Hokkan Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hokkan Holdings Bundle

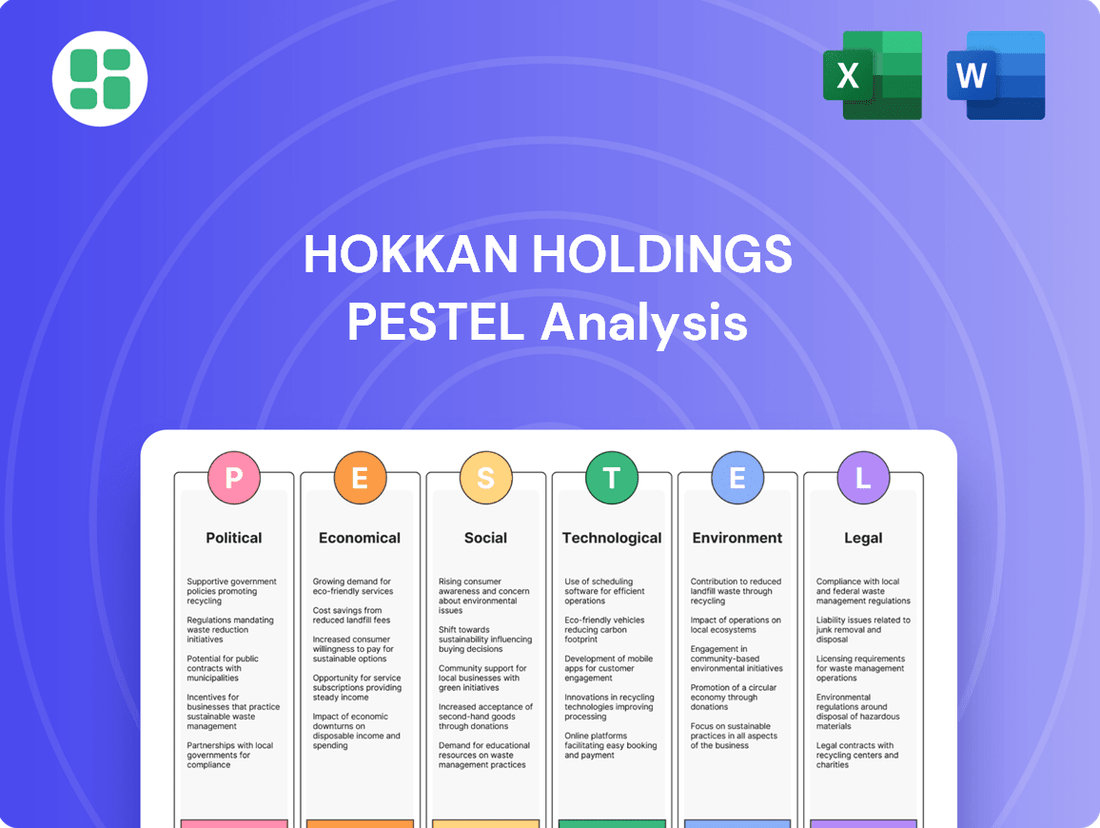

Navigate the dynamic external landscape impacting Hokkan Holdings with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are crucial for strategic planning and risk mitigation. Gain a competitive edge by leveraging these expert insights.

Unlock actionable intelligence on Hokkan Holdings's operating environment. Our PESTLE analysis dives deep into the forces shaping its future, offering a clear roadmap for informed decision-making. Secure your advantage – download the full report now.

Political factors

Governments, especially in Japan and the EU, are tightening regulations around packaging waste and recycling. This includes expanding Extended Producer Responsibility (EPR) schemes and setting ambitious targets for the use of recycled materials in packaging. For Hokkan Holdings, this means a push towards investing in more sustainable packaging solutions and adapting to new compliance requirements, which could also bring incentives for eco-friendly innovation.

Japan, for example, is moving towards obligating major manufacturers to incorporate recycled plastics into their products. The nation's plastic packaging is targeted for complete reuse or recycling by 2035, a significant directive that will shape material sourcing and product design for companies like Hokkan Holdings.

Trade policies and tariffs significantly shape Hokkan Holdings' operational landscape. For instance, the United States' imposition of tariffs on steel and aluminum in 2018, while partially eased, still created price volatility for these key raw materials used in container manufacturing. Such measures directly impact Hokkan's input costs and the competitiveness of its finished goods in international markets. The ongoing evolution of trade agreements, such as potential shifts in the USMCA or new EU trade pacts, will continue to influence Hokkan's ability to source materials affordably and export its products efficiently.

Regulatory bodies are consistently updating food safety and hygiene standards for packaging. This is to ensure public health is protected, especially concerning beverage and food containers. These updates directly impact manufacturers like Hokkan Holdings.

