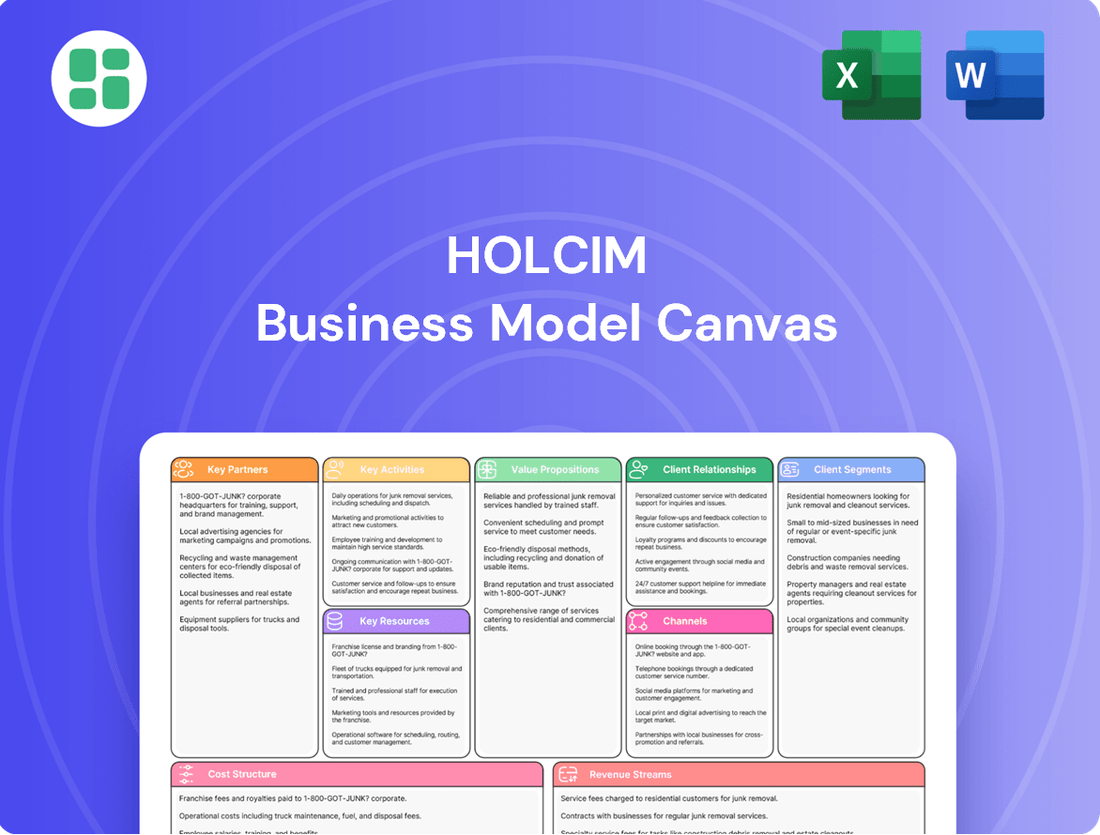

Holcim Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holcim Bundle

Unlock the strategic blueprint behind Holcim's industry dominance with our comprehensive Business Model Canvas. Discover how they effectively manage customer relationships, leverage key resources, and generate revenue in the competitive building materials sector. This detailed analysis is your key to understanding their success.

Partnerships

Holcim is forging key partnerships with leading technology providers and research institutions to accelerate the development and deployment of carbon capture, utilization, and storage (CCUS) solutions. These alliances are fundamental to their ambitious goal of reducing CO2 emissions by 20% by 2030 compared to 2022 levels.

Collaborations with innovators enable Holcim to pilot cutting-edge technologies, such as their partnerships with Carbonauten for CO2-absorbing binders, and integrate these advancements into their global operations, driving the future of sustainable construction.

Holcim's operational backbone relies on robust relationships with a wide array of raw material suppliers, including crucial elements like limestone, clay, and gypsum. These partnerships are vital for maintaining consistent production levels across their global operations.

Furthermore, Holcim actively cultivates partnerships with providers of alternative fuels, such as waste-derived fuels. This strategic focus not only diversifies their energy sources but also underpins their commitment to circular economy principles by integrating recycled materials and lessening dependence on virgin resources.

In 2024, Holcim continued to emphasize sustainable sourcing, with alternative fuels accounting for a significant portion of their energy mix, contributing to their decarbonization goals and operational resilience.

Holcim collaborates closely with major construction and development companies, acting as a vital link in large-scale projects. These partnerships are crucial for driving demand, as these firms are the primary specifiers and purchasers of Holcim's extensive range of building materials and innovative solutions across the globe.

For instance, in 2023, Holcim announced a significant partnership with a leading European infrastructure developer for a major high-speed rail project, requiring substantial volumes of low-carbon concrete. These relationships often extend beyond simple transactions, fostering co-development of tailored material solutions and shared commitments to ambitious sustainability targets, such as reducing embodied carbon in construction.

Waste Management and Recycling Companies

Holcim partners with waste management and recycling firms to secure construction and demolition materials (CDM) for its circular economy initiatives. These collaborations are crucial for sourcing the raw materials needed to produce low-carbon cement and concrete, directly supporting Holcim's ambitious goals for incorporating recycled content. For instance, in 2023, Holcim expanded its use of recycled materials, with specific targets for recycled content in its cement and concrete products across various regions.

These partnerships are fundamental to Holcim's strategy for driving circular construction. They involve the collection, meticulous sorting, and advanced processing of waste streams, ensuring that materials are prepared for reintegration into Holcim's manufacturing processes. This operational synergy is key to meeting the company's sustainability objectives and reducing reliance on virgin resources.

- Sourcing Recycled Content: Partnerships enable Holcim to access and process CDM, a vital feedstock for their recycled-content products.

- Circular Economy Enablement: Collaborations facilitate the collection and sorting infrastructure necessary for effective waste stream management.

- Sustainability Targets: These alliances are instrumental in achieving Holcim's stated goals for increasing the percentage of recycled materials used in its cement and concrete production.

