Hooker Furniture Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hooker Furniture Bundle

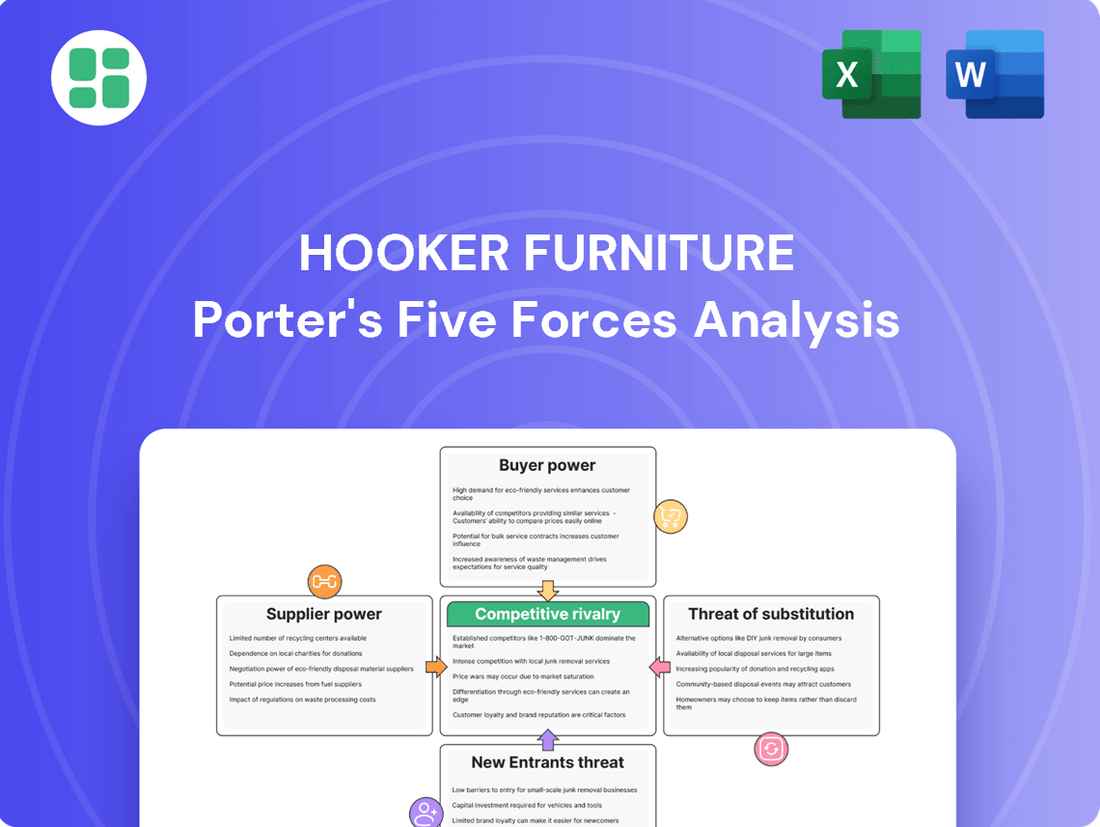

Hooker Furniture operates within a competitive landscape shaped by powerful buyer bargaining, moderate supplier influence, and the constant threat of new entrants. Understanding these dynamics is crucial for any strategic decision. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hooker Furniture’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hooker Furnishings sources a broad range of materials, with imported casegoods and upholstered furniture making up about 71% of their net sales in fiscal 2025. This diversification generally limits the power of any single supplier.

However, for domestic upholstery production, the top five suppliers provided a substantial amount of raw materials in fiscal 2025. This concentration in a specific segment indicates that these key suppliers may hold more leverage, influencing costs and terms for Hooker Furnishings.

Hooker Furniture faces considerable switching costs, particularly for specialized materials such as Italian and South American leather essential for their domestic upholstery lines. These costs involve the time and expense of establishing new supplier relationships, potentially retooling manufacturing processes, and rigorously ensuring consistent quality from alternative sources.

For instance, in 2023, the company reported that the cost of goods sold was $658 million, highlighting the significant investment in raw materials and components. The intricate nature of sourcing premium leathers means that finding and vetting new suppliers capable of meeting Hooker's quality standards could take months, if not longer, impacting production schedules and potentially increasing per-unit costs during the transition.

