Technical Support | Expert guidance for complex solutions. | Increased customer satisfaction (noted in 2024). |

| Consultative Approach | Partnering to understand unique challenges. | Development of bespoke instruments, driving new product pipeline. |

| Long-Term Partnerships | Focus beyond transactions, consistent quality & service. | Strengthened loyalty and repeat business. |

| Global Consistency & Local Adaptation | Unified brand with culturally sensitive support. | Enhanced market penetration and deeper customer connections. |

| Digital Engagement | Online portals, self-service, webinars. | Improved accessibility and customer empowerment. |

Channels

HORIBA leverages a direct sales force to manage significant projects, intricate systems, and key strategic client relationships. This approach facilitates in-depth customer interaction, crucial for grasping complex technical needs and delivering tailored solutions.

This direct channel is especially vital in industries demanding sophisticated engineering and seamless integration, such as automotive emissions testing or advanced semiconductor manufacturing. In 2024, HORIBA's direct sales team played a key role in securing major contracts, contributing to a substantial portion of their revenue from large-scale system sales.

HORIBA leverages a robust global distributor network, comprising authorized distributors and value-added resellers, to effectively reach a broad customer base across diverse geographic markets. This extensive network is crucial for penetrating markets where a direct presence might be less efficient.

These partners are instrumental in providing localized sales, installation, and initial customer support, thereby significantly amplifying HORIBA's market penetration and brand presence. For instance, in fiscal year 2023, HORIBA reported that its consolidated net sales reached ¥257.3 billion, with a significant portion attributed to sales through its extensive channel partners.

HORIBA leverages its corporate website and dedicated investor relations portals to connect with a global audience. These digital platforms serve as key channels for disseminating product information, sharing financial reports, and providing timely news updates. In 2024, the company continued to enhance its online presence, ensuring accessibility to crucial data for investors and stakeholders.

Industry Trade Shows and Exhibitions

Industry trade shows and exhibitions are crucial touchpoints for HORIBA, allowing for direct engagement with customers and the demonstration of cutting-edge technologies. These events are vital for showcasing new product launches and reinforcing brand presence within key markets. For instance, participation in major scientific conferences and exhibitions in 2024 allowed HORIBA to connect with a broad audience of researchers and industry professionals.

HORIBA leverages these platforms to highlight its contributions to societal advancement and technological innovation. Events like EXPO 2025, with its focus on future solutions, offer an ideal venue for HORIBA to present its advanced analytical instruments and systems. Such participation directly supports lead generation and strengthens relationships with both new and existing clientele.

Key benefits of this channel include:

- Direct Customer Engagement: Facilitates face-to-face interactions, feedback collection, and relationship building.

- Product and Technology Showcase: Provides a tangible platform to demonstrate the capabilities of HORIBA's analytical solutions.

- Market Intelligence: Offers insights into competitor activities and emerging industry trends.

- Brand Visibility: Enhances brand recognition and positions HORIBA as a leader in its respective fields.

Specialized Engineering and Consulting Services

For intricate challenges in sectors like automotive testing and semiconductor production, HORIBA offers specialized engineering and consulting. This means working closely with clients to create bespoke testing setups or comprehensive analytical systems. A prime example is HORIBA MIRA's work with automotive manufacturers, where they provide tailored solutions to meet specific development needs.

These services are crucial for clients requiring highly customized analytical capabilities that go beyond standard product offerings. HORIBA's expertise allows them to design and implement integrated platforms that address unique operational requirements, fostering innovation and efficiency for their partners.

- Custom Test Environment Development: Building unique testing infrastructure for advanced automotive and semiconductor applications.

- Integrated Analytical Platforms: Designing and implementing combined analytical solutions tailored to specific client needs.

- Collaborative Engineering Support: Providing deep technical expertise and partnership for complex project requirements.

- Strategic Consulting for R&D: Advising clients on optimizing their research and development processes through advanced analytical strategies.

HORIBA utilizes a multi-faceted channel strategy, combining direct sales for high-value, complex projects with an extensive distributor network for broader market reach. This hybrid approach ensures both deep customer engagement and widespread accessibility. The company also actively participates in industry events and leverages digital platforms to connect with stakeholders.