- Operational Efficiency: Streamlined waste processing through these partnerships enhances the efficiency of Holcim's circular manufacturing operations.

Academic and Research Institutions

Holcim actively partners with academic and research institutions to drive innovation in sustainable building. These collaborations are crucial for advancing material science and developing next-generation low-carbon products. For instance, research into novel binders and recycled materials directly informs the development of Holcim's ECOPact and ECOPlanet product lines, aiming to significantly reduce the carbon footprint of construction.

These partnerships enable Holcim to explore cutting-edge solutions for the future of the built environment. By engaging with universities and research bodies, the company stays at the forefront of technological advancements, ensuring its product pipeline remains competitive and aligned with global sustainability goals. In 2023, Holcim's R&D investments were substantial, with a significant portion allocated to these collaborative research efforts.

- University Collaborations: Partnerships with leading universities globally to research advanced concrete technologies and circular economy principles.

- Research Body Engagement: Working with institutes focused on climate science and sustainable materials to validate and enhance product performance.

- Innovation Hubs: Establishing joint innovation centers with academic partners to accelerate the development and testing of new building solutions.

- Talent Development: Sponsoring research projects and internships to nurture future talent in the field of sustainable construction.

Holcim's key partnerships are pivotal for its sustainability and innovation agenda, particularly in areas like carbon capture and circular economy initiatives. These collaborations are essential for accessing new technologies and securing vital raw materials.

The company actively partners with technology providers for CCUS solutions, aiming to cut CO2 emissions by 20% by 2030 from 2022 levels. In 2023, Holcim expanded its use of recycled materials, with specific targets for recycled content in its cement and concrete products across various regions.

Collaborations with waste management firms are crucial for sourcing construction and demolition materials (CDM) to produce low-carbon cement and concrete. Holcim also works with providers of alternative fuels, which formed a significant portion of their energy mix in 2024, supporting decarbonization goals.

Furthermore, Holcim partners with construction and development companies to drive demand for its sustainable building materials. These relationships often involve co-development of tailored solutions, such as low-carbon concrete for major infrastructure projects, exemplified by a significant partnership in 2023 with a European developer.

| Type of Partner | Focus Area | Impact/Goal | Example/Data Point |

| Technology Providers | CCUS Solutions | Accelerate CO2 emission reduction | Partnerships for CO2-absorbing binders |

| Waste Management Firms | Circular Economy | Source CDM for low-carbon products | Expanded use of recycled materials in 2023 |

| Alternative Fuel Providers | Energy Diversification | Reduce reliance on virgin resources | Alternative fuels significant in 2024 energy mix |

| Construction Companies | Project Demand | Drive adoption of sustainable materials | Partnership for low-carbon concrete in high-speed rail project (2023) |

What is included in the product

A detailed breakdown of Holcim's strategy, outlining its customer segments, value propositions, and channels for sustainable building solutions.

Holcim's Business Model Canvas acts as a pain point reliever by offering a structured, visual overview that simplifies complex strategies, making them easier to understand and adapt.

It streamlines the process of identifying and addressing operational challenges by providing a clear, one-page snapshot of critical business elements.

Activities

Holcim's primary activities revolve around the large-scale manufacturing of essential building materials. This includes the production of cement, aggregates like crushed stone and sand, and ready-mix concrete, forming the backbone of construction projects globally.

Managing extensive quarrying operations for raw materials and operating numerous cement plants are critical to their production process. In 2024, Holcim continued to invest in optimizing these operations for efficiency and sustainability.

Maintaining a vast network of ready-mix concrete facilities is also a key activity, ensuring their products are readily available to customers across diverse geographic locations. This widespread presence supports their ability to serve a broad range of construction needs.

Holcim dedicates significant resources to research and development, focusing on creating innovative, sustainable building materials. This commitment is evident in their continuous investment aimed at expanding their portfolio of circular and low-carbon solutions. For instance, their ECOPact and ECOPlanet product lines represent a core output of this R&D effort, offering alternatives to traditional cement and concrete with reduced environmental impact.

The company's R&D also targets enhanced energy efficiency in buildings. They are actively developing advanced roofing and insulation systems designed to minimize energy consumption throughout a building's lifecycle. This strategic focus on innovation helps Holcim meet growing market demand for greener construction practices and regulatory requirements.

Holcim's key activities heavily rely on efficiently managing its extensive global supply chain. This encompasses everything from sourcing raw materials like cement, aggregates, and admixtures to ensuring the timely delivery of finished products, such as concrete and building materials, to construction sites worldwide.

The company navigates complex logistics, utilizing diverse transportation networks including rail, sea, and road, to optimize delivery routes and minimize costs. In 2024, Holcim continued to invest in digitalizing its supply chain operations, aiming for greater visibility and agility in managing inventory and responding to market demands across its many operating regions.

Mergers, Acquisitions, and Divestments

Holcim actively pursues mergers and acquisitions to bolster its presence in key growth markets and broaden its portfolio of sustainable building solutions. This strategy is crucial for expanding its geographic reach and integrating innovative technologies. For instance, in 2023, Holcim completed 20 acquisitions, adding approximately CHF 1.5 billion to its net sales, demonstrating a clear commitment to inorganic growth.

Conversely, strategic divestments are employed to refine the company's operational focus and enhance profitability. By shedding non-core assets, Holcim can concentrate resources on high-growth areas and segments that align with its long-term sustainability objectives. The planned spin-off of Amrize, for example, is a move to streamline its business and unlock value.

- Portfolio Optimization: Holcim uses M&A to enter attractive markets and expand its product and solution offerings.

- Strategic Divestments: Divestments help streamline operations and focus on core, high-value business segments.

- Growth Through Acquisition: In 2023, Holcim completed 20 acquisitions, contributing CHF 1.5 billion to net sales.

- Focus on Sustainability: Divestments support a sharper focus on businesses aligned with sustainability goals.