These substantial switching barriers inherently grant suppliers a stronger bargaining position. It discourages Hooker Furniture from frequently changing its material sourcing partners, as the disruption and investment required outweigh the potential benefits of seeking out cheaper alternatives for these critical inputs.

The availability of substitute inputs for furniture manufacturing, like various woods, fabrics, or metals, can impact supplier power. While many materials are available, specific design or quality needs for Hooker Furnishings' brands might restrict viable alternatives.

Hooker Furnishings' strategy of sourcing both imported and domestic products offers some flexibility. However, unique material demands for certain collections could strengthen the bargaining power of specialized suppliers, potentially affecting costs.

Supplier's Product Differentiation

Hooker Furniture's reliance on suppliers offering highly differentiated or proprietary materials, components, or manufacturing processes significantly impacts supplier bargaining power. If specific suppliers provide unique designs, advanced finishes, or patented technologies that are integral to Hooker's product lines, their leverage to dictate terms and pricing escalates. This is especially true for premium or custom furniture segments where distinctive inputs command higher value.

In 2024, the furniture industry, including companies like Hooker, faced ongoing supply chain complexities. For instance, the availability and cost of specialized wood treatments or unique hardware components can vary, giving suppliers with exclusive offerings more sway. Companies often invest in long-term relationships or seek alternative sourcing to mitigate this, but the intrinsic value of differentiation remains a key driver of supplier power.

- Supplier Differentiation: Suppliers providing unique materials, finishes, or patented technologies gain leverage.

- Impact on Pricing: Highly differentiated inputs allow suppliers to command higher prices from Hooker Furniture.

- Segment Relevance: This power is amplified in higher-end or custom furniture lines where uniqueness is paramount.

- Mitigation Strategies: Hooker may explore long-term contracts or dual-sourcing to manage this supplier influence.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into furniture manufacturing is generally low for companies like Hooker Furniture. This is primarily due to the significant capital investment and established distribution channels needed to compete effectively in the furniture sector. For instance, the furniture manufacturing industry requires substantial upfront costs for machinery, factory space, and logistics, creating a barrier to entry for many component suppliers.

However, a scenario where a critical component supplier, such as a specialized wood or fabric provider, were to start producing finished furniture could pose a disruption. This would not only alter the supply chain dynamics but also introduce a new competitor directly into Hooker Furniture's market. While this remains a possibility, it is considered a less significant factor compared to other aspects of supplier power within the furniture industry.

In 2023, the global furniture market was valued at approximately $736 billion, indicating a highly competitive landscape where established players have significant advantages. Suppliers looking to enter this market would face challenges in replicating the brand recognition, retail presence, and customer loyalty that companies like Hooker Furniture have cultivated over time. Therefore, the risk of backward integration by suppliers impacting Hooker Furniture's market position is currently assessed as relatively minor.

Key considerations regarding supplier forward integration:

- High Capital Requirements: Entering furniture manufacturing demands substantial investment in plant, equipment, and inventory.

- Established Distribution Networks: Existing furniture manufacturers possess established relationships with retailers and direct-to-consumer channels.

- Brand Recognition and Marketing: Competing requires significant investment in brand building and marketing to capture consumer attention.

- Economies of Scale: Larger furniture manufacturers benefit from economies of scale in production and procurement, making it difficult for new entrants to compete on price.

Hooker Furniture's bargaining power with suppliers is influenced by several factors, including the concentration of suppliers in specific segments and the switching costs associated with critical materials. While overall diversification of sourcing limits the power of any single supplier, the domestic upholstery segment, for example, saw its top five suppliers provide a substantial portion of raw materials in fiscal 2025, suggesting these key players may wield more influence over pricing and terms.

Switching costs are particularly high for specialized inputs like premium leathers, essential for Hooker's domestic upholstery lines. The expense and time involved in finding, vetting, and integrating new suppliers for these unique materials, along with potential retooling and quality assurance, create significant barriers. This makes Hooker Furniture hesitant to change sourcing partners frequently, thereby strengthening the leverage of existing suppliers for these critical components.

The availability of substitutes for furniture manufacturing materials can moderate supplier power. However, when Hooker Furniture requires specific designs or quality standards for its brands, the pool of viable alternatives shrinks, empowering suppliers who can meet these specialized needs. This is especially true for differentiated or proprietary materials, finishes, or technologies integral to Hooker's product lines, allowing such suppliers to command higher prices and dictate terms, particularly in premium segments.

