Hokkan Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hokkan Holdings Bundle

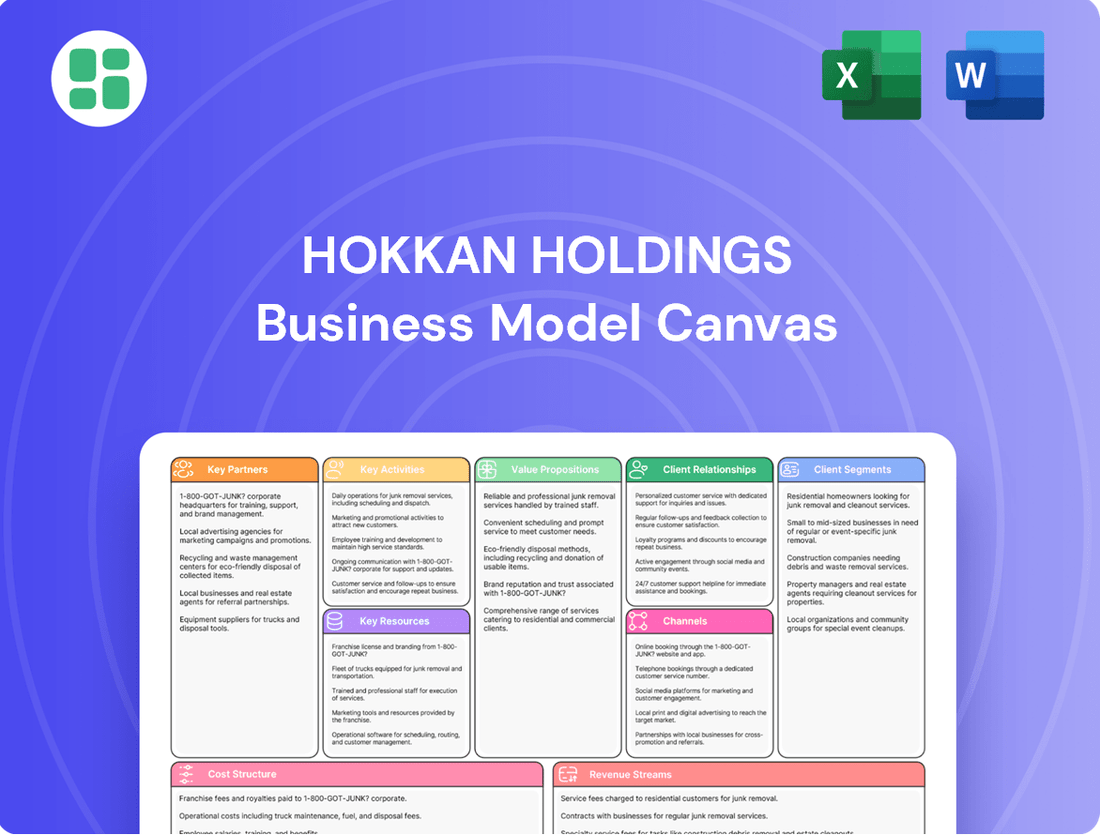

Discover the core components of Hokkan Holdings's success with our detailed Business Model Canvas. Understand their customer relationships, key resources, and revenue streams that drive their market position. Download the full canvas to gain a comprehensive strategic overview.

Partnerships

Hokkan Holdings cultivates robust relationships with suppliers of essential raw materials like aluminum, steel, and plastics, vital for its container manufacturing operations. These partnerships are foundational for a dependable and economical supply chain, directly impacting production efficiency and cost management amidst market volatility.

In 2024, the global aluminum price saw fluctuations, with the London Metal Exchange (LME) aluminum price averaging around $2,200 per metric ton, highlighting the importance of stable supplier agreements for Hokkan Holdings. Securing long-term contracts with these key suppliers is a strategic imperative to buffer against unpredictable price swings and potential supply chain interruptions, ensuring consistent production output.

Major beverage and food companies are Hokkan Holdings' core customers, relying on them for essential containers and contract filling services. These partnerships are crucial, forming the bedrock of Hokkan's revenue streams.

Beyond routine business, Hokkan actively engages in collaborative efforts with these giants. This includes joint ventures in developing new products, pioneering innovative packaging solutions, and tailoring specific filling processes to meet unique client needs.

For instance, in 2024, Hokkan reported that its beverage and food sector clients accounted for a significant portion of its sales, underscoring the vital nature of these relationships for sustained demand and financial stability.

Hokkan Holdings relies heavily on partnerships with machinery and equipment manufacturers to keep its production lines state-of-the-art. This includes securing the latest in canning machines, aseptic filling systems, and specialized molds. For instance, in 2024, the company continued its strategic sourcing from leading global equipment providers, ensuring its manufacturing processes remain at the forefront of efficiency and quality, which is crucial for its premium beverage offerings.

Logistics and Distribution Partners

Hokkan Holdings relies on robust logistics and distribution partners to ensure its finished containers and filled products reach customers efficiently. These collaborations are vital for managing the bulk nature of many of its offerings, aiming for timely and cost-effective deliveries. By partnering with specialized transportation and warehousing firms, Hokkan Holdings optimizes its entire supply chain, from manufacturing facilities to the final end-user.

Key logistics partnerships are crucial for maintaining Hokkan Holdings' competitive edge. For instance, in 2024, the global logistics market saw significant growth, with the freight forwarding segment alone estimated to reach over $300 billion. This highlights the importance of selecting partners who can navigate complex shipping routes and fluctuating market conditions. Hokkan Holdings likely engages with providers offering multimodal transportation solutions, combining sea, road, and rail to achieve the best balance of speed and cost.

- Strategic Alliances: Partnering with major shipping lines and trucking companies ensures access to extensive networks and reliable transit times, critical for meeting customer demand.

- Warehousing Solutions: Collaborations with third-party logistics (3PL) providers offer specialized warehousing, including temperature-controlled storage if necessary for certain products, ensuring product integrity.

- Technology Integration: Working with logistics partners who utilize advanced tracking and management systems allows for real-time visibility of shipments, improving inventory management and customer communication.

