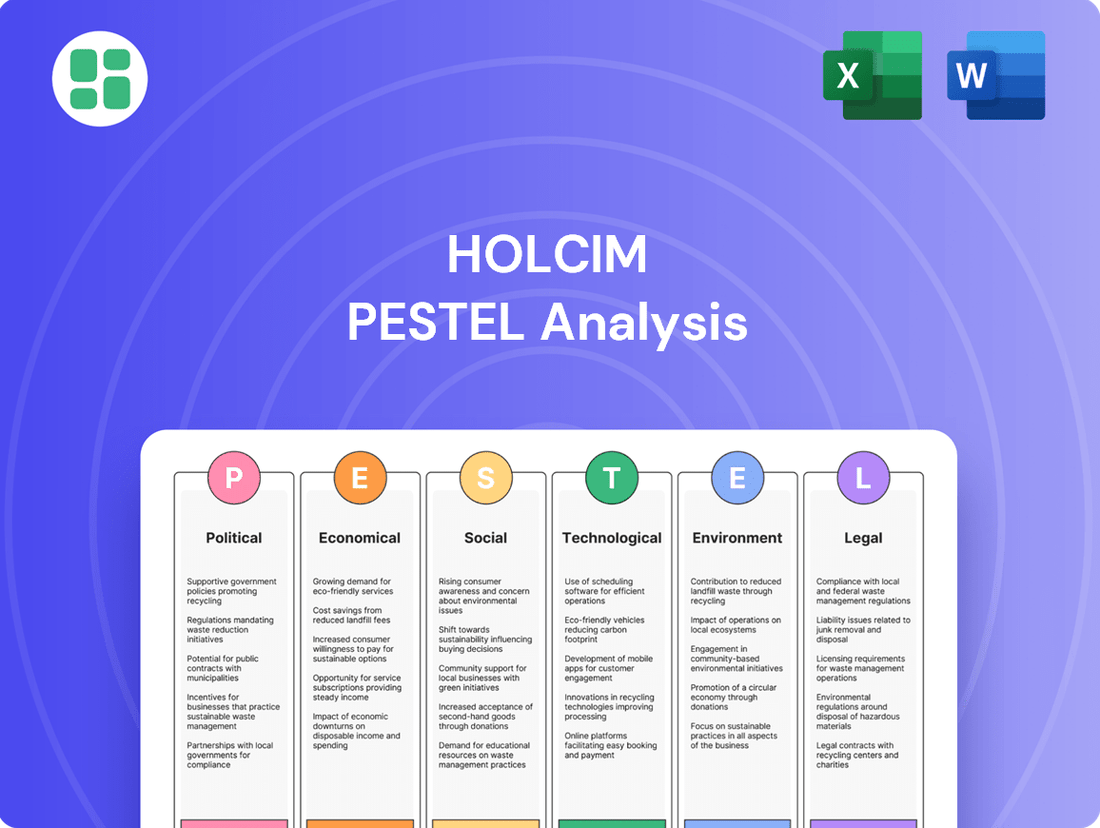

Holcim PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holcim Bundle

Navigate the complex external forces shaping Holcim's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements directly impact the building materials giant. Equip yourself with actionable intelligence to anticipate market shifts and refine your strategic approach. Download the full analysis now and gain a critical competitive advantage.

Political factors

Governments globally are prioritizing infrastructure development, with significant investments planned and underway. For instance, the United States' Infrastructure Investment and Jobs Act, enacted in 2021, allocates approximately $1.2 trillion, with a substantial portion dedicated to transportation and public works. This surge in public spending directly fuels demand for Holcim's core products like cement, aggregates, and concrete, which are essential building blocks for roads, bridges, and other vital infrastructure.

In Europe, the NextGenerationEU recovery fund, totaling €806.9 billion, also earmarks considerable funds for green and digital transitions, often involving infrastructure upgrades. Holcim, as a major supplier to the construction sector, benefits from these policy-driven initiatives. The pace and scale of these government infrastructure programs are critical drivers for Holcim's revenue and market growth, making policy decisions on stimulus and public works a key factor to monitor.

Holcim operates within a complex web of national and international regulations governing building standards, safety protocols, and material specifications. These frameworks directly shape its product innovation and market entry strategies. For instance, evolving building codes in Europe, particularly those emphasizing energy efficiency and low-carbon materials, are a key driver for Holcim's sustainable product portfolio, which saw significant growth in 2023.

Shifts in these regulatory landscapes, especially those pushing for greener or more resilient construction practices, present both avenues for expansion and necessitate substantial operational adjustments. The company's commitment to circular economy principles, for example, is increasingly aligned with regulatory trends that encourage the use of recycled materials in construction projects, a trend gaining momentum across North America and Europe.