The threat of suppliers integrating forward into furniture manufacturing is generally low for Hooker Furniture. The substantial capital investment, established distribution networks, brand recognition, and economies of scale enjoyed by existing manufacturers present significant hurdles for component suppliers looking to enter the market. For instance, the global furniture market's value in 2023, approximately $736 billion, underscores the competitive landscape where established players have considerable advantages.

What is included in the product

This analysis meticulously examines the five forces impacting Hooker Furniture, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes. It provides strategic insights into how these forces shape Hooker Furniture's competitive environment and profitability.

Easily identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces on a customizable dashboard.

Customers Bargaining Power

Hooker Furnishings interacts with a variety of customers, from furniture stores and interior designers to online marketplaces. This diversity helps spread risk, but the company did face a significant challenge in fiscal year 2025 when a major customer declared bankruptcy.

This event directly impacted Hooker Furnishings' net sales, demonstrating that even with multiple sales channels, the loss of a large buyer can create substantial pressure. It suggests that for specific customer segments, there is a degree of buyer concentration that can influence bargaining power.

For larger buyers like furniture retailers or interior design firms, switching suppliers from Hooker Furnishings could incur moderate costs. These might include the effort to reconfigure inventory systems, update marketing materials to reflect new product lines, and retrain sales staff. However, the sheer number of furniture manufacturers available in the market, estimated to be in the thousands globally, can help reduce the perceived impact of these costs.

Customers today, particularly through online channels, have a wealth of information at their fingertips. They can easily research product details, compare prices, and read reviews for furniture from companies like Hooker Furnishings and its rivals such as Arhaus, Brooklinen, and La-Z-Boy.

This enhanced transparency allows buyers to make more informed choices, directly impacting their bargaining power. For instance, a customer can quickly see if Hooker Furnishings' pricing for a sofa is competitive with similar models from other well-known brands.

Price Sensitivity of Buyers

Consumer price sensitivity in the furniture market is a significant factor, especially when the economy feels uncertain. Hooker Furnishings, for instance, had to increase discounting in fiscal 2025 to manage its inventory, a clear sign they were reacting to buyers being more cost-conscious.

While Hooker has a range of products and brands catering to different budgets, the broader industry trend of consumers seeking more affordable furniture puts pressure on profit margins. This means that even with diverse offerings, the overall market's focus on price can impact a company's ability to maintain profitability.

- Hooker Furnishings' fiscal 2025 saw increased discounting to manage inventory.

- Economic uncertainty often elevates consumer price sensitivity in the furniture sector.

- Industry-wide shift towards lower-priced furniture can compress margins for companies like Hooker.

Availability of Substitute Products for Buyers

The bargaining power of customers is significantly influenced by the availability of substitute products. Hooker Furniture faces this challenge as buyers can readily access a vast selection of furniture from numerous manufacturers, both domestically and internationally. This includes offerings from large retailers and online vendors, creating a highly competitive landscape.

The ease with which consumers can find comparable furniture from competing brands directly strengthens their negotiating position. This is further amplified by the growing popularity of the secondhand furniture market, which presents yet another set of alternatives for shoppers.

- Broad Availability of Substitutes: Buyers can choose from a wide range of furniture options from various domestic and international manufacturers, big-box retailers, and online sellers.

- Growing Secondhand Market: The increasing trend of purchasing pre-owned furniture provides consumers with additional, often more affordable, alternatives.

- Enhanced Customer Leverage: The sheer volume of comparable products available from competitors empowers customers, giving them considerable bargaining power when making purchasing decisions.

Hooker Furnishings faces considerable customer bargaining power due to the wide availability of substitutes and increasing price sensitivity. In fiscal year 2025, the company increased discounting to manage inventory, reflecting a market where consumers are more cost-conscious. The growing secondhand furniture market further strengthens buyer leverage by offering additional, often lower-priced, alternatives to new products.

| Factor | Impact on Hooker Furnishings | Supporting Data/Observation |

|---|---|---|

| Availability of Substitutes | High | Thousands of furniture manufacturers globally; strong online and retail competition. |

| Price Sensitivity | Increasing | Hooker Furnishings increased discounting in FY2025 to manage inventory. |

| Switching Costs | Moderate | Costs include system reconfiguration and marketing updates for large buyers. |

| Information Transparency | High | Online platforms allow easy price and product comparison. |

Full Version Awaits

Hooker Furniture Porter's Five Forces Analysis

This preview showcases the complete Hooker Furniture Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the furniture industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, providing actionable insights into industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes. Rest assured, there are no placeholders or generic content; you're getting the full, ready-to-use analysis.