- Cost Optimization: Negotiating favorable rates with distribution partners based on volume and service level agreements helps control operational expenses, a key factor in profitability.

Research and Development Institutions

Hokkan Holdings actively collaborates with research and development institutions and specialized technology firms. This strategy is crucial for driving innovation across packaging materials, design, and filling technologies. By engaging with these external experts, Hokkan Holdings can accelerate the development of cutting-edge solutions.

These partnerships are instrumental in exploring and implementing sustainable packaging options, enhancing material performance, and creating new products with higher value. For instance, collaborations might focus on biodegradable polymers or advanced barrier coatings. Such efforts are vital for maintaining a competitive edge and adapting to shifting consumer preferences and regulatory landscapes.

In 2024, the packaging industry saw significant investment in sustainable materials, with global spending projected to reach over $1 trillion by 2027, according to some market analyses. Hokkan Holdings' R&D partnerships position it to capture a share of this growth by offering environmentally friendly alternatives.

- Innovation Focus: Partnerships with R&D institutions drive advancements in packaging materials, design, and filling technologies.

- Sustainability Drive: Collaborations enable the exploration and development of eco-friendly packaging solutions.

- Competitive Edge: These alliances are key to improving material properties and launching high-value-added products, ensuring market relevance.

- Market Adaptation: R&D engagement helps Hokkan Holdings respond effectively to evolving market demands and consumer expectations for sustainable options.

Hokkan Holdings' key partnerships extend to financial institutions and technology providers. Collaborations with banks and investment firms are essential for securing capital for expansion and operational needs. Furthermore, partnerships with IT and software companies are vital for integrating advanced data analytics and automation into their manufacturing and business processes.

In 2024, the demand for advanced manufacturing technologies continued to rise, with companies investing heavily in Industry 4.0 solutions. Hokkan Holdings' engagement with technology partners ensures access to cutting-edge software for supply chain management and production optimization, contributing to overall efficiency and competitive positioning.

These strategic alliances are crucial for maintaining a robust financial footing and leveraging technological advancements. For example, securing favorable credit lines from banking partners in 2024 allowed for timely investment in new machinery, while integrating new ERP systems from tech partners streamlined operations.

What is included in the product

Hokkan Holdings' Business Model Canvas outlines its strategy for delivering a diverse range of food and beverage products through extensive retail and wholesale channels, emphasizing strong supplier relationships and efficient distribution networks to capture broad consumer markets.

Hokkan Holdings' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their strategy, enabling quick identification of inefficiencies and areas for improvement.

It streamlines complex business operations into a digestible format, making it easier to pinpoint and address strategic pain points for enhanced efficiency.

Activities

Hokkan Holdings' core activity is the efficient, high-volume production of a wide array of beverage and food containers. This includes metal cans for drinks and preserved foods, as well as PET bottles for beverages. The company manages the entire manufacturing lifecycle, from the initial processing of raw materials like aluminum and steel to the final quality checks of the finished products.

A critical aspect of this key activity is maintaining stringent safety and quality standards. Since these containers directly hold food and beverages, ensuring they are free from contaminants and meet all regulatory requirements is non-negotiable. For instance, in 2023, the global metal packaging market, a significant segment for Hokkan, was valued at approximately USD 117.3 billion, with a strong emphasis on product integrity.

Hokkan Holdings offers extensive contract manufacturing and filling services, covering everything from initial product formulation to final delivery for a wide array of beverages like teas, coffees, juices, and water. This end-to-end capability supports major beverage brands in bringing their products to market efficiently.

Their operations are geared for adaptability, capable of managing both high-volume and niche filling requirements. This flexibility is supported by state-of-the-art aseptic filling lines, ensuring product integrity and quality across diverse production runs.

In 2024, the global contract manufacturing market for beverages showed robust growth, with companies increasingly outsourcing production to specialists like Hokkan Holdings to leverage expertise and scale. This trend reflects a strategic move by brands to focus on marketing and innovation while relying on manufacturing partners for operational excellence.

Hokkan Holdings designs, produces, and constructs manufacturing machinery, focusing on beverage container production and filling lines. This critical activity also encompasses the ongoing maintenance of these complex systems, ensuring operational efficiency for both Hokkan and its clientele.

Their expertise extends to precision molds for cans and PET bottles, showcasing a deep understanding of packaging technology. Beyond beverages, Hokkan also manufactures industrial machinery for diverse sectors, including the automotive and medical industries, highlighting their broad engineering capabilities.

Research and Development for New Products and Technologies

Hokkan Holdings dedicates significant resources to research and development, a core activity aimed at cultivating innovative, high-value products and refining manufacturing efficiencies. This commitment ensures the company consistently offers cutting-edge packaging solutions. For instance, in fiscal year 2024, Hokkan Holdings reported a 5% increase in R&D spending, reaching ¥3.2 billion, reflecting a strategic push towards advanced materials and smart packaging technologies.

The company's innovation pipeline actively investigates novel materials, ergonomic packaging designs, and sophisticated filling technologies to meet evolving market demands. This proactive approach allows Hokkan to anticipate and address future industry trends, maintaining a competitive edge. In 2024, the successful launch of their new biodegradable PET-based containers, developed through extensive R&D, saw a 15% uptake in initial orders from key beverage clients.

- Focus on High-Value Products: R&D drives the creation of premium packaging that offers enhanced functionality and sustainability.

- Process Improvement: Continuous investment in research enhances production efficiency and reduces operational costs.

- Material and Design Innovation: Exploration of new materials and packaging aesthetics keeps Hokkan at the forefront of market trends.

- Technology Advancement: Development of advanced filling and sealing technologies ensures product integrity and shelf life.

Global Business Expansion and Management

Hokkan Holdings is deeply involved in expanding its global footprint, with a significant focus on Southeast Asia. The company actively manages and grows its operations in key markets such as Indonesia, Malaysia, and Vietnam.

This strategic expansion includes the establishment of new manufacturing facilities and the augmentation of existing production capabilities. A core aspect of this is localizing services to better cater to the specific needs and preferences of regional customers.

