Hooker Furniture Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hooker Furniture Bundle

Unlock the strategic blueprint behind Hooker Furniture's success with our comprehensive Business Model Canvas. Discover how they effectively reach their diverse customer segments, build strong partnerships, and generate revenue through a multi-channel approach.

This detailed canvas reveals Hooker Furniture's core activities, key resources, and unique value propositions that drive their competitive advantage in the furniture industry. It's an essential tool for anyone looking to understand their operational efficiency and market positioning.

Ready to gain a deeper understanding of Hooker Furniture's winning strategy? Download the full Business Model Canvas to access all nine building blocks, providing actionable insights for your own business planning and competitive analysis.

Partnerships

Hooker Furnishings relies heavily on a global network of manufacturers and suppliers to source its diverse residential furniture, encompassing casegoods, upholstery, and accent pieces. This extensive international reach allows them to offer a wide product selection at competitive price points, a cornerstone of their business strategy.

A recent strategic move in 2024 saw Hooker Furnishings open a new facility in Vietnam. This expansion is designed to significantly reduce lead times and enhance the efficiency of their global supply chain operations, demonstrating a commitment to optimizing these critical partnerships.

Furniture retailers serve as a primary distribution channel for Hooker Furnishings, reaching consumers across North America. These partnerships are crucial for Hooker to connect with a broad customer base and allow shoppers to physically interact with their extensive product offerings. In 2024, Hooker continued to rely on this extensive network, which includes both independent boutiques and large retail chains, to drive sales volume and expand its market presence.

Hooker Furnishings strategically partners with interior designers who are crucial gateways to the hospitality and contract sectors. These designers specify furniture for projects, directly influencing purchasing decisions for hotels, restaurants, and senior living facilities.

Through its H Contract and Samuel Lawrence Hospitality divisions, Hooker Furnishings offers specialized, durable furniture designed for commercial environments. This allows them to meet the unique demands of hospitality clients, often requiring custom solutions and robust construction that still offers residential appeal.

These partnerships are vital for consistent revenue streams, as contract projects typically involve larger, more predictable order volumes compared to the retail segment. In 2023, the hospitality and contract segment represented a significant portion of Hooker Furnishings' business, demonstrating the strength of these key relationships.

Logistics and Freight Partners

Hooker Furniture relies heavily on its logistics and freight partners to manage its extensive import operations. These partnerships are essential for moving products from overseas manufacturing, primarily in Asia, to their distribution centers and then to customers. For instance, in 2023, the company continued to navigate complex global supply chains, which often involve significant freight costs.

The company's strategic decision to close its Savannah, Georgia distribution center and establish a new warehouse in Vietnam underscores the importance of optimizing these logistics relationships. This move aims to streamline operations and potentially lower transportation expenses, reflecting an ongoing effort to adapt to changing market dynamics and improve cost-efficiency in their supply chain management.

- Global Freight Management: Partnerships with ocean carriers and freight forwarders are crucial for managing the inbound flow of furniture from Asian factories.

- Domestic Distribution Networks: Relationships with trucking companies and third-party logistics (3PL) providers are vital for last-mile delivery to retailers and direct-to-consumer shipments.

- Strategic Warehouse Locations: The shift to a Vietnam warehouse signifies a proactive approach to leverage partnerships for enhanced supply chain agility and cost savings.

Technology and E-commerce Platforms

Hooker Furnishings actively collaborates with major e-commerce platforms to broaden its market presence. This strategic move allows them to connect with a wider customer base, moving beyond the limitations of physical retail spaces. These digital partnerships are crucial for driving direct-to-consumer sales and enhancing online marketing efforts.

The company's commitment to digital transformation is evident in its ongoing investments, which are designed to leverage these technological alliances for sustained growth. For instance, Hooker Furnishings has been increasing its digital marketing spend, with a significant portion allocated to online advertising and platform integrations. This focus on e-commerce partnerships is a cornerstone of their strategy to adapt to evolving consumer purchasing habits.

- E-commerce Platform Integration: Hooker Furnishings partners with leading online retailers and marketplaces to offer its product catalog, increasing accessibility and sales volume.

- Digital Marketing and Customer Engagement: These collaborations facilitate targeted digital marketing campaigns and provide channels for direct customer interaction and feedback.

- Investment in Digital Capabilities: The company's recent financial reports highlight increased investment in e-commerce infrastructure and digital marketing technologies to support these partnerships.

- Sales Channel Diversification: By expanding onto various e-commerce platforms, Hooker Furnishings diversifies its revenue streams and reduces reliance on traditional wholesale channels.

Hooker Furnishings cultivates vital relationships with a diverse array of manufacturers, primarily located in Asia, to produce its extensive furniture lines. These partnerships are fundamental to their ability to offer a broad product assortment, from casegoods to upholstery. In 2024, the company continued to emphasize sourcing efficiency, with a significant portion of production originating from Vietnam and other Asian countries, aiming to optimize costs and lead times.

The company's retail partners, encompassing both large chains and independent stores across North America, are essential for reaching the end consumer. These relationships allow Hooker Furnishings to maintain a strong physical presence and facilitate customer interaction with their products. By the end of 2023, Hooker Furnishings reported continued reliance on this robust wholesale network, which underpins a substantial portion of their sales volume.

Hooker Furnishings strategically engages with interior designers and specifiers within the hospitality and contract sectors through its H Contract and Samuel Lawrence Hospitality divisions. These collaborations are critical for securing large-scale projects, such as hotel renovations and new commercial builds, which often involve substantial and predictable order volumes. The contract segment demonstrated resilience, contributing significantly to Hooker's revenue in 2023.

Logistics and freight providers are indispensable partners for Hooker Furnishings, facilitating the complex movement of goods from overseas production sites to distribution centers and ultimately to customers. The company's ongoing efforts to optimize its supply chain, including strategic warehouse placements, highlight the importance of these relationships for cost management and operational efficiency.

The company actively partners with major e-commerce platforms to expand its digital footprint and reach a wider consumer base. These digital alliances are crucial for driving direct-to-consumer sales and enhancing online brand visibility. Hooker Furnishings has been increasing its investment in digital marketing and e-commerce infrastructure, with a notable rise in online sales contributing to overall revenue growth in recent years.

