Hooker Furniture Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hooker Furniture Bundle

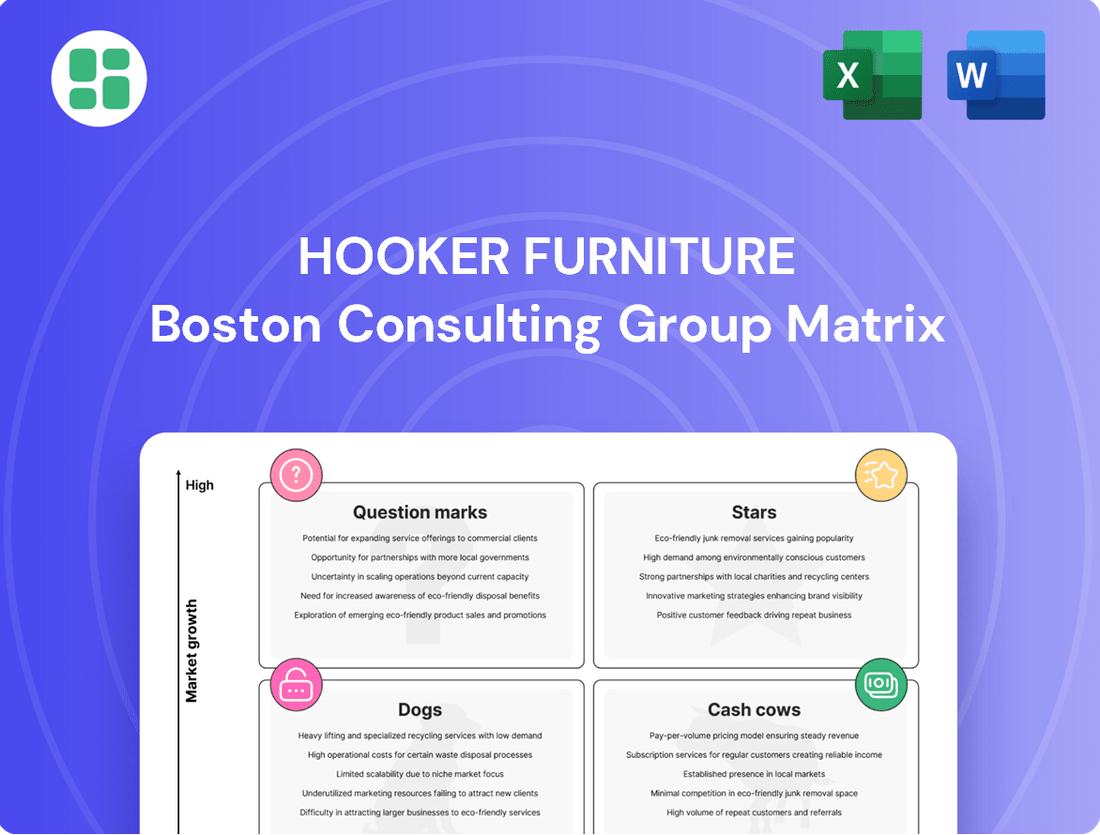

Hooker Furniture's BCG Matrix offers a crucial lens to understand their product portfolio's performance in the dynamic furniture market. By identifying their Stars, Cash Cows, Dogs, and Question Marks, you can grasp their current strategic position at a glance.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Hooker Furniture.

Stars

Sunset West Outdoor Furniture, a luxury outdoor furniture brand, is demonstrating resilience with single-digit sales growth despite broader market headwinds for Hooker Furniture. This performance suggests a strong position within its niche.

The brand's strategic bi-coastal expansion and planned new initiatives and product launches for 2025 highlight its potential for significant growth. This positions Sunset West as a potential star in the BCG matrix, capitalizing on a growing demand for premium outdoor living spaces.

Hooker Furnishings' hospitality division, encompassing H Contract and Samuel Lawrence Hospitality, is a significant growth driver. Samuel Lawrence Hospitality, in particular, experienced a robust 38% sales surge in fiscal year 2024, with expectations for continued expansion into fiscal 2025.

This segment is strategically vital, with the company consolidating leadership to better leverage opportunities within the commercial furniture sector. This focus positions the hospitality furniture business as a key high-growth area for Hooker Furnishings.

