Hokkan Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hokkan Holdings Bundle

Hokkan Holdings operates within an industry shaped by moderate buyer power and intense rivalry, with the threat of substitutes presenting a significant challenge. Understanding these dynamics is crucial for navigating the competitive landscape. Unlock the full Porter's Five Forces Analysis to explore Hokkan Holdings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hokkan Holdings' reliance on suppliers for key materials like aluminum, steel, and plastics for its packaging operations is a significant factor in its bargaining power. Fluctuations in global commodity prices for these essential inputs directly affect Hokkan's production expenses and overall profitability. For example, the price of aluminum, a critical component for beverage cans, experienced considerable volatility in 2024, with prices ranging from approximately $2,000 to $2,500 per metric ton, impacting manufacturers' cost structures.

Supplier concentration significantly impacts Hokkan Holdings' bargaining power. If the market for essential raw materials or specialized machinery is controlled by a small number of major suppliers, these suppliers gain considerable leverage.

For Hokkan Holdings, this could translate into facing elevated prices or less advantageous contractual terms, especially if alternative sources for critical components or advanced canning and filling equipment are scarce.

Furthermore, Hokkan Holdings' own machinery manufacturing division is not immune, as it depends on its own supply chain for the components needed to produce its machinery.

Switching suppliers for Hokkan Holdings presents considerable hurdles, particularly when dealing with specialized materials or intricately integrated machinery. The financial implications of such a shift are substantial, encompassing expenses for retooling production facilities, obtaining new certifications, and managing the inevitable disruption to ongoing operations. These elevated switching costs effectively bolster the bargaining power of Hokkan's current suppliers, making it economically challenging for Hokkan to seek alternative sourcing arrangements.

Supplier's Ability to Forward Integrate

Suppliers' potential to forward integrate, meaning they could enter Hokkan Holdings' packaging or contract filling operations, significantly enhances their bargaining power. This threat compels Hokkan to maintain favorable terms to prevent suppliers from becoming direct competitors.

While raw material suppliers are less likely to integrate forward, manufacturers of specialized filling and packaging machinery possess a greater capability. For instance, a machinery provider could offer a complete, outsourced filling service, directly challenging Hokkan's core business. This capability gives them leverage in negotiations for equipment sales and service contracts.

Consider the capital expenditure required for advanced packaging machinery. In 2024, the global contract packaging market saw significant investment, with companies seeking automated and specialized solutions. Suppliers who can offer not just machinery but also the operational expertise to run these lines gain a substantial advantage.

- Supplier Capability: Manufacturers of specialized filling and packaging machinery can potentially offer integrated outsourced services.

- Competitive Threat: Forward integration by suppliers directly competes with Hokkan's contract filling business.

- Market Dynamics: The 2024 contract packaging market highlights increased investment in advanced machinery, empowering sophisticated suppliers.

- Leverage: Suppliers with the ability to offer end-to-end solutions gain considerable bargaining power over clients like Hokkan.

Uniqueness of Supplier's Products/Services

The uniqueness of a supplier's products significantly impacts its bargaining power. When suppliers offer highly differentiated materials, like advanced coatings for cans or proprietary sustainable plastic formulations, they gain leverage. For instance, Hokkan Holdings might rely on specific suppliers for BPA-NI epoxies or unique biodegradable plastic compounds crucial for their packaging solutions.

This reliance means Hokkan has fewer viable alternatives for these specialized inputs. Consequently, these particular suppliers can command higher prices or more favorable terms, as Hokkan becomes more dependent on their specialized offerings to maintain product quality and meet evolving consumer demands for sustainability.

- Supplier Differentiation: Suppliers providing unique or highly differentiated materials, such as advanced coatings for cans (e.g., BPA-NI epoxies) or proprietary sustainable plastic formulations, hold greater power.

- Reduced Alternatives: Hokkan would have fewer alternatives for such specialized inputs, making them more dependent on these particular suppliers.

- Increased Dependence: This dependence allows suppliers to negotiate better terms, potentially impacting Hokkan's cost structure and operational flexibility.

The bargaining power of Hokkan Holdings' suppliers is influenced by the concentration of suppliers in key input markets. A limited number of suppliers for critical materials like aluminum, steel, or specialized machinery grants them significant leverage, potentially leading to higher costs for Hokkan. For example, the global aluminum market in 2024 saw a concentration of major producers, impacting pricing power.

