Hooker Furniture SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hooker Furniture Bundle

Hooker Furniture, a well-established player in the furniture industry, demonstrates a clear understanding of its market position. Their strengths lie in brand recognition and a diverse product portfolio, while potential threats include evolving consumer preferences and supply chain disruptions.

Want the full story behind Hooker Furniture's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hooker Furnishings Corporation offers a broad spectrum of furniture, encompassing casegoods, upholstery, and accent pieces, effectively serving diverse consumer needs across various rooms. This wide product range, as of their Q1 2024 report, contributed to net sales of $216.6 million, demonstrating their ability to capture market share across different segments. Their diversified approach mitigates risks associated with over-reliance on any single furniture category.

Hooker Furnishings boasts over a century of operation, a testament to its resilience and deep understanding of the home furnishings market. This longevity translates into significant brand equity and a loyal customer base, built on trust and consistent quality. In 2023, the company reported net sales of $1.03 billion, demonstrating its continued relevance and market penetration.

Hooker Furniture is strategically reducing costs through a multi-phase restructuring plan. This initiative is projected to yield significant annualized savings, reaching approximately $30 million by fiscal year 2027. These efforts are crucial for enhancing operational efficiency and bolstering long-term profitability.

Strong Balance Sheet and Consistent Dividends

Hooker Furnishings demonstrates robust financial health, highlighted by a solid balance sheet. For instance, as of their latest reports in early 2024, the company has maintained healthy cash reserves, providing a buffer against economic volatility and enabling strategic investments. This financial prudence underpins its ability to weather industry challenges.

A key strength is Hooker Furnishings' consistent commitment to shareholder returns through regular dividend payments. The company has a long track record of distributing quarterly dividends, a practice that signals financial stability and management's confidence in ongoing profitability. This reliability makes it an attractive option for income-focused investors.

- Strong Cash Position: Improved cash and cash equivalents provide resilience.

- Consistent Dividend Payouts: A history of quarterly dividends indicates financial stability.

- Shareholder Value Focus: Commitment to returning capital to investors.

- Financial Prudence: Ability to manage finances effectively through economic cycles.

Omnichannel Distribution and Strategic Partnerships

Hooker Furniture (HFC) leverages a strong omnichannel distribution strategy, reaching customers through traditional furniture retailers, interior designers, and its growing e-commerce presence. This multi-channel approach ensures broad market penetration and accessibility for its diverse product lines.

Strategic partnerships, such as the recent Margaritaville licensing agreement, are crucial for expanding brand visibility and accessing new customer segments. These collaborations not only drive revenue but also reinforce HFC's market position by associating its brand with popular lifestyle and entertainment properties.

- Omnichannel Reach: HFC's distribution spans physical retail, interior design channels, and direct-to-consumer e-commerce.

- Brand Expansion: The Margaritaville licensing deal, announced in late 2023, is a prime example of strategic partnership aimed at broadening brand appeal and market reach.

- Revenue Diversification: These partnerships open new revenue streams beyond traditional wholesale and retail channels.

Hooker Furnishings' diverse product portfolio, encompassing casegoods and upholstery, is a significant strength, as evidenced by their Q1 2024 net sales of $216.6 million. This broad offering allows them to cater to a wide range of consumer preferences and market segments, reducing reliance on any single product category.

The company's century-long operational history has cultivated strong brand equity and customer loyalty, underpinned by a commitment to quality. This longevity is reflected in their 2023 net sales reaching $1.03 billion, demonstrating sustained market presence and consumer trust.

Hooker Furnishings maintains a robust financial position, characterized by healthy cash reserves and a prudent approach to financial management. This stability provides a crucial buffer against economic downturns and supports strategic growth initiatives.

A key strength lies in Hooker's consistent focus on shareholder returns, demonstrated by regular quarterly dividend payments. This practice signals financial health and management's confidence in the company's ongoing profitability, making it attractive to income-oriented investors.

| Strength | Description | Supporting Data |

|---|---|---|

| Product Diversification | Broad range of casegoods, upholstery, and accent pieces. | Q1 2024 Net Sales: $216.6 million |

| Brand Equity & Longevity | Over a century of operation builds trust and loyalty. | 2023 Net Sales: $1.03 billion |

| Financial Prudence | Strong cash position and effective financial management. | Healthy cash reserves reported in early 2024 |

| Shareholder Returns | Consistent quarterly dividend payments. | Long track record of dividend distribution |

