Holcim Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holcim Bundle

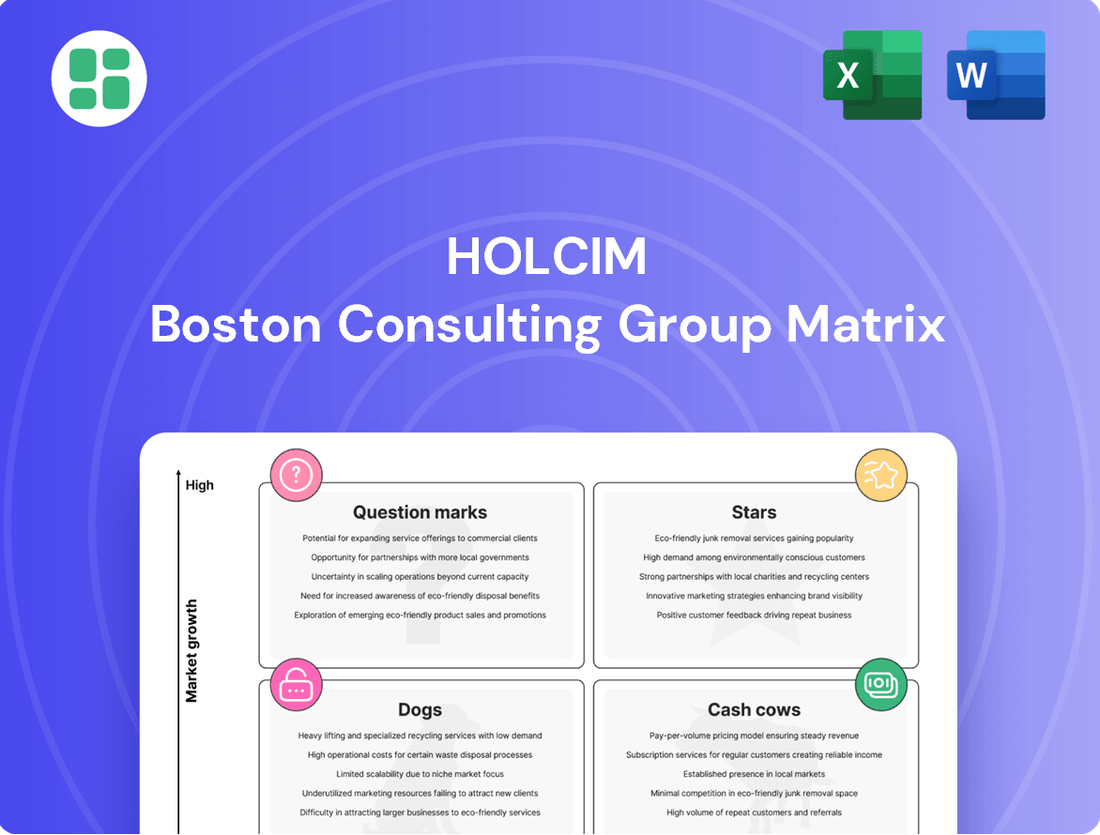

Curious about Holcim's strategic product portfolio? Our preview offers a glimpse into their market positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock actionable insights and understand how to optimize their resource allocation, you need the full picture.

Don't get left behind in the competitive building materials landscape. Purchase the complete Holcim BCG Matrix to gain a detailed, quadrant-by-quadrant analysis and receive data-backed recommendations for smart investment and product development decisions.

Invest in clarity and strategic advantage. The full Holcim BCG Matrix report provides the essential roadmap for navigating market dynamics and ensuring your capital is deployed for maximum impact.

Stars

ECOPact and ECOPlanet represent Holcim's commitment to sustainable building materials, fitting squarely into the Stars quadrant of the BCG Matrix. These low-carbon concrete and cement products are experiencing substantial sales growth, capturing an increasing share of their respective markets. This performance highlights both the high growth rate of the sustainable construction sector and Holcim's robust market position within it.

Holcim's strategic focus on scaling these eco-friendly offerings directly addresses the escalating customer demand for greener building solutions. The rapid adoption of ECOPact and ECOPlanet underscores Holcim's leadership in a rapidly expanding, high-growth segment of the construction industry, driving profitable growth for the company.

