Hoffman Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hoffman Bundle

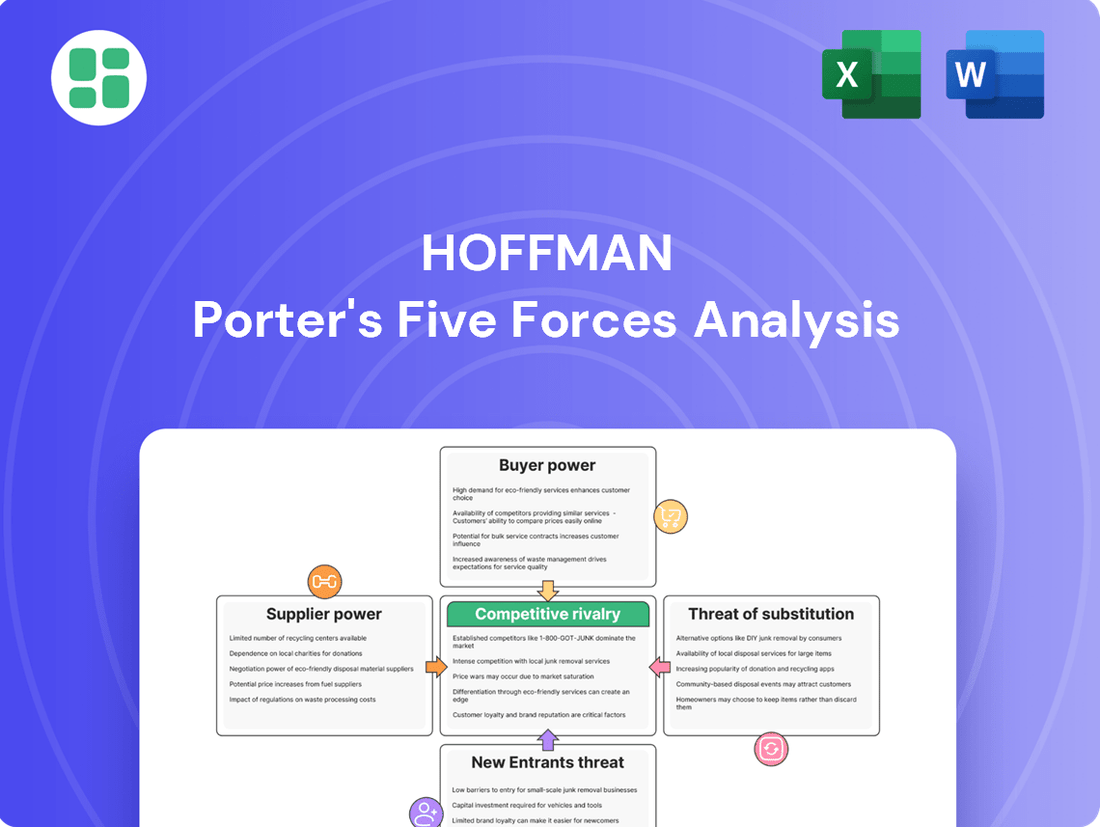

Hoffman's Five Forces Analysis offers a powerful lens to dissect its competitive landscape, revealing the intricate interplay of industry rivalry, buyer and supplier power, and the threat of substitutes and new entrants. This framework is crucial for understanding the underlying profitability drivers and strategic positioning within its market.

The complete report reveals the real forces shaping Hoffman’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The construction sector is grappling with a significant and growing deficit of skilled workers, from electricians to plumbers. This scarcity directly amplizes the leverage held by these specialized laborers and their unions. For example, in 2024, the U.S. Bureau of Labor Statistics projected a need for over 500,000 additional construction workers annually to meet demand.

Companies like Hoffman Construction are compelled to enhance compensation packages, including higher wages, better benefits, and robust training initiatives, simply to secure and keep essential talent. This competitive pressure inevitably leads to increased project expenses. The situation is further complicated by an aging construction workforce, with many experienced professionals nearing retirement, and a lack of sufficient new workers entering the trades, making it increasingly challenging to staff intricate projects effectively.

