Holcim Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holcim Bundle

Holcim operates in a dynamic construction materials sector, where the bargaining power of buyers, particularly large construction firms, can significantly impact pricing. The threat of new entrants is moderate, as substantial capital investment is required, but the industry's profitability can attract new players. Understanding these pressures is crucial for any stakeholder.

The complete report reveals the real forces shaping Holcim’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Holcim's significant reliance on essential raw materials like limestone, clay, and gypsum for cement, alongside sand and gravel for aggregates, places considerable power in the hands of its suppliers. The cost and consistent availability of these natural resources are critical determinants of Holcim's manufacturing expenses.

The production of cement and building materials is incredibly energy-hungry, especially for the high-temperature kilns. This means that when energy prices swing, Holcim's costs are directly impacted. For instance, in 2024, global natural gas prices saw significant volatility, impacting energy-intensive industries like cement manufacturing.

This energy cost volatility gives suppliers of coal, natural gas, and electricity considerable leverage. Holcim must therefore focus on improving energy efficiency and exploring alternative fuels to mitigate this supplier power and stabilize its operational expenses.

The construction materials industry, including cement and aggregates, grapples with ongoing labor shortages, especially for crucial roles like heavy equipment operators and plant technicians. This scarcity directly impacts Holcim by potentially driving up wage demands and creating production delays.

In 2024, reports indicated a significant deficit in skilled trades across many developed economies, with the construction sector being particularly affected. For instance, some industry surveys from late 2023 and early 2024 highlighted that over 60% of construction firms struggled to find qualified workers, a trend that continued into 2024.

To counter this, Holcim must prioritize investments in robust training programs and offer competitive compensation packages to effectively attract and retain the skilled workforce necessary for its operations.

Limited Suppliers for Specialized Equipment

The bargaining power of suppliers for Holcim is significantly influenced by the limited availability of specialized equipment crucial for advanced cement and concrete production. Manufacturers of highly specialized machinery and technology for modern plants are few, granting them considerable leverage over pricing, maintenance contracts, and the terms of technological upgrades. This concentration of suppliers means Holcim, like other major players, must often accept supplier-dictated terms.

For instance, Holcim's strategic investments in cutting-edge technologies, such as carbon capture systems, are heavily reliant on a narrow base of qualified suppliers. These suppliers can command higher prices and dictate delivery schedules, impacting Holcim's capital expenditure and project timelines. In 2024, the global market for advanced industrial equipment, particularly that incorporating sustainability features, saw price increases driven by supply chain constraints and high demand from sectors undergoing green transitions.

- Limited Supplier Pool: The market for highly specialized cement and concrete production technology is concentrated, with few manufacturers capable of meeting Holcim's advanced operational needs.

- Pricing Leverage: These specialized suppliers can exert significant influence on pricing for new equipment and ongoing maintenance, directly impacting Holcim's cost structure.

- Technological Dependence: Holcim's adoption of innovative technologies, like carbon capture, creates a dependency on a small number of suppliers who control access to these critical systems.

- Impact on Upgrades: The bargaining power of these suppliers extends to the terms and costs associated with technological upgrades, potentially slowing down Holcim's modernization efforts.

Sustainability and Regulatory Demands

Suppliers offering sustainable raw materials, alternative fuels, or low-carbon technologies are gaining significant bargaining power as Holcim intensifies its focus on net-zero emissions and circular economy principles. For instance, Holcim's 2024 sustainability report highlights a growing demand for recycled aggregates and low-carbon cementitious materials, creating an advantage for suppliers capable of meeting these specifications.

Furthermore, evolving environmental regulations, such as stricter emissions standards and waste management directives, compel Holcim to partner with suppliers who can provide compliant and greener solutions. This regulatory push effectively transfers some leverage to those suppliers who are at the forefront of environmentally responsible innovation within the supply chain.

- Sustainable Material Sourcing: Holcim's 2024 procurement strategy emphasizes sourcing materials with a lower embodied carbon footprint, increasing supplier power for those offering certified low-carbon cement or recycled content.

- Alternative Fuel Adoption: The company's commitment to increasing the use of alternative fuels in its kilns, aiming for 30% by 2030, bolsters the position of suppliers providing waste-derived fuels or biomass.

- Regulatory Compliance: Suppliers who can demonstrate adherence to emerging carbon pricing mechanisms and waste reduction mandates gain a competitive edge and enhanced bargaining power.

