Hokkan Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hokkan Holdings Bundle

Hokkan Holdings demonstrates compelling strengths in its established market presence and diverse product portfolio, yet faces potential threats from evolving consumer preferences and intense competition. Understanding these dynamics is crucial for navigating its future.

Want the full story behind Hokkan Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hokkan Holdings' integrated business model is a significant strength, positioning the company as a one-stop shop for beverage and food packaging needs. This encompasses everything from container manufacturing and packaging materials to contract filling services.

This end-to-end capability allows Hokkan to provide comprehensive solutions to its clients. For example, in fiscal year 2023, Hokkan reported total revenue of ¥155.6 billion, demonstrating the scale and demand for their integrated services.

By controlling multiple stages of the value chain, Hokkan can foster deeper client relationships and potentially achieve higher profit margins. This vertical integration also offers greater control over quality and supply chain efficiency.

Hokkan Holdings boasts a robust business model with its core operations strategically divided into the Container Business, Filling Business, and Machinery Manufacturing. This segmentation is a key strength, offering significant diversification across various facets of the packaging industry. Such a structure inherently reduces the risk tied to over-reliance on any single product or service, fostering greater stability and resilience in its overall financial performance.

Hokkan Holdings’ clear specialization in beverage and food containers gives it a significant edge. This deep industry knowledge allows for highly optimized production processes and product development tailored precisely to the stringent quality demands of the food and beverage sectors. For instance, in fiscal year 2024, the company reported net sales of ¥167.7 billion, a testament to its strong market position within these specialized segments.

Contract Manufacturing Capabilities

Hokkan Holdings' contract manufacturing and filling services are a significant strength, allowing them to cater to a diverse clientele, from major corporations to emerging brands. This capability broadens their market reach beyond solely supplying containers, opening up new revenue streams and optimizing the use of their existing infrastructure and technical know-how.

By offering these services, Hokkan Holdings effectively diversifies its revenue sources. For instance, in fiscal year 2024, the company reported that its contract manufacturing segment contributed to overall growth, even as the core container business navigated market fluctuations. This dual approach enhances financial resilience.

- Expanded Customer Base: Serves both large enterprises and smaller businesses seeking manufacturing solutions.

- Revenue Diversification: Generates income beyond just container sales, mitigating risks associated with a single product line.

- Asset Utilization: Leverages existing manufacturing facilities and expertise to increase operational efficiency and profitability.

- Market Adaptability: Positions Hokkan Holdings to capitalize on trends in outsourced manufacturing across various industries.

Improved Profit Outlook for FY2025

Hokkan Holdings anticipates a brighter profit picture for fiscal year 2025, even with projected lower net sales. The company has upwardly revised its operating and ordinary profit forecasts, a testament to its robust container business and successful cost-saving initiatives across factory and distribution operations.

This financial resilience is underpinned by several key factors:

- Container Business Strength: The company's container division has demonstrated significant performance, driving profitability.

- Cost Reduction Efforts: Hokkan Holdings has actively implemented cost-saving measures in its factory and distribution segments, enhancing operational efficiency.

- Revised Profit Forecast: For the fiscal year ending March 31, 2025, the company now expects higher operating and ordinary profits than previously forecast.

- Strategic Focus: These improvements highlight a strategic focus on profitability through operational excellence and core business strength, rather than solely on top-line revenue growth.

Hokkan Holdings' robust container business is a core strength, consistently driving profitability. This is evident in their revised profit forecasts for fiscal year 2025, which anticipate higher operating and ordinary profits despite potentially lower net sales. The company's focus on operational efficiency, including cost-saving initiatives in factory and distribution operations, further bolsters this strength.

| Fiscal Year | Net Sales (¥ billion) | Operating Profit (¥ billion) | Ordinary Profit (¥ billion) |

|---|---|---|---|

| 2023 | 155.6 | N/A | N/A |

| 2024 | 167.7 | N/A | N/A |

| 2025 (Forecast) | (Projected lower than FY24) | (Revised upward) | (Revised upward) |

What is included in the product

Delivers a strategic overview of Hokkan Holdings’s internal and external business factors, identifying key strengths and weaknesses alongside market opportunities and potential threats.