What is included in the product

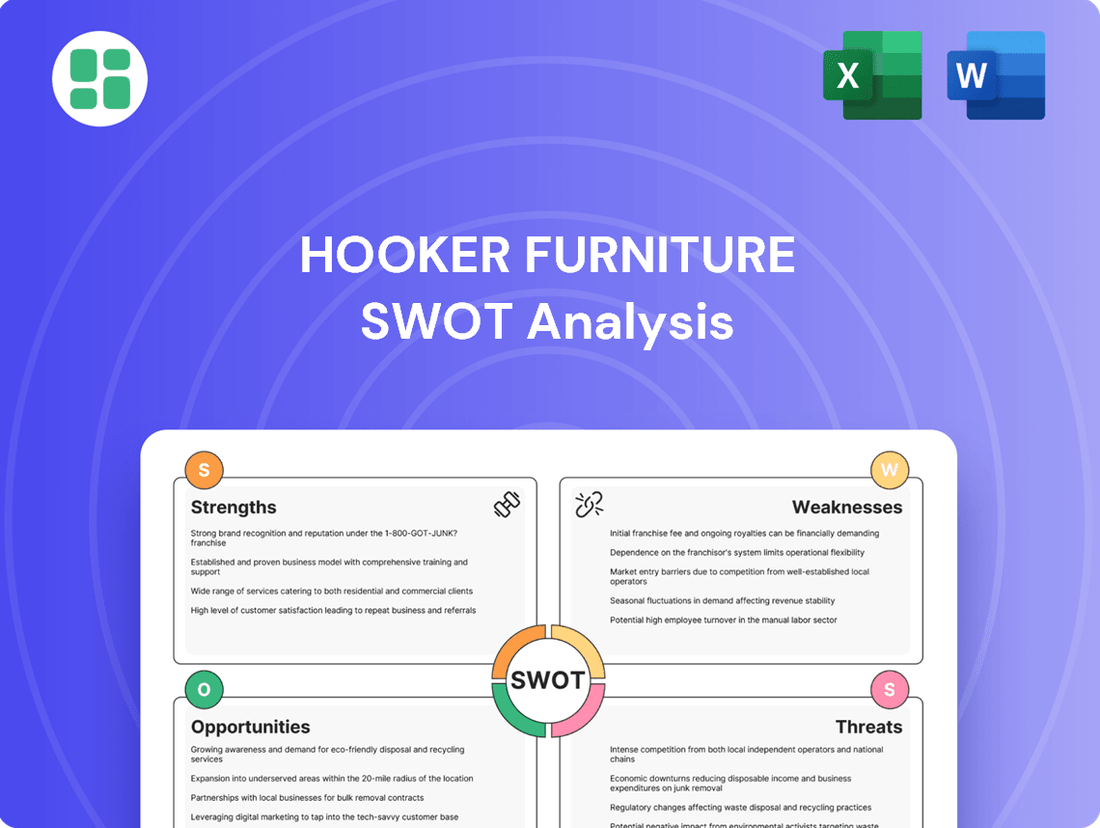

Analyzes Hooker Furniture’s competitive position through key internal and external factors, highlighting its brand reputation and distribution network while considering market shifts and competition.

Offers a clear, actionable framework to identify and leverage Hooker Furniture's competitive advantages while mitigating potential threats.

Weaknesses

Hooker Furnishings faced significant headwinds in fiscal year 2025, reporting consolidated operating and net losses. This financial downturn was accompanied by a noticeable decrease in overall net sales, signaling a challenging period for the company.

The primary driver behind these declining figures appears to be sluggish demand within the broader home furnishings retail industry. A difficult market environment has clearly impacted the company's ability to generate revenue and maintain profitability.

Hooker Furniture's profitability is highly susceptible to macroeconomic shifts. For instance, the Federal Reserve's interest rate hikes throughout 2023 and into 2024 have made mortgages more expensive, dampening the housing market and consequently reducing demand for new home furnishings.

Weak consumer confidence, often a byproduct of inflation and economic uncertainty, directly translates to reduced discretionary spending on items like furniture. This was evident in the retail sector's performance, with many furniture retailers reporting slower sales in late 2023 and early 2024 compared to prior periods.