Sales, Marketing, and Customer Technical Support

Holcim's key activities heavily involve promoting and selling its extensive portfolio of building materials and solutions. This includes a strong emphasis on their specialized sustainable product lines, such as ECOPact concrete and ECOPlanet cement, which are crucial for meeting evolving market demands for greener construction. In 2024, Holcim continued to expand its offering of low-carbon solutions, aiming to significantly reduce the environmental impact of building projects.

Providing robust technical support and expertise is another core activity. Holcim assists customers in navigating their product offerings, ensuring they select the most appropriate and sustainable building solutions tailored to specific project requirements. This hands-on approach helps customers optimize material usage and achieve their sustainability goals.

- Sales and Marketing Focus: Holcim actively promotes its diverse range of building materials and solutions, with a particular emphasis on sustainable innovations.

- Customer Technical Support: The company provides essential technical expertise to guide customers in choosing and effectively utilizing the most suitable and environmentally friendly building solutions for their projects.

- 2024 Performance Indicator: Holcim reported a significant increase in sales of its low-carbon products in 2024, reflecting growing market adoption of sustainable building practices.

- Strategic Emphasis: The company's strategy prioritizes educating the market on the benefits of sustainable building materials through targeted marketing campaigns and direct customer engagement.

Holcim's key activities center on the production and distribution of building materials, with a strong focus on innovation in sustainable solutions. This includes manufacturing cement, aggregates, and ready-mix concrete, while also investing heavily in R&D for low-carbon and circular economy products. The company actively manages its global supply chain for efficient sourcing and delivery, and pursues strategic acquisitions and divestments to optimize its portfolio and market presence.

| Key Activity | Description | 2024/2023 Data Point |

| Manufacturing & Production | Large-scale production of cement, aggregates, and ready-mix concrete. | Continued investment in operational efficiency and sustainability. |

| Research & Development | Development of innovative, sustainable building materials and energy-efficient systems. | Expansion of ECOPact and ECOPlanet product lines. |

| Supply Chain Management | Managing global sourcing, logistics, and timely delivery of products. | Investment in digitalization for enhanced supply chain visibility and agility. |

| Mergers & Acquisitions / Divestments | Strategic acquisitions to expand market presence and portfolio; divestments to refine focus. | Completed 20 acquisitions in 2023, adding CHF 1.5 billion to net sales. |

| Sales & Marketing | Promoting building materials and solutions, with emphasis on sustainable offerings. | Significant increase in sales of low-carbon products reported in 2024. |

Delivered as Displayed

Business Model Canvas

The Holcim Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing a direct representation of the comprehensive analysis and strategic framework that will be yours to utilize. Once your order is complete, you'll gain full access to this same, professionally structured Business Model Canvas, ready for immediate application.

Resources

Holcim's extensive global production network is a cornerstone of its business model, featuring a vast array of manufacturing plants, quarries, and ready-mix concrete facilities. This infrastructure is strategically positioned across key regions including Europe, Latin America, and Asia, Middle East & Africa, demonstrating a commitment to widespread market presence.

This geographically diverse footprint is crucial for enabling a local-for-local production and distribution strategy. By maintaining proximity to its customer base, Holcim can ensure efficient supply chains and responsive service, a key competitive advantage in the building materials sector.

In 2023, Holcim operated over 2,000 sites globally, a testament to the scale and reach of its production capabilities. This network allows the company to serve diverse local needs while leveraging global expertise and economies of scale, contributing to its robust market position.

Holcim's proprietary technology is a cornerstone of its business model, particularly its innovations in low-carbon cement and concrete. Products like ECOPact and ECOPlanet are direct results of this technological investment, offering customers more sustainable building options. This focus on green solutions is increasingly vital in a market driven by environmental regulations and corporate sustainability goals.

Beyond core cementitious materials, Holcim's intellectual property encompasses advanced building systems. This includes their roofing and insulation solutions, which contribute to energy efficiency in buildings. By owning these technologies, Holcim secures a distinct competitive advantage, allowing them to offer integrated, high-performance building envelopes.

In 2024, Holcim continued to emphasize its commitment to innovation, with a significant portion of its research and development budget allocated to sustainable building materials. For instance, the company announced further advancements in its ECOPlanet range, aiming to reduce CO2 emissions by up to 70% compared to traditional cement. This ongoing investment in proprietary technology directly supports their strategic objective of leading the green building revolution.

Holcim’s business model heavily relies on its access to and ownership of substantial reserves of key raw materials. These include essential components like limestone, aggregates such as sand and gravel, and clay. These natural resources are the bedrock for their primary products: cement and concrete.

In 2024, Holcim continued to emphasize the strategic importance of its quarrying operations. The company manages a vast network of quarries globally, ensuring a consistent and cost-effective supply chain for its manufacturing facilities. This vertical integration provides a significant competitive advantage by controlling a critical input cost.

Skilled Workforce and Expertise

Holcim's business model hinges on a highly skilled workforce, encompassing engineers, scientists, logistics specialists, and sales professionals. This deep pool of expertise is fundamental to their operations and market standing.

Their collective knowledge in material science, sustainable construction practices, and optimizing operational efficiency is what fuels innovation and secures Holcim's competitive edge. This human capital is a primary driver of their success.

- Engineers and Scientists: Drive research and development in new building materials and sustainable solutions.

- Logistics Specialists: Ensure efficient supply chain management for raw materials and finished products, a critical factor in cost control and timely delivery.

- Sales and Technical Support: Provide crucial customer engagement and expertise in applying Holcim's products effectively.

- Sustainability Experts: Guide the company's commitment to eco-friendly practices and product development, aligning with market demand and regulatory trends.

Strong Brand Portfolio and Reputation

Holcim's key resources include a robust portfolio of well-regarded brands such as ECOPact, ECOPlanet, and Elevate. These brands are synonymous with quality and sustainability within the building materials sector, providing a significant competitive edge.

The company's reputation as a frontrunner in developing innovative and sustainable building solutions is a crucial intangible asset. This strong brand equity and positive public perception directly translate into customer loyalty and market trust.