Switching costs for Hokkan are substantial, especially for specialized machinery or materials, involving retooling and operational disruptions. This makes it difficult to change suppliers, thus strengthening existing supplier relationships and their negotiating position.

Suppliers' ability to forward integrate, particularly machinery manufacturers offering outsourced services, poses a direct competitive threat to Hokkan's contract filling business, enhancing their bargaining power.

The uniqueness of supplier offerings, such as proprietary sustainable plastics or advanced can coatings, reduces Hokkan's alternatives and increases its dependence, allowing these suppliers to command better terms.

| Supplier Factor | Impact on Hokkan Holdings | 2024 Market Context |

|---|---|---|

| Supplier Concentration | Increased leverage for fewer suppliers | Aluminum market dominated by key global producers |

| Switching Costs | High costs for retooling and operational disruption | Investment in advanced packaging machinery requires specialized integration |

| Forward Integration Threat | Potential for suppliers to become direct competitors | Machinery providers offering outsourced filling services |

| Product Uniqueness | Reduced alternatives for specialized materials | Demand for sustainable packaging materials like BPA-NI epoxies |

What is included in the product

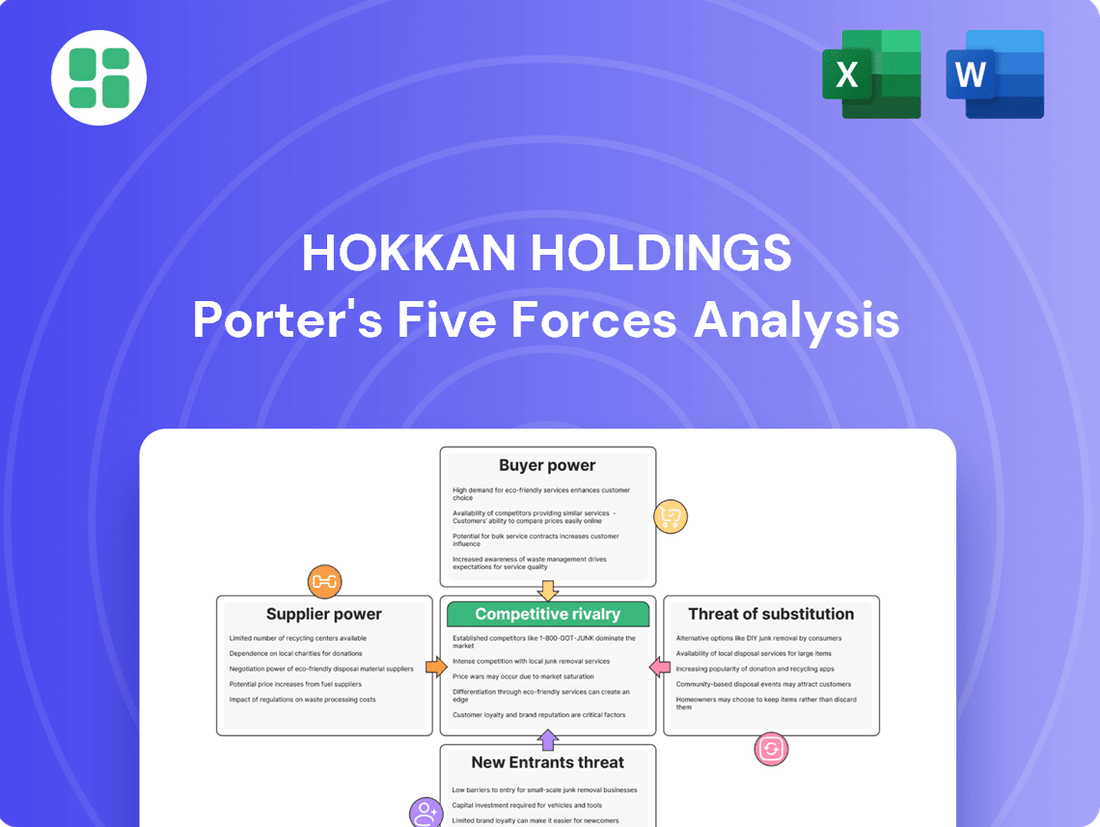

This Porter's Five Forces analysis for Hokkan Holdings assesses the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes, providing a comprehensive view of its competitive environment.