Provides a clear, actionable SWOT analysis for Hokkan Holdings, pinpointing key areas for strategic improvement and risk mitigation.

Weaknesses

Hokkan Holdings' manufacturing processes are significantly tied to the cost of essential raw materials like aluminum, steel, and plastics. These commodity prices are inherently volatile, meaning Hokkan Holdings faces a direct risk of increased production expenses. For instance, a notable surge in aluminum prices, which saw a significant increase in early 2024 due to supply chain disruptions and geopolitical factors, could directly squeeze Hokkan's profit margins.

Hokkan Holdings' capital-intensive operations, particularly its large-scale manufacturing and filling facilities, necessitate substantial upfront investment in machinery, ongoing maintenance, and essential technological upgrades. This significant capital expenditure creates a high fixed cost structure, which can constrain the company's financial agility and demand continuous investment to maintain its competitive edge and operational efficiency.

While Hokkan Holdings has expanded its overseas presence, a substantial portion of its operations likely remains concentrated in Japan. This geographic concentration could make the company particularly vulnerable to region-specific economic downturns or heightened local competition, potentially hindering growth compared to more globally diversified peers.

Environmental Compliance Costs

Hokkan Holdings, like many in the packaging sector, faces growing pressure to meet stringent environmental regulations. This includes mandates for waste reduction, increased recycling rates, and lower carbon emissions. For instance, the EU's Packaging and Packaging Waste Regulation (PPWR), which is expected to be finalized in 2024, aims to harmonize rules and set ambitious targets for recyclability and recycled content, potentially impacting packaging design and material choices.

Adhering to these evolving environmental standards necessitates significant investment. Hokkan Holdings may need to allocate capital towards upgrading manufacturing processes, developing new eco-friendly packaging materials, and implementing more robust waste management systems. These investments, while crucial for long-term sustainability and market access, can directly increase operational costs and potentially compress profit margins in the short to medium term.

- Increased Capital Expenditure: Investments in new machinery for recycled material processing or biodegradable packaging production.

- Higher Material Costs: Sourcing sustainable or recycled materials can sometimes be more expensive than virgin alternatives.

- Compliance and Reporting: Costs associated with monitoring, reporting, and ensuring adherence to various environmental regulations.

Dividend Volatility in the Past

Hokkan Holdings has experienced dividend volatility in the past, with a notable dividend cut occurring within the last decade. This historical instability, despite recent positive trends in dividend growth, could be a point of concern for investors prioritizing predictable income streams. For instance, a dividend reduction in previous years might temper the confidence of income-focused investors even with current optimistic projections.

This past dividend instability raises questions about the reliability of future payouts, particularly for investors seeking consistent income. While recent performance shows an upward trajectory, the memory of past cuts can influence investor perception and risk assessment.

- Past Dividend Cuts: Hokkan Holdings has a history of dividend reductions, impacting investor confidence in payout consistency.

- Investor Concerns: Income-focused investors may be wary due to the past volatility, despite recent positive dividend growth.

- Reliability Questions: Historical instability can lead to doubts about the long-term reliability of future dividend payments.

Hokkan Holdings' reliance on volatile commodity prices, such as aluminum and steel, directly impacts its production costs and profit margins. For example, a significant increase in aluminum prices, which saw a notable upward trend in early 2024, could squeeze profitability. The company's capital-intensive nature also means substantial ongoing investment in machinery and technology, creating high fixed costs that limit financial flexibility.