What is included in the product

A detailed breakdown of Hooker Furniture's strategy, covering its diverse customer segments, multi-channel distribution, and core value propositions in furniture manufacturing and retail.

This model reflects Hooker Furniture's established operations and strategic plans, offering insights into its customer relationships, revenue streams, and key resources for investor and internal analysis.

Provides a clear, visual roadmap of Hooker Furniture's operations, simplifying complex strategies for easier understanding and alignment.

Offers a structured framework to identify and address potential inefficiencies or market gaps within Hooker Furniture's existing business model.

Activities

Hooker Furnishings dedicates significant resources to designing and developing furniture that is both innovative and visually appealing. This spans across their diverse portfolio, encompassing casegoods, upholstery, and accent pieces, all tailored to distinct consumer preferences and market niches. In 2024, the company continued to invest in this area, with a focus on creating collections that capture current design trends.

The company's approach involves meticulous trend forecasting and careful material selection to ensure their new product lines meet evolving market demands. This commitment to design excellence is further reinforced by strategic appointments, like that of a Chief Creative Officer, tasked with enhancing creative output and ensuring cohesive merchandising across all Hooker Furnishings brands.

Hooker Furniture's core operations heavily rely on global sourcing and importing, with a substantial amount of their furniture originating from Vietnam and other international manufacturers. This strategic approach allows them to access diverse production capabilities and cost efficiencies. For instance, in 2024, the company continued to leverage its established relationships with overseas suppliers to ensure a steady flow of products.

Effectively managing these international relationships is paramount. It involves rigorous quality control processes to meet brand standards and navigating complex international trade regulations, including tariffs and shipping logistics. This intricate dance of international trade is crucial for maintaining competitive pricing and ensuring product availability for their customers.

Hooker Furnishings orchestrates a diverse brand portfolio, with each brand tailored to specific consumer groups and sales avenues. This involves crafting distinct brand identities and implementing targeted marketing initiatives across multiple platforms to cultivate brand awareness and stimulate sales.

A significant part of their strategy involves executing comprehensive marketing campaigns designed to resonate with their varied customer bases. This includes digital marketing, traditional advertising, and public relations efforts to enhance product visibility and desirability.

The company recently rolled out a new merchandising strategy specifically for its Hooker Branded division. This move is aimed at optimizing product presentation and market positioning to better capture consumer interest and drive sales growth.

Distribution and Logistics Management

Hooker Furniture's distribution and logistics management is a core function, ensuring timely delivery across its diverse customer base. This involves operating a complex network of warehouses, meticulously managing inventory levels, and efficiently shipping products to furniture retailers, interior designers, and direct-to-consumer e-commerce channels. For instance, in 2023, the company reported a net sales increase of 4.8% to $1.04 billion, highlighting the scale of their distribution operations.

Recent strategic initiatives underscore a commitment to optimizing this network. Hooker Furniture has been consolidating its operations, exemplified by its exit from the Savannah distribution center. Simultaneously, the company is establishing a new facility in Vietnam. This move is designed to streamline the overall logistics process, reduce product lead times, and ultimately enhance the efficiency of their supply chain, contributing to better product flow and reduced operational expenses.

The effectiveness of these activities is directly tied to financial performance. Efficient logistics can translate into lower carrying costs for inventory and reduced transportation expenses. In the first quarter of 2024, Hooker Furniture reported a gross profit margin of 36.2%, demonstrating the importance of well-managed distribution in maintaining profitability.

Key activities within distribution and logistics management include:

- Warehousing and Inventory Control: Maintaining optimal stock levels across various locations to meet demand without incurring excessive holding costs.

- Transportation Management: Coordinating the movement of goods from manufacturing or import points to distribution centers and then to end customers, optimizing routes and carriers.

- Order Fulfillment: Accurately and efficiently processing customer orders, picking, packing, and shipping products.

- Reverse Logistics: Managing product returns and exchanges effectively to maintain customer satisfaction and minimize losses.

Sales and Customer Support

Hooker Furnishings actively engages in direct sales through its dedicated sales force, a critical activity for driving revenue. This direct engagement allows them to build relationships and understand customer needs firsthand.

Supporting their network of retail partners and design professionals is another cornerstone activity. This involves providing them with essential product information, marketing materials, and sales support to ensure they can effectively represent Hooker Furnishings products.

The company is also focused on enhancing its customer care infrastructure. For instance, in 2023, Hooker Furnishings reported net sales of $720.3 million, highlighting the significant volume of customer interactions and the importance of efficient support processes. They are actively reimagining corporate customer care policies and processes to improve the overall customer experience and build lasting loyalty.

- Direct Sales Force Engagement

- Retail and Design Partner Support

- Order Management and Product Information Provision

- Post-Sale Customer Support and Process Reimagining

Hooker Furnishings' key activities revolve around designing and developing stylish furniture, global sourcing and manufacturing, brand management, and efficient distribution. They also focus on direct sales engagement and robust customer support. In 2024, the company continued to invest in design and optimize its supply chain, exemplified by its exit from the Savannah distribution center and establishment of a new facility in Vietnam.

These activities are supported by a commitment to quality control and customer satisfaction. For example, in the first quarter of 2024, Hooker Furniture reported a gross profit margin of 36.2%, underscoring the impact of efficient operations on profitability.

The company's brand portfolio is managed with targeted marketing, and their sales force directly engages with customers and partners. In 2023, Hooker Furnishings achieved net sales of $720.3 million, demonstrating the scale of their customer interactions and sales efforts.