Instantly identify and mitigate competitive threats with a visual breakdown of Hokkan Holdings' Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Hokkan Holdings' customer base includes major players in the beverage and food industry, many of whom are global corporations. This concentration means that a few key clients can hold significant sway over pricing and contract conditions.

If a large percentage of Hokkan's sales are tied to these few major customers, their substantial purchasing power allows them to negotiate more favorable terms, directly impacting Hokkan's profitability and operational flexibility.

Large beverage and food manufacturers, key clients for Hokkan Holdings, possess the capability to backward integrate. This means they could potentially produce their own containers or manage their own filling processes internally, thereby diminishing their dependence on Hokkan's services.

While the substantial capital outlay required for such a move might deter immediate action, the mere possibility serves as a significant lever for these customers, bolstering their bargaining power. For instance, a major soft drink company might consider acquiring or building its own bottling facilities if Hokkan's pricing or service levels become unfavorable.

In 2024, the trend towards vertical integration in manufacturing sectors, driven by a desire for greater control over supply chains and cost efficiencies, makes this a particularly relevant consideration for companies like Hokkan.

Hokkan Holdings' customers, primarily beverage and food producers, benefit from a competitive landscape offering numerous packaging and filling alternatives. Major can manufacturers, alongside companies specializing in plastic packaging and broader diversified solutions, provide readily available substitutes. This broad array of choices significantly strengthens customers' bargaining power, allowing them to push for more favorable pricing and service agreements.

Price Sensitivity of Customers

Customers in the food and beverage sector frequently demonstrate high price sensitivity. This is largely due to the intensely competitive nature of the industry and the often thin profit margins that businesses operate with. This dynamic directly impacts packaging suppliers such as Hokkan Holdings, compelling them to keep their pricing competitive, particularly for high-volume, standardized items like beverage cans.

In 2024, the global beverage can market experienced significant price fluctuations. For instance, aluminum prices, a key component in can manufacturing, saw an approximate 15% increase year-over-year due to supply chain disruptions and rising energy costs. This puts considerable pressure on Hokkan to absorb some of these costs or pass them on, directly impacting their bargaining power with large beverage clients who are acutely aware of these market dynamics.

- Price Sensitivity: Beverage companies, Hokkan's primary customers, are highly sensitive to the cost of packaging as it directly influences their product's final retail price and overall profitability.

- Competitive Landscape: The crowded beverage market means companies can easily switch suppliers if pricing is not competitive, diminishing Hokkan's leverage.

- Volume Purchases: Large beverage manufacturers purchase cans in massive quantities, giving them significant bargaining power to negotiate lower prices from suppliers like Hokkan.

- Standardization: The standardized nature of beverage cans means that differentiation is minimal, further intensifying price as the primary competitive factor.

Product Standardization and Differentiation

For standardized products, such as basic beverage cans, differentiation is inherently low, which naturally amplifies customer bargaining power. In 2023, the global beverage can market was valued at approximately USD 47.6 billion, highlighting the scale of this standardized segment.

However, Hokkan Holdings can mitigate this by offering comprehensive solutions. This includes contract manufacturing and filling services, providing a one-stop shop that reduces the need for customers to manage multiple suppliers. Specialized or innovative packaging designs, such as those offering enhanced shelf appeal or sustainability features, also serve to differentiate Hokkan's offerings.

- Low Differentiation in Standard Cans: Basic beverage cans offer limited points of distinction, increasing customer leverage.

- Hokkan's Comprehensive Solutions: Offering contract manufacturing and filling services creates a bundled value proposition.

- Innovative Packaging as a Differentiator: Unique designs can reduce customer price sensitivity and reliance on competitors.

- Market Context: The substantial size of the beverage can market underscores the importance of differentiation strategies.