Hooker Furniture's new casegoods collections, including Driftwood, Eleana, and Nouveau Chic, were launched at High Point Market in late 2024 and early 2025 as a key part of their remerchandising strategy for Hooker Legacy Brands. These introductions highlight an elevated aesthetic and a modern luxury focus, designed to capture consumer interest in cohesive, design-forward home furnishings.

The strategic aim for these collections is a 'whole-home' approach, tapping into evolving consumer desires for curated living spaces and sophisticated design. This initiative is expected to drive significant market adoption and increase market share within their targeted segments, reflecting a commitment to innovation and consumer-centric product development in the competitive furniture market.

Revitalized Hooker Branded Offerings

Hooker Furniture is strategically revitalizing its branded offerings to create a more integrated and consumer-focused experience. This initiative aims to significantly boost market share by elevating the presentation and appeal of its core products.

The early results of this repositioning appear promising. For instance, Hooker Branded saw a substantial increase in orders, with fiscal May 2025 orders climbing nearly 33% compared to the previous year. This growth indicates that the strategy is resonating with consumers and driving increased demand.

- Revitalized Brand Presentation: The company is enhancing the overall look and feel of its Hooker Legacy Brands to be more consumer-centric.

- Market Share Capture: This strategic move is designed to attract a larger segment of the market.

- Strong Order Growth: Fiscal May 2025 orders for Hooker Branded products surged by approximately 33% year-over-year, demonstrating early positive traction.

High-Velocity, Profitable SKU Investments

Hooker Furniture strategically bolstered inventory for its top-performing, high-velocity SKUs in Q4 FY2025. This move aimed to enhance product availability and accelerate delivery timelines.

By concentrating resources on these proven winners, the company demonstrates a clear strategy of maximizing the return on investment from its most successful individual products. This approach capitalizes on existing high demand and signals confidence in continued growth for these specific items within their broader product catalog.

- Focus on Profitability: Investment centers on SKUs that already demonstrate strong profit margins.

- Inventory Optimization: Increased stock levels for high-demand items to prevent stockouts.

- Market Responsiveness: Aims to reduce lead times and improve customer satisfaction through better availability.

- Strategic Growth: Prioritizes resources for products with a proven track record of high sales velocity.

Hooker Branded, with a significant 33% year-over-year increase in fiscal May 2025 orders, demonstrates strong market resonance and growth potential. This performance, driven by a revitalized brand presentation and a focus on cohesive, design-forward collections like Driftwood and Nouveau Chic, positions it as a star performer. The strategic emphasis on whole-home solutions and elevated aesthetics is capturing consumer interest and driving demand.

What is included in the product

The Hooker Furniture BCG Matrix analyzes its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide strategic decisions.

A clear, visual BCG Matrix mapping Hooker Furniture's business units, providing instant clarity on strategic direction.

Cash Cows

The Hooker Branded Casegoods Portfolio, encompassing established lines like home entertainment, dining, and bedroom furniture, acts as a quintessential Cash Cow for Hooker Furniture. This segment has demonstrated remarkable resilience, capturing increasing market share in the residential furniture sector through the third quarter of fiscal 2025, even amidst broader industry challenges.

This consistent market share gain underscores the mature yet robust nature of these products. They are dependable revenue generators, providing the stable financial foundation necessary for the company to invest in other growth areas.

Bradington-Young, a specialist in upscale, handcrafted leather furniture, operates within Hooker Furniture's portfolio. Its focus on the premium segment, particularly motion and stationary leather pieces made in North Carolina, suggests a strong brand identity and consistent customer loyalty.

The brand's commitment to quality and its established reputation likely translate into healthy profit margins and stable revenue streams. In 2024, the luxury furniture market, including high-end leather goods, continued to show resilience, with consumer spending on home furnishings remaining robust, particularly in the upper-income brackets.

HF Custom Upholstery, a segment within Hooker Furniture, likely operates as a cash cow. Its focus on fashion-forward, custom upholstery, including chairs, sofas, and accent pieces, caters to a niche market demanding personalization. This specialization typically translates to higher profit margins and a dedicated customer base, allowing it to generate consistent cash flow with minimal reinvestment needs.

Shenandoah Furniture Private Label Upholstery

Shenandoah Furniture Private Label Upholstery operates as a cash cow within Hooker Furniture's portfolio. Its specialization in high-end private label upholstered goods, such as sectionals and sofas, suggests strong, ongoing partnerships with major retailers.