Holcim's suppliers of essential raw materials like limestone and aggregates hold significant power due to the limited availability of high-quality deposits and the inherent transportation costs. The concentration of these resources in specific geographic locations means Holcim must secure favorable terms from suppliers controlling these critical inputs. In 2024, disruptions in global shipping and logistics further amplified the bargaining power of domestic raw material suppliers who could ensure more reliable delivery.

The energy sector, particularly suppliers of natural gas and electricity, wield considerable influence over Holcim's operational costs. Cement production is highly energy-intensive, making the company vulnerable to price fluctuations. For instance, in early 2024, a surge in natural gas prices in Europe directly translated to higher production expenses for Holcim's regional operations, demonstrating the suppliers' leverage.

Suppliers of specialized equipment and advanced technologies, especially those related to sustainability and decarbonization, possess strong bargaining power. Holcim's commitment to net-zero goals necessitates partnerships with a limited number of firms offering cutting-edge solutions, such as carbon capture technology or low-carbon binders. The scarcity of these specialized providers, coupled with high demand in 2024, allowed them to dictate terms and pricing.

| Supplier Category | Bargaining Power Factors | 2024 Impact Example |

|---|---|---|

| Raw Materials (Limestone, Aggregates) | Limited high-quality deposits, transportation costs, geographic concentration | Increased reliance on domestic suppliers due to global shipping volatility |

| Energy (Natural Gas, Electricity) | High energy intensity of cement production, price volatility | Higher European operational costs due to rising natural gas prices |

| Specialized Equipment & Technology | Scarcity of advanced/sustainable solutions, high demand for decarbonization tech | Higher prices and dictated terms for carbon capture and low-carbon binder suppliers |

What is included in the product

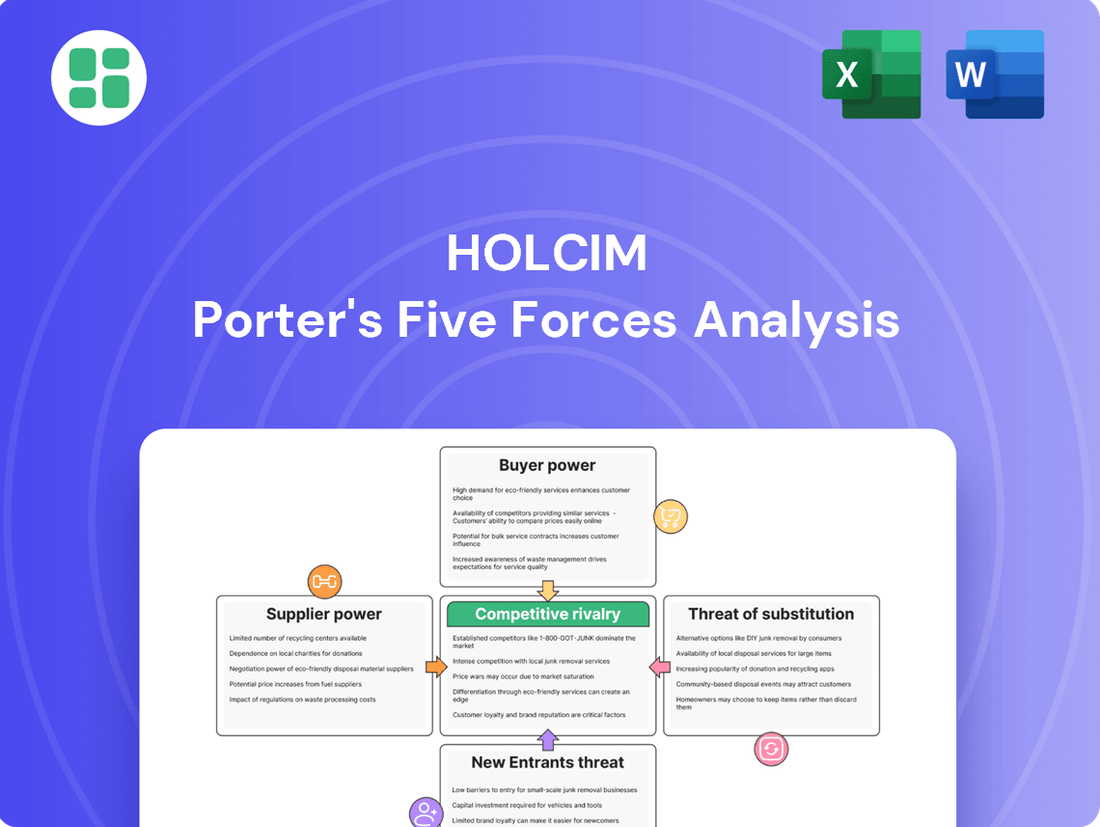

This analysis dissects the competitive forces impacting Holcim, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes within the cement and building materials industry.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's five forces on a dynamic dashboard.