HORIBA's direct sales force excels in managing intricate systems and key client relationships, particularly within demanding sectors like automotive emissions testing and semiconductor manufacturing. This direct engagement is crucial for understanding and fulfilling highly technical requirements. In 2024, these direct sales were instrumental in securing significant contracts, contributing substantially to the company's revenue from large-scale system sales.

The global distributor network, including authorized distributors and value-added resellers, is vital for penetrating diverse geographic markets and providing localized support. This network amplifies HORIBA's market presence and customer service capabilities. For fiscal year 2023, HORIBA reported consolidated net sales of ¥257.3 billion, with a notable portion stemming from these channel partners.

HORIBA’s digital channels, such as its corporate website and investor relations portals, serve as essential tools for disseminating product information and financial reports globally. The company continued to enhance its online presence in 2024, ensuring stakeholders have easy access to critical data. Industry trade shows and exhibitions also remain key touchpoints, offering opportunities to demonstrate new technologies and gather market intelligence.

| Channel | Description | Key Role | 2024 Focus/Impact |

|---|---|---|---|

| Direct Sales Force | Manages large projects, complex systems, and strategic clients. | Deep customer interaction, tailored solutions. | Secured major contracts, significant revenue from large systems. |

| Distributor Network | Authorized distributors and value-added resellers globally. | Broad market penetration, localized sales and support. | Amplified market reach and brand presence. |

| Digital Platforms (Website, IR Portals) | Online presence for product info, financial reports, news. | Global information dissemination, accessibility. | Enhanced online presence for stakeholder data access. |

| Trade Shows & Exhibitions | Industry events for customer engagement and technology demonstration. | Showcasing new products, brand reinforcement, lead generation. | Connected with researchers and industry professionals. |

Customer Segments

Automotive Original Equipment Manufacturers (OEMs), research and development (R&D) centers, and aftermarket service providers represent a core customer segment for HORIBA. These entities rely heavily on HORIBA's advanced measurement and testing solutions for critical aspects of vehicle development and validation. This includes sophisticated equipment for engine exhaust gas analysis, driveline performance testing, and comprehensive brake system evaluations.

HORIBA's technology plays a pivotal role in the ongoing evolution of the automotive sector, particularly with the surge in Battery Electric Vehicles (BEVs) and hybrid powertrains. The company's solutions are instrumental in ensuring these new vehicle technologies meet stringent performance benchmarks. Furthermore, HORIBA's expertise is essential for helping manufacturers comply with increasingly rigorous global emission regulations, a constant challenge in 2024 and beyond.

The global automotive market, valued at trillions of dollars, sees significant investment in R&D, with a substantial portion dedicated to emissions control and new energy vehicle development. For instance, in 2023, global automotive R&D spending was estimated to be over $200 billion, with a growing emphasis on electrification and sustainability, directly benefiting HORIBA's product demand.

HORIBA’s semiconductor manufacturing segment is a powerhouse, serving both fabless companies and integrated device manufacturers. This segment is crucial, with the global semiconductor manufacturing equipment market projected to reach $137.3 billion in 2024, according to industry analysts.

HORIBA’s offerings, including mass flow controllers and advanced metrology systems, are vital for the precision required in cutting-edge chip production. These solutions directly support the industry’s drive for smaller, faster, and more efficient semiconductors.

This segment represents a significant and highly profitable area for HORIBA. The company's deep integration into the complex semiconductor supply chain, particularly in areas like process control and yield enhancement, underpins its strong financial performance in this market.

HORIBA's Healthcare and Medical Diagnostics customer segment encompasses a vital network of hospitals, independent diagnostic laboratories, and medical device manufacturers. These entities rely on HORIBA for advanced solutions that underpin accurate patient assessment and treatment.

The company provides a range of critical products, including sophisticated blood cell counting devices, precise immunoassay analyzers, and high-quality hematology reagents. These offerings directly contribute to enhancing patient care through more reliable and efficient diagnostics.

Demonstrating a commitment to global health, HORIBA is actively investing in expanding its production capabilities within this segment, with a notable focus on emerging markets. For instance, in 2024, HORIBA announced significant investments to boost its manufacturing capacity for medical diagnostic equipment in India, aiming to meet the growing demand for advanced healthcare solutions in the region.