Holcim's ECOCycle technology platform is a significant driver in the circular construction space, focusing on recycling construction and demolition materials. This initiative reflects a substantial volume growth and highlights the strategic importance of embracing circular economy principles within the construction industry. Holcim's commitment to sustainability is clearly demonstrated here.

The company has not only aligned with the high-growth trend of circularity but has also established itself as a leader. Notably, Holcim surpassed its 2025 targets for recycled materials, underscoring its strong market position and proactive approach in this rapidly developing sector.

Advanced Roofing Systems, under brands like Elevate, is a significant contributor to Holcim's Solutions & Products segment. This area is experiencing robust growth, fueled by demand in both new building projects and the essential repair and renovation market. Holcim's strategic acquisitions in advanced roofing are solidifying its market leadership and expanding its reach.

Carbon Capture, Utilization, and Storage (CCUS) Projects

Holcim is making significant investments in Carbon Capture, Utilization, and Storage (CCUS) projects, aiming to be a leader in near-zero cement production. Initiatives like the GO4ZERO plant in Belgium and the OLYMPUS project in Greece exemplify this commitment. These ventures, though requiring substantial capital, are seen as vital for securing future market share in the growing segment of decarbonized construction materials.

These CCUS projects directly address the increasing global demand for sustainable building solutions. By positioning itself at the forefront of this technological advancement, Holcim is tapping into a high-growth market. For instance, the cement industry is responsible for about 8% of global CO2 emissions, making CCUS a critical area for innovation and market differentiation.

- Investment in CCUS: Holcim's GO4ZERO plant in Belgium is designed to capture up to 1.3 million tonnes of CO2 annually.

- Strategic Importance: These projects are crucial for Holcim's strategy to offer low-carbon and net-zero cement products.

- Market Demand: The demand for sustainable construction materials is projected to grow significantly, with CCUS technologies playing a key role.

- Technological Advancement: Holcim's commitment to CCUS places it as an innovator in a sector undergoing rapid decarbonization.

High-Growth Markets in Latin America

Holcim's Latin American operations are a prime example of its Star category. These markets consistently show robust profitability and industry-leading margins, signifying a dominant market share within a region experiencing significant expansion. For instance, in 2024, Holcim reported strong performance in Latin America, with sales growth exceeding 10% year-over-year, driven by infrastructure development and a recovering construction sector.

The company's strategic approach includes targeted acquisitions, such as the expansion of its presence in Peru and Mexico during 2023 and early 2024. These moves bolster its position in already attractive and growing markets. Guatemala also remains a key focus area, contributing substantially to the region's overall success.

- Latin America's economic growth: Projections for 2024 indicate GDP growth of around 2.5% across key Latin American economies where Holcim operates.

- Holcim's market share: In several Latin American countries, Holcim holds leading positions, with market shares often above 30% in cement and concrete.

- Acquisition impact: Recent acquisitions in Peru and Mexico are expected to add an estimated $200 million in annual revenue for Holcim by the end of 2024.

- Profitability metrics: Holcim's EBITDA margins in Latin America have consistently outperformed the group average, reaching approximately 22% in the first half of 2024.

Holcim's advanced roofing systems, including brands like Elevate, are performing exceptionally well, fitting the Star category. This segment benefits from strong demand in both new construction and the crucial repair and renovation markets, indicating high growth potential and a solid market position for Holcim.

| Product/Segment | BCG Category | 2024 Performance Indicators | Strategic Significance |

|---|---|---|---|

| ECOPact & ECOPlanet | Stars | High sales growth, increasing market share in sustainable building materials. | Addresses growing demand for green construction, drives profitable growth. |

| ECOCycle Technology | Stars | Surpassed 2025 recycled materials targets, significant volume growth. | Leadership in circular construction, aligns with sustainability focus. |

| Advanced Roofing Systems (e.g., Elevate) | Stars | Robust growth in new build and renovation markets. | Solidifies market leadership, expands reach through strategic acquisitions. |

| Latin American Operations | Stars | Sales growth exceeding 10% YoY in 2024, industry-leading margins. | Dominant market share in expanding region, strategic acquisitions enhance position. |

What is included in the product

The Holcim BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Holcim BCG Matrix clarifies resource allocation, easing the pain of inefficient investment decisions.

Cash Cows

Holcim's traditional cement production is a classic Cash Cow within its BCG Matrix. This segment boasts a substantial global market share, consistently delivering robust and stable cash flows that underpin the company's broader strategic initiatives.