Hooker Furniture's multi-phase restructuring initiatives, while strategically designed for long-term gains, have led to substantial one-time charges. These include significant costs associated with employee severance packages and necessary inventory write-downs as operations are streamlined.

These unavoidable expenses directly impact Hooker Furniture's short-term profitability, creating a drag on financial results during the transition periods. For instance, the company reported restructuring charges impacting its fiscal year ending January 28, 2024, which affected earnings per share.

Reliance on Potentially Volatile Channels

Hooker Furniture's reliance on traditional retail channels, including independent furniture stores and major chains, presents a significant weakness. While e-commerce is growing, these brick-and-mortar partners remain crucial for a substantial portion of sales. This dependence exposes the company to the inherent volatility of the retail sector, where shifts in consumer spending and economic downturns can directly impact demand.

Furthermore, the financial health of these retail partners poses a direct risk. The potential for customer bankruptcies, as seen with some retailers in recent years, can lead to write-offs of accounts receivable and a sudden loss of sales volume. For instance, the retail industry has faced increased bankruptcies and store closures, particularly in the wake of economic pressures and changing consumer habits, making these channels less predictable.

- Channel Dependence: A significant portion of Hooker Furniture's revenue is still tied to independent retailers and large furniture chains, which are susceptible to market volatility.

- Customer Financial Risk: The risk of customer bankruptcies within these channels can negatively affect sales and the company's accounts receivable.

- Market Fluctuations: Economic downturns and shifts in consumer spending directly impact the performance of these traditional retail channels, creating an unstable sales environment.

Impact of Unprofitable Line Exits and Customer Bankruptcies

Hooker Furniture has experienced headwinds from the strategic decision to exit unprofitable product lines. This move, while aimed at long-term efficiency, can create short-term revenue dips and require careful management to mitigate the impact on overall sales performance.

Furthermore, the company has been impacted by losses stemming from major customer bankruptcies. These events not only result in write-offs of outstanding receivables but also disrupt established sales channels, creating financial charges and highlighting concentration risks within its customer base.

- Sales Impact: The exit of unprofitable lines and customer defaults directly contributed to a sales decrease in recent periods.

- Financial Charges: Bankruptcies of key clients have led to significant financial charges, impacting profitability.

- Segment Vulnerability: These issues underscore vulnerabilities in specific business segments or customer relationships.

Hooker Furniture's financial performance in fiscal year 2025 was marked by consolidated operating and net losses, alongside a decrease in net sales, largely due to sluggish demand in the home furnishings sector. This downturn was exacerbated by macroeconomic factors like rising interest rates, which cooled the housing market, and weakened consumer confidence due to inflation, leading to reduced discretionary spending.

The company's profitability is sensitive to economic shifts; for example, higher mortgage rates in 2023-2024 directly impacted housing demand and, consequently, furniture sales. Similarly, reduced consumer confidence, a common effect of economic uncertainty, curbed spending on non-essential items like furniture, as observed in the broader retail sector's performance during late 2023 and early 2024.

Restructuring efforts, while strategic for long-term growth, incurred substantial one-time costs, including severance packages and inventory write-downs, which negatively affected short-term profitability. For instance, fiscal year 2024 results were impacted by these restructuring charges.

Hooker Furniture's reliance on traditional retail channels, such as independent stores and large chains, presents a weakness due to the sector's volatility and the financial health risks associated with these partners, including potential bankruptcies that can lead to accounts receivable write-offs and lost sales volume.

The exit from unprofitable product lines and losses from major customer bankruptcies also contributed to sales declines and financial charges, highlighting vulnerabilities in specific customer relationships and business segments.

| Weakness | Description | Impact |

| Channel Dependence | Reliance on traditional retail channels (independent stores, chains) | Susceptibility to market volatility and retail sector downturns. |

| Customer Financial Risk | Risk of bankruptcies among retail partners | Potential for accounts receivable write-offs and sudden sales volume loss. |

| Market Fluctuations | Sensitivity to economic downturns and consumer spending shifts | Creates an unstable and unpredictable sales environment for traditional channels. |

| Restructuring Costs | One-time charges from operational streamlining | Negatively impacts short-term profitability and earnings per share. |

| Customer Defaults | Losses from major customer bankruptcies | Results in write-offs of receivables and disrupted sales channels. |

Preview the Actual Deliverable

Hooker Furniture SWOT Analysis

This is the actual Hooker Furniture SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, as well as external opportunities and threats, all ready for your strategic planning.