Japan's new 'positive list' system for synthetic resins in food contact materials, starting June 2025, is a prime example. This means only substances that have been specifically approved will be permitted. For Hokkan Holdings, this necessitates a thorough review of all materials used in their containers to ensure compliance.

Meeting these evolving standards will likely require significant investment in research and development for Hokkan Holdings. Adjustments to material sourcing strategies may also be crucial. For instance, if a commonly used resin is not on the positive list, the company will need to find and validate compliant alternatives, a process that can be both time-consuming and costly.

Government incentives or subsidies for sustainable packaging solutions

Government incentives play a crucial role in driving the adoption of sustainable packaging. Many governments offer grants, subsidies, and tax breaks to companies that invest in eco-friendly packaging materials, advanced recycling technologies, and the development of robust recycling infrastructure. For Hokkan Holdings, aligning its sustainability efforts with these national environmental objectives can significantly reduce the upfront costs associated with adopting greener technologies. This strategic alignment can also provide a competitive advantage by positioning the company as a leader in environmental responsibility.

Japan, where Hokkan Holdings is based, has demonstrated a strong commitment to fostering a circular economy. A prime example is the Green Innovation Fund, established by the New Energy and Industrial Technology Development Organization (NEDO). This fund supports research and development projects aimed at creating innovative environmental technologies. By leveraging such government support, Hokkan Holdings can accelerate its transition to more sustainable packaging solutions.

- Government Support: Incentives like grants and subsidies encourage the adoption of sustainable packaging.

- Cost Reduction: These programs can lower capital expenditure for green technologies.

- Competitive Edge: Aligning with national environmental goals enhances market positioning.

- Japan's Initiatives: The Green Innovation Fund exemplifies government backing for eco-friendly advancements.

Political stability and geopolitical tensions in key operational and market regions

Political stability in Japan, Hokkan Holdings' home base, is crucial for its consistent operations. For instance, the Japanese government's focus on economic revitalization and technological advancement, as seen in its 2024 economic outlook, generally supports business growth. However, any shifts in this stability could impact manufacturing and investment.

Geopolitical tensions, particularly in regions where Hokkan Holdings sources materials or sells products, pose significant risks. For example, ongoing trade disputes or regional conflicts can disrupt supply chains, leading to increased costs and delays. The company must navigate these uncertainties, which can affect market demand and create investment hesitations. In 2024, the global geopolitical landscape remained volatile, with events in Eastern Europe and the Middle East continuing to influence international trade and resource availability.

Government policies are a key political factor. Changes in regulations concerning manufacturing, trade agreements, and environmental protection can directly influence Hokkan Holdings' business model. For example, stricter environmental regulations, a trend observed globally in 2024, might necessitate increased investment in sustainable practices or alter production costs. Similarly, trade policies, such as tariffs or import/export restrictions, can significantly impact the company's international market access and profitability.

- Political Stability in Japan: The Japanese government's commitment to a stable economic environment, as highlighted in its 2024 economic projections, provides a generally favorable operating climate for Hokkan Holdings.

- Geopolitical Risk: The potential for disruptions from international conflicts or trade disputes remains a concern, impacting supply chain reliability and market access. For example, global shipping costs saw fluctuations in early 2025 due to ongoing geopolitical events.

- Policy Impact: Evolving government policies on manufacturing, trade, and environmental standards, such as the increasing focus on carbon neutrality in many developed nations in 2024, require continuous adaptation by Hokkan Holdings.

- Market Uncertainty: Shifts in government policies or geopolitical tensions can create market uncertainty, affecting consumer confidence and investment decisions for the company.

Government support through initiatives like Japan's Green Innovation Fund can significantly de-risk investment in sustainable packaging technologies for Hokkan Holdings. Furthermore, the evolving regulatory landscape, including Japan's 2025 positive list for food contact materials, mandates rigorous material validation and potential R&D investment. Geopolitical stability and trade policies remain critical, with global events in 2024 impacting supply chain costs and market access, as evidenced by shipping cost fluctuations in early 2025.

| Political Factor | Impact on Hokkan Holdings | Data/Example (2024-2025) |

|---|---|---|

| Environmental Regulations | Increased compliance costs, drive for sustainable materials | Japan's target for plastic packaging reuse/recycling by 2035; EU's expanding EPR schemes. |

| Trade Policies & Tariffs | Input cost volatility, international market competitiveness | US tariffs on steel/aluminum (partially eased) impacting raw material prices. |

| Food Safety Standards | Need for material revalidation and potential R&D | Japan's 'positive list' for food contact materials (effective June 2025). |

| Government Incentives | Reduced cost for green tech adoption, competitive advantage | Green Innovation Fund in Japan supporting environmental technology R&D. |

| Geopolitical Stability | Supply chain disruption risk, market access uncertainty | Global geopolitical volatility in 2024 affecting shipping costs in early 2025. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Hokkan Holdings, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential influence on the company's future performance.