Navigating and adhering to the multitude of local regulations across its global operations remains a continuous and critical aspect of Holcim's day-to-day business. This includes compliance with varying environmental permits, zoning laws, and product certification requirements in markets like India and Brazil, where regulatory environments can differ significantly.

Holcim's global operations are significantly influenced by international trade policies and tariffs. For instance, the United States' imposition of tariffs on steel and aluminum in 2018, while not directly impacting cement production, could indirectly raise costs for construction projects that utilize these materials, potentially softening demand for Holcim's products in that market. Conversely, trade agreements like the EU's Single Market facilitate smoother cross-border movement of goods, benefiting Holcim's European operations by reducing logistical complexities and associated costs.

Political Stability and Geopolitical Risks

Holcim's global operations are significantly influenced by political stability in its key markets. For instance, regions experiencing political turmoil can lead to project delays and increased operational costs. In 2024, the ongoing geopolitical shifts, particularly in Eastern Europe and parts of Africa where Holcim has a presence, present ongoing challenges to supply chain reliability and investment security.

Geopolitical risks directly impact Holcim's ability to undertake and complete large-scale construction projects. Disruptions from conflicts or civil unrest can halt production, damage existing facilities, and create uncertainty for future capital expenditures. The company's strategy involves continuous monitoring of these risks to safeguard its assets and ensure business continuity across its diverse portfolio.

- Political Stability: Holcim's long-term investments are directly tied to the political stability of its operating regions, impacting project continuity and financial planning.

- Geopolitical Tensions: Conflicts and civil unrest in key markets can disrupt supply chains, damage infrastructure, and lead to unpredictable business environments, affecting Holcim's global footprint.

- Risk Mitigation: Proactive assessment and mitigation of geopolitical risks are essential for Holcim's operational resilience and strategic decision-making in a dynamic global landscape.

Carbon Pricing and Climate Policies

Governments globally are intensifying efforts to combat climate change through various policy instruments. These include the expansion of carbon pricing mechanisms, such as emissions trading schemes (ETS) and carbon taxes, designed to internalize the cost of carbon emissions. For instance, the European Union's ETS saw average carbon prices reach €90 per tonne of CO2 in early 2024, a significant increase that directly impacts heavy industries.

Holcim, as a significant player in the building materials sector, faces direct implications from these climate policies. Increased operational costs due to carbon pricing can affect profitability, but these policies also serve as a powerful incentive for investing in and adopting low-carbon technologies and sustainable building solutions. The company's strategic adaptation to comply with and leverage these evolving regulations is therefore crucial for its long-term competitiveness and growth.

- Carbon Pricing Impact: Rising carbon prices, such as the EU ETS averaging €90/tonne in early 2024, directly increase operational expenses for cement production.

- Incentive for Innovation: Climate policies encourage Holcim's investment in greener technologies and sustainable product development to reduce emissions and comply with regulations.

- Strategic Adaptation: Proactive compliance and strategic shifts towards low-carbon solutions are vital for Holcim to mitigate risks and capitalize on opportunities presented by climate policy.

Government infrastructure spending is a major driver for Holcim. The US Infrastructure Investment and Jobs Act, with its $1.2 trillion allocation, and Europe's NextGenerationEU fund are prime examples of policy-driven demand for construction materials. These large-scale public works projects directly translate into increased sales for Holcim's cement, aggregates, and concrete.

Regulatory frameworks significantly influence Holcim's operations and product development. Stricter building codes, particularly those promoting energy efficiency and low-carbon materials, are pushing Holcim to innovate its sustainable product portfolio. Compliance with diverse local regulations, from environmental permits to product certifications, remains a constant operational focus across its global markets.

Geopolitical stability and international trade policies are critical for Holcim's global footprint. Political unrest in regions like Eastern Europe and Africa can disrupt supply chains and investment security, as seen in 2024. Trade agreements, conversely, can streamline cross-border operations, reducing logistical costs and complexities for the company.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Holcim across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying opportunities and threats within Holcim's operating landscape.

A clear, actionable summary of Holcim's PESTLE factors, enabling rapid identification of external threats and opportunities to inform strategic decisions.

Economic factors

Global economic growth is a primary driver for the construction industry, directly influencing Holcim's demand. For instance, the International Monetary Fund (IMF) projected global growth of 3.2% for 2024, signaling a potentially robust environment for construction projects. Strong economic expansion typically translates into higher spending on new homes, commercial buildings, and essential infrastructure, all of which require Holcim's cement, aggregates, and concrete solutions.

Conversely, economic slowdowns pose a significant risk. A projected dip in global growth or regional recessions can curb investment in new construction, leading to reduced sales volumes and impacting Holcim's profitability. For example, if a major region experiences a contraction, like a -0.5% GDP decline, the impact on construction activity and material demand can be substantial.

Holcim's manufacturing processes are fundamentally tied to the availability and cost of essential raw materials such as limestone, clay, and sand, alongside significant energy consumption from coal, natural gas, and electricity. These input costs directly impact the company's cost of goods sold and, consequently, its profitability.