Opportunities

The furniture e-commerce sector is booming, projected to reach $200 billion globally by 2027, fueled by advancements such as AI-powered personalization and immersive AR/VR shopping experiences. Hooker Furnishings can leverage these technologies to create more engaging online showrooms and streamline the customer journey, directly tapping into this expanding digital marketplace.

Hooker Furniture Corporation (HFC) is experiencing robust growth in its hospitality and outdoor furniture sectors. The H Contract division, serving commercial clients, and the Samuel Lawrence Hospitality division have both reported encouraging sales figures, indicating a strong market reception.

Furthermore, the acquisition of Sunset West has bolstered HFC's presence in the rapidly expanding outdoor furniture market. This strategic move positions the company to leverage increasing consumer interest in outdoor living and entertainment spaces, a trend that continued to gain momentum through 2024 and into early 2025.

Hooker Furniture's strategic partnerships and licensing are proving to be a significant growth driver. For instance, their licensing agreement with Margaritaville, launched in 2024, aims to tap into a lifestyle-oriented consumer base, potentially boosting brand visibility and sales. This diversification of revenue streams through such collaborations is a key opportunity for the company to reach new markets and customer demographics.

Optimizing Supply Chain and Logistics Efficiencies

Hooker Furniture is actively optimizing its supply chain and logistics, a critical move for enhancing operational efficiency. The company's strategic decision to establish a new facility in Vietnam is a key initiative aimed at significantly shortening lead times for customers. This move is projected to improve product availability and accelerate the speed at which products reach the market.

Furthermore, the exit from the Savannah warehouse is anticipated to generate substantial long-term cost savings. These combined efforts are designed to bolster supply chain resilience, ensuring a more robust and responsive operational framework. For instance, by streamlining logistics, Hooker Furniture can better navigate potential disruptions and maintain consistent delivery schedules, a crucial factor in customer satisfaction and market competitiveness.

- Vietnam Facility: Aims to reduce lead times and enhance product availability.

- Savannah Warehouse Exit: Expected to deliver significant long-term cost savings.

- Supply Chain Resilience: Initiatives focus on creating a more robust and responsive network.

- Market Competitiveness: Improved logistics directly contribute to faster time-to-market and customer satisfaction.

Improving Macroeconomic Environment

The macroeconomic landscape is showing signs of improvement, which presents a significant opportunity for Hooker Furniture (HFC). A cooling inflation rate, projected to be around 3.1% by the end of 2024 according to the Congressional Budget Office, could lead to more disposable income for consumers. This, coupled with anticipated interest rate cuts by the Federal Reserve in late 2024 or early 2025, is expected to stimulate housing market activity. Increased home sales directly translate into higher demand for home furnishings, a core market for HFC.

This shift in economic conditions could bolster HFC's revenue streams. For instance, a more favorable interest rate environment often encourages larger purchases, including furniture for new homes or renovations. The National Association of Realtors reported a slight uptick in existing home sales in early 2024, a trend that could accelerate with lower borrowing costs.

Key opportunities include:

- Increased Consumer Spending: Easing inflation and potential wage growth can boost discretionary spending on home goods.

- Stimulated Housing Market: Lower mortgage rates could drive new home construction and sales, increasing demand for furniture.

- Improved Retail Environment: A generally healthier economy often leads to greater foot traffic and sales in retail sectors, including furniture stores.

Hooker Furniture is well-positioned to capitalize on the expanding e-commerce furniture market, projected to reach $200 billion globally by 2027, by integrating AI and AR/VR technologies for enhanced customer experiences.

The company's strategic acquisitions, like Sunset West, and licensing deals, such as the Margaritaville partnership launched in 2024, are broadening its reach into growing segments like outdoor living and lifestyle-focused consumers.

Operational efficiencies are being boosted through supply chain optimization, including a new facility in Vietnam to shorten lead times, and the exit from the Savannah warehouse, expected to yield significant cost savings.