Customers Bargaining Power

Major construction companies, government agencies overseeing large infrastructure projects, and significant commercial developers are key customers for Holcim. These entities often procure materials in massive quantities, which naturally gives them considerable sway in negotiating prices and delivery schedules. For instance, a single government infrastructure bid might involve hundreds of thousands of tons of cement or aggregates, making the supplier's pricing critically important.

This substantial volume allows these large customers to demand favorable terms, potentially impacting Holcim's profit margins. Their ability to switch suppliers, especially for standardized products like cement or concrete, further amplifies their bargaining power. In 2023, Holcim reported that its largest customers accounted for a significant portion of its revenue, highlighting the importance of these relationships.

Holcim's strategy to counter this involves offering integrated solutions that go beyond basic material supply. By providing a comprehensive suite of products and services, such as admixtures, precast concrete, and even digital construction solutions, Holcim aims to create stickiness with these major clients. This approach not only helps retain these high-volume customers but also allows Holcim to capture more value across the construction lifecycle.

Customers are increasingly demanding sustainable and low-carbon building materials, driven by evolving regulations, corporate environmental targets, and growing public awareness. This shift significantly amplifies their bargaining power, as they can choose suppliers who meet these criteria.

Holcim's robust offering of ECOPact low-carbon concrete and ECOPlanet low-carbon cement positions it favorably. This product differentiation allows Holcim to command premium pricing and foster deeper customer loyalty among environmentally conscious buyers.

In 2024, Holcim reported a significant increase in sales for its sustainable building solutions, reflecting this market trend. For instance, its ECOPact range saw double-digit growth in key European markets, underscoring customer preference for greener alternatives.

The bargaining power of customers in the building materials sector is significantly influenced by regional market dynamics, particularly the high cost of transporting heavy products like cement and aggregates. This geographical constraint often compels customers to source from local suppliers, fostering a more localized competitive landscape. In 2024, transportation costs for bulk construction materials remained a substantial factor, with fuel price volatility directly impacting delivered prices and reinforcing the preference for nearby providers.

When multiple local suppliers are available within a reasonable delivery radius, customers gain considerable leverage. They can more easily compare prices and negotiate better terms, as switching costs are relatively low. This situation can put pressure on profit margins for suppliers like Holcim, especially in markets with a fragmented supplier base.

Holcim's strategy to counter this involves maintaining a decentralized operating model and securing leading positions in local markets. By having a strong presence and efficient distribution networks in key regions, Holcim aims to be the preferred local supplier, thereby reducing the customer's incentive and ability to switch to competitors based solely on price.

Commoditization of Standard Products

When ready-mix concrete and basic aggregates become standard, undifferentiated products, price becomes the main driver for customer decisions. This shift significantly boosts customer bargaining power because they can readily switch suppliers based on the lowest cost. For instance, in many regional markets, the price difference for standard concrete can be as little as 1-2% per cubic yard, making switching economically attractive for buyers. This pressure forces suppliers to compete primarily on cost, squeezing profit margins.

Holcim actively addresses this by moving beyond basic commodities. They focus on developing and marketing value-added products and advanced solutions, such as high-performance concrete or eco-friendly alternatives. This strategy aims to create differentiation, allowing them to command premium pricing and reduce reliance on price alone. For example, their investments in sustainable building materials aim to capture a growing segment of environmentally conscious customers who prioritize performance and sustainability over the lowest price point.

- Commoditization Drives Price Sensitivity: For standard ready-mix concrete and aggregates, price is paramount, leading customers to seek the lowest cost options.

- Ease of Switching Increases Power: Customers can easily shift between suppliers for undifferentiated products, amplifying their bargaining leverage.

- Holcim's Differentiation Strategy: The company counters this by emphasizing value-added products and innovative solutions to reduce price-based competition.

- Focus on Premium Segments: By offering specialized concrete mixes or sustainable materials, Holcim aims to attract customers willing to pay more for performance and environmental benefits.