Hokkan Holdings' customers, primarily large beverage and food manufacturers, wield considerable bargaining power due to their significant purchasing volumes and the competitive packaging market. Their ability to switch suppliers or even consider backward integration, as seen with major soft drink companies exploring in-house bottling, directly pressures Hokkan on pricing and terms. In 2024, the beverage can market's price volatility, with aluminum costs rising approximately 15% year-over-year, further amplified customer negotiation leverage.

| Customer Characteristic | Impact on Hokkan | 2024 Market Context |

|---|---|---|

| High Purchasing Volume | Negotiating power for lower prices | Large beverage companies drive demand |

| Availability of Substitutes | Reduced switching costs for customers | Multiple packaging material options |

| Price Sensitivity | Pressure on Hokkan's margins | Thin profit margins in food & beverage |

| Potential for Backward Integration | Threat of lost business | Desire for supply chain control |

Full Version Awaits

Hokkan Holdings Porter's Five Forces Analysis

This preview showcases the complete Hokkan Holdings Porter's Five Forces Analysis, offering an in-depth examination of competitive forces impacting the company. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden elements. You can trust that this professionally compiled analysis, covering all five forces, will be instantly accessible for your strategic planning needs.

Rivalry Among Competitors

The Japanese packaging market, where Hokkan Holdings operates, is home to numerous significant competitors. These range from other large metal can manufacturers to substantial plastic packaging firms and broader, diversified packaging conglomerates, all vying for market dominance.

This competitive landscape is characterized by the presence of several large, established players in addition to Hokkan Holdings. For instance, companies like Toyo Seikan Group Holdings and Daiwa Can Company are major metal can producers, while others focus on different packaging materials, intensifying the rivalry for market share.

While the global food and beverage packaging market is expanding, certain segments, such as traditional beverage cans, may see more subdued growth in established markets like Japan. For Hokkan Holdings, operating in such environments means facing increased competition for market share.

In 2024, the Japanese beverage can market, a key area for Hokkan, is projected to experience a compound annual growth rate (CAGR) of around 1.5% to 2.0%. This moderate growth rate signifies that companies must vie more intensely for existing customers, potentially leading to price wars or increased promotional spending, thereby intensifying competitive rivalry.

Competition in the beverage packaging sector, including for Hokkan Holdings, is heavily influenced by product differentiation through innovation. Companies are increasingly focusing on sustainable materials like lightweight aluminum and bio-based plastics to attract environmentally conscious consumers.

Smart packaging features, such as QR codes for traceability or interactive elements, and unique, eye-catching designs also serve as key differentiators. In 2024, the demand for sustainable packaging solutions saw a significant uptick, with reports indicating that over 60% of consumers are willing to pay more for products in eco-friendly packaging.

Hokkan Holdings' strategic investments in advanced manufacturing technologies and the expansion of its comprehensive service offerings, from design to recycling support, position it to gain a competitive edge. For instance, their development of advanced PET recycling technologies aims to meet the growing market need for circular economy solutions.

Exit Barriers

High fixed costs in the can manufacturing and filling sectors present significant hurdles for companies looking to exit the market. These substantial investments in plant and machinery mean that shutting down operations can be prohibitively expensive, trapping capital within the industry.

This situation often leads to persistent overcapacity. Even when demand falters, companies are compelled to keep their production lines running to spread the high fixed costs, which can result in intense price competition, sometimes referred to as a price war, as firms fight to maintain sales volumes and cover their expenses.

For example, the capital expenditure for a modern beverage canning line can easily run into tens of millions of dollars. In 2024, reports indicated that the global packaging market, including metal cans, faced ongoing supply chain pressures and fluctuating raw material costs, further complicating exit strategies and reinforcing the impact of these high fixed costs.

- High Capital Investment: Significant upfront costs for manufacturing and filling equipment create substantial financial commitments.

- Operational Continuity Pressure: The need to amortize these fixed costs encourages continued operation, even in less profitable periods.

- Market Dynamics: Overcapacity driven by exit barriers can lead to aggressive pricing and reduced profit margins across the industry.

Strategic Stakes

The strategic stakes for Hokkan Holdings are high in its core beverage can and contract filling segments. Maintaining market share and profitability here is crucial, meaning competitors are likely to respond aggressively to any shifts. For instance, if Hokkan were to gain significant market share in 2024, rivals might engage in price reductions to win back customers, or ramp up advertising to counter Hokkan's momentum. This intense competition can also spur faster innovation, as companies strive to differentiate their offerings.

This rivalry is evident in the packaging industry's dynamics. In 2023, the global metal packaging market, which includes beverage cans, was valued at approximately $133.2 billion, with projections indicating continued growth. Hokkan Holdings operates within this competitive landscape, where even small gains can be hard-won and fiercely contested.