A favorable macroeconomic outlook, with cooling inflation and potential interest rate cuts in late 2024/early 2025, is anticipated to stimulate the housing market and increase consumer disposable income, directly benefiting furniture demand.

| Opportunity Area | Key Trend/Driver | Hooker Furniture's Action/Benefit | Projected Impact (2024-2025) |

|---|---|---|---|

| E-commerce Growth | Global furniture e-commerce to reach $200B by 2027 | Leveraging AI/AR/VR for online showrooms | Increased digital sales and customer engagement |

| Market Expansion | Growth in hospitality and outdoor furniture sectors | Acquisition of Sunset West; Margaritaville licensing (2024) | Broader market penetration and diversified revenue |

| Supply Chain Efficiency | Need for reduced lead times and cost savings | Vietnam facility; Savannah warehouse exit | Improved product availability and operational cost reduction |

| Macroeconomic Improvement | Cooling inflation (~3.1% end of 2024); potential Fed rate cuts | Increased consumer spending and housing market activity | Higher demand for home furnishings |

Threats

The home furnishings sector is experiencing a persistent slump, with consumer spending remaining subdued. Factors such as elevated interest rates and a sluggish housing market are contributing to this prolonged weakness. This environment directly affects sales volumes and profit margins for companies like Hooker Furniture Corporation (HFC).

Hooker Furnishings faces a fiercely competitive furniture market, populated by both established giants and nimble online retailers. This crowded field, featuring companies like Ashley Furniture Industries and Wayfair, often forces price adjustments, impacting profit margins.

The furniture industry's intense rivalry means that maintaining or growing market share requires constant innovation and efficient operations. For instance, in 2023, the U.S. furniture and bedding market saw significant competition, with major players reporting varied growth trajectories, underscoring the need for strategic differentiation.

Hooker Furniture is vulnerable to supply chain disruptions, like port congestion or labor disputes, which can significantly delay shipments and increase transportation costs. For instance, the ongoing global shipping challenges experienced throughout 2023 and into early 2024 have kept freight rates elevated, impacting companies like Hooker.

Geopolitical risks, particularly tariffs on imported furniture, pose a direct threat by raising the cost of goods. These tariffs can squeeze profit margins or force price increases, potentially dampening consumer demand for Hooker's products.

Fluctuations in Operational Costs

While ocean freight rates have seen a decline from their peaks, Hooker Furniture still faces threats from the fluctuating costs of raw materials like lumber and steel, as well as other operational expenses. For instance, lumber prices, a key input for furniture manufacturing, experienced significant volatility throughout 2023 and early 2024, impacting production budgets.

These unpredictable cost increases can directly squeeze gross margins, potentially reducing profitability if not effectively managed through pricing strategies or cost-saving measures. The company's ability to absorb or pass on these rising costs is crucial for maintaining its financial health.

- Volatility in lumber prices: Key raw materials remain susceptible to price swings, impacting manufacturing costs.

- Increased energy and transportation expenses: Beyond freight, fuel and utility costs can also rise unexpectedly.

- Erosion of gross margins: Unfavorable cost shifts directly threaten profitability by reducing the spread between revenue and direct costs.

Rapidly Evolving Consumer Preferences and Digital Expectations

Hooker Furniture faces a significant threat from rapidly changing consumer tastes and digital demands. Customers now expect highly personalized online shopping journeys, often enhanced by AI and immersive technologies like augmented reality (AR) for visualizing furniture in their homes. The growing emphasis on sustainable practices also influences purchasing decisions, with consumers increasingly seeking eco-friendly options.

Failure to quickly adapt to these shifts and invest in cutting-edge technology could diminish Hooker Furniture's market standing. For instance, in 2024, a significant portion of furniture sales are influenced by online research and digital engagement, with younger demographics particularly prioritizing brands that offer seamless digital experiences and demonstrate a commitment to sustainability.

- Digital Experience Gap: Consumers expect intuitive websites, personalized recommendations, and easy online purchasing, with a growing demand for AR/VR visualization tools.

- Sustainability Imperative: A strong consumer push towards environmentally conscious products and transparent supply chains poses a risk if not adequately addressed.

- Market Relevance Erosion: Companies slow to adopt new technologies and cater to evolving preferences risk losing market share to more agile competitors.

Hooker Furniture faces intense competition from established players and online disruptors, impacting pricing power and profit margins. The ongoing slump in home furnishings, driven by high interest rates and a weak housing market, continues to suppress consumer spending, directly affecting sales volumes and profitability. Supply chain vulnerabilities, including shipping costs and potential disruptions, alongside geopolitical risks like tariffs, add layers of operational and financial uncertainty for the company.

SWOT Analysis Data Sources

This Hooker Furniture SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry analysis to ensure a robust and insightful assessment.