Environmental and Process Monitoring

Customers in this segment are primarily industrial plants, environmental agencies, and utilities. These entities are keenly focused on both monitoring and actively controlling pollution emissions and process efficiency. For instance, in 2024, global spending on environmental monitoring equipment was projected to reach over $40 billion, highlighting the significant market demand.

HORIBA addresses these needs by offering a comprehensive suite of solutions. This includes advanced flue gas analyzers crucial for power plants and manufacturing facilities, sophisticated water quality measuring devices for wastewater treatment and environmental protection, and precise air pollution monitoring analyzers essential for regulatory compliance and public health initiatives.

- Industrial Plants: Seeking to optimize combustion, reduce emissions, and ensure compliance with environmental regulations.

- Environmental Agencies: Requiring accurate data for pollution tracking, policy enforcement, and public health assessments.

- Utilities: Monitoring emissions from power generation and ensuring the quality of water and air resources.

Scientific Research and Academia

Scientific Research and Academia is a key customer segment for HORIBA, comprising universities, independent research institutions, and the research and development divisions within corporations. These entities rely on HORIBA's advanced scientific instruments for both foundational scientific discovery and practical, applied research across a multitude of disciplines.

This segment utilizes HORIBA's extensive product portfolio, which includes sophisticated particle size distribution measuring devices, precise metal analyzers, and a wide array of spectrometers tailored for diverse scientific applications. For instance, university physics departments might use HORIBA spectrometers for advanced material analysis, while pharmaceutical R&D labs could employ their particle characterization tools to optimize drug formulation.

- Key Instruments: Particle size analyzers, metal analyzers, various spectrometers.

- Applications: Fundamental research, applied science, materials characterization, quality control in R&D.

- Market Importance: Drives innovation and provides critical data for scientific advancement.

- Example Use Case: A university's materials science department utilizing HORIBA's X-ray fluorescence (XRF) analyzers to determine elemental composition of novel alloys, contributing to new material development.

HORIBA serves a diverse customer base, with key segments including automotive OEMs, semiconductor manufacturers, healthcare providers, industrial plants, and scientific research institutions. These diverse groups depend on HORIBA's specialized analytical and measurement technologies for critical applications ranging from emissions testing and chip production to medical diagnostics and environmental monitoring.

The automotive sector, a significant focus, sees HORIBA providing essential tools for developing cleaner and more efficient vehicles, particularly in the burgeoning electric and hybrid markets. Similarly, the semiconductor industry relies on HORIBA for precision equipment vital for producing advanced microchips, a market projected for substantial growth.

In healthcare, HORIBA's diagnostic instruments are crucial for accurate patient assessments, with ongoing investments in expanding production to meet global demand. Environmental and industrial sectors utilize HORIBA's analyzers for pollution control and process optimization, a critical need amplified by tightening regulations in 2024.

Scientific research and academia also form a core segment, leveraging HORIBA's sophisticated instruments for discovery and innovation across various scientific disciplines.

| Customer Segment | Key Needs | HORIBA Solutions | Market Relevance (2024 Data) |

|---|---|---|---|

| Automotive OEMs | Emissions compliance, EV/hybrid development | Exhaust gas analyzers, driveline testers | Global auto R&D spending > $200 billion (2023 est.) |

| Semiconductor Manufacturers | Precision manufacturing, yield enhancement | Mass flow controllers, metrology systems | Semiconductor equipment market ~$137.3 billion |

| Healthcare & Medical Diagnostics | Accurate patient assessment, efficient diagnostics | Blood cell counters, immunoassay analyzers | Focus on emerging market expansion |

| Industrial Plants & Utilities | Pollution control, process efficiency | Flue gas analyzers, water quality meters | Environmental monitoring equipment spending > $40 billion |

| Scientific Research & Academia | Materials analysis, scientific discovery | Particle size analyzers, spectrometers | Drives innovation and data generation |

Cost Structure

HORIBA dedicates a significant portion of its financial resources to Research and Development (R&D), underscoring its dedication to innovation and maintaining technological superiority in its markets. For instance, in fiscal year 2023, HORIBA reported R&D expenses amounting to approximately 37.5 billion JPY, which represented roughly 9.8% of its total net sales. This consistent investment, often targeting around 10% of sales, is crucial for developing next-generation products and refining current technological offerings, thereby securing its competitive advantage.