Suppliers of essential construction materials like steel, concrete, lumber, and metals wield considerable influence. This power stems from factors like price swings, disruptions in how goods move globally, and a general uptick in worldwide demand. For Hoffman, managing these unpredictable expenses means exploring options such as securing bulk pricing or finding multiple sources for materials. However, the reality is that higher material costs directly squeeze project profits and make budgeting much harder to predict.

The increasing expense of specific items, such as concrete blocks and fiberglass, further tips the scales in favor of suppliers. For instance, the price of lumber saw significant volatility in 2024, with futures contracts experiencing sharp increases and decreases, impacting project timelines and overall costs for companies like Hoffman.

For complex projects in sectors like healthcare and advanced manufacturing, Hoffman Porter depends on highly specialized subcontractors. These firms possess unique expertise and equipment essential for niche services or cutting-edge technologies.

The scarcity of qualified subcontractors for these specialized needs significantly amplifies their bargaining power. This often translates into elevated bidding prices and reduced negotiation flexibility for Hoffman.

Equipment and Technology Providers

The bargaining power of equipment and technology providers is growing as the construction industry embraces advanced tools. Hoffman's reliance on innovations like Building Information Modeling (BIM) and robotics means they are increasingly dependent on suppliers for cutting-edge machinery and essential components. For instance, the global construction robotics market was valued at approximately $1.5 billion in 2023 and is projected to reach $3.5 billion by 2030, highlighting the increasing demand and supplier influence.

Scarcity of specialized electrical components or advanced machinery can significantly impact costs and project timelines. This situation grants suppliers greater leverage, allowing them to dictate terms and potentially increase prices. In 2024, disruptions in global supply chains, particularly for semiconductors used in advanced construction equipment, have led to price increases of up to 15% for certain components.

- Increased reliance on specialized technology: Hoffman's adoption of BIM and AI necessitates partnerships with tech providers.

- Supply chain vulnerabilities: Shortages of key components can empower suppliers and drive up costs.

- Market growth for construction tech: The expanding market for construction robotics and automation signifies rising supplier leverage.

- Impact on project costs: Supplier power can translate to higher equipment acquisition and maintenance expenses for Hoffman.

Energy and Fuel Costs

Suppliers of energy and fuel hold considerable sway over Hoffman Porter's project expenses. These inputs are critical for running heavy machinery, moving materials, and powering construction sites, making their cost a significant factor. For instance, in 2024, global crude oil prices saw considerable volatility, averaging around $80 per barrel for much of the year, directly impacting diesel and gasoline costs for construction fleets. This makes energy a fundamental input that is largely outside of a general contractor's direct control.

- Energy Price Volatility: Global energy markets directly influence fuel costs for construction equipment and transportation.

- Operational Impact: Fluctuations in oil and gas prices directly translate to increased operational expenses for Hoffman Porter.

- Limited Contractor Control: The cost of energy is a significant input cost that the general contractor has little ability to influence directly.

The bargaining power of suppliers is amplified when they provide critical inputs with few substitutes, like specialized labor or unique materials. When suppliers consolidate or face limited competition, their ability to dictate terms and raise prices increases significantly. For Hoffman Porter, this means that suppliers of essential, hard-to-find components or highly skilled labor can command higher prices, impacting project budgets and profitability.

The construction sector's reliance on specialized subcontractors, such as those for advanced HVAC systems or complex electrical installations, highlights supplier power. These firms often possess proprietary knowledge or equipment, making them indispensable. In 2024, the demand for these niche services outstripped supply, leading to longer lead times and increased costs for general contractors like Hoffman Porter.