Despite operating in a mature, lower-growth market, this foundational business provides the essential financial bedrock for Holcim's investments in more dynamic areas like sustainable building solutions. Its extensive operational footprint and deeply entrenched customer relationships guarantee ongoing profitability and financial resilience.

For 2024, Holcim reported a significant contribution from its cement business to overall group sales, underscoring its role as a primary cash generator. This segment’s predictable revenue streams are vital for funding research and development into greener cement alternatives and circular economy initiatives.

Holcim's aggregates business, encompassing crushed stone, sand, and gravel, operates in a mature market where the company enjoys a robust position. This segment is a significant contributor to Holcim's cash flow, acting as a cornerstone of its financial strength.

Recent strategic acquisitions in Europe and North America have been instrumental in bolstering Holcim's market share within the aggregates sector. These moves, completed prior to the spin-off of its North American business, demonstrate a clear intent to consolidate and expand its presence in key geographies.

The aggregates segment is characterized by its relatively low capital expenditure requirements for maintenance. This efficiency translates into strong cash conversion, meaning a larger portion of the revenue generated is available as free cash flow, supporting other business activities or shareholder returns.

Ready-mix concrete for Holcim is a classic Cash Cow, holding a substantial market share within a mature industry. This stability is crucial, as it translates into a consistent and reliable revenue stream for the company.

The localized operational model and the steady demand for construction materials mean Holcim's ready-mix concrete business doesn't face the volatility often seen in other sectors. This predictability allows for efficient resource allocation and planning.

With established production facilities and distribution networks already in place, Holcim benefits from lower promotional and marketing costs for its ready-mix concrete. This operational efficiency directly contributes to its strong cash-generating capabilities.

In 2023, Holcim reported strong performance in its Europe, Middle East & Africa segment, which includes significant ready-mix concrete operations, demonstrating the continued strength of these mature markets.

Established European Operations

Holcim's established European operations represent a significant Cash Cow within its portfolio. These operations have demonstrated consistent performance, particularly in recurring EBIT growth and margin expansion. This strength is largely attributed to the increasing adoption of sustainable building solutions, a segment where Holcim holds a strong market position.

The European market, while mature, is strategically important and benefits from a robust pipeline of infrastructure projects. This ongoing development ensures sustained demand for Holcim's products and services. The company's ability to leverage its established presence and product innovation in this region solidifies its Cash Cow status.

- Strong Recurring EBIT Growth: Holcim's European segment has shown consistent year-over-year increases in recurring EBIT, reflecting operational efficiency and market demand. For instance, in 2023, the region contributed significantly to the group's overall profitability, with EBIT margins in Europe often outperforming global averages.

- Margin Expansion Driven by Sustainability: The focus on sustainable building solutions has been a key driver for margin expansion. Holcim's ECOPact concrete, for example, has seen substantial uptake across Europe, commanding premium pricing due to its reduced carbon footprint.

- High Market Share in a Mature Market: Holcim maintains a leading market share in several key European countries. This dominance in a stable, albeit mature, market allows for predictable cash flow generation.

- Robust Infrastructure Pipeline: Significant government investments in infrastructure renewal and green energy projects across the EU, such as the European Green Deal initiatives, provide a steady stream of demand for Holcim's core offerings.

Strong Free Cash Flow Generation

Holcim's position as a cash cow is strongly supported by its impressive free cash flow generation. In 2024, the company reported free cash flow exceeding CHF 3.8 billion. This substantial financial inflow is expected to continue, with projections indicating around CHF 2 billion post-spin-off in 2025, underscoring the stability and maturity of its core businesses.

This consistent and robust cash generation is a hallmark of a healthy cash cow. It provides Holcim with the necessary financial flexibility to pursue various strategic objectives. These include funding internal growth initiatives, executing strategic acquisitions to further strengthen its market position, and delivering returns to shareholders through dividends or share buybacks.

- Consistent Free Cash Flow: Holcim generated over CHF 3.8 billion in free cash flow in 2024.

- Projected Stability: Post-spin-off in 2025, free cash flow is projected to be around CHF 2 billion.

- Financial Flexibility: Robust cash generation enables funding of growth, acquisitions, and shareholder returns.

- Operational Efficiency: Strong performance in mature segments drives this financial strength.

Holcim's cement, aggregates, and ready-mix concrete businesses are prime examples of Cash Cows within its BCG Matrix. These segments benefit from high market share in mature industries, consistently generating substantial and stable cash flows. This financial strength is crucial, providing the capital needed to invest in newer, high-growth areas.