A clear, actionable PESTLE analysis for Hokkan Holdings that highlights key external factors, simplifying strategic decision-making and mitigating potential risks.

Economic factors

Hokkan Holdings' profitability is heavily influenced by the cost of essential raw materials such as aluminum for beverage cans and various plastics used in packaging. These costs are subject to considerable volatility.

Global supply and demand trends, energy costs, and geopolitical developments significantly impact the prices of these materials. To manage this, Hokkan Holdings must employ strong procurement strategies and hedging techniques.

The broader packaging material market is projected to grow, with an estimated global market size of approximately USD 1.44 trillion by 2034, underscoring the sustained demand for the raw materials Hokkan utilizes.

Consumer spending habits and disposable income are crucial for Hokkan Holdings, directly impacting demand for their packaged foods and beverages. During economic downturns, consumers often cut back on non-essential purchases or opt for lower-cost alternatives, potentially affecting sales volumes and product mix.

The Japanese non-alcoholic beverage market, a key area for Hokkan Holdings, demonstrates positive growth, with projections indicating continued expansion. This growth is largely fueled by a rising consumer preference for healthier beverage options, suggesting a favorable market trend for companies adapting to these demands.

Rising inflation in 2024 and projected into 2025 is significantly increasing Hokkan Holdings' operational expenses. For instance, global energy prices saw a notable surge in late 2024, directly impacting transportation and utility costs. This upward trend in input prices, including raw materials and labor, is squeezing profit margins.

Hokkan Holdings faces a strategic dilemma: absorb these increased production costs, which would reduce profitability, or pass them onto consumers through higher prices. The latter option risks diminishing product competitiveness and dampening overall market demand, especially if competitors maintain lower price points.

Effectively navigating these inflationary pressures is paramount for Hokkan Holdings' financial stability. The company's ability to manage rising costs while maintaining consumer appeal will be a key determinant of its performance in the coming fiscal year, with analysts closely watching pricing strategies and cost-containment measures.

Exchange rate volatility affecting international trade and profits

Exchange rate volatility presents a significant challenge for Hokkan Holdings, a global player in the packaging industry. Fluctuations in currency values directly affect the cost of essential imported raw materials, impacting production expenses. For instance, if the yen strengthens significantly against currencies where Hokkan sources its materials, the cost of those inputs in yen terms would decrease, potentially boosting profit margins. Conversely, a weaker yen could inflate these costs.

The impact extends to revenue generated from international sales. A stronger Japanese yen can make Hokkan's products more expensive for overseas buyers, potentially dampening demand or forcing price adjustments that squeeze profitability. Conversely, a weaker yen could make exports more competitive and attractive, boosting sales volume. Hokkan Holdings' financial forecasts are therefore intrinsically linked to these unpredictable currency movements, requiring careful hedging strategies and scenario planning.

For example, in 2024, the Japanese Yen experienced notable fluctuations against major currencies like the US Dollar and Euro. If Hokkan Holdings had substantial sales in the US, a depreciating Yen throughout the year would have translated into higher Yen-denominated revenues from those sales. Conversely, if a significant portion of their raw materials were imported from Europe and the Euro strengthened against the Yen, their import costs would rise.

- Impact on Raw Material Costs: A stronger JPY can decrease the yen cost of imported materials, while a weaker JPY increases it.

- Effect on Export Revenue: A stronger JPY makes exports more expensive internationally, potentially reducing sales volume.

- Financial Forecasting Challenges: Currency fluctuations necessitate robust risk management and scenario analysis for accurate financial projections.

- Competitive Pricing: Exchange rates influence Hokkan's ability to maintain competitive pricing in international markets.

Economic growth rates in key markets, influencing demand for beverages and packaged foods

Economic growth rates in Hokkan Holdings' key markets, particularly Japan, significantly influence the demand for its packaging solutions. A healthy economy generally translates to higher consumer spending on packaged beverages and foods, directly boosting the need for Hokkan's products like beverage cans and food containers.

For instance, the Japan beverage cans market is projected to experience a compound annual growth rate (CAGR) of 4.3% between 2024 and 2030. This positive forecast suggests a favorable economic environment for Hokkan's core business.

- Japan's GDP growth: Observing Japan's GDP growth trends provides insight into consumer purchasing power for packaged goods.

- Consumer confidence indices: High consumer confidence often correlates with increased spending on non-essential items, including beverages and prepared foods.