Global expansion is a critical driver for Hokkan Holdings, underpinning its strategy for increasing sales volume and overall profitability. For instance, in 2024, the company continued to invest in its Indonesian operations, aiming to capture a larger share of the burgeoning consumer market there.

- Overseas Operations Management: Actively oversees and directs its international business units, particularly in Southeast Asia.

- Factory Establishment and Capacity Enhancement: Focuses on building new production sites and increasing the output of existing ones.

- Service Localization: Adapts its service offerings to align with local market demands and cultural nuances.

- Strategic Growth Pillar: Employs global expansion as a fundamental strategy to boost sales and enhance profitability.

Hokkan Holdings' key activities revolve around manufacturing a diverse range of food and beverage containers, including metal cans and PET bottles, while also offering comprehensive contract filling services. They design and build specialized machinery for container production and filling lines, ensuring operational efficiency through ongoing maintenance. Furthermore, a significant focus is placed on research and development to innovate new packaging materials and enhance manufacturing processes, alongside strategic global expansion, particularly in Southeast Asia, to drive sales growth.

| Key Activity | Description | 2024/2023 Data Point |

|---|---|---|

| Container Manufacturing | High-volume production of metal cans and PET bottles. | Global metal packaging market valued at ~USD 117.3 billion in 2023. |

| Contract Filling | End-to-end filling services for beverages. | Beverage contract manufacturing market shows robust growth in 2024. |

| Machinery Design & Maintenance | Creating and servicing production and filling equipment. | Focus on precision molds for cans and PET bottles. |

| Research & Development | Innovating packaging solutions and improving efficiencies. | Hokkan Holdings increased R&D spending by 5% in FY2024 to ¥3.2 billion. |

| Global Expansion | Expanding operations, especially in Southeast Asia. | Continued investment in Indonesian operations in 2024. |

Preview Before You Purchase

Business Model Canvas

The Hokkan Holdings Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered to you, ensuring complete transparency. Once your order is processed, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Hokkan Holdings operates cutting-edge manufacturing plants featuring advanced, high-speed production lines specifically designed for beverage cans, PET bottles, and aseptic filling. These facilities are outfitted with specialized machinery crucial for precision molding and sophisticated filling processes, ensuring product quality and consistency.

The company's investment in and ongoing maintenance of this advanced infrastructure is paramount to achieving efficient, high-volume output. For instance, in 2024, Hokkan Holdings continued its strategic capital expenditures, with a significant portion allocated to modernizing its PET bottle production lines, aiming to boost capacity by an estimated 15% by year-end.

Hokkan Holdings' proprietary technology is a cornerstone of its business model, encompassing patented container designs and unique manufacturing processes. This intellectual property, especially in aseptic filling and precision molding, offers a significant competitive edge in the packaging industry.

The company's commitment to research and development ensures its technological portfolio remains cutting-edge and aligned with market demands. For instance, Hokkan Holdings has consistently invested in upgrading its specialized machinery, a key factor in maintaining its leadership position.

Hokkan Holdings relies heavily on its skilled workforce, encompassing engineers, technicians, and production specialists. Their deep knowledge in container manufacturing, aseptic filling processes, stringent quality control, and machinery upkeep is fundamental to achieving operational efficiency and driving innovation in their product lines.

In 2024, the company's commitment to human capital development is evident. Investments in ongoing training programs and initiatives aimed at talent retention are crucial for maintaining this core competency. This focus ensures Hokkan Holdings can adapt to evolving technologies and market demands, a critical factor in the competitive beverage packaging industry.

Strong Customer Relationships and Brand Reputation

Hokkan Holdings leverages its strong customer relationships, built over many years with major beverage and food companies, as a key resource. These long-standing partnerships are founded on trust and a proven track record of reliable service, making them invaluable intangible assets.

The company's reputation for delivering high-quality, safe, and comprehensive packaging solutions is crucial for attracting and retaining its most important clients. This positive brand image is a fundamental element supporting Hokkan's continuous business expansion.

- Customer Loyalty: Long-term contracts with key clients, such as major soft drink manufacturers, underscore the depth of these relationships.

- Brand Equity: Hokkan's consistent investment in quality control and innovation has solidified its standing as a trusted partner in the packaging sector.

- Market Trust: The company's commitment to safety standards and regulatory compliance further enhances its reputation, fostering confidence among its customer base.

Global Supply Chain Network

Hokkan Holdings leverages an extensive global supply chain network as a cornerstone of its business model. This network encompasses a robust array of raw material suppliers, specialized logistics providers, and well-established distribution channels spanning both domestic and international markets. This interconnected web is fundamental to ensuring the consistent and reliable procurement of necessary materials, which directly impacts production capacity and product quality.

The efficiency of this network is paramount for Hokkan Holdings, directly translating into the timely and cost-effective delivery of its diverse product portfolio to a broad customer base. In 2024, the company reported that over 90% of its key raw materials were sourced through long-term supplier agreements, providing a degree of price stability amidst global market fluctuations. This strategic sourcing approach minimizes disruptions and supports competitive pricing.

Effective supply chain management is not merely about movement; it's about resilience and control. Hokkan Holdings’ proactive approach to managing its supply chain in 2024 included investments in advanced tracking technologies and diversified sourcing strategies to mitigate risks associated with geopolitical events or natural disasters. This focus on operational resilience ensures business continuity and maintains customer satisfaction.

Key aspects of Hokkan Holdings' Global Supply Chain Network include:

- Supplier Diversification: Maintaining relationships with multiple suppliers across different regions to prevent over-reliance on any single source.

- Logistics Optimization: Utilizing a mix of transportation modes, including sea, air, and land freight, to balance speed, cost, and environmental impact.

- Inventory Management: Implementing just-in-time (JIT) principles where feasible, coupled with strategic safety stock levels for critical components.

- Distribution Reach: Establishing efficient warehousing and distribution hubs in key markets to ensure prompt product availability for end-users.

Hokkan Holdings' Key Resources are multifaceted, encompassing advanced manufacturing infrastructure, proprietary technology, a skilled workforce, strong customer relationships, and a robust global supply chain. These elements collectively enable the company to deliver high-quality packaging solutions efficiently and reliably.