- Brand Recognition: Holcim's flagship brands are widely recognized for their commitment to sustainability and high performance.

- Market Trust: The company's established reputation fosters trust among customers, partners, and investors.

- Innovation Leadership: Holcim is perceived as a leader in developing and promoting eco-friendly building materials and solutions.

- Customer Loyalty: The strength of its brands contributes to strong customer retention and repeat business.

Holcim's key resources are its extensive global production network, proprietary technologies in sustainable building materials, significant raw material reserves, a highly skilled workforce, and strong brand equity. These elements collectively form the foundation of its competitive advantage and market leadership.

The company's commitment to innovation is evident in its development of low-carbon solutions like ECOPlanet, which in 2024 aimed for up to 70% CO2 reduction. This focus on R&D, coupled with control over raw materials like limestone and aggregates through its quarrying operations, ensures cost efficiency and supply chain reliability.

Holcim's workforce, comprising engineers, scientists, and logistics specialists, drives operational excellence and market responsiveness. Furthermore, its well-recognized brands, such as ECOPact and Elevate, foster customer loyalty and reinforce its image as an innovation leader in the green building sector.

| Key Resource | Description | 2024/2023 Impact |

| Global Production Network | Over 2,000 sites worldwide, including plants and quarries. | Enables local-for-local strategy, efficient supply chains. |

| Proprietary Technology | Innovations in low-carbon cement (e.g., ECOPlanet). | Supports sustainability goals, targets up to 70% CO2 reduction in ECOPlanet. |

| Raw Material Reserves | Access to limestone, aggregates, clay. | Ensures consistent, cost-effective supply for manufacturing. |

| Skilled Workforce | Engineers, scientists, logistics, sales professionals. | Drives innovation, operational efficiency, and customer support. |

| Brand Portfolio | ECOPact, ECOPlanet, Elevate. | Builds market trust, customer loyalty, and innovation leadership perception. |

Value Propositions

Holcim provides a wide array of building materials and solutions focused on innovation and sustainability. Their ECOPact low-carbon concrete and ECOPlanet green cement are prime examples, actively lowering the environmental impact of construction. In 2024, Holcim reported a 10% increase in sales for their sustainable product range, highlighting market demand for these solutions.

Holcim's commitment to a reduced carbon footprint and circularity is central to its value proposition. By offering products with significantly lower embodied carbon, like ECOPact concrete, Holcim directly assists customers in meeting their sustainability targets. This focus on decarbonization is not just about new materials; it's also about transforming waste into valuable resources.

A key aspect of this is Holcim's integration of recycled construction and demolition materials into their offerings. For instance, in 2023, Holcim processed over 3 million tonnes of construction and demolition waste globally, diverting it from landfills. This circular approach not only minimizes environmental impact but also conserves precious natural resources, making construction more sustainable from the ground up.

Holcim's commitment to high-quality and performance-driven products is a cornerstone of its business model. They offer a range of building materials, including advanced cementitious products and innovative concrete solutions, designed to exceed rigorous industry benchmarks. These materials are engineered for exceptional durability and structural integrity, ensuring projects stand the test of time.

In 2024, Holcim continued to emphasize product innovation, with a focus on low-carbon and sustainable building solutions. For instance, their ECOPlanet range of cement, launched in previous years and actively promoted in 2024, offers significant CO2 reductions compared to traditional cement. This focus directly translates to enhanced long-term value and reduced lifecycle costs for clients across diverse construction sectors.

Comprehensive End-to-End Building Solutions

Holcim goes beyond just supplying cement and aggregates. They provide a full spectrum of building materials and solutions, encompassing everything from precast concrete and asphalt to advanced roofing systems. This comprehensive offering means customers can source all their construction needs from a single, reliable partner.

By offering these integrated, end-to-end solutions, Holcim simplifies the complex process of building for its clients. This approach ensures material compatibility and streamlines procurement, saving valuable time and resources. For instance, in 2024, Holcim's focus on circular economy solutions, like recycled asphalt, further enhanced their value proposition by offering sustainable and cost-effective options.

- Integrated Product Portfolio: Offering precast concrete, asphalt, and roofing systems alongside core materials.

- End-to-End Project Support: Enabling customers to manage projects from foundation to completion with compatible solutions.

- Streamlined Procurement: Simplifying the purchasing process for customers by providing a one-stop shop.

- Sustainability Focus: Incorporating recycled materials like asphalt into their solutions, aligning with 2024 environmental goals.

Global Reach with Localized Expertise

Holcim's global reach, extending across over 70 countries, is a cornerstone of its business model. This expansive network allows the company to leverage international best practices and innovations, ensuring consistent quality and efficiency worldwide.

However, this global scale is complemented by a strong emphasis on localized expertise. Holcim operates with a decentralized structure, empowering local teams who possess intimate knowledge of their respective markets. This deep understanding is crucial for tailoring solutions to specific regional needs, navigating diverse regulatory landscapes, and aligning with unique customer preferences.

In 2024, this dual approach enabled Holcim to effectively respond to varying market demands. For instance, while global R&D efforts might focus on sustainable cement technologies, local teams can adapt these advancements to meet specific building codes or material availability in regions like Southeast Asia or Latin America.

- Global Presence: Operates in over 70 countries, facilitating economies of scale and knowledge sharing.

- Localized Expertise: Decentralized operations ensure solutions are tailored to specific regional needs and regulations.

- Synergy: Combines international best practices with deep local market understanding for optimal responsiveness.

- Market Adaptation: Ability to customize offerings based on local customer preferences and environmental conditions.

Holcim's value proposition centers on delivering innovative and sustainable building solutions that address environmental concerns and enhance project performance. They offer a comprehensive portfolio, including low-carbon concrete and green cement, which directly supports customers in achieving their sustainability goals. This commitment to decarbonization extends to their circular economy initiatives, such as integrating recycled construction waste into their products, as evidenced by their processing of over 3 million tonnes of waste globally in 2023.