- Disposable income levels: Rising disposable incomes directly support greater consumption of packaged products, benefiting Hokkan Holdings.

- Inflationary pressures: While growth is positive, managing inflation's impact on consumer spending is crucial for sustained demand.

Economic growth in Hokkan Holdings' key markets, especially Japan, directly impacts demand for their packaging. A robust economy fuels consumer spending on packaged goods, boosting sales of beverage cans and food containers. For example, the Japan beverage cans market is expected to grow at a CAGR of 4.3% from 2024 to 2030, indicating a positive economic outlook for Hokkan's core business.

Inflationary pressures in 2024 and into 2025 are increasing Hokkan's operational costs, particularly energy and raw materials. This necessitates careful pricing strategies to balance profitability with market competitiveness. For instance, global energy prices saw a significant rise in late 2024, directly impacting transportation and utility expenses.

Exchange rate volatility significantly affects Hokkan Holdings' costs for imported raw materials and the competitiveness of its export revenues. The Japanese Yen's fluctuations in 2024 against major currencies like the US Dollar and Euro highlight the need for robust risk management and currency hedging strategies to ensure stable financial projections.

| Economic Factor | Hokkan Holdings Impact | 2024/2025 Data/Projection |

| Economic Growth (Japan) | Drives demand for packaging solutions | Japan beverage cans market projected CAGR of 4.3% (2024-2030) |

| Inflation | Increases operational costs (raw materials, energy) | Global energy prices surged in late 2024; ongoing inflationary pressures |

| Exchange Rates (JPY) | Affects import costs and export revenue competitiveness | Notable JPY fluctuations against USD and EUR in 2024 |

Same Document Delivered

Hokkan Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hokkan Holdings PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing crucial insights for strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a detailed understanding of the external forces shaping Hokkan Holdings' operational landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It offers a thorough examination of the PESTLE elements relevant to Hokkan Holdings, equipping you with actionable intelligence.

Sociological factors

Consumers are increasingly prioritizing environmentally friendly products and packaging, with a significant portion willing to pay a premium. For instance, a 2024 NielsenIQ report indicated that 73% of global consumers would change their purchasing habits to reduce environmental impact, and 41% are willing to pay more for sustainable products. This growing demand for recyclable, biodegradable, and reusable solutions directly influences companies like Hokkan Holdings, compelling them to invest in innovative material science and adopt circular economy principles to meet consumer expectations and maintain market competitiveness.

Consumer tastes are changing, with a noticeable shift towards healthier choices like low-sugar and functional beverages. This trend directly impacts Hokkan Holdings, as it necessitates adapting the types and sizes of containers produced to align with these evolving preferences. For instance, the demand for smaller, more convenient portion sizes reflects a broader societal move towards mindful consumption.

The Japanese non-alcoholic beverage market, a key area for Hokkan Holdings, is experiencing growth driven by this very demand for healthier options. Data from 2023 indicated a significant increase in sales for beverages marketed with health benefits, such as those fortified with vitamins or natural sweeteners, underscoring the need for container innovation that supports these product categories.

Consumers are increasingly focused on food safety and want to know exactly where their food comes from. This growing concern is pushing companies to be more open about their supply chains. For instance, a 2024 survey showed that 78% of consumers consider food origin a key factor when purchasing groceries.

This demand for transparency is leading to the adoption of smart packaging. Technologies like QR codes and embedded sensors are becoming more common, allowing shoppers to access detailed information about a product's journey and ensure its freshness. In 2025, the smart packaging market is projected to reach $45 billion globally, up from $30 billion in 2023, highlighting this significant shift.

Demographic changes, such as aging populations or urbanization, influencing packaging needs

Demographic shifts, particularly Japan's rapidly aging population, are significantly shaping packaging demands for Hokkan Holdings. This trend necessitates packaging that is easier to open, often featuring larger print for readability and smaller, single-serving portions to cater to smaller households. For instance, the proportion of Japanese citizens aged 65 and over reached a record 29.1% in 2023, highlighting the growing market for senior-friendly products.

Urbanization and the prevalence of busy lifestyles further drive the need for convenient packaging solutions. Consumers increasingly seek ready-to-drink beverages and on-the-go options that require minimal preparation. This aligns with Hokkan Holdings' focus on PET bottle production, which is well-suited for single-use, portable beverage consumption.

- Aging Population Impact: Japan's elderly population, exceeding 29% in 2023, demands packaging with enhanced usability, such as easy-open caps and clear, large-print labels.

- Urbanization and Convenience: Growing urban centers and fast-paced lifestyles fuel demand for convenient, single-serving, and ready-to-consume packaged goods, a key area for PET bottle manufacturers.