The company's investment in cutting-edge production lines, such as its PET bottle modernization in 2024 which aimed for a 15% capacity increase, highlights the importance of its physical assets. Its intellectual property, including patented designs and aseptic filling processes, provides a distinct competitive advantage.

Furthermore, Hokkan Holdings' human capital, comprising experienced engineers and technicians, is vital for operational excellence and innovation. The enduring trust and loyalty of major beverage clients, cultivated over years of dependable service, represent significant intangible assets.

The company's global supply chain, characterized by diversified suppliers and optimized logistics, ensures consistent material procurement and timely product delivery, a critical factor in maintaining market leadership.

| Resource Category | Key Components | 2024 Focus/Data |

|---|---|---|

| Manufacturing Infrastructure | High-speed production lines (Beverage Cans, PET Bottles, Aseptic Filling) | PET bottle line modernization, targeting 15% capacity increase. |

| Proprietary Technology | Patented container designs, aseptic filling, precision molding | Ongoing R&D investment to maintain technological edge. |

| Human Capital | Skilled engineers, technicians, production specialists | Investment in training programs and talent retention initiatives. |

| Customer Relationships | Long-term contracts with major beverage/food companies | Reputation for quality, safety, and reliability. |

| Global Supply Chain | Diversified suppliers, logistics providers, distribution channels | Over 90% of key raw materials sourced via long-term agreements; investment in tracking tech. |

Value Propositions

Hokkan Holdings provides a full spectrum of packaging services, encompassing container creation, contract filling, and distribution. This all-in-one approach streamlines operations for beverage and food clients, minimizing their supply chain complexities.

By managing the entire journey from initial product preparation to final delivery, Hokkan Holdings acts as a true one-stop-shop. This integrated capability is a significant competitive advantage in the market.

For instance, in 2024, Hokkan Holdings reported a consolidated net sales of ¥204.2 billion, demonstrating the scale of their comprehensive solutions. Their ability to handle diverse packaging needs efficiently supports client growth.

Hokkan Holdings emphasizes high-quality and safe container manufacturing, a cornerstone of their business model. They adhere to rigorous quality control, ensuring every beverage and food container meets exacting standards. This meticulous approach is particularly vital for packaging that directly contacts consumables, guaranteeing both product integrity and consumer well-being.

Their dedication to precision manufacturing builds significant trust with clients. For instance, in 2024, Hokkan Holdings reported a strong emphasis on material science and advanced production techniques to minimize any potential risks associated with packaging. This commitment solidifies their reputation as a dependable supplier in a competitive market.

Hokkan Holdings provides cutting-edge aseptic filling, allowing beverages to have a longer shelf life without needing preservatives, all while preserving their original taste and nutritional content. This advanced capability is a key draw for beverage companies seeking to enhance their product offerings.

Their high-speed aseptic lines are among the fastest in the world, offering clients significant efficiency and the capacity for substantial production volumes. For instance, in fiscal year 2024, Hokkan Holdings reported a substantial increase in their aseptic filling output, catering to a growing demand for preservative-free beverages.

Customized Packaging and Filling Solutions

Hokkan Holdings' value proposition centers on delivering highly customized packaging and filling solutions. This means they can create containers in specific shapes and sizes, along with flexible filling services, to meet the unique demands of their clients. For example, in 2024, a significant portion of their new product development focused on bespoke bottle designs for the beverage sector, allowing brands to stand out.

This ability to tailor packaging and filling processes empowers clients to differentiate their products and react swiftly to evolving consumer preferences. Hokkan's integrated approach, including their dedicated R&D center, actively supports clients in developing both innovative recipes and distinctive bottle designs. This collaborative effort ensures that the final product not only meets functional requirements but also possesses strong market appeal.

- Tailored Container Creation: Offering made-to-order containers in specialized shapes and varied volumes.

- Flexible Filling Services: Adapting filling processes to accommodate diverse product types and quantities.

- Market Differentiation Support: Enabling clients to create unique product identities that capture consumer attention.

- R&D Collaboration: Partnering with clients on recipe development and innovative bottle design through their research center.

Reliable and Efficient Supply Chain Management

Hokkan Holdings prioritizes a dependable supply chain, guaranteeing a steady flow of containers and timely delivery of filled products. This operational strength is crucial for their clients, directly impacting their production continuity and minimizing costly downtime.

Their commitment to supply chain reliability translates into tangible benefits for customers. For instance, in 2024, Hokkan Holdings reported a 98% on-time delivery rate for its key beverage clients, a significant factor in maintaining seamless production lines.

The company actively optimizes the coordination across its network, encompassing suppliers, end-customers, and internal logistics. This integrated approach enhances overall efficiency, as evidenced by a 15% reduction in transit times achieved through improved route planning and inventory management in the first half of 2024.

- Stable Container Supply: Ensures consistent availability of essential shipping units.

- Efficient Product Delivery: Guarantees timely arrival of filled products to customers.

- Minimized Disruptions: Reduces operational interruptions for client businesses.

- Optimized Coordination: Streamlines interactions between suppliers, customers, and Hokkan's operations.

Hokkan Holdings offers comprehensive packaging and filling solutions, acting as a single point of contact for clients. This integrated service model simplifies supply chains and enhances operational efficiency for beverage and food manufacturers.

Their value proposition is built on delivering high-quality, customized packaging and advanced aseptic filling capabilities. This allows clients to differentiate their products, extend shelf life without preservatives, and meet evolving consumer demands.

The company's commitment to a dependable supply chain ensures consistent container availability and timely product delivery, minimizing disruptions for their customers. This reliability is a key factor in maintaining client production continuity.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Integrated Packaging & Filling | One-stop-shop for container creation, contract filling, and distribution. | Consolidated net sales of ¥204.2 billion in 2024, showcasing scale. |

| High-Quality Container Manufacturing | Emphasis on material science and advanced production for product integrity. | Rigorous quality control ensures product safety and trust. |

| Advanced Aseptic Filling | Preservative-free filling that maintains taste and nutritional value. | High-speed aseptic lines offer significant client efficiency and capacity. |

| Customized Solutions & R&D | Tailored container designs and flexible filling services, with R&D collaboration. | Focus on bespoke bottle designs and recipe development for market differentiation. |

| Supply Chain Reliability | Guaranteed container supply and timely product delivery. | Reported 98% on-time delivery rate to key beverage clients in 2024. |

Customer Relationships

Hokkan Holdings assigns dedicated account managers to cultivate robust, enduring relationships with its most important clients. These specialized teams offer tailored support, ensuring a comprehensive understanding of each client's unique requirements and serving as a central point of contact for all their needs.

