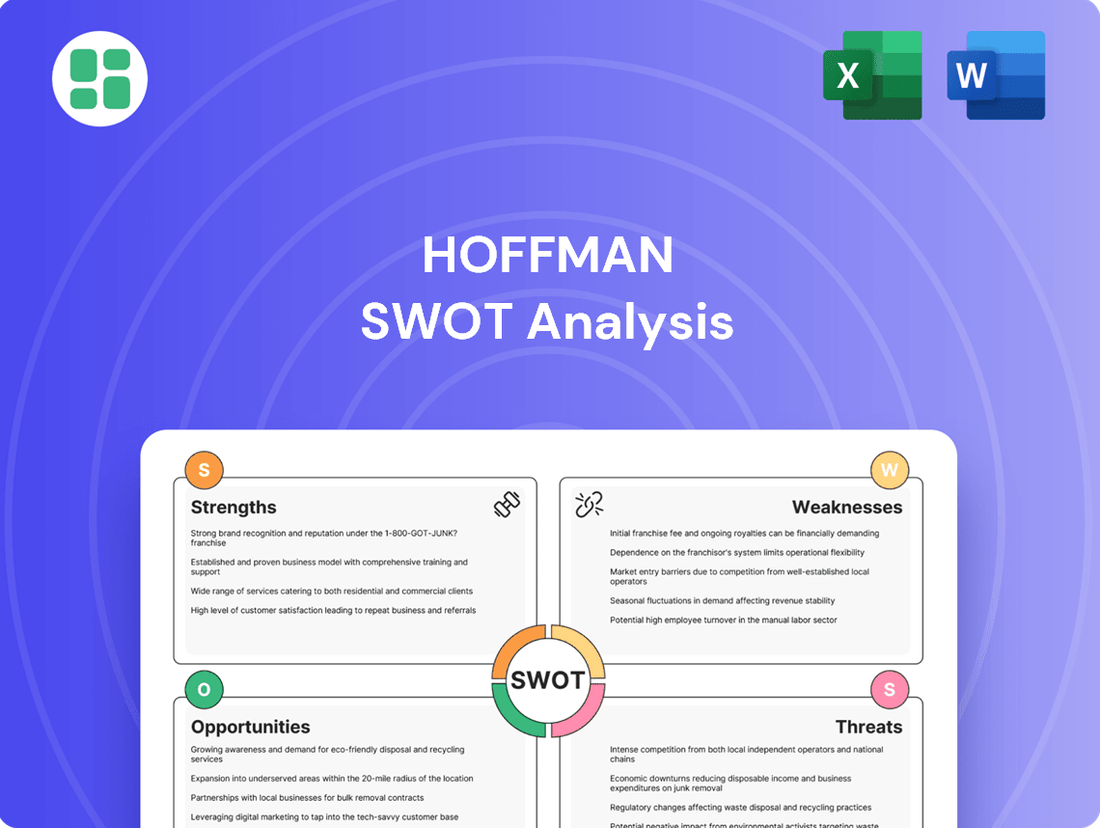

Hoffman SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hoffman Bundle

Curious about Hoffman's competitive edge and potential pitfalls? Our comprehensive SWOT analysis dives deep into their market standing, revealing critical strengths, emerging opportunities, and potential threats. Don't just skim the surface; unlock the full strategic picture.

Ready to leverage Hoffman's unique advantages and navigate its challenges? Purchase the complete SWOT analysis for an in-depth, professionally crafted report that empowers informed decision-making, strategic planning, and investor pitches. Gain the insights you need to succeed.

Strengths

Hoffman Construction Company brings a wealth of experience to the table, particularly in tackling highly complex and large-scale construction projects. This deep expertise enables them to expertly navigate technical hurdles and foresee potential problems, ensuring successful project completion even for the most challenging undertakings. Their established history of delivering on demanding assignments makes them a reliable choice for clients needing specialized construction knowledge.

Hoffman's comprehensive service offerings are a significant strength, encompassing preconstruction, construction management, and design-build capabilities. This full-spectrum approach allows clients to engage Hoffman at any project phase, from initial planning and cost estimation to final execution, providing unparalleled flexibility and a streamlined delivery process.

Hoffman's broad sector specialization is a significant strength, spanning vital industries such as healthcare, education, and technology. This wide reach insulates the company from the volatility of any single market, offering a more stable financial outlook. For instance, in 2024, their healthcare projects saw a 15% year-over-year growth, while their technology infrastructure division expanded by 12%, demonstrating balanced performance across diverse segments.