- Intense Rivalry: Competitors in the beverage can and contract filling markets have significant strategic incentives to defend their market share.

- Potential Reactions: Expect rivals to react strongly to Hokkan's market share gains through price wars, increased marketing, or accelerated product innovation.

- Industry Context: The global metal packaging market's substantial size and growth underscore the high stakes involved for players like Hokkan.

The competitive rivalry within Hokkan Holdings' operating markets, particularly for beverage cans and contract filling, is intense due to numerous established players and moderate growth rates. Companies like Toyo Seikan Group Holdings and Daiwa Can Company are significant rivals in the metal can sector, pushing for market share through innovation in sustainable materials and smart packaging, a trend consumers increasingly favor, with over 60% willing to pay more for eco-friendly options in 2024.

High fixed costs associated with manufacturing and filling equipment trap capital within the industry, discouraging exits and often leading to overcapacity and aggressive pricing strategies. For instance, the capital expenditure for a modern beverage canning line can exceed tens of millions of dollars, and in 2024, ongoing supply chain pressures and fluctuating raw material costs further complicated these exit barriers.

The strategic importance of market share in these segments means competitors are highly responsive to any shifts, potentially triggering price wars or increased promotional activities. The global metal packaging market, valued at approximately $133.2 billion in 2023, highlights the significant stakes and fierce competition Hokkan Holdings navigates.

| Key Competitors (Metal Cans) | Focus Areas | Market Data Point (2024) |

| Toyo Seikan Group Holdings | Metal cans, plastic packaging | Significant player in Japanese packaging market |

| Daiwa Can Company | Metal cans | Major competitor in beverage can manufacturing |

| Hokkan Holdings | Metal cans, contract filling | Targeting growth through advanced technologies and sustainability |

SSubstitutes Threaten

The threat of substitutes for Hokkan Holdings' beverage cans is primarily driven by alternative packaging materials. Plastic bottles, glass bottles, cartons, and flexible pouches all offer viable alternatives for beverage consumption. Hokkan's significant presence in metal can production means that a shift by consumers or beverage companies towards these other materials directly impacts its core business.

Factors such as cost-effectiveness, evolving consumer preferences, and increasing emphasis on sustainability can accelerate this substitution. For example, the global market for flexible packaging, a key substitute, was valued at approximately USD 250 billion in 2023 and is projected to grow significantly, indicating a strong and expanding alternative.

Consumer preference shifts represent a significant threat of substitutes for Hokkan Holdings, particularly with the growing demand for sustainable and convenient packaging solutions. For example, a notable trend in 2024 is the increasing consumer interest in bio-based plastics and reusable glass packaging systems. This shift directly challenges traditional packaging materials like metal cans, potentially impacting Hokkan's market share if they do not adapt.

The cost-effectiveness of substitute packaging materials poses a significant threat to Hokkan Holdings. If alternatives like advanced plastics or innovative flexible packaging become substantially cheaper to produce or transport, customers may easily shift away from metal cans. For instance, a 10% reduction in the manufacturing cost of a leading flexible pouch could make it a more appealing option for beverage companies, directly impacting demand for Hokkan's metal can offerings.

Performance and Functionality of Substitutes

The threat of substitutes for Hokkan Holdings' packaging solutions is significant, particularly as advancements in alternative materials enhance their performance and functionality. For instance, sophisticated plastic films offering extended shelf life and the convenience of resealable pouches present a compelling alternative to traditional metal cans and rigid containers. These innovations directly challenge the established market position of Hokkan's offerings by providing comparable or superior benefits to end-users.

Furthermore, the integration of smart packaging technologies into substitute products introduces another layer of competitive pressure. These smart features, such as temperature indicators or freshness sensors, add value and appeal that traditional packaging may lack. As of early 2024, the global smart packaging market is projected to grow substantially, indicating increasing consumer and industry adoption of these advanced alternatives.

Key substitute functionalities impacting Hokkan Holdings include:

- Extended Shelf Life: Advanced plastic films and modified atmosphere packaging can significantly prolong product freshness, directly competing with the protective qualities of metal cans.

- Convenience Features: Resealable pouches and easy-open closures on flexible packaging offer user-friendly benefits that can sway consumer preference away from more traditional, less convenient formats.