Spin-off Impact on North American Customers

Holcim's planned spin-off of its North American business into a new entity, Amrize, is designed to sharpen focus and potentially improve customer service in this key region. This move could lead to more tailored solutions and a deeper engagement with North American clients, impacting their overall bargaining power.

The strategic separation aims to unlock value and allow Amrize to operate with greater agility, directly addressing the specific needs of its customer base. While the immediate intent is to strengthen customer relationships, the ultimate effect on customer bargaining power will depend on Amrize's market positioning and competitive landscape post-spin-off.

- Focused Strategy: Amrize's dedicated North American focus may allow for more responsive customer service and product development.

- Market Dynamics: The spin-off could alter competitive dynamics, potentially influencing customer leverage.

- Uncertain Long-Term Impact: The full extent of the change in customer bargaining power is yet to be determined as Amrize establishes its independent market presence.

The bargaining power of customers for Holcim is significant, particularly with large construction firms and government bodies that purchase in massive volumes, allowing them to negotiate favorable pricing and delivery terms. In 2023, Holcim's largest customers represented a substantial portion of its revenue, underscoring their influence.

The increasing demand for sustainable building materials, such as Holcim's ECOPact and ECOPlanet lines, further empowers customers. Holcim reported double-digit growth for its ECOPact range in key European markets in 2024, demonstrating a clear customer preference for greener alternatives that can command premium pricing.

Furthermore, the localized nature of the building materials market, influenced by high transportation costs for heavy items, means customers often favor local suppliers. This can lead to price sensitivity, especially when multiple suppliers are available, putting pressure on Holcim's margins unless they offer differentiated, value-added solutions.

Holcim's strategic move to spin off its North American business into Amrize aims to enhance customer focus and potentially improve tailored solutions, which could impact customer leverage in that region as Amrize establishes its independent market presence.

Same Document Delivered

Holcim Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Holcim Porter's Five Forces Analysis you see here details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This professionally formatted report is ready for your immediate use.

Rivalry Among Competitors

Holcim faces intense competition from global giants such as CRH, Cemex, and Heidelberg Materials, all vying for dominance in the building materials sector. These major players actively compete across key segments including cement, aggregates, and ready-mix concrete, driving a dynamic market landscape.

The competitive rivalry is further amplified by factors like market growth rates and the strategic utilization of production capacity. For instance, in 2024, the global construction market is projected to see moderate growth, intensifying the pressure on companies to secure market share and optimize their operations.

Product differentiation also plays a crucial role, with companies investing in innovative solutions and sustainable offerings to stand out. This focus on unique value propositions is essential for maintaining a competitive edge in an industry where price sensitivity can be high.

Holcim actively differentiates its offerings through innovative and sustainable building solutions, moving beyond pure price competition. Products like ECOPact, their low-carbon concrete, and ECOPlanet, a range of sustainable cement, are key examples of this strategy in action.

This focus on low-carbon and circular economy products allows Holcim to tap into an expanding market segment that prioritizes environmental responsibility. By providing these greener alternatives, the company strengthens its competitive advantage and appeals to a growing demand for sustainable construction practices across the industry.

Holcim's extensive geographic footprint, spanning over 70 countries by the end of 2023, creates a significant barrier to entry. This vast network allows for optimized logistics and supply chains, crucial in the building materials sector where transportation costs are substantial. The company's ability to serve diverse markets efficiently, often through a 'local-for-local' approach, means it can adapt to regional needs and maintain a strong competitive edge against less geographically diversified rivals.

M&A as a Growth and Market Consolidation Strategy

Holcim's aggressive pursuit of mergers and acquisitions is a significant driver of competitive rivalry within the construction materials sector. In 2024 alone, the company completed 27 transactions, a clear indication of its commitment to growth and market consolidation. This strategic M&A activity allows Holcim to not only expand its geographic reach and product offerings, particularly in emerging areas like circular construction, but also to integrate new technologies and capabilities.

This active M&A strategy directly impacts competitive dynamics by consolidating market positions and increasing the scale of operations for acquirers. For instance, Holcim's acquisitions aim to strengthen its presence in key markets and enhance its overall competitive standing. The intensified activity means that companies looking to grow through acquisition face a more competitive landscape, often bidding against larger, well-capitalized players like Holcim for attractive targets.

- Holcim's 2024 M&A Activity: Completed 27 transactions.