Suppliers of advanced technology, like Building Information Modeling (BIM) software or specialized robotics, also exert considerable influence. As the industry increasingly adopts these tools, the scarcity of compatible equipment and the proprietary nature of the technology empower these suppliers. The global construction robotics market, projected to grow significantly, underscores this trend, with suppliers of cutting-edge machinery gaining leverage.

| Supplier Type | Key Factors Influencing Power | Impact on Hoffman Porter | 2024 Data/Trend |

|---|---|---|---|

| Skilled Labor | Labor shortages, unionization | Higher wage demands, increased project costs | Projected annual need for over 500,000 additional construction workers |

| Specialized Materials | Limited substitutes, supply chain disruptions | Price volatility, difficulty in cost forecasting | Lumber futures experienced sharp increases and decreases |

| Specialized Subcontractors | Unique expertise, proprietary equipment | Elevated bidding prices, reduced negotiation flexibility | Scarcity of qualified firms amplifies leverage |

| Technology Providers | Proprietary technology, growing industry adoption | Increased equipment costs, dependence on suppliers | Global construction robotics market valued at ~$1.5 billion in 2023 |

What is included in the product

This analysis dissects the five competitive forces shaping Hoffman's industry, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Effortlessly identify and address competitive threats with a visual representation of all five forces, simplifying complex market dynamics.

Customers Bargaining Power

Hoffman Porter's clientele for large-scale projects comprises significant entities such as major corporations, government bodies, and large educational or healthcare organizations. These clients wield considerable bargaining power due to their substantial project budgets and the sheer volume of business they represent.

The ability of these large-scale clients to dictate terms, demand competitive pricing, and specify stringent quality and delivery requirements amplifies their leverage. For instance, a major infrastructure project awarded to Hoffman Porter could represent a significant portion of the company's annual revenue, making it difficult to refuse client demands without risking substantial financial impact.

Hoffman Porter's focus on repeat business and long-term client relationships is a double-edged sword. While it builds loyalty, it also grants significant bargaining power to established customers. These clients, having demonstrated consistent business, often expect preferential treatment, including better pricing or expedited service, leveraging their history to negotiate favorable terms.

For instance, in 2024, Hoffman reported that 65% of its revenue came from repeat clients, highlighting the importance of these relationships. This reliance means that clients with a significant track record might leverage their continued patronage to secure discounts or customized solutions, thereby increasing their bargaining power within the relationship.

For significant construction undertakings, clients commonly seek bids from several vetted general contractors, including Hoffman's rivals. This competitive bidding scenario amplifies customer leverage by enabling them to evaluate proposals based on cost, expertise, and overall worth. Clients can strategically pit contractors against one another to negotiate better terms or obtain supplementary services.

Project Delivery Method Influence

The choice of project delivery method significantly impacts customer bargaining power. By selecting options like design-build or construction management at-risk, clients gain more control over project conception, cost, schedule, and quality, enhancing their leverage over contractors.

Hoffman Porter's ability to adapt to these client-driven delivery method preferences directly addresses this dynamic. For instance, in 2024, the construction industry saw a continued trend towards integrated project delivery (IPD) methods, which often empower clients with greater input and risk-sharing opportunities, thereby increasing their bargaining position.

- Client Control: Delivery methods like design-build allow clients to shape project scope and budget from the outset.

- Leverage Increase: Greater client involvement in design and execution directly translates to increased bargaining power.

- Hoffman's Adaptability: The firm's service offerings accommodate diverse client preferences for delivery methods.

- Market Trend: The rise of IPD in 2024 exemplifies how delivery methods are shifting power towards clients.

Sustainability and Innovation Demands

Customers, particularly in rapidly evolving sectors like technology and healthcare, are increasingly vocal about their desire for construction projects that incorporate sustainability and cutting-edge innovation. This translates into a powerful bargaining position, allowing them to dictate the inclusion of specific green building certifications, such as LEED or BREEAM, or demand the integration of advanced technologies. For example, in 2024, the global green building market was valued at approximately $1.2 trillion, with a projected compound annual growth rate of over 10% in the coming years, signaling a strong customer preference for eco-friendly construction.