The volatility inherent in global commodity and energy markets presents a significant challenge. For instance, the average price of thermal coal in Europe saw substantial increases throughout 2023, impacting energy-intensive industries like cement production. Effectively managing these price fluctuations through strategies like hedging or implementing energy efficiency measures is crucial for maintaining healthy profit margins.

Interest rate shifts directly impact Holcim's borrowing expenses and the affordability of construction for its clientele. For instance, if central banks, like the Federal Reserve, maintain or increase benchmark rates, Holcim's cost of capital for new ventures or existing debt rises. This also translates to higher mortgage rates and construction loan costs for developers, potentially dampening demand for cement, aggregates, and ready-mix concrete.

In 2024, many central banks have signaled a cautious approach to rate cuts, with inflation remaining a key consideration. For example, the European Central Bank (ECB) began its easing cycle in June 2024, but the pace and extent of future reductions remain uncertain, influencing investment decisions across the construction sector. Higher rates can also make it more expensive for Holcim to fund strategic acquisitions or significant capital expenditures aimed at sustainability initiatives.

Inflationary Pressures

Inflationary pressures directly impact Holcim's operational costs, affecting everything from the wages paid to its workforce to the fuel for its delivery trucks and the price of essential raw materials like cement and aggregates. For instance, rising energy prices in 2024, a key component of construction material production, have put significant upward pressure on input costs across the industry.

While Holcim can implement price increases to offset some of these rising expenses, sustained high inflation, as seen in various economies throughout 2024 and projected into 2025, can dampen consumer and business confidence. This erosion of purchasing power can lead to a slowdown in construction projects, ultimately reducing overall demand for Holcim's products and services.

- Rising input costs: Increased expenses for energy, labor, and raw materials in 2024 have directly impacted Holcim's cost of goods sold.

- Pricing strategy challenges: Balancing the need to pass on costs with maintaining market competitiveness is a critical challenge for Holcim's pricing strategies in the current inflationary climate.

- Demand sensitivity: Sustained inflation can reduce disposable income and business investment, potentially leading to lower demand for construction materials.

- Global inflation trends: Monitoring and adapting to varying inflation rates across Holcim's diverse global markets is essential for effective financial management.

Currency Exchange Rate Fluctuations

Holcim's global operations mean it's constantly navigating the ups and downs of currency exchange rates. For instance, in 2024, the strengthening US dollar against many emerging market currencies could have reduced the reported value of Holcim's earnings from those regions when translated into its reporting currency, likely Swiss Francs (CHF).

These fluctuations directly affect Holcim's bottom line. A weaker local currency in a country where Holcim sources raw materials means those materials become more expensive. Conversely, if Holcim exports products, a stronger local currency makes those exports less competitive on the international market.

To manage this, Holcim utilizes various hedging strategies. These financial tools aim to lock in exchange rates for future transactions, thereby reducing the uncertainty and potential negative impact of currency volatility on its financial performance. For example, forward contracts or currency options might be employed to protect against adverse movements.

- Impact on Earnings: Currency depreciation in key markets can significantly reduce the reported value of foreign subsidiaries' profits when converted to the group's reporting currency.

- Input Costs: Fluctuations affect the cost of imported raw materials, such as cement additives or specialized machinery, impacting production expenses.

- Export Competitiveness: A strong home currency can make Holcim's exported cement and building materials more expensive for international buyers, potentially dampening sales volume.

- Hedging Effectiveness: The success of hedging strategies in mitigating these risks is crucial for maintaining stable financial results amidst global economic shifts.

Global economic growth is a primary driver for the construction industry, directly influencing Holcim's demand. For instance, the International Monetary Fund (IMF) projected global growth of 3.2% for 2024, signaling a potentially robust environment for construction projects. Strong economic expansion typically translates into higher spending on new homes, commercial buildings, and essential infrastructure, all of which require Holcim's cement, aggregates, and concrete solutions.

Holcim's manufacturing processes are fundamentally tied to the availability and cost of essential raw materials such as limestone, clay, and sand, alongside significant energy consumption from coal, natural gas, and electricity. These input costs directly impact the company's cost of goods sold and, consequently, its profitability. The volatility inherent in global commodity and energy markets presents a significant challenge. For instance, the average price of thermal coal in Europe saw substantial increases throughout 2023, impacting energy-intensive industries like cement production.

Interest rate shifts directly impact Holcim's borrowing expenses and the affordability of construction for its clientele. In 2024, many central banks have signaled a cautious approach to rate cuts, with inflation remaining a key consideration. For example, the European Central Bank (ECB) began its easing cycle in June 2024, but the pace and extent of future reductions remain uncertain, influencing investment decisions across the construction sector.