Key activities include product design, global sourcing, brand marketing, logistics management, direct sales, and customer service. The company's strategic moves in 2024, such as consolidating operations and establishing new facilities, aim to streamline these processes and enhance efficiency.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Design & Development | Creating innovative and appealing furniture across diverse categories. | Focus on current design trends in 2024. |

| Global Sourcing & Manufacturing | Importing furniture, primarily from Vietnam, for cost efficiencies. | Continued leveraging of established overseas supplier relationships. |

| Brand Management | Cultivating distinct brand identities and targeted marketing. | Rolled out new merchandising strategy for Hooker Branded division. |

| Distribution & Logistics | Managing warehousing, transportation, and order fulfillment. | Net sales of $1.04 billion in 2023; exiting Savannah, establishing Vietnam facility. |

| Sales & Customer Engagement | Direct sales force, partner support, and customer care. | Net sales of $720.3 million in 2023; reimagining customer care processes. |

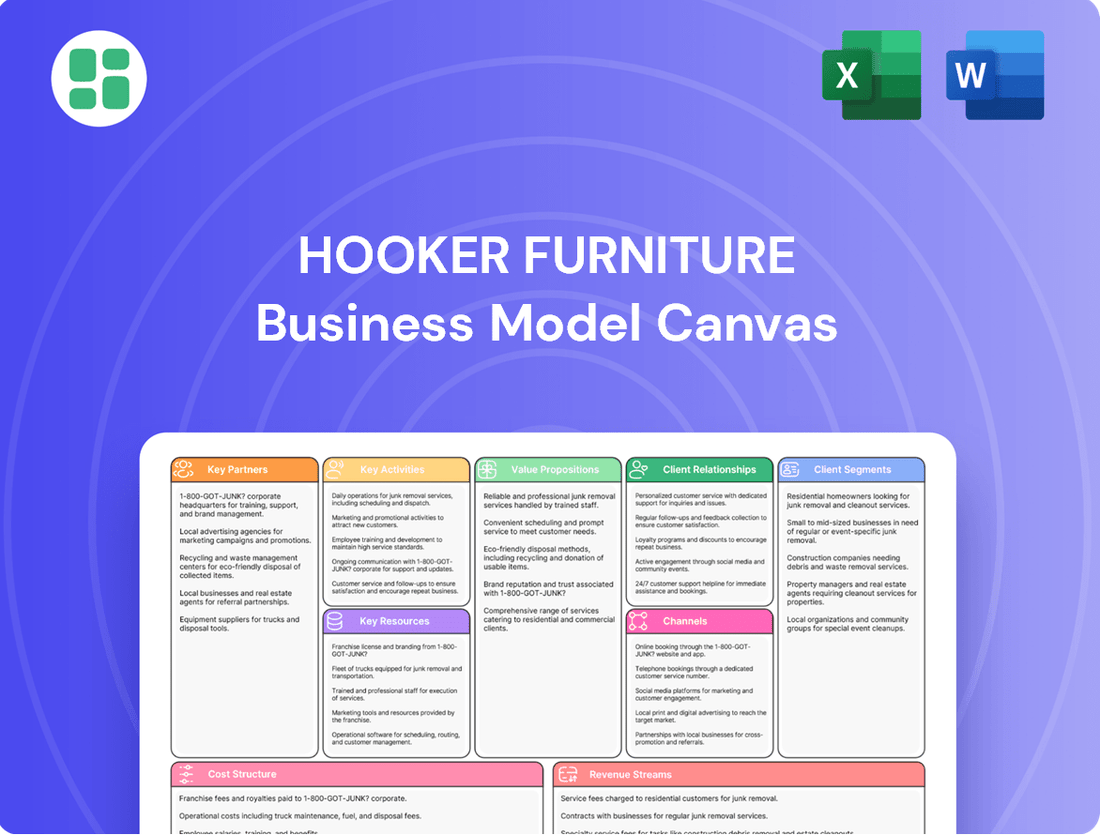

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview of Hooker Furniture's strategic framework is not a sample, but a direct representation of the final deliverable, ensuring complete transparency and immediate usability for your analysis.

Resources

Hooker Furnishings boasts a robust collection of well-recognized furniture brands, including Hooker Furniture, Bradington-Young, HF Custom, Pulaski, and Sunset West. This diverse brand portfolio is a critical asset, embodying significant intellectual property and strong market recognition across various customer segments and price tiers.

Hooker Furniture leverages a robust global network of manufacturing partners, particularly in Vietnam, to efficiently source a wide array of products. This extensive reach, coupled with domestic capabilities for custom upholstery and outdoor furniture, forms a critical resource for their business model.

The company's strategic relationships with factories are vital for maintaining product diversity and managing costs. In 2023, Hooker Furniture's net sales reached $1.07 billion, highlighting the scale and effectiveness of these global sourcing operations.

The recent establishment of a new warehouse in Vietnam is a significant asset, enhancing supply chain agility and providing greater control over costs. This move is expected to streamline operations and improve inventory management, further solidifying their competitive advantage in the furniture market.

Hooker Furnishings operates a strong distribution and showroom network. This includes company-owned distribution centers and strategically located showrooms in major markets such as High Point, Las Vegas, and Atlanta. These physical locations are vital for ensuring timely product delivery and for presenting their wide range of furniture collections to both retail partners and interior designers.

The company's investment in these showrooms directly supports customer engagement and brand visibility. For instance, their presence at key industry events and permanent showrooms allows for hands-on product experience, which is essential in the furniture sector. This network is a cornerstone of their go-to-market strategy, facilitating efficient operations and broad market reach.

Human Capital and Expertise

Hooker Furniture's human capital is a cornerstone of its operations, comprising a dedicated team of experienced designers, merchandisers, sales professionals, and supply chain experts. This collective expertise is crucial for driving innovation in furniture design, understanding evolving market trends, and managing complex global sourcing networks. Their proficiency in customer relationship management directly contributes to maintaining product quality and securing a competitive edge in the furniture industry.

The company's commitment to leveraging its human resources is evident in strategic staff additions aimed at modernizing business operations. For instance, in fiscal year 2024, Hooker Furniture continued to invest in talent development, recognizing that skilled personnel are indispensable for navigating the dynamic retail landscape. This focus on expertise underpins their ability to deliver high-quality products and maintain strong customer relationships.

- Experienced Design and Merchandising Teams: These professionals are key to developing aesthetically pleasing and commercially viable furniture collections, staying ahead of design trends.

- Skilled Sales and Customer Relationship Management: A strong sales force and effective customer service are vital for building brand loyalty and driving revenue.

- Supply Chain and Sourcing Expertise: Navigating global logistics and supplier relationships efficiently ensures timely product availability and cost-effectiveness.

- Recent Staff Additions: Investments in new talent are specifically targeted at transforming business operations and enhancing overall efficiency and innovation.