Rivalry Among Competitors

The furniture sector is incredibly fragmented, featuring a vast array of companies. This includes long-standing manufacturers and newer online-focused businesses. Hooker Furnishings faces competition from over 1,100 active companies in this dynamic market.

Key players such as Ashley Home Stores, La-Z-Boy, and Ethan Allen Interiors represent significant competitive forces. The sheer volume and variety of competitors, from those offering budget-friendly options to high-end luxury goods, significantly escalates the rivalry within the industry.

The global furniture market is expected to see growth, but the home furnishings sector, including companies like Hooker Furniture, encountered a slowdown in fiscal 2025. This was largely due to economic challenges and reduced consumer spending. Hooker Furnishings, for instance, reported a dip in its consolidated net sales for fiscal 2025, reflecting the tougher market conditions.

A slower industry growth rate naturally fuels more intense competition. When the overall market isn't expanding rapidly, businesses must fight harder for their existing customer base and try to capture market share from rivals. This dynamic can lead to price pressures and increased marketing efforts as companies strive to stand out.

Hooker Furnishings differentiates itself by offering a broad spectrum of furniture across various categories and managing multiple brands, each targeting distinct consumer groups and sales channels. This multi-brand strategy allows them to capture different market niches effectively.

However, the furniture industry sees many players focusing on similar differentiation tactics such as unique styles, superior quality, and strong brand recognition. For instance, in 2024, many furniture brands continued to invest heavily in marketing campaigns highlighting artisanal craftsmanship and exclusive designs to stand out.

The evolving consumer preference for personalized and technologically integrated furniture, often termed smart furniture, is also a significant driver for differentiation. Companies are increasingly incorporating features like built-in charging ports and adjustable settings, a trend that saw significant growth in new product launches throughout 2024.

Exit Barriers for Competitors

Exit barriers for competitors in the furniture manufacturing sector are notably high, largely due to the significant capital tied up in specialized production equipment, extensive inventory, and established distribution channels. These substantial fixed costs make it economically challenging for companies to cease operations or divest assets without incurring substantial losses.

Hooker Furnishings, for instance, is actively engaged in cost-saving measures, such as consolidating its warehouse operations. This strategic move, while aimed at improving efficiency, highlights the complexity and expense involved in restructuring physical assets, further underscoring the challenges of exiting the market. Such initiatives can take considerable time and resources to implement effectively.

The presence of these high exit barriers means that even when market conditions are unfavorable or profitability is low, many furniture manufacturers may continue to operate. This persistence can intensify competitive rivalry, as these firms strive to maintain market share and cover their fixed costs, potentially leading to price wars or increased promotional activities.

- High Capital Investment: Furniture manufacturing requires substantial investment in specialized machinery, factories, and logistics infrastructure.

- Inventory Holding Costs: Significant capital is often tied up in raw materials and finished goods inventory, making liquidation difficult and costly.

- Distribution Network Commitment: Established relationships with retailers and distributors represent a valuable asset that is hard to abandon.

- Operational Restructuring Costs: Initiatives like warehouse consolidations, as seen with Hooker Furnishings, involve significant upfront costs and operational disruptions.

Strategic Stakes of Competitors

Many furniture companies, including Hooker Furnishings, have significant strategic stakes in maintaining or growing their market share. This is driven by long-standing brand reputations, established retail partnerships, and substantial capital investments made over decades.

Hooker Furnishings, a company with over a century of history, is deeply committed to profitability, growth, and enhancing long-term shareholder value. This dedication to its market position and the industry itself naturally encourages competitive and aggressive strategies among its rivals.

- Brand Loyalty: Competitors strive to retain and grow market share by leveraging established brand recognition and customer loyalty, built over many years.

- Retailer Relationships: Strong, long-standing relationships with retailers are crucial, as they provide access to consumers and influence purchasing decisions.

- Capital Intensity: The furniture industry requires significant capital for manufacturing, distribution, and marketing, creating high barriers to entry and reinforcing the strategic importance of existing market positions.