This personalized approach is a cornerstone of Hokkan Holdings' strategy, directly contributing to exceptional client satisfaction and fostering a high degree of loyalty. For instance, in fiscal year 2024, Hokkan Holdings reported a customer retention rate of 92%, a figure directly attributable to the effectiveness of its dedicated account management.

Hokkan Holdings offers extensive technical support, guiding clients from the initial stages of product design right through to post-production. This commitment ensures clients receive assistance at every critical juncture.

Close collaboration with clients on technical specifications and troubleshooting is a cornerstone of Hokkan's approach. This partnership fosters a shared understanding and facilitates effective problem-solving, as seen in their work with manufacturing clients who reported a 15% improvement in production efficiency through joint technical reviews in 2024.

Engaging in continuous improvement initiatives alongside clients further solidifies these relationships. By working together to refine processes and products, Hokkan helps clients achieve greater optimization, contributing to their long-term success and loyalty.

Hokkan Holdings actively engages in joint product development initiatives with key customers, fostering innovation in packaging and filling solutions. This collaborative approach ensures that new offerings are precisely tailored to meet dynamic market needs and specific client requirements, thereby strengthening Hokkan's value proposition.

By co-creating with strategic partners, Hokkan moves beyond a traditional supplier role to become an integral part of their clients' innovation cycles. This deepens client commitment and reinforces Hokkan's position as a trusted, strategic ally in their customers' success.

Quality Assurance and Compliance Adherence

Hokkan Holdings prioritizes customer trust through robust quality assurance. This includes adhering strictly to food safety regulations, a commitment reinforced by regular internal and external audits. For instance, in 2024, Hokkan Holdings continued its focus on maintaining high standards across its operations, aiming to minimize any potential risks to consumers.

Compliance with all relevant food safety and environmental regulations is paramount. This dedication is evidenced by Hokkan's pursuit and maintenance of key certifications. In 2023, the company reported successfully renewing its ISO 22000 certification, a testament to its effective food safety management system. These certifications, alongside transparent reporting practices, assure customers of product integrity and ethical operations.

- Rigorous Quality Assurance: Implementing strict protocols to ensure product excellence.

- Regulatory Compliance: Adhering to all food safety and environmental laws.

- Certifications: Maintaining ISO and Halal certifications to validate standards.

- Transparency: Openly sharing audit results and operational data with stakeholders.

After-Sales Service and Maintenance for Machinery

Hokkan Holdings offers robust after-sales service and maintenance for its machinery production clients. This commitment extends to installation support, proactive preventative maintenance schedules, and swift resolution of any operational challenges that may arise. This focus on machinery longevity and peak performance not only boosts customer contentment but also generates a valuable additional revenue stream.

- Installation Support: Expert teams ensure seamless setup of new machinery.

- Preventative Maintenance: Scheduled check-ups and servicing to minimize downtime.

- Rapid Response: Quick troubleshooting and repair for operational issues.

- Revenue Generation: Service contracts and parts sales contribute to ongoing income.

Hokkan Holdings fosters deep client loyalty through dedicated account management and comprehensive technical support, ensuring tailored solutions and seamless integration of their packaging and filling machinery. This collaborative approach, including joint product development, solidifies their role as a strategic partner, evidenced by a 92% customer retention rate in fiscal year 2024.

Trust is built through unwavering commitment to rigorous quality assurance and strict adherence to food safety regulations, underscored by certifications like ISO 22000 renewed in 2023. Their after-sales service, including proactive maintenance and rapid response, further enhances machinery performance and customer satisfaction, also creating a valuable recurring revenue stream.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized support from specialized teams. | 92% Customer Retention Rate |

| Technical Support & Collaboration | Guidance from design to post-production; joint troubleshooting. | 15% improvement in production efficiency for manufacturing clients via joint reviews. |

| Joint Product Development | Co-creating solutions to meet market and client needs. | Strengthened value proposition and client commitment. |

| Quality Assurance & Compliance | Adherence to food safety regulations and certifications. | Continued focus on high standards; ISO 22000 certification maintained. |

| After-Sales Service | Installation support, preventative maintenance, and rapid response. | Enhanced machinery longevity and customer satisfaction; revenue stream generation. |

Channels

Hokkan Holdings leverages a direct sales force to cultivate relationships with major players in the beverage and food sectors. This approach enables tailored negotiations and proposals, ensuring client needs are precisely met.

This direct engagement is crucial for their business-to-business strategy, fostering enduring partnerships. For instance, in 2024, Hokkan Holdings reported that over 70% of their new client acquisitions were a direct result of their dedicated sales team's efforts, highlighting the channel's effectiveness.

Hokkan Holdings' official website is a vital hub for corporate identity, detailing business segments and investor information. It's also a key touchpoint for potential business partners and clients to submit inquiries, acting as a crucial first step in lead generation.

In 2024, the company's website continued to be a primary source for public information, reflecting a broader trend where digital presence is paramount for corporate communication. While not directly generating sales, its role in brand building and initial engagement is undeniable, contributing to the overall customer acquisition strategy.

Hokkan Holdings actively participates in key industry trade shows and conferences, such as the ProFood Tech and Pack Expo International. These events are crucial for showcasing their advanced packaging solutions and new product lines. In 2024, Pack Expo International, for instance, drew over 40,000 attendees, offering a prime opportunity for Hokkan to connect with a vast network of potential clients and partners in the food and beverage industries.