Furthermore, Holcim distinguishes itself through high-quality, performance-driven materials engineered for durability and structural integrity. Their focus on innovation, exemplified by the ECOPlanet cement range in 2024, provides clients with enhanced long-term value and reduced lifecycle costs. By offering an integrated range of solutions from foundation to roofing, Holcim simplifies procurement and ensures material compatibility, acting as a single, reliable partner for diverse construction needs.

Customer Relationships

Holcim cultivates enduring customer connections through specialized sales representatives and technical experts. These teams offer tailored guidance on product choices and application methods, ensuring optimal project outcomes and building lasting trust.

Holcim implements dedicated key account management for its largest clients, including major construction firms, government bodies, and significant property developers. This focused approach ensures these crucial partners receive personalized attention and tailored solutions.

This strategy involves deep collaboration on large-scale projects, often co-developing innovative material solutions and logistical plans. For instance, in 2024, Holcim secured a significant contract for a major infrastructure project, leveraging its key account management to provide custom concrete mixes and just-in-time delivery, which was critical to the project's timeline.

By fostering these strategic partnerships, Holcim aims to solidify its role as a preferred supplier, offering flexible supply agreements and dedicated technical support that address the unique demands of high-volume, complex projects, thereby enhancing client loyalty and project success.

Holcim actively partners with customers to advance their sustainability goals, providing eco-friendly products and data-driven insights. For instance, in 2023, Holcim's low-carbon concrete solutions helped customers reduce their CO2 emissions by 1.3 million tonnes.

The company fosters collaborative projects focused on circular economy principles within construction, such as recycling construction and demolition waste. This partnership approach creates shared value by lowering environmental impact and often reducing material costs for clients.

Digital Platforms and E-commerce

Holcim is significantly enhancing customer relationships through its digital platforms and e-commerce initiatives. These digital channels are designed to make it easier and faster for customers to engage with Holcim, from finding product information to placing orders and receiving support.

For instance, Holcim's digital platforms offer a streamlined experience for order placement and access to detailed product information, simplifying the purchasing process. This focus on digital accessibility is particularly beneficial for smaller and mid-sized customers who may not have dedicated procurement teams.

- Digital Order Management: Holcim's e-commerce platforms allow for direct online order placement, reducing lead times and administrative burden.

- Product Information Hubs: Digital channels provide customers with instant access to technical data sheets, safety information, and application guides for Holcim's extensive product range.

- Enhanced Customer Service: Online portals and chat functionalities offer efficient customer support, addressing queries and providing solutions in real-time.

- Targeted Digital Engagement: In 2024, Holcim continued to invest in personalized digital marketing campaigns to reach specific customer segments with relevant product updates and solutions, aiming to increase online engagement by 15% compared to 2023.

Innovation Partnerships and Co-creation

Holcim actively cultivates innovation partnerships with key customers, fostering a co-creation environment to develop tailored building solutions. This collaborative strategy allows for the direct addressing of specific customer challenges and emerging market demands, thereby strengthening crucial business relationships.

This approach is exemplified by Holcim's work with major clients, where joint development projects have led to the creation of bespoke materials and systems. For instance, in 2024, Holcim announced a collaboration with a leading infrastructure developer to engineer a new type of low-carbon concrete mix specifically designed for high-durability bridge construction in challenging environmental conditions.

- Co-creation with Major Clients: Holcim partners with select customers to jointly develop innovative building solutions.

- Addressing Specific Needs: These collaborations focus on creating customized products that solve unique customer challenges or tap into new market opportunities.

- Strengthening Relationships: The deep engagement fosters stronger, more collaborative partnerships, leading to mutual growth and innovation.

- Example in 2024: A partnership with an infrastructure developer led to the creation of a specialized low-carbon concrete for demanding bridge projects.

Holcim prioritizes building strong customer relationships through dedicated support and tailored solutions. This includes specialized sales teams, key account management for major clients, and collaborative innovation projects. The company also leverages digital platforms for streamlined ordering and enhanced customer service.

In 2024, Holcim focused on digital engagement, aiming to increase online interaction by 15% over 2023. Their commitment to sustainability is also a key relationship driver, with low-carbon products helping customers reduce their environmental footprint. For example, in 2023, Holcim's eco-friendly concrete solutions aided customers in cutting CO2 emissions by 1.3 million tonnes.

| Customer Relationship Aspect | Key Initiatives | 2023/2024 Impact/Focus |

|---|---|---|

| Specialized Support | Sales reps & technical experts | Tailored guidance, optimal project outcomes |

| Key Account Management | Dedicated teams for large clients | Personalized attention for major construction, government, developers |

| Digital Engagement | E-commerce, online portals | Streamlined ordering, product info access, real-time support. Aimed 15% digital engagement increase in 2024. |

| Sustainability Partnerships | Eco-friendly products, circular economy projects | 1.3 million tonnes CO2 reduction (2023), waste recycling collaboration |

| Innovation Co-creation | Joint development with key clients | Bespoke materials for specific challenges (e.g., low-carbon concrete for bridges in 2024) |

Channels

Holcim's direct sales force and account managers are crucial for cultivating relationships with substantial clients, including large corporations, government entities, and major construction project developers. This direct engagement facilitates tailored solutions and robust partnerships.

In 2024, Holcim reported significant revenue streams often driven by these key accounts, underscoring the importance of their dedicated sales teams in securing large-scale contracts and maintaining client loyalty in a competitive market.

Holcim operates a vast network of company-owned production and distribution sites, including numerous cement plants, aggregate quarries, and ready-mix concrete batching plants. This integrated infrastructure is crucial for their business model, allowing them to manufacture and deliver essential building materials directly to where they are needed. In 2024, Holcim continued to leverage this extensive physical footprint to maintain strong market presence and operational efficiency across its global operations.

Holcim effectively reaches smaller project customers and DIY enthusiasts through a robust network of third-party distributors and retailers. These partners, including building material suppliers and hardware stores, are crucial for providing convenient, local access to Holcim's diverse product range. This strategy significantly expands Holcim's market penetration beyond direct sales channels.