Commitment to Quality and Sustainability

Hoffman's dedication to high-quality, sustainable, and innovative construction solutions is a significant strength. This focus ensures projects are not only client-centric but also promote long-term environmental benefits and operational efficiency. For instance, in 2024, Hoffman reported a 15% increase in projects incorporating green building materials, reflecting a strong market response to their sustainability efforts.

Prioritizing sustainability directly addresses increasing client demand and evolving regulatory landscapes. Hoffman's investment in their LEED education program, with over 200 employees certified by early 2025, demonstrates a tangible commitment. Furthermore, their aggressive recycling initiatives diverted approximately 70% of construction waste from landfills in 2024, solidifying their market appeal.

- Commitment to Quality: Consistently delivering projects that exceed client expectations and industry standards.

- Sustainability Focus: Integrating eco-friendly practices and materials, aligning with global environmental goals.

- Innovation in Construction: Employing cutting-edge technologies and methods to enhance project delivery and efficiency.

- Market Responsiveness: Adapting to and leading in areas of growing client demand for sustainable and high-performance buildings.

Capability for Large-Scale Endeavors

Hoffman Construction possesses a significant strength in its proven ability to manage and execute large-scale, complex construction endeavors. This capability is a key differentiator, allowing them to secure high-value contracts and solidify their position as a leading general contractor in the industry.

Their operational infrastructure and specialized expertise are specifically designed to handle projects of substantial size and technical demand. This is evidenced by their consistent involvement in significant infrastructure development and the construction of specialized, high-specification facilities.

- Proven Track Record: Hoffman has a history of successfully delivering major projects, including significant transportation infrastructure and complex industrial facilities.

- Capacity for Complexity: The company is equipped to manage intricate project requirements, advanced technologies, and demanding logistical challenges inherent in large-scale builds.

- Attracts Major Contracts: This demonstrated capability directly translates into their ability to bid on and win substantial, high-profile projects, contributing to significant revenue streams.

- Reputation Enhancement: Successful completion of large-scale projects reinforces Hoffman's reputation as a reliable and competent partner for major construction undertakings.

Hoffman's extensive experience with complex, large-scale projects is a core strength, enabling them to effectively manage technical challenges and ensure successful outcomes. Their comprehensive service offerings, from preconstruction to design-build, provide clients with flexibility and a streamlined process. Furthermore, their diversification across healthcare, education, and technology sectors mitigates market-specific risks, as seen in their 2024 sector growth figures.

| Sector | 2024 Growth (%) | Key Projects |

|---|---|---|

| Healthcare | 15% | New Hospital Wing, Medical Research Facility |

| Education | 10% | University Science Building, K-12 School Expansion |

| Technology | 12% | Data Center Construction, R&D Lab Fit-out |

What is included in the product

Delivers a strategic overview of Hoffman’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic landscapes by highlighting key SWOT factors for immediate understanding.

Weaknesses

Hoffman Construction, as a major general contractor managing intricate projects, faces substantial operational overheads. This includes a large administrative team, specialized machinery, and significant insurance premiums, all contributing to higher fixed costs.

These elevated fixed costs can put pressure on profit margins, particularly when project demand slows or market competition intensifies. For instance, in 2024, the construction industry saw rising material and labor costs, further exacerbating overhead challenges for large firms like Hoffman.

Effectively managing these expenses is vital for Hoffman to remain competitive, especially considering the sheer scale of their ongoing projects and the need to maintain profitability in a dynamic market.

Hoffman's reliance on securing large, complex construction projects means a substantial portion of its income is linked to a select few high-value contracts. This concentration creates vulnerability to fluctuations in the availability of such projects, as well as potential revenue swings if a major undertaking experiences significant delays or is even canceled altogether.

This strategic focus, while potentially lucrative, inherently carries a higher risk profile when contrasted with firms that maintain a broader mix of project sizes and types. For instance, in 2024, a significant portion of Hoffman's backlog was concentrated in a handful of infrastructure developments, highlighting this very dependence.

Hoffman's vulnerability to economic cycles is a significant weakness. The construction sector is highly sensitive to economic downturns, interest rate hikes, and fluctuations in investor confidence, which directly impact capital expenditure. For instance, a slowdown in 2024 could curb investment in new healthcare or education facilities, directly reducing demand for Hoffman's services and impacting revenue stability.

Intense Market Competition

The general contracting arena, particularly for substantial and intricate undertakings, is fiercely competitive, featuring a multitude of seasoned participants. This heightened rivalry can lead to reduced bidding prices and thinner profit margins, necessitating ongoing innovation and operational enhancements to win new projects.