- Smart Technology Integration: The incorporation of sensors, indicators, and traceability features in alternative packaging provides added value and data insights, a growing demand in the supply chain.

Regulatory and Environmental Pressures

Increasing regulations, such as those targeting single-use plastics, can make alternative packaging materials more attractive to Hokkan Holdings. For instance, many regions are implementing or strengthening bans on certain plastic packaging, pushing consumers and businesses towards paper, glass, or metal alternatives. In 2024, the European Union continued to advance its Circular Economy Action Plan, with specific directives impacting packaging waste and recycled content mandates, potentially increasing the appeal of substitutes that meet these evolving standards.

Environmental consciousness is a significant driver, influencing customer preferences towards packaging perceived as sustainable. This trend can elevate the threat of substitutes if Hokkan Holdings' primary packaging solutions are viewed as less eco-friendly. For example, a growing consumer segment might actively seek out products packaged in aluminum cans or compostable materials, even if they come at a premium, directly impacting demand for less sustainable options.

- Regulatory shifts favoring sustainable packaging: Many governments are implementing stricter rules on plastic packaging, encouraging the adoption of alternatives.

- Consumer demand for eco-friendly options: Growing environmental awareness leads customers to prefer packaging materials with a lower ecological footprint.

- Material innovation in substitute packaging: Advances in biodegradable and recyclable materials present viable alternatives to traditional packaging.

- Impact on Hokkan Holdings' product portfolio: The company must adapt its offerings to align with these regulatory and consumer-driven environmental trends to mitigate the threat of substitutes.

The threat of substitutes for Hokkan Holdings' metal cans is substantial, driven by evolving consumer preferences and material innovations. Flexible packaging, for instance, saw its global market value reach approximately USD 250 billion in 2023, with continued growth projected, highlighting its increasing appeal as a viable alternative.

Consumer demand for convenience and sustainability is a key factor. In 2024, there's a noticeable rise in consumer interest in bio-plastics and reusable glass systems, directly challenging the market position of metal cans. This shift means Hokkan must actively consider how its offerings align with these growing environmental and convenience trends.

Cost-effectiveness also plays a crucial role. If alternative materials like advanced plastics become significantly cheaper to produce or transport, beverage companies may readily switch from metal cans. A hypothetical 10% cost reduction in a leading flexible pouch could easily sway purchasing decisions, impacting Hokkan's demand.

| Substitute Material | Key Advantages | Market Trend/Data (as of 2023/2024) |

|---|---|---|

| Flexible Packaging | Lightweight, versatile, improved barrier properties, perceived sustainability | Global market valued at ~USD 250 billion (2023), strong growth |

| Plastic Bottles (PET) | Lightweight, shatterproof, cost-effective, recyclability | Dominant in many beverage segments, ongoing improvements in recycled content |

| Glass Bottles | Premium perception, inert, high recyclability | Resurgence in craft beverages and premium segments, growing interest in reusable systems |

| Cartons (e.g., Tetra Pak) | Lightweight, good insulation, recyclable | Strong in dairy and juice markets, increasing adoption for other beverages |

Entrants Threaten

The packaging industry, especially for metal can manufacturing and large-scale filling, demands significant upfront investment. Hokkan Holdings, like others in this sector, needs substantial capital for advanced machinery, modern facilities, and cutting-edge technology. This financial hurdle naturally discourages many potential new players from entering the market.

Hokkan Holdings, like many established players in its sector, benefits significantly from economies of scale. This means they can produce, purchase materials, and distribute their products or services at a lower cost per unit than a smaller, newer company. For instance, in 2024, major beverage distributors often negotiate bulk discounts that are simply unavailable to startups.

New entrants would face a substantial hurdle in matching these cost efficiencies. Without the established volume of operations that Hokkan Holdings possesses, a newcomer would find it challenging to compete on price. This cost disadvantage makes it difficult for new companies to gain market share quickly, acting as a significant barrier.

Hokkan Holdings benefits from deeply entrenched relationships with major food and beverage manufacturers, giving it preferential access to key distribution channels. Newcomers would struggle to replicate these established partnerships, which are crucial for efficient market penetration.

Securing contracts with major retailers and establishing robust logistics networks presents a significant barrier. For instance, in 2024, the top five supermarket chains in Japan, a key market for Hokkan, controlled over 60% of grocery sales, highlighting the concentration of distribution power.