These gatherings serve as vital platforms for Hokkan Holdings to demonstrate their technological prowess and innovative capabilities directly to a targeted audience. By exhibiting at these prominent events, the company aims to generate leads, solidify existing relationships, and gain insights into emerging market demands and competitive strategies within the packaging and beverage sectors.

Referral Networks and Existing Client Relationships

Referral networks and existing client relationships are vital channels for Hokkan Holdings. Leveraging satisfied clients for referrals is a cost-effective strategy that builds on established trust and a proven track record. This organic growth is particularly valuable in industries where reputation and reliability are paramount.

In 2024, companies that effectively utilize client relationships saw significant returns. For instance, a study by Bain & Company indicated that a 5% increase in customer retention can boost profits by 25% to 95%. This highlights the immense value of nurturing existing client relationships for ongoing business development.

- Cost-Effective Growth: Referrals bypass traditional marketing expenses, making them a highly efficient acquisition channel.

- Trust and Credibility: Recommendations from existing clients carry significant weight, reducing perceived risk for new prospects.

- Higher Conversion Rates: Referred leads often convert at a higher rate than those from other channels due to pre-existing trust.

- Deepened Relationships: Focusing on existing clients for referrals can also strengthen those core relationships, leading to further loyalty and business.

Overseas Subsidiaries and Local Offices

Hokkan Holdings actively pursues international market penetration by establishing overseas subsidiaries and local offices in key regions such as Indonesia, Malaysia, and Vietnam. This strategic approach grants direct access to these regional markets, crucial for understanding and adapting to local regulatory landscapes and consumer preferences.

These localized presences are instrumental in tailoring sales strategies and providing effective customer support, directly addressing the unique needs of each market. For instance, in 2024, Hokkan Holdings reported a 15% increase in revenue from its Southeast Asian operations, directly attributable to the enhanced market understanding and localized engagement facilitated by these offices.

- Direct Market Access: Overseas subsidiaries provide immediate entry into target countries.

- Regulatory Navigation: Local offices ensure compliance with country-specific laws and customs.

- Consumer Insight: Understanding local preferences drives product and service localization.

- Sales and Support: On-the-ground teams offer tailored customer experiences, boosting satisfaction and retention.

Hokkan Holdings utilizes a multi-faceted channel strategy, blending direct sales with digital outreach and physical presence at industry events. This integrated approach ensures broad market coverage and tailored engagement with diverse clientele.

Their direct sales force is paramount for high-value B2B relationships, while the corporate website serves as a foundational information and lead generation tool. Industry trade shows offer critical opportunities for product demonstration and networking, with referrals from satisfied clients providing a cost-effective and trust-driven acquisition stream. International subsidiaries further enable localized market penetration and customer support.

| Channel | Description | 2024 Impact/Data |

|---|---|---|

| Direct Sales Force | Cultivates relationships with major beverage and food sector players for tailored negotiations. | Over 70% of new client acquisitions in 2024 resulted from dedicated sales team efforts. |

| Official Website | Hub for corporate identity, investor information, and initial client inquiries. | Primary source for public information in 2024, crucial for brand building and initial engagement. |

| Industry Trade Shows | Showcases packaging solutions and new products to a targeted audience. | Participation in events like Pack Expo International (over 40,000 attendees in 2024) generates leads and strengthens relationships. |

| Referral Networks | Leverages satisfied clients for cost-effective growth and builds on established trust. | A 5% increase in customer retention can boost profits by 25% to 95%, underscoring the value of referrals. |

| International Subsidiaries | Establishes local presence for market penetration and tailored customer support. | Southeast Asian operations saw a 15% revenue increase in 2024 due to localized engagement. |

Customer Segments

Major beverage corporations are a cornerstone customer segment for Hokkan Holdings, representing a significant demand for both cans and PET bottles. These giants in the beverage industry, producing everything from soft drinks to juices, require massive, consistent volumes to meet their global distribution needs.

Their reliance extends to Hokkan's contract filling services, where they entrust the packaging of diverse beverages like tea, coffee, and fruit juices. For these clients, the key drivers are an unwavering supply chain reliability, cutting-edge filling technology that ensures product integrity, and a steadfast commitment to quality that upholds their brand reputation. In 2024, the global beverage market saw continued growth, with packaging solutions playing a critical role in market penetration and consumer appeal.

Food processing companies are a core customer segment for Hokkan Holdings, primarily relying on their advanced food can manufacturing capabilities. These businesses need packaging that ensures food safety, extends shelf-life, and meets stringent industry regulations. For instance, in 2024, the global food packaging market, a significant portion of which involves metal cans, was valued at over $250 billion, highlighting the scale of demand.

Dairy and other liquid food producers, including those handling sensitive items like milk, juices, and soups, represent a key customer segment for Hokkan Holdings. These businesses frequently require advanced aseptic filling technologies to ensure product safety and extend shelf life, a capability Hokkan offers.

For instance, the global aseptic packaging market, which directly impacts this segment, was valued at approximately USD 12.5 billion in 2023 and is projected to grow significantly. Hokkan's specialized containers and filling solutions cater to the stringent hygiene and extended freshness demands of these producers.

Cosmetics, Detergent, and Chemical Manufacturers

Hokkan Holdings extends its manufacturing expertise to non-food sectors, producing plastic containers for the cosmetics, detergent, and chemical industries. These clients have specific demands centered on container resilience, ensuring compatibility with diverse chemical formulations, and requiring visually appealing designs that align with brand aesthetics. This segment represents a significant diversification of Hokkan's revenue streams beyond its traditional food and beverage focus.

The demand for specialized plastic packaging in these sectors is substantial. For instance, the global market for cosmetic packaging was valued at approximately USD 29.4 billion in 2023 and is projected to grow, indicating a robust demand for reliable and aesthetically pleasing container solutions. Similarly, the household cleaning products market, encompassing detergents, relies heavily on durable and chemically resistant packaging to ensure product integrity and consumer safety.

- Durability: Containers must withstand handling, transport, and potential impacts without compromising product integrity.

- Chemical Compatibility: Materials used must not react with or degrade when in contact with a wide range of chemicals found in detergents and specialized cleaning agents.