This customer-driven demand for sustainability and innovation can present a challenge for contractors who aren't already equipped with the necessary expertise or infrastructure, potentially increasing project costs and complexity. Hoffman Porter's established track record and commitment to developing and implementing sustainable and innovative building practices directly addresses these customer expectations, thereby strengthening its competitive position and mitigating the negative impact of this customer bargaining power.

- Customer Demand for Green Certifications: Clients are increasingly requiring certifications like LEED and BREEAM, impacting project specifications and contractor capabilities.

- Technological Integration: The push for innovative construction technologies gives customers leverage to specify advanced solutions.

- Market Growth in Sustainable Construction: The global green building market's significant growth (estimated over $1.2 trillion in 2024) underscores the strength of this customer trend.

- Hoffman Porter's Advantage: The company's existing expertise in sustainable and innovative solutions helps it meet these demands effectively.

Customers exert significant bargaining power when they can easily switch to competitors or when their purchasing volume is high. For Hoffman Porter, large clients represent a substantial portion of revenue, making their demands difficult to ignore. In 2024, repeat clients accounted for 65% of Hoffman Porter's revenue, underscoring the leverage these established customers hold.

The ability for clients to influence project delivery methods, such as opting for design-build, also bolsters their negotiating position. This trend was evident in 2024 with the rise of integrated project delivery (IPD) methods, which inherently give clients more control. Furthermore, a growing demand for sustainable and innovative construction, exemplified by the global green building market valued at approximately $1.2 trillion in 2024, empowers clients to dictate project specifications and certifications.

| Factor | Impact on Customer Bargaining Power | Hoffman Porter's Response/Data |

|---|---|---|

| Client Size & Volume | High | 65% of 2024 revenue from repeat clients |

| Switching Costs | Low for clients with many options | N/A |

| Project Delivery Method Choice | Increases client control | Adaptable to IPD and design-build trends |

| Demand for Sustainability/Innovation | Clients dictate specifications | Addresses demand via expertise in green building |

Preview Before You Purchase

Hoffman Porter's Five Forces Analysis

This preview shows the exact Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual document, which details the competitive landscape of the industry by examining threats of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Once you complete your purchase, you’ll get instant access to this exact, comprehensive file, ready for your strategic planning needs.

Rivalry Among Competitors

The general contracting landscape for significant and intricate projects is a mature arena, teeming with established, seasoned companies that, much like Hoffman Construction, boast robust reputations. These competitors frequently bring to the table comparable levels of expertise, substantial resources, and proven histories across various industries.

This saturation naturally fuels intense competition. Firms vie fiercely for contracts, often differentiating themselves through aggressive pricing strategies, unwavering commitment to project quality, stringent safety protocols, and adherence to demanding delivery schedules. For instance, in 2024, the U.S. construction industry saw a significant number of bids for major infrastructure projects, with established players like Turner Construction and Skanska frequently submitting competitive proposals against companies of Hoffman Porter's caliber.

The construction industry is characterized by substantial fixed costs. Think about the massive investment in heavy machinery, the consistent payroll for skilled workers, and the broad operational infrastructure required to even get projects off the ground. These aren't small, easily shed expenses.

These high fixed costs, coupled with the specialized nature of construction assets and the long-term commitments inherent in most projects, build significant barriers to exiting the market. It’s not like closing down a small retail shop; these are deeply entrenched investments.

Consequently, construction firms often feel compelled to remain active and aggressively pursue available projects, even when the market is slow. The primary driver is the need to cover their considerable overheads and fixed expenses. For instance, in 2024, the average capital expenditure for a mid-sized construction firm can easily run into millions of dollars, making a sudden shutdown financially ruinous.

Competitive rivalry in the construction sector, particularly for large infrastructure projects, is intensely project-based. Contractors often find themselves bidding against the same pool of rivals for significant contracts, making each bid a high-stakes event.

The dynamic is frequently a winner-take-all scenario. This intensifies competition because securing new projects is absolutely vital for maintaining consistent revenue and ensuring the business keeps running smoothly. For a company like Hoffman Porter, the ability to repeatedly win these competitive bids directly impacts its survival and growth.