Financial Capital and Market Access

Hooker Furniture's access to financial capital is a cornerstone of its business model. This includes not only its substantial cash reserves but also its established credit lines, which are crucial for funding day-to-day operations, pursuing strategic growth opportunities, and effectively managing its inventory levels.

The company's financial strength is evident in its consistent ability to maintain dividend payments to shareholders, even when the broader market faces headwinds. This resilience is underpinned by a robust balance sheet, demonstrating prudent financial management and a capacity to weather economic fluctuations.

Hooker Furniture's listing on the NASDAQ under the ticker HOFT provides vital access to public markets. This accessibility is instrumental in raising additional capital when needed and offers shareholders the benefit of liquidity, allowing them to buy or sell their shares readily.

- Financial Capital: Cash reserves and credit lines are essential for operations, investments, and inventory management.

- Financial Resilience: Demonstrated by consistent dividend payments and a strong balance sheet, even in challenging markets.

- Market Access: Public listing on NASDAQ (HOFT) facilitates capital raising and provides shareholder liquidity.

Hooker Furnishings' intellectual property is a significant asset, encompassing its diverse portfolio of well-recognized furniture brands like Hooker Furniture, Bradington-Young, HF Custom, Pulaski, and Sunset West. This brand equity translates into strong market recognition and customer loyalty across various segments.

The company's proprietary manufacturing processes and design patents further contribute to its competitive advantage. In fiscal year 2024, Hooker Furniture continued to invest in product development, ensuring its offerings remain innovative and aligned with market trends.

Hooker Furniture's established distribution and showroom network is a critical physical asset, comprising company-owned distribution centers and showrooms in key markets such as High Point, Las Vegas, and Atlanta. This network facilitates efficient product delivery and provides crucial touchpoints for customer engagement and product showcasing.

Value Propositions

Hooker Furnishings provides a vast selection of residential furniture, encompassing everything from bedroom sets and dining tables to sofas and accent pieces. This extensive catalog covers a wide spectrum of design preferences, from timeless traditional looks to sleek contemporary styles, ensuring customers can furnish their entire homes with cohesive aesthetics.

The company's commitment to variety extends across its product categories, including casegoods, upholstery, and decorative accent furniture. This comprehensive approach means a single brand can meet diverse furnishing needs, simplifying the shopping experience for consumers seeking to outfit different rooms with complementary items.

Leveraging a multi-brand strategy, Hooker Furnishings effectively reaches a broader market by offering distinct collections at various price points. For example, as of their 2024 reporting, their brands like Hooker Furniture, Sam Moore, and Bradington-Young cater to different consumer segments, from value-conscious buyers to those seeking premium, handcrafted pieces.

Hooker Furniture's core value proposition centers on delivering exceptional quality craftsmanship and enduring durability in every piece. This focus ensures customers receive furniture designed to last, fostering long-term satisfaction and trust in the brand.

The company's dedication to longevity is evident in its domestic manufacturing operations, particularly for premium custom leather and fabric-upholstered items. This commitment reinforces their standing as a dependable provider in the competitive home furnishings sector.

Hooker Furnishings consistently leads in design innovation, launching fresh collections that capture both current and future home furnishing trends. This commitment to creative excellence and strategic merchandising ensures they offer aspirational products tailored to evolving consumer preferences.

In 2024, the company's dedication to staying ahead of the curve was evident in its proactive approach to market shifts, a crucial element in maintaining its established presence in the competitive furniture industry.

Multi-Channel Accessibility and Convenience

Hooker Furniture ensures customers can find their products through various avenues, including traditional furniture retailers, interior design professionals, and direct-to-consumer e-commerce. This broad availability caters to diverse customer preferences, offering flexibility in how and where they make their purchases.

The company's strategy emphasizes convenience, allowing shoppers to engage with the brand through physical showrooms for a tactile experience or online for ease of browsing and purchase. This dual approach meets modern consumer demands for accessible shopping. For instance, Hooker Furniture's commitment to reaching customers was evident in its 2023 financial reporting, which highlighted steady growth across its various sales channels.

- Diverse Distribution: Products available via furniture retailers, interior designers, and e-commerce platforms.

- Customer Convenience: Flexible shopping options to suit individual preferences and lifestyles.

- Enhanced Accessibility: Bi-coastal expansion, like that of Sunset West, further broadens reach and availability.

- Omnichannel Experience: Seamless integration of physical and digital touchpoints for a cohesive customer journey.

'Whole-Home' Furnishings Solutions

Hooker Furnishings positions itself as a comprehensive 'whole-home' furnishings provider, simplifying the decorating process for consumers. This strategy leverages their diverse brand portfolio to offer a cohesive aesthetic across multiple rooms or an entire residence.

The convenience of sourcing complementary pieces from a single, trusted entity streamlines decision-making for both individual buyers and interior designers. This integrated approach aims to reduce the complexity often associated with furnishing a complete home.

For instance, Hooker Furnishings reported net sales of $1.78 billion for the fiscal year ended January 28, 2024, indicating a significant market presence and the capacity to serve a broad range of customer needs for complete home outfitting.

- Brand Synergy: Offering a unified design language across multiple Hooker brands.

- Consumer Convenience: Simplifying the purchase journey for customers furnishing entire homes.

- Designer Appeal: Providing a reliable resource for cohesive interior design projects.

- Market Reach: Catering to a wide audience seeking comprehensive home furnishing solutions.

Hooker Furnishings offers a comprehensive range of home furnishings, simplifying the process for customers to achieve a cohesive look throughout their homes. This 'whole-home' approach leverages their diverse brand portfolio to cater to various design preferences and needs. Their extensive product catalog ensures that consumers can source complementary pieces from a single, trusted provider, reducing the complexity of interior design projects and enhancing the overall customer experience.