What You See Is What You Get

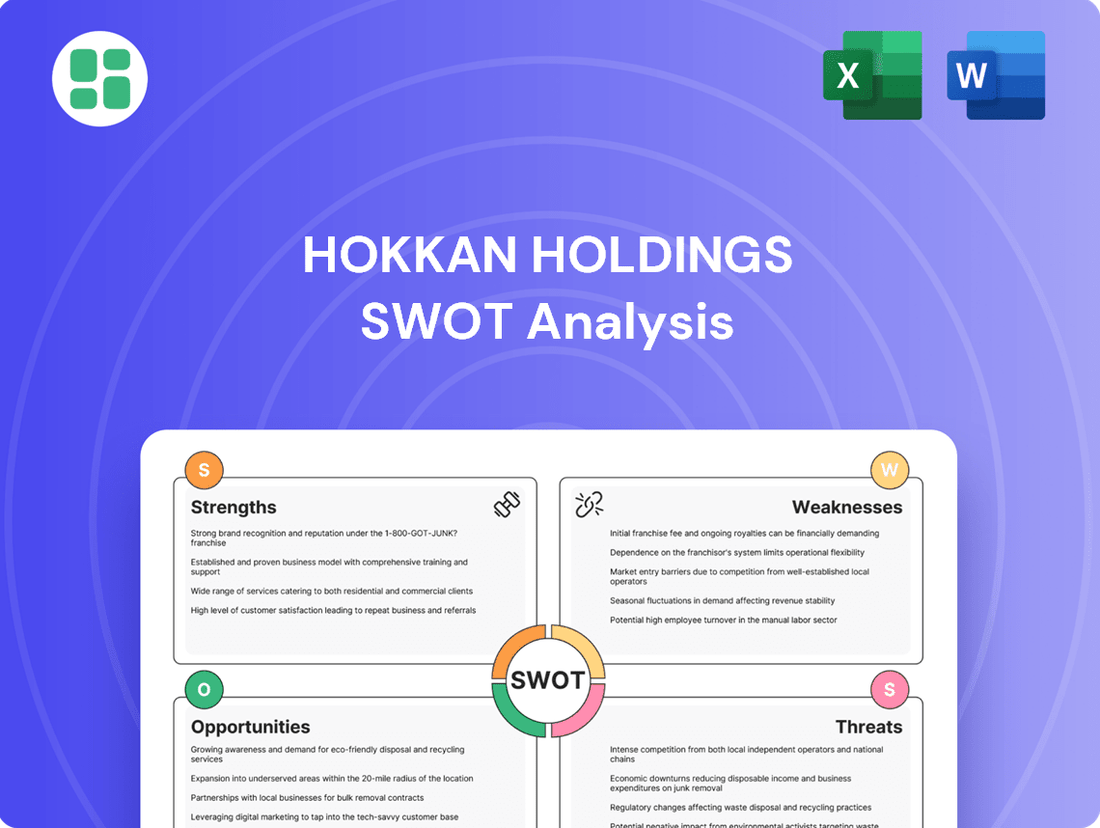

Hokkan Holdings SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Hokkan Holdings' Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights into Hokkan Holdings' competitive landscape and internal capabilities.

Opportunities

The global market for sustainable packaging is experiencing robust growth, projected to reach an estimated $413.5 billion by 2027, up from $267.4 billion in 2022. This expansion is fueled by increasing consumer awareness and stringent environmental regulations worldwide. Hokkan Holdings is well-positioned to leverage this trend by expanding its portfolio of recyclable and biodegradable packaging options.

By investing in innovative materials and production methods, Hokkan can tap into new customer bases and improve its brand reputation as an environmentally conscious company. This strategic shift aligns with the growing expectation for businesses to adopt more sustainable practices, offering a competitive advantage in the evolving packaging industry.

Hokkan Holdings' 'Overseas business' segment presents a clear opportunity for expansion into emerging markets. Southeast Asia, in particular, is a prime target due to growing disposable incomes and increasing urbanization, which naturally boosts demand for packaged food and beverages. This strategic move could unlock substantial sales and profit growth for the company.

Innovations like smart packaging, which can monitor product freshness, and advanced barrier materials that extend shelf life, present significant opportunities for Hokkan Holdings. These technologies allow for product differentiation and can lead to substantial efficiency gains in logistics and waste reduction.

By investing in research and development for cutting-edge packaging solutions, Hokkan Holdings can position itself to offer premium products. For instance, the global smart packaging market was valued at approximately USD 28.5 billion in 2023 and is projected to grow significantly, offering a clear path for Hokkan to capture market share and enhance its brand image.