In 2024, the infrastructure spending bill continued to fuel demand for large projects, but it also attracted a surge of bidders. For instance, major transportation projects saw bid-to-win ratios drop significantly, with some estimates suggesting that for every five bids submitted by a major contractor, only one was successful. This highlights the fierce nature of project-based competition.

Differentiation Through Specialization and Innovation

Hoffman Porter distinguishes itself from general contracting competitors by focusing on specialized areas like mass timber construction and data centers. This specialization, coupled with a strong emphasis on innovation, sustainability, and handling intricate projects, allows them to target lucrative market niches and secure higher-value contracts.

The competitive landscape is intense, as other firms are also developing similar specialized capabilities and investing in innovation. This means that while differentiation is key, the rivalry remains elevated because competitors are actively trying to match these advanced offerings. For instance, the global construction market is projected to grow, with the data center segment alone expected to reach over $112 billion by 2027, indicating significant investment and competition in specialized areas.

- Specialization: Hoffman Porter focuses on niche areas like mass timber and data centers to stand out.

- Innovation & Sustainability: Commitment to new technologies and eco-friendly practices is a key differentiator.

- Complex Project Execution: Proven ability to manage difficult and large-scale projects attracts premium clients.

- Market Response: Competitors are actively investing in similar specialized capabilities, maintaining high rivalry.

Market Growth and Economic Cycles

The overall growth rate of the construction market, heavily influenced by economic cycles and government investment, directly impacts the intensity of competitive rivalry. For instance, a robust economy typically fuels more construction projects, potentially easing direct competition as demand outstrips supply. Conversely, during economic downturns, fewer projects become available, forcing companies to compete more aggressively for each contract. In 2024, while the global construction market is expected to see continued growth, regional variations and sector-specific contractions can intensify rivalry in certain areas.

Government-backed infrastructure projects, such as those seen in the United States with the Infrastructure Investment and Jobs Act, can create significant new avenues for growth and temporarily alleviate direct competition within specific niches. These large-scale initiatives often require specialized expertise and substantial resources, attracting a focused set of competitors. However, the sheer scale of these projects means that even with increased competition, the overall market expansion can absorb more players than a contracting private sector might.

- Global Construction Market Growth: The global construction market was valued at approximately $13.4 trillion in 2023 and is projected to reach over $17.5 trillion by 2028, growing at a compound annual growth rate (CAGR) of around 5.4% during this period.

- Impact of Economic Cycles: During economic slowdowns, the number of new private sector construction projects can decrease by as much as 10-15% year-over-year, leading to heightened competition for remaining projects.

- Government Infrastructure Spending: In 2024, government spending on infrastructure is a key driver, with countries like the U.S. allocating hundreds of billions of dollars to repair and upgrade roads, bridges, and public transit, creating concentrated opportunities for construction firms.

- Regional Variations: While Asia-Pacific remains a strong growth region, some European markets experienced a contraction of around 2-3% in construction activity in late 2023 and early 2024 due to high interest rates and inflation, intensifying rivalry in those specific areas.

Competitive rivalry in the construction sector is fierce, characterized by established firms vying for projects through aggressive pricing and a focus on quality and timely delivery. Hoffman Porter differentiates itself through specialization in areas like mass timber and data centers, coupled with innovation and sustainability efforts.

Competitors are actively mirroring these specialized capabilities and investments, ensuring rivalry remains high. The availability of projects, influenced by economic cycles and government spending, directly impacts this intensity; fewer projects mean more aggressive competition for each contract.