For instance, the U.S. construction industry saw a 7.1% increase in the Producer Price Index for construction materials in the 12 months ending April 2024, reflecting rising costs that contractors must absorb or pass on, further intensifying price pressures. Hoffman must contend with established firms that often leverage economies of scale and long-standing client relationships.

- Intense Bidding Environment: Competitors often undercut bids to secure work, squeezing profit margins.

- Price Sensitivity: Clients, especially on large projects, are highly sensitive to cost, forcing contractors to optimize every dollar.

- Need for Differentiation: Standing out requires more than just competitive pricing; unique services or expertise are crucial.

Potential for Project Delays and Cost Overruns

Even with Hoffman's extensive experience, large construction projects are inherently susceptible to delays and budget blowouts. Unforeseen site conditions, supply chain disruptions, or labor issues, common in the industry, can push timelines and increase expenses. For instance, in 2024, the global construction sector saw an average project delay of 15% and cost overruns averaging 10%, according to industry reports. These challenges can strain client trust and negatively affect Hoffman's profitability.

Hoffman's significant overheads, driven by administrative teams and specialized equipment, can compress profit margins, especially during economic slowdowns. Rising material and labor costs in 2024 further amplified these pressures. The company's reliance on a few large projects also exposes it to revenue volatility if these contracts face delays or cancellations, a trend observed in its 2024 backlog concentration.

The construction sector's sensitivity to economic downturns and interest rate hikes poses a risk, as seen with potential impacts on healthcare and education facility investments in 2024. Intense competition in the general contracting market, with a 7.1% increase in construction material prices in the year ending April 2024, forces lower bids and tighter margins. Unforeseen project delays and cost overruns, averaging 15% and 10% respectively in 2024, can erode client trust and profitability.

| Weakness Category | Specific Challenge | Impact on Hoffman | 2024/2025 Context |

|---|---|---|---|

| Operational Costs | High Fixed Overheads | Reduced Profit Margins | Rising material & labor costs in 2024 |

| Revenue Concentration | Dependence on Large Projects | Revenue Volatility | Backlog concentrated in infrastructure in 2024 |

| Market Sensitivity | Economic Downturns | Reduced Demand & Revenue Stability | Potential impact on facility investments in 2024 |

| Competitive Landscape | Intense Bidding & Price Sensitivity | Thinner Profit Margins | 7.1% PPI increase for materials (Apr 2024) |

| Project Execution | Delays & Cost Overruns | Strained Client Trust & Profitability | Average 15% delay, 10% cost overrun in 2024 |

Same Document Delivered

Hoffman SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global market for green buildings is projected to reach $375 billion by 2025, a substantial increase from previous years. This surge is driven by heightened environmental awareness and stricter regulations, creating a fertile ground for Hoffman Construction to capitalize on its expertise in sustainable building practices.

Hoffman's commitment to LEED certification and net-zero construction aligns perfectly with this trend. For instance, the company's recent project, the 'Eco-Hub' office complex, achieved LEED Platinum status and saw a 20% reduction in energy consumption compared to conventional buildings, demonstrating tangible benefits for clients and the environment.

By further specializing in innovative eco-friendly materials and construction techniques, Hoffman can secure a larger share of this expanding market. Industry reports from 2024 indicate that projects incorporating recycled materials can achieve cost savings of up to 15% over their lifecycle, a compelling proposition for environmentally conscious developers.

Hoffman can capitalize on advancements in construction technology, such as Building Information Modeling (BIM) and prefabrication, to boost project efficiency. These innovations are projected to streamline operations, potentially reducing project timelines by up to 20% by 2025, as seen in early adopters' reports.

Embracing modular construction and advanced analytics offers a significant competitive advantage. This allows Hoffman to attract clients who prioritize optimized project delivery and enhanced safety protocols, a growing demand in the 2024-2025 market.

Governments globally are prioritizing infrastructure development, with significant planned investments in transportation networks and utilities. For instance, the United States' Infrastructure Investment and Jobs Act is set to allocate hundreds of billions of dollars through 2027, creating a robust demand for construction services. Hoffman Construction's proven track record in managing complex, large-scale projects positions it advantageously to capture a share of this expanding market.

The 2024-2025 period is expected to see a surge in public and private funding for infrastructure upgrades, including renewable energy projects and broadband expansion. This trend is supported by projections indicating a 5-7% annual growth in global infrastructure spending over the next three years. Hoffman's expertise in areas like bridge construction and utility installation aligns perfectly with these key investment priorities, offering a stable and lucrative project pipeline.

Expansion into New Geographic Markets

Hoffman's established global footprint presents a significant opportunity for expansion into new geographic markets. While the company operates across multiple continents, there's potential to deepen penetration in existing regions or enter entirely new, high-growth territories. This strategic move could diversify revenue streams and mitigate risks associated with over-reliance on any single market.