Inflationary pressures directly impact Holcim's operational costs, affecting everything from the wages paid to its workforce to the fuel for its delivery trucks and the price of essential raw materials like cement and aggregates. For instance, rising energy prices in 2024, a key component of construction material production, have put significant upward pressure on input costs across the industry.

Preview the Actual Deliverable

Holcim PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Holcim PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to this professionally structured analysis upon completion of your purchase.

Sociological factors

Global urbanization continues at a rapid pace, with projections indicating that by 2050, nearly 70% of the world's population will reside in urban areas. This surge in city living directly fuels demand for construction, benefiting companies like Holcim which supply essential building materials. For instance, the United Nations reported that in 2023, over 4.5 billion people lived in cities, a figure expected to climb significantly in the coming years, creating a sustained need for housing and infrastructure development.

Holcim is well-positioned to capitalize on this demographic shift by offering solutions for efficient and sustainable urban development. As cities expand, the need for advanced building materials that reduce environmental impact and improve infrastructure longevity becomes paramount. The company's focus on green building solutions aligns perfectly with the challenges and opportunities presented by growing urban populations, aiming to meet the demand for resilient and eco-friendly construction.

Consumer and developer preferences are increasingly leaning towards sustainable, energy-efficient, and visually appealing construction. This shift directly benefits Holcim's strategic emphasis on pioneering green building materials, including their advancements in low-carbon concrete and the utilization of recycled aggregates. For instance, in 2024, the global green building materials market was valued at approximately $300 billion and is projected to grow significantly, underscoring the market's embrace of these solutions.

By aligning its product development with these evolving demands, Holcim is well-positioned to gain a distinct competitive advantage. The growing consumer awareness around environmental impact, coupled with regulatory pushes for greener construction, means that companies offering such solutions will likely see increased market share and stronger brand loyalty in the coming years.

The availability of skilled labor in construction and manufacturing is a key sociological driver for Holcim. As of late 2024, many developed nations, including those in Europe and North America, continue to face a deficit in skilled tradespeople, impacting project execution timelines and costs for the entire sector.

Shortages of qualified workers directly affect Holcim's production capacity and the ability of its customers to complete projects on schedule. This can lead to increased labor costs and potential delays in delivering essential building materials.

To counter these trends, Holcim's strategic focus on investing in robust training and talent retention programs is paramount. Initiatives aimed at upskilling the existing workforce and attracting new talent are crucial for maintaining competitive advantage and ensuring operational continuity through 2025 and beyond.

Health, Safety, and Community Engagement

Societal expectations for corporate responsibility are steadily rising, with a particular focus on worker health and safety. Holcim's dedication to upholding stringent safety protocols and fostering positive community relationships around its operational sites is therefore crucial for maintaining its social license to operate.

A strong commitment to safety not only protects employees but also builds trust with local communities. For instance, Holcim reported a Lost Time Injury Frequency Rate (LTIFR) of 0.86 in 2023, demonstrating a continuous effort to minimize workplace accidents. This focus is essential, as negative incidents can significantly damage a company's reputation and invite increased regulatory oversight.

Holcim's community engagement initiatives aim to create shared value and address local concerns. These efforts are vital for ensuring long-term operational stability and social acceptance. The company actively invests in local development projects, contributing to the well-being of the communities where it operates.

- Rising Societal Expectations: Increased demand for corporate accountability in worker health and safety.

- Holcim's Safety Performance: Maintained a Lost Time Injury Frequency Rate (LTIFR) of 0.86 in 2023.

- Social License to Operate: Robust safety standards and positive community engagement are key to maintaining public trust and operational continuity.

- Reputational Risk: Negative incidents can lead to reputational damage and heightened regulatory scrutiny.

Demand for Sustainable and Circular Construction

Societal expectations are increasingly prioritizing sustainability, driving a significant demand for eco-conscious construction practices. This shift is pushing the industry towards circular economy models, where waste is minimized and resources are reused. By 2024, for instance, the global green building market was valued at over $1.5 trillion, with projections indicating continued robust growth as public awareness intensifies.

Holcim is strategically positioned to capitalize on this trend. Their commitment to recycling construction and demolition waste, which can significantly reduce landfill burden, and their development of low-carbon cementitious materials directly address this growing societal need. This focus not only enhances their brand reputation but also strengthens their market appeal among environmentally conscious consumers and businesses. In 2023, Holcim reported a 12% increase in the use of recycled materials in their products, demonstrating a tangible response to this demand.

- Growing public awareness: Consumers and businesses are actively seeking sustainable building options.

- Circular economy adoption: The industry is moving towards recycling and resource efficiency, with Holcim investing heavily in these areas.

- Low-carbon products: Demand for materials like low-carbon concrete is rising, creating new market opportunities.

- Brand enhancement: Companies demonstrating strong environmental stewardship, like Holcim, benefit from improved brand image and customer loyalty.