The company's robust free cash flow generation, exceeding CHF 3.8 billion in 2024, is a testament to the maturity and efficiency of these core operations. This predictable income stream allows Holcim significant financial flexibility for strategic investments and shareholder returns.

| Business Segment | BCG Category | Key Characteristics | 2024 Financial Highlight |

|---|---|---|---|

| Cement Production | Cash Cow | High market share, stable demand, mature market | Significant contributor to group sales, primary cash generator |

| Aggregates | Cash Cow | Robust market position, low capital expenditure needs, strong cash conversion | Key contributor to group cash flow, foundational financial strength |

| Ready-Mix Concrete | Cash Cow | Substantial market share, localized operations, steady demand, low marketing costs | Consistent and reliable revenue stream |

Full Transparency, Always

Holcim BCG Matrix

The Holcim BCG Matrix preview you are currently viewing is the identical, fully unlocked document you will receive immediately after purchase. This comprehensive report, meticulously crafted by industry analysts, offers a clear and actionable strategic overview of Holcim's business units. You can confidently rely on this preview as a true representation of the professional-grade analysis that will be yours to download, edit, and implement for your strategic decision-making.

Dogs

Holcim has strategically divested non-core assets, a move often seen in BCG Matrix analysis where a company sheds "Dogs" – businesses with low market share in low-growth industries. For instance, Holcim's divestment from its former India business, which had a relatively small market share in a competitive landscape, exemplifies this strategy. Such divestitures free up valuable capital and management attention.

These divested entities, like Karbala Cement Manufacturing in Iraq, likely operated in markets with limited growth potential and faced significant challenges. By exiting these operations, Holcim can reallocate resources towards higher-potential segments of its portfolio, aiming to improve overall profitability and shareholder value. This aligns with a proactive approach to portfolio management.

Outdated production facilities at Holcim, those not aligned with its low-carbon roadmap, likely fall into the Dogs category of the BCG Matrix. These older plants often struggle with higher operating costs and reduced efficiency compared to modern facilities. For instance, while Holcim invested €1.2 billion in sustainability initiatives in 2023, older plants might not be fully benefiting from these upgrades, leading to a lower return on investment for those specific assets.

Niche, non-sustainable products within Holcim's portfolio represent offerings that don't fit the company's overarching sustainability goals and possess limited market appeal. These are often traditional, smaller-scale items with little competitive edge. For instance, if Holcim were to maintain a line of non-eco-friendly cement additives in a market increasingly demanding green building materials, this would exemplify such a category.

These products typically occupy a small slice of the market, often within sub-sectors that are either stagnant or shrinking. Their presence is usually a result of divestiture challenges or situations where the cost of exiting the market outweighs the benefits of doing so. In 2024, Holcim's strategic focus has been heavily on sustainable solutions, with investments in low-carbon concrete and circular economy initiatives, making these niche, non-sustainable products increasingly out of sync with the company's forward-looking strategy.

Operations in Highly Fragmented, Low-Growth Local Markets

Operations in highly fragmented, low-growth local markets are often characterized as Dogs within the BCG Matrix. These segments within Holcim’s portfolio typically exhibit low relative market share and operate in industries with minimal expansion prospects. For instance, in some smaller, established European markets where Holcim might have a presence, the construction materials sector could be experiencing near-zero growth, with numerous small, local players competing. This scenario makes it challenging to achieve economies of scale or significant market penetration.

These Dog units face inherent difficulties in generating substantial returns or cash flow. Their inability to capture a dominant market position in a stagnant environment limits their potential for growth. Holcim's strategy for such operations would likely focus on cost optimization, efficiency improvements, or potentially divesting these assets to redeploy capital into more promising areas of the business. In 2024, for example, Holcim continued its portfolio optimization, which could involve the sale of smaller, underperforming regional businesses that fit this description.

- Low Market Share: Operations in markets with many small competitors, where Holcim holds a minor stake.

- Stagnant Growth: Industries experiencing very little to no annual expansion, limiting opportunities for increased sales volume.

- Resource Reallocation: Potential for divestment or restructuring to free up capital for higher-growth ventures.

- Efficiency Focus: Emphasis on maximizing operational efficiency and cost control to maintain profitability, however limited.