Increasing Demand for Convenience Products

Modern lifestyles are increasingly prioritizing convenience, leading to a surge in demand for ready-to-eat and ready-to-drink food and beverage options. This shift directly benefits packaging companies like Hokkan Holdings, as consumers seek easy-to-consume formats that require minimal preparation. The global convenience food market was valued at approximately $150 billion in 2023 and is projected to grow steadily, indicating a robust and expanding customer base for Hokkan's packaging solutions.

This growing consumer preference for convenience translates into a consistent and expanding market for Hokkan Holdings' core product offerings, which include various packaging materials and solutions designed for ready-to-consume items. Furthermore, the trend supports the company's contract filling services, as manufacturers increasingly outsource the production and packaging of these convenient products.

- Growing Market: The global convenience food market is on an upward trajectory, offering significant opportunities for packaging suppliers.

- Packaging Demand: Increased consumption of ready-to-eat and ready-to-drink products directly fuels the demand for Hokkan's packaging solutions.

- Contract Filling Synergy: The convenience trend enhances Hokkan's contract filling services, aligning with manufacturers' outsourcing needs.

Strategic Partnerships and Acquisitions

Hokkan Holdings has a proven track record of growth through strategic moves, including its acquisition of beverage packaging units in Indonesia. This history suggests a strong capability to integrate new businesses and technologies. For example, in 2023, the company continued its expansion by acquiring a stake in a new beverage packaging facility, demonstrating ongoing commitment to this strategy.

Continuing this approach of strategic partnerships and acquisitions presents a significant opportunity for Hokkan Holdings. It allows for accelerated market entry and portfolio diversification. By acquiring companies with complementary technologies or established market positions, Hokkan can bypass lengthy organic development cycles.

- Expand Product Portfolio: Acquire companies in related sectors like food packaging or specialized beverage components.

- Gain New Technologies: Invest in or acquire firms with innovative packaging solutions, such as advanced barrier materials or sustainable alternatives.

- Enter New Markets: Target acquisitions in high-growth regions where Hokkan currently has limited presence, leveraging the target company's existing infrastructure and customer base.

- Strengthen Supply Chain: Acquire upstream suppliers to secure raw materials and improve cost efficiencies.

Hokkan Holdings can capitalize on the expanding global market for sustainable packaging, which is projected to reach $413.5 billion by 2027. By developing more recyclable and biodegradable options, the company can attract environmentally conscious consumers and gain a competitive edge. Furthermore, innovations in smart packaging, expected to see significant growth from its 2023 valuation of approximately USD 28.5 billion, offer opportunities for product differentiation and improved logistics.

The company's overseas business segment, particularly in Southeast Asia, presents a strong avenue for growth due to rising disposable incomes and urbanization, driving demand for packaged goods. Hokkan's strategic acquisitions, like its 2023 investment in a new beverage packaging facility, demonstrate its capability to expand its market reach and technological base through mergers and partnerships.

| Opportunity Area | Market Trend/Data | Hokkan's Potential Action |

|---|---|---|

| Sustainable Packaging | Global market projected to reach $413.5 billion by 2027 | Expand portfolio of recyclable and biodegradable options |

| Smart Packaging | Market valued at approx. USD 28.5 billion in 2023, with significant growth expected | Invest in R&D for advanced packaging technologies |

| Overseas Expansion | Growth in Southeast Asian markets driven by increasing disposable incomes | Target emerging markets with strategic partnerships and acquisitions |

Threats

Globally, environmental regulations are becoming stricter, especially regarding plastic waste and carbon emissions. For Hokkan Holdings, this means a growing need to adapt its operations to comply with these evolving standards.

Failure to meet these new environmental mandates could lead to substantial fines or necessitate expensive upgrades to production processes. For instance, the European Union's proposed Plastic Levy, aiming to increase the use of recycled plastics, could directly impact packaging costs for companies like Hokkan Holdings if not proactively addressed.