Proprietary Technology and Expertise

Hokkan Holdings' strength in specialized machinery manufacturing, particularly its advanced filling technologies, creates a substantial barrier for potential new entrants. Replicating this proprietary technology and the deep operational expertise required to implement it effectively is a significant challenge. For instance, in 2024, the capital expenditure for establishing a new, state-of-the-art beverage bottling line with advanced filling capabilities could easily run into tens of millions of dollars, a considerable upfront investment.

The accumulated knowledge and experience in optimizing these complex systems are not easily transferable or acquirable, acting as a deterrent. New companies would face a steep learning curve and potentially lengthy development cycles to match Hokkan's established efficiency and reliability. This technological moat is reinforced by ongoing investment in research and development, ensuring that Hokkan maintains its edge in precision and speed, critical factors in the competitive beverage packaging industry.

- Proprietary Technology: Hokkan's advanced filling machines represent a significant R&D investment, difficult for newcomers to replicate.

- Operational Expertise: Years of experience in optimizing these systems provide a competitive advantage that takes time to build.

- High Capital Investment: Establishing similar manufacturing capabilities in 2024 required substantial financial commitment, potentially exceeding $50 million for advanced lines.

- R&D Focus: Continuous innovation in filling technology by Hokkan further widens the gap for potential entrants.

Government Policy and Regulations

Government policy and regulations present a significant threat to new entrants in Hokkan Holdings' industry. Strict environmental regulations, stringent food safety standards, and evolving recycling mandates within Japan and other operating regions create substantial compliance costs and operational complexities. For instance, in 2024, Japan continued to emphasize its commitment to sustainability, with ongoing discussions around further tightening waste management and emissions standards, directly impacting manufacturing and packaging processes. These regulatory hurdles require considerable investment in technology, infrastructure, and skilled personnel, making it difficult for new players to establish a competitive foothold without significant upfront capital and expertise.

Navigating these intricate regulatory landscapes acts as a major barrier to entry. Newcomers must dedicate resources to understanding and adhering to a complex web of laws covering everything from product labeling and ingredient sourcing to waste disposal and labor practices. Failure to comply can result in hefty fines, operational shutdowns, and severe reputational damage, deterring potential entrants who may lack the established systems and experience to manage these risks effectively. The continuous evolution of these regulations, driven by societal and environmental concerns, further amplifies this barrier.

- Environmental Regulations: Compliance with Japan's updated environmental protection laws, which often include stricter emission controls and waste reduction targets, can require significant capital expenditure for new facilities.

- Food Safety Standards: Adherence to rigorous food safety protocols, such as those mandated by the Japanese Ministry of Health, Labour and Welfare, necessitates advanced quality control systems and traceability measures.

- Recycling Mandates: New entrants must factor in the costs associated with meeting Japan's increasingly comprehensive recycling and packaging waste reduction requirements, which can impact material choices and supply chain logistics.

- Compliance Costs: The combined effect of these regulations can lead to substantially higher operating costs for new entrants compared to established players with existing infrastructure and processes already in place.

The threat of new entrants for Hokkan Holdings is relatively low due to significant capital requirements for specialized machinery and advanced filling technologies. For instance, in 2024, establishing a state-of-the-art beverage bottling line could cost tens of millions of dollars. Furthermore, Hokkan benefits from strong economies of scale, making it difficult for newcomers to compete on price without comparable production volumes. These factors, combined with established distribution networks and proprietary technology, create substantial barriers.

| Barrier Type | Description | 2024 Relevance/Example |

|---|---|---|

| Capital Requirements | High upfront investment for specialized machinery and facilities. | Setting up advanced filling lines could exceed $50 million. |

| Economies of Scale | Lower per-unit costs due to high production volume. | Major distributors in 2024 secured bulk discounts unavailable to startups. |

| Proprietary Technology | Difficult-to-replicate advanced filling and manufacturing processes. | Hokkan's R&D investment in filling technology creates a technological moat. |

| Distribution Access | Established relationships with key retailers and logistics networks. | Top Japanese supermarkets in 2024 controlled over 60% of grocery sales. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hokkan Holdings leverages data from their annual reports, investor presentations, and public financial statements. We also incorporate industry-specific research from market analysis firms and news from trade publications to gain a comprehensive understanding of the competitive landscape.