These established private label agreements are crucial, as they generate a steady and reliable income. For instance, private label manufacturing often involves long-term contracts that ensure consistent order volumes, insulating the business from the volatility often seen in more exposed market segments. This stability is a hallmark of a cash cow, providing dependable cash flow to support other ventures within the parent company.

The consistent revenue stream from these private label contracts allows Shenandoah Furniture to maintain its market position without requiring significant new investment. This financial stability is key to its role as a cash cow, contributing positively to Hooker Furniture's overall financial health.

- Consistent Revenue: Long-term private label contracts provide a predictable and stable income.

- Low Investment Needs: As an established player, it likely requires minimal new capital for growth.

- Profitability: The focus on upscale products suggests healthy profit margins.

- Market Stability: Private label relationships offer a degree of insulation from market fluctuations.

Prime Resources International (PRI) Value-Conscious Leather

Prime Resources International (PRI) represents a Cash Cow within Hooker Furniture's portfolio, specifically within its Home Meridian segment. This brand focuses on value-conscious imported leather upholstered furniture, catering to a wide consumer base looking for accessible leather options.

PRI's strategy of offering affordable leather furniture positions it in a mature but stable market segment. This consistent demand translates into predictable sales volumes and a reliable source of cash flow for the parent company. For instance, in 2024, the upholstered furniture market, where PRI primarily operates, saw steady demand, with reports indicating a 3.5% growth in the U.S. furniture market overall, driven by continued consumer spending on home goods.

- Market Position: PRI targets the value segment of the leather furniture market.

- Sales Performance: The brand contributes stable sales volume due to its price point.

- Financial Contribution: It acts as a consistent generator of cash flow for Hooker Furniture.

- Growth Outlook: While in a mature market, PRI benefits from ongoing consumer demand for affordable home furnishings.

The Hooker Branded Casegoods Portfolio, including established lines like home entertainment, dining, and bedroom furniture, functions as a prime Cash Cow for Hooker Furniture. This segment has shown remarkable resilience, increasing its market share in the residential furniture sector through Q3 fiscal 2025, even amidst broader industry headwinds.

This consistent market share expansion highlights the mature yet robust nature of these products. They are dependable revenue generators, providing the stable financial foundation necessary for the company to invest in other growth areas.

Bradington-Young, specializing in upscale, handcrafted leather furniture, also operates as a Cash Cow. Its focus on the premium segment, particularly motion and stationary leather pieces, suggests strong brand identity and consistent customer loyalty, leading to healthy profit margins and stable revenue streams. In 2024, the luxury furniture market, including high-end leather goods, demonstrated resilience, with consumer spending on home furnishings remaining robust, particularly in upper-income brackets.

HF Custom Upholstery, with its fashion-forward, custom upholstery offerings, likely functions as a cash cow. This specialization in personalized pieces typically yields higher profit margins and a dedicated customer base, allowing for consistent cash flow generation with minimal reinvestment requirements.

| Brand/Segment | BCG Category | Key Characteristics | 2024 Market Insight |

| Hooker Branded Casegoods | Cash Cow | Established product lines, increasing market share, mature but robust. | Resilient performance in residential furniture sector. |

| Bradington-Young | Cash Cow | Upscale, handcrafted leather furniture, premium segment focus, strong brand loyalty. | Resilience in luxury furniture market, robust consumer spending in upper-income brackets. |

| HF Custom Upholstery | Cash Cow | Fashion-forward, custom upholstery, niche market, higher profit margins. | Consistent cash flow generation with minimal reinvestment. |

| Shenandoah Furniture Private Label | Cash Cow | High-end private label upholstery, strong retailer partnerships, stable income. | Long-term contracts ensure consistent order volumes, insulating from market volatility. |

| Prime Resources International (PRI) | Cash Cow | Value-conscious imported leather furniture, accessible price point, stable market segment. | Steady demand and predictable sales volumes in upholstered furniture market. |

What You See Is What You Get

Hooker Furniture BCG Matrix

The Hooker Furniture BCG Matrix preview you are currently viewing is the identical, fully rendered document you will receive immediately after your purchase. This means no watermarks, no altered content, and no hidden surprises—just the complete, professionally formatted analysis ready for your strategic decision-making. You can confidently assess the quality and detail of this report, knowing the final version will be exactly as presented, enabling you to seamlessly integrate this valuable business intelligence into your planning processes.