Societal trends significantly influence Holcim's market, particularly the growing demand for sustainable and energy-efficient buildings. This is evident in the global green building market, which was valued at over $1.5 trillion in 2024 and continues to expand as public awareness of environmental issues rises.

Holcim's commitment to incorporating recycled materials, such as their reported 12% increase in recycled material usage in 2023, and developing low-carbon cementitious materials directly addresses these evolving consumer and developer preferences. This strategic alignment not only enhances their brand image but also positions them favorably for increased market share in the environmentally conscious construction sector.

The availability of skilled labor remains a critical sociological factor, with many developed nations facing a deficit in tradespeople as of late 2024. This shortage impacts project timelines and costs across the construction industry, directly affecting Holcim's operational efficiency and its customers' ability to complete projects.

Furthermore, rising societal expectations for corporate responsibility, especially concerning worker health and safety, are paramount. Holcim's focus on stringent safety protocols, evidenced by their 2023 Lost Time Injury Frequency Rate (LTIFR) of 0.86, is crucial for maintaining public trust and their social license to operate, mitigating risks of reputational damage and regulatory scrutiny.

Technological factors

Technological advancements are reshaping the building materials sector, with a strong focus on reducing carbon emissions. Innovations in cement and concrete production are at the forefront of this shift, directly impacting the environmental footprint of construction.

Holcim is a key player in this space, actively investing in research and development to pioneer sustainable solutions. Their ECOPact range of low-carbon concrete and ECOPlanet green cement are prime examples, offering substantial CO2 reductions compared to traditional alternatives. For instance, ECOPlanet Zero cement can achieve up to 100% CO2 reduction in its production process.

These innovations are not just about environmental responsibility; they are becoming essential for meeting stringent sustainability targets set by governments and international bodies, and for catering to a growing market demand for greener building practices. This technological push is critical for Holcim's strategy to lead in sustainable construction.

Holcim is increasingly integrating digital technologies and automation across its operations to boost efficiency and cut costs. For instance, the company is implementing AI-powered predictive maintenance in its cement plants, aiming to minimize downtime and optimize equipment lifespan. This push towards digitalization is crucial for maintaining competitiveness in the construction materials sector.

The adoption of IoT sensors and advanced analytics is transforming Holcim's supply chain management. These technologies enable real-time tracking of materials and improved logistics planning, leading to faster delivery times and reduced transportation expenses. In 2024, Holcim reported significant improvements in operational efficiency attributed to these digital initiatives.

Advanced manufacturing techniques like 3D concrete printing and modular construction are reshaping the building industry. These innovations enable quicker, more economical, and environmentally friendly construction processes. For instance, in 2024, projects utilizing 3D printed concrete have demonstrated up to 50% faster build times compared to traditional methods.

Holcim can capitalize on these advancements to provide superior construction solutions, potentially boosting its market share. By integrating these technologies, the company can unlock new opportunities in specialized construction segments and expand the application range for its innovative building materials, aligning with a growing demand for sustainable infrastructure.

Waste Valorization and Recycling Technologies

Technological advancements in processing and recycling construction and demolition (C&D) waste are pivotal for Holcim's strategy. These innovations enable the company to integrate a higher percentage of recycled materials into its product portfolio, a key move towards embracing circular economy principles. For instance, Holcim's ECOPact concrete range, launched in 2020, incorporates recycled aggregates, demonstrating a commitment to reducing virgin resource consumption.

Further technological progress lies in converting waste streams into alternative fuels and raw materials. This not only diminishes Holcim's dependence on primary resources but also significantly cuts down its environmental footprint. In 2023, Holcim reported that its alternative fuels and raw materials (AFR) usage reached 22.1% of its total fuel and raw material consumption, a testament to its investment in these technologies.

- Recycled Content Integration: Holcim's ECOPact concrete utilizes recycled aggregates, supporting circularity.

- AFR Usage Growth: The company's AFR usage increased to 22.1% in 2023, reducing reliance on virgin materials.

- Waste-to-Energy Innovations: Technologies converting waste into alternative fuels lower carbon emissions and operational costs.

- Circular Economy Focus: Investments in waste valorization align with Holcim's broader sustainability and decarbonization goals.

Data Analytics for Market Insights

Holcim leverages data analytics to dissect market dynamics and customer preferences, enabling strategic adjustments. This is crucial in a sector where understanding regional demand shifts and material usage patterns can significantly impact profitability. For instance, by analyzing vast datasets, Holcim can refine its product offerings to better suit local construction needs, a strategy vital for maintaining competitiveness.

The company's investment in advanced analytics supports data-driven decision-making across its operations. This technological edge helps in optimizing supply chains, predicting equipment maintenance needs, and identifying emerging market opportunities. In 2023, Holcim reported a significant increase in digital sales channels, underscoring the growing importance of data in customer engagement and transaction processing.