Manufacturing and production costs are a cornerstone of HORIBA's cost structure, encompassing everything from the basic raw materials and intricate components to the skilled labor and factory overheads required to build their analytical and measurement instruments. For instance, the company's commitment to precision engineering means significant investment in high-quality materials.

HORIBA's strategic investments in new manufacturing facilities, such as their advanced production sites, highlight a continuous effort to optimize these production expenses and guarantee a consistent, reliable supply chain. This ongoing capital expenditure is crucial for maintaining competitiveness and meeting global demand for their sophisticated equipment.

HORIBA's cost structure heavily features expenses tied to its global sales, marketing, and distribution efforts. This includes the significant operational costs of maintaining a worldwide sales force, executing diverse marketing campaigns, participating in international exhibitions, and managing the intricate logistics of distributing its advanced products across various regions.

Building and sustaining a robust global network of both direct sales teams and independent distributors necessitates substantial investment. These investments are primarily channeled into personnel costs, extensive travel for client engagement and market development, and a variety of promotional activities designed to enhance brand visibility and product adoption.

For instance, in their fiscal year ending March 2024, HORIBA reported selling, general, and administrative expenses amounting to ¥104.7 billion, a portion of which directly reflects these sales, marketing, and distribution outlays. This figure underscores the considerable financial commitment required to reach and serve their international customer base effectively.

Personnel Costs (Salaries and Benefits)

Personnel costs, encompassing salaries and benefits for a highly skilled workforce, represent a significant portion of HORIBA's cost structure. This is driven by the need for specialized engineers, researchers, sales experts, and essential support staff in a technology-focused organization.

Investing in 'HORIBARIANs' through continuous training and development is paramount. This commitment ensures their expertise remains cutting-edge, fostering ongoing innovation across the company's product lines and research initiatives.

- Salaries and Wages: Compensation for engineers, scientists, sales teams, and administrative staff.

- Employee Benefits: Health insurance, retirement plans, and other welfare programs.

- Training and Development: Investment in upskilling employees to maintain technological leadership.

- Recruitment Costs: Expenses associated with attracting and onboarding top talent.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for HORIBA encompass essential overheads like administrative salaries, IT infrastructure, and corporate governance. These costs are crucial for the smooth functioning and management of the entire HORIBA Group worldwide. For instance, in fiscal year 2023, HORIBA reported consolidated selling, general and administrative expenses of ¥82.6 billion, reflecting significant investment in these foundational operational areas.

These G&A costs are vital for ensuring HORIBA's compliance with regulations and maintaining efficient business processes across its global operations. They cover critical functions such as legal, finance, and human resources, which are indispensable for strategic oversight and operational stability.

- Administrative Salaries: Compensation for management and support staff.

- IT Infrastructure: Costs associated with technology systems and digital operations.

- Legal & Compliance: Expenses related to legal counsel and regulatory adherence.

- Finance & Accounting: Costs for financial management and reporting.

HORIBA's cost structure is significantly influenced by its substantial investments in Research and Development (R&D), aiming to maintain technological leadership. In fiscal year 2023, R&D expenses were approximately 37.5 billion JPY, about 9.8% of net sales. This ongoing commitment fuels the development of advanced analytical and measurement instruments.

Manufacturing and production costs form a core element, covering high-quality materials, precise components, skilled labor, and factory overheads. Strategic investments in new, advanced production facilities are also key to optimizing these expenses and ensuring a robust supply chain to meet global demand.

Sales, marketing, and distribution expenses are considerable, reflecting the costs of a global sales force, international marketing campaigns, and complex logistics for product distribution. Personnel costs, including salaries and benefits for a highly skilled workforce of engineers, researchers, and sales experts, are also a significant component.

| Cost Category | Description | Fiscal Year 2023 (Approx. JPY) |

|---|---|---|

| R&D Expenses | Investment in innovation and technological advancement | 37.5 billion |

| SG&A Expenses | Sales, general, and administrative costs | 82.6 billion |

| Personnel Costs | Salaries, benefits, training for skilled workforce | Included within SG&A and COGS |

| Manufacturing Costs | Raw materials, components, labor, factory overheads | Included within COGS |

Revenue Streams

HORIBA's primary revenue driver is the sale of a wide array of analytical and measurement instruments, alongside sophisticated integrated systems. This encompasses critical equipment for automotive testing, advanced metrology tools for the semiconductor industry, essential medical diagnostic devices, and a broad spectrum of scientific instruments catering to research and development worldwide.