- Profitability Focus: Companies like Hooker Furnishings are driven by profitability targets, leading to strategic maneuvers aimed at capturing a larger slice of the market to achieve economies of scale and improve margins.

The furniture industry is highly fragmented with over 1,100 companies competing, including major players like Ashley Home Stores and La-Z-Boy. This intense rivalry is amplified by a slower growth rate in the home furnishings sector, as evidenced by Hooker Furnishings' consolidated net sales dip in fiscal 2025 due to economic challenges and reduced consumer spending. Companies are resorting to differentiation through unique styles, quality, and smart furniture features, a trend prominent in 2024 product launches.

High exit barriers, such as significant capital investment in specialized equipment and established distribution networks, keep many firms operating even in challenging conditions. This persistence, coupled with companies like Hooker Furnishings’ long-term strategic commitment to market share, fuels aggressive competition and potential price wars.

| Metric | Hooker Furniture (FY25) | Industry Trend (2024) |

|---|---|---|

| Consolidated Net Sales | Decreased | Slowdown in home furnishings |

| Number of Competitors | 1,100+ | High fragmentation |

| Differentiation Focus | Multi-brand strategy, broad spectrum | Unique styles, quality, smart furniture |

SSubstitutes Threaten

Consumers increasingly opt for built-in cabinetry, wall-mounted shelving, and minimalist living, directly reducing the demand for traditional furniture. For instance, in 2024, the global market for custom cabinetry saw significant growth, indicating a shift away from freestanding units.

The integration of smart home technology and the popularity of multifunctional furniture also present viable alternatives. These innovations often combine storage and utility, lessening the perceived need for separate furniture pieces, a trend that gained further traction throughout 2024.

Shifting consumer lifestyles present a significant threat of substitutes for Hooker Furniture. Increased urbanization, for instance, is leading many to embrace smaller living spaces, which in turn fuels demand for adaptable furniture such as modular or folding pieces that offer flexibility and mobility. This contrasts with traditional, larger furniture items.

Furthermore, evolving media consumption habits are influencing furniture choices. The trend of consumers spending more time in bedrooms, engaging with media, has boosted demand for specific items like bed frames with integrated headboards, demonstrating how external lifestyle shifts can redirect furniture purchasing decisions away from conventional living room sets.

The burgeoning rental and secondhand furniture markets also act as potent substitutes. In 2024, the global secondhand furniture market was valued at approximately $12 billion and is projected to grow significantly, offering consumers a cost-effective alternative to purchasing new furniture from traditional retailers like Hooker Furniture.

The burgeoning DIY and upcycling movement directly challenges the demand for new furniture. Consumers increasingly see value in refurbishing existing pieces or crafting their own, driven by both environmental consciousness and cost savings. For instance, a 2024 survey indicated that over 40% of consumers considered upcycling when looking for home furnishings, highlighting a significant shift away from solely new purchases.

Digital and Virtual Home Furnishing Solutions

The rise of sophisticated digital tools like augmented reality (AR) and virtual showrooms presents a potential threat of substitutes for traditional home furnishing solutions. These technologies enable consumers to visualize furniture in their own spaces before buying, potentially reducing the perceived need for immediate physical interaction or even purchase. For instance, a study in 2024 indicated that 65% of consumers find AR visualization tools helpful in their furniture buying journey, suggesting a shift in how consumers engage with the product before committing.

While these digital solutions primarily enhance the furniture purchasing process, they could, in certain niche scenarios, act as partial substitutes. Consumers might use these tools for aesthetic planning and design conceptualization without the immediate intention of acquiring physical goods, thereby fulfilling a part of the need for home beautification. The market for virtual goods, including digital furnishings for metaverses or gaming, is also expanding, hinting at a future where purely virtual decor could substitute for some physical home furnishing needs.

- Augmented Reality (AR) in Furniture Retail: AR adoption in furniture retail has seen significant growth, with many major players integrating it into their apps. In 2023, the global AR market size was valued at approximately $30 billion, with a substantial portion attributed to retail applications.

- Virtual Showrooms: Online retailers are increasingly investing in immersive virtual showroom experiences, allowing customers to browse and interact with products in a simulated environment. This reduces reliance on physical store visits.

- Digital Decor for Virtual Worlds: The burgeoning metaverse and gaming industries are creating demand for digital assets, including virtual furniture. This segment, while nascent, represents a new category of substitute for physical decor in specific contexts.