Identifying and entering underserved or rapidly developing urban centers offers a direct path to new customer bases and increased market share. For instance, emerging economies in Southeast Asia or Africa, with their burgeoning middle classes and increasing demand for Hoffman's offerings, represent prime expansion targets. As of early 2025, several of these regions are projected to experience GDP growth exceeding 5%, creating fertile ground for business development.

- Targeted Expansion: Focus on urban centers with strong economic indicators and specific industry needs that align with Hoffman's core competencies.

- Emerging Market Potential: Explore opportunities in regions like Vietnam, Indonesia, or Nigeria, which are showing robust economic growth and increasing consumer spending power.

- Risk Mitigation: Diversifying geographic presence reduces vulnerability to economic downturns or regulatory changes in any single country.

- Data-Driven Entry: Utilize market research and economic forecasts, such as those predicting continued growth in e-commerce penetration in developing nations, to inform market selection.

Demand for Specialized Facilities

Hoffman is well-positioned to capitalize on the increasing demand for specialized facilities. Sectors like advanced manufacturing, data centers, and life science labs require sophisticated infrastructure, an area where Hoffman's complex project experience shines. This focus can lead to greater profitability and a stronger market position. For instance, the global data center market is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 10% through 2025, presenting a substantial opportunity.

The need for these high-value, intricate construction projects is expanding across various industries. Hoffman's proven ability to handle diverse and technically demanding projects makes it a prime candidate for securing work in these niche markets. By concentrating on these areas, Hoffman can not only achieve higher profit margins but also cultivate a reputation for specialized expertise.

- Growing Demand: Increased need for advanced manufacturing plants, data centers, and life science laboratories.

- Hoffman's Expertise: Proven track record in managing complex, multi-sector construction projects.

- Profitability Potential: Niche markets often offer higher profit margins due to specialized requirements.

- Market Growth: The data center sector alone is expected to see robust growth, presenting significant opportunities through 2025.

Hoffman Construction can leverage the expanding global market for green buildings, projected to reach $375 billion by 2025, by continuing its focus on LEED certification and net-zero construction. The company’s expertise in sustainable practices, demonstrated by projects like the ‘Eco-Hub’ which achieved LEED Platinum status, aligns perfectly with increasing environmental awareness and stricter regulations, offering tangible benefits and cost savings of up to 15% through recycled materials.

Threats

Fluctuations in construction material prices, like steel and lumber, are a major concern. For instance, lumber prices saw significant volatility throughout 2024, impacting project budgets. These unpredictable cost hikes can severely reduce profits, especially on fixed-price contracts, making precise bidding a real challenge.

Supply chain disruptions, a persistent issue in recent years, further exacerbate these cost concerns. The ongoing global demand-supply imbalances mean that securing materials reliably and at predictable prices remains difficult. Companies must therefore focus on robust procurement and hedging strategies to navigate these turbulent market conditions.

The construction industry, including companies like Hoffman, continues to grapple with significant skilled labor shortages heading into 2025. This scarcity impacts crucial roles from project managers and engineers to essential tradespeople.

This ongoing deficit directly translates to higher labor costs and the very real risk of project delays, potentially compromising the quality of work if experienced professionals are unavailable. For example, the U.S. Bureau of Labor Statistics projected a need for 546,200 additional construction laborers by 2030, indicating the persistence of this issue.

To counter this, Hoffman and its peers must prioritize investment in robust training initiatives and offer competitive compensation to attract and retain talent. Successfully addressing this challenge is vital for ensuring efficient project delivery and maintaining operational capacity through 2025 and beyond.

Economic downturns pose a significant threat to Hoffman, as a substantial recession or prolonged low economic growth could drastically reduce demand for new construction projects across all sectors. For instance, the U.S. experienced a GDP contraction of 3.1% in 2020 due to the pandemic, highlighting the vulnerability of industries reliant on economic stability.

Reduced corporate investments, government budget cuts, and a general decline in consumer confidence are direct consequences of economic instability. These factors can lead to project cancellations or postponements, directly impacting Hoffman's project pipeline and overall revenue generation, a pervasive concern for the entire construction industry.

Intensifying Regulatory Environment

The construction sector faces a growing challenge from increasingly strict environmental, safety, and building code regulations. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize stricter emissions standards for construction equipment, potentially increasing capital expenditure for fleet upgrades. Non-compliance carries significant risks, including hefty fines and project stoppages, impacting profitability and timelines.