For example, Hooker Furnishings reported net sales of $1.78 billion for the fiscal year ended January 28, 2024. This substantial revenue underscores their capability to serve a broad customer base seeking complete home furnishing solutions. The company's strategy focuses on brand synergy, allowing for a unified design language across their various offerings, which appeals to both individual buyers and interior designers seeking reliable resources for cohesive projects.

| Value Proposition | Description | Supporting Data (FY2024) |

|---|---|---|

| Whole-Home Solutions | Comprehensive product selection for entire residences. | Net sales of $1.78 billion. |

| Design Cohesion | Unified aesthetic across diverse brands. | Multi-brand strategy including Hooker Furniture, Sam Moore, Bradington-Young. |

| Consumer Convenience | Simplified sourcing of complementary furnishings. | Broad market reach across various sales channels. |

| Designer Resource | Reliable provider for cohesive interior design projects. | Commitment to design innovation and trend capture. |

Customer Relationships

Hooker Furnishings cultivates robust relationships with its furniture retailer partners by offering extensive support. This includes providing essential marketing collateral, in-depth product training sessions, and streamlined logistics to ensure smooth operations. In 2023, the company reported approximately $1.1 billion in net sales, underscoring the importance of these retail channels.

This collaborative strategy empowers retailers to effectively showcase and sell Hooker's diverse product lines, fostering mutual growth. The company's dedicated sales teams are instrumental in nurturing and strengthening these vital partnerships, ensuring consistent product availability and reliable service for their clients.

Hooker Furniture cultivates strong ties with interior designers through dedicated programs and resources. These initiatives acknowledge the significant role designers play in driving sales for both home and business projects. For instance, in 2024, the company continued to offer exclusive access to their showrooms and curated product collections specifically for design professionals, ensuring they have the tools to satisfy diverse client requirements.

The company's commitment extends to providing personalized service, a key element in fostering loyalty among interior designers. This tailored support is particularly vital for Hooker Furniture's growth in the hospitality and contract sectors, where designer recommendations heavily influence large-scale purchasing. By investing in these professional relationships, Hooker Furniture solidifies its position as a preferred supplier within these influential markets.

Hooker Furnishings offers robust online customer service for its e-commerce patrons, providing essential features like detailed product information, real-time order tracking, and streamlined processes for returns and general inquiries. This digital-first approach is designed to mirror the convenience and efficiency modern consumers expect from online retail, ensuring a smooth and positive shopping journey. In 2023, Hooker Furnishings reported a significant increase in online sales, highlighting the importance of these customer service channels.

Brand-Specific Engagement

Hooker Furnishings cultivates brand-specific engagement, understanding that its diverse portfolio, including brands like Hooker, Bradington-Young, and Sam Moore, appeals to distinct customer segments with varying tastes and budgets. This approach allows for highly tailored marketing and product development, ensuring each brand resonates effectively with its target demographic.

For instance, the Hooker brand might focus on broader appeal and accessible luxury, while Bradington-Young emphasizes premium leather upholstery and craftsmanship for a discerning clientele. Sam Moore, on the other hand, caters to those seeking customizable, fashion-forward accent seating.

- Targeted Brand Messaging: Hooker Furnishings crafts distinct marketing campaigns and content for each brand, aligning with its unique value proposition and customer profile.

- Personalized Product Offerings: The company tailors product assortments and customization options within brands to meet specific consumer preferences, enhancing relevance.

- Channel Specialization: Engagement strategies are adapted to the channels where each brand's target customers are most active, from broad retail partnerships to more niche online platforms.

- Customer Segmentation: By recognizing the differences between buyers of Hooker versus those of Bradington-Young, Hooker Furnishings can foster deeper loyalty through more pertinent interactions.

Long-Term Value and Trust Building

Hooker Furnishings prioritizes cultivating enduring connections with its diverse customer base, encompassing retailers, interior designers, and individual consumers. This commitment is underpinned by a consistent delivery of high-quality furniture and dependable service, fostering a foundation of trust and reliability.

Building this long-term value and trust is paramount for customer retention and repeat business. The company's adaptability, particularly in navigating fluctuating market dynamics, reinforces its dedication to customer loyalty. For instance, in fiscal year 2024, Hooker Furnishings reported net sales of $1.1 billion, demonstrating its sustained market presence and ability to serve a broad customer network.

- Focus on Quality and Reliability: Consistent product excellence and dependable service are central to Hooker Furnishings' customer relationship strategy.

- Adaptability in Market Conditions: The company showcases its ability to adjust and remain a trusted partner, even during challenging economic periods.

- Long-Term Value Creation: Hooker Furnishings aims for sustainable growth and customer satisfaction over extended periods.

- Fiscal Year 2024 Performance: Net sales of $1.1 billion highlight the company's significant engagement and continued relevance in the furniture market.

Hooker Furnishings nurtures relationships through dedicated support for retail partners, offering marketing materials and product training. Their sales teams actively build and maintain these partnerships, ensuring product availability. In fiscal year 2024, net sales reached $1.1 billion, reflecting the strength of these channels.

The company also engages interior designers with exclusive programs and showroom access, recognizing their influence in driving sales, especially in contract and hospitality sectors. This personalized approach fosters loyalty among these key influencers.

For online customers, Hooker Furnishings provides robust e-commerce support, including detailed product information and order tracking, mirroring the convenience expected in digital retail. This focus on digital engagement is crucial, as online sales saw a notable increase in 2023.

By segmenting its approach across brands like Hooker, Bradington-Young, and Sam Moore, Hooker Furnishings tailors its marketing and product development to resonate with distinct customer preferences, enhancing relevance and fostering deeper loyalty.

Channels

Independent furniture retailers are a cornerstone for Hooker Furnishings, offering a vital local touch and personalized service. These stores are crucial for showcasing Hooker's extensive product range, providing a familiar and trusted way for customers to buy furniture. In 2024, Hooker continued to invest in supporting these partners through robust inventory management and targeted marketing initiatives, recognizing their significant contribution to sales volume and brand visibility.

Hooker Furnishings leverages major national furniture chains to achieve significant market penetration and boost sales volume. These partnerships are vital for broad distribution and enhancing brand recognition across diverse geographic regions.

In the third quarter of fiscal year 2025, sales through these large retail partners experienced a decline. This downturn is indicative of wider economic headwinds impacting the broader furniture industry.

Hooker Furniture leverages dedicated trade showrooms in prominent design centers like High Point, Las Vegas, and Atlanta. These spaces are crucial for interior designers to experience products firsthand, explore customization, and place orders for client projects.