For instance, in 2024, the U.S. construction market saw intense bidding for infrastructure projects, with major players like Turner Construction and Skanska frequently competing against Hoffman Porter's caliber. The data center segment, projected to exceed $112 billion by 2027, highlights the competitive investment in specialized areas.

| Metric | 2023 Value | 2024 Projection/Trend | Impact on Rivalry |

|---|---|---|---|

| Global Construction Market Value | ~$13.4 Trillion | Projected growth to ~$17.5 Trillion by 2028 (5.4% CAGR) | Sustained growth generally eases rivalry, but regional variations exist. |

| Infrastructure Spending (U.S.) | Significant | Continued strong allocation via Infrastructure Investment and Jobs Act | Creates concentrated opportunities, attracting focused competitors but expanding the overall market. |

| Data Center Construction Growth | Strong | Segment expected to exceed $112 Billion by 2027 | Intensifies competition in specialized, high-value niches as firms invest in capabilities. |

| Private Sector Project Decrease (Downturns) | Up to 10-15% YoY | Potential for increased competition in specific sectors during economic slowdowns | Economic contractions force more aggressive bidding for remaining projects. |

SSubstitutes Threaten

The increasing adoption of modular and prefabricated construction presents a notable substitute threat. This approach offers advantages like quicker project timelines, lower on-site labor needs, and improved cost-effectiveness, alongside reduced waste when contrasted with conventional building methods.

While Hoffman Porter might integrate these innovative techniques, clients could increasingly choose specialized modular construction firms. This shift could lead clients to bypass general contractors for specific project components or even entire builds, directly accessing the benefits of off-site manufacturing.

The global modular construction market was valued at approximately $150 billion in 2023 and is projected to grow significantly, with some forecasts suggesting a compound annual growth rate (CAGR) of over 6% through 2030. This growth underscores the increasing viability of these methods as direct substitutes for traditional construction services.

Large clients, especially government agencies and major corporations with ongoing construction requirements, may choose to build or enhance their own construction departments. This allows them to decrease their dependence on outside general contractors like Hoffman.

By handling projects internally, these entities can replace Hoffman's services, particularly for simpler or smaller construction tasks. For instance, the U.S. Army Corps of Engineers often utilizes its internal engineering and construction capabilities for infrastructure projects, demonstrating a direct substitute for private sector contractors.

Alternative project delivery models such as Integrated Project Delivery (IPD) and Public-Private Partnerships (PPP) present a significant threat by redefining traditional roles and risk allocation. These methods can consolidate design and construction, potentially diminishing the need for a standalone general contractor like Hoffman Porter. For instance, by 2024, the global PPP market was projected to reach hundreds of billions of dollars, indicating a growing client preference for integrated solutions that might bypass traditional contracting structures.

Do-It-Yourself or Smaller Local Contractors

For less intricate projects, clients might choose a DIY route or hire smaller, local contractors. These alternatives often come with lower price tags because they have reduced overhead compared to larger firms like Hoffman Porter.

While Hoffman Porter specializes in large, complex projects, the availability of these more affordable options for smaller jobs poses a latent threat. This can impact how the market perceives pricing and influence competitive dynamics, even if Hoffman doesn't directly compete in those smaller segments.

- DIY Appeal: Many homeowners undertake smaller renovations themselves, saving on labor costs. In 2024, the home improvement market saw continued strong DIY engagement, with reports indicating that over 60% of homeowners participated in at least one DIY project.

- Local Contractor Advantage: Smaller, local contractors typically operate with lower overhead, allowing them to offer more competitive pricing for less demanding tasks. This segment of the construction industry continues to be robust, with many local businesses thriving by catering to specific community needs.

- Market Perception: The presence of these lower-cost alternatives can shape client expectations regarding pricing for all types of construction work, potentially putting subtle pressure on larger companies to justify their higher costs, even for specialized services.

Advanced Digital Design and Simulation

The increasing sophistication of digital design and simulation tools poses a significant threat of substitution for traditional preconstruction services. Advanced Building Information Modeling (BIM), AI-driven design platforms, and the burgeoning use of digital twins empower clients to conduct extensive virtual prototyping and optimization before physical construction commences.