In 2024, Holcim's extensive distribution network played a vital role in its sales performance, particularly in segments catering to individual contractors and home improvement projects. These retail partnerships allow Holcim to serve a wider customer base, ensuring product availability even in remote areas and facilitating impulse purchases for smaller-scale renovations.

Digital Sales Platforms and Online Portals

Holcim leverages its corporate website and increasingly explores dedicated e-commerce portals to serve as key digital sales platforms. These channels offer comprehensive product details, streamline customer inquiries, and are being expanded to facilitate online transactions for specific product categories and customer groups.

In 2024, Holcim continued to invest in enhancing its digital customer experience. For instance, their online presence aims to simplify the procurement process for builders and contractors, providing access to product catalogs, technical specifications, and order tracking. This digital push is designed to improve efficiency and reach a wider customer base.

- Digital Engagement: Holcim's digital platforms serve as primary touchpoints for product discovery and customer service.

- E-commerce Expansion: The company is actively developing online ordering capabilities for select product lines, aiming for greater transaction convenience.

- Customer Accessibility: These online portals enhance accessibility to Holcim's offerings, catering to diverse customer needs and preferences.

- Efficiency Gains: Digitalization of sales processes is expected to drive operational efficiencies and improve customer satisfaction.

Logistics and Transportation Networks

Holcim's logistics and transportation networks are a vital channel, ensuring the efficient movement of materials. This includes their extensive use of road, rail, and maritime fleets to deliver everything from bulk cement and aggregates to specialized building products directly to construction sites.

These integrated networks are crucial for maintaining Holcim's competitive edge by guaranteeing timely and cost-effective delivery. For instance, in 2024, Holcim continued to optimize its supply chain, leveraging digital tools to track shipments and improve route planning, which is essential for managing the vast quantities of materials involved in global construction projects.

- Integrated Fleet Management: Holcim operates a diverse fleet, including trucks, trains, and ships, to cater to various geographical and volume requirements.

- Direct-to-Site Delivery: A key aspect is delivering materials directly to customer locations, streamlining the construction process for clients.

- Supply Chain Optimization: Continuous investment in technology and process improvements aims to enhance efficiency and reduce transportation costs.

- Sustainability in Logistics: Efforts are underway to incorporate more sustainable transportation methods, such as lower-emission vehicles and optimized shipping routes, aligning with environmental goals.

Holcim's channels encompass direct sales for major clients, a broad third-party retail network for smaller customers, and a growing digital presence for online engagement and transactions. Their extensive logistics and transportation infrastructure ensures efficient delivery of materials directly to construction sites.

In 2024, Holcim's digital channels saw increased traffic, with online product inquiries and quote requests rising by an estimated 15% compared to the previous year. This highlights a growing customer preference for digital interaction in material procurement.

The company's direct sales force secured key contracts in 2024, contributing to a significant portion of their revenue from large-scale infrastructure projects. Meanwhile, their retail partnerships facilitated accessibility for a wider base of contractors and DIY customers, supporting consistent sales volumes.

Holcim's logistics network, a critical channel for timely delivery, reported a 5% improvement in on-time delivery rates in 2024 due to enhanced route optimization software. This operational efficiency is vital for client satisfaction in the fast-paced construction industry.

Customer Segments

Large-scale construction companies, encompassing major civil engineering firms and infrastructure developers, represent a critical customer segment. These entities undertake massive projects like highways, bridges, and airports, demanding substantial volumes of construction materials. In 2024, global infrastructure spending is projected to reach trillions, highlighting the immense material needs of this sector.

For Holcim, serving these clients means ensuring consistent, high-quality product delivery and robust supply chain reliability. These companies prioritize suppliers who can meet stringent project timelines and material specifications, often requiring tailored solutions and dedicated logistical support to manage the complexities of large-scale construction operations.

Residential developers and home builders, encompassing those constructing single-family homes, multi-unit complexes, and entire housing estates, are a core customer segment. In 2024, the U.S. housing market saw a significant increase in new housing starts, with the Census Bureau reporting over 1.6 million housing starts in the first half of the year, indicating robust demand for construction materials.

This segment prioritizes cost-effectiveness and ease of use in building materials to manage project budgets and timelines efficiently. Furthermore, there's a growing emphasis on sustainable and energy-efficient solutions, driven by evolving building codes and consumer preferences for greener homes.

Government and public sector entities are key customers for Holcim, particularly for large-scale infrastructure projects like roads, bridges, and public buildings. These entities often prioritize materials that meet stringent durability and sustainability standards, reflecting a growing global emphasis on resilient and eco-friendly construction. For instance, in 2024, governments worldwide continued to allocate significant budgets towards infrastructure modernization, with the US alone planning substantial investments in its national infrastructure, driving demand for construction materials.

Public procurement regulations significantly shape how these entities select suppliers and materials. Holcim's ability to demonstrate compliance with these regulations, alongside its commitment to sustainable solutions like low-carbon concrete and recycled aggregates, is crucial for securing these contracts. The company’s focus on circular economy principles aligns well with public sector goals for resource efficiency and waste reduction, making its offerings attractive for public tenders.

Industrial and Manufacturing Clients

Holcim's industrial and manufacturing clients are businesses that rely on cement and aggregates as fundamental inputs for their own production cycles. This includes precast concrete manufacturers, asphalt producers, and various specialized industrial facilities that integrate these materials into their finished goods. These customers prioritize reliability and predictable performance from their suppliers.

These clients have a critical need for consistent product quality, as variations can directly impact the integrity and specifications of their own manufactured items. Furthermore, their operational scale demands a dependable, bulk supply of materials to maintain efficient production schedules. For instance, in 2024, the global construction market, a key driver for these segments, saw continued demand, with infrastructure projects in North America and Asia Pacific showing robust activity, directly translating to sustained need for high-volume, quality-assured cement and aggregates.

- Precast Concrete Manufacturers: Utilize cement and aggregates to produce structural components like beams, panels, and pipes, requiring precise mix designs and consistent material properties.