The company's commitment to these trade-focused channels underscores their strategy to directly engage with design professionals. Some of these showrooms operate year-round, ensuring continuous access for designers seeking to specify furniture for their clients.

E-commerce Platforms and Company Websites

Hooker Furnishings leverages its direct-to-consumer (DTC) strategy through its proprietary brand websites and participation on major e-commerce platforms. This dual approach expands market reach significantly, tapping into the robust online furniture market. In 2024, the home furnishings sector continued to see a strong shift towards digital sales, with online channels becoming crucial for growth.

These digital channels offer Hooker Furnishings direct engagement with a wider customer base, allowing for better brand control and customer data collection. The company's investment in digital infrastructure aims to optimize the online shopping experience, a key factor for conversion in the furniture industry. For instance, many consumers now expect detailed product information, high-quality imagery, and seamless checkout processes when buying furniture online.

- Direct-to-Consumer Sales: Hooker Furnishings' own websites serve as a primary DTC channel.

- E-commerce Platform Presence: The company partners with third-party online retailers to broaden distribution.

- Digital Investment: Ongoing enhancements to online capabilities are a strategic priority.

- Market Trend Alignment: This strategy caters to the increasing consumer preference for online furniture purchases.

Hospitality and Contract Sales Division

The Hospitality and Contract Sales Division, including Samuel Lawrence Hospitality, acts as a specialized sales channel for Hooker Furniture, targeting commercial clients like hotels and senior living communities. This division caters to the distinct requirements of large-scale projects, providing furniture that is both durable and aesthetically pleasing.

This segment is a key component of Hooker Furniture's business model, ensuring a direct approach to the B2B market. In 2024, the company reported a notable increase in sales within this sector, demonstrating its growing importance. For instance, the company's overall net sales for the fiscal year ending January 28, 2024, reached $1.16 billion, with the contract channel contributing significantly to this performance.

- Specialized Market Focus: Targets the hospitality and contract sectors with tailored furniture solutions.

- Clientele: Serves hotels, senior living facilities, and other commercial establishments.

- Product Offering: Emphasizes durable, stylish, and project-specific furnishings.

- Performance: This division has experienced positive sales growth, contributing to overall company revenue.

Hooker Furnishings utilizes a multi-channel approach to reach its diverse customer base. This includes independent retailers for personalized service, large national chains for broad reach, and dedicated trade showrooms for interior designers. Additionally, a strong direct-to-consumer presence via proprietary websites and e-commerce platforms, alongside a specialized Hospitality and Contract Sales Division, ensures comprehensive market coverage.

| Channel | Key Characteristics | 2024/2025 Relevance |

|---|---|---|

| Independent Retailers | Local touch, personalized service, product showcasing | Continued investment in inventory and marketing support. |

| National Furniture Chains | Broad distribution, brand recognition | Sales experienced a decline in Q3 FY25 due to economic headwinds. |

| Trade Showrooms | Direct engagement with designers, product experience, customization | Year-round operation in key design centers ensures continuous access. |

| Direct-to-Consumer (DTC) / E-commerce | Online sales, brand control, customer data | Crucial for growth, aligning with increasing consumer preference for online purchases. |

| Hospitality & Contract Sales | B2B focus, large-scale projects, durability | Notable sales increase in 2024, contributing significantly to overall revenue. |

Customer Segments

This segment comprises individuals who invest in premium residential furniture, prioritizing superior craftsmanship, sophisticated design, and the prestige associated with established brands. They are typically less swayed by price, focusing instead on the enduring quality and aesthetic appeal of their home furnishings.

Hooker Furniture, along with its specialized brands like Bradington-Young for leather upholstery and HF Custom for tailored pieces, directly caters to this discerning clientele. These consumers expect their furniture to be a statement of style and a long-term investment, valuing durability and intricate detailing.

In 2023, the U.S. furniture and bedding stores sector generated approximately $120 billion in revenue, with a significant portion attributed to the higher-end market where quality and brand perception are paramount drivers of purchase decisions.

Value-conscious residential consumers represent a significant portion of Hooker Furniture's customer base, actively seeking furniture that balances style with affordability. This segment prioritizes getting the most aesthetic appeal and functionality for their budget. In 2024, the furniture industry, particularly the mid-market segment, continued to navigate fluctuating consumer spending patterns influenced by inflation and interest rates.

Brands under Hooker Furniture's Home Meridian division, like Pulaski Furniture and Samuel Lawrence Furniture, are specifically curated to appeal to these price-sensitive households. These brands aim to deliver desirable designs without the premium price tag often associated with higher-end furniture. For instance, Samuel Lawrence Furniture often features adaptable collections suitable for various home styles, directly addressing the desire for both trendiness and practicality.

This demographic is particularly sensitive to economic headwinds. Factors like ongoing inflation in 2024, which impacted disposable income, and the potential for increased import costs due to tariffs, directly affect their purchasing power and willingness to spend on home furnishings. This makes them a segment that requires careful market monitoring and strategic pricing by Hooker Furniture.

Interior designers and decorators are a key customer segment for Hooker Furniture, as they frequently source pieces for their clients' residential and commercial projects. This group relies on a broad selection of furniture styles, the availability of custom options, and a dependable supply chain to bring their design concepts to life. In 2024, the interior design industry continued its robust growth, with many designers actively seeking partners like Hooker Furniture to meet the demands of a recovering housing market and a resurgence in commercial renovations.

Hospitality and Contract Market Businesses

The hospitality and contract market segment represents a crucial customer base for Hooker Furniture, encompassing hotels, resorts, senior living facilities, and corporate offices. These businesses demand furniture that is not only durable and functional but also aligns with specific aesthetic and brand requirements for commercial spaces. Hooker Furniture's brands, including H Contract and Samuel Lawrence Hospitality, are specifically designed to cater to the large-scale, institutional purchasing needs of this sector.

This market segment has demonstrated notable resilience and growth. For instance, the global hospitality market was projected to reach approximately $1.5 trillion in 2024, indicating substantial demand for furnishings. Similarly, the contract furniture market, driven by corporate office renovations and the expanding senior living sector, continues to be a significant revenue driver.

- Target Clients: Hotels, resorts, senior living communities, corporate offices, and other commercial establishments requiring bulk furniture orders.