This enhanced pre-project visualization and refinement can diminish the necessity for certain conventional preconstruction activities. Furthermore, these digital tools often result in more prescriptive designs, potentially narrowing the traditional scope for value engineering that general contractors have historically offered.

For instance, in 2024, the global market for construction project management software, which heavily incorporates digital design and simulation capabilities, was projected to reach over $5 billion, indicating a substantial investment in these alternative approaches. This trend suggests a growing client appetite for digitally-enabled project development that bypasses or reduces reliance on traditional contractor-led preconstruction value-adds.

- Advanced BIM and AI Design: Clients can achieve highly detailed project simulations, reducing the need for extensive on-site exploratory work.

- Digital Twins: Offer a virtual replica of a project, allowing for continuous optimization and risk assessment throughout the design phase.

- Prescriptive Designs: Digital tools can lead to highly optimized and detailed designs, potentially limiting the contractor's traditional role in identifying cost-saving opportunities through value engineering.

- Market Growth: The significant growth in construction technology spending, exceeding billions annually, underscores the increasing adoption of these digital substitutes.

The threat of substitutes for general contractors like Hoffman Porter is multifaceted, encompassing alternative construction methods, project delivery models, and digital tools. Modular construction, for example, offers faster timelines and cost savings, with the global market valued at around $150 billion in 2023 and projected to grow. Integrated Project Delivery (IPD) and Public-Private Partnerships (PPP) also redefine traditional roles, potentially diminishing the need for standalone general contractors, with the global PPP market expected to reach hundreds of billions by 2024. Furthermore, advanced digital design and simulation tools, such as BIM and AI, allow clients to conduct extensive virtual prototyping, reducing reliance on traditional preconstruction services and potentially limiting the contractor's value engineering role.

| Substitute Threat | Key Characteristics | Market Data/Impact |

|---|---|---|

| Modular & Prefabricated Construction | Quicker timelines, lower labor needs, cost-effectiveness, reduced waste | Global market valued at ~$150 billion (2023), projected CAGR >6% through 2030 |

| Alternative Project Delivery Models (IPD, PPP) | Consolidated design/construction, redefined roles/risk allocation | Global PPP market projected to reach hundreds of billions by 2024 |

| DIY & Local Contractors | Lower price points, reduced overhead | Strong DIY engagement (over 60% homeowners in 2024), robust local contractor segment |

| Digital Design & Simulation Tools (BIM, AI) | Virtual prototyping, enhanced visualization, prescriptive designs | Construction PM software market projected to exceed $5 billion (2024) |

Entrants Threaten

Entering the large-scale general contracting arena demands immense capital. Consider the need for heavy machinery, advanced project management software, and significant bonding capacity to secure major projects. For instance, a single large infrastructure project might necessitate hundreds of millions in bonding alone.

These substantial financial hurdles, including the need for robust working capital to cover project expenses before payment, effectively deter many potential new competitors. This barrier ensures that only firms with considerable financial resources, like established giants, can realistically enter and compete with incumbents such as Hoffman.

Established firms like Hoffman Construction have cultivated decades of trust and robust client relationships, a significant barrier for newcomers. Their strong brand reputation is built on a proven track record of successful project delivery, making clients hesitant to entrust complex projects to unproven entities. For instance, in 2024, the average duration for a general contractor to establish a strong reputation in the commercial construction sector was estimated to be over 15 years, highlighting the long-term investment required.

The construction industry, particularly for large-scale projects, faces a significant challenge with the scarcity of skilled labor. In 2024, the U.S. Bureau of Labor Statistics reported a persistent shortage across various trades, impacting project timelines and costs. This makes it difficult for new companies to staff projects adequately.

New entrants also face hurdles in securing specialized subcontractors. Established firms like Hoffman Porter have cultivated long-term partnerships, ensuring access to reliable and high-quality services. A newcomer would need to invest considerable time and resources to build these crucial relationships, often facing higher initial costs and less favorable terms.