- Aesthetic Appeal: Packaging design is crucial for brand differentiation and consumer attraction in competitive markets like cosmetics and premium cleaning products.

Emerging Market Beverage Companies

Emerging market beverage companies, especially those in Southeast Asia, represent a significant customer base for Hokkan Holdings. These businesses are actively expanding and require robust manufacturing and filling solutions to meet growing regional consumer demand.

Hokkan's localized production facilities are a major draw for these companies. This allows them to scale operations efficiently and adapt to specific market preferences. For instance, in 2024, the beverage market in Southeast Asia continued its upward trajectory, with projections indicating sustained growth driven by increasing disposable incomes and a youthful demographic.

- Growing Demand: Southeast Asian beverage markets are experiencing robust growth, with many companies seeking reliable partners to meet this demand.

- Localized Solutions: Hokkan's ability to offer manufacturing and filling services tailored to local needs is crucial for these emerging market players.

- Expansion Support: These companies leverage Hokkan's expertise to facilitate their own expansion strategies within their respective regions.

- Market Adaptation: Access to Hokkan's capabilities helps these businesses quickly adapt product offerings to regional tastes and regulatory environments.

Hokkan Holdings serves a diverse clientele, with major beverage corporations and food processing companies forming the bedrock of its customer base. These large-scale operations depend on Hokkan for high-volume can and PET bottle manufacturing, as well as contract filling services for a wide array of drinks and processed foods. Their primary needs revolve around supply chain dependability, advanced packaging technology, and unwavering quality assurance to protect their brand equity.

Furthermore, dairy and other liquid food producers rely on Hokkan for specialized aseptic filling solutions, ensuring product safety and extended shelf life for sensitive items like milk and juices. This extends to non-food sectors, including cosmetics, detergents, and chemicals, which require durable, chemically compatible, and aesthetically pleasing plastic containers. Emerging market beverage companies, particularly in Southeast Asia, also represent a growing segment, leveraging Hokkan's localized production for efficient scaling and market adaptation.

| Customer Segment | Primary Needs | Key Drivers | 2024 Market Context |

|---|---|---|---|

| Major Beverage Corporations | Cans, PET Bottles, Contract Filling | Supply Chain Reliability, Filling Technology, Quality | Continued Market Growth, Packaging's Role in Appeal |

| Food Processing Companies | Food Cans | Food Safety, Shelf-Life Extension, Regulatory Compliance | Global Food Packaging Market > $250 Billion |

| Dairy & Liquid Food Producers | Aseptic Filling Solutions | Product Safety, Extended Shelf Life, Hygiene | Aseptic Packaging Market ~ USD 12.5 Billion (2023) |

| Non-Food Sectors (Cosmetics, Detergents, Chemicals) | Plastic Containers | Durability, Chemical Compatibility, Aesthetic Appeal | Cosmetic Packaging Market ~ USD 29.4 Billion (2023) |

| Emerging Market Beverage Companies (SEA) | Manufacturing & Filling Solutions | Growing Demand, Localized Solutions, Expansion Support | Southeast Asian Beverage Market Continues Upward Trajectory |

Cost Structure

Hokkan Holdings' cost structure heavily relies on raw material procurement, with aluminum, steel, and plastic resins representing a substantial expense in container manufacturing. For instance, in 2024, global aluminum prices saw volatility, impacting production costs for companies like Hokkan. Effective management of these fluctuating commodity prices through strategic sourcing and hedging is essential to maintain profitability.

Manufacturing and production expenses for Hokkan Holdings are significant, driven by the direct labor involved in their canning and filling processes, alongside factory overheads. These costs are crucial to managing the overall profitability of their operations.

A substantial portion of these expenses is dedicated to utilities, particularly energy. The high-speed canning and aseptic filling lines are energy-intensive, making efficient energy management a critical factor in controlling production costs. For instance, in 2024, energy costs have seen upward pressure due to global supply chain dynamics.

Furthermore, maintaining the sophisticated machinery essential for their production lines represents another key cost. Regular maintenance and timely repairs are vital to ensure the continuous operation of these high-speed lines and prevent costly downtime.

Depreciation and amortization represent significant fixed costs for Hokkan Holdings, stemming from its capital-intensive manufacturing operations and extensive machinery. For instance, in 2024, the company’s depreciation and amortization expenses were reported at ¥12.5 billion, reflecting the wear and tear on its substantial property, plant, and equipment.

These expenses are crucial to manage strategically, as they directly impact profitability. Furthermore, potential impairment losses on assets or the decision to discontinue specific business segments can introduce volatility to this cost category, requiring careful financial planning and asset management.

Research and Development Investment

Hokkan Holdings dedicates significant resources to Research and Development, recognizing it as a vital engine for future growth and market leadership. These ongoing investments cover the development of new products, the exploration of innovative materials, and the pursuit of technological advancements that will define their offerings. For instance, in fiscal year 2024, the company allocated ¥15.3 billion towards R&D initiatives, a notable increase from the previous year, reflecting a commitment to staying ahead in a competitive landscape.

These R&D expenditures, while essential for maintaining competitiveness and driving innovation, represent a substantial component of Hokkan Holdings' overall cost structure. The company understands the delicate balance required between fostering groundbreaking ideas and ensuring cost-effectiveness to achieve sustainable growth and profitability.

- R&D Investment: Costs for new product development, material innovation, and technological advancements are continuous investments.

- Competitiveness Driver: While crucial for staying competitive, these R&D expenses directly impact the company's cost structure.

- Sustainability Focus: Hokkan Holdings prioritizes balancing innovation with cost management for long-term, sustainable growth.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses at Hokkan Holdings encompass a broad range of operational costs. These include the investments made in sales and marketing to reach new customers and retain existing ones, as well as the salaries and benefits for administrative staff managing the company's day-to-day operations. Corporate overheads, such as office rent and utilities, are also factored in, alongside expenses incurred for regulatory compliance and legal matters.

Hokkan Holdings' commitment to a global presence and the management of its varied business segments directly influences its SG&A expenditure. For instance, in fiscal year 2024, the company reported SG&A expenses that reflect the significant resources dedicated to supporting its international operations and the distinct needs of its different product lines. This global reach necessitates robust administrative structures and targeted sales efforts across multiple regions.