- Market Trend Analysis: Utilizing big data to identify shifts in construction activity and material demand across different regions.

- Customer Behavior: Analyzing purchasing patterns and feedback to tailor product development and service offerings.

- Operational Efficiency: Employing analytics to optimize logistics, production, and resource allocation, aiming for cost reductions.

- Demand Forecasting: Using predictive models to anticipate future market needs, ensuring adequate supply and minimizing waste.

Technological advancements are central to Holcim's strategy for sustainable construction, particularly in reducing the carbon footprint of building materials. Innovations in low-carbon concrete and green cement, such as their ECOPact and ECOPlanet lines, are key, with ECOPlanet Zero offering up to 100% CO2 reduction in production. These developments are driven by stringent environmental regulations and increasing market demand for eco-friendly solutions.

Digitalization and automation are enhancing operational efficiency at Holcim. The company is implementing AI for predictive maintenance in its cement plants to minimize downtime and using IoT sensors for real-time supply chain tracking and logistics optimization, which contributed to significant efficiency gains in 2024.

Holcim is also embracing advanced manufacturing techniques like 3D concrete printing and modular construction, which offer faster and more economical building processes. Projects utilizing 3D printed concrete in 2024 demonstrated up to 50% faster build times, presenting opportunities for Holcim to expand into specialized construction segments.

The company is also a leader in processing construction and demolition waste, integrating recycled materials into its products like ECOPact concrete. Furthermore, Holcim utilizes technologies to convert waste into alternative fuels and raw materials, with its alternative fuels and raw materials (AFR) usage reaching 22.1% in 2023, reducing reliance on virgin resources and lowering its environmental impact.

| Technology Area | Holcim's Application/Product | Key Benefit/Impact | Data Point (2023/2024) |

|---|---|---|---|

| Low-Carbon Materials | ECOPlanet Zero Cement | Up to 100% CO2 reduction in production | N/A (Product feature) |

| Digitalization & Automation | AI-powered predictive maintenance | Minimizes plant downtime, optimizes equipment | Significant efficiency improvements reported in 2024 |

| Advanced Manufacturing | 3D Concrete Printing | Up to 50% faster build times | Reported in 2024 projects |

| Circular Economy | Alternative Fuels & Raw Materials (AFR) usage | Reduces virgin resource dependence, lowers footprint | 22.1% of total fuel/raw material consumption in 2023 |

Legal factors

Holcim's operations are heavily influenced by stringent environmental regulations covering air emissions, water discharge, and waste management. For instance, in 2024, the European Union's Industrial Emissions Directive continues to set benchmarks for pollution control across member states where Holcim operates, requiring significant investment in abatement technologies.

Securing and retaining permits for its numerous quarries and manufacturing plants is a legally intricate and time-consuming process, often involving extensive environmental impact assessments. In the US, the Environmental Protection Agency's permitting processes for new or expanded facilities can take years, impacting project timelines and costs.

Failure to adhere to these environmental laws can result in substantial financial penalties, with fines potentially reaching millions of euros or dollars, alongside the risk of temporary or permanent operational shutdowns. Such non-compliance also poses a significant threat to Holcim's reputation, affecting stakeholder trust and market position.

Holcim navigates a complex web of global labor laws, impacting everything from minimum wages and working hours to employee safety and union rights. For instance, in 2024, the European Union continued to strengthen directives on worker protection and fair wages, requiring multinational companies like Holcim to adapt their employment practices across member states.

Compliance with these diverse regulations, such as Germany's Works Constitution Act or France's stringent employment protection laws, is paramount. Failure to adhere can lead to significant fines, reputational damage, and operational disruptions, underscoring the need for robust internal compliance frameworks and legal expertise.

Building codes and construction standards are a significant legal factor for Holcim, as they differ greatly across regions and countries. These regulations specify the necessary performance and safety benchmarks for all building materials, including those produced by Holcim. For instance, in 2024, the European Union continued to harmonize construction product regulations, impacting how Holcim markets its cement and concrete in member states.

Holcim must ensure its extensive product portfolio complies with these varied legal requirements to gain market access and ensure safe usage. This often means adapting product formulations or obtaining certifications for specific markets, adding complexity and cost to operations. For example, meeting the stringent fire safety standards in the UK, which were updated in 2023, requires specific product testing and documentation for materials used in residential buildings.

Antitrust and Competition Laws

Holcim, as a global leader in building materials, operates under strict antitrust and competition laws worldwide, designed to foster fair markets and prevent anti-competitive behavior. These regulations are crucial for maintaining market integrity and ensuring consumers benefit from competitive pricing and innovation. Failure to comply can result in significant financial penalties and reputational damage.

Key aspects of these laws for Holcim include:

- Merger Control: Holcim's acquisitions and mergers, such as its proposed merger with Lafarge in 2015 (which was later restructured due to regulatory concerns, leading to the sale of certain assets), are scrutinized by competition authorities like the European Commission and the US Federal Trade Commission to prevent undue market concentration.