In 2024, HORIBA continued to see robust demand for its specialized equipment, particularly in the automotive sector as it navigates stricter emissions regulations and the transition to electric vehicles. The semiconductor industry's ongoing expansion also fueled sales of their metrology solutions, a key area for the company.

HORIBA generates recurring revenue through the sale of consumables and reagents, which are crucial for the ongoing operation of their analytical instruments. This is particularly significant in their medical and scientific equipment divisions.

For instance, the consistent demand for hematology reagents used in medical diagnostic devices creates a stable and predictable income stream for the company. This segment highlights the importance of a robust consumables business in supporting instrument sales.

HORIBA generates revenue through essential after-sales services, including instrument maintenance, calibration, and repair. These services are crucial for ensuring the continued optimal performance of their sophisticated analytical and measurement equipment. For instance, in fiscal year 2023, HORIBA reported that its Services segment contributed a significant portion to its overall revenue, demonstrating the value customers place on ongoing support.

Engineering and Consulting Services

HORIBA leverages its deep technical expertise to offer specialized engineering and consulting services, particularly within the demanding automotive and industrial markets. This segment focuses on providing tailored solutions, including custom system integration and the creation of unique analytical tools designed to meet precise client requirements.

These services are crucial for clients needing to optimize complex processes or develop novel applications. For instance, in 2024, HORIBA's advanced emission measurement systems and consulting were instrumental in helping automotive manufacturers navigate evolving regulatory landscapes and achieve stringent environmental targets.

- Custom System Integration: Tailoring HORIBA's core technologies into complete, application-specific solutions for clients.

- Bespoke Analytical Solutions: Developing unique analytical methods and equipment to address niche customer challenges.

- Expert Consulting: Providing specialized advice on testing protocols, data interpretation, and process optimization.

- Targeted Sectors: Primarily serving the automotive industry for emissions testing and powertrain development, alongside other industrial applications requiring advanced measurement and analysis.

Software and Data Solutions

HORIBA's revenue streams are evolving to include sophisticated software and data solutions as analytical instruments become more interconnected. This shift is driven by the increasing demand for deeper insights and optimized processes from measurement data.

The company offers software licenses for its advanced analytical tools, enabling customers to unlock the full potential of their instruments. Furthermore, data analysis platforms and cloud-based solutions are becoming key revenue drivers, allowing users to process, interpret, and leverage their experimental data more effectively.

- Software Licenses: Recurring revenue from users accessing specialized analytical software.

- Data Analysis Platforms: Monetization of sophisticated tools for processing and interpreting complex measurement data.

- Cloud-Based Solutions: Subscription-based access to data storage, analysis, and remote instrument management.

- Value-Added Services: Revenue generated from services that help customers extract maximum insights and optimize operations using HORIBA's data.

HORIBA's revenue is primarily generated from the sale of analytical and measurement instruments, a segment that saw continued strong performance in 2024, particularly in automotive and semiconductor markets. Complementing this, the company secures recurring income through the sale of consumables and reagents essential for instrument operation, a stable revenue source especially in medical diagnostics. Furthermore, HORIBA generates significant revenue from crucial after-sales services like maintenance and calibration, alongside specialized engineering and consulting services tailored for industries such as automotive.

| Revenue Stream | Description | 2023 Contribution (Approx.) | 2024 Outlook |

| Instrument Sales | Sale of analytical and measurement instruments and integrated systems. | High | Continued growth driven by automotive and semiconductor sectors. |

| Consumables & Reagents | Sale of essential supplies for instrument operation. | Moderate, Recurring | Stable demand, particularly for medical and scientific applications. |

| After-Sales Services | Maintenance, calibration, repair, and support for instruments. | Significant | Expected to grow with installed base and focus on customer support. |

| Engineering & Consulting | Custom system integration, bespoke solutions, and expert advice. | Moderate | Strong demand from automotive for regulatory compliance and development. |

Business Model Canvas Data Sources

The HORIBA Business Model Canvas is informed by a blend of internal financial reports, extensive market research, and customer feedback. These diverse data sources ensure a comprehensive and accurate representation of our business strategy and market positioning.