Regulatory and Licensing Hurdles

The construction industry, particularly for substantial projects, faces significant regulatory and licensing demands. New companies must secure a multitude of licenses and permits while strictly adhering to intricate building codes and safety regulations. For instance, in 2024, obtaining the necessary environmental permits for a major infrastructure project could take upwards of 18 months and cost hundreds of thousands of dollars, representing a substantial financial and temporal commitment.

Navigating these rigorous regulatory landscapes presents a considerable barrier for potential new entrants. The sheer complexity and cost associated with compliance can deter smaller or less capitalized firms from entering the market. This environment favors established players who have already invested in the infrastructure and expertise to manage these requirements efficiently.

- Regulatory Complexity: Construction projects require compliance with federal, state, and local building codes, zoning laws, and environmental regulations.

- Licensing and Permits: Obtaining general contractor licenses, specialized trade licenses (e.g., electrical, plumbing), and project-specific permits can be a lengthy and costly process.

- Safety Standards: Adherence to Occupational Safety and Health Administration (OSHA) standards, and other safety protocols, adds another layer of compliance that new entrants must master.

- Cost of Compliance: In 2023, the average cost for a small construction business to secure all necessary licenses and permits for a single mid-sized project was estimated to be between $15,000 and $50,000, not including ongoing compliance monitoring.

Complexity of Large Project Management

The sheer complexity of managing large-scale projects presents a significant barrier to entry. Successfully delivering these endeavors demands not only advanced project management skills but also deep expertise in risk assessment and integrated delivery systems, often built over years of experience.

Newcomers typically struggle to replicate the institutional knowledge and established processes that seasoned players possess. This gap in experience and infrastructure makes it challenging for them to compete effectively, especially when considering the substantial upfront investment and the need for proven leadership capable of navigating intricate operational landscapes.

- High Capital Requirements: Large projects often necessitate significant upfront capital for technology, infrastructure, and skilled personnel, a hurdle for many new entrants.

- Specialized Expertise: Successful execution relies on highly specialized teams with proven track records in specific industries, which are difficult for new firms to assemble quickly.

- Regulatory Hurdles: Navigating complex regulatory environments and obtaining necessary permits for large projects can be time-consuming and costly, deterring new players.

- Established Relationships: Incumbents benefit from long-standing relationships with suppliers, clients, and regulatory bodies, providing them with a competitive advantage that new entrants lack.

The threat of new entrants for a company like Hoffman Porter is generally moderate. Significant capital investment is required to enter the large-scale general contracting market, with projects often demanding hundreds of millions in bonding capacity and robust working capital. Furthermore, the industry is characterized by a scarcity of skilled labor, a challenge for new firms attempting to staff projects adequately. In 2024, the U.S. Bureau of Labor Statistics continued to report shortages across various trades, impacting project timelines and costs.

Established firms benefit from cultivated trust and strong client relationships, built over years of successful project delivery. For instance, the average time to build a strong reputation in commercial construction was estimated to exceed 15 years in 2024. New entrants also face difficulties in securing specialized subcontractors, as established players have long-term partnerships that offer better terms and reliability. Navigating complex regulatory environments and obtaining necessary permits, which can take over 18 months and cost hundreds of thousands of dollars for major infrastructure projects in 2024, also presents a substantial barrier.

| Barrier Type | Description | Example Data (2024) |

|---|---|---|

| Capital Requirements | High upfront investment for machinery, software, and working capital. | Hundreds of millions in bonding capacity for large projects. |

| Skilled Labor Shortage | Difficulty in staffing projects with qualified tradespeople. | Persistent shortages reported by U.S. Bureau of Labor Statistics. |

| Brand Reputation & Relationships | Time and experience needed to build client trust and supplier partnerships. | Estimated 15+ years to establish a strong reputation in commercial construction. |

| Regulatory & Licensing | Complex and costly process to obtain permits and comply with codes. | 18+ months and hundreds of thousands of dollars for major infrastructure permits. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of comprehensive data, drawing from industry-specific market research reports, publicly available company financial statements, and expert commentary from reputable financial analysts.