- Prohibition of Cartels and Price Fixing: Holcim must ensure its operations do not involve agreements with competitors to fix prices, divide markets, or rig bids, which are serious offenses with substantial fines. For instance, the European Commission has imposed multi-million euro fines on companies in the cement and construction materials sectors for such practices.

- Abuse of Dominant Position: Companies with significant market share, like Holcim, are prohibited from abusing their dominant position to stifle competition, for example, through predatory pricing or exclusive dealing arrangements.

Product Liability and Safety Laws

Holcim operates under stringent product liability and safety laws, requiring its building materials to be safe and perform as advertised. Failure to meet these standards can lead to substantial legal claims and damage to its reputation. For instance, in 2023, the construction industry globally saw significant settlements related to defective building materials, underscoring the financial and reputational risks involved.

To mitigate these risks, Holcim must maintain rigorous quality control processes and provide clear, accurate product specifications. This legal imperative ensures consumer safety and product integrity. The company's commitment to safety is reflected in its 2024 sustainability report, which details investments in advanced testing and material science to prevent product failures.

- Legal Compliance: Adherence to product liability laws is non-negotiable for building material manufacturers like Holcim.

- Risk Mitigation: Robust quality control and transparent product information are crucial to avoid costly lawsuits and reputational damage.

- Industry Trends: The construction sector continues to face scrutiny over material safety, with regulatory bodies increasing enforcement actions.

- Holcim's Focus: The company prioritizes safety and performance, investing in research and development to ensure its products meet and exceed legal requirements.

Holcim's operations are significantly shaped by environmental regulations, demanding substantial investment in pollution control technologies, as seen with the EU's Industrial Emissions Directive in 2024. Securing permits for facilities involves complex environmental impact assessments, a process that can take years in markets like the US, impacting project timelines and costs.

The company must also navigate a complex landscape of global labor laws, including those concerning worker protection and fair wages, which were further strengthened across the EU in 2024. Adherence to building codes and construction standards, which vary globally and were subject to EU harmonization efforts in 2024, is crucial for market access and product safety, necessitating product adaptation and certification.

Holcim faces strict antitrust and competition laws, with merger controls, like those applied to its past Lafarge merger, and prohibitions against cartels and price fixing being key areas of scrutiny. The company is also subject to product liability and safety laws, requiring rigorous quality control and clear product specifications to avoid costly lawsuits and reputational damage, as highlighted by industry trends in 2023 and Holcim's 2024 sustainability report investments.

| Legal Factor | Impact on Holcim | Example/Data (2023-2025) |

| Environmental Regulations | Compliance costs, operational permits, potential fines | EU Industrial Emissions Directive (2024); EPA permitting timelines in US |

| Labor Laws | Employment practice adaptation, wage compliance | EU worker protection directives (ongoing); Germany's Works Constitution Act |

| Building Codes | Product adaptation, certification costs, market access | EU construction product regulation harmonization (2024); UK fire safety standards (updated 2023) |

| Antitrust & Competition | Merger scrutiny, risk of fines for anti-competitive behavior | Past Lafarge merger restructuring; EU fines for cement sector cartels |

| Product Liability & Safety | Quality control investment, risk of litigation, reputational damage | Holcim's 2024 sustainability report on R&D investment; 2023 global settlements for defective materials |

Environmental factors

Holcim faces intense pressure to address climate change, impacting its operations across Scope 1, 2, and 3 emissions. The company's commitment to net-zero concrete by 2050 requires substantial capital allocation towards developing and implementing low-carbon production methods and embracing circular economy principles.

In 2023, Holcim achieved a 10% reduction in its Scope 1 and 2 CO2 emissions intensity compared to 2022, reaching 488 kg CO2 per tonne of cementitious material. This progress is crucial for meeting its ambitious 2030 target of a 42% reduction from a 2018 baseline.

Growing concerns over the depletion of essential raw materials such as limestone, sand, and water are increasingly influencing Holcim's operational strategies, driving a significant shift towards circular economy principles. This focus means maximizing the integration of recycled content into its product lines.

Holcim is actively utilizing industrial by-products and transforming construction and demolition waste into valuable resources, a key component of its sustainability roadmap. For instance, in 2023, the company reported that 30% of its raw materials were recycled or low-carbon, a figure it aims to increase further.

Holcim's quarrying activities inherently affect local ecosystems, making biodiversity protection a critical environmental concern. The company actively implements biodiversity action plans at its sites, aiming to minimize habitat disruption and promote the recovery of native flora and fauna. For instance, Holcim reported that in 2023, they had 275 biodiversity action plans in place across their operations, demonstrating a commitment to this area.