Dogs

Hooker Furniture's decision to exit the ACH product line in fiscal year 2024 clearly categorized it as a 'Dog' in their BCG Matrix. This strategic move involved divesting an unprofitable segment that was consuming valuable resources without generating sufficient returns.

The liquidation of the ACH product line had a direct and noticeable impact, contributing to a decline in sales within the Home Meridian segment. This action underscores the company's commitment to shedding underperforming assets to streamline operations and focus on more promising areas.

Within the Hooker Furniture BCG Matrix, Home Meridian's traditional channels are likely positioned as Dogs. This segment faced significant sales declines in fiscal 2025, with reports indicating substantial drops across traditional furniture chains and mass merchants. The e-commerce channel also contributed to this downturn, further weakening the overall performance of these channels.

The challenges are compounded by external factors, including a major customer bankruptcy that directly impacted sales figures for Home Meridian. These underperforming channels, lacking a clear path to recovery, are acting as a drag on the company's broader financial results, necessitating careful strategic consideration.

Hooker Furniture's Home Meridian segment successfully liquidated obsolete inventories in fiscal 2024, a strategic move to free up capital. This involved significant discounting of excess stock, which had been tying up resources and necessitating markdowns. Clearing these items was crucial for improving overall financial efficiency.

Certain Legacy Collections Requiring Deep Discounts

Certain legacy collections within Hooker Furniture's branded segment are likely positioned as Dogs in the BCG Matrix. The company's acknowledgment of increased discounting on excess inventories in 2024 to re-balance stock levels points to these older or less popular lines facing subdued market demand. This necessitates significant price reductions to clear inventory, a hallmark of Dog products with low market share and low growth potential.

This strategy of deep discounting on legacy items is a clear indicator of their Dog status.

- Low Market Demand: Older furniture collections often struggle to compete with newer designs and trends, leading to reduced consumer interest.

- Excess Inventory: Holding onto unsold legacy items ties up capital and storage space, prompting aggressive clearance tactics.

- Price Sensitivity: The need for deep discounts highlights that these products can only attract buyers when priced significantly lower than competitors or newer offerings.

- Strategic Divestment Potential: Companies often look to phase out or discontinue Dog products to focus resources on more promising Stars and Cash Cows.

Specific Upholstery Lines with Persistent Unit Volume Declines

Within Hooker Furniture's Domestic Upholstery segment, specific product lines are showing concerning trends. While Sunset West experienced growth, other areas, including certain offerings from Bradington-Young and HF Custom, faced a downturn in unit volume during fiscal 2025. This indicates a potential shift towards 'Dog' products if these lower sales volumes persist without effective recovery plans.

These underperforming upholstery lines are characterized by declining unit sales, reflecting soft consumer demand. For instance, specific product collections within Bradington-Young and HF Custom saw notable decreases in volume. If these negative sales trends continue, they would likely be categorized as 'Dogs' in the BCG Matrix, suggesting they require careful evaluation for potential divestment or restructuring.

- Declining Unit Volume: Certain product lines within Bradington-Young and HF Custom experienced lower unit sales in fiscal 2025.

- Soft Demand: The overall market for these specific upholstery lines showed weak consumer interest.

- Potential 'Dog' Classification: Persistent declines without clear turnaround strategies place these products in the 'Dog' category of the BCG Matrix.

- Impact on Segment Performance: These underperforming lines can drag down the overall performance of the Domestic Upholstery segment.

Hooker Furniture's strategic decision to exit the ACH product line in fiscal year 2024 clearly marked it as a 'Dog' within their BCG Matrix, representing an unprofitable segment divested to conserve resources. Similarly, Home Meridian's traditional sales channels are likely classified as Dogs due to substantial sales declines observed across traditional furniture chains and mass merchants in fiscal 2025, further exacerbated by a weak e-commerce performance.

Legacy collections within Hooker Furniture's branded segment also exhibit 'Dog' characteristics, evidenced by increased discounting on excess inventories in 2024 to re-balance stock levels, indicating low market demand and slow growth potential. This aggressive clearance strategy highlights the need to phase out or discontinue these underperforming products to reallocate resources effectively.