- Product Focus: Durable, aesthetically appropriate furniture designed for high-traffic commercial environments, often with customizability options.

- Market Performance: This segment has shown consistent demand, bolstered by ongoing development and renovation projects within the hospitality and senior living industries.

- Brand Strategy: Leveraging specialized brands like H Contract and Samuel Lawrence Hospitality to directly address the unique needs and procurement processes of institutional buyers.

E-commerce Shoppers

E-commerce shoppers represent a significant and expanding customer segment for Hooker Furniture. These consumers prioritize the ease of researching and buying furniture from the comfort of their homes, appreciating the ability to browse digitally and have items delivered directly to their doors. Hooker Furnishings actively engages this group through its own e-commerce sites and online marketplaces, ensuring detailed product descriptions and a smooth purchasing process.

The shift towards online furniture purchasing has been a notable trend, with e-commerce sales for furniture showing consistent growth. For instance, in 2023, the online furniture market continued its upward trajectory, driven by consumer demand for convenience and wider selection. Hooker Furnishings has capitalized on this by enhancing its digital presence and optimizing the online customer journey.

Key characteristics and behaviors of this segment include:

- Preference for digital research: Shoppers heavily rely on online reviews, product images, and detailed specifications before making a purchase.

- Value on convenience: Direct-to-consumer delivery and easy online checkout are paramount.

- Increased online engagement: This segment actively seeks out brand websites and online retailers for furniture needs.

- Growing market share: E-commerce channels are increasingly contributing to overall furniture sales, reflecting a durable shift in consumer habits.

Hooker Furniture serves a diverse customer base, including affluent individuals seeking high-quality, designer pieces for their homes, and value-conscious consumers prioritizing affordability and style. The company also caters to interior designers who source furniture for client projects, and the hospitality and contract market, which requires durable, aesthetically aligned furnishings for commercial spaces.

The e-commerce shopper segment is also crucial, valuing convenience and digital research, with online sales consistently growing. In 2024, the U.S. furniture industry continued to adapt to economic factors like inflation, impacting consumer spending across different market segments.

| Customer Segment | Key Characteristics | Hooker Furniture's Approach |

|---|---|---|

| Affluent Residential | Prioritize craftsmanship, design, brand prestige. | Specialized brands like Bradington-Young, HF Custom. |

| Value-Conscious Residential | Seek style and affordability. | Brands like Pulaski Furniture, Samuel Lawrence Furniture. |

| Interior Designers | Source for clients, need broad selection and reliability. | Offer extensive collections and dependable supply. |

| Hospitality & Contract | Require durable, functional, and brand-aligned commercial furniture. | Brands like H Contract, Samuel Lawrence Hospitality. |

| E-commerce Shoppers | Value convenience, digital research, direct delivery. | Enhance digital presence, optimize online customer journey. |

Cost Structure

Hooker Furniture's manufacturing and sourcing costs are a substantial part of its business model. These costs encompass the direct expenses involved in creating furniture, whether produced in-house or acquired from international partners. For instance, in 2024, the company continued to manage the fluctuating prices of essential raw materials like lumber and upholstery fabrics, which are key drivers of production expenses.

The cost structure is heavily influenced by the purchase of finished goods from global suppliers, alongside the expenses tied to domestic manufacturing. This includes labor at their own facilities and the procurement costs from overseas partners. Fluctuations in global labor rates and the cost of imported components directly affect the overall manufacturing and sourcing expenses.

Hooker Furnishings, as a significant importer, faces considerable expenses from import duties and international freight. These costs are a direct consequence of sourcing products globally.

The company experienced a notable impact from post-COVID surges in container freight rates, which directly affected their bottom line. This volatility even prompted strategic shifts, such as discontinuing certain brands that became unprofitable due to these escalating costs.

For instance, in the first quarter of 2023, Hooker Furnishings reported that increased freight and import costs contributed to a decline in diluted earnings per share compared to the previous year, highlighting the sensitivity of their cost structure to these global logistics factors.

Operating and maintaining a robust distribution and warehousing network is a significant expense for Hooker Furniture. This includes costs associated with rent for facilities, utilities to power them, and the labor required for efficient warehousing and inventory management.

In 2024, Hooker Furniture continued its strategic initiative to optimize its logistics. This involved the closure of its distribution center in Savannah, Georgia, a move aimed at consolidating operations and thereby reducing overall fixed costs related to warehousing and distribution.

Sales, Marketing, and Showroom Expenses

Hooker Furniture's cost structure heavily features sales, marketing, and showroom expenses, which are crucial for reaching customers and driving revenue. These costs encompass advertising campaigns, promotional events, sales team salaries and commissions, and the upkeep of their physical showrooms. In 2024, the company continued to invest in these areas to maintain brand presence and stimulate demand across its various sales channels.

These expenditures are directly tied to the company's strategy of maximizing sales through effective merchandising and customer engagement. The operational costs of maintaining showrooms, which serve as key touchpoints for consumers and trade professionals alike, represent a substantial part of this category. Hooker Furniture's focus remains on ensuring these investments translate into increased market share and robust top-line growth.

- Advertising and Promotion: Costs related to national and regional advertising, digital marketing, and in-store promotions.

- Sales Force Compensation: Salaries, commissions, and benefits for the direct sales team.

- Showroom Operations: Expenses for rent, utilities, staffing, and visual merchandising for company-owned and operated showrooms.

- Trade Show Participation: Costs associated with exhibiting at industry trade shows to connect with retailers and designers.

Administrative and Restructuring Costs

Hooker Furniture's cost structure includes significant general and administrative (G&A) expenses. These are largely fixed costs encompassing corporate salaries, the ongoing investment in IT systems such as their new ERP system, and various professional fees. For instance, in the fiscal year ending January 28, 2024, Hooker Furniture reported Selling, General, and Administrative expenses of $129.3 million, reflecting these operational overheads.

Furthermore, the company has been actively engaged in restructuring initiatives. These efforts have led to substantial restructuring charges as Hooker Furniture implements cost reduction plans, exits underperforming facilities, and realigns its organization. These charges, while impacting short-term profitability, are strategically aimed at achieving greater long-term operational efficiencies and savings.