The need for costly operational overhauls to meet these standards, such as investing in new recycling technologies or reducing carbon footprints, could significantly impact Hokkan Holdings' profitability. This also limits the company's flexibility in its strategic planning and day-to-day operations.

Volatile commodity and energy prices present a significant threat to Hokkan Holdings. Beyond the cost of raw materials, energy expenses are a major part of manufacturing, and unpredictable price swings can severely impact operational costs. This volatility makes financial planning and cost management difficult, a challenge that has been evident in past fiscal periods.

Competitors are introducing innovative packaging materials and production techniques that could challenge Hokkan Holdings' established methods. For instance, advancements in biodegradable plastics or new, more efficient manufacturing processes could significantly alter the competitive landscape. If Hokkan Holdings fails to integrate these disruptive innovations, it risks losing market share to more agile rivals, as seen in the beverage packaging sector where companies adopting lighter, more sustainable materials have gained traction.

Economic Downturns and Consumer Spending

Economic downturns pose a significant threat to Hokkan Holdings. During recessions or periods of low consumer confidence, demand for packaged food and beverages can shrink. Consumers often reduce discretionary spending or shift towards more budget-friendly options, directly affecting Hokkan's sales volumes.

For instance, a slowdown in global economic growth, as projected by the IMF with a revised forecast of 3.1% for 2024, could dampen consumer purchasing power. This environment makes it harder for companies like Hokkan to maintain sales momentum.

- Reduced Demand: Economic slowdowns lead consumers to cut back on non-essential purchases, impacting sales of packaged goods.

- Price Sensitivity: Consumers become more price-conscious, favoring lower-cost alternatives over premium or branded products.

- Profit Margin Squeeze: Increased competition for a smaller consumer wallet can force price reductions, squeezing profit margins for Hokkan.

Supply Chain Disruptions

Hokkan Holdings faces significant threats from supply chain disruptions. Global events, like the ongoing geopolitical tensions and the lingering effects of the COVID-19 pandemic, continue to pose risks. These can impact the availability and price of essential raw materials and components, as well as disrupt logistics networks. For instance, a significant portion of global shipping experienced delays and increased costs throughout 2023 and into early 2024.

These disruptions can directly translate into production delays, higher operational expenses, and an inability to fulfill customer orders promptly. The semiconductor shortage, which significantly affected various industries in 2022 and 2023, serves as a prime example of how component scarcity can cripple manufacturing output. Such challenges can erode market share and damage brand reputation if not managed proactively.

The ongoing volatility in energy prices, influenced by global conflicts and production decisions, also adds another layer of complexity to supply chain stability. For example, fluctuations in oil prices directly impact transportation costs, a critical component of Hokkan Holdings' supply chain.

Key potential impacts include:

- Increased lead times for critical components, impacting production schedules.

- Higher input costs due to scarcity and elevated shipping expenses, reducing profit margins.

- Potential inability to meet seasonal demand, leading to lost sales opportunities.

- The need for greater investment in inventory management and alternative sourcing strategies.

Intensifying global environmental regulations, particularly concerning plastic waste and carbon emissions, pose a significant challenge. Failure to adapt could result in substantial fines or necessitate costly operational upgrades, impacting profitability and strategic flexibility.

Volatile commodity and energy prices directly affect raw material and manufacturing costs, making financial planning difficult. Competitors introducing innovative packaging materials and production techniques could erode Hokkan's market share if it fails to keep pace.

Economic downturns can reduce consumer spending on packaged goods, leading to lower sales volumes and increased price sensitivity among customers. This dynamic can squeeze profit margins as companies compete for a smaller consumer wallet.

Supply chain disruptions, exacerbated by geopolitical tensions and global events, threaten the availability and cost of raw materials and components. These disruptions can lead to production delays, higher expenses, and missed sales opportunities, as seen with shipping cost increases throughout 2023 and early 2024.

SWOT Analysis Data Sources

This SWOT analysis for Hokkan Holdings is built upon a robust foundation of data, including their official financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and insightful assessment.