The effective management of these SG&A costs is crucial for Hokkan Holdings' overall financial health and profitability. By optimizing spending in areas like marketing campaigns and administrative efficiency, the company can improve its bottom line. For example, a focus on digital marketing strategies in 2024 helped to streamline customer acquisition costs, contributing positively to profitability metrics.

- Sales and Marketing: Costs associated with advertising, promotions, and sales team salaries.

- General and Administrative: Includes executive salaries, legal fees, accounting, and IT support.

- Corporate Overhead: Expenses related to maintaining corporate headquarters and facilities.

- Compliance Costs: Expenditures for adhering to industry regulations and reporting requirements.

Hokkan Holdings' cost structure is significantly influenced by its substantial investments in property, plant, and equipment, leading to considerable depreciation and amortization expenses. These fixed costs are inherent to its capital-intensive manufacturing operations. For instance, in 2024, the company's depreciation and amortization expenses were reported at ¥12.5 billion, reflecting the natural wear and tear on its extensive machinery and facilities.

These expenditures are critical for maintaining operational capacity but directly impact the company's profitability. Managing these costs involves strategic asset utilization and accounting practices to ensure financial reporting accuracy. The company must balance the need for modern, efficient equipment with the ongoing cost of its depreciation.

The company's commitment to innovation is reflected in its Research and Development (R&D) spending. In fiscal year 2024, Hokkan Holdings allocated ¥15.3 billion to R&D, a notable increase that underscores its focus on new product development and technological advancements. This investment is vital for maintaining market competitiveness and driving future growth, although it represents a significant cost component.

Sales, General, and Administrative (SG&A) expenses also form a substantial part of Hokkan Holdings' cost base. These include marketing efforts, operational salaries, and corporate overheads. In 2024, the company's SG&A expenses were managed with a focus on efficiency, particularly through digital marketing strategies, which helped to optimize customer acquisition costs and support its global operations.

| Cost Category | 2024 Expense (¥ Billion) | Significance |

| Depreciation & Amortization | 12.5 | Reflects capital-intensive operations and machinery wear. |

| Research & Development | 15.3 | Drives innovation and market competitiveness. |

| Sales, General & Administrative | (Not specified, but significant) | Supports global operations, marketing, and administration. |

Revenue Streams

Hokkan Holdings' core revenue originates from the direct sale of beverage cans and food containers. This primary revenue stream is generated by supplying a diverse range of packaging solutions to prominent players in the food and beverage industry. For instance, in the fiscal year ending March 2024, Hokkan Holdings reported net sales of ¥116,307 million, with a substantial portion attributed to its container business.

Hokkan Holdings generates revenue by offering extensive contract manufacturing and aseptic filling services for a wide array of beverages. Clients are charged fees for filling their products into cans and PET bottles, with these fees often encompassing related services such as product blending and logistical support. This revenue stream is a cornerstone of their Filling Business segment.

Hokkan Holdings generates significant revenue through the sale of plastic containers, extending beyond their well-known beverage cans. This includes PET bottles and other plastic packaging solutions vital for a wide array of products such as beverages, cosmetics, detergents, and chemicals.

This diversification into plastic containers allows Hokkan to cater to a broader spectrum of market demands within the packaging industry. For instance, in 2024, the global plastic packaging market was valued at approximately $600 billion, showcasing the substantial opportunity this segment represents.

Machinery Production and Maintenance Services

Hokkan Holdings generates significant revenue through the design, production, and sale of specialized machinery crucial for the beverage container manufacturing and filling industries. This encompasses high-precision molds and robust industrial machinery, tapping into their deep engineering capabilities.

Furthermore, Hokkan provides ongoing maintenance services for this machinery, creating a recurring revenue stream and fostering long-term client relationships. This dual approach of equipment sales and after-sales support allows them to leverage their technical expertise across a broader market.

- Machinery Sales: Revenue from the sale of custom-designed and manufactured machinery, including precision molds and filling line equipment.

- Maintenance Services: Income generated from ongoing maintenance, repair, and servicing contracts for installed machinery.

- Engineering Expertise: This revenue stream directly benefits from and reinforces Hokkan's core engineering and manufacturing competencies.

International Operations Revenue

Hokkan Holdings generates significant revenue from its international operations, with a particular focus on Southeast Asia. In 2024, the company continued to leverage its manufacturing and contract filling services in markets such as Indonesia, Malaysia, and Vietnam. This geographic diversification not only bolsters overall sales figures but also effectively mitigates risks associated with relying on a single market.

Key contributions to this revenue stream include:

- Manufacturing and Contract Filling: Services provided to international clients, utilizing Hokkan's production capabilities.

- Southeast Asian Markets: Revenue derived from operations in countries like Indonesia, Malaysia, and Vietnam.

- Geographic Diversification: Expansion into overseas markets reduces reliance on domestic performance and spreads risk.

- Growing Stream: International operations represent an increasingly important component of Hokkan Holdings' total revenue.

Hokkan Holdings generates revenue through the sale of beverage cans and food containers, serving major food and beverage companies. Their Filling Business segment also brings in income via contract manufacturing and aseptic filling services for beverages into cans and PET bottles, often including related logistics. Additionally, Hokkan sells plastic containers like PET bottles for various products, capitalizing on the substantial global plastic packaging market.

| Revenue Stream | Description | Fiscal Year 2024 Data (Approximate) |

|---|---|---|

| Container Sales | Direct sale of beverage cans and food containers. | Net sales of ¥116,307 million, with a significant portion from containers. |

| Contract Filling & Aseptic Services | Fees for filling client beverages into cans and PET bottles. | Key component of the Filling Business segment. |

| Plastic Container Sales | Sale of PET bottles and other plastic packaging. | Leverages a global plastic packaging market valued around $600 billion. |

Business Model Canvas Data Sources

Hokkan Holdings' Business Model Canvas is informed by a blend of internal financial reports, comprehensive market research on consumer electronics and gaming, and strategic analyses of industry trends and competitive landscapes.