- Strategic Objectives: Portfolio strengthening, market expansion (especially circular construction), technology acquisition.

- Impact on Rivalry: Intensifies competition for acquisition targets and consolidates market share.

- Competitive Advantage: Larger players leverage M&A for scale, technology, and market dominance.

Impact of North American Spin-off

The strategic spin-off of Holcim's North American operations into a new entity, Amrize, is poised to significantly alter the competitive landscape. This separation allows Amrize to pursue its own growth trajectory, potentially leading to more aggressive strategies within the North American market.

Holcim, now free to concentrate on its global portfolio and sustainability initiatives, may see its competitive focus shift away from North America. This could create opportunities for Amrize to gain market share, especially as it aims to achieve ambitious growth targets. For instance, Holcim's 2023 revenue was CHF 30.5 billion, with its North American segment contributing a substantial portion, indicating the scale of the newly independent Amrize.

- Amrize's Focused Growth: The spin-off enables Amrize to implement tailored strategies for the North American market, potentially intensifying competition.

- Holcim's Global Strategy: Holcim can now dedicate resources to international markets and its sustainability agenda, altering its competitive priorities.

- Market Dynamics Shift: The creation of two distinct entities is expected to foster more agile competitive responses and strategic maneuvering.

The building materials sector is characterized by fierce competition, with Holcim facing off against major global players like CRH, Cemex, and Heidelberg Materials. This rivalry is evident across core segments such as cement, aggregates, and ready-mix concrete. The intensity is further fueled by market growth dynamics and strategic capacity utilization.

| Competitor | Key Segments | 2023 Revenue (Approx. USD Billion) |

|---|---|---|

| CRH | Cement, Aggregates, Asphalt, Building Products | 47.0 |

| Cemex | Cement, Ready-mix Concrete, Aggregates | 17.9 |

| Heidelberg Materials | Cement, Aggregates, Ready-mix Concrete, Building Products | 21.0 |

SSubstitutes Threaten

The threat of substitutes for traditional Portland cement is growing, driven by innovations in alternative binders. Limestone Calcined Clay Cement (LC3) and alkali-activated materials are gaining traction due to their significantly lower carbon footprints, a key differentiator in today's environmentally conscious market. For instance, LC3 can reduce the CO2 emissions associated with cement production by up to 40% compared to conventional Portland cement.

These emerging technologies pose a long-term challenge by offering viable alternatives that could lessen the demand for Holcim's core products. This shift is particularly pronounced as regulatory pressures and customer preferences increasingly favor sustainable building materials. Holcim's strategic investments in developing and marketing these low-carbon cement solutions, such as their participation in initiatives promoting LC3, directly address this evolving threat by positioning themselves as leaders in the transition.

The increasing focus on circular economy principles is boosting the use of recycled aggregates and construction and demolition materials (CDM). This trend directly impacts the threat of substitutes by offering viable alternatives to virgin resources.

Holcim is actively embracing this shift, showcasing how substitutes can be incorporated into a core business strategy. In 2024, the company recycled over 10 million tons of CDM, highlighting the growing availability and acceptance of these materials.

This surge in recycled materials can potentially decrease the demand for primary resources, thereby intensifying the competitive pressure from substitute products within the construction sector.

Advances in prefabrication and modular construction are a growing threat. These methods, where building components are made off-site, can lessen the reliance on traditional on-site ready-mix concrete. For instance, the global modular construction market was valued at approximately $150 billion in 2023 and is projected to reach over $250 billion by 2030, indicating a significant shift.

While concrete remains integral to many prefabricated elements, the demand for materials delivered directly to the construction site may decrease. This evolving landscape necessitates innovation in precast concrete solutions to maintain market relevance and capture value within these new construction paradigms.

Engineered Wood and Steel Alternatives

Engineered wood and steel represent viable substitutes for concrete in various construction sectors, notably residential and commercial projects. The increasing emphasis on sustainability is a key driver, as these alternatives are often perceived as having a lower environmental impact, potentially swaying material choices. For instance, the global engineered wood market was valued at approximately USD 115 billion in 2023 and is projected to grow, highlighting its increasing adoption.

Holcim is actively addressing this threat by expanding its portfolio to include advanced building solutions, such as comprehensive roofing systems. This diversification strategy aims to capture a broader share of the construction materials market and reduce reliance solely on traditional concrete offerings. In 2024, Holcim reported significant growth in its specialty products segment, which includes these advanced solutions, demonstrating their strategic importance.