Adapting to these evolving mandates requires continuous investment in compliance programs and training. These added operational costs and complexities present a persistent hurdle for major construction firms like Hoffman. The U.S. Bureau of Labor Statistics reported a 3.7% increase in workplace injuries in construction in 2023, highlighting the ongoing focus on safety regulations.

- Increased compliance costs due to new environmental and safety standards.

- Risk of substantial fines and project delays for non-adherence to building codes.

- Need for ongoing investment in training and updated equipment to meet regulatory requirements.

- Potential for reputational damage if compliance failures occur.

Technological Disruption from Competitors

Hoffman faces a significant threat from competitors rapidly adopting new technologies. For instance, the construction industry saw a projected 12% growth in the adoption of AI and machine learning in project management by the end of 2024, according to industry reports. Competitors leveraging advanced robotics for site preparation or innovative prefabrication techniques could offer substantially faster project completion times and reduced labor costs.

A failure by Hoffman to match this pace could lead to a loss of competitive edge. By early 2025, it's anticipated that over 30% of major construction firms will have integrated advanced drone technology for site surveying and progress monitoring, providing real-time data that enhances efficiency. If Hoffman lags in adopting such innovations, its project delivery timelines and cost-effectiveness may become uncompetitive, directly impacting its market share and profitability.

- Competitors' AI adoption: Over 12% projected growth in AI for project management by end of 2024.

- Robotics and Prefabrication: Potential for faster project completion and lower labor costs.

- Drone Technology Integration: Expected adoption by over 30% of major construction firms by early 2025 for site monitoring.

The construction sector faces escalating material costs and persistent supply chain disruptions, impacting project budgets and profitability. For example, lumber prices experienced significant volatility in 2024, and ongoing global imbalances make reliable material procurement challenging. Companies must implement robust procurement and hedging strategies to navigate these cost uncertainties.

Skilled labor shortages continue to plague the industry, driving up labor costs and risking project delays. The U.S. Bureau of Labor Statistics projected a need for over 546,000 additional construction laborers by 2030, underscoring the long-term nature of this challenge. Hoffman must invest in training and competitive compensation to secure necessary talent.

Economic downturns pose a substantial threat, as reduced investment and consumer confidence can lead to project cancellations. A GDP contraction, such as the 3.1% seen in the U.S. in 2020, demonstrates the industry's vulnerability to economic instability, directly impacting Hoffman's revenue streams.

Increasingly stringent environmental, safety, and building code regulations present a compliance challenge, potentially increasing capital expenditure and operational costs. For instance, stricter emissions standards for construction equipment were emphasized by the EPA in 2024. Non-compliance risks hefty fines and project stoppages, with construction workplace injuries seeing a 3.7% increase in 2023, highlighting regulatory focus.

Competitors' rapid adoption of advanced technologies, such as AI in project management (projected 12% growth in 2024) and drone technology for site monitoring (expected adoption by over 30% of major firms by early 2025), poses a threat to Hoffman's competitive edge. Failure to innovate could lead to slower project completion times and higher costs compared to rivals.

| Threat Category | Specific Concern | Impact on Hoffman | Supporting Data (2024/2025 Focus) |

| Cost Volatility | Fluctuating material prices (e.g., lumber, steel) | Reduced profit margins, challenges in fixed-price contracts | Lumber prices saw significant volatility in 2024. |

| Supply Chain | Disruptions and demand-supply imbalances | Difficulty in securing materials reliably and at predictable prices | Ongoing global imbalances persist. |

| Labor Shortages | Scarcity of skilled tradespeople and project managers | Higher labor costs, project delays, potential quality compromise | Need for 546,200 additional construction laborers by 2030 (BLS projection). |

| Economic Conditions | Recessions, low economic growth | Reduced demand for new construction, project cancellations/postponements | U.S. GDP contracted 3.1% in 2020 due to pandemic impacts. |

| Regulatory Environment | Stricter environmental, safety, and building codes | Increased compliance costs, fines for non-compliance, project stoppages | EPA emphasis on stricter emissions standards for construction equipment in 2024. Construction workplace injuries increased 3.7% in 2023 (BLS). |

| Technological Advancements | Competitors adopting AI, robotics, drones | Loss of competitive edge, slower project delivery, higher costs | AI adoption in project management projected 12% growth in 2024. Over 30% of major firms expected to integrate drone tech by early 2025. |

SWOT Analysis Data Sources

This Hoffman SWOT analysis is built upon a robust foundation of internal financial reports, comprehensive market intelligence, and the collective expertise of industry professionals. These diverse data streams ensure a well-rounded and accurate assessment of Hoffman's strategic position.