- General and Administrative Expenses: Corporate salaries, IT system upgrades (e.g., ERP), and professional fees form a core part of the fixed cost base.

- Restructuring Charges: Costs associated with cost reduction, facility exits, and organizational realignments are significant.

- Fiscal Year 2024 Impact: Selling, General, and Administrative expenses were $129.3 million for the fiscal year ending January 28, 2024.

- Strategic Objective: Restructuring aims to achieve long-term cost savings and operational improvements.

Hooker Furniture's cost structure is dominated by manufacturing and sourcing expenses, including raw materials like lumber and upholstery, as well as the purchase of finished goods from global suppliers. Import duties and international freight costs are significant due to their global sourcing strategy, with freight rates impacting profitability.

Operating a distribution network and investing in sales, marketing, and showrooms are also major cost drivers. In fiscal year 2024, Selling, General, and Administrative expenses totaled $129.3 million, reflecting these operational overheads and investments in brand presence.

The company also incurs substantial general and administrative costs, including corporate salaries and IT system investments. Restructuring charges, stemming from cost reduction and facility realignments, also contribute to the overall cost base, aiming for long-term efficiency gains.

| Cost Category | Key Components | Fiscal Year 2024 Impact (Approx.) |

|---|---|---|

| Manufacturing & Sourcing | Raw materials, finished goods imports, labor | Significant portion of COGS |

| Logistics & Distribution | Warehousing, freight, import duties | Impacted by global freight volatility |

| Sales, Marketing & Showrooms | Advertising, sales force, showroom upkeep | Investments to drive revenue |

| General & Administrative | Corporate overhead, IT, professional fees | $129.3 million (SG&A) |

| Restructuring Charges | Cost reduction, facility exits | Impacted short-term profitability |

Revenue Streams

Hooker Furniture primarily generates revenue through the sale of casegoods, encompassing wooden and metal furniture for bedrooms, dining rooms, home offices, and accent pieces. This core product category is a significant contributor to their overall sales, featuring prominently under well-known brands like Hooker Furniture, Pulaski, and Samuel Lawrence Furniture.

Hooker Furniture generates significant revenue from selling upholstered furniture, including a wide array of sofas, sectionals, chairs, and recliners made from both leather and fabric. Brands such as Bradington-Young, HF Custom, and Shenandoah Furniture are key players in this segment, offering a range of custom and premium choices.

This upholstered furniture category is diverse, featuring both imported and domestically manufactured pieces, catering to various market preferences and price points. For instance, in the first quarter of 2024, Hooker Furniture reported net sales of $183.2 million, with their upholstery segment being a substantial contributor to this overall figure.

Hooker Furniture generates revenue through the sale of accent furniture, lighting, and home décor, which are designed to enhance their main furniture offerings. This diversification allows them to capture additional customer spending on home styling.

The strategic acquisition of brands such as Sunset West has significantly boosted revenue by tapping into the growing outdoor furniture market. This move expands their reach and customer base into a new segment.

In 2023, Hooker Furniture reported a strategic decision to exit an underperforming accent product line, indicating a focus on optimizing profitability and resource allocation towards more successful categories.

Hospitality and Contract Sales

Hooker Furniture's hospitality and contract sales, primarily through its H Contract and Samuel Lawrence Hospitality divisions, form a significant revenue stream. This segment caters to the unique needs of the hospitality industry, including hotels and senior living communities, often with large-scale, customized orders.

This specialized market requires tailored product offerings and a dedicated sales approach, differentiating it from the company's broader retail operations. The company's commitment to this sector underscores its diversified business strategy.

- Revenue Contribution: This segment consistently contributes to Hooker Furniture's overall revenue, demonstrating its stability and importance within the company's portfolio.

- Market Focus: The primary focus is on furnishing hotels, senior living facilities, and other commercial spaces, requiring specialized product development and sales expertise.

- Order Characteristics: Sales in this segment typically involve larger volume orders and often necessitate custom product specifications to meet client requirements.

E-commerce Direct Sales

Hooker Furniture's e-commerce direct sales represent a significant and expanding revenue stream. As the company strengthens its digital footprint, sales generated directly through its own websites and online platforms are increasingly contributing to overall revenue. This direct-to-consumer approach allows Hooker Furnishings to connect with customers without the intermediaries of traditional retail, potentially leading to better margins and a more controlled brand experience.

In 2023, Hooker Furniture reported that its e-commerce channel, including direct-to-consumer sales, was a key driver of growth. The company has been investing in its digital infrastructure to enhance the online shopping experience, making it easier for consumers to browse and purchase furniture directly. This focus on digital expansion is a strategic move to capture a larger share of the online furniture market.

- Direct E-commerce Revenue: Sales made directly to consumers via Hooker Furniture's brand websites and dedicated e-commerce platforms.

- Bypassing Retail Markups: This channel enables the company to potentially offer competitive pricing and retain a larger portion of the sale price.

- Growing Sales Channel: E-commerce direct sales are identified as a key area for future growth and revenue contribution for Hooker Furnishings.

Hooker Furniture's revenue is diversified across several key areas, including casegoods, upholstery, and hospitality sales. The company's strategic focus on optimizing its product lines and expanding its e-commerce presence are crucial for its financial performance.

In the first quarter of 2024, Hooker Furniture reported net sales of $183.2 million, with upholstery and casegoods forming the backbone of their revenue generation. The company's commitment to expanding its direct-to-consumer e-commerce channel is also a significant factor in its revenue growth strategy.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Casegoods | Wooden and metal furniture for various rooms. | Significant contributor to overall sales. |

| Upholstery | Sofas, sectionals, chairs, and recliners. | Substantial contributor to Q1 2024 net sales of $183.2 million. |

| Hospitality & Contract Sales | Custom orders for hotels, senior living. | Consistent contributor to revenue, demonstrating stability. |

| E-commerce Direct Sales | Sales via company websites. | Key driver of growth in 2023, with ongoing investment. |

Business Model Canvas Data Sources

The Hooker Furniture Business Model Canvas is constructed using a blend of internal financial reports, detailed market research on the furniture industry, and strategic insights gleaned from competitive analysis. These diverse data sources ensure each component of the canvas is grounded in accurate and relevant information.