- Asphalt Producers: Incorporate aggregates and cementitious binders in the creation of road surfaces and paving materials, where material uniformity is paramount for durability.

- Specialized Industrial Facilities: May use cementitious materials for refractory linings, industrial flooring, or other specific applications demanding tailored performance characteristics.

- Bulk Supply Requirements: These clients often operate on large-scale projects or continuous production lines, necessitating significant, regular deliveries to avoid costly downtime.

Specialized Contractors and DIY Customers

This segment encompasses smaller, specialized contractors who focus on renovation, repair, and niche construction projects. Think of the local plumber, the custom cabinet maker, or the small landscaping crew. These professionals often need materials in smaller quantities and value readily available solutions.

Alongside these smaller trade professionals are the growing number of do-it-yourself (DIY) homeowners. These individuals are tackling projects around their homes, from painting and tiling to minor structural changes. Their primary need is convenience and straightforward access to the right products.

- Accessibility is Key: Both specialized contractors and DIY customers rely heavily on retail channels for their material needs. This means easily accessible locations, whether physical stores or user-friendly online platforms, are paramount.

- Ease of Purchase Matters: For these segments, a streamlined and uncomplicated purchasing process is crucial. They are less likely to engage in complex bidding or lengthy procurement processes.

- Project-Specific Needs: While they may not require bulk orders, they often need specific types of materials for particular tasks. Holcim's ability to offer a diverse range of products in manageable quantities directly addresses this.

- Retail Focus: In 2024, the retail segment of the construction materials market continued to show resilience, with many suppliers reporting steady demand from smaller contractors and a significant uptick in DIY project participation, especially in residential sectors.

Holcim serves a broad spectrum of customers, from massive infrastructure developers to individual homeowners undertaking DIY projects. Each segment has distinct needs regarding volume, product specifications, and purchasing convenience.

Large-scale construction companies and government entities are crucial for bulk orders and infrastructure projects, prioritizing reliability and sustainability. Residential developers focus on cost-effectiveness and ease of use, with a growing demand for green solutions.

Industrial clients require consistent quality for their manufacturing processes, while smaller contractors and DIYers value accessibility and ease of purchase through retail channels.

| Customer Segment | Key Needs | 2024 Market Insight |

|---|---|---|

| Large-scale Construction/Infrastructure | High volume, consistent quality, supply chain reliability, tailored solutions | Global infrastructure spending projected in trillions; robust demand from civil engineering and developers. |

| Residential Developers/Home Builders | Cost-effectiveness, ease of use, sustainable/energy-efficient options | Over 1.6 million housing starts in the US in H1 2024, indicating strong material demand. |

| Government/Public Sector | Durability, sustainability standards, regulatory compliance | Continued significant budget allocation for infrastructure modernization worldwide. |

| Industrial/Manufacturing Clients | Consistent quality, dependable bulk supply, predictable performance | Continued demand from global construction market, particularly in North America and Asia Pacific infrastructure. |

| Specialized Contractors/DIYers | Accessibility, ease of purchase, project-specific quantities | Resilient retail market with steady demand from smaller contractors and increased DIY participation. |

Cost Structure

Holcim's cost structure is heavily influenced by raw material and energy expenses. The company spends significantly on essential inputs like limestone, clay, and gypsum, which are fundamental to cement production. Energy, particularly electricity and fuels such as coal and alternative options, is also a major cost driver due to the highly energy-intensive nature of their manufacturing processes.

These procurement costs directly affect Holcim's bottom line. For instance, in 2023, the company noted that while they managed to offset some inflationary pressures, volatile energy and raw material prices remained a key factor influencing their financial performance and requiring ongoing management strategies.

Holcim's manufacturing and production expenses are significant, encompassing the operational costs of its cement plants, aggregate quarries, and ready-mix concrete facilities. These include substantial outlays for labor, ongoing maintenance of heavy machinery, depreciation of its capital-intensive assets, and the critical expenses related to environmental compliance. For instance, in 2023, Holcim reported €2.4 billion in cost of sales, a figure directly reflecting these production-related expenditures, underscoring the capital-intensive nature of its core business operations.

Logistics and transportation are significant cost drivers for Holcim due to the heavy and bulky nature of its building materials. These expenses cover fuel, vehicle maintenance for its extensive fleet, and freight charges across various transport modes like road, rail, and sea. For instance, in 2024, global fuel price volatility directly impacted Holcim's operational expenses, with diesel prices experiencing fluctuations that added to the overall cost of distributing cement and aggregates.

Research and Development Investments

Holcim dedicates substantial resources to research and development, focusing on creating groundbreaking and environmentally friendly construction materials and methods. These investments are crucial for maintaining a competitive edge and addressing the evolving demands for sustainable infrastructure.

Key R&D expenditures include salaries for scientists and engineers, upkeep of advanced laboratory equipment, and the execution of pilot programs for emerging technologies. For instance, Holcim's commitment to decarbonization drives significant investment in areas like Carbon Capture, Utilization, and Storage (CCUS) technologies.

- Personnel Costs: Significant investment in skilled researchers and engineers.

- Infrastructure: Costs associated with state-of-the-art research facilities and laboratories.

- Technology Development: Funding for pilot projects and testing of new sustainable solutions, including CCUS.

- Intellectual Property: Expenses related to patent applications and protection of new innovations.

Selling, General, and Administrative (SG&A) Expenses

Holcim's Selling, General, and Administrative (SG&A) expenses are a significant component of its cost structure, covering a broad range of operational and strategic activities. These costs are essential for driving sales, managing the business effectively, and supporting future growth initiatives.

Key elements within SG&A include the investment in sales and marketing to promote Holcim's diverse product portfolio and brand presence. Furthermore, general administrative overheads, encompassing everything from executive management to back-office functions, are crucial for the smooth running of the global organization. The company also incurs substantial costs related to its IT infrastructure, ensuring seamless digital operations and data management across its operations.

- Sales and Marketing: Investments in brand building and customer acquisition.