- Consumer Behavior Shift: Consumer willingness to engage with digital tools for home design is increasing. A 2024 survey revealed that 70% of Gen Z consumers are more likely to purchase furniture if they can visualize it using AR.

Rental and Subscription Furniture Models

The rise of furniture rental and subscription services presents a significant threat of substitutes for traditional furniture ownership, impacting companies like Hooker Furniture. These models cater to a growing segment of consumers prioritizing flexibility and lower initial investment over outright purchase. For instance, companies like Feather and Fernish have seen substantial growth, particularly in urban centers, by offering stylish, curated furniture packages on a monthly basis.

This shift is driven by evolving consumer preferences, especially among younger demographics and those in transient living situations. In 2024, the furniture rental market is projected to continue its upward trajectory, with consumers increasingly valuing the ability to change their decor without the long-term commitment and high upfront costs associated with buying new furniture. This directly challenges the traditional sales model of furniture manufacturers and retailers.

- Market Growth: The global furniture rental market is expected to reach over $10 billion by 2025, indicating a strong demand for alternative ownership models.

- Consumer Appeal: Flexibility, affordability, and the ability to refresh living spaces are key drivers for consumers adopting rental services.

- Competitive Pressure: Hooker Furniture must consider how to integrate or compete with these rental and subscription offerings to maintain market share.

The threat of substitutes for Hooker Furniture is amplified by the growing popularity of integrated home solutions and digital design tools. Consumers are increasingly turning to built-in cabinetry and wall-mounted shelving, a trend evidenced by the significant growth in the custom cabinetry market in 2024. Furthermore, the rise of augmented reality (AR) in furniture retail, with 65% of Gen Z consumers finding AR visualization helpful in 2024, allows for virtual planning that can sometimes bypass the immediate need for physical furniture acquisition.

The burgeoning rental and secondhand furniture markets also pose a substantial threat. In 2024, the global secondhand furniture market was valued at approximately $12 billion, offering a cost-effective alternative to new purchases. Similarly, the furniture rental market is projected for continued growth, with consumers valuing flexibility and lower upfront costs over ownership, directly impacting traditional sales models.

| Substitute Category | Description | 2024 Relevance/Data |

| Integrated Home Solutions | Built-in cabinetry, wall units, multifunctional furniture | Custom cabinetry market saw significant growth in 2024. |

| Digital Design & Visualization | AR/VR for home planning, virtual showrooms | 65% of Gen Z find AR visualization helpful (2024); AR market substantial portion in retail. |

| Rental & Secondhand Markets | Furniture rental services, pre-owned furniture | Secondhand furniture market valued at ~$12 billion (2024); Furniture rental market projected to exceed $10 billion by 2025. |

| DIY & Upcycling | Consumers refurbishing or creating their own furniture | Over 40% of consumers considered upcycling in 2024. |

Entrants Threaten

Entering the furniture manufacturing and distribution sector, especially at a scale comparable to Hooker Furnishings, demands significant upfront capital. This includes investments in production plants, maintaining substantial inventory levels, and building out widespread distribution channels. For instance, a new competitor would need to secure significant funding to acquire or lease manufacturing space and invest in machinery, a process that can easily run into millions of dollars.

While online sales platforms have somewhat reduced the initial investment for direct-to-consumer models, establishing a comprehensive supply chain and a recognizable brand across various sales avenues still necessitates considerable financial resources. Building a reliable logistics network and marketing a brand effectively to compete with established players like Hooker Furnishings requires substantial financial backing, making it a formidable hurdle for newcomers.

Hooker Furniture, like many established players in the furniture industry, benefits significantly from economies of scale. This means they can produce goods more cheaply per unit because they operate on a larger scale. For example, their ability to buy lumber, fabric, and other materials in massive quantities often secures them lower per-unit costs than a smaller, newer company could achieve. In 2023, the global furniture market was valued at over $700 billion, and companies with established supply chains and high production volumes, like Hooker, are positioned to leverage this scale for cost advantages.

This cost advantage makes it challenging for new entrants to compete, particularly on price. A new company would need substantial upfront investment to build production facilities and establish sourcing relationships that can match Hooker's existing efficiencies. Without these economies of scale, new competitors would likely face higher production costs, making it difficult to offer competitive pricing in segments where price is a major purchasing factor.