- Market Shift: Engineered wood and steel are increasingly competitive alternatives to concrete, especially in residential and commercial construction.

- Sustainability Influence: Growing environmental awareness favors alternatives perceived as greener, impacting material selection decisions.

- Holcim's Response: Diversification into advanced building solutions like roofing systems helps Holcim mitigate the threat of substitutes.

- Market Data: The engineered wood market's substantial valuation and growth underscore the competitive landscape.

Innovation in Material-Efficient Design

New architectural and engineering designs are increasingly optimizing material usage, directly impacting demand for traditional cement and concrete. For instance, advancements in structural engineering allow for lighter, more efficient building components, potentially reducing the volume of materials needed per project. This shift encourages a move towards higher-performance, lower-volume solutions within the construction sector.

Holcim is actively addressing this threat by investing in innovative and smart building solutions. Their development of advanced concrete formulations and sustainable building materials aims to meet the evolving demands for efficiency and performance. In 2023, Holcim reported a significant portion of its revenue derived from its sustainable product portfolio, demonstrating its strategic response to these material-substitution trends.

- Material Optimization: Innovative designs reduce the quantity of traditional cement and concrete required.

- Performance Focus: The industry is shifting towards higher-performance, lower-volume construction materials.

- Holcim's Strategy: The company is investing in smart building solutions and advanced material development.

The threat of substitutes for traditional cement is intensifying due to innovations in lower-carbon binders like Limestone Calcined Clay Cement (LC3), which can cut CO2 emissions by up to 40%. Furthermore, the growing adoption of recycled construction and demolition materials (CDM) offers viable alternatives to virgin resources, with Holcim recycling over 10 million tons of CDM in 2024. Advances in prefabrication and modular construction, a market valued at approximately $150 billion in 2023, also reduce reliance on traditional on-site concrete, while engineered wood and steel are gaining favor for their perceived lower environmental impact.

| Substitute Type | Key Driver | 2024 Holcim Action/Data | Market Trend/Data |

|---|---|---|---|

| Low-Carbon Binders (e.g., LC3) | Environmental Impact Reduction | Investment in LC3 promotion | Up to 40% CO2 reduction potential |

| Recycled Materials (CDM) | Circular Economy Principles | Recycled >10 million tons CDM | Growing availability and acceptance |

| Prefabrication/Modular Construction | Efficiency & Speed | Focus on precast solutions | Global market ~ $150 billion (2023) |

| Engineered Wood & Steel | Sustainability Perception | Diversification into advanced solutions | Engineered wood market ~ $115 billion (2023) |

Entrants Threaten

The building materials industry, especially for cement and aggregates, demands substantial capital. Companies need to invest heavily in manufacturing plants, quarrying operations, and intricate distribution systems. For instance, establishing a new cement plant can easily cost hundreds of millions of dollars, a significant hurdle for newcomers.

These high upfront costs act as a formidable barrier to entry, discouraging many potential competitors from even attempting to enter the market. The sheer scale of investment required means only well-funded entities can realistically consider competing. Holcim's vast existing network of quarries and production facilities, built over decades, represents a significant competitive advantage that is extremely difficult and costly for a new entrant to replicate.

The cement industry is characterized by stringent permitting and regulatory hurdles, which act as a significant barrier to new entrants. Establishing new cement plants or aggregate quarries requires navigating complex and often lengthy approval processes, frequently facing local opposition due to environmental and land use concerns. For instance, in 2024, the average time to secure permits for new industrial facilities in developed economies can extend to several years, with environmental impact assessments alone being a substantial undertaking.

These environmental regulations and land use restrictions create substantial barriers to entry, making it difficult and costly for new companies to establish operations. The capital expenditure required not only for construction but also for compliance with evolving environmental standards is immense. This regulatory complexity, coupled with the need for extensive land acquisition and public consultation, gives established players with existing infrastructure and a proven track record a significant advantage in the market.

Holcim benefits from well-developed and efficient logistics and distribution networks, a significant barrier for new entrants. These networks are essential for delivering heavy and often perishable products like ready-mix concrete across vast geographical areas. For instance, in 2024, Holcim's extensive fleet and strategically located production facilities enabled them to service a wide range of construction projects efficiently.