- Shifting Household Structures: Smaller household sizes, often associated with aging populations and urbanization, increase the preference for smaller portion sizes in packaging.

Lifestyle trends impacting convenience and on-the-go consumption of packaged goods

Modern life is increasingly about speed and ease, and this is directly influencing how people consume packaged goods. There's a growing preference for items that are quick to prepare, easy to transport, and ready to eat or drink without much fuss. This shift means more demand for single-serving portions and packaging designed for portability.

Hokkan Holdings is in a prime position to benefit from this lifestyle trend. Their core businesses in beverage cans and filling services allow them to provide the very packaging formats consumers are looking for. This aligns perfectly with the rising demand for convenient, on-the-go options in the packaged goods sector.

The drive for convenience is a significant contributor to the growth of the flexible packaging market in Japan. Consumers are actively seeking out products that fit seamlessly into their busy schedules. This trend is not just a passing fad; it's a fundamental change in consumer behavior.

- Demand for Single-Serve Packaging: The market for single-serving beverage cans and ready-to-drink products is expanding as consumers prioritize convenience.

- On-the-Go Consumption: Lifestyles emphasizing mobility and reduced time for meal preparation fuel the need for easily portable and consumable packaged goods.

- Flexible Packaging Growth: This societal shift is a key driver for the flexible packaging industry in Japan, with an estimated market value of ¥1.5 trillion in 2024, projected to grow by 3-4% annually.

- Hokkan Holdings' Strategic Fit: The company's expertise in beverage can manufacturing and filling directly addresses this consumer demand for convenient packaging solutions.

Societal values are shifting, with a growing emphasis on health and wellness influencing beverage choices. This trend, particularly evident in Japan's market, pushes demand for low-sugar, functional drinks, requiring packaging innovation to support these healthier product lines.

Consumer desire for transparency in food sourcing is paramount, driving the adoption of technologies like QR codes on packaging. This allows consumers to track product origins, with the smart packaging market projected to reach $45 billion globally by 2025, up from $30 billion in 2023.

Demographic changes, especially Japan's aging population (29.1% over 65 in 2023), necessitate user-friendly packaging. This includes features like easy-open mechanisms and clear labeling, catering to the needs of an older consumer base.

| Sociological Factor | Impact on Hokkan Holdings | Supporting Data |

| Health and Wellness Trend | Increased demand for packaging suitable for low-sugar and functional beverages. | Japanese non-alcoholic beverage market saw growth in sales of health-benefit beverages in 2023. |

| Demand for Transparency | Need for smart packaging solutions (e.g., QR codes) to provide supply chain information. | Smart packaging market projected to reach $45 billion by 2025. |

| Aging Population | Requirement for easy-to-open packaging and larger print for labels. | 29.1% of Japan's population was aged 65+ in 2023. |

Technological factors

Ongoing research is driving significant advancements in packaging materials. Innovations like bioplastics, which can biodegrade or compost, and active packaging that extends shelf life by controlling spoilage are becoming more prevalent. Lightweight designs are also gaining traction, reducing material usage and transportation costs.

For Hokkan Holdings, embracing these material and design evolutions is crucial. For instance, the global bioplastics market was valued at approximately $50.7 billion in 2023 and is projected to grow significantly. Investing in such materials aligns with increasing consumer demand for sustainable options and helps Hokkan meet its environmental, social, and governance (ESG) targets, a key factor for investors in 2024 and beyond.

Hokkan Holdings can leverage automation, robotics, and AI to boost efficiency and cut costs in its manufacturing and filling operations. These advancements translate to higher output and improved product consistency.

The global market for smart packaging, a key area for Hokkan, is projected to reach $40.8 billion by 2025, highlighting the demand for technologically advanced solutions.

Smart packaging, featuring QR codes and freshness sensors, is revolutionizing how consumers interact with products. These technologies provide detailed information, enhance traceability, and offer real-time updates on product condition, significantly boosting consumer confidence and engagement. For Hokkan Holdings, integrating these advancements into their container solutions can unlock new avenues for value creation and supply chain transparency.

Innovation in recycling and waste processing technologies

Innovation in recycling and waste processing technologies is a key technological driver for companies like Hokkan Holdings. New methods for sorting, reprocessing, and recycling packaging materials, such as advanced mechanical and chemical recycling, are essential for meeting circular economy objectives. Hokkan Holdings' sustainability efforts are directly tied to how effectively these technologies can be used to integrate recycled content back into their production processes.

Japan, a significant market for Hokkan Holdings, already boasts a high recycling rate for aluminum cans, approximately 98.8% as of 2022 data. The nation is actively investing in and developing advanced waste processing technologies to further enhance resource recovery and reduce landfill waste. This technological advancement directly impacts the availability and quality of recycled materials that Hokkan Holdings can utilize.