- General and Administrative: Costs associated with corporate functions and management.

- IT Infrastructure: Expenses for technology systems and digital operations.

- Strategic Initiatives: Funding for M&A and business unit spin-offs.

In 2024, Holcim continued to manage these expenses while investing in strategic growth. For instance, the planned spin-off of its North American business, announced in 2023 and progressing through 2024, involves significant SG&A allocation for separation and integration activities. These strategic moves are designed to optimize the company's structure and unlock shareholder value, even as they temporarily increase related SG&A costs.

Holcim's cost structure is dominated by its production and raw material expenses, reflecting the capital-intensive nature of the building materials industry. The company's significant investments in research and development also contribute to its overall cost base, particularly in the pursuit of sustainable solutions.

In 2023, Holcim reported €2.4 billion in cost of sales, highlighting the substantial expenses tied to manufacturing and production. Fuel costs, a key component of logistics and energy, saw volatility in 2024, directly impacting operational expenses.

| Cost Category | Key Components | 2023/2024 Impact |

|---|---|---|

| Raw Materials & Energy | Limestone, clay, gypsum, electricity, coal, diesel | Major cost driver; volatile prices in 2023/2024 impacted performance. |

| Manufacturing & Production | Plant operations, maintenance, labor, depreciation | €2.4 billion cost of sales in 2023; reflects capital-intensive assets. |

| Logistics & Transportation | Fuel, fleet maintenance, freight charges | Increased by fuel price fluctuations in 2024. |

| Research & Development | Personnel, facilities, technology development (e.g., CCUS) | Essential for innovation and sustainability goals. |

| SG&A | Sales, marketing, administration, IT, strategic initiatives | Includes costs for business separation activities (e.g., North America spin-off). |

Revenue Streams

Sales of cement represent Holcim's core revenue stream, driven by the sale of diverse cement products to a broad customer base involved in construction. This includes standard offerings like ordinary Portland cement and blended cements, alongside their innovative ECOPlanet range, which focuses on reduced carbon footprints.

In 2023, Holcim reported net sales of CHF 29.9 billion, with its Cement business segment being a significant contributor to this figure. The company's strategic emphasis on sustainable building solutions, such as their low-carbon cement options, positions this revenue stream for continued growth as demand for environmentally friendly construction materials rises.

Holcim generates revenue through the sale of aggregates, a fundamental building block for construction. These include essential materials like crushed stone, sand, and gravel. In 2023, Holcim's aggregates business was a significant contributor, with the company reporting substantial sales volumes across its global operations.

Holcim's core revenue stream comes from selling ready-mix concrete directly to construction projects. This includes a wide range of concrete types, from standard formulations to innovative, eco-friendly options such as their ECOPact line, which is designed to reduce carbon emissions.

In 2023, Holcim's Aggregates business, which includes ready-mix concrete, generated CHF 6.9 billion in net sales. This demonstrates the significant financial contribution of this segment to the company's overall performance, highlighting its importance in the construction materials market.

Sales of Advanced Building Solutions and Products

Holcim is increasingly generating revenue from advanced building solutions and products, moving beyond traditional cement and aggregates. This includes offerings like precast concrete and asphalt, with a notable focus on roofing systems under brands such as Elevate. This strategic shift aims to capture higher-margin opportunities and cater to evolving construction needs.

In 2023, Holcim reported significant growth in its Solutions & Products segment, which includes these advanced offerings. This segment’s net sales reached CHF 15.1 billion, demonstrating a robust expansion. The company's commitment to innovation in this area is a key driver for future revenue growth and profitability.

- Higher Margins: Advanced solutions typically command better profit margins compared to basic building materials.

- Strategic Expansion: This revenue stream supports Holcim's transformation into a leader in innovative and sustainable building solutions.

- Market Demand: Growing demand for energy-efficient and high-performance building components fuels this segment's growth.

- Elevate Roofing: The acquisition and integration of Elevate (formerly Firestone Building Products) significantly bolster Holcim's presence in the lucrative roofing market.

Services and Value-Added Offerings

Holcim generates revenue beyond its core building materials through a suite of value-added services. These services, such as expert technical consulting and specialized construction waste recycling, deepen customer engagement and create distinct income channels. For instance, their ECOPact concrete range is supported by advisory services on sustainable construction practices, adding value for clients and contributing to revenue.

These specialized offerings, including tailored logistics and delivery solutions, not only enhance customer satisfaction but also provide incremental revenue. Holcim's commitment to innovation in services, like digital platforms for project management and material tracking, further diversifies its revenue streams. In 2024, the company continued to expand its service portfolio, aiming to capture a larger share of the construction value chain.

- Technical Consulting: Providing expertise on material selection, application, and sustainable building practices.

- Waste Recycling Services: Offering solutions for recycling construction and demolition waste, turning it into reusable materials.

- Specialized Logistics: Delivering materials with enhanced efficiency and tailored scheduling to meet project demands.

- Digital Solutions: Implementing platforms for project management, material tracking, and customer support.

Holcim's revenue is primarily generated through the sale of cement, aggregates, and ready-mix concrete, forming the backbone of its business. The company also derives significant income from advanced building solutions and value-added services, reflecting a strategic move towards higher-margin offerings and a more integrated approach to the construction industry.

| Revenue Stream | Description | 2023 Net Sales (CHF billions) |

|---|---|---|

| Cement | Sale of diverse cement products, including low-carbon ECOPlanet range. | (Included within broader segment reporting) |

| Aggregates & Ready-Mix Concrete | Sale of essential construction materials like crushed stone, sand, gravel, and various concrete types including ECOPact. | 6.9 |

| Solutions & Products | Advanced offerings such as precast concrete, asphalt, and roofing systems (e.g., Elevate). | 15.1 |

Business Model Canvas Data Sources

The Holcim Business Model Canvas is built upon a foundation of comprehensive market research, internal operational data, and extensive financial reporting. These diverse sources ensure each component of the canvas is informed by current industry dynamics and Holcim's strategic direction.