Inefficient Legacy Logistics or Supply Chain Components

Inefficient legacy logistics or supply chain components within Holcim represent areas not yet fully integrated into their digital transformation. These segments, characterized by manual processes and outdated systems, likely incur higher operational costs and slower delivery times. For instance, older warehousing management systems or manual route planning for certain delivery fleets could fall into this category, consuming resources without delivering optimal efficiency.

These underperforming segments act as drains on the company's resources, failing to contribute to a competitive advantage. In 2024, Holcim's ongoing digital initiatives, such as the implementation of ConcreteDirect for customer order management and the Logistics Optimizer for route and fleet efficiency, directly target these legacy areas. The goal is to streamline operations, reduce waste, and improve overall supply chain agility.

- High operational costs: Manual processes in legacy logistics lead to increased labor and error correction expenses.

- Slow delivery times: Outdated systems hinder real-time tracking and efficient route optimization, impacting customer satisfaction.

- Resource drain: These segments consume capital and personnel without generating significant returns or competitive differentiation.

- Digital transformation targets: Holcim's investment in ConcreteDirect and Logistics Optimizer aims to convert these inefficiencies into strengths.

Holcim's "Dogs" are essentially business units or product lines that operate in slow-growing markets and hold a small market share. These are often characterized by older, less efficient operations or niche products that don't align with the company's sustainability focus. For example, legacy logistics systems or non-eco-friendly additives might fit this description. Holcim's strategy typically involves either improving efficiency or divesting these assets to reallocate resources to more promising areas, a move that continued to be a focus in 2024.

These underperforming segments, like outdated production facilities not aligned with low-carbon goals, represent areas with limited growth potential and often higher operating costs. Holcim invested €1.2 billion in sustainability in 2023, highlighting the contrast with older plants that may not fully benefit. Divesting non-core assets, such as its former India business, exemplifies shedding these "Dogs" to free up capital and management focus for higher-potential segments.

Operations in fragmented, low-growth local markets, where Holcim has a minor stake, are prime examples of "Dogs." These segments struggle to generate substantial returns due to stagnant industries and intense competition. Holcim's ongoing portfolio optimization in 2024 likely included the sale of such smaller, underperforming regional businesses to redirect capital into more strategic ventures.

| Category | Characteristics | Holcim Example | Strategic Action | 2024 Focus Relevance |

| Dogs | Low market share, low market growth | Legacy logistics, non-sustainable niche products, smaller regional businesses | Divestment, restructuring, cost optimization | Continued portfolio optimization, digital transformation of logistics |

Question Marks

Holcim's emerging digital construction platforms, such as ConcreteDirect for supply chain management and OptiCEM for concrete mix optimization, exhibit characteristics of question marks in the BCG matrix. These innovative solutions address critical industry needs for efficiency and sustainability, indicating high potential for growth and market disruption.

While these digital tools offer significant value, their market share and adoption rates are still in their nascent stages, requiring substantial investment to achieve scale. For instance, the global construction technology market was valued at approximately $11.4 billion in 2023 and is projected to grow significantly, but widespread integration of new platforms like Holcim's is a gradual process.

The success of these platforms is contingent upon rapid customer uptake and seamless integration into established construction workflows. As of early 2024, the construction industry is increasingly embracing digital transformation, with a growing demand for solutions that enhance productivity and reduce waste, creating a fertile ground for these question mark offerings to mature.

Holcim's investments in novel sustainable building materials, such as advanced bio-composites or carbon-negative concrete additives, are firmly in the question mark category of the BCG matrix. These nascent technologies, while holding significant potential for future market disruption and environmental impact, are currently in their infancy, demanding considerable research and development expenditure with uncertain commercial viability.

For instance, the company's exploration into mycelium-based insulation or recycled plastic aggregates represents a high-risk, high-reward proposition. While the global market for sustainable construction materials is projected to reach over $400 billion by 2027, these cutting-edge materials are yet to capture a meaningful share, necessitating substantial upfront capital for scaling production and market education.

Holcim's advanced insulation and building envelope solutions, while a growing area within its Solutions & Products segment, are likely positioned as Question Marks when expanding into new geographic regions or highly competitive specialized markets. This means they are entering markets with high growth potential, but currently hold a small market share and face strong established competitors.