- Advanced Sorting: Technologies like AI-powered optical sorters are improving the separation of different plastic types and materials, increasing the purity of recycled feedstock.

- Chemical Recycling: Processes such as pyrolysis and depolymerization are gaining traction, enabling the conversion of mixed plastic waste back into its basic chemical components, which can then be used to create virgin-quality plastics.

- Material Innovation: Development of new packaging materials that are more easily recyclable or biodegradable also plays a crucial role in the waste processing ecosystem.

- Japan's Focus: In 2023, Japan's Ministry of the Environment continued to promote initiatives for a circular economy, encouraging investment in advanced recycling infrastructure and technologies.

Emergence of new filling and sealing technologies for diverse beverage and food products

Continuous innovation in filling and sealing technologies is a significant technological factor for Hokkan Holdings. These advancements allow for the efficient handling of a broader spectrum of beverage and food products, crucially including those demanding aseptic filling or specialized barrier properties to maintain product integrity and extend shelf life. This capability directly supports Hokkan Holdings' strategy to expand its contract manufacturing and filling services, enabling them to serve a more diverse client base with specialized requirements.

The beverage and liquid food manufacturing sector actively showcases these technological leaps. For instance, events like Drink JAPAN expo highlight cutting-edge solutions in filling and sealing. These exhibitions often feature machinery that significantly boosts production efficiency and product quality, directly impacting the operational capabilities and service offerings of companies like Hokkan Holdings. The market for beverage packaging machinery in Asia Pacific, for example, was valued at approximately USD 3.5 billion in 2023 and is projected to grow, indicating strong demand for such technological advancements.

- Aseptic Filling Capabilities: New technologies enable the sterile filling of products, crucial for extending shelf life without preservatives, opening doors to new product categories for contract manufacturing.

- Specialized Barrier Properties: Innovations in sealing materials and methods provide enhanced protection against oxygen and moisture, vital for sensitive products like functional beverages or premium juices.

- Increased Throughput: Advanced machinery offers higher filling speeds and reduced downtime, directly improving operational efficiency and cost-effectiveness for Hokkan Holdings' clients.

- Sustainability Focus: Many new technologies also incorporate eco-friendly materials and energy-efficient designs, aligning with growing market demand for sustainable packaging solutions.

Technological advancements in packaging materials, such as biodegradable bioplastics and lightweight designs, are reshaping the industry. The global bioplastics market, valued at approximately $50.7 billion in 2023, highlights a strong shift towards sustainable options that Hokkan Holdings can capitalize on.

Automation, robotics, and AI are key to enhancing operational efficiency and reducing costs in manufacturing and filling processes. The smart packaging market, projected to reach $40.8 billion by 2025, underscores the growing demand for technologically sophisticated container solutions that improve consumer engagement and supply chain transparency.

Innovations in recycling technologies, including AI-powered sorting and chemical recycling, are vital for circular economy goals. Japan's high aluminum can recycling rate of 98.8% in 2022 demonstrates the nation's commitment to advanced waste processing, directly impacting the availability of recycled materials for Hokkan Holdings.

Cutting-edge filling and sealing technologies, such as aseptic filling, are enabling Hokkan Holdings to handle a wider array of products and expand its contract manufacturing services. The Asia Pacific beverage packaging machinery market, valued at USD 3.5 billion in 2023, indicates robust demand for these advanced solutions.

Legal factors

Hokkan Holdings navigates a growing landscape of environmental regulations impacting its packaging. The company must comply with Japan's evolving waste management and recycling laws, which are increasingly emphasizing circular economy principles. This includes adapting to potential mandates for recycled content in packaging materials.

Internationally, Hokkan Holdings faces significant regulatory shifts. The European Union's Packaging and Packaging Waste Regulation (PPWR), set to be fully implemented by 2025, introduces ambitious targets for recycled content and waste reduction across all member states. This will necessitate substantial changes in packaging design and sourcing for any operations or sales within the EU.

Adherence to food and beverage labeling regulations is paramount for Hokkan Holdings. Strict laws mandate the inclusion of nutritional facts, ingredients, allergens, and origin on packaging. For instance, Japan's Food Sanitation Act and its associated ordinances are critical, requiring precise information that Hokkan's packaging must accommodate to ensure client compliance.

Hokkan Holdings must adhere to stringent labor laws governing working conditions, wages, and employment practices across its manufacturing sites. For instance, in Japan, the Industrial Safety and Health Act mandates specific safety protocols, with workplace accidents in manufacturing industries seeing a slight decrease in recent years, though specific figures for Hokkan are not publicly available. Failure to comply can lead to significant penalties and operational disruptions.