Replicating Holcim's established logistical infrastructure would require substantial capital investment and considerable time for new players. This logistical advantage, built over years, reinforces the competitive position of incumbents by making it difficult and expensive for newcomers to match their reach and delivery capabilities.

Brand Recognition and Customer Relationships

Established players like Holcim have cultivated formidable brand recognition and fostered deep, enduring relationships with a diverse customer base, encompassing major construction conglomerates and governmental entities. Newcomers would encounter substantial hurdles in cultivating the necessary trust and securing lucrative, large-scale contracts against such entrenched loyalty.

Holcim's strategic emphasis on developing and promoting Advanced Branded Solutions actively reinforces customer allegiance by offering specialized, high-value products and services tailored to specific project needs. This focus on innovation and customer-centricity creates a significant barrier to entry for potential competitors seeking to disrupt the market.

- Brand Loyalty: Holcim's long history and consistent delivery have built a strong reputation, making customers hesitant to switch to unproven alternatives.

- Customer Relationships: Deeply embedded relationships with key accounts, often cultivated over decades, provide a significant competitive advantage.

- Contractual Barriers: Long-term supply agreements and preferred vendor status with major clients act as a deterrent to new entrants.

- Value-Added Services: Holcim's 'Advanced Branded Solutions' offer more than just materials, providing technical support and customized applications that are difficult for new entrants to replicate quickly.

Access to Raw Material Reserves

The threat of new entrants into the cement industry, specifically concerning access to raw material reserves, is significantly mitigated by Holcim's established position. Securing long-term access to high-quality limestone and aggregates is absolutely crucial for any cement producer to maintain consistent operations and competitive pricing. Holcim's extensive portfolio of mineral reserves provides a distinct, long-term supply advantage that new players would find incredibly difficult to replicate.

New companies entering the market would face substantial hurdles in acquiring comparable reserves. This difficulty is compounded by increasingly stringent environmental regulations and complex land-use restrictions, which often make the acquisition of new, viable quarry sites a lengthy and costly endeavor. For instance, in 2023, the average cost of acquiring suitable land for quarrying in many developed regions saw an uptick due to these regulatory pressures and competition for limited resources.

- Holcim's Reserve Advantage: Holcim benefits from a substantial and diversified base of mineral reserves, ensuring a reliable and cost-effective supply of key raw materials for its global operations.

- Barriers for New Entrants: New competitors would struggle to match Holcim's access to high-quality limestone and aggregates, a critical factor for sustained production and market competitiveness.

- Regulatory Hurdles: Increasing environmental and land-use regulations create significant barriers to entry, making the acquisition of new quarrying rights a complex and expensive process for potential new players.

- Long-Term Supply Security: Holcim's established reserve base provides a crucial long-term supply security, insulating it from the price volatility and availability issues that could plague new entrants.

The threat of new entrants for Holcim is generally considered low, primarily due to the immense capital requirements for establishing cement and aggregate operations. Building a new cement plant can cost hundreds of millions of dollars, a significant deterrent. Furthermore, securing necessary permits and navigating complex environmental regulations, which can take years, adds substantial cost and time, making it difficult for newcomers to compete with established players like Holcim.

Holcim's extensive and efficient logistics networks, along with strong brand loyalty and established customer relationships, present further barriers. New entrants would need significant investment to replicate these logistical capabilities and build trust with major clients. Access to raw materials is also a hurdle, as Holcim possesses a vast portfolio of mineral reserves, making it challenging for new companies to secure a comparable long-term supply advantage.

| Barrier Type | Description | Impact on New Entrants | Holcim's Advantage |

|---|---|---|---|

| Capital Requirements | High cost of building plants and infrastructure | Significant financial barrier | Decades of investment in existing facilities |

| Regulatory Hurdles | Complex permitting and environmental compliance | Time-consuming and expensive | Established processes and compliance expertise |

| Logistics & Distribution | Need for extensive transportation networks | Costly to build and maintain | Nationwide and global distribution capabilities |

| Brand & Customer Relationships | Building trust and securing large contracts | Difficult against established loyalty | Long-standing relationships with key clients |

| Raw Material Access | Securing long-term supply of limestone and aggregates | Limited availability and high acquisition costs | Extensive owned mineral reserves |

Porter's Five Forces Analysis Data Sources

Our Holcim Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Holcim's annual reports, investor presentations, and sustainability reports. We also incorporate industry-specific data from reputable sources like the Global Cement and Concrete Association and market intelligence platforms.