Within the Domestic Upholstery segment, certain product lines from Bradington-Young and HF Custom faced a downturn in unit volume during fiscal 2025, pointing towards a potential 'Dog' classification if these trends persist, as they reflect soft consumer demand and could negatively impact the segment's overall performance.

| Segment/Product Line | BCG Category (Likely) | Key Indicators | Fiscal Year Data Point |

|---|---|---|---|

| ACH Product Line | Dog | Divested due to unprofitability | Exited in FY2024 |

| Home Meridian - Traditional Channels | Dog | Significant sales decline | FY2025 sales drop across channels |

| Hooker Branded - Legacy Collections | Dog | Increased discounting on excess inventory | FY2024 stock re-balancing |

| Domestic Upholstery - Bradington-Young/HF Custom | Dog (Potential) | Declining unit volume | FY2025 unit volume decrease |

Question Marks

The Margaritaville licensing agreement, a significant development for fiscal 2025, positions Hooker Furnishings to tap into a new lifestyle brand, potentially expanding into different product lines and customer bases. This strategic move signifies a high-growth opportunity, leveraging the established recognition of the Margaritaville name.

While the agreement offers substantial growth prospects, the Margaritaville segment currently represents a nascent market share within Hooker Furnishings' broader portfolio. This necessitates strategic investment to cultivate and expand its presence, aligning with its placement as a potential star or question mark within a BCG matrix analysis.

The Collected Living by HF merchandising platform represents Hooker Furniture's strategic move to become a holistic, consumer-focused provider for the entire home. This initiative requires substantial investment in marketing and product innovation to achieve widespread market acceptance.

While the platform shows promise, its future market share remains a key variable, making it a potential question mark in the BCG matrix. Hooker Furniture's 2024 performance will be crucial in assessing the early traction of this consumer-centric approach.

Hooker Furniture is significantly investing in its digital infrastructure, with a redesigned corporate website slated for launch in October 2025. This strategic move is designed to elevate the online customer journey, boost lead generation capabilities, and crucially, underpin the company's expansion across all sales channels, known as omni-channel growth. This initiative is a direct response to the booming e-commerce furniture sector, a market segment experiencing substantial expansion where Hooker aims to solidify and grow its footprint.

BOBO Intriguing Objects Integration and Expansion

BOBO Intriguing Objects, acquired by Hooker Furniture in 2023, is positioned to bolster Hooker's status as a comprehensive home furnishings provider by introducing new product lines such as lighting, decorative accessories, and wall art. This strategic move signifies Hooker's expansion into adjacent markets, offering substantial avenues for future growth.

The integration of BOBO Intriguing Objects represents a nascent stage of market penetration for Hooker Furniture. While the acquisition broadens the company's product portfolio and targets a potentially high-growth segment, the full realization of market share and operational synergies is still unfolding.

- Market Entry: BOBO Intriguing Objects signifies Hooker Furniture's entry into the lighting and accessories market.

- Growth Potential: This acquisition is expected to unlock significant growth opportunities for Hooker.

- Integration Phase: Full integration and market share capture are ongoing processes.

Investment in Cloud-Based ERP System

Hooker Furniture's investment in a new cloud-based ERP system, exceeding $50 million in 2024, is a strategic move to bolster operational efficiency and pave the way for future expansion. This foundational technology upgrade is critical for supporting the company’s high-growth initiatives, even though it’s not a direct revenue-generating product itself.

- Operational Efficiency: The ERP system aims to streamline processes across departments, reducing manual work and potential errors.

- Scalability Support: It provides the necessary technological backbone to handle increased transaction volumes and data as the company grows.

- Future Growth Enablement: By improving responsiveness and agility, the ERP positions Hooker Furniture to capitalize on new market opportunities and emerging trends.

- Competitive Advantage: Modern ERP systems can offer real-time data analytics, enabling faster and more informed decision-making, crucial in today's dynamic market.

The Margaritaville and BOBO Intriguing Objects segments represent emerging opportunities for Hooker Furniture, requiring significant investment to build market share. Their current market penetration is low, but the potential for high growth exists, characteristic of question marks in a BCG matrix. Hooker's 2024 fiscal year performance will be key to evaluating the early success of these ventures.

Hooker Furniture's strategic investments in digital infrastructure and its Collected Living by HF platform also fall into the question mark category. These initiatives aim to capture future growth in the e-commerce and consumer-focused home furnishings markets, respectively. The success of these ventures hinges on effective execution and market adoption, with 2024 data offering initial insights.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.