Evolving labor regulations, such as potential increases in minimum wage or new mandates for employee benefits, could directly impact Hokkan's operational expenses and necessitate adjustments to its human resource strategies. For example, a hypothetical 5% increase in average manufacturing wages in Japan could add millions to Hokkan's annual labor costs, influencing pricing and profitability.

Intellectual property laws protecting proprietary packaging designs and technologies

Intellectual property laws are fundamental to safeguarding Hokkan Holdings' innovations. Protecting proprietary packaging designs, unique material compositions, and advanced manufacturing processes through patents and other IP rights is crucial for maintaining a competitive edge in the dynamic packaging industry. These legal protections ensure that the company's significant investments in research and development are secure from unauthorized use or imitation.

The legal framework surrounding intellectual property directly impacts Hokkan Holdings' ability to innovate and differentiate itself. For instance, a patent on a novel, sustainable packaging material could prevent competitors from using it, thereby preserving Hokkan's market share. The World Intellectual Property Organization (WIPO) reported a 3.5% increase in international patent filings in 2023, highlighting the growing global emphasis on IP protection, which directly benefits companies like Hokkan that rely on technological advancements.

- Patent Protection: Secures exclusive rights for novel container designs and manufacturing techniques, preventing competitors from replicating them.

- Trade Secrets: Safeguards confidential information regarding material formulations and production processes that provide a competitive advantage.

- Enforcement: Legal recourse against infringement ensures that Hokkan can defend its IP investments and maintain market exclusivity.

- Global IP Treaties: Adherence to international agreements facilitates the protection of Hokkan's innovations across multiple jurisdictions.

Product liability laws and consumer protection regulations

Hokkan Holdings operates under stringent product liability laws, making the company accountable for any damages or defects arising from its beverage products. This legal framework necessitates robust quality assurance processes to mitigate risks and potential litigation. For instance, in 2023, the total value of product liability claims filed in Japan saw a notable increase, underscoring the importance of compliance for companies like Hokkan Holdings.

Consumer protection regulations further shape Hokkan Holdings' operations by dictating essential quality and safety standards for its offerings. Adherence to these mandates is crucial for maintaining brand reputation and consumer confidence. Japan's recent implementation of a positive list for food contact materials, effective from June 2020 and updated in subsequent years, exemplifies the evolving regulatory landscape aimed at enhancing consumer safety in the food and beverage sector.

- Product Liability: Hokkan Holdings is legally responsible for harm caused by product defects, requiring rigorous quality control.

- Consumer Protection: Regulations mandate specific quality and safety standards for all products.

- Regulatory Compliance: Adherence to laws like Japan's positive list for food contact materials is vital for avoiding legal issues and maintaining trust.

- Risk Mitigation: Proactive measures in quality assurance and legal compliance are essential to prevent costly disputes and protect brand image.

Hokkan Holdings must navigate a complex web of international and domestic regulations. The EU's Packaging and Packaging Waste Regulation (PPWR), with its 2025 implementation, mandates increased recycled content, impacting global operations. Japan's Food Sanitation Act requires precise labeling, including nutritional facts and allergens, which Hokkan must accurately reflect on its packaging to ensure client compliance and consumer safety.

The company's commitment to intellectual property protection is crucial for its competitive edge, with global patent filings increasing by 3.5% in 2023, according to WIPO. Furthermore, product liability laws hold Hokkan accountable for defects, necessitating robust quality assurance. Japan's evolving positive list for food contact materials, updated in recent years, highlights the ongoing focus on consumer safety, directly influencing packaging material choices and compliance strategies.

Environmental factors

Governments, consumers, and investors are increasingly demanding that companies actively measure and reduce their greenhouse gas (GHG) emissions throughout their entire supply chains. This pressure extends from the initial sourcing of raw materials all the way through manufacturing and final distribution. For Hokkan Holdings, this translates into a strategic imperative to bolster its environmental responsiveness and pursue sustainable growth.

Hokkan Holdings' reliance on recycled content for packaging materials is directly tied to the market dynamics of secondary aluminum, steel, and plastics. Meeting ambitious sustainability targets and regulatory requirements hinges on securing a consistent supply of these materials. For instance, Japan's impressive aluminum can recycling rate, exceeding 90%, provides a strong domestic foundation, but global demand and supply chain efficiencies still dictate price points.

Growing global concern over plastic pollution is prompting stricter regulations on single-use packaging and driving demand for sustainable alternatives. This trend significantly impacts companies like Hokkan Holdings, which rely on plastic for their containers.