For example, in 2023, the global building insulation market was valued at approximately $55 billion and is projected to reach over $80 billion by 2028, indicating significant growth opportunities. Holcim's strategic acquisitions, like the acquisition of Malarkey Roofing Products in 2021, demonstrate an intent to bolster its offerings in these advanced areas, but gaining substantial traction against established players in new territories requires sustained effort and investment.

New Strategic Acquisitions in Nascent Markets

Holcim's strategic acquisitions in nascent markets are designed to be value-accretive bolt-on moves, aiming to establish a foothold in attractive, high-growth segments. These new ventures, while potentially starting with a low market share, are positioned within burgeoning industries, offering significant future potential. For instance, Holcim's 2024 expansion into the green building materials market in Southeast Asia, a region experiencing rapid urbanization, exemplifies this strategy. The initial investment focuses on integrating these new entities and fostering their growth, with the aim of transforming them into future Stars within the BCG matrix.

These acquisitions are crucial for Holcim's long-term growth trajectory, allowing the company to diversify its portfolio and tap into emerging demand. The company's 2024 financial reports indicate a dedicated capital allocation of approximately €500 million towards such strategic market entries and integrations. The success of these nascent market plays hinges on effective operational integration and sustained investment to capture market share and drive profitability.

- Market Entry: Targeting nascent markets with high growth potential, such as sustainable construction solutions in developing economies.

- Low Initial Share: These acquisitions often begin with a modest market presence, requiring focused development.

- Integration Investment: Significant capital and management resources are deployed to integrate and scale operations for future growth.

- Star Potential: The objective is to cultivate these new market entries into leading positions, transforming them into Stars.

Specific Decarbonization Technologies (e.g., Green Hydrogen applications)

Holcim is actively exploring green hydrogen as a decarbonization pathway for cement production. This technology, while promising for reducing direct emissions, is still in its early stages of development and commercialization within the sector.

While large-scale carbon capture, utilization, and storage (CCUS) is a significant focus, Holcim's investment in areas like green hydrogen signifies a commitment to a broader range of innovative solutions. These emerging technologies are vital for achieving ambitious net-zero targets, though they currently face challenges in market adoption and scalability, necessitating considerable financial commitment and risk management.

- Green Hydrogen Potential: Offers a pathway to reduce direct CO2 emissions in cement manufacturing, potentially replacing fossil fuels in kilns.

- Early Stage Development: Holcim's involvement in pilot projects indicates a focus on nascent technologies with unproven large-scale viability in cement.

- High Growth, High Risk: These technologies represent significant long-term growth potential but are characterized by limited current market share and require substantial investment.

- Strategic Importance: Crucial for Holcim's long-term net-zero strategy, despite the inherent risks and need for further technological advancement.

Holcim's investments in emerging digital construction platforms and novel sustainable building materials are classic examples of Question Marks in the BCG matrix. These initiatives, while holding substantial promise for future growth and market disruption, currently possess low market share and require significant investment to scale. For instance, the global construction technology market was valued at approximately $11.4 billion in 2023, with Holcim's digital platforms aiming to capture a slice of this expanding pie.

The company's strategic acquisitions in nascent markets, such as its 2024 expansion into the green building materials sector in Southeast Asia, also fall into this category. These ventures are characterized by high growth potential but a low initial market share, necessitating substantial capital allocation, with Holcim earmarking around €500 million in 2024 for such strategic entries.

Furthermore, Holcim's exploration into green hydrogen for cement production represents a high-risk, high-reward Question Mark. While vital for its net-zero ambitions, this technology is still in early development, demanding considerable R&D and facing uncertain commercial viability in the current market landscape.

| Holcim Business Area | BCG Category | Market Potential | Current Market Share | Investment Needs |

|---|---|---|---|---|

| Digital Construction Platforms (e.g., ConcreteDirect) | Question Mark | High (Construction Tech Market ~$11.4B in 2023) | Low | High (R&D, Adoption Drive) |

| Novel Sustainable Materials (e.g., bio-composites) | Question Mark | High (Sustainable Building Materials Market >$400B by 2027) | Low | High (Scaling Production, Market Education) |

| Green Building Materials (New Market Entry, e.g., SE Asia) | Question Mark | High (Rapid Urbanization) | Low (Initial Stage) | High (Integration, Growth Capital ~€500M in 2024) |

| Green Hydrogen for Cement Production | Question Mark | High (Decarbonization Pathway) | Very Low (Early Stage Development) | Very High (R&D, Pilot Projects, Scalability) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.