Hooker Furniture's long history, spanning over a century, has cultivated significant brand loyalty and recognition across its various brands. This deep-seated customer trust, built through consistent quality and marketing, presents a formidable barrier for newcomers. For instance, in 2023, Hooker Furniture reported net sales of $1.2 billion, underscoring its substantial market presence.

The furniture industry demands considerable investment in marketing and product development to establish a reputable brand. New entrants would need to allocate substantial resources to compete with Hooker Furniture's established brand equity and diverse product offerings, making it difficult to gain traction quickly.

New competitors entering the market would struggle to replicate Hooker Furniture's established customer relationships and brand perception, which are crucial differentiators in the furniture sector. This makes the threat of new entrants relatively low for established players like Hooker Furniture.

Access to Distribution Channels

Hooker Furnishings has cultivated strong, long-standing relationships with a wide array of furniture retailers, interior designers, and prominent e-commerce platforms. This established network presents a substantial barrier for any new company looking to enter the market. Newcomers will find it difficult to replicate Hooker's extensive reach and the trust it has built with these key distribution partners.

While the digital landscape has opened up direct-to-consumer avenues, achieving a truly comprehensive omnichannel presence, which includes a robust physical retail footprint, remains an exceptionally costly and complex undertaking for emerging businesses. For instance, in 2024, the average cost for a new furniture retailer to establish just one physical showroom could range from $150,000 to $500,000, not including inventory and staffing.

- Established Retailer Relationships: Hooker's existing partnerships with major furniture chains and independent dealers provide immediate market penetration.

- Designer Endorsements: Access to interior designers, who often specify brands for their clients, is crucial and hard-won.

- E-commerce Platform Integration: Securing prominent placement and favorable terms on popular online marketplaces requires significant effort and investment.

- Omnichannel Complexity: The cost and logistical challenges of building both online and brick-and-mortar distribution networks deter many new entrants.

Government Policy and Regulations

Government policies and regulations significantly influence the threat of new entrants in the furniture industry. These can include stringent safety standards for materials and manufacturing processes, as well as environmental compliance requirements. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) continues to enforce flammability standards for upholstered furniture, adding to the operational costs for any new player. Furthermore, import/export duties and trade agreements can create substantial hurdles for companies looking to source materials or sell finished goods internationally.

New entrants must invest heavily in understanding and adhering to these complex regulatory frameworks, which often require specialized legal and compliance expertise. This can be a substantial barrier, especially when compared to established companies like Hooker Furnishings, which have developed robust systems for regulatory adherence over years of operation. The cost of compliance, including testing and certification, can deter smaller or less-capitalized entrants.

- Safety Standards: Compliance with CPSC flammability standards and other product safety regulations requires investment in materials and manufacturing processes.

- Environmental Regulations: Adherence to regulations concerning sustainable sourcing, chemical content, and waste disposal adds to operational complexity and cost.

- Import/Export Duties: Navigating tariffs, quotas, and international trade agreements impacts the cost of goods and market access for new entrants.

- Legal Expertise: New companies need to acquire or contract specialized legal counsel to ensure compliance with a constantly evolving regulatory landscape.

The threat of new entrants into the furniture manufacturing and retail space is generally low for established companies like Hooker Furniture. Significant capital is required for manufacturing facilities, inventory, and distribution networks, often running into millions of dollars. For example, establishing a single physical furniture showroom in 2024 can cost between $150,000 and $500,000. Furthermore, economies of scale, brand loyalty built over decades, and established retailer relationships create substantial barriers that new players find difficult to overcome. In 2023, Hooker Furniture reported net sales of $1.2 billion, highlighting its significant market presence and the challenge for newcomers to match this scale and brand recognition.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

| Capital Requirements | High upfront investment in plants, inventory, and distribution. | Significant financial hurdle. | Showroom setup cost: $150k - $500k (2024) |

| Economies of Scale | Lower per-unit costs due to high production volume. | Difficulty competing on price. | Global furniture market value: >$700 billion (2023) |

| Brand Loyalty & Recognition | Established trust and reputation built over time. | Requires substantial marketing investment to build awareness. | Hooker Furniture Net Sales: $1.2 billion (2023) |

| Distribution Channels | Existing relationships with retailers and e-commerce platforms. | Challenging to secure comparable market access. | N/A (relationship-based) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hooker Furniture leverages data from industry-specific market research reports, financial statements of key competitors, and trade publications to understand the competitive landscape.