Hokkan Holdings faces pressure to innovate, either by developing more sustainable plastic solutions, enhancing the recyclability of existing products, or transitioning to alternative materials altogether. Japan's commitment to obligating manufacturers to incorporate recycled plastics into their products by 2025 underscores this regulatory shift.

Water usage and waste management in manufacturing processes

Hokkan Holdings' manufacturing processes, particularly for beverage and food containers, are inherently water-intensive. Effective water usage and waste management are therefore critical environmental considerations. The company's commitment to sustainability necessitates robust systems for water conservation and efficient waste handling to meet regulatory requirements and bolster its environmental credentials.

Hokkan Holdings actively monitors and reports on its water footprint. For instance, their 2023 sustainability report indicated a total water intake of 5.2 million cubic meters across all operations. This data underscores the importance of their ongoing efforts in water management and waste reduction.

- Water Intake: Hokkan Holdings reported a total water intake of 5.2 million cubic meters in 2023, highlighting the significance of water conservation in their manufacturing.

- Waste Management Focus: The company is implementing programs to reduce manufacturing waste, aiming for a 15% reduction in non-recyclable waste by 2025.

- Recycling Initiatives: Efforts are underway to increase the recycling rate of production byproducts, with a target of achieving 80% recycling of metal and plastic scrap by the end of 2024.

Impact of climate change on raw material sourcing and logistics

Climate change poses a significant threat to Hokkan Holdings' supply chain. Extreme weather events, such as droughts and floods, can severely impact the availability and price of agricultural raw materials, a key component for many packaged goods. For instance, in 2024, several regions experienced unseasonable weather patterns that led to crop yield reductions, affecting commodity prices globally. This scarcity directly translates to increased procurement costs and potential disruptions in production schedules for Hokkan Holdings.

The logistical side of the business is also vulnerable. Increased frequency of severe storms or rising sea levels can damage infrastructure, leading to delays and higher transportation expenses. For example, disruptions in major shipping lanes due to extreme weather in 2024 caused a noticeable uptick in freight rates. Hokkan Holdings must proactively address these environmental factors by strengthening its supply chain resilience.

- Diversification of Sourcing: Reducing reliance on single geographic regions for key agricultural inputs can mitigate the impact of localized climate events.

- Logistics Optimization: Investing in more efficient and resilient transportation methods, including exploring alternative routes and modes of transport, can buffer against weather-related disruptions.

- Climate-Resilient Operations: Implementing strategies to protect facilities and operations from extreme weather, such as improved storage or flood defenses, is crucial.

- Agricultural Partnerships: Collaborating with agricultural suppliers to promote sustainable farming practices that are more resistant to climate variability can ensure a more stable supply of raw materials.

Environmental factors are increasingly shaping business strategy, with a strong push towards sustainability and reduced emissions across supply chains. Hokkan Holdings, like many in the packaging sector, faces growing pressure from consumers and regulators to adopt greener practices. This includes managing water usage, which was 5.2 million cubic meters in 2023, and minimizing waste, with a target to cut non-recyclable waste by 15% by 2025.

The company's reliance on recycled materials, such as aluminum and plastics, directly links its operations to the circular economy. Japan's high recycling rates, over 90% for aluminum cans, provide a solid base, but global market dynamics still influence costs. Furthermore, the global concern over plastic pollution is driving stricter regulations, pushing companies like Hokkan Holdings to innovate with more sustainable packaging solutions or increase the use of recycled plastics, a trend reinforced by Japan's 2025 mandate for recycled plastic incorporation.

Climate change also presents tangible risks, impacting raw material availability and logistics. Extreme weather events in 2024, for instance, led to crop yield reductions and increased freight rates, highlighting the need for supply chain resilience. Hokkan Holdings is addressing this through diversified sourcing, logistics optimization, and fostering climate-resilient agricultural partnerships.

| Environmental Factor | Hokkan Holdings' Response/Impact | Key Data/Target |

|---|---|---|

| Emissions Reduction | Pressure for supply chain GHG reduction | N/A |

| Water Management | Focus on conservation and waste reduction | 5.2 million cubic meters water intake (2023) |

| Waste Management | Programs to reduce manufacturing waste | 15% reduction in non-recyclable waste by 2025 |

| Recycling Initiatives | Increasing recycling of production byproducts | 80% recycling of metal/plastic scrap by end of 2024 |

| Plastic Pollution | Innovation in sustainable packaging, use of recycled plastics | Japan's mandate for recycled plastic use by 2025 |

| Climate Change Impact | Supply chain disruption from extreme weather | Increased crop prices and freight rates observed in 2024 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Hokkan Holdings is built on a comprehensive review of official government publications, reputable economic databases, and leading industry research reports. This ensures that each factor—political, economic, social, technological, legal, and environmental—is grounded in current, verifiable data.