Increasingly stringent environmental regulations and growing societal pressure necessitate robust land rehabilitation strategies post-extraction. Holcim's approach includes restoring quarry sites to create valuable habitats or for other beneficial land uses, aligning with its goal of achieving net positive impact on biodiversity by 2030. This commitment is reflected in their ongoing investments in rehabilitation projects, with a focus on creating long-term ecological value.

Water Scarcity and Management

Water scarcity is a significant environmental challenge impacting industries like cement production, where it's essential for cooling and material processing. Holcim is actively addressing this by prioritizing water optimization and recycling. For instance, in 2023, the company reported that 70% of its water withdrawal came from recycled or reused sources, a notable increase from previous years and a testament to their commitment to sustainable water management, particularly in regions facing high water stress.

Holcim's strategy involves implementing advanced water management techniques across its global operations. This includes investing in closed-loop systems and exploring innovative solutions to minimize freshwater intake. The company aims to further reduce its reliance on freshwater resources, with a target to increase the proportion of recycled and reused water in its operations. This focus is crucial as global freshwater availability continues to be a concern, with projections indicating increased water stress in many of Holcim's key operating markets by 2030.

- Water Use in Cement Production: Water is vital for concrete mixing, dust suppression, and cooling equipment in cement plants.

- Holcim's Water Management Goals: The company aims to reduce freshwater withdrawal by 20% by 2030 compared to a 2018 baseline.

- Recycling and Reuse Efforts: In 2023, Holcim achieved 70% recycled or reused water, up from 63% in 2022.

- Addressing Water-Stressed Regions: Specific initiatives are in place for sites located in areas identified as having high water stress, ensuring responsible resource use.

Pollution Control and Waste Management

Holcim actively addresses environmental factors through robust pollution control and waste management strategies. The company focuses on minimizing emissions of air pollutants like NOx, SOx, and dust, alongside managing wastewater and operational waste. This commitment is crucial for regulatory compliance and reducing its ecological impact.

In 2023, Holcim continued its investment in advanced technologies to enhance pollution control. For instance, their efforts to reduce CO2 emissions from cement production are ongoing, with targets aligned with global climate goals. The company's waste management protocols aim to increase the use of alternative fuels and raw materials, diverting significant volumes from landfill.

- Air Quality: Holcim implements advanced filtration systems and process optimizations to control NOx, SOx, and particulate matter emissions, meeting or exceeding local air quality standards across its operations.

- Water Management: The company employs wastewater treatment technologies to ensure discharged water quality meets stringent environmental regulations, often recycling water within its processes.

- Waste Reduction: Holcim prioritizes the circular economy by increasing the use of waste materials as alternative fuels and raw materials in cement production, thereby reducing reliance on virgin resources and minimizing landfill waste.

- Regulatory Compliance: Continuous monitoring and adherence to evolving environmental legislation in various operating regions are paramount, ensuring Holcim's practices align with global sustainability expectations.

Holcim is deeply invested in mitigating its environmental footprint, particularly regarding carbon emissions and resource depletion. The company is actively pursuing net-zero concrete by 2050, a goal that necessitates significant innovation in low-carbon production and circular economy practices. In 2023, Holcim reported a 10% reduction in Scope 1 and 2 CO2 emissions intensity, reaching 488 kg CO2 per tonne of cementitious material, moving closer to its 2030 target of a 42% reduction from a 2018 baseline.

The increasing scarcity of raw materials like limestone and sand is driving Holcim's strategic shift towards circularity, with a strong emphasis on incorporating recycled content. By 2023, 30% of their raw materials were recycled or low-carbon, a figure they aim to expand. Biodiversity protection is also a key focus, with 275 biodiversity action plans in place across operations in 2023 to minimize habitat disruption.

Water management is critical, with Holcim aiming to reduce freshwater withdrawal by 20% by 2030. In 2023, 70% of water withdrawal came from recycled or reused sources, an increase from 63% in 2022. The company also prioritizes pollution control, investing in technologies to reduce air pollutants and managing waste effectively, with a focus on using waste as alternative fuels and raw materials.

| Environmental Factor | Holcim's 2023 Performance/Initiatives | Targets/Goals |

| CO2 Emissions Intensity (Scope 1 & 2) | 488 kg CO2 per tonne of cementitious material (10% reduction vs. 2022) | 42% reduction from 2018 baseline by 2030; Net-zero concrete by 2050 |

| Recycled/Low-Carbon Materials | 30% of raw materials | Increase utilization |

| Biodiversity Action Plans | 275 in place | Net positive impact on biodiversity by 2030 |

| Recycled/Reused Water Withdrawal | 70% | Reduce freshwater withdrawal by 20% by 2030 (vs. 2018 baseline) |

PESTLE Analysis Data Sources

Our Holcim PESTLE analysis is built on a robust foundation of data from leading international financial institutions like the IMF and World Bank, alongside government publications and